Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Croydon reveals an overall ranking slightly below national averages considering recent, and medium term trends

As of November 2025, the estimated population for Croydon (NSW) statistical area (Lv2) is around 11,162 people. This reflects a growth of 407 individuals since the 2021 Census, which reported a population of 10,755 people. The increase was inferred from AreaSearch's estimated resident population of 11,134 based on the latest ERP data release by the ABS in June 2024 and an additional 38 validated new addresses since the Census date. This results in a population density ratio of 4,574 persons per square kilometer, placing Croydon (NSW) within the top 10% nationally according to AreaSearch. The area's growth rate of 3.8% since the Census is competitive with its SA4 region (6.3%), demonstrating strong growth fundamentals. Overseas migration contributed approximately 96.0% of overall population gains in recent periods.

Population projections indicate an above median growth for statistical areas nationally, with Croydon (NSW) expected to increase by 1,774 persons to 2041 based on aggregated SA2-level projections, reflecting a total increase of 15.0% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Croydon, placing the area among the bottom 25% of areas assessed nationally

Croydon has recorded approximately 24 residential properties granted approval per year. Between FY-21 and FY-25, around 123 homes were approved, with an additional 18 approved so far in FY-26. The average construction cost value for new properties is $681,000.

In FY-26, $70,000 in commercial development approvals have been recorded. Compared to Greater Sydney, Croydon has significantly less development activity, 55.0% below the regional average per person. The area's population has experienced decline, but new supply has likely kept up with demand. New building activity shows 59.0% standalone homes and 41.0% townhouses or apartments. Croydon indicates a mature market with around 361 people per approval.

Looking ahead, Croydon is expected to grow by 1,679 residents through to 2041. At current development rates, housing supply may struggle to match population growth, potentially heightening buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Croydon has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 39 projects that could affect the area. Key projects include Croydon Transport Oriented Development Precinct, The Carlyle Enfield, 15-33 Brighton Avenue Croydon Park, and Burwood Culture House. A list detailing those most relevant follows.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro West - Burwood North Station

Underground metro station on the 24 km Sydney Metro West line. Features two entrances on Burwood Road, north and south of Parramatta Road. Tunnelling is over 95% complete as of late 2025, with major contract signings in early 2026 for linewide trackwork and station fit-out. The station will support the Burwood North Metro Precinct rezoning, planned to deliver approximately 15,000 new homes. Expected to provide 20-minute travel times to the Sydney CBD upon completion in 2032.

Burwood Culture House

A city-shaping cultural hub transforming the former Burwood Library car park into a vibrant precinct. The development features a 250-seat theatre, multipurpose studios, a community lounge, and a new urban park with a public plaza, water play area, and garden terrace. Designed by CHROFI and Tyrrell Studio, the project integrates terracotta textures inspired by local heritage and includes a 50-space underground car park. A major partnership with the Museum of Contemporary Art Australia (MCA) will support programming at the site.

Sydney Metro Sydenham to Bankstown Conversion

The Sydenham to Bankstown conversion upgrades 13 kilometres of the century-old T3 Bankstown Line to modern metro standards. The project includes the installation of platform screen doors, mechanical gap fillers, and full accessibility upgrades across 10 stations. Once complete, the line will feature turn-up-and-go services every four minutes during peak periods. As of February 2026, high-speed testing is underway with multiple trains, and station upgrades are approximately 80% complete, focusing on final tiling, signage, and landscaping.

Croydon Transport Oriented Development Precinct

A state-led urban renewal initiative delivering high-density, mixed-use housing around Croydon Station. The project involves two distinct planning frameworks: the NSW Government TOD SEPP controls for the Inner West LGA (commenced January 2025) and a tailored alternative masterplan (Option 4) for the Burwood LGA side, which was finalised in February 2026. The combined precinct aims to deliver approximately 4,540 new homes (2,700 in Inner West and 1,840 in Burwood) over 15 years. Key features include buildings up to 10 storeys near the station, heritage protections for The Strand and Malvern Hill, enhanced active transport links, and a 2% affordable housing requirement for large developments.

WestConnex M4 East

5.5km twin three-lane motorway tunnels connecting the M4 at Homebush to Haberfield via Concord, part of the 33km WestConnex network. Known as Stage 1B of WestConnex, this was Australia's longest urban road tunnel at the time of completion. Features advanced safety systems and removes thousands of vehicles from surface roads, providing traffic-light free motorway connection. Opened July 13, 2019. Delivered by Leighton Contractors, Samsung and John Holland joint venture.

Cardinal Freeman Final Release Development - Wattle Building

The final stage of development at Cardinal Freeman retirement village, featuring the new Wattle building with 41 contemporary independent living apartments. This represents the last opportunity to secure brand-new apartments in this highly sought-after Inner West retirement community. Construction began April 2025 following demolition of the original Building One, with sales launching November 2025 and move-in Spring 2026.

NSW School Infrastructure Program - Inner West

Part of broader NSW school infrastructure program delivering new and upgraded schools across NSW. Includes funding for public school infrastructure improvements in Inner West region serving Croydon Park area students.

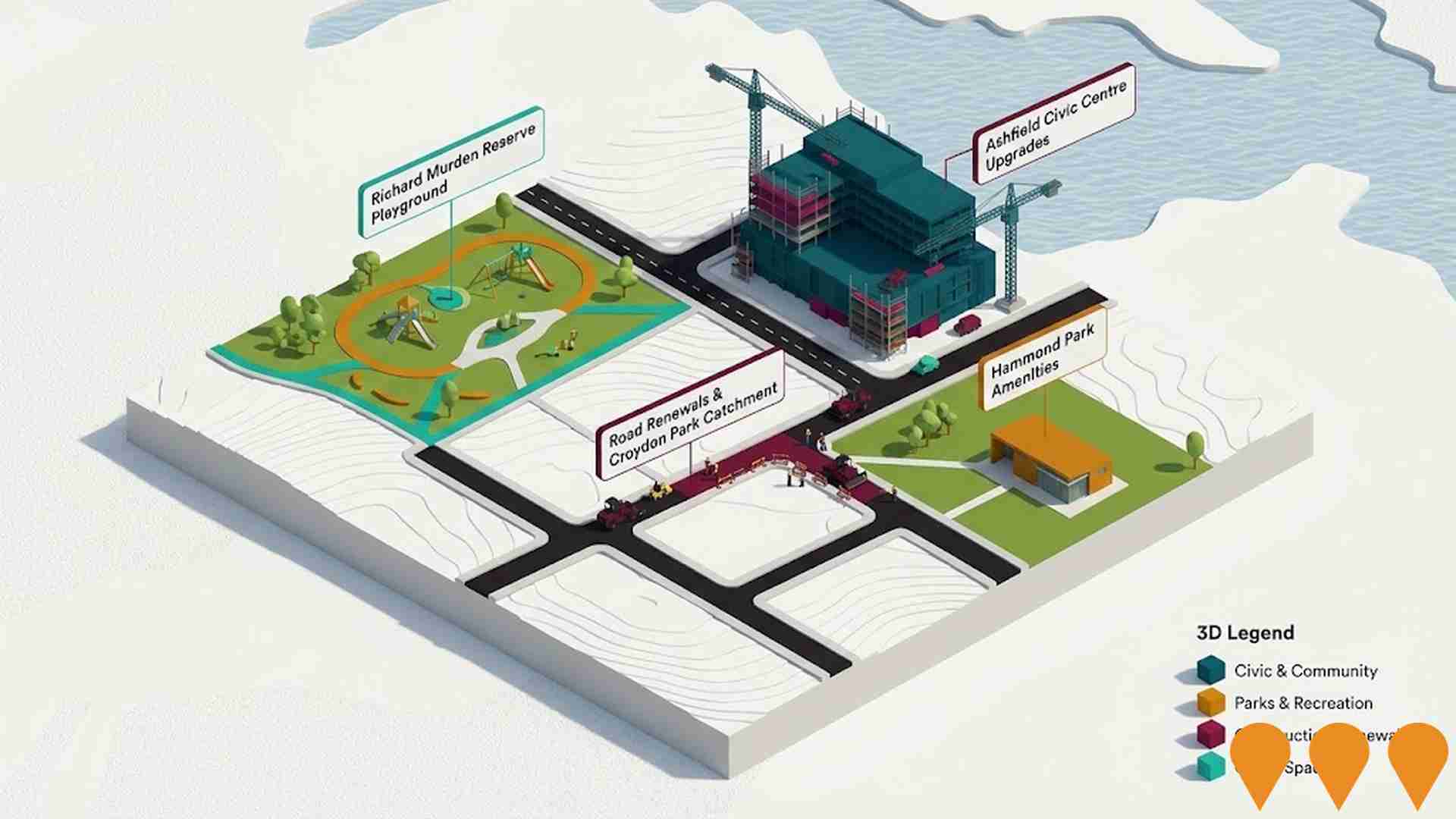

Inner West Council Infrastructure Program

Comprehensive infrastructure upgrade program including Richard Murden Reserve inclusive playground, Ashfield Civic Centre upgrades, Hammond Park amenities, and various road renewals across the Inner West including Croydon Park catchment.

Employment

The employment landscape in Croydon shows performance that lags behind national averages across key labour market indicators

Croydon has a highly educated workforce with the technology sector being notably represented. Its unemployment rate was 4.1% in September 2025, which is 0.1% lower than Greater Sydney's rate of 4.2%.

Workforce participation was 57.8%, slightly below Greater Sydney's 60.0%. Key employment industries among residents are health care & social assistance, professional & technical services, and education & training. Croydon has a particular specialization in education & training, with an employment share 1.4 times the regional level. Conversely, construction shows lower representation at 6.4% compared to the regional average of 8.6%.

The area offers limited local employment opportunities as indicated by the difference between Census working population and resident population. Over the year to September 2025, labour force levels increased by 0.3%, while employment decreased by 0.2%, causing the unemployment rate to rise by 0.5 percentage points. In contrast, Greater Sydney experienced employment growth of 2.1% and labour force growth of 2.4%, with a 0.2 percentage point rise in unemployment. State-level data from 25-Nov shows NSW employment contracted by 0.03%, losing 2,260 jobs, with the state unemployment rate at 3.9%. National employment forecasts from May-25 project national growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Croydon's employment mix suggests local employment should increase by 7.0% over five years and 14.2% over ten years, though this is a simple extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

According to AreaSearch's aggregation of ATO data released for financial year ended June 2023, Croydon had a median taxpayer income of $56,480 and an average income of $77,952. Nationally, the median was $60,817 and the average was $83,003. By September 2025, estimated incomes would be approximately $61,484 (median) and $84,859 (average), based on Wage Price Index growth of 8.86%. From the Australian Bureau of Statistics Census conducted in August 2021, Croydon's household income ranked at the 75th percentile ($2,157 weekly) and personal income at the 56th percentile. The predominant income cohort was 28.4% (3,170 people) earning $1,500 - $2,999 weekly, similar to Greater Sydney's 30.9%. High-income households (exceeding $3,000 weekly) comprised 35.1%, indicating strong consumer spending. Housing costs consumed 16.4% of income, but disposable income remained high at the 75th percentile. Croydon's SEIFA income ranking placed it in the 8th decile.

Frequently Asked Questions - Income

Housing

Croydon displays a diverse mix of dwelling types, with above-average rates of outright home ownership

Croydon's dwelling structures, as per the latest Census, consisted of 54.9% houses and 45.1% other dwellings (semi-detached, apartments, 'other' dwellings). This contrasts with Sydney metro's structure of 33.5% houses and 66.5% other dwellings. Home ownership in Croydon stood at 36.2%, with mortgaged dwellings at 33.0% and rented ones at 30.9%. The median monthly mortgage repayment was $2,700, higher than Sydney metro's average of $2,436. Median weekly rent in Croydon was $480, compared to Sydney metro's $465. Nationally, Croydon's mortgage repayments were significantly higher at $1,863 and rents substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Croydon features high concentrations of group households, with a higher-than-average median household size

Family households constitute 73.2% of all households, including 37.6% couples with children, 23.3% couples without children, and 10.9% single parent families. Non-family households comprise the remaining 26.8%, with lone person households at 22.7% and group households making up 4.1%. The median household size is 2.7 people, larger than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Croydon shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Croydon's educational attainment exceeds national averages significantly. Among residents aged fifteen or above, 44.9% hold university qualifications compared to Australia's 30.4% and NSW's 32.2%, indicating a substantial educational advantage for the area. Bachelor degrees are most prevalent at 28.3%, followed by postgraduate qualifications (13.5%) and graduate diplomas (3.1%). Vocational pathways account for 21.5% of qualifications, with advanced diplomas at 9.7% and certificates at 11.8%.

Educational participation is high, with 30.2% currently enrolled in formal education. This includes 8.4% in primary education, 7.9% in tertiary education, and 7.8% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Croydon has 92 active public transport stops, offering a mix of train and bus services. These stops are served by 48 individual routes, collectively facilitating 5,953 weekly passenger trips. Transport accessibility is rated excellent, with residents typically located 141 meters from the nearest stop.

Service frequency averages 850 trips per day across all routes, equating to approximately 64 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Croydon is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Croydon shows above-average health outcomes for both young and elderly residents, with low prevalence of common health conditions.

Approximately 58% (~6,441 people) have private health cover, which is very high. The most prevalent medical conditions are arthritis (6.6%) and mental health issues (6.2%). About 72.6% of residents report no medical ailments, compared to 77.0% in Greater Sydney. Residents aged 65 and over comprise 20.8% (2,321 people), higher than the 14.5% in Greater Sydney. Health outcomes among seniors are strong, similar to those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Croydon is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Croydon has a high level of cultural diversity, with 42.9% of its population born overseas and 46.7% speaking a language other than English at home. Christianity is the predominant religion in Croydon, accounting for 51.1% of people. Notably, Buddhism is overrepresented in Croydon compared to Greater Sydney, comprising 5.1% versus 6.2%.

The top three ancestry groups based on country of birth of parents are Chinese (18.5%), Australian (14.0%), and English (13.8%). Some ethnic groups have notable divergences in representation: Lebanese is overrepresented at 4.5% compared to the regional average of 3.1%, Korean at 1.6% versus 2.8%, and Croatian at 1.4% compared to 0.7%.

Frequently Asked Questions - Diversity

Age

Croydon's median age exceeds the national pattern

The median age in Croydon is 42 years, which is significantly higher than Greater Sydney's average of 37 years, and also older than Australia's median age of 38 years. The proportion of the population aged 85 and above is 4.5% in Croydon, compared to Greater Sydney. Meanwhile, the percentage of people aged 35-44 is lower at 12.3%. According to post-2021 Census data, the age group of 15-24 has increased from 11.8% to 14.1%, while the 5-14 age group has decreased from 10.9% to 9.5%. Population forecasts for 2041 suggest substantial demographic changes in Croydon. Notably, the 35-44 age group is projected to grow by 62%, adding 850 people to reach a total of 2,223 from 1,372 currently. The combined 65+ age groups are expected to account for 61% of the total population growth, reflecting Croydon's aging demographic profile. In contrast, the 0-4 and 5-14 age cohorts are projected to experience population declines.