Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Summer Hill is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

As of November 2025, the estimated population of Summer Hill (Inner West - NSW) statistical area (Lv2) is around 7,648. This reflects an increase of 360 people since the 2021 Census, which reported a population of 7,288. The change was inferred from AreaSearch's estimate of resident population at 7,608 following examination of ABS's latest ERP data release (June 2024), and an additional 25 validated new addresses since the Census date. This level of population equates to a density ratio of 6,373 persons per square kilometer, placing Summer Hill in the top 10% nationally according to AreaSearch. The area's 4.9% growth since census is within 1.4 percentage points of its SA4 region (6.3%), indicating competitive growth fundamentals. Overseas migration was the primary driver of population gains recently.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections from 2022 with a base year of 2021 are utilized. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. By 2041, the area's population is projected to decline by 329 persons according to this methodology. However, specific age cohorts like the 75 to 84 group are expected to grow, with projections indicating an increase of 143 people in this age bracket over this period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Summer Hill is very low in comparison to the average area assessed nationally by AreaSearch

AreaSearch analysis of ABS building approval numbers in Summer Hill shows around 10 residential properties granted approval per year. Over the past five financial years, from FY21 to FY25, approximately 51 homes were approved, with a further three approved so far in FY26. This results in an average of about 0.6 new residents per year per dwelling constructed during this period, indicating that supply is meeting or exceeding demand and supporting potential population growth while offering greater buyer choice.

The average construction cost value of new homes is around $934,000, suggesting a focus on the premium market with high-end developments. In FY26, $40.1 million in commercial approvals have been registered, indicating robust local business investment. Compared to Greater Sydney, Summer Hill has substantially reduced construction levels, at 73.0% below the regional average per person, which typically strengthens demand and prices for existing properties. This activity is also lower than the national average, reflecting market maturity and possible development constraints. Recent construction comprises approximately 22.0% standalone homes and 78.0% attached dwellings, offering affordable entry pathways and attracting downsizers, investors, and first-time purchasers. The location has about 2167 people per dwelling approval, demonstrating an established market with population projections showing stability or decline, which should reduce housing demand pressures and benefit potential buyers.

With population projections showing stability or decline, Summer Hill should see reduced housing demand pressures, benefiting potential buyers.

Frequently Asked Questions - Development

Infrastructure

Summer Hill has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

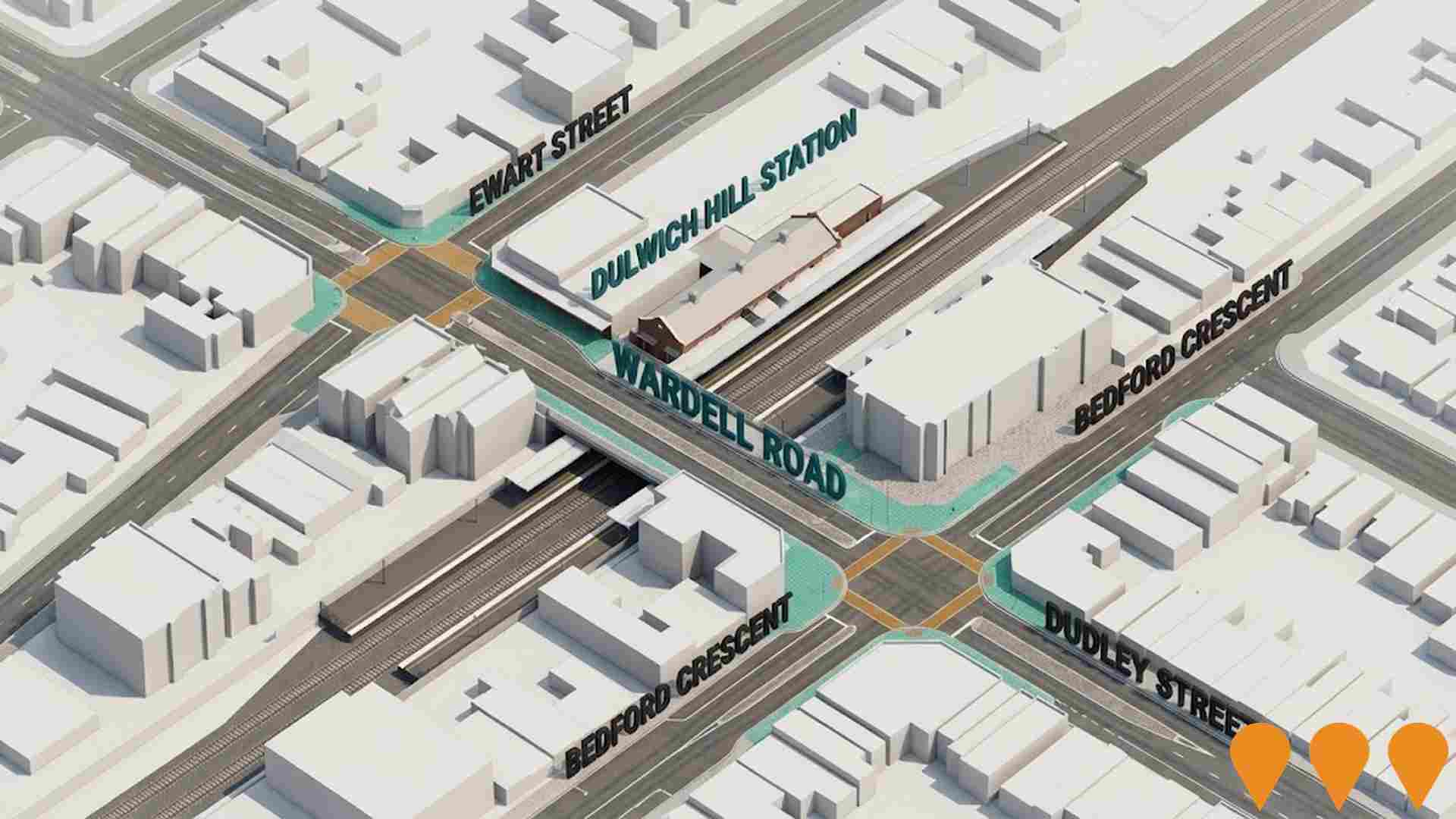

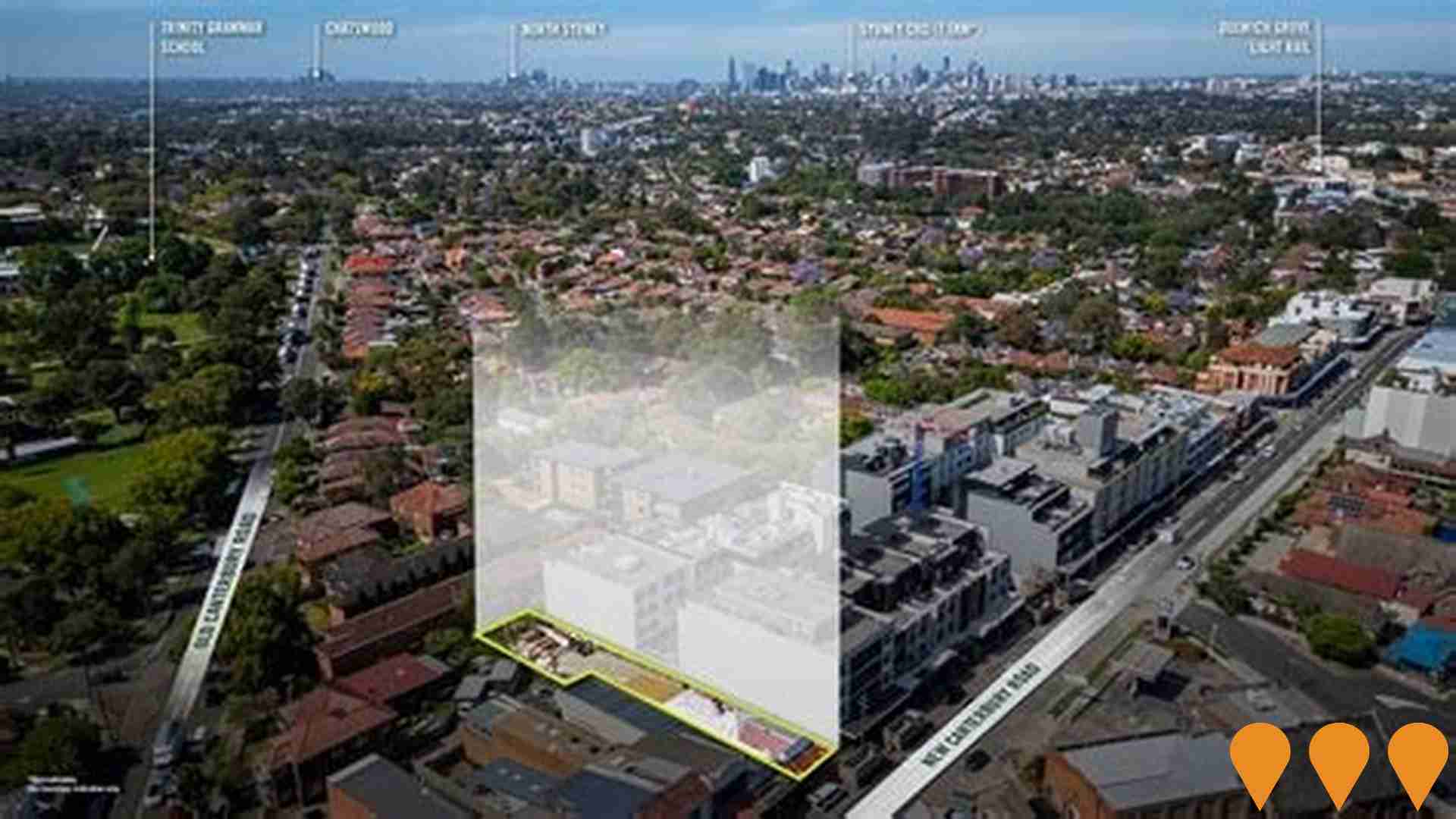

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 23 projects potentially affecting this region. Notable ones include Sydney Metro Sydenham to Bankstown Conversion, 845-847 New Canterbury Road Development, Our Fairer Future Plan (Housing Investigation Areas), and Dulwich Hill Station Precinct Public Domain Improvements. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro Sydenham to Bankstown Conversion

The Sydenham to Bankstown conversion upgrades 13 kilometres of the century-old T3 Bankstown Line to modern metro standards. The project includes the installation of platform screen doors, mechanical gap fillers, and full accessibility upgrades across 10 stations. Once complete, the line will feature turn-up-and-go services every four minutes during peak periods. As of February 2026, high-speed testing is underway with multiple trains, and station upgrades are approximately 80% complete, focusing on final tiling, signage, and landscaping.

Our Fairer Future Plan (Housing Investigation Areas)

A comprehensive Council-led housing strategy and alternative to NSW Government TOD reforms. The plan focuses on Housing Investigation Areas around transport nodes including Ashfield, Croydon, Dulwich Hill, Marrickville, and the Parramatta Road corridor. It aims to deliver 20,000 to 30,000 new homes over 15 years through masterplanned density increases, supported by a $500 million community infrastructure fund for new parks, plazas, and multi-purpose facilities.

The Flour Mill of Summer Hill

A significant urban renewal, master-planned community development transforming the former Allied Mills Flour Mill site. Features 360 apartments and terrace houses, heritage restoration including the iconic silos and former flour mill bakery building, ground-floor retail and commercial spaces, and new public plazas connected to the Lewisham West Light Rail and Summer Hill Station. The final stage was completed in early 2019.

Inner West Light Rail Extension

5.6km light rail extension from Lilyfield to Dulwich Hill with 9 new stops including Taverners Hill (near Summer Hill). Part of Sydney's expanding light rail network providing improved public transport connectivity for the Inner West.

Alterations and Additions to Ashfield Mall

Completed redevelopment of Ashfield Mall including 6,464 sqm of retail space, 67 serviced apartments (Ashfield Central), 101 residential dwellings, a 100-place childcare centre, and associated car parking. The project was completed in stages with retail expansion and childcare centre opening in 2017, and Ashfield Central serviced apartments completed in early 2018.

The Flour Mill of Summer Hill

The Flour Mill of Summer Hill is a completed master-planned community redevelopment of the former Allied Mills Flour Mill site, including adaptive reuse of heritage industrial buildings like the Mungo Scott Building and silos. The project delivered 360 apartments and terraces, along with retail and commercial space, and public open space dedicated to Council. It is located near Summer Hill Station and the Lewisham West light rail stop.

NSW School Infrastructure Program - Inner West

Part of broader NSW school infrastructure program delivering new and upgraded schools across NSW. Includes funding for public school infrastructure improvements in Inner West region serving Croydon Park area students.

Inner West GreenWay (Cooks to Cove)

A 6-kilometre environmental and active travel corridor linking the Cooks River at Earlwood with Iron Cove at Balmain. The $58 million project features shared cycling and walking paths, public art, cultural sites, cafes, playgrounds, off-leash dog parks, community gardens, biodiversity areas, wetlands, sustainable transport infrastructure, and active transport connectivity. Construction is 80% complete as of May 2025, with opening expected later in 2025. The project is funded by $41 million from NSW Government, $11 million from Inner West Council, and $6 million from Commonwealth Government, creating connected green infrastructure benefiting communities including Croydon Park.

Employment

Employment conditions in Summer Hill remain below the national average according to AreaSearch analysis

Summer Hill has a highly educated workforce, with the technology sector prominently represented. Its unemployment rate is 4.4%, according to AreaSearch's aggregation of statistical area data.

As of September 2025, there are 4,877 residents employed, with an unemployment rate of 4.6% compared to Greater Sydney's 4.2%. Workforce participation in Summer Hill stands at 71.7%, exceeding Greater Sydney's 60.0%. The dominant employment sectors among residents include professional & technical, health care & social assistance, and education & training. Notably, the area has a high concentration of professional & technical jobs, with levels at 1.4 times the regional average.

Conversely, construction shows lower representation at 4.4% compared to the regional average of 8.6%. The predominantly residential area appears to offer limited local employment opportunities, as indicated by the difference between Census working population and resident population numbers. Over the 12 months to September 2025, labour force levels decreased by 0.4%, while employment declined by 1.0% in Summer Hill, causing the unemployment rate to rise by 0.6 percentage points. In contrast, Greater Sydney experienced employment growth of 2.1% and labour force growth of 2.4%. State-level data for NSW up to 25-Nov shows employment contracted by 0.03%, with a state unemployment rate of 3.9%. This compares favourably to the national unemployment rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that over five years, employment is expected to expand by 6.6% nationally, while over ten years, it is projected to increase by 13.7%. Applying these industry-specific projections to Summer Hill's employment mix suggests local employment should increase by 7.3% over five years and 14.6% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

According to AreaSearch's aggregation of ATO data released for financial year 2023, Summer Hill had a median income among taxpayers of $75,604 and an average level of $118,015. These figures place Summer Hill in the top percentile nationally, compared to Greater Sydney's levels of $60,817 and $83,013 respectively. Based on Wage Price Index growth of 8.86% from financial year 2023 to September 2025, estimated median income is approximately $82,303 and average income is around $128,471. The 2021 Census figures show that Summer Hill's household, family, and personal incomes rank between the 81st and 94th percentiles nationally. Income distribution in Summer Hill indicates that 34.1% of individuals earn within the $1,500 - $2,999 range, aligning with regional trends where this cohort represents 30.9%. Notably, 36.0% of residents earn over $3,000 per week, supporting premium retail and service offerings. Despite high housing costs consuming 18.1% of income, strong earnings place disposable income at the 77th percentile nationally. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Summer Hill features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

In Summer Hill, as per the latest Census evaluation, 19.6% of dwellings were houses while 80.3% consisted of other types such as semi-detached homes, apartments, and 'other' dwellings. In contrast, Sydney metropolitan area had 33.5% houses and 66.5% other dwellings. Home ownership in Summer Hill stood at 21.4%, with mortgaged dwellings at 28.3% and rented ones at 50.3%. The median monthly mortgage repayment in the area was $2,708, exceeding Sydney metro's average of $2,436. The median weekly rent figure for Summer Hill was recorded at $460, slightly higher than Sydney metro's $465. Nationally, Summer Hill's mortgage repayments were significantly higher compared to the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Summer Hill features high concentrations of group households and lone person households, with a lower-than-average median household size

Family households constitute 59.3% of all households, including 23.2% couples with children, 26.4% couples without children, and 8.3% single parent families. Non-family households account for the remaining 40.7%, with lone person households making up 34.2% and group households comprising 6.7%. The median household size is 2.1 people, which is smaller than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Summer Hill demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Summer Hill's residents aged 15 and above have a higher university qualification rate at 57.7%, compared to Australia's 30.4% and NSW's 32.2%. This is due to a high proportion of Bachelor degrees (36.3%), postgraduate qualifications (17.0%), and graduate diplomas (4.4%). Vocational pathways account for 19.6%, including advanced diplomas (9.4%) and certificates (10.2%). Educational participation is notably high, with 27.7% currently enrolled in formal education, comprising tertiary education (8.8%), primary education (6.7%), and secondary education (5.4%).

Educational participation is notably high, with 27.7% of residents currently enrolled in formal education. This includes 8.8% in tertiary education, 6.7% in primary education, and 5.4% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Summer Hill has 35 active public transport stops, offering a mix of train and bus services. These stops are served by 30 different routes, collectively facilitating 4,890 weekly passenger trips. The area's transport accessibility is rated excellent, with residents typically located 160 meters from the nearest stop.

Services run an average of 698 trips per day across all routes, equating to approximately 139 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Summer Hill is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Summer Hill shows better-than-average health results, with both younger and older age groups experiencing low rates of common health conditions. Approximately 73% of its total population of 5,612 people have private health cover, compared to Greater Sydney's 57.8% and the national average of 55.7%. Mental health issues and asthma are the most prevalent medical conditions in the area, affecting 11.3% and 7.9% of residents respectively.

70.2% of residents report no medical ailments, compared to 77.0% across Greater Sydney. The area has 12.3% of residents aged 65 and over (940 people), lower than Greater Sydney's 14.5%. Despite this, health outcomes among seniors in Summer Hill are strong and align with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Summer Hill was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Summer Hill's population was found to be more culturally diverse than most local markets, with 33.5% born overseas and 27.2% speaking a language other than English at home. Christianity was the predominant religion in Summer Hill, comprising 35.3%. Judaism, however, was overrepresented at 0.5%, compared to 0.2% across Greater Sydney.

The top three ancestry groups were English (20.7%), Australian (16.8%), and Other (12.5%). These figures were substantially higher than the regional averages of 12.9%, 11.5%, and 17.6%, respectively. Notably, Hungarian was overrepresented at 0.6% compared to the regional average of 0.3%. Korean and Welsh also showed notable divergences, with Korean at 1.5% (vs 2.8%) and Welsh at 0.8% (vs 0.3%).

Frequently Asked Questions - Diversity

Age

Summer Hill's population is slightly younger than the national pattern

Summer Hill's median age is 36 years, nearly matching Greater Sydney's average of 37 years, which is slightly below Australia's median age of 38 years. Compared to Greater Sydney, Summer Hill has a higher proportion of residents aged 25-34 (23.1%) but fewer residents aged 5-14 (7.6%). This concentration of 25-34 year-olds is significantly higher than the national average of 14.5%. According to the 2021 Census, Summer Hill's population has shifted slightly since then, with the 15-24 age group growing from 9.8% to 11.2%, while the 45-54 cohort has declined from 13.7% to 12.4%. By 2041, demographic projections suggest Summer Hill's age profile will change significantly. The 75-84 age group is expected to grow by 44%, adding 131 residents to reach a total of 430. Residents aged 65 and above are projected to drive 98% of population growth, reflecting broader demographic aging trends. Conversely, the 45-54 and 0-4 age groups are expected to experience population declines.