Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Wareemba is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

As of November 2025, the estimated population of the Wareemba statistical area (Lv2) is around 1,541 people. This figure reflects an increase from the 2021 Census total of 1,519 people, marking a rise of approximately 22 individuals or 1.4%. The recent resident population estimate of 1,536 by AreaSearch, following examination of the June 2024 ABS ERP data release and validation of additional addresses since the Census date, supports this growth trend. This results in a high population density ratio of 4,815 persons per square kilometer, placing Wareemba (SA2) within the top 10% of national locations assessed by AreaSearch. Overseas migration has been the primary driver for population growth in the area, contributing roughly 75.0% of overall population gains during recent periods.

For future projections until 2041, AreaSearch is utilising ABS/Geoscience Australia projections released in 2024 with a base year of 2022 for SA2 areas covered by this data. For areas not covered, NSW State Government's SA2 level projections released in 2022 with a base year of 2021 are being used. Applying growth rates from these aggregations to all areas until 2041, AreaSearch anticipates lower quartile growth for statistical areas analysed, projecting an increase of approximately 61 persons by the year 2041. This reflects a total increase of about 4.7% over the 17-year period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Wareemba is very low in comparison to the average area assessed nationally by AreaSearch

AreaSearch analysis of ABS building approval numbers in Wareemba shows an average of approximately 8 new dwelling approvals per year over the past five financial years, totalling around 42 homes. As of FY-26, 79 approvals have been recorded. The population has fallen during this period, suggesting that new supply is likely keeping pace with demand and offering good choice to buyers. The average value of new homes being built is $913,000, indicating that developers are targeting the premium market segment with higher-end properties.

This financial year, $2.0 million in commercial approvals have been registered, suggesting minimal commercial development activity. Compared to Greater Sydney, Wareemba records 14.0% less building activity per person and ranks among the 26th percentile of areas assessed nationally, indicating more limited choices for buyers and supporting demand for existing homes. The new development consists of 33.0% detached dwellings and 67.0% townhouses or apartments, offering affordable entry pathways and attracting downsizers, investors, and first-time purchasers. This represents a notable shift from the area's existing housing composition, which is currently 56.0% houses, suggesting decreasing availability of developable sites and reflecting changing lifestyles and demand for more diverse, affordable housing options. With around 618 people per dwelling approval, Wareemba reflects a highly mature market.

Population forecasts indicate that Wareemba will gain approximately 72 residents by 2041, based on the latest AreaSearch quarterly estimate. Given current construction levels, housing supply should adequately meet demand, creating favourable conditions for buyers and potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Wareemba has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified one major project likely affecting this region. Key projects include Parramatta Road Corridor Urban Transformation Strategy (PRCUTS) Stage 2, TOGA Five Dock Mixed-Use Masterplan, Kings Bay Village, and Five Dock Station - Sydney Metro West.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro West

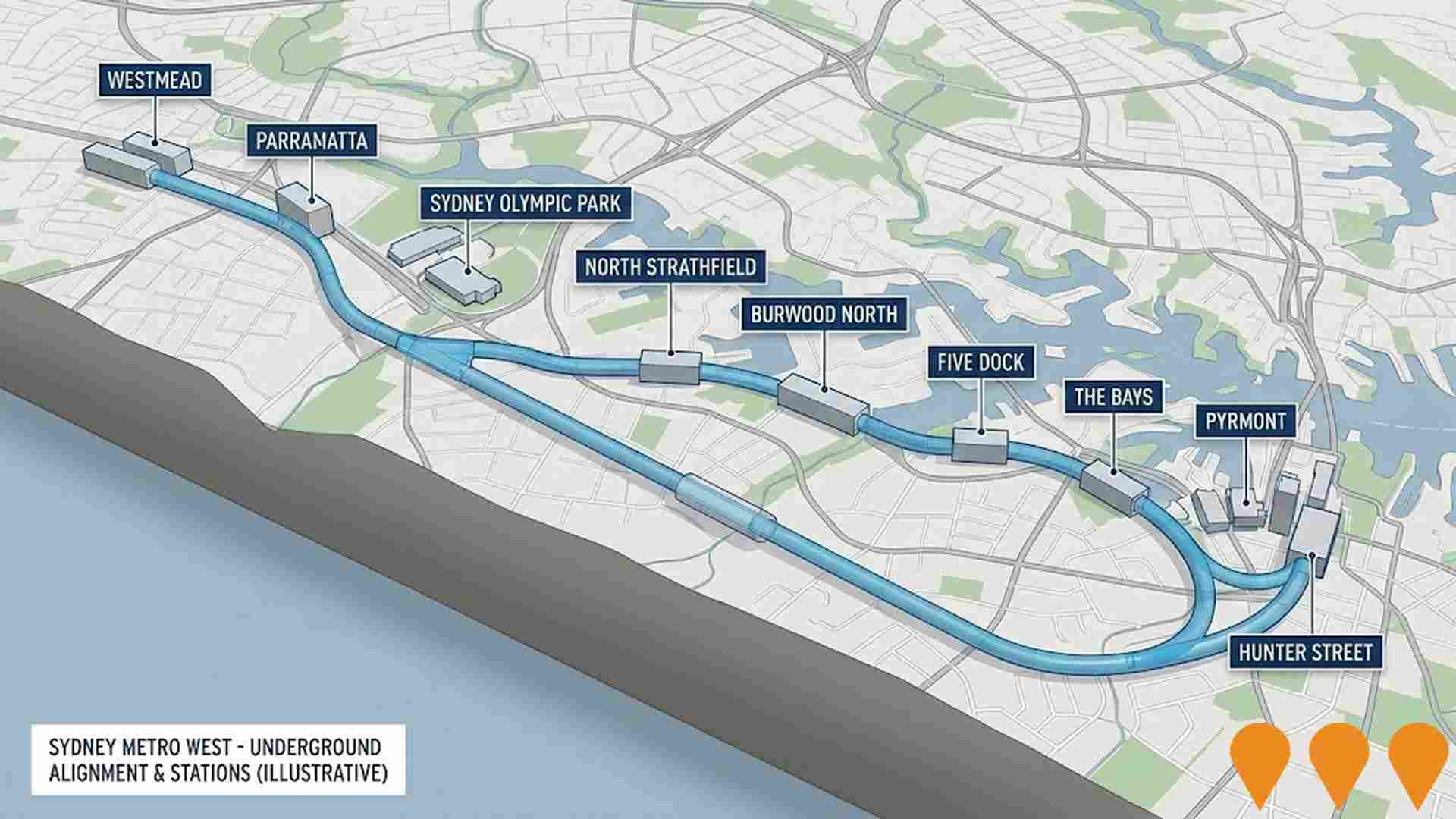

Sydney Metro West is a 24-kilometre underground driverless railway connecting Westmead to the Sydney CBD. As of February 2026, the project has reached significant milestones including the completion of the landmark tunnelling program, with work transitioning to station construction and line-wide fit-out. Key contracts for trains, maintenance, and operations (TSMO) and line-wide systems have been awarded to the Metro Trains West and John Holland respectively. The project features nine new stations, including an integrated precinct at Hunter Street, and aims to double rail capacity between Greater Parramatta and the CBD by its target opening in 2032.

Concord Hospital Redevelopment Stage 1

The $341 million Stage 1 redevelopment delivered the Rusty Priest Centre for Rehabilitation and Aged Care, a new eight-storey clinical services building. Key features include 214 beds, a comprehensive cancer centre, aged health and rehabilitation services, and Australia's first National Centre for Veterans' Healthcare. It also includes ambulatory care clinics, therapy areas, and specialised rehabilitation gyms, linked to the existing hospital via a three-storey atrium.

Parramatta Road Urban Amenity Improvement Program

A $198 million NSW Government initiative (PRUAIP) revitalizing the 20km Parramatta Road corridor through 32 urban amenity projects across six local government areas. The program delivers significant public domain upgrades including over 10,000 new trees, separated cycleways, wider footpaths, and new urban plazas. Major works include the extension of Auburn Park, streetscape improvements in Homebush, and active transport links from Concord to the Bay Run. As of early 2026, while many streetscape and public art components are complete, key infrastructure stages including pedestrian fencing and signalized crossing upgrades remain under construction.

Five Dock Station - Sydney Metro West

Five Dock Station is a key underground stop on the 24km Sydney Metro West line, providing a 20-minute link between Parramatta and the Sydney CBD. Located beneath the Five Dock town centre with a single entrance at Fred Kelly Place, the station features dual island platforms and full accessibility via lifts. Following the completion of cavern excavation in 2024, works in 2025 and 2026 focus on station fit-out, utility relocations, and mechanical and electrical installations. The project aims to revitalise the local precinct while doubling rail capacity on the corridor.

Sydney Metro West - Trains, Systems, Maintenance and Operations

The Trains, Systems, Maintenance and Operations (TSMO) package is a 22-year contract to deliver the core infrastructure for Sydney Metro West. It includes the procurement of 16 next-generation driverless trains, installation of 60km of track, advanced signaling, and the construction of a 38-hectare maintenance facility at Clyde. The project also covers 15 years of network operation and maintenance following the line's opening. As of 2026, contracts have been finalized, and design integration is being led by an AECOM-WSP joint venture to support the shift from tunneling to track-laying and systems installation.

WestConnex M4-M5 Link

The WestConnex M4-M5 Link is a critical 7.5km twin-tunnel motorway connecting the M4 at Haberfield to the M8 at St Peters. It forms the central 'missing link' of the WestConnex network, featuring four lanes in each direction and the complex Rozelle Interchange. The project bypasses 52 sets of traffic lights and reduces travel times between Parramatta and Sydney Airport by up to 40 minutes.

Sydney Metro Sydenham to Bankstown Conversion

The Sydenham to Bankstown conversion upgrades 13 kilometres of the century-old T3 Bankstown Line to modern metro standards. The project includes the installation of platform screen doors, mechanical gap fillers, and full accessibility upgrades across 10 stations. Once complete, the line will feature turn-up-and-go services every four minutes during peak periods. As of February 2026, high-speed testing is underway with multiple trains, and station upgrades are approximately 80% complete, focusing on final tiling, signage, and landscaping.

Our Fairer Future Plan (Housing Investigation Areas)

A comprehensive Council-led housing strategy and alternative to NSW Government TOD reforms. The plan focuses on Housing Investigation Areas around transport nodes including Ashfield, Croydon, Dulwich Hill, Marrickville, and the Parramatta Road corridor. It aims to deliver 20,000 to 30,000 new homes over 15 years through masterplanned density increases, supported by a $500 million community infrastructure fund for new parks, plazas, and multi-purpose facilities.

Employment

Employment performance in Wareemba exceeds national averages across key labour market indicators

Wareemba has a highly educated workforce, with the technology sector notably represented. The unemployment rate as of September 2025 is 2.9%, lower than Greater Sydney's 4.2%.

There are 772 residents in work, and the workforce participation rate is similar to Greater Sydney's at 60.0%. Dominant employment sectors include professional & technical, finance & insurance, and health care & social assistance. Finance & insurance stands out with an employment share of 1.5 times the regional level, while retail trade is under-represented at 5.2% compared to Greater Sydney's 9.3%. The area offers limited local employment opportunities, as indicated by Census data comparing working population and resident population.

Between September 2024 and September 2025, Wareemba's labour force decreased by 0.4%, with employment declining by 1.0% leading to a rise in unemployment of 0.6 percentage points. In contrast, Greater Sydney saw employment grow by 2.1%. State-level data from NSW to 25-Nov-25 shows employment contracted by 0.03%, with an unemployment rate of 3.9%. National employment forecasts from Jobs and Skills Australia project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Wareemba's employment mix suggests local employment should increase by 7.0% over five years and 14.1% over ten years, though this is a simplified extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows Wareemba's median income among taxpayers is $63,458. The average income is $95,212. These figures are among the highest in Australia. Greater Sydney's median income is $60,817 with an average of $83,013. Based on Wage Price Index growth of 8.86% since financial year 2023, current estimates for Wareemba would be approximately $69,080 (median) and $103,648 (average) as of September 2025. Census data reveals household, family and personal incomes in Wareemba rank highly nationally, between the 81st and 83rd percentiles. The $4000+ income bracket dominates with 29.0% of residents. Unlike regional trends where 30.9% fall within the $1,500 - 2,999 range, higher earners represent a substantial presence in Wareemba with 40.4% exceeding $3,000 weekly. High housing costs consume 16.2% of income. Despite this, strong earnings place disposable income at the 81st percentile nationally. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Wareemba displays a diverse mix of dwelling types, with above-average rates of outright home ownership

Dwelling structure in Wareemba, as per the latest Census, consisted of 55.7% houses and 44.4% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Sydney metro's 37.8% houses and 62.2% other dwellings. Home ownership in Wareemba stood at 43.0%, with mortgaged dwellings at 28.2% and rented ones at 28.9%. The median monthly mortgage repayment was $3,033, higher than Sydney metro's average of $3,000. Median weekly rent in Wareemba was $600, compared to Sydney metro's $560. Nationally, Wareemba's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Wareemba has a typical household mix, with a higher-than-average median household size

Family households account for 72.5% of all households, including 36.2% couples with children, 25.2% couples without children, and 10.3% single parent families. Non-family households constitute the remaining 27.5%, with lone person households at 24.8% and group households comprising 1.7%. The median household size is 2.6 people, which is larger than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Wareemba shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's university qualification rate is 37.3%, significantly lower than the SA4 region average of 49.5%. Bachelor degrees are most common at 26.6%, followed by postgraduate qualifications (9.0%) and graduate diplomas (1.7%). Vocational credentials are prevalent, with 28.3% of residents aged 15+ holding them - advanced diplomas at 12.5% and certificates at 15.8%. Educational participation is high, with 26.9% of residents currently enrolled in formal education.

This includes 9.4% in primary education, 7.7% in secondary education, and 4.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows five active stops operating in Wareemba, offering a mix of bus services. These stops are served by twelve distinct routes, collectively facilitating 1967 weekly passenger trips. Transport accessibility is rated excellent, with residents typically situated 128 metres from the nearest stop.

Service frequency averages 281 trips daily across all routes, equating to approximately 393 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Wareemba is notably higher than the national average with prevalence of common health conditions low among the general population though higher than the nation's average across older, at risk cohorts

Wareemba shows better-than-average health outcomes, with lower prevalence of common conditions among its general population compared to national averages, but higher in older, at-risk cohorts. Private health cover is exceptionally high here, with 64% of the total population (993 people) having it, compared to Greater Sydney's 69.2%. Nationally, this figure stands at 55.7%.

The most prevalent conditions are arthritis and asthma, affecting 8.8% and 6.3% of residents respectively. 72% of residents report no medical ailments, compared to Greater Sydney's 76.3%. Wareemba has a higher proportion of seniors aged 65 and over at 21.8% (335 people), compared to Greater Sydney's 18.4%. Health outcomes among seniors require more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Wareemba was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Wareemba's population showed higher cultural diversity than most nearby markets, with 29.7% born overseas and 29.4% speaking a language other than English at home. Christianity was the predominant religion in Wareemba, accounting for 70.8%, compared to 57.1% across Greater Sydney. The top three ancestral groups were Italian (23.2%), English (18.6%), and Australian (18.1%).

Notably, Spanish (0.9%) was slightly overrepresented compared to the regional average of 0.8%. Similarly, Greek representation stood at 3.7%, higher than the regional 3.1%. Croatian ancestry also had a notable presence at 0.9%, matching the regional figure.

Frequently Asked Questions - Diversity

Age

Wareemba hosts a notably older demographic compared to the national average

The median age in Wareemba is 43 years, which is higher than Greater Sydney's average of 37 years and exceeds the national average of 38 years. The age profile shows that those aged 75-84 years make up 7.9%, while those aged 25-34 years comprise 9.5%. Between 2021 and present, the proportion of individuals aged 15-24 has increased from 9.7% to 12.0%, while the percentage of those aged 25-34 has decreased from 10.6% to 9.5%. By 2041, demographic projections indicate significant shifts in Wareemba's age structure. The number of individuals aged 75-84 is projected to rise by 69 people (57%), from 121 to 191. Notably, the combined age groups of 65 and above will account for 91% of total population growth. Conversely, the age cohorts of 45-54 years and 25-34 years are expected to experience population declines.