Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Bowen are above average based on AreaSearch's ranking of recent, and medium to long-term trends

Based on ABS population updates and AreaSearch validation, as of Nov 2025, Bowen's estimated population is around 12,605. This reflects an increase of 1,400 people since the 2021 Census, which reported a population of 11,205. The change was inferred from AreaSearch's estimate of 12,438 residents following examination of ABS's latest ERP data release (June 2024) and an additional 95 validated new addresses since the Census date. This level of population equates to a density ratio of 7.0 persons per square kilometer. Bowen's growth rate of 12.5% since the 2021 census exceeded both the SA4 region (7.8%) and non-metro areas, marking it as a regional growth leader. Interstate migration contributed approximately 51.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. These state projections do not provide age category splits; hence proportional growth weightings aligned with ABS Greater Capital Region projections (released in 2023, based on 2022 data) for each age cohort are applied where utilised. Looking ahead, an above median population growth is projected for the Bowen statistical area (Lv2), with an expected increase of 2,883 persons to 2041, reflecting a total increase of 21.4% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Bowen among the top 25% of areas assessed nationwide

AreaSearch analysis of ABS building approval numbers allocated from statistical area data indicates Bowen has experienced around 43 dwellings receiving development approval each year. Over the past 5 financial years, between FY-21 and FY-25, approximately 218 homes were approved, with an additional 14 approved so far in FY-26. On average, 7.1 new residents per year arrive per dwelling constructed over these years.

This indicates demand significantly exceeds new supply, typically leading to price growth and increased buyer competition. Developers target the premium market segment, with new dwellings developed at an average expected construction cost of $992,000.

In FY-26, $7.3 million in commercial development approvals have been recorded, suggesting the area's residential character. New development consists of 71.0% detached houses and 29.0% townhouses or apartments, maintaining Bowen's traditional low density character focused on family homes appealing to those seeking space. With around 238 people per dwelling approval, Bowen shows a developing market. Population forecasts indicate Bowen will gain 2,699 residents through to 2041, based on the latest AreaSearch quarterly estimate. Should current construction levels persist, housing supply could lag population growth, likely intensifying buyer competition and underpinning price growth.

Frequently Asked Questions - Development

Infrastructure

Bowen has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

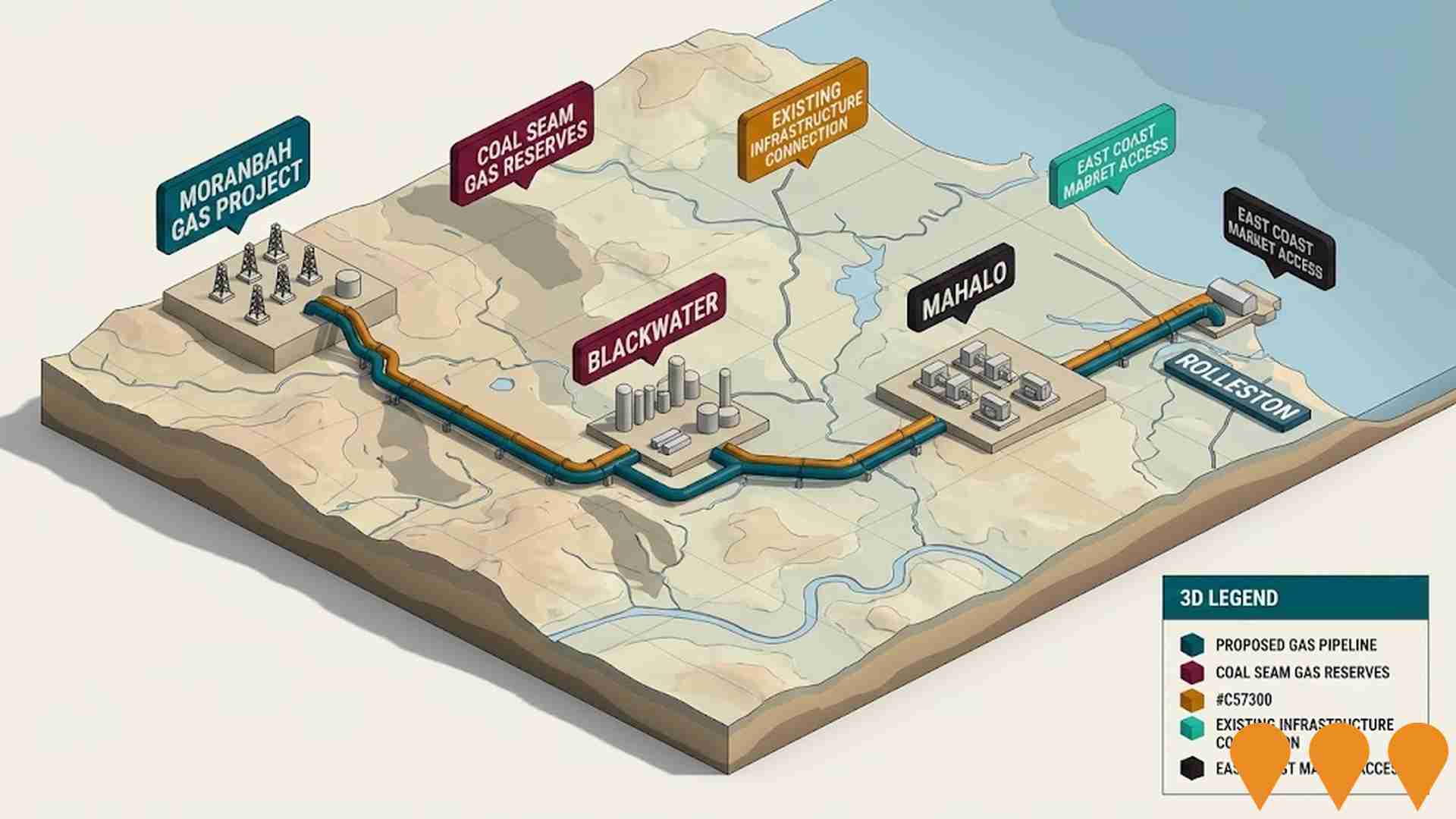

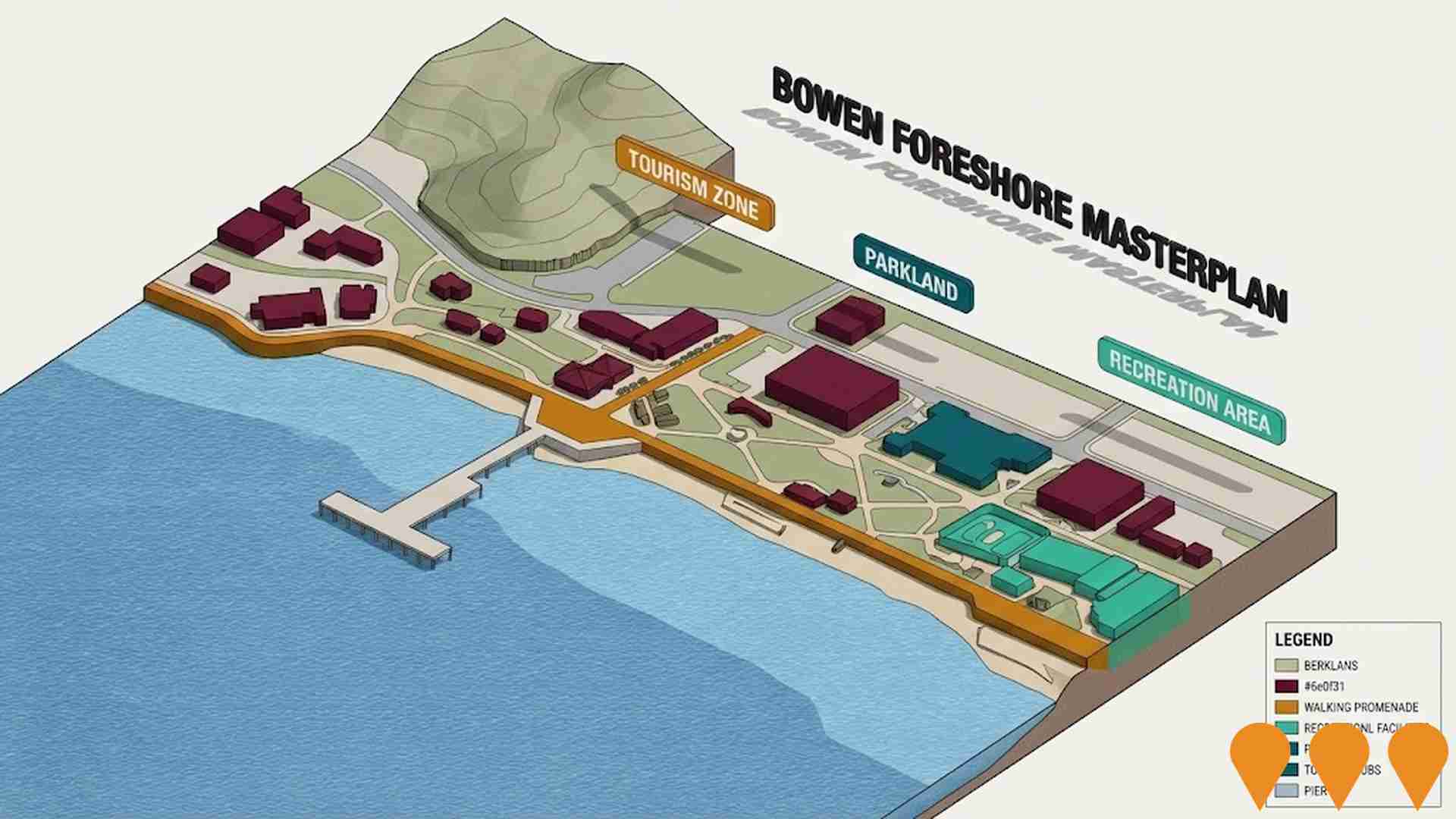

Changes to local infrastructure can significantly influence an area's performance. Eleven projects have been identified by AreaSearch as potentially impacting the area. Notable ones include the Bowen Pipeline Project, Bowen Industrial Estate Development, Bowen Courthouse Restoration, and Bowen Wharf Replacement Project. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Abbot Point Multi-Use Industrial Hub (HyNQ Clean Energy Project)

HyNQ is a large-scale integrated renewable energy project at the Abbot Point State Development Area. It features over 1 GW of electrolyser capacity to produce green hydrogen and approximately 500,000 tonnes per annum of green ammonia for export. The project utilizes a 'behind-the-meter' renewable energy solution from wind and solar to power its Process Precinct. Key milestones include a completed Pre-FEED study and the entry of IHI Corporation into the development consortium. Target production for domestic liquid hydrogen is set for 2027-2028, with the hub leveraging existing infrastructure at the North Queensland Export Terminal (NQXT).

Bowen Pipeline Project

A 182 km underground water pipeline project designed to deliver 100,000 ML of water annually from the Burdekin River to the Bowen and Collinsville regions. The project utilizes high-density polyethylene (HDPE) technology and on-site extrusion to reduce transport emissions. It aims to support the Abbot Point State Development Area, local agriculture (including high-value crops like macadamias and legumes), and emerging green energy industries such as green hydrogen and ammonia production. Notably, the project features a first-of-its-kind equity partnership with the Juru and Bindal Traditional Owners.

Bowen Industrial Estate Development

Strategically located between Townsville and Mackay, this major industrial estate provides large-scale land parcels for manufacturing and logistics. The project is designed to leverage regional proximity to the Abbot Point Coal Terminal and the Bruce Highway to support economic growth and job creation in North Queensland.

Whitsunday Paradise

Whitsunday Paradise is a $1.1 billion master-planned coastal community in Bowen, Queensland. The 20-year project delivers 1,757 residential lots along with a retirement village, a 150-room hotel, and a marina village featuring retail and commercial precincts. The development also includes an AFL-standard sports complex and extensive parklands. In late 2025, the project secured a $33 million state government grant for the Build Bowen South Utilities project to upgrade critical sewerage infrastructure, facilitating further housing activation.

Whitsunday Coast Airport Expansion

The Whitsunday Coast Airport Expansion, guided by the 2024 Master Plan, involves a multi-stage redevelopment to support rapid passenger growth. Priority 1 works focus on a significant terminal extension and expanding the Air Transport Operations (ATO) apron to accommodate longer-haul routes and increased flight frequencies. Future stages include a new corporate apron for freight and VTOL aircraft, a loop road, and an accommodation precinct. The project aims to transform the site into an international tourism and export hub, supporting the region's aquaculture and agricultural sectors.

Burdekin Falls Dam Raising and Improvement

A major proposal to raise the Burdekin Falls Dam spillway and abutments by two metres to increase storage capacity by approximately 574,240 megalitres. The project involves concrete buttressing, widening of existing saddle dams, and the construction of a new saddle dam on the right bank. It aims to secure long-term water supply for agriculture, industry (including green hydrogen), and urban use while improving dam safety to meet modern standards. The Environmental Impact Statement (EIS) process is currently active with a project declaration lapse date of April 2027.

Collinsville Green Energy Hub

Large-scale renewable energy hub proposed north-west of Collinsville, Queensland. The project is planned to deliver up to 3,000 MW of renewable energy through a combination of wind generation (approx. 268 turbines), solar PV, and battery energy storage (BESS). It is located within the Northern Queensland Renewable Energy Zone and is expected to generate significant economic benefits, including over 350 construction jobs and $1 billion in local expenditure.

Bowen Orbital Spaceport

Australia's first commercial orbital launch facility, developed and operated by Gilmour Space Technologies. The spaceport was granted Australia's first orbital launch facility licence in March 2024 and was the launch site for the maiden test flight of the Australian-designed and built Eris rocket in July 2025. This test successfully validated the key launch systems, propulsion technology, and infrastructure, marking a major milestone for Australia's sovereign launch capability.

Employment

Bowen has seen below average employment performance when compared to national benchmarks

Bowen's workforce comprises an equal mix of white and blue-collar jobs across various sectors. Its unemployment rate is 4.8%, with an estimated employment growth of 4.7% over the past year (AreaSearch data).

As of September 2025, 6,129 residents are employed, with an unemployment rate of 4.1% above Rest of Qld's rate. Workforce participation is lower at 56.1%. Dominant sectors include agriculture, forestry & fishing, health care & social assistance, and transport, postal & warehousing. Bowen specializes in agriculture, forestry & fishing, with an employment share four times the regional level.

However, health care & social assistance employs only 11.0% of local workers, below Rest of Qld's 16.1%. Employment opportunities appear limited locally, as indicated by Census data. Over the year to September 2025, employment increased by 4.7%, labour force by 4.9%, and unemployment rose by 0.2 percentage points (AreaSearch analysis). In comparison, Rest of Qld recorded employment growth of 1.7% and unemployment rise of 0.3 percentage points. State-level data to 25-Nov shows Queensland's employment contracted by 0.01%, with an unemployment rate of 4.2%. Jobs and Skills Australia forecasts national employment growth at 6.6% over five years and 13.7% over ten years. Applying these projections to Bowen's employment mix suggests local employment should increase by 5.3% over five years and 11.7% over ten years.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

The suburb of Bowen had a median taxpayer income of $48,062 and an average income of $63,613 in the latest postcode level ATO data aggregated by AreaSearch for the financial year 2023. This is lower than the national average, with Rest of Qld having a median income of $53,146 and an average income of $66,593. Based on Wage Price Index growth of 9.91% since the financial year 2023, estimated incomes for September 2025 would be approximately $52,825 (median) and $69,917 (average). Census data shows that household, family, and personal incomes in Bowen rank modestly, between the 23rd and 30th percentiles. The income distribution reveals that the $1,500 - $2,999 bracket dominates with 28.6% of residents (3,605 people), similar to the metropolitan region where this cohort represents 31.7%. After housing costs, 85.4% of income remains, which ranks at the 26th percentile nationally.

Frequently Asked Questions - Income

Housing

Bowen is characterized by a predominantly suburban housing profile, with strong rates of outright home ownership

The dwelling structure in Bowen, as per the latest Census, consisted of 83.6% houses and 16.4% other dwellings such as semi-detached properties, apartments, and 'other' dwellings. Home ownership in Bowen stood at 34.7%, with 26.1% of dwellings mortgaged and 39.2% rented. The median monthly mortgage repayment in the area was $1500, while the median weekly rent figure was recorded as $270. Nationally, Bowen's median monthly mortgage repayments were significantly lower than the Australian average of $1863, as reported on 24th May 2021. Meanwhile, rents in Bowen were substantially below the national figure of $375, according to data from 1st April 2021.

Frequently Asked Questions - Housing

Household Composition

Bowen features high concentrations of group households, with a median household size of 2.4 people

Family households constitute 66.5% of all households, including 24.6% couples with children, 31.1% couples without children, and 9.7% single parent families. Non-family households comprise the remaining 33.5%, with lone person households at 29.2% and group households at 4.3%. The median household size is 2.4 people.

Frequently Asked Questions - Households

Local Schools & Education

Bowen faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 12.2%, significantly lower than Australia's average of 30.4%. This discrepancy presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 9.2%, followed by postgraduate qualifications (1.7%) and graduate diplomas (1.3%). Vocational credentials are prevalent, with 40.7% of residents aged 15+ holding them, including advanced diplomas (8.1%) and certificates (32.6%).

Educational participation is high at 29.5%, with 12.2% in primary education, 10.0% in secondary education, and 1.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Bowen has 89 active public transport stops, all of which are bus stops. These are served by four different routes that together offer 136 weekly passenger trips. The accessibility of these services is limited, with residents typically located 1007 meters from the nearest stop.

On average, there are 19 trips per day across all routes, equating to approximately one weekly trip per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Bowen is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Bowen faces significant health challenges with common health conditions prevalent among both younger and older age cohorts.

The rate of private health cover is approximately 52%, covering about 6,606 people, which leads that of the average SA2 area. The most common medical conditions are arthritis and mental health issues, affecting 9.6% and 7.7% of residents respectively. Sixty-six point seven percent of residents declared themselves completely clear of medical ailments, compared to 0% across Rest of Qld. Nineteen point eight percent of residents are aged 65 and over, totaling 2,495 people.

Frequently Asked Questions - Health

Cultural Diversity

Bowen ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Bowen's population showed low cultural diversity, with 82.3% citizens, 83.8% born in Australia, and 91.1% speaking English only at home. Christianity was the dominant religion, comprising 55.4%. This contrasts with no data available for other religions across Queensland (Rest of Qld).

The top three ancestry groups were Australian (29.3%), English (27.2%), and Other (7.8%). Notably, Australian Aboriginal were overrepresented at 7.1%, while Samoan was at 0.2% and German at 4.0%.

Frequently Asked Questions - Diversity

Age

Bowen's median age exceeds the national pattern

The median age in Bowen is 42 years, close to Rest of Qld's average of 41 and well above Australia's median of 38. Compared to the Rest of Qld average, the 25-34 age group is notably over-represented at 14.2% in Bowen, while the 45-54 age group is under-represented at 11.4%. Between the 2021 Census and present, the 25 to 34 age group has grown from 12.7% to 14.2%, and the 15 to 24 cohort increased from 10.1% to 11.2%. Conversely, the 5 to 14 cohort declined from 13.1% to 11.6%. Population forecasts for 2041 indicate substantial demographic changes for Bowen. The 25 to 34 age group is projected to expand by 559 people (31%) from 1,789 to 2,349, while the 15 to 24 cohort is projected to decline by 32 people.