Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Collinsville reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on analysis of ABS population updates for the broader area, as of Nov 2025, Collinsville's population is estimated at around 1,602. This reflects an increase of 106 people since the 2021 Census, which reported a population of 1,496. The change was inferred from AreaSearch validation of addresses using ERP data released by ABS in Jun 2024 and additional validated new addresses since the Census date. This level of population equates to a density ratio of 46 persons per square kilometer. Collinsville's growth rate of 7.1% positions it within 0.7 percentage points of its SA3 area (7.8%), demonstrating competitive growth fundamentals. Population growth was primarily driven by natural growth contributing approximately 62.0%.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. Lower quartile growth of national non-metropolitan areas is anticipated moving forward with demographic trends, with the Collinsville (Qld) statistical area expected to expand by 6 persons to 2041, reflecting a decrease of 3.4% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Collinsville according to AreaSearch's national comparison of local real estate markets

Collinsville experienced limited development activity with an average of 3 approvals per year over five years (18 approvals). This reflects its rural nature where development is driven by local housing needs rather than broad market demand. The small sample size means individual projects can significantly influence annual growth and relativity statistics.

Compared to Rest of Qld, Collinsville has much lower development activity, with levels also below national averages. Recent development comprised entirely of detached houses aligns with rural living preferences for space and privacy. With an estimated 1540 people per dwelling approval, it indicates a quiet, low activity development environment. Given stable or declining population forecasts, Collinsville may experience less housing pressure, creating favourable conditions for buyers.

Given stable or declining population forecasts, Collinsville may experience less housing pressure, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Collinsville has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

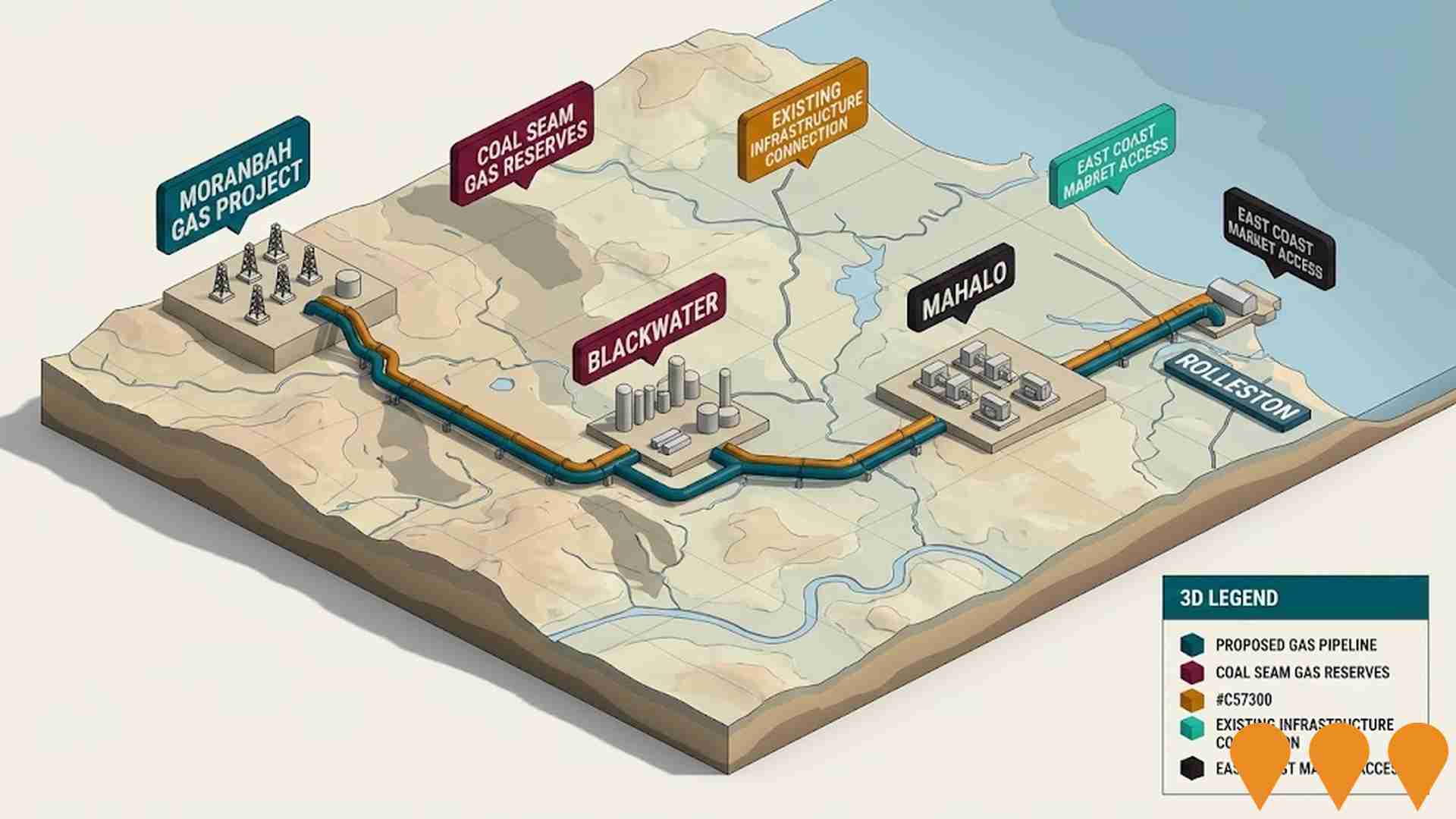

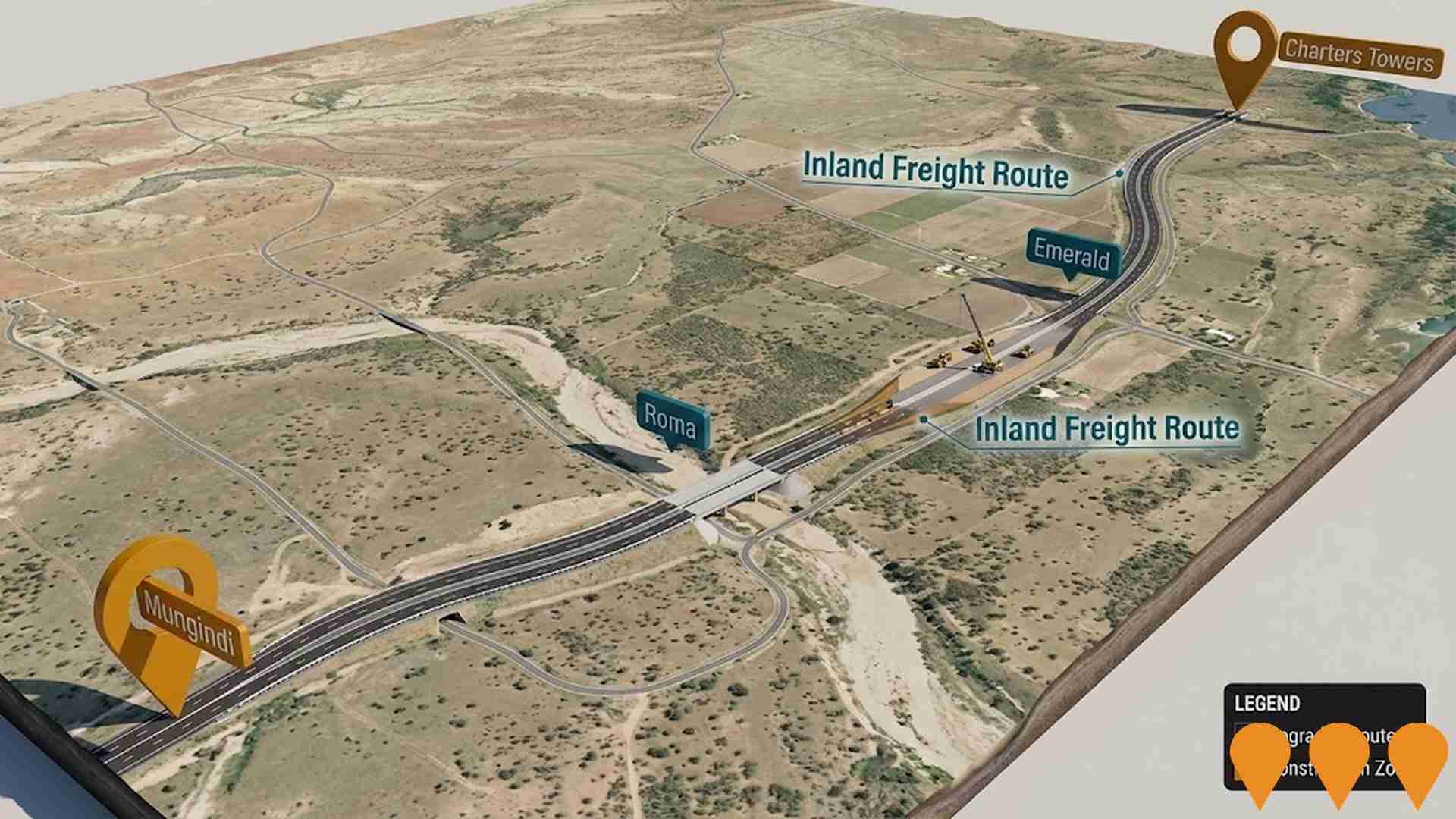

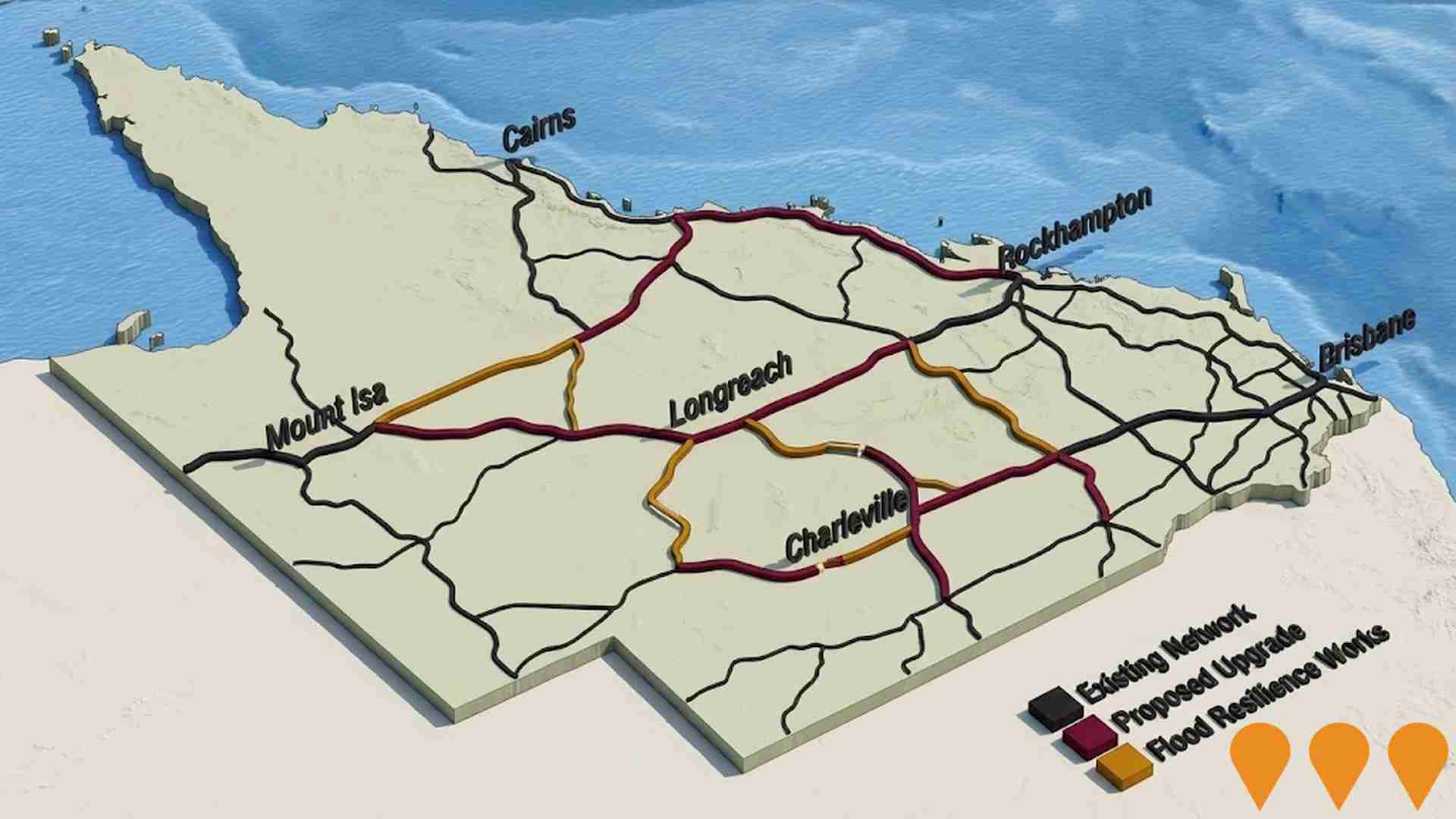

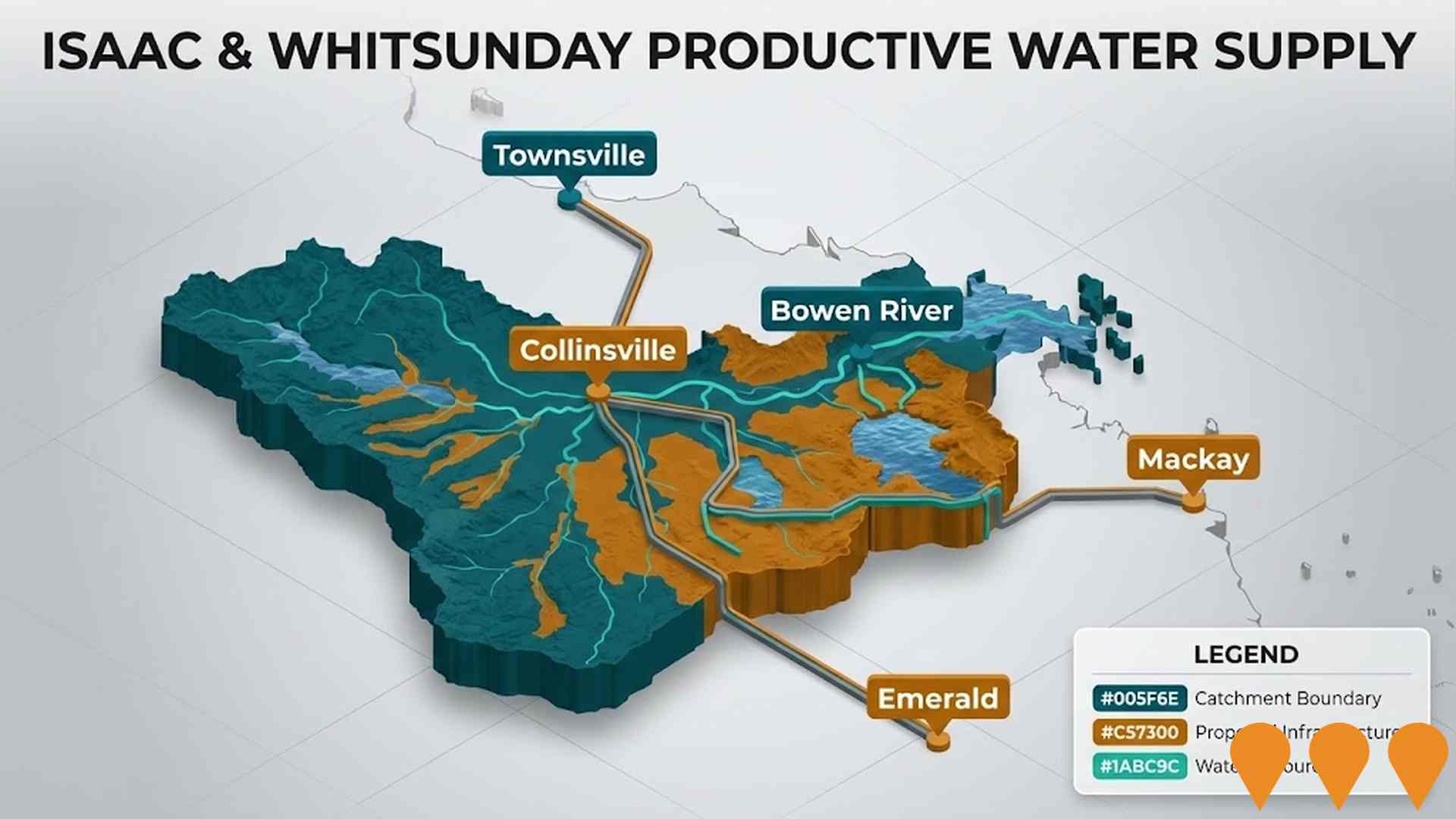

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified two projects likely impacting the area: Bowen Basin Gas Pipeline, Collinsville Green Energy Hub, Burdekin Falls Dam Raising and Improvement, Isaac And Whitsunday Regions Productive Water Supply. The following details those projects considered most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

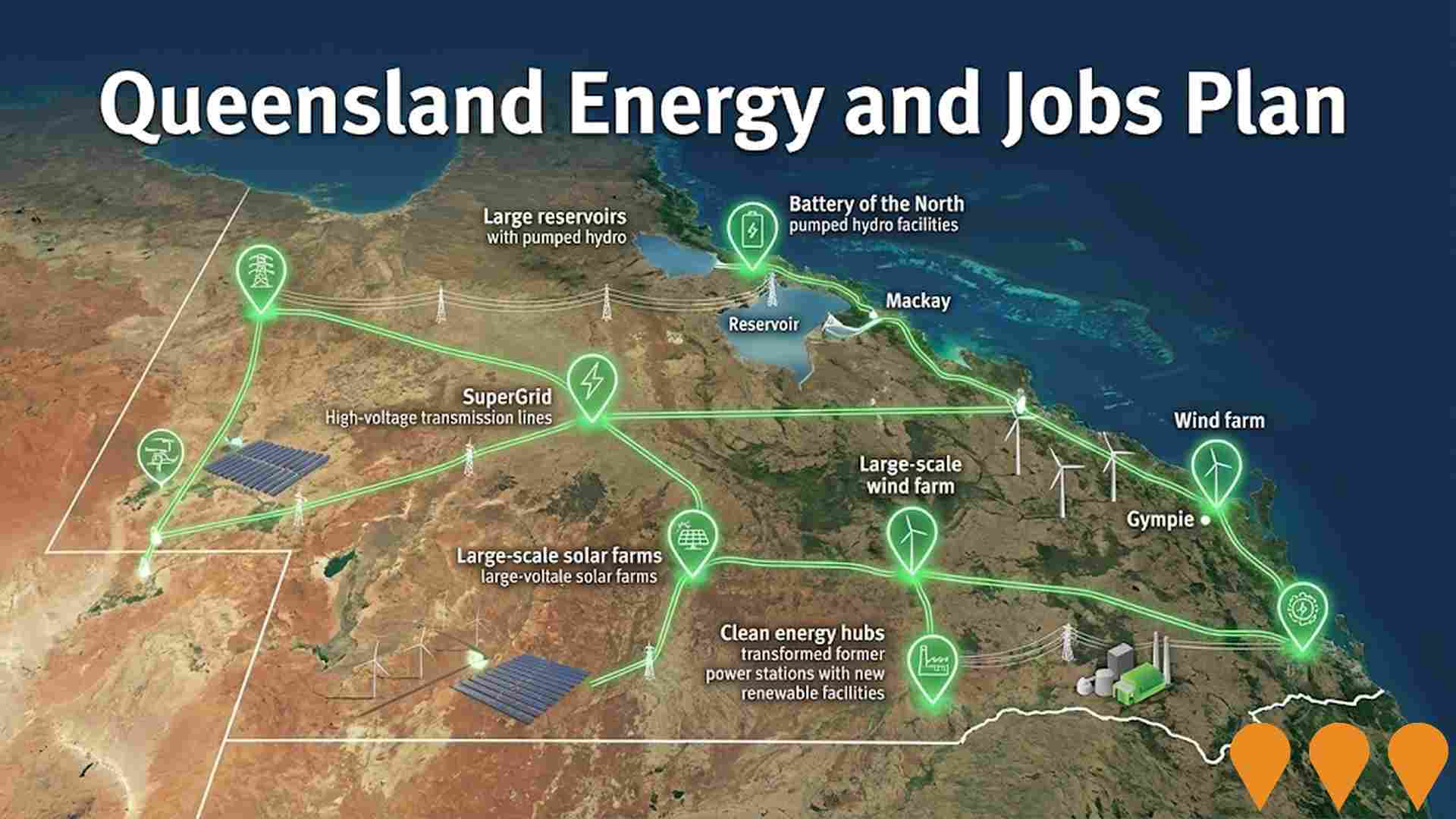

Queensland Energy Roadmap

A statewide energy transformation program following the 2025 pivot from the original Energy and Jobs Plan. The roadmap shifts focus toward a mix of existing coal asset retention until 2046, new gas-fired generation, and private sector-led renewable growth. Key active components include the CopperString transmission line, the Gladstone Grid Reinforcement, and various battery storage projects aimed at maintaining grid reliability and affordability.

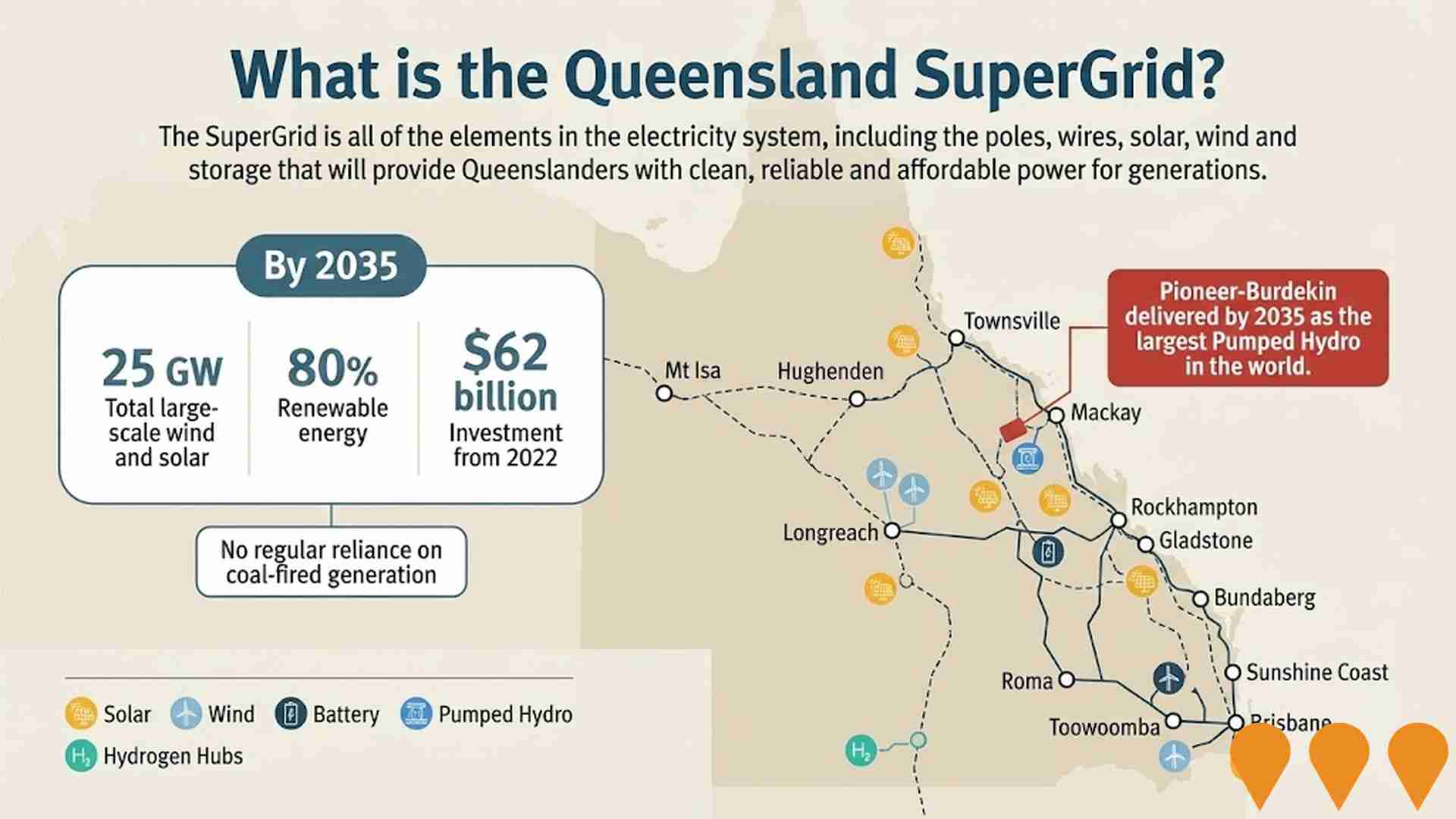

Queensland Energy and Jobs Plan SuperGrid

The Queensland SuperGrid is a high-capacity statewide electricity network connecting renewable energy zones, storage, and demand centers. As of 2026, the program is transitioning under the new Queensland Energy Roadmap, moving from rigid percentage targets to an emission-reduction focus while maintaining critical infrastructure delivery. Major works include the CopperString 2032 link, the Gladstone Grid Reinforcement (Stage 1), and the Borumba Pumped Hydro transmission connections. The plan integrates 22 GW of new renewables through Regional Energy Hubs and state-owned clean energy hubs at repurposed coal-fired power station sites.

Queensland Energy Roadmap

The Queensland Energy Roadmap is the state's revised energy strategy as of 2025-2026, replacing the previous Energy and Jobs Plan. It focuses on a market-based transition to net-zero by 2050 while extending the life of state-owned coal assets until at least 2046. Key components include the delivery of CopperString 2032 (a 1,000km transmission line), the Borumba Pumped Hydro Project, and the conversion of Renewable Energy Zones into Regional Energy Hubs. The plan prioritizes targeted transmission upgrades and gas-fired generation for grid firming.

Burdekin Falls Dam Raising and Improvement Project

A major infrastructure proposal to raise the Burdekin Falls Dam spillway by 2 metres, increasing storage capacity by 574,240 megalitres to a total of approximately 2,434,240 megalitres. The project aims to enhance water security for agriculture, urban use, and emerging industries like green hydrogen, while simultaneously performing essential safety improvements to meet modern ANCOLD standards. Works include concrete buttressing of the spillway and abutments, and the raising or construction of several saddle dams. The Environmental Impact Statement (EIS) is currently active with a draft being prepared for adequacy review.

Collinsville Green Energy Hub

Large-scale renewable energy hub proposed north-west of Collinsville, Queensland. The project is planned to deliver up to 3,000 MW of renewable energy through a combination of wind generation (approx. 268 turbines), solar PV, and battery energy storage (BESS). It is located within the Northern Queensland Renewable Energy Zone and is expected to generate significant economic benefits, including over 350 construction jobs and $1 billion in local expenditure.

Burdekin Falls Dam Raising and Improvement

A major proposal to raise the Burdekin Falls Dam spillway and abutments by two metres to increase storage capacity by approximately 574,240 megalitres. The project involves concrete buttressing, widening of existing saddle dams, and the construction of a new saddle dam on the right bank. It aims to secure long-term water supply for agriculture, industry (including green hydrogen), and urban use while improving dam safety to meet modern standards. The Environmental Impact Statement (EIS) process is currently active with a project declaration lapse date of April 2027.

Bowen Pipeline Project

A 182 km underground water pipeline project designed to deliver 100,000 ML of water annually from the Burdekin River to the Bowen and Collinsville regions. The project utilizes high-density polyethylene (HDPE) technology and on-site extrusion to reduce transport emissions. It aims to support the Abbot Point State Development Area, local agriculture (including high-value crops like macadamias and legumes), and emerging green energy industries such as green hydrogen and ammonia production. Notably, the project features a first-of-its-kind equity partnership with the Juru and Bindal Traditional Owners.

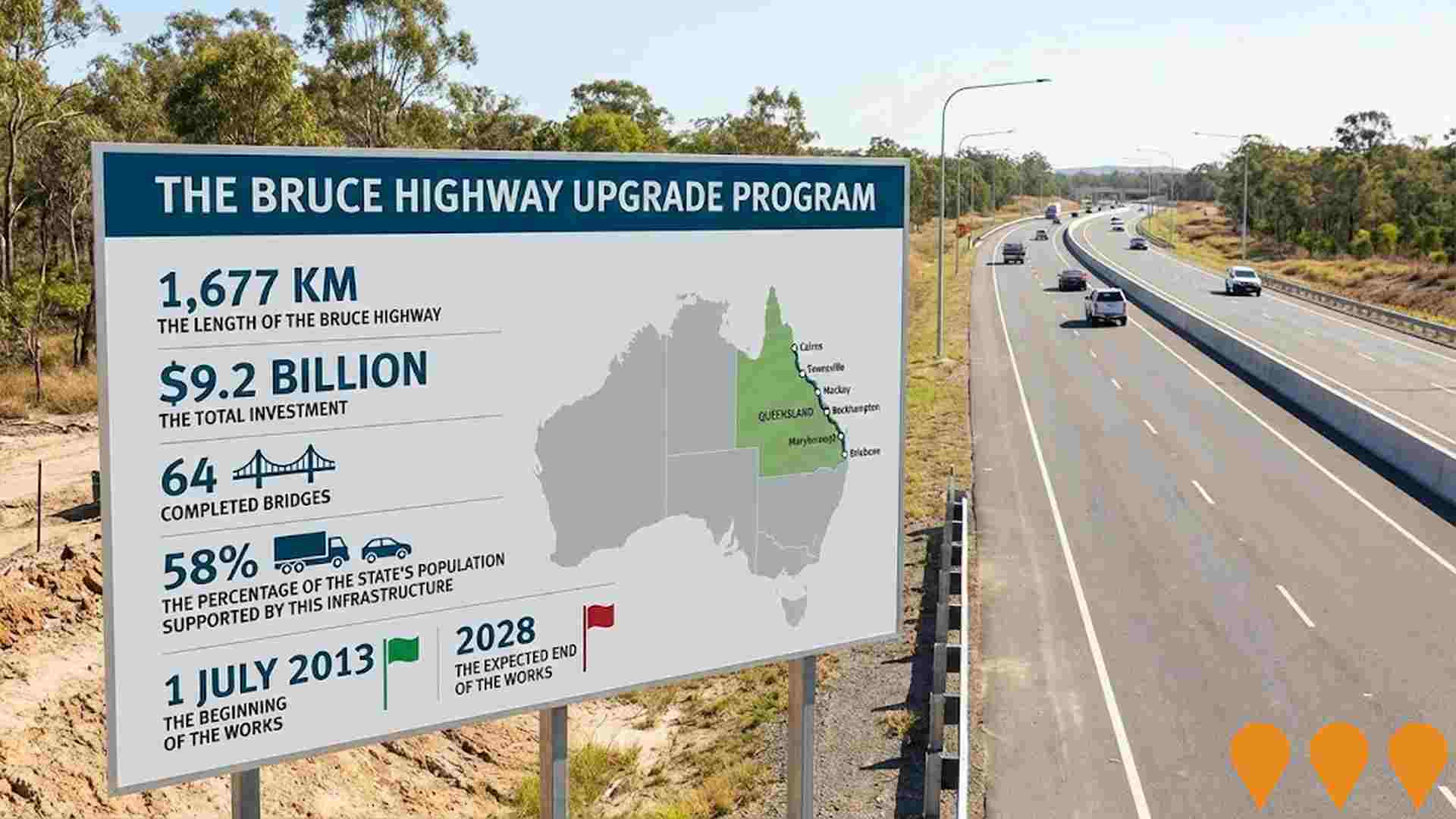

Bruce Highway Upgrade Program

The Bruce Highway Upgrade Program is a multi-decade infrastructure initiative improving the 1,677km corridor between Brisbane and Cairns. As of early 2026, the program is focused on the $9 billion Targeted Safety Program, which includes over 80 active or planned projects such as the Rockhampton Ring Road, Tiaro Bypass, and extensive wide centre line treatments. The program aims to achieve a minimum three-star safety rating by 2032 through road widening, flood immunity upgrades, and intersection improvements.

Employment

AreaSearch assessment indicates Collinsville faces employment challenges relative to the majority of Australian markets

Collinsville's workforce spans various sectors with manufacturing and industrial jobs prominent. The unemployment rate was 8.0% as of September 2025.

Employment growth over the past year was estimated at 3.9%. This is based on AreaSearch aggregation of statistical area data. As of September 2025727 residents were employed while the unemployment rate stood at 3.9%, above Rest of Qld's rate of 4.1%. Workforce participation lagged significantly at 50.2% compared to Rest of Qld's 59.1%.

Leading employment industries included mining, education & training, and accommodation & food. Mining was particularly specialized with an employment share 9.0 times the regional level. Health care & social assistance was under-represented at 8.0%, compared to Rest of Qld's 16.1%. Employment opportunities locally appeared limited based on Census working population vs resident population comparison. Between September 2024 and September 2025, employment levels increased by 3.9% while labour force grew by 3.8%, reducing the unemployment rate by 0.2 percentage points. In contrast, Rest of Qld saw employment grow by 1.7%, labour force expand by 2.1%, and unemployment rise by 0.3 percentage points. State-level data to 25-Nov-25 showed Queensland's employment contracted by 0.01% (losing 1,210 jobs) with the state unemployment rate at 4.2%. National employment forecasts from Jobs and Skills Australia projected national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Collinsville's employment mix suggested local employment should increase by 4.8% over five years and 11.3% over ten years, though these are simple weighted extrapolations for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2023 shows that in Collinsville, median income is $44,721 and average income is $59,602. This is lower than Rest of Qld's figures, which are a median income of $53,146 and an average income of $66,593. Based on Wage Price Index growth of 9.91% since financial year 2023, estimated current incomes would be approximately $49,153 (median) and $65,509 (average) as of September 2025. Census data reveals that household, family, and personal incomes in Collinsville all fall between the 17th and 18th percentiles nationally. Income distribution shows that 25.8% of the population (413 individuals) have incomes ranging from $1,500 to $2,999, similar to the broader area where 31.7% fall into this bracket. Housing costs are modest, with 90.2% of income retained, but total disposable income ranks at just the 26th percentile nationally.

Frequently Asked Questions - Income

Housing

Collinsville is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Collinsville, as per the latest Census evaluation, 92.9% of dwellings were houses, with the remaining 7.1% being other types such as semi-detached homes and apartments. This is in contrast to Non-Metro Qld's figures of 86.1% houses and 13.8% other dwellings. Home ownership in Collinsville stood at 42.7%, with mortgaged properties accounting for 18.7% and rented dwellings making up 38.7%. The median monthly mortgage repayment was $1,083, lower than Non-Metro Qld's average of $1,300. The median weekly rent in Collinsville was recorded at $200, matching the Non-Metro Qld figure. Nationally, Collinsville's median monthly mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Collinsville features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 63.6% of all households, including 22.6% couples with children, 29.1% couples without children, and 10.1% single parent families. Non-family households constitute the remaining 36.4%, with lone person households at 35.3% and group households making up 1.6%. The median household size is 2.2 people, smaller than the Rest of Qld average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Collinsville faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 10.4%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 8.2%, followed by postgraduate qualifications (1.8%) and graduate diplomas (0.4%). Vocational credentials are prevalent, with 45.8% of residents aged 15+ holding them, including advanced diplomas (6.1%) and certificates (39.7%). Educational participation is high at 30.5%, comprising 15.2% in primary education, 8.3% in secondary education, and 1.3% in tertiary education.

Educational participation is notably high, with 30.5% of residents currently enrolled in formal education. This includes 15.2% in primary education, 8.3% in secondary education, and 1.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Collinsville is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data indicates significant health challenges in Collinsville, with notable prevalence of common conditions across both younger and older age groups. Approximately 51% (~814 people) have private health cover, lower than Rest of Qld's 60.5%.

The most prevalent medical conditions are arthritis (10.5%) and mental health issues (7.5%). About 65.2% report no medical ailments, compared to Rest of Qld's 72.7%. Collinsville has a higher proportion of seniors aged 65 and over at 19.6% (313 people), compared to Rest of Qld's 12.6%. Senior health outcomes present challenges broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Collinsville is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Collinsville's cultural diversity was found to be below average, with 79.7% of its population being citizens, 89.3% born in Australia, and 95.1% speaking English only at home. Christianity is the main religion in Collinsville, comprising 53.3% of the population, which is similar to the regional figure of 53.6%. The top three ancestry groups are Australian (32.3%), English (29.9%), and Scottish (9.1%).

Notably, Welsh representation is higher at 1.2%, compared to 0.4% regionally. Also, Australian Aboriginal representation stands at 6.4%, slightly above the regional figure of 5.1%. Filipino representation is also higher at 2.4%, compared to 1.6% regionally.

Frequently Asked Questions - Diversity

Age

Collinsville hosts a notably older demographic compared to the national average

The median age in Collinsville is 42 years, similar to Rest of Qld's average of 41 years, but higher than Australia's median age of 38 years. In Collinsville, the 0-4 age group comprises 7.8%, which is notably higher than the Rest of Qld average, while the 15-24 age group constitutes 8.0%, lower than the Rest of Qld average. Between the 2021 Census and present, the 35 to 44 age group has increased from 10.0% to 11.3%. Conversely, the 55 to 64 age group has decreased from 15.3% to 13.8%, and the 45 to 54 age group has dropped from 15.3% to 14.0%. By 2041, population forecasts indicate significant demographic changes in Collinsville. The 25 to 34 age cohort is projected to grow by 24 people (an increase of 11%), from 227 to 252 people. Meanwhile, the 0-4 and 5-14 age cohorts are expected to experience population declines.