Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Austinmer has seen population growth performance typically on par with national averages when looking at short and medium term trends

As of Nov 2025, AreaSearch estimates Austinmer's population at around 2,691, a decrease of 34 people since the 2021 Census which reported 2,725 residents. This estimate is based on AreaSearch's validation of new addresses and examination of ERP data released by ABS in June 2024. The population density is approximately 800 persons per square kilometer. Overseas migration contributed about 62% of recent population gains. For projections, AreaSearch uses ABS/Geoscience Australia estimates for each SA2 area released in 2024 with a base year of 2022, and NSW State Government's SA2 level projections for areas not covered by this data, released in 2022 with a base year of 2021.

Growth rates by age group are applied to all areas from 2032 to 2041. By 2041, the Austinmer statistical area is expected to grow by approximately 211 persons, reflecting a total increase of around 10.4% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Austinmer according to AreaSearch's national comparison of local real estate markets

Austinmer had three new dwelling approvals annually from 2016 to 2020. This totals 16 dwellings over five years. The area's rural nature and specific local housing needs drive development, rather than broad market demand.

Small sample sizes can significantly impact annual growth and relativity statistics. Austinmer has lower development levels than the Rest of NSW and nationally. New building activity shows 67% detached dwellings and 33% townhouses or apartments, expanding medium-density options across price brackets. This shift reflects reduced development sites and changing lifestyle demands. The area's population per dwelling approval is estimated at 612 people.

By 2041, Austinmer is expected to grow by 280 residents. At current development rates, housing supply may struggle to meet population growth, potentially increasing buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Austinmer has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

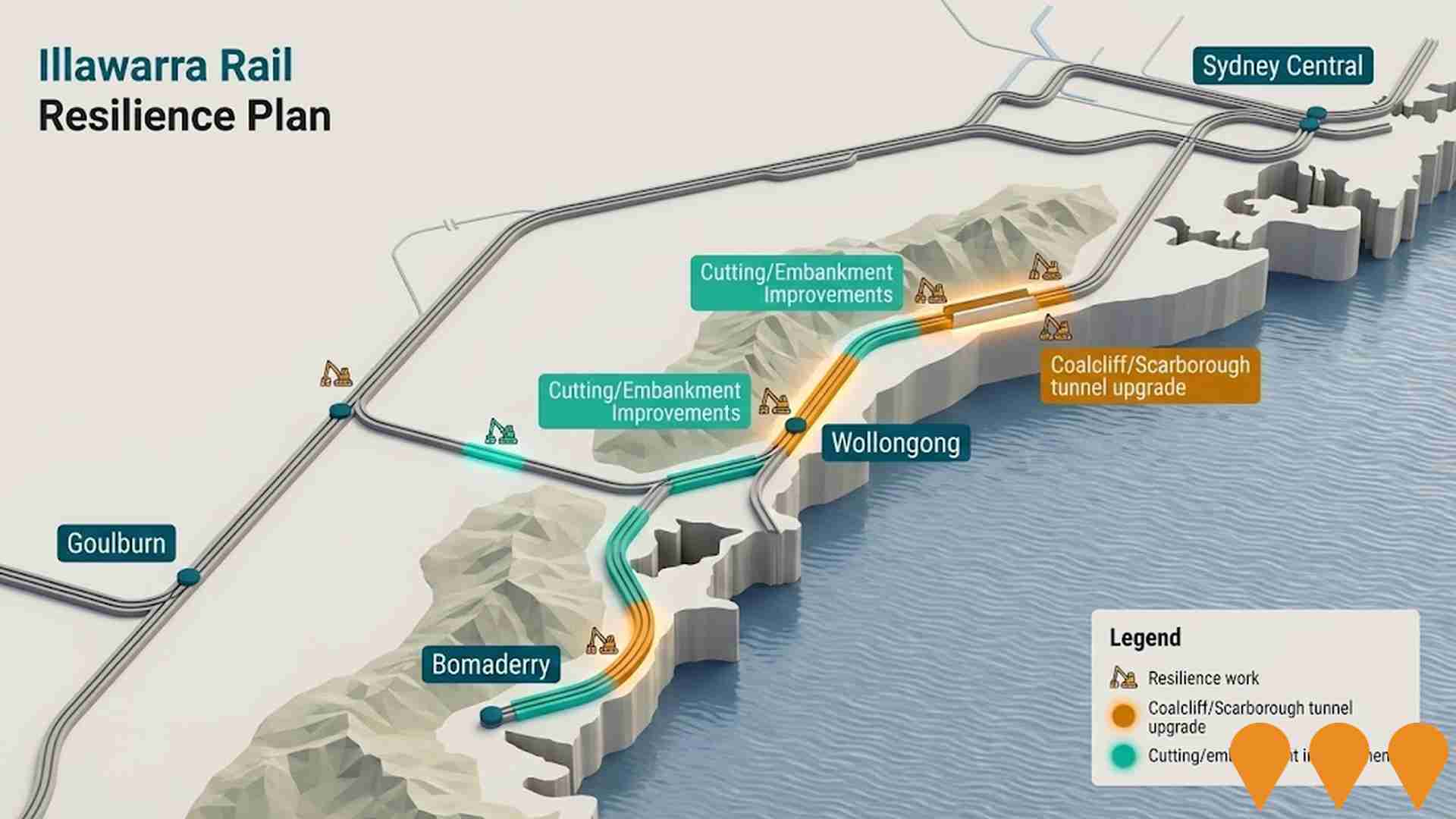

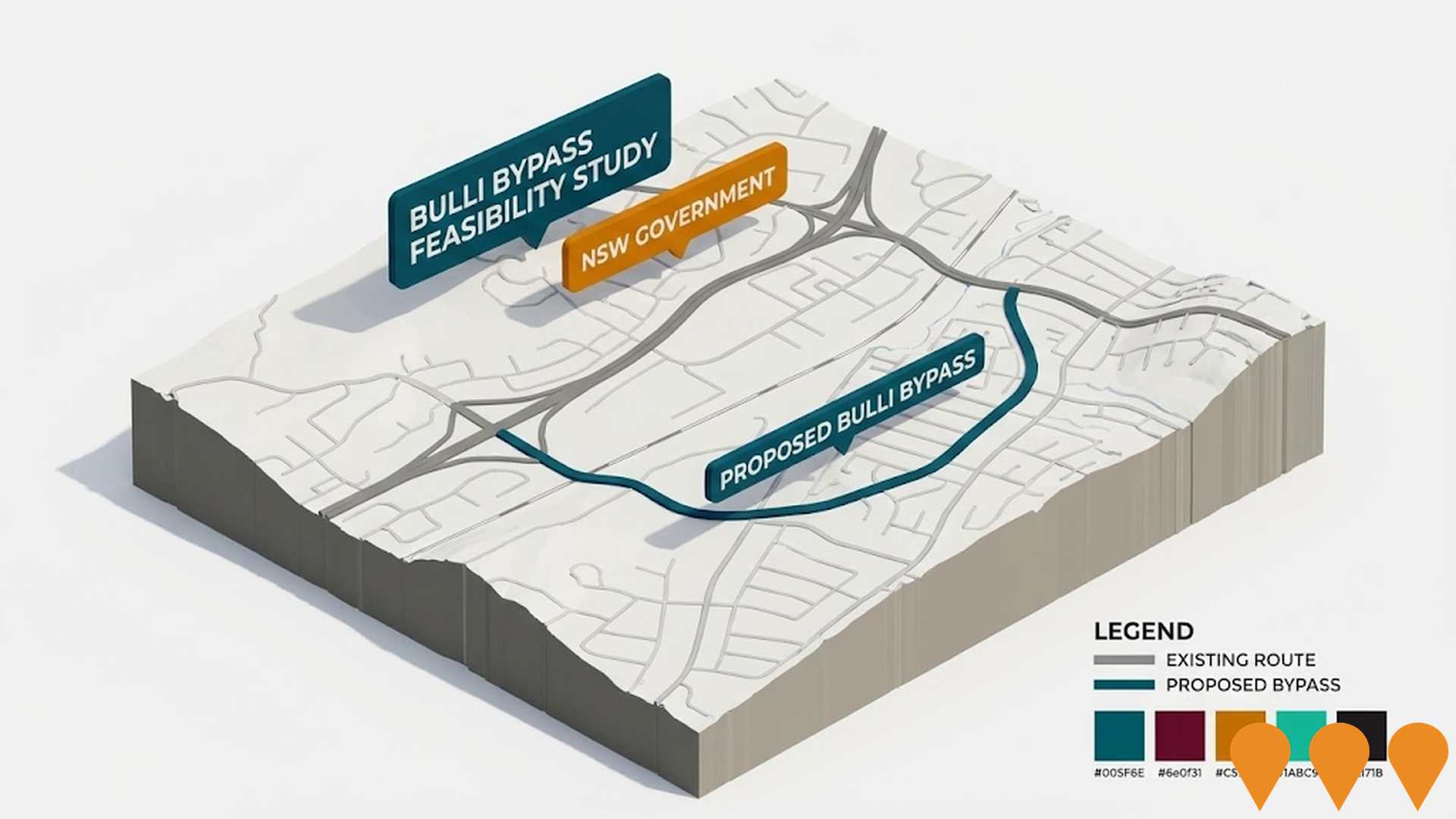

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified a single project likely affecting this area: Electrify 2515 Community Pilot. Other key projects are More Trains More Services Stage Two - Mortdale to Kiama Capital Works, Bulli Bypass Feasibility Study, and Woonona Place.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

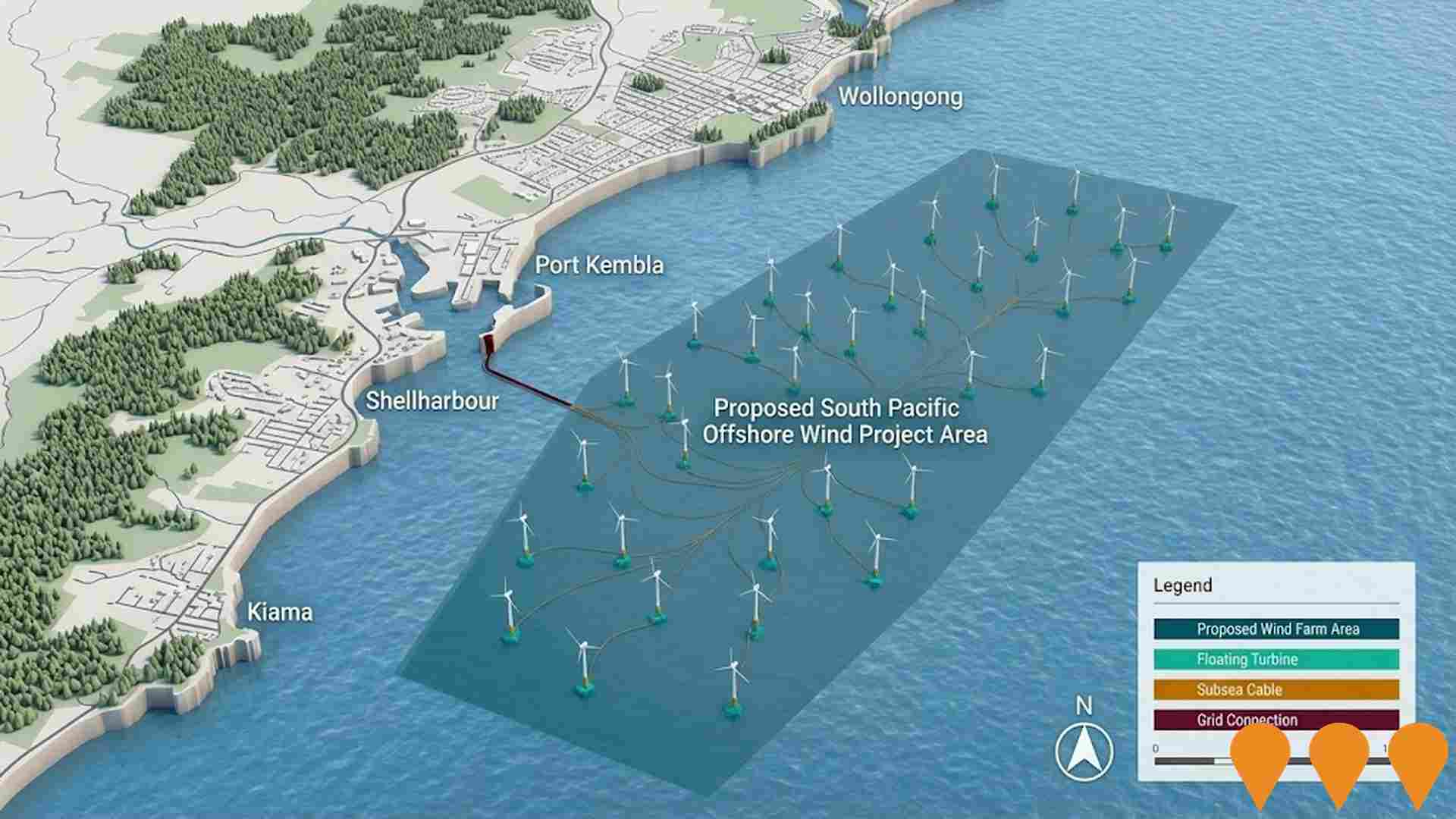

Illawarra Offshore Wind Zone

The Illawarra Offshore Wind Zone is a 1,022 square kilometre declared area in the Pacific Ocean located at least 20 km offshore between Wombarra and Kiama. Declared on June 15, 2024, the zone has a potential generation capacity of 2.9 GW, sufficient to power 1.8 million homes. As of January 2026, the project is in a transitional phase; the sole feasibility licence applicant, BlueFloat Energy, formally withdrew in early 2026 due to global supply chain and commercial pressures. While no feasibility licences are currently active for generation, the zone remains officially declared. The Federal Government has opened applications for Research and Demonstration (R&D) licences to test emerging technologies like floating foundations and wave energy within the zone.

Illawarra Offshore Wind Zone

The Illawarra Offshore Wind Zone is a Commonwealth-declared area covering 1,022 square kilometres in the Pacific Ocean, located 20km to 45km off the NSW coast between Wombarra and Kiama. Declared on 15 June 2024, the zone has a potential generation capacity of 2.9 GW, enough to power approximately 1.8 million homes. Following a competitive application process in late 2024, Corio Generation Australia was awarded the first feasibility licence in December 2025. This allows for seven years of detailed environmental assessments, geotechnical surveys, and community consultation to determine the technical and commercial viability of a large-scale floating offshore wind farm.

Sydney Metro

Australia's largest public transport project, comprising four main lines. As of February 2026, the City & Southwest M1 line is operational to Sydenham, with the Sydenham-to-Bankstown conversion reaching 80% completion and intensive dynamic train testing underway for a late 2026 opening. Sydney Metro West has achieved major tunneling milestones at Westmead, with fit-out contracts worth $11.5 billion signed to target a 2032 opening. The Western Sydney Airport line remains under heavy construction with stations and viaducts progressing for an opening aligned with the airport in late 2026.

Woonona Place

A $122 million masterplanned redevelopment of the historic IRT Woonona site into a modern vertical seniors community. The project features 98 independent living units across five buildings (up to four storeys), a 700sqm Social and Wellness Centre with a hydrotherapy pool and gym, a 450sqm clubhouse, and a major refurbishment of the existing Flame Tree Aged Care Centre. The site will also include the adaptive reuse of the heritage-listed Blue Gum Sanctuary church as a restaurant and community hub.

Rail Service Improvement Program - T4 Illawarra & Eastern Suburbs Line

A major multi-billion-dollar upgrade program (formerly More Trains, More Services) designed to modernize the rail network for higher frequency and reliability. Key works for the T4 line include the Digital Systems Program replacing traditional signalling with ETCS Level 2 'in-cab' technology, platform extensions at stations like Waterfall and Kiama to accommodate New Intercity Fleet (Mariyung) trains, power supply upgrades, and a new stabling yard at Waterfall. Testing for Digital Systems is currently underway between Sutherland and Cronulla, with the Bondi Junction to Erskineville section beginning tests in 2026.

Mariyung Fleet (New Intercity Fleet)

The Mariyung Fleet is a 610-carriage double-deck electric train fleet (D sets) replacing the aging V-set fleet across the NSW intercity network. Delivered by the RailConnect consortium, the trains feature 2x2 seating, charging ports, dedicated luggage/bicycle spaces, and enhanced accessibility with wheelchair spaces and accessible toilets. The fleet operates in 4, 6, 8, or 10-car formations. Passenger services commenced on the Central Coast & Newcastle Line on 3 December 2024 and the Blue Mountains Line on 13 October 2025. South Coast Line services are scheduled to begin in the first half of 2026. The project includes the Kangy Angy Maintenance Facility and extensive corridor upgrades such as platform extensions and signaling modifications.

Rail Service Improvement Program (Mortdale-Kiama)

The Rail Service Improvement Program (formerly More Trains, More Services) is a multi-billion-dollar NSW Government initiative to modernize the rail network for the Mariyung fleet. The Mortdale to Kiama package involves infrastructure upgrades including the Mortdale Maintenance Centre (active maintenance and shunting works in February 2026), platform extensions at Kiama (completed), and ongoing signaling, power supply, and station improvements at Thirroul and Shellharbour Junction to enable increased service frequency on the T4 Illawarra and South Coast lines.

Electrify 2515 Community Pilot

The Electrify 2515 Community Pilot is an Australian-first initiative providing subsidies and support to upgrade 500 households in the 2515 postcode area of northern Illawarra, NSW, to efficient electric appliances, household batteries, and home energy management systems. The project aims to demonstrate the technical and economic feasibility of household electrification, reduce emissions and energy costs, and provide insights into network impacts and barriers to scaling electrification nationwide. As of August 2025, stage one has been completed with 60 homes upgraded, and the pilot continues toward its goal of 500 homes.

Employment

Employment performance in Austinmer exceeds national averages across key labour market indicators

Austinmer has a highly educated workforce with strong professional services representation. Its unemployment rate is 2.8%, lower than Rest of NSW's 3.8%.

Employment stability has been maintained over the past year. As of September 2025, 1,449 residents are employed, with an unemployment rate 1.1% below the regional average. Workforce participation in Austinmer is higher at 63.0%, compared to Rest of NSW's 56.4%. Key employment sectors include health care & social assistance, education & training, and professional & technical services.

Notably, education & training has an employment level 1.8 times the regional average, while agriculture, forestry & fishing has limited presence at 0.4% compared to 5.3% regionally. The area appears to offer limited local employment opportunities based on Census data comparison of working population and resident population. Between September 2024 and September 2025, employment levels increased by 0.1%, labour force by 0.3%, leading to a 0.2 percentage point rise in unemployment. In contrast, Rest of NSW saw employment fall by 0.5% and unemployment rise by 0.4 percentage points during the same period. State-level data as of 25-Nov-25 shows NSW employment contracted by 0.03%, with a state unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Job and Skills Australia's national employment forecasts from May-25 project overall employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Austinmer's employment mix suggests local employment should increase by 7.3% over five years and 14.8% over ten years, assuming constant population projections for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

The suburb of Austinmer has one of the highest income levels nationally, according to AreaSearch's aggregation of ATO data for financial year 2023. The median income among taxpayers in Austinmer is $64,723, with an average income of $98,209. These figures compare to $52,390 and $65,215 respectively for the Rest of NSW. Based on Wage Price Index growth of 8.86% since financial year 2023, estimates as of September 2025 would be approximately $70,457 (median) and $106,910 (average). Census data shows that household, family, and personal incomes in Austinmer all rank highly nationally, between the 85th and 92nd percentiles. The earnings profile indicates that the $4000+ bracket dominates with 30.6% of residents (823 people), contrasting with the region where the $1,500 - 2,999 bracket leads at 29.9%. Economic strength is evident through 43.9% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. After housing costs, residents retain 87.4% of income, reflecting strong purchasing power. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Austinmer is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Austinmer, as per the latest Census, consisted of 82.7% houses and 17.3% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro NSW's 58.9% houses and 41.1% other dwellings. Home ownership in Austinmer stood at 45.7%, with the rest of dwellings either mortgaged (35.3%) or rented (19.0%). The median monthly mortgage repayment was $2,726, exceeding Non-Metro NSW's average of $2,189. The median weekly rent figure in Austinmer was recorded at $550, compared to Non-Metro NSW's $400. Nationally, Austinmer's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Austinmer features high concentrations of family households, with a higher-than-average median household size

Family households account for 80.5% of all households, including 40.6% couples with children, 29.6% couples without children, and 9.6% single parent families. Non-family households constitute the remaining 19.5%, with lone person households at 17.1% and group households comprising 2.8%. The median household size is 2.8 people, which is larger than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Austinmer demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

In Austinmer, 51.2% of residents aged 15 and above have university qualifications, compared to 21.3% in the rest of NSW and 25.2% in the SA4 region as of the latest data. Bachelor degrees are most common at 30.0%, followed by postgraduate qualifications at 16.0% and graduate diplomas at 5.2%. Vocational credentials are held by 26.4% of residents aged 15 and above, with advanced diplomas at 10.9% and certificates at 15.5%. Educational participation is high, with 29.7% of residents currently enrolled in formal education.

This includes 10.0% in primary education, 7.8% in secondary education, and 6.4% pursuing tertiary education as per the latest available figures.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Austinmer has 21 active public transport stops. These include a mix of train and bus services. There are 21 routes operating in total, providing 1,267 weekly passenger trips combined.

Transport accessibility is rated good, with residents typically located 215 meters from the nearest stop. On average, there are 181 trips per day across all routes, equating to approximately 60 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Austinmer's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Austinmer shows excellent health outcomes, with very low prevalence of common health conditions across all age groups. Private health cover is exceptionally high at approximately 66%, comprising 1,766 people, compared to 56.8% in Rest of NSW and 55.7% nationally. The most prevalent medical conditions are arthritis (7.2%) and mental health issues (7.1%).

A total of 73.4% of residents report being completely clear of medical ailments, higher than the 68.6% in Rest of NSW. Austinmer has a higher proportion of seniors aged 65 and over at 20.6%, with 554 people, compared to 17.7% in Rest of NSW. Health outcomes among seniors are strong and align with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Austinmer ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Austinmer was found to be below average in terms of cultural diversity, with 82.8% of its population born in Australia, 93.8% being citizens, and 95.5% speaking English only at home. The main religion in Austinmer was Christianity, comprising 41.8% of the people. However, Judaism was overrepresented at 0.4%, compared to 0.1% across Rest of NSW.

The top three ancestry groups were English (28.7%), Australian (25.9%), and Irish (12.3%). Other ethnic groups with notable divergences included Welsh (1.0% vs regional 0.8%), Dutch (1.8% vs 1.5%), and Russian (0.5% vs 0.2%).

Frequently Asked Questions - Diversity

Age

Austinmer's median age exceeds the national pattern

Austinmer's median age is 42 years, similar to Rest of NSW's average of 43 but considerably older than Australia's 38 years. The age profile shows that those aged 45-54 are particularly prominent at 13.0%, while the 75-84 group is comparatively smaller at 6.5% compared to Rest of NSW. Between 2021 and present, the 15-24 age group has grown from 9.9% to 11.4% of the population, while the 75-84 cohort increased from 5.2% to 6.5%. Conversely, the 55-64 cohort has declined from 14.9% to 13.3%. Population forecasts for 2041 indicate substantial demographic changes in Austinmer. The 75-84 cohort is projected to grow by 63%, adding 110 residents to reach 285. Senior residents aged 65 and above will drive 50% of population growth, highlighting demographic aging trends. Conversely, population declines are projected for the 15-24 and 55-64 cohorts.