Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Greenwich - Riverview reveals an overall ranking slightly below national averages considering recent, and medium term trends

Greenwich - Riverview's population was around 13,165 as of Nov 2025. This reflected an increase of 237 people since the 2021 Census, which reported a population of 12,928. The change was inferred from the estimated resident population of 13,152 in June 2024 and an additional 8 validated new addresses since the Census date. This level of population resulted in a density ratio of 2,868 persons per square kilometer, placing it in the upper quartile relative to national locations assessed by AreaSearch. Population growth was primarily driven by overseas migration, contributing approximately 78.8% of overall population gains during recent periods.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilised NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations were applied to all areas for years 2032 to 2041. Future population trends indicated an increase just below the median of Australian statistical areas, with the area expected to grow by 1,614 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of 12.2% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Greenwich - Riverview among the top 25% of areas assessed nationwide

Greenwich - Riverview has received around 245 dwelling approvals per year over the past five financial years, totalling 1,225 homes. As of FY-26339 approvals have been recorded. Despite a declining population in recent years, development activity has been adequate relative to other areas. The average construction value of new properties is $565,000, indicating a focus on the premium segment.

In FY-26, $6.7 million in commercial development approvals have been recorded, reflecting the area's primarily residential nature. Compared to Greater Sydney, Greenwich - Riverview has 196.0% more construction activity per person, offering buyers greater choice and suggesting strong developer confidence in the location. New developments consist of 7.0% detached houses and 93.0% townhouses or apartments, providing affordable entry pathways for downsizers, investors, and first-time purchasers. This represents a shift from the area's existing housing composition, which is currently 65.0% houses. The location has approximately 69 people per dwelling approval, indicating a low density market. By 2041, Greenwich - Riverview is expected to grow by 1,601 residents. Based on current development patterns, new housing supply should meet demand, offering good conditions for buyers and potentially facilitating further population growth.

Looking ahead, Greenwich - Riverview is expected to grow by 1,601 residents through to 2041 (from the latest AreaSearch quarterly estimate). Based on current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

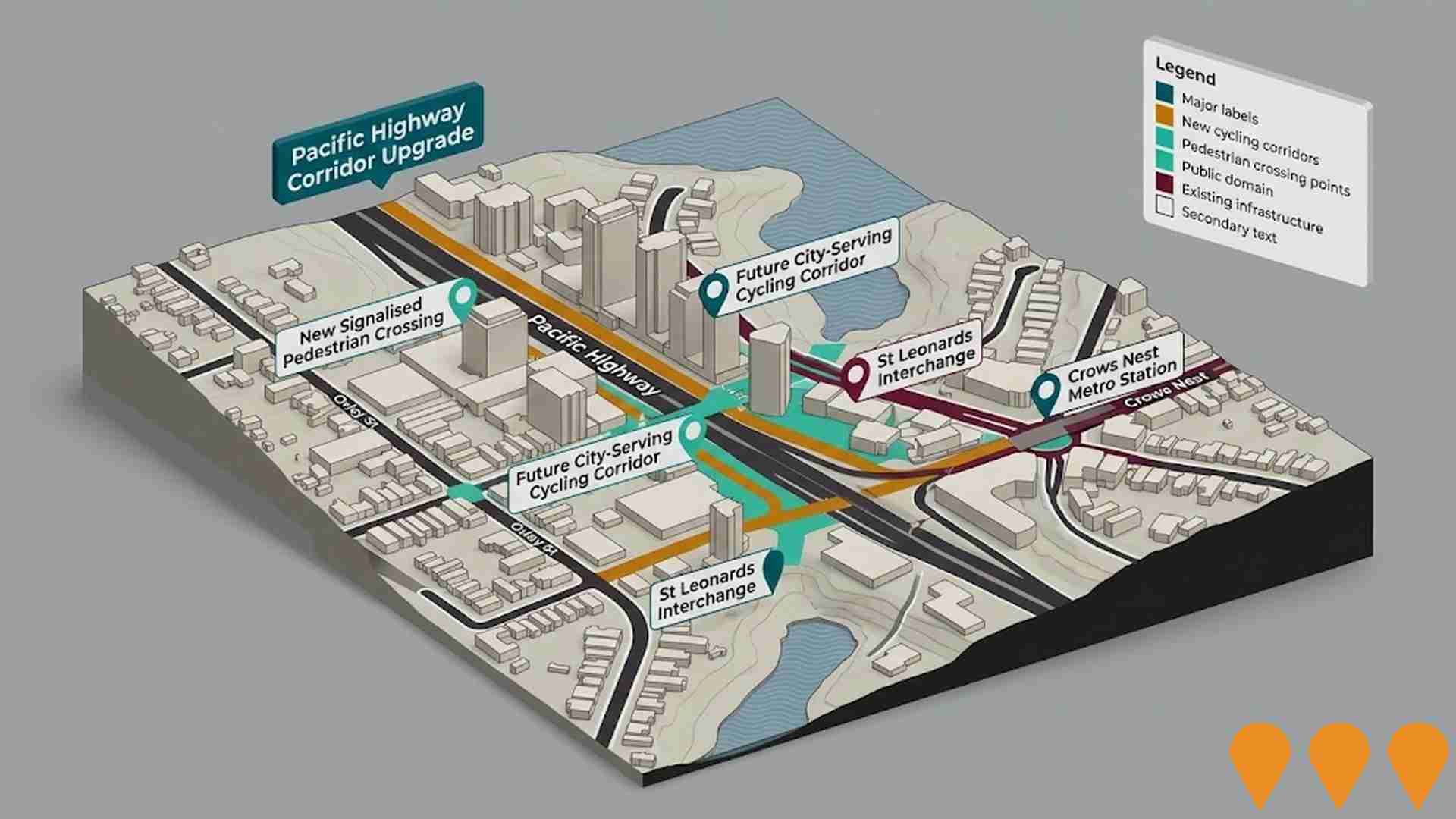

Infrastructure

Greenwich - Riverview has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

The performance of an area can significantly influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified 78 such projects that could potentially impact the area. Notable projects include The Landmark Quarter St Leonards, St Leonards South Precinct, St Leonards South Residential Precinct, and The Bellevue Greenwich. For further detail on those most relevant, see below list.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

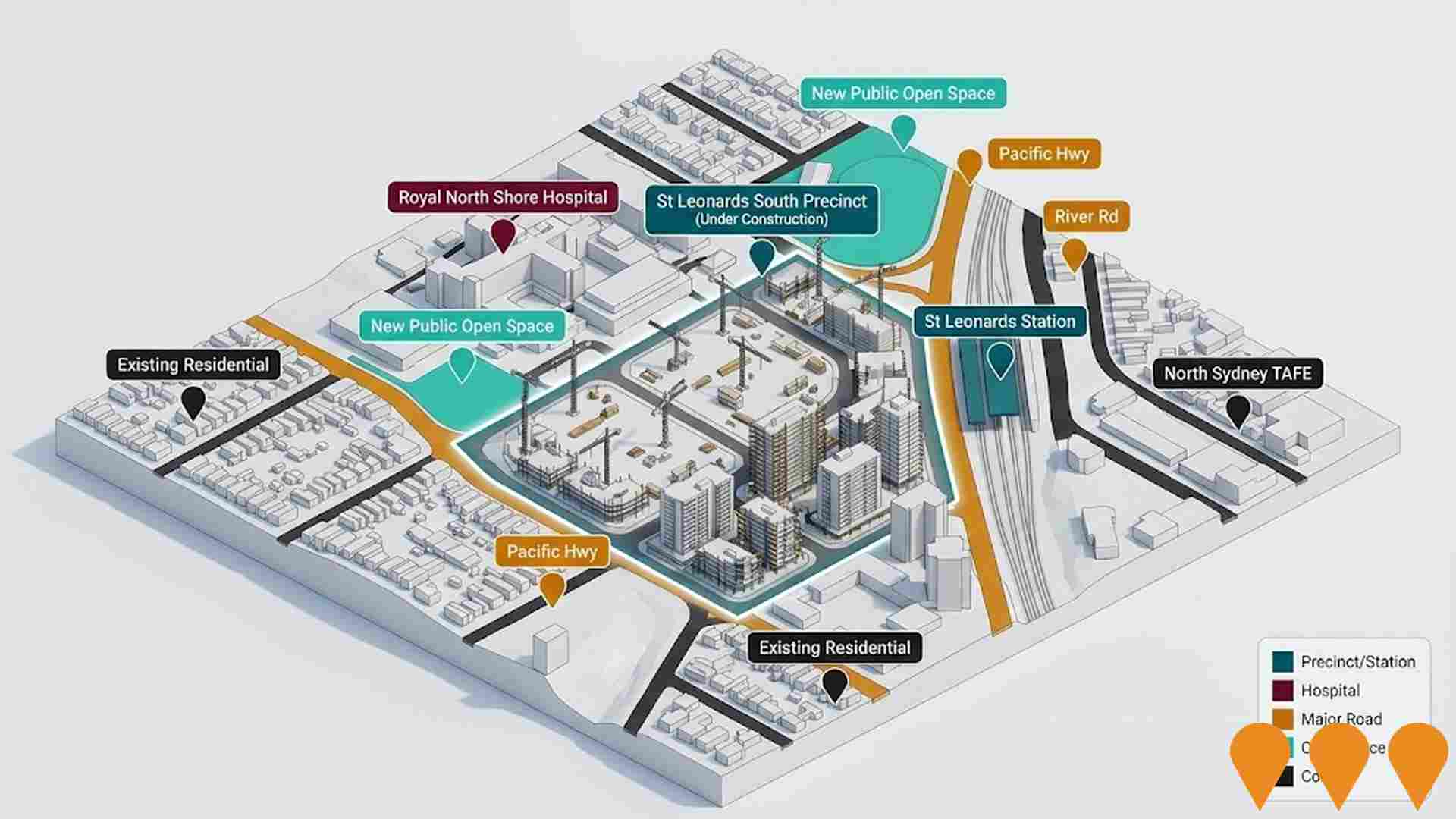

Royal North Shore Hospital (RNSH) Campus Master Plan

A comprehensive 40-year strategic master plan (2023-2063) guiding the future expansion of the Royal North Shore Hospital precinct. The plan delineates zones for acute clinical services, research and education, and support facilities. Key components include the 'Herbert Street Precinct' (Lot 4B) redevelopment, managed by Property and Development NSW, which aims to deliver mixed-use commercial spaces and approximately 448 new homes, including affordable housing for health workers.

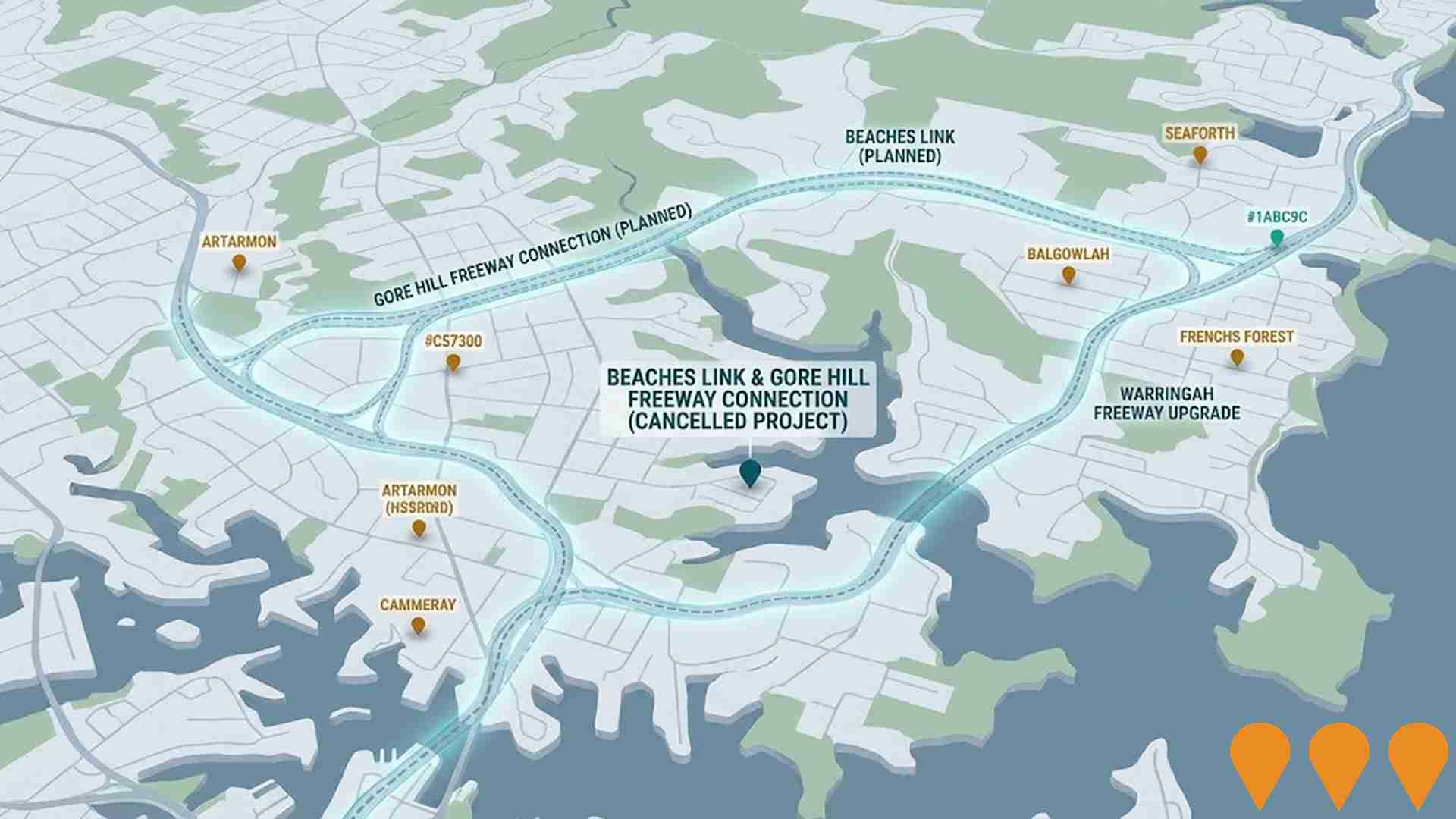

Western Harbour Tunnel and Warringah Freeway Upgrade

A major transport infrastructure project delivering a 6.5km dual three-lane tunnel under Sydney Harbour, connecting the Warringah Freeway at Cammeray to the Rozelle Interchange. The project creates a western bypass of the CBD to relieve congestion on the Sydney Harbour Bridge and Tunnel. Includes significant upgrades to the Warringah Freeway to integrate the new tunnel and improve traffic flow.

Forum Place by Mirvac

Mirvac's $300+ million mixed-use precinct featuring residential towers, commercial spaces, retail, and public amenities. Located at the former St Leonards Forum site.

The Landmark Quarter St Leonards

Luxury residential development by New Hope Group featuring three sculpted towers with 234 apartments, townhomes and penthouses designed by Rothelowman. Includes resort-style amenities, harbour views, and premium finishes. Located at 8 Marshall Avenue, St Leonards.

Park Avenue Residences St Leonards

Major residential development by JQZ at 26-50 Park Road, St Leonards. The existing buildings and trees will be demolished to make way for 4 new residential buildings with 306 apartments.

Willoughby Square (Stage 1 - 507-509 Pacific Highway)

Mixed-use tower delivering approximately 400 apartments, retail and public domain improvements as part of the emerging Willoughby Square precinct.

St Andrews Anglican Church Redevelopment

Mixed-use renewal of the St Andrews Anglican Church site delivering new church and ministry facilities, a 400+ seat community auditorium, retail space and 47 apartments over part seven and part eight storeys. The proposal retains and adapts heritage elements of the original church hall. Development Application DA152/2024 was unanimously approved by the Sydney North Planning Panel in July 2025.

St Leonards South Precinct

Council-led urban renewal of the St Leonards South area to deliver mid-to-high density housing, new public open space, local road upgrades and community facilities. The precinct is progressing via multiple private DAs, supported by an IPART-assessed Section 7.11 Contributions Plan. Council indicates substantial construction activity is underway across several sites.

Employment

AreaSearch assessment positions Greenwich - Riverview ahead of most Australian regions for employment performance

Greenwich Riverview has a highly educated workforce. In the technology sector, it stands out significantly.

As of September 2025, its unemployment rate is 3.4%, lower than Greater Sydney's 4.2%. Employment stability over the past year is relatively high. There are 7,464 employed residents, with a participation rate of 66.5% compared to Greater Sydney's 60.0%. Key employment sectors include professional & technical, health care & social assistance, and finance & insurance.

Professional & technical jobs are particularly concentrated, at 1.7 times the regional average. However, construction jobs have limited presence, at 4.5% compared to the regional 8.6%. Over the past year, labour force increased by 0.4%, but employment declined by 0.1%, raising unemployment by 0.5 percentage points. In contrast, Greater Sydney saw employment rise by 2.1%. Statewide in NSW as of 25-Nov-25, employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%, compared to the national rate of 4.3%. Jobs and Skills Australia's forecasts indicate that nationally, employment should expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Greenwich Riverview's employment mix suggests local employment could increase by 7.8% over five years and 15.5% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch's latest postcode level ATO data for financial year 2022 shows Greenwich - Riverview SA2 had a median income among taxpayers of $79,629 and an average of $122,798. This places it in the top percentile nationally. Greater Sydney's median was $56,994 with an average of $80,856. Based on Wage Price Index growth of 12.61% since financial year 2022, estimated incomes as of September 2025 would be approximately $89,670 (median) and $138,283 (average). Census data reveals all income types rank highly in Greenwich - Riverview, between the 97th and 99th percentiles nationally. The earnings profile shows 47.1% of residents earn over $4,000 per week (6,200 people), differing from surrounding regions where the $1,500 - 2,999 bracket predominates at 30.9%. This affluence supports premium retail and service offerings. After housing costs, residents retain 88.4% of income, indicating strong purchasing power. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Greenwich - Riverview displays a diverse mix of dwelling types, with above-average rates of outright home ownership

Greenwich-Riverview's dwelling structures, as per the latest Census, were 65.4% houses and 34.5% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Sydney metro's 41.1% houses and 58.9% other dwellings. Home ownership in Greenwich-Riverview stood at 40.4%, with mortgaged dwellings at 32.8% and rented ones at 26.8%. The median monthly mortgage repayment was $3,500, exceeding Sydney metro's average of $3,033. Weekly rent in the area was $600, compared to Sydney metro's $560. Nationally, Greenwich-Riverview's mortgage repayments were higher at $3,500 than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Greenwich - Riverview has a typical household mix, with a higher-than-average median household size

Family households account for 76.1% of all households, including 39.1% couples with children, 29.1% couples without children, and 7.2% single parent families. Non-family households constitute the remaining 23.9%, with lone person households at 20.6% and group households comprising 3.3% of the total. The median household size is 2.7 people, larger than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational achievement in Greenwich - Riverview places it within the top 10% nationally, reflecting strong academic performance and high qualification levels across the community

Greenwich - Riverview has a higher educational attainment than the national average. As of 15+ years old residents, 63.2% hold university qualifications, compared to Australia's 30.4% and NSW's 32.2%. Bachelor degrees are most common at 38.8%, followed by postgraduate qualifications (20.5%) and graduate diplomas (3.9%). Vocational pathways account for 15.3%, with advanced diplomas at 8.6% and certificates at 6.7%.

Educational participation is high, with 31.6% currently enrolled in formal education. This includes 9.5% in secondary education, 9.4% in primary education, and 8.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Greenwich-Riverview has 111 active public transport stops offering a mix of ferry and bus services. These stops are served by 46 different routes, collectively facilitating 4,440 weekly passenger trips. The area's transport accessibility is rated excellent, with residents typically residing 109 meters from the nearest stop.

Service frequency averages 634 trips daily across all routes, translating to approximately 40 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Greenwich - Riverview's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Health outcomes data shows excellent results across Greenwich-Riverview, with very low prevalence of common health conditions across all age groups. Approximately 79% of the total population (10,453 people) has private health cover, compared to the national average of 55.3%.

The most prevalent medical conditions are asthma and arthritis, affecting 6.7% and 6.1% of residents respectively. A total of 75.5% of residents declare themselves completely clear of medical ailments, compared to 78.0% across Greater Sydney. In terms of age distribution, 19.1% of residents are aged 65 and over (2,521 people), which is higher than the 15.7% in Greater Sydney. Health outcomes among seniors are particularly strong, broadly aligning with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Greenwich - Riverview was found to be above average when compared nationally for a number of language and cultural background related metrics

Greenwich-Riverview has a higher cultural diversity than most local markets, with 19.8% of its residents speaking languages other than English at home and 32.9% born overseas. Christianity is the predominant religion in Greenwich-Riverview, accounting for 53.0% of the population. Notably, Judaism is slightly overrepresented at 1.1%, compared to the Greater Sydney average of 1.0%.

The top three ancestry groups are English (23.6%), Australian (20.2%), and Irish (10.6%). Some ethnic groups show notable differences: Hungarian is overrepresented at 0.5% versus 0.4% regionally, French at 0.9% versus 0.7%, and Chinese at 8.4% compared to the regional average of 17.1%.

Frequently Asked Questions - Diversity

Age

Greenwich - Riverview's population is slightly older than the national pattern

Greenwich - Riverview's median age is 41 years, significantly higher than Greater Sydney's average of 37 years and slightly older than Australia's median of 38 years. The 2021 Census showed that the 15-24 age group was notably over-represented at 14.9%, while the 25-34 cohort was under-represented at 11.0%. Between censuses, the 15 to 24 age group grew from 12.7% to 14.9%, and the 75 to 84 cohort increased from 5.7% to 6.8%. Conversely, the 5 to 14 cohort declined from 13.4% to 11.8%, and the 45 to 54 group dropped from 15.2% to 14.0%. Demographic projections suggest that by 2041, Greenwich - Riverview's age profile will change significantly. The 45-54 cohort is projected to grow by 39%, adding 725 residents to reach a total of 2,569. Meanwhile, both the 0-4 and 5-14 age groups are expected to decrease in number.