Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in McMahons Point reveals an overall ranking slightly below national averages considering recent, and medium term trends

As of November 2025, the estimated population for the McMahons Point statistical area (Lv2) is around 2,533. This figure reflects a growth of 218 people since the 2021 Census, which reported a population of 2,315. The increase was inferred from AreaSearch's estimation of 2,531 residents based on the latest ERP data release by the ABS in June 2024, along with an additional four validated new addresses since the Census date. This results in a population density ratio of 7,237 persons per square kilometer, placing McMahons Point (SA2) in the top 10% nationally. The area's 9.4% growth rate exceeded both its SA3 area (5.4%) and SA4 region, indicating it as a regional growth leader. Overseas migration contributed approximately 84.0% of overall population gains during recent periods.

AreaSearch projects future population trends based on ABS/Geoscience Australia projections for each SA2 area released in 2024 with 2022 as the base year, and NSW State Government's SA2 level projections released in 2022 with 2021 as the base year. By 2041, the area is forecasted to increase by 746 persons, reflecting a total growth of 30.0% over the 17-year period.

Frequently Asked Questions - Population

Development

The level of residential development activity in McMahons Point is very low in comparison to the average area assessed nationally by AreaSearch

McMahons Point has experienced around 1 dwelling receiving development approval annually based on AreaSearch analysis of ABS building approval numbers allocated from statistical area data.

Population in the area has fallen over the past period, yet development activity has been adequate relative to this decline, which is positive for buyers. Compared to Greater Sydney, McMahons Point records markedly lower building activity, typically strengthening demand and prices for existing properties due to scarcity of new homes. This level of activity is also below average nationally, reflecting the area's maturity and possible planning constraints.

Frequently Asked Questions - Development

Infrastructure

McMahons Point has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified one major project likely affecting this region: Affinity Place, East Walker Residences, MLC Building North Sydney - Adaptive Reuse (105-153 Miller Street), and Victoria Cross Station and Tower are key projects, with the following list detailing those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

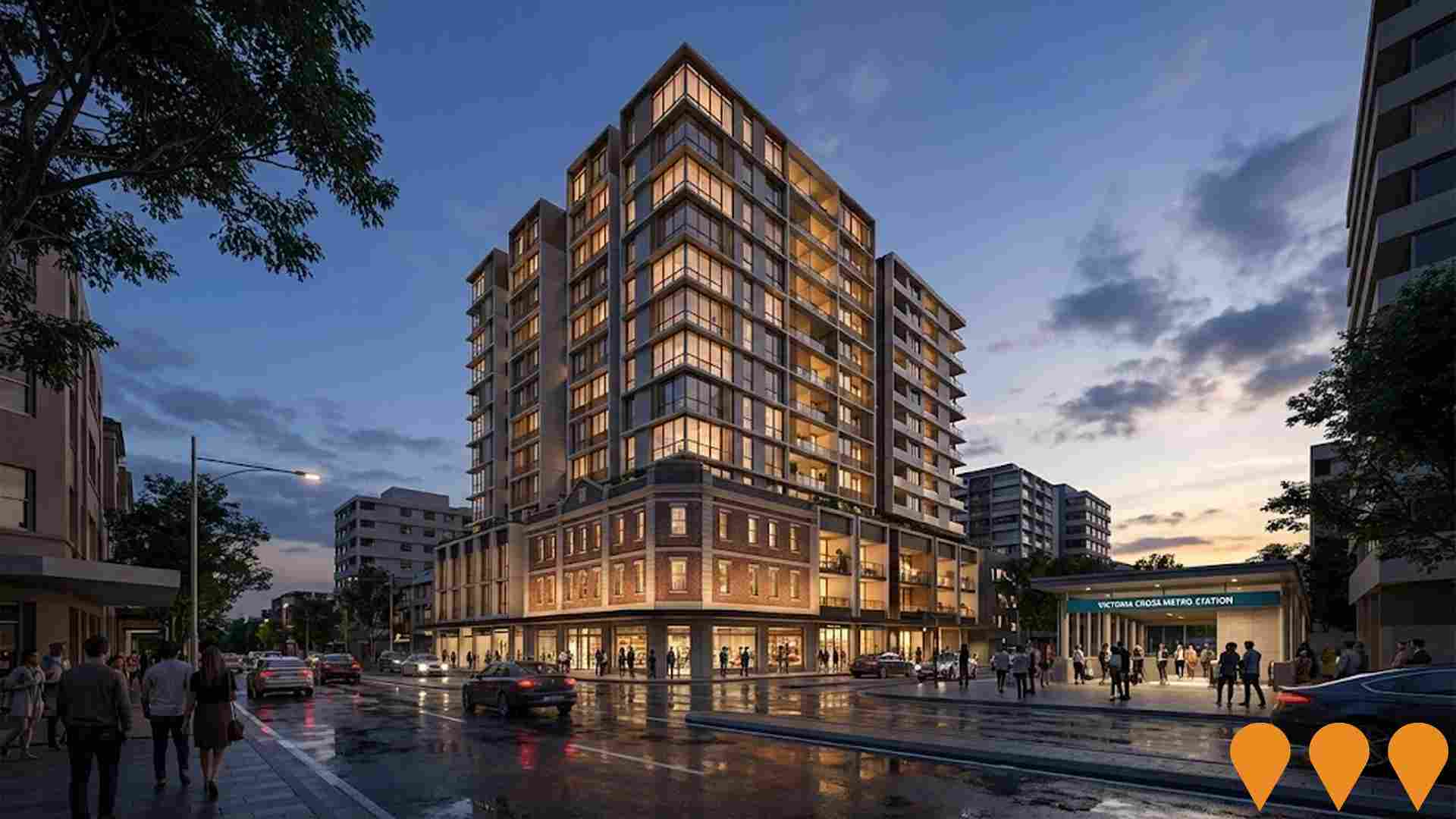

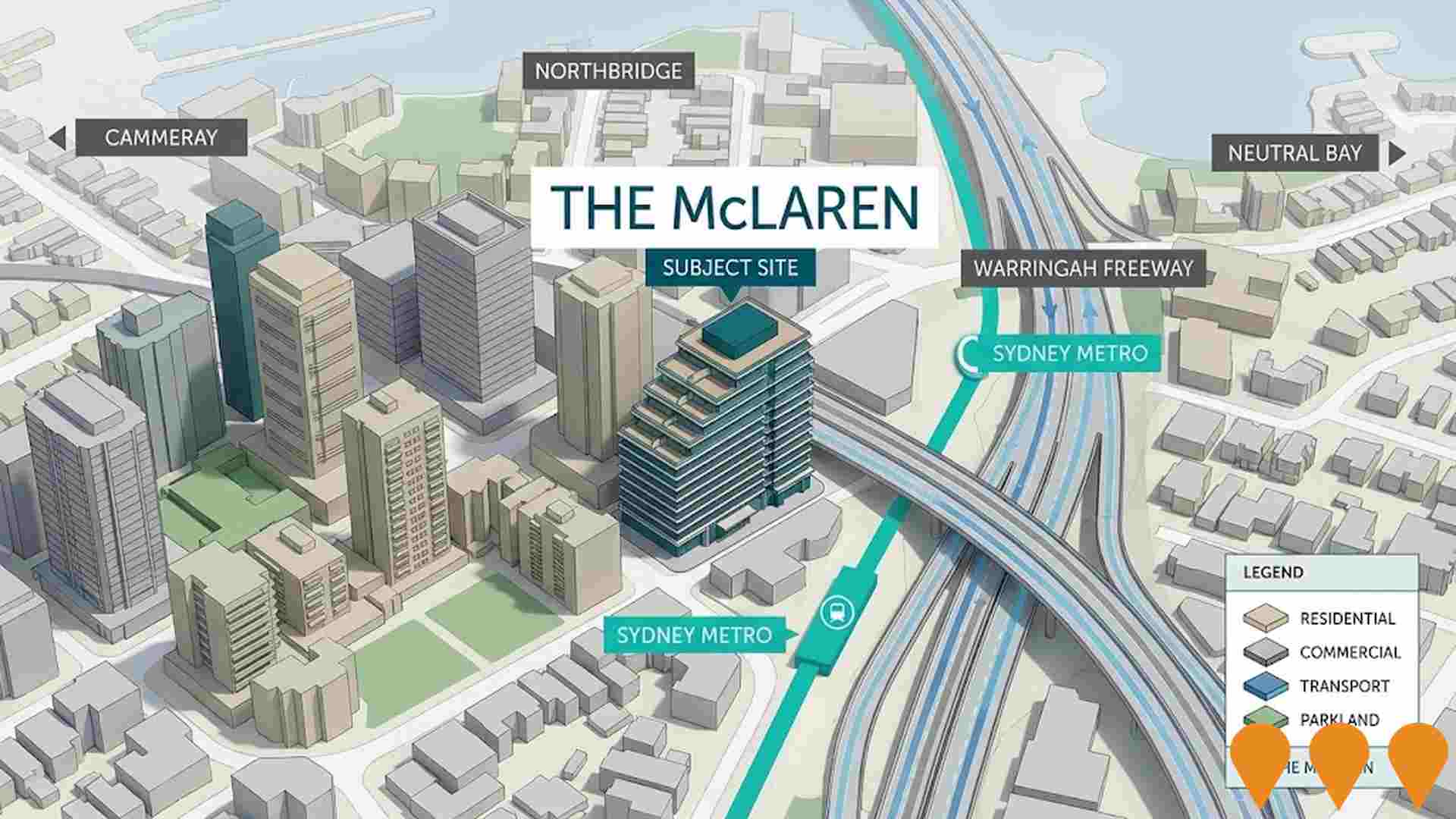

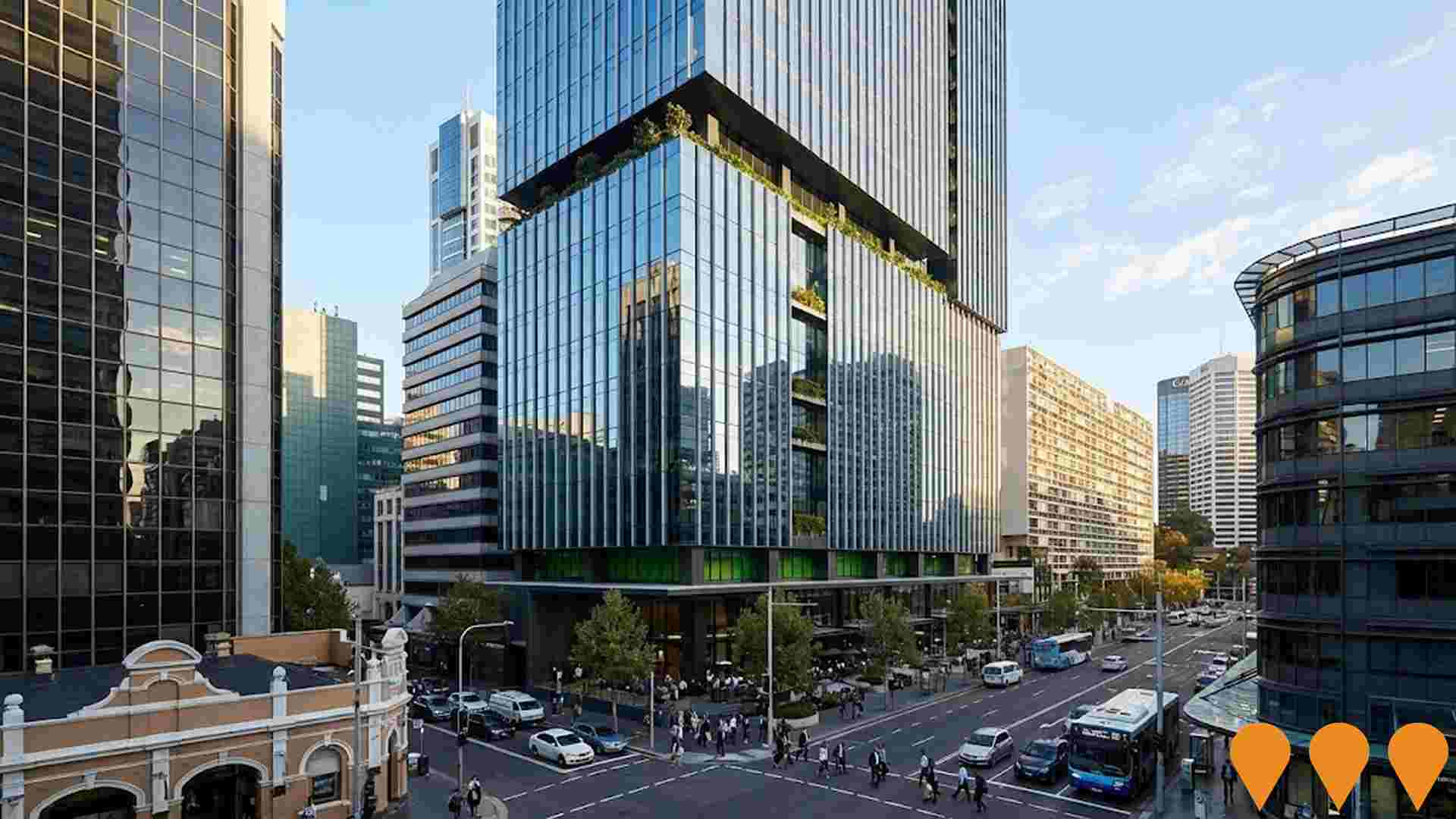

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Victoria Cross Station and Tower

An integrated station development by Lendlease featuring the 42-storey Victoria Cross Tower. The Sydney Metro station opened in August 2024, while the net-zero carbon commercial tower reached its highest point in April 2025. The project delivers 58,000 sqm of premium office space for approximately 7,000 workers, a multi-level dining hub known as Miller House, and a retail precinct with over 20 outlets including One Playground gym.

Waverton Peninsula Strategic Masterplan (Berrys Bay)

A long-term strategic masterplan transforming former industrial sites (Coal Loader, Caltex, BP, and Woodleys Shipyard) into public parklands. Current works focus on the Berrys Bay foreshore parkland, delivered by Transport for NSW and ACCIONA as part of the Western Harbour Tunnel project. The project includes a reimagined Woodley's Shed community pavilion, a continuous foreshore path connecting Carradah Park to Balls Head Reserve, sea wall rectification, and ground remediation.

Affinity Place

51-storey premium office tower by Stockland, designed by Hassell. Approximately 58,500-59,000 sqm of office and retail space with a public sky garden. Targeting 6 Star Green Star and 5-5.5 Star NABERS Energy. DA approved June 2022; AIPP summary indicates construction sequencing through to Q1 2028.

East Walker Residences

Cbus Property and Galileo Group development featuring two towers (12-storey affordable housing and 30-storey luxury apartments) with 263 total residences. Mix of build-to-sell and affordable housing apartments near Victoria Cross Metro Station.

100-102 Walker Street Commercial Tower, North Sydney

DA-approved redevelopment of an existing B-grade office at 100-102 Walker Street into a ~45-48 storey next-gen commercial tower designed by Bates Smart for Pro-invest Group. The scheme includes approx. 37,000-42,500 sqm of commercial NLA, retail at ground and podium, end-of-trip facilities, and a new 6m wide public laneway connection linking Walker Street to Little Spring Street and the Victoria Cross Metro. Sydney North Planning Panel granted development approval on 26 Aug 2022. As of 2025, construction has not commenced and the existing building remains in use (leasing and flexible offices).

MLC Building North Sydney - Adaptive Reuse (105-153 Miller Street)

Adaptive reuse of the State-heritage listed MLC Building in North Sydney. Current State Significant Development proposal (SSD) seeks refurbishment and restoration of the Miller Street wing, demolition of the Denison Street wing and central core, and construction of a new ~22-storey tower. The scheme is positioned for a tertiary education campus with ground-floor retail and improved public domain connections to Victoria Cross station and Miller Place. A separate local DA (Jan 2025) proposed a commercial office scheme; the BtR scheme has been withdrawn.

Warada on Walker

A proposed 22 to 26 storey premium office tower in North Sydney inspired by the Waratah flower. The scheme includes approx. 27,000 to 33,000 sqm NLA, large 1,000 sqm rooftop garden, end of trip facilities, and a through-site link activating the podium with retail and hospitality. DA approved by North Sydney Council; builder appointed, but no verified construction start as of 2025.

5 Blue Street Mixed-Use Redevelopment (Zurich Building)

Proposal for the demolition of the existing 14-storey commercial Zurich Building and construction of a new 29-storey mixed-use tower. The tower will include commercial space on the ground floor, and residential dwellings, including approximately 195 affordable housing co-living units. The project, declared a State Significant Development (SSD-86270706) under the Housing Delivery Authority (HDA) pathway, aims to deliver high-density housing and public domain upgrades above North Sydney Railway Station.

Employment

The employment landscape in McMahons Point shows performance that lags behind national averages across key labour market indicators

McMahons Point has a highly educated workforce with notable representation in the technology sector. As of September 2025, its unemployment rate is 4.9%, based on AreaSearch's aggregation of statistical area data.

In terms of employment, McMahons Point has an unemployment rate of 0.7% above Greater Sydney's rate of 4.2%. The workforce participation rate in McMahons Point is 68.2%, compared to Greater Sydney's 60.0%. Employment among residents is concentrated in professional & technical services (2 times the regional average), health care & social assistance, and finance & insurance sectors. Retail trade is under-represented with only 4.2% of McMahons Point's workforce compared to 9.3% in Greater Sydney.

The area functions as an employment hub with a ratio of 3.1 workers per resident, attracting workers from surrounding areas. Between September 2024 and September 2025, the labour force increased by 0.7%, while employment decreased by 0.7%, causing the unemployment rate to rise by 1.3 percentage points. In comparison, Greater Sydney saw employment grow by 2.1% and the labour force expand by 2.4%, with a smaller increase in unemployment of 0.2 percentage points. As of 25-November-25 in NSW, employment contracted by 0.03% (losing 2,260 jobs), with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that over five years, employment should increase by 7.8%, and over ten years by 15.3% in McMahons Point.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch's latest postcode level ATO data for financial year 2023 shows that McMahons Point has median income of $79,793 and average income of $142,709. This is higher than Greater Sydney's median income of $60,817 and average income of $83,003. Considering an 8.86% Wage Price Index growth since financial year 2023, estimated incomes for September 2025 would be approximately $86,863 (median) and $155,353 (average). Census 2021 data indicates that McMahons Point's household, family, and personal incomes rank between the 91st and 99th percentiles nationally. The earnings profile shows that 35.5% of locals earn more than $4000 weekly, compared to the broader area where 30.9% earn between $1500 - $2999 weekly. A significant 46.3% earn above $3000 weekly. High housing costs consume 15.9% of income, but strong earnings place disposable income at the 91st percentile nationally. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

McMahons Point features a more urban dwelling mix with significant apartment living, with above-average rates of outright home ownership

In McMahons Point, as per the latest Census, 13.1% of dwellings were houses while 87.0% were other types such as semi-detached homes and apartments. This is compared to Sydney metropolitan areas where 17.9% of dwellings are houses and 82.1% are other types. Home ownership in McMahons Point stood at 32.4%, with mortgaged dwellings at 14.6% and rented ones at 53.0%. The median monthly mortgage repayment was $3,000, lower than the Sydney metro average of $3,085. The median weekly rent in McMahons Point was $580, similar to the Sydney metro figure of $582. Nationally, McMahons Point's mortgage repayments were higher at $3,000 compared to Australia's average of $1,863, and rents were substantially higher at $580 versus the national average of $375.

Frequently Asked Questions - Housing

Household Composition

McMahons Point features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 52.7% of all households, including 13.7% couples with children, 33.5% couples without children, and 4.1% single parent families. Non-family households comprise the remaining 47.3%, with lone person households at 44.1% and group households making up 3.0% of the total. The median household size is 1.8 people, which is smaller than the Greater Sydney average of 2.1.

Frequently Asked Questions - Households

Local Schools & Education

Educational achievement in McMahons Point places it within the top 10% nationally, reflecting strong academic performance and high qualification levels across the community

McMahons Point has a notably higher educational attainment than broader averages. Among residents aged 15 and above, 68.8% hold university qualifications, compared to the national average of 30.4% and the NSW average of 32.2%. This high level of attainment is led by bachelor degrees (40.9%), followed by postgraduate qualifications (23.2%) and graduate diplomas (4.7%). Vocational pathways account for 16.8%, with advanced diplomas at 8.5% and certificates at 8.3%.

A significant portion of the population, 20.8%, is actively pursuing formal education. This includes 8.5% in tertiary education, 3.7% in secondary education, and 3.4% pursuing primary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Public transport analysis shows that there are 23 active transport stops operating within McMahons Point. These consist of a mix of ferry and bus services. There are 10 individual routes servicing these stops, collectively providing 3904 weekly passenger trips.

Transport accessibility is rated as excellent, with residents typically located 113 meters from the nearest transport stop. Service frequency averages 557 trips per day across all routes, equating to approximately 169 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

McMahons Point's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Health outcomes data shows excellent results in McMahons Point with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 83% of the total population (2,103 people), compared to the national average of 55.7%.

The most common medical conditions are asthma and arthritis, impacting 6.8 and 6.5% of residents respectively. Seventy-three point three percent declared themselves completely clear of medical ailments, compared to 75.2% across Greater Sydney. The area has 23.0% of residents aged 65 and over (582 people), higher than the 20.1% in Greater Sydney. Health outcomes among seniors are particularly strong, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in McMahons Point was found to be above average when compared nationally for a number of language and cultural background related metrics

McMahons Point had a higher cultural diversity than most local areas, with 17.4% speaking a language other than English at home and 37.0% born overseas. Christianity was the predominant religion, accounting for 42.5%. Judaism showed an overrepresentation of 0.9%, compared to Greater Sydney's 1.0%.

For ancestry, the top groups were English (29.3%), Australian (16.9%), and Irish (11.4%). Some ethnic groups had notable differences: French was at 1.1% (vs regional 1.1%), Polish at 1.2% (vs 0.9%), and Scottish at 9.7% (vs 8.0%).

Frequently Asked Questions - Diversity

Age

McMahons Point hosts a notably older demographic compared to the national average

McMahons Point has a median age of 44, which is higher than Greater Sydney's figure of 37 and the national norm of 38. The 55-64 age group makes up 14.9% of McMahons Point's population, compared to Greater Sydney, while the 5-14 cohort comprises only 4.0%. According to the 2021 Census, the 75 to 84 age group has increased from 8.0% to 9.5% of the population. Conversely, the 25 to 34 age group has decreased from 19.9% to 18.2%, and the 45 to 54 group has dropped from 13.2% to 12.1%. Demographic modeling indicates that McMahons Point's age profile will change significantly by 2041. Leading this shift, the 75 to 84 age group is projected to grow by 87%, reaching 451 people from 240. The aging population trend is evident, with those aged 65 and above accounting for 69% of the projected growth. Meanwhile, the 25 to 34 and 0 to 4 age groups are expected to experience population declines.