Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Gordon - Killara are slightly above average based on AreaSearch's ranking of recent, and medium term trends

Gordon-Killara's population is 23,962 as of November 2025. This shows an increase of 1,529 people since the 2021 Census, which reported a population of 22,433. The change is inferred from ABS estimated resident population of 23,783 in June 2024 and 133 validated new addresses since the Census date. This results in a density ratio of 2,053 persons per square kilometer, above national averages assessed by AreaSearch. Gordon-Killara's growth of 6.8% since the 2021 census exceeded its SA3 area (4.4%) and SA4 region, marking it as a growth leader. Overseas migration primarily drove this growth.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections from 2022 with a base year of 2021 are used. Growth rates by age group are applied to all areas for years 2032 to 2041. By 2041, based on latest annual ERP population numbers, the area is expected to increase by 2,594 persons, reflecting a gain of 10.1% over 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Gordon - Killara recording a relatively average level of approval activity when compared to local markets analysed countrywide

Gordon-Killara has seen approximately 47 dwellings receive development approval annually over the past five financial years, totalling 236 homes. As of FY-26, 28 approvals have been recorded. On average, each dwelling built between FY-21 and FY-25 attracted 2.9 new residents per year, indicating strong demand which may support property values. New homes are being constructed at an average cost of $705,000, suggesting developers target the premium market segment with higher-end properties.

This financial year, $114.7 million in commercial approvals have been registered, reflecting high local commercial activity. Compared to Greater Sydney, Gordon-Killara records roughly half the building activity per person and ranks among the 18th percentile of areas assessed nationally, suggesting limited buyer options but strong demand for established dwellings. This lower activity may reflect market maturity or potential development constraints. New development consists of 71.0% detached houses and 29.0% townhouses or apartments, maintaining the area's suburban character with a focus on detached housing attracting space-seeking buyers.

The location has approximately 815 people per dwelling approval, indicating an established market. According to AreaSearch's latest quarterly estimate, Gordon-Killara is expected to grow by 2,415 residents by 2041. At current development rates, housing supply may struggle to match population growth, potentially intensifying buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Gordon - Killara has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

The performance of an area can significantly be influenced by changes to local infrastructure, major projects, and planning initiatives. AreaSearch has identified 48 projects that are likely to impact the area. Notable projects include The Marian - 20, 22A & 22 Marian Street TOD Site, Killara Golf Club Residential Development, IC3 Super West Data Centre, and Stanhope Road Development Site. The following list details those projects expected to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

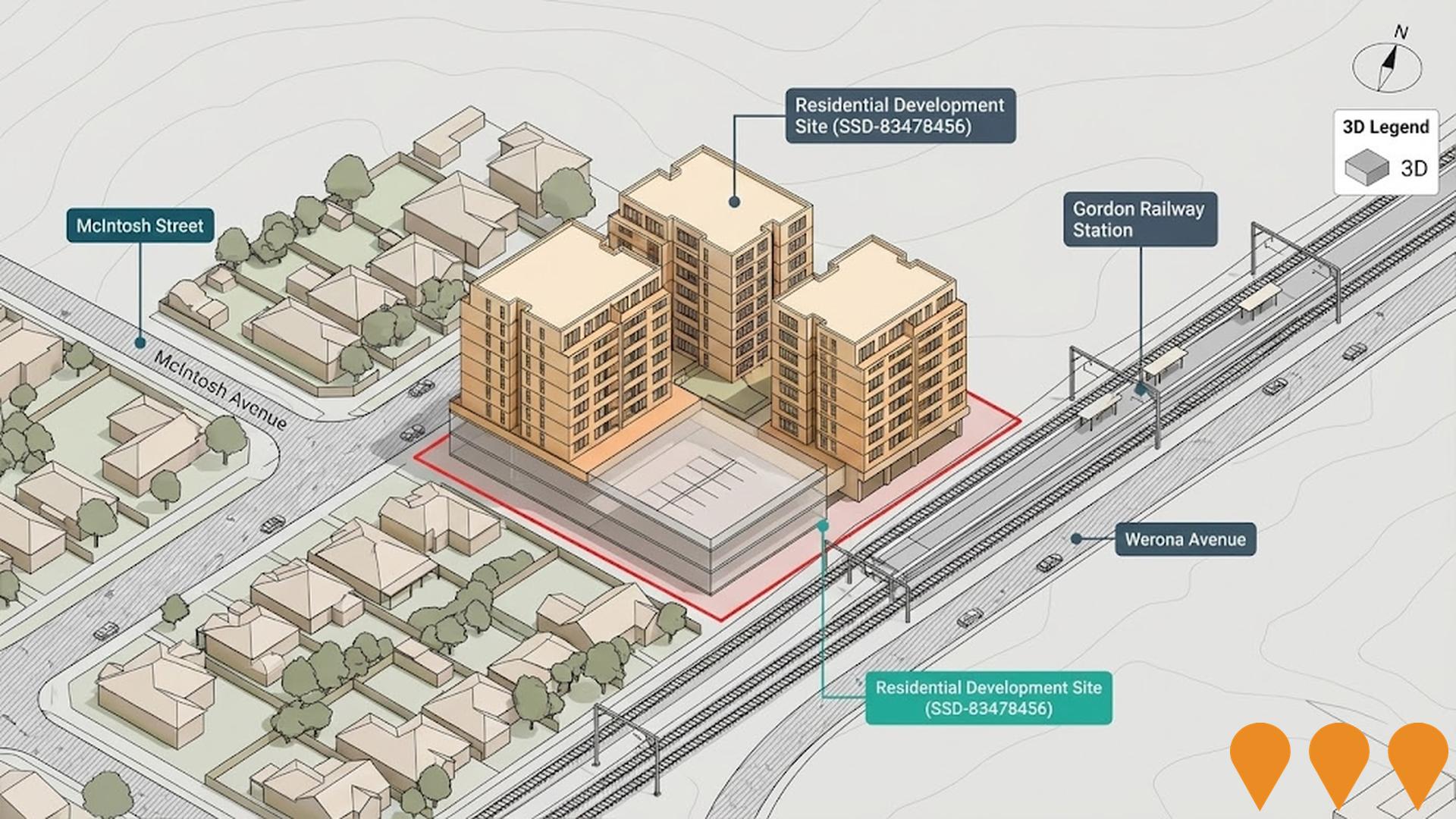

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Transport Oriented Development & Rail Infrastructure - Lindfield Precinct

The Lindfield Precinct project is part of the NSW Government's Transport Oriented Development (TOD) program, which aims to increase housing density and mixed-use development within 400m of Lindfield Station. Ku-ring-gai Council developed and submitted an **Alternative Plan** for the four TOD precincts (Lindfield, Gordon, Killara, Roseville), which the NSW Government formally adopted in **November 2025**. This plan delivers required housing capacity while protecting heritage and tree canopy. The rail infrastructure upgrades (signal improvements, platform extensions, accessibility enhancements) are typically bundled with these large TOD programs, and while specific details are less public than the planning controls, the project is progressing under the adopted scheme.

Lindfield Village Hub

Major urban renewal project by Ku-ring-gai Council featuring new library, community centre, childcare facility, underground parking, housing, shops, and public park. Located on Woodford Lane car park site.

Bridgestone Projects Lindfield

Residential development by Bridgestone Projects featuring modern apartments with integrated commercial spaces. Focus on sustainable design and community amenities. Harmonizing with local environment with generous living spaces.

IC3 Super West Data Centre

Australias first purpose-built AI and cloud data centre at the Macquarie Park Data Centre Campus, offering 11,700 square meters of technical space and 47MW capacity. Designed with fungible data halls supporting air, liquid, and hybrid cooling for high-density AI and cloud workloads, providing flexibility for hyperscalers, government, and enterprise customers.

Gordon Grand

Contemporary residential development designed by award-winning architects Marchese Partners, featuring 58 apartments across 7 floors with premium finishes, now completed and operational.

The Marian - 20, 22A & 22 Marian Street TOD Site

Amalgamated residential development opportunity branded 'The Marian' comprising 20, 22A and 22 Marian Street (approx. 3,876 sqm site) about 200 m to Killara Station. Within NSW TOD area around Killara Station with indicative FSR up to 2.5:1 under the government's TOD policy. Marketed via EOI closing 31 July 2024. No development application identified for the combined site as at August 17, 2025. Planning controls and local council positions on TOD are evolving in Ku-ring-gai.

Lourdes Retirement Village Expansion

Redevelopment of the existing Lourdes Retirement Village to deliver 141 independent living units, 63 townhouses and a 110 bed residential aged care facility with upgraded community facilities and road improvements. Following community consultation and assessment, the Planning Proposal to enable the expansion was not supported by the Minister's delegate in July 2024 due to issues including bushfire risk. The community is currently withdrawn from sale while future options are considered.

Killara Golf Club Residential Development

Residential development on the northeast portion of Killara Golf Club comprising 165 apartments and 14 detached dwellings (179 total dwellings). The planning proposal seeks to rezone approximately 2.5 hectares from Residential 2(b) to R4 High Density Residential and R2 Low Density Residential zones with RE2 Private Recreation overlay. The proposal includes adaptive reuse or continued operation of the heritage-listed Art Deco clubhouse building (circa 1930s), retention of significant Blue Gum High Forest vegetation, and protection of heritage curtilage. Maximum building heights of 17.5m are proposed for R4 areas with floor space ratios ranging from 0.36:1 to 1.3:1. The Club submitted the planning proposal in 2017, which was publicly exhibited in May 2018 and adopted by Ku-ring-gai Council in November 2018. The proposal aims to provide financial sustainability for the golf club while delivering diverse housing options close to Killara Railway Station (800m walking distance). The development will maintain the 18-hole championship golf course and associated sporting facilities including tennis, bowls and squash courts.

Employment

The employment landscape in Gordon - Killara shows performance that lags behind national averages across key labour market indicators

Killara's workforce is highly educated with notable representation in the technology sector. The unemployment rate as of September 2025 was 4.4%.

In that month, 12,100 residents were employed at an unemployment rate of 4.6% compared to Greater Sydney's 4.2%. Workforce participation was on par with Greater Sydney's 60.0%. Key industries for employment among residents were professional & technical, health care & social assistance, and finance & insurance. Killara had a particular specialization in professional & technical jobs with an employment share of 1.6 times the regional level.

Construction employment was limited at 4.1% compared to the regional average of 8.6%. The area appeared to offer limited local employment opportunities based on Census data. Between September 2024 and September 2025, Killara's labour force increased by 0.7% while employment declined by 0.8%, causing unemployment to rise by 1.4 percentage points. In contrast, Greater Sydney experienced employment growth of 2.1% and labour force growth of 2.4%. State-level data as of 25-Nov-25 showed NSW employment had contracted by 0.03% (losing 2,260 jobs) with an unemployment rate of 3.9%, compared to the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 projected overall employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Killara's employment mix suggested local employment should increase by 7.6% over five years and 15.1% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Gordon-Killara SA2 had a median income of $59,739 and an average income of $120,764. Nationally, these figures are exceptionally high compared to Greater Sydney's median of $56,994 and average of $80,856. By September 2025, estimates suggest the median income will be approximately $67,272 and the average will be around $135,992, based on a 12.61% growth in Wage Price Index since financial year 2022. Census data indicates that household, family, and personal incomes in Gordon-Killara rank highly nationally, between the 84th and 93rd percentiles. Income distribution shows 33.7% of the population (8,075 individuals) earn $4000 or more weekly, differing from regional patterns where $1,500 - 2,999 is dominant at 30.9%. Notably, 45.3% earn above $3,000 weekly. High housing costs consume 15.8% of income, but strong earnings place disposable income at the 92nd percentile nationally. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Gordon - Killara features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

The dwelling structure in Gordon-Killara, as per the latest Census, consisted of 55.7% houses and 44.3% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Sydney metro's 68.8% houses and 31.3% other dwellings. Home ownership in Gordon-Killara stood at 38.1%, with the rest being mortgaged (33.1%) or rented (28.8%). The median monthly mortgage repayment was $3,200, below Sydney metro's average of $3,500. The median weekly rent figure was $600, compared to Sydney metro's $630. Nationally, Gordon-Killara's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Gordon - Killara features high concentrations of family households, with a lower-than-average median household size

Family households constitute 79.6 percent of all households, consisting of couples with children (43.5%), couples without children (24.1%), and single parent families (11.0%). Non-family households comprise the remaining 20.4%, with lone person households at 18.7% and group households making up 1.8%. The median household size is 2.8 people, which is smaller than the Greater Sydney average of 2.9.

Frequently Asked Questions - Households

Local Schools & Education

Gordon - Killara demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Gordon-Killara has a notably high level of educational attainment, with 59.5% of residents aged 15 and above holding university qualifications. This figure exceeds the national average of 30.4% and the NSW average of 32.2%, indicating a significant educational advantage for the area. Bachelor degrees are the most common at 36.1%, followed by postgraduate qualifications at 20.1% and graduate diplomas at 3.3%. Vocational pathways account for 16.1% of qualifications, with advanced diplomas making up 9.6% and certificates 6.5%.

Educational participation is high in the area, with 32.9% of residents currently enrolled in formal education. This includes 10.3% in secondary education, 9.5% in primary education, and 8.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The transport analysis indicates that there are 116 active transport stops operating within Gordon-Killara. These stops offer a mix of train and bus services. A total of 98 individual routes service these stops, collectively facilitating 7,426 weekly passenger trips.

The report rates transport accessibility as excellent, with residents typically residing just 166 meters from the nearest transport stop. On average, service frequency stands at 1,060 trips per day across all routes, which translates to approximately 64 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Gordon - Killara's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Gordon-Killara shows excellent health outcomes, with low prevalence rates of common conditions across all ages. Private health cover stands at approximately 80%, significantly higher than the national average of 55.3%.

Asthma and arthritis are the most prevalent conditions, affecting 5.5% and 4.6% respectively. Overall, 78.4% report no medical ailments, slightly above Greater Sydney's 76.0%. The area has a lower proportion of seniors aged 65 and over at 19.0%, compared to Greater Sydney's 20.2%. Despite this, health outcomes among seniors align with the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

Gordon - Killara is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Gordon-Killara has a high level of cultural diversity, with 46.9% of its population speaking a language other than English at home and 51.5% born overseas. Christianity is the predominant religion in Gordon-Killara, comprising 41.1% of the population. However, Judaism is overrepresented compared to Greater Sydney, making up 1.8% versus 2.5%.

The top three ancestry groups are Chinese (27.6%), English (18.1%), and Australian (14.1%). Notably, Korean (3.7%) and Russian (0.6%) are overrepresented compared to regional averages of 2.3% and 0.5%, respectively, while South African representation is lower at 0.8% versus the regional average of 1.6%.

Frequently Asked Questions - Diversity

Age

Gordon - Killara's population is slightly older than the national pattern

Gordon-Killara's median age is 41 years, which is significantly higher than Greater Sydney's average of 37 years and slightly older than Australia's median age of 38 years. Comparing with Greater Sydney, residents aged 15-24 are notably over-represented at 16.0% locally, while those aged 25-34 are under-represented at 9.5%. Post the 2021 Census, the 15 to 24 age group increased from 14.0% to 16.0%, while the 0 to 4 cohort decreased from 4.0% to 3.1%. By 2041, demographic projections suggest significant changes in Gordon-Killara's age profile. The 75 to 84 age group is expected to grow by 56%, adding 884 residents to reach 2,456. Residents aged 65 and older are projected to represent 70% of the population growth. Conversely, population declines are anticipated for the 0 to 4 and 25 to 34 age groups.