Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in East Lindfield reveals an overall ranking slightly below national averages considering recent, and medium term trends

As of Nov 2025, the estimated population of the East Lindfield statistical area (Lv2) is around 3,771. This figure reflects an increase of 61 people since the 2021 Census, which reported a population of 3,710. The change was inferred from AreaSearch's estimate of 3,729 residents in Jun 2024, based on examination of ABS ERP data release and validation of two new addresses since the Census date. This results in a population density ratio of 1,618 persons per square kilometer, above national averages assessed by AreaSearch. Over the past decade, East Lindfield has shown resilient growth patterns with a compound annual growth rate of 1.0%, outpacing its SA3 area. Overseas migration contributed approximately 92.0% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024, with 2022 as the base year. For areas not covered by this data, NSW State Government's SA2 level projections released in 2022 with a 2021 base year are utilized. Future population dynamics anticipate above median growth for national statistical areas. By 2041, East Lindfield (SA2) is projected to expand by 540 persons, reflecting an increase of 17.5% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in East Lindfield according to AreaSearch's national comparison of local real estate markets

Based on AreaSearch analysis of ABS building approval numbers allocated from statistical area data, East Lindfield has experienced around 1 dwelling receiving development approval each year. Approximately 7 homes were approved over the past five financial years between FY-21 and FY-25, with 1 more approved so far in FY-26.

This results in an average of about 13.1 people moving to the area per year for each dwelling built during this period. Supply is substantially lagging demand, leading to heightened buyer competition and pricing pressures. New properties are constructed at an average expected cost value of $900,000, indicating a focus on the premium segment with upmarket properties. Compared to Greater Sydney, East Lindfield shows significantly reduced construction activity, 90.0% below the regional average per person. This constrained new construction typically reinforces demand and pricing for existing homes, which is also below average nationally. This reflects the area's maturity and possible planning constraints. Recent development has been entirely comprised of attached dwellings, appealing to downsizers, investors, and entry-level buyers.

This marks a notable shift from the area's existing housing composition, currently 88.0% houses. The location has approximately 7725 people per dwelling approval, indicating an established market. According to AreaSearch's latest quarterly estimate, East Lindfield is expected to grow by 660 residents through to 2041. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

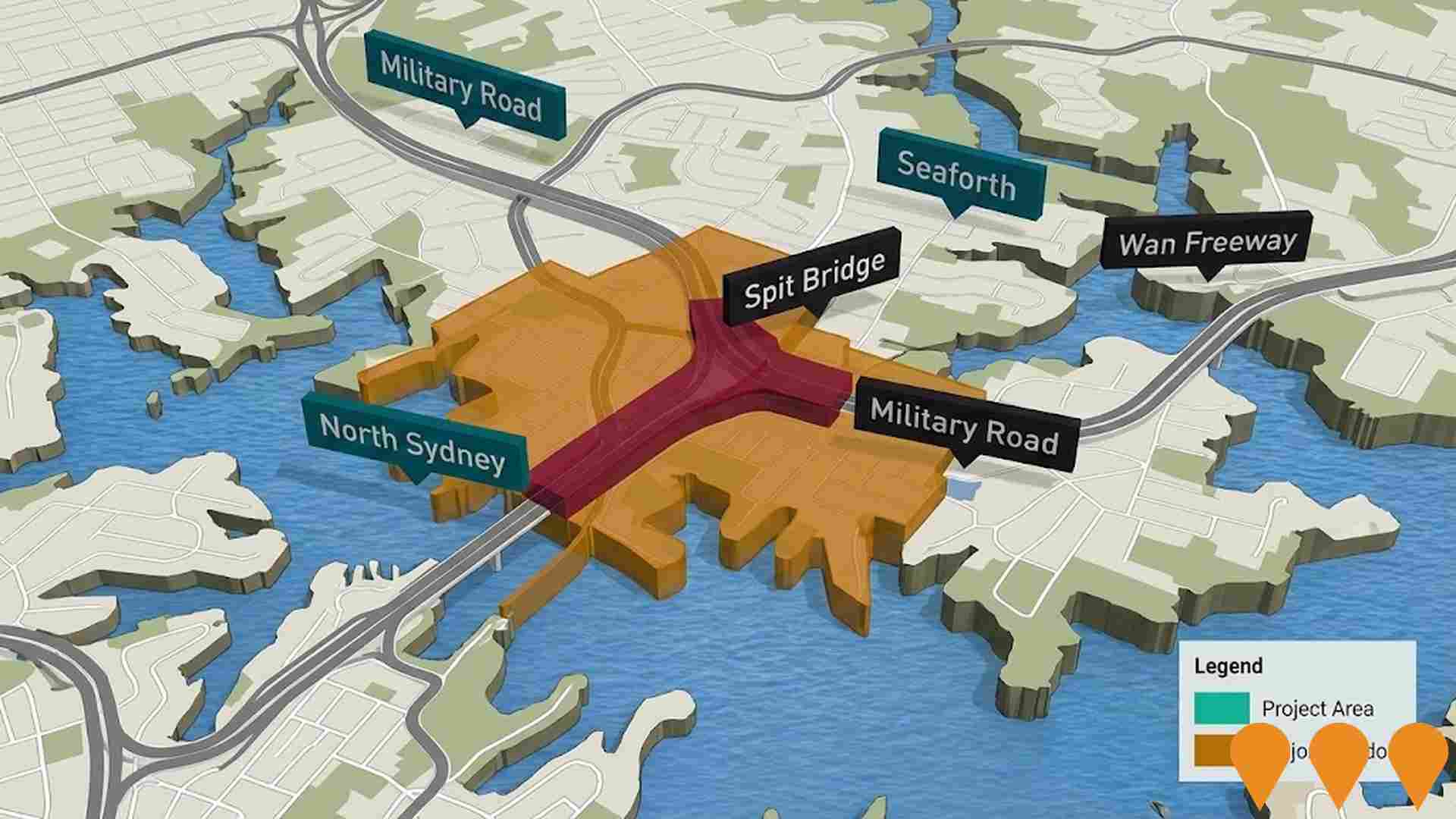

East Lindfield has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes to local infrastructure significantly affect an area's performance. AreaSearch has identified one major project likely impacting the region: Lourdes Retirement Village Expansion, Beaconsfield Parade Luxury Apartments, Forestville Rsl Club Redevelopment, and Killara High School Upgrade are key projects, with the following list focusing on those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

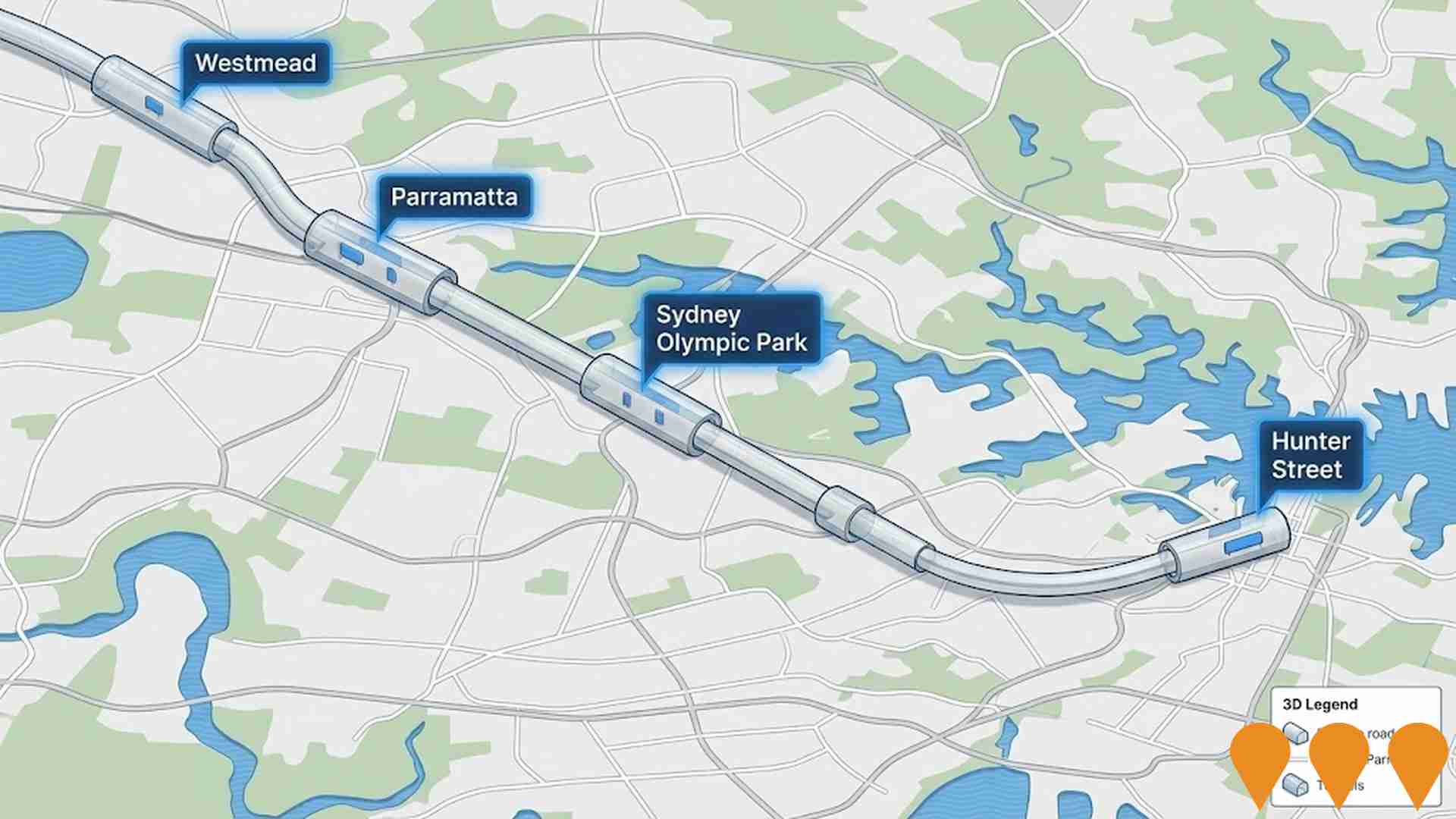

Sydney Metro West

A 24km underground metro line doubling rail capacity between Greater Parramatta and the Sydney CBD. The project features nine new stations and will utilize next-generation driverless trains. In early 2026, the project transitioned from tunnelling to the 'Linewide' phase, involving track laying across 60km of rail, station fit-outs, and the construction of a 38-hectare maintenance facility at Clyde.

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms to enable diverse low and mid-rise housing, including dual occupancies, terraces, townhouses, and apartment buildings up to 6 storeys. The policy applies to residential zones within 800m of 171 nominated transport hubs and town centres. Stage 1 (dual occupancies) commenced 1 July 2024, and Stage 2 (mid-rise apartments and terraces) commenced 28 February 2025. In June 2025, further amendments adjusted aircraft noise thresholds and clarified storey definitions to expand the policy's reach. The initiative is expected to facilitate approximately 112,000 additional homes by 2030.

Sydney Metro

Australia's largest public transport project, comprising four main lines. As of February 2026, the City & Southwest M1 line is operational to Sydenham, with the Sydenham-to-Bankstown conversion reaching 80% completion and intensive dynamic train testing underway for a late 2026 opening. Sydney Metro West has achieved major tunneling milestones at Westmead, with fit-out contracts worth $11.5 billion signed to target a 2032 opening. The Western Sydney Airport line remains under heavy construction with stations and viaducts progressing for an opening aligned with the airport in late 2026.

Frenchs Forest Housing and Productivity Contribution (HPC)

The Housing and Productivity Contribution (HPC) is a state-led infrastructure funding framework that replaced the former Special Infrastructure Contribution (SIC) on 1 October 2023. It facilitates the Frenchs Forest 2041 Place Strategy by funding critical regional infrastructure including schools, health facilities, and major road upgrades. For FY2025-26, contribution rates are indexed quarterly, with residential development charges currently set at approximately $7,801 (Area 1) and $23,403 (Area 2) per additional dwelling. The scheme supports the delivery of 2,000 new homes and 2,000 jobs within a revitalized town center anchored by the Northern Beaches Hospital.

Sydney Metro West - Trains, Systems, Maintenance and Operations

The Trains, Systems, Maintenance and Operations (TSMO) package is a 22-year contract to deliver the core infrastructure for Sydney Metro West. It includes the procurement of 16 next-generation driverless trains, installation of 60km of track, advanced signaling, and the construction of a 38-hectare maintenance facility at Clyde. The project also covers 15 years of network operation and maintenance following the line's opening. As of 2026, contracts have been finalized, and design integration is being led by an AECOM-WSP joint venture to support the shift from tunneling to track-laying and systems installation.

Newcastle-Sydney and Wollongong-Sydney Rail Line Upgrades

Program of upgrades to existing intercity rail corridors linking Newcastle-Central Coast-Sydney and Wollongong-Sydney to reduce travel times and improve reliability. Current scope includes timetable and service changes under the Rail Service Improvement Program, targeted network upgrades (signalling, power, station works) and the introduction of the Mariyung intercity fleet on the Central Coast & Newcastle Line, alongside Federal planning led by the High Speed Rail Authority for a dedicated Sydney-Newcastle high speed corridor.

Opal Next Generation Ticketing System

NSW is upgrading the Opal ticketing system to an account-based platform (Opal Next Gen). The program adds digital Opal cards to device wallets, expands contactless options, modernises bus equipment, and improves apps and web services for planning, payment and travel information. Procurement and enabling contracts are underway led by Transport for NSW.

Killara High School Upgrade

Major upgrade to Killara High School completed in April 2020, delivering 17 new permanent teaching spaces and two specialist teaching spaces. The project included a multi-level concrete framed building with state-of-the-art technology and visual arts facilities, a Mac lab, general learning spaces, and upgrades to existing core facilities. The building features an inground stormwater drainage catchment tank and was constructed on a challenging steep sloping site. The upgrade accommodated student population growth and removed 6 demountable classrooms from the site.

Employment

The employment landscape in East Lindfield presents a mixed picture: unemployment remains low at 3.7%, yet recent job losses have affected its comparative national standing

East Lindfield has a highly educated workforce with significant representation in the technology sector. Its unemployment rate stands at 3.7%, lower than Greater Sydney's 4.2%.

Employment stability has been maintained over the past year. As of September 2025, 1,848 residents are employed, with an unemployment rate 0.5% below the regional average and workforce participation similar to Greater Sydney's 60.0%. Residents are predominantly employed in professional & technical, finance & insurance, and health care & social assistance roles. The area shows strong specialization in professional & technical employment, which is 1.7 times higher than the regional level.

Conversely, construction has limited presence with only 5.1% of residents employed in this sector compared to the regional average of 8.6%. Over the year to September 2025, labour force levels increased by 0.7%, while employment decreased slightly by 0.1%, leading to a rise in unemployment rate by 0.8 percentage points. In comparison, Greater Sydney saw employment growth of 2.1% and a smaller increase in unemployment rate of 0.2%. State-level data from 25-Nov shows NSW's unemployment rate at 3.9%, slightly lower than the national average of 4.3%. Job projections from Jobs and Skills Australia suggest national employment will expand by 6.6% over five years and 13.7% over ten years, with varying growth rates across industry sectors. Applying these projections to East Lindfield's current employment mix indicates potential local employment growth of 7.5% over five years and 14.9% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

According to AreaSearch's aggregation of ATO data released on 30 June 2023 for financial year 2023, East Lindfield had a median income among taxpayers of $63,318 and an average income of $132,799. Nationally, these figures place East Lindfield in the top percentile. In Greater Sydney, the median income was $60,817 and the average was $83,003. Based on Wage Price Index growth of 8.86% since financial year 2023, estimated incomes for September 2025 would be approximately $68,928 (median) and $144,565 (average). Census 2021 data shows East Lindfield's household, family, and personal incomes rank between the 87th and 99th percentiles nationally. The income bracket of $4000+ dominates in East Lindfield with 45.3% of residents (1,708 people), unlike metropolitan regions where the $1,500 - 2,999 bracket dominates at 30.9%. High weekly earnings exceeding $3,000 are achieved by 56.3% of households, indicating strong consumer spending. Housing accounts for 14.0% of income, and residents rank in the 98th percentile for disposable income. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

East Lindfield is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

East Lindfield's dwelling structure in its latest Census data showed 88.0% houses and 12.0% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Sydney metro's 68.8% houses and 31.3% other dwellings. Home ownership in East Lindfield was 48.5%, with mortgaged dwellings at 39.0% and rented ones at 12.5%. The median monthly mortgage repayment was $4,000, above Sydney metro's average of $3,500. Median weekly rent in the area was $990, higher than Sydney metro's $630. Nationally, East Lindfield's mortgage repayments were significantly higher than Australia's average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

East Lindfield features high concentrations of family households, with a higher-than-average median household size

Family households account for 82.4% of all households, including 53.6% couples with children, 20.5% couples without children, and 7.9% single parent families. Non-family households constitute the remaining 17.6%, with lone person households at 16.9% and group households comprising 0.6%. The median household size is 3.1 people, larger than the Greater Sydney average of 2.9.

Frequently Asked Questions - Households

Local Schools & Education

East Lindfield demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

East Lindfield has a notably high level of educational attainment among its residents aged 15 and above, with 57.4% holding university qualifications compared to the national average of 30.4% and the NSW average of 32.2%. This advantage is reflected in the types of qualifications held: bachelor degrees are most common at 34.9%, followed by postgraduate qualifications (18.6%) and graduate diplomas (3.9%). Vocational pathways also contribute to educational attainment, with advanced diplomas accounting for 9.1% and certificates for 6.7%. Educational participation is high in the area, with 35.2% of residents currently enrolled in formal education.

This includes secondary education (12.0%), primary education (11.4%), and tertiary education (7.6%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

East Lindfield has 47 active public transport stops, all of which are bus stops. These stops are served by 27 different routes that together facilitate 1,304 weekly passenger trips. The area's transport accessibility is rated as excellent, with residents on average located 145 meters from the nearest stop.

Across all routes, service frequency averages 186 trips per day, equating to approximately 27 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

East Lindfield's residents are extremely healthy with very low prevalence of common health conditions across all age groups

Analysis of health metrics shows strong performance throughout East Lindfield. Prevalence of common health conditions is very low across all age groups.

Private health cover rate is exceptionally high at approximately 79% of the total population (2,985 people), compared to the national average of 55.7%. The most common medical conditions are arthritis and asthma, impacting 6.5% and 5.9% of residents respectively. 75.3% of residents declare themselves completely clear of medical ailments, compared to 76.0% across Greater Sydney. East Lindfield has 20.4% of residents aged 65 and over (769 people). Health outcomes among seniors are particularly strong, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

East Lindfield is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

East Lindfield has a high level of cultural diversity, with 34.3% speaking a language other than English at home and 40.6% born overseas. Christianity is the main religion in East Lindfield, comprising 47.3%. Judaism is overrepresented compared to Greater Sydney, making up 2.5%.

The top three ancestry groups are Chinese (22.9%, higher than the regional average of 17.8%), English (22.9%) and Australian (17.7%). Korean is notably overrepresented at 1.3% in East Lindfield compared to regionally, while Hungarian and Russian are also slightly overrepresented at 0.4%.

Frequently Asked Questions - Diversity

Age

East Lindfield hosts a notably older demographic compared to the national average

The median age in East Lindfield is 43 years, which is higher than Greater Sydney's average of 37 years and exceeds the national average of 38 years. The age profile shows that individuals aged 5-14 years make up 16.2% of the population, while those aged 25-34 years constitute only 4.8%. Between 2021 and present, the percentage of the population aged 15-24 years has increased from 14.0% to 16.4%, while the percentage of those aged 35-44 years has decreased from 12.0% to 10.8%. By 2041, demographic projections indicate significant shifts in East Lindfield's age structure. The number of individuals aged 85 and above is projected to grow by 173 people (an increase of 110%), from 158 to 332. Notably, the combined population of those aged 65 and above will account for 64% of total population growth, reflecting East Lindfield's aging demographic profile. Conversely, populations aged 5-14 years and 0-4 years are expected to decline in size.