Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Gordon are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch since the Census, Gordon's population is estimated at around 9,496 as of November 2025. This reflects an increase of 701 people (8.0%) since the 2021 Census, which reported a population of 8,795 people in the Gordon (NSW) statistical area (Lv2). The change is inferred from the resident population of 9,424, estimated by AreaSearch following examination of the latest ERP data release by the ABS on June 2024, and an additional 64 validated new addresses since the Census date. This level of population equates to a density ratio of 2,479 persons per square kilometer, placing it in the upper quartile relative to national locations assessed by AreaSearch. Gordon's 8.0% growth since the 2021 census exceeded the SA3 area (4.3%), along with the SA4 region, marking it as a growth leader in the region. Population growth for the area was primarily driven by overseas migration.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections released in 2022 with 2021 as the base year. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Looking at population projections moving forward, a population increase just below the median of statistical areas analysed by AreaSearch is expected in the Gordon (NSW) (SA2), with an expected expansion of 853 persons to 2041 based on aggregated SA2-level projections, reflecting a gain of 7.5% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Gordon according to AreaSearch's national comparison of local real estate markets

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Gordon has seen around 23 new homes approved each year. Over the past 5 financial years, between FY-21 and FY-25, approximately 115 homes were approved, with an additional 11 approved so far in FY-26. On average, over these years, about 2 new residents arrived per new home annually, indicating balanced supply and demand.

However, recent data shows this ratio has intensified to 22.4 people per dwelling over the past 2 financial years, suggesting growing popularity and potential undersupply. New properties are constructed at an average value of $1,319,000, reflecting developers' focus on the premium market with high-end developments. Compared to Greater Sydney, Gordon has around two-thirds the rate of new dwelling approvals per person, placing it among the 19th percentile of areas assessed nationally. This results in relatively constrained buyer choice, supporting interest in existing properties.

The lower rate also reflects market maturity and possible development constraints. New development consists of 62.0% detached dwellings and 38.0% medium and high-density housing, offering choices across price ranges from spacious family homes to more accessible compact options. Interestingly, developers are building more traditional houses than the current mix suggests (45.0% at Census), indicating continued strong demand for family homes despite density pressures. Gordon shows a mature, established area with around 843 people per approval. Looking ahead, Gordon is expected to grow by 711 residents through to 2041, according to the latest AreaSearch quarterly estimate. Construction maintains a reasonable pace with projected growth, although buyers could encounter growing competition as population increases.

Frequently Asked Questions - Development

Infrastructure

Gordon has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Twenty-eight projects have been identified by AreaSearch as potentially impacting the area. Key projects include Pymble Grand, Coachwood Residences, 4-10 Bridge Street Mixed Use Development, and The Marian - 20, 22A & 22 Marian Street TOD Site. Below is a list detailing those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

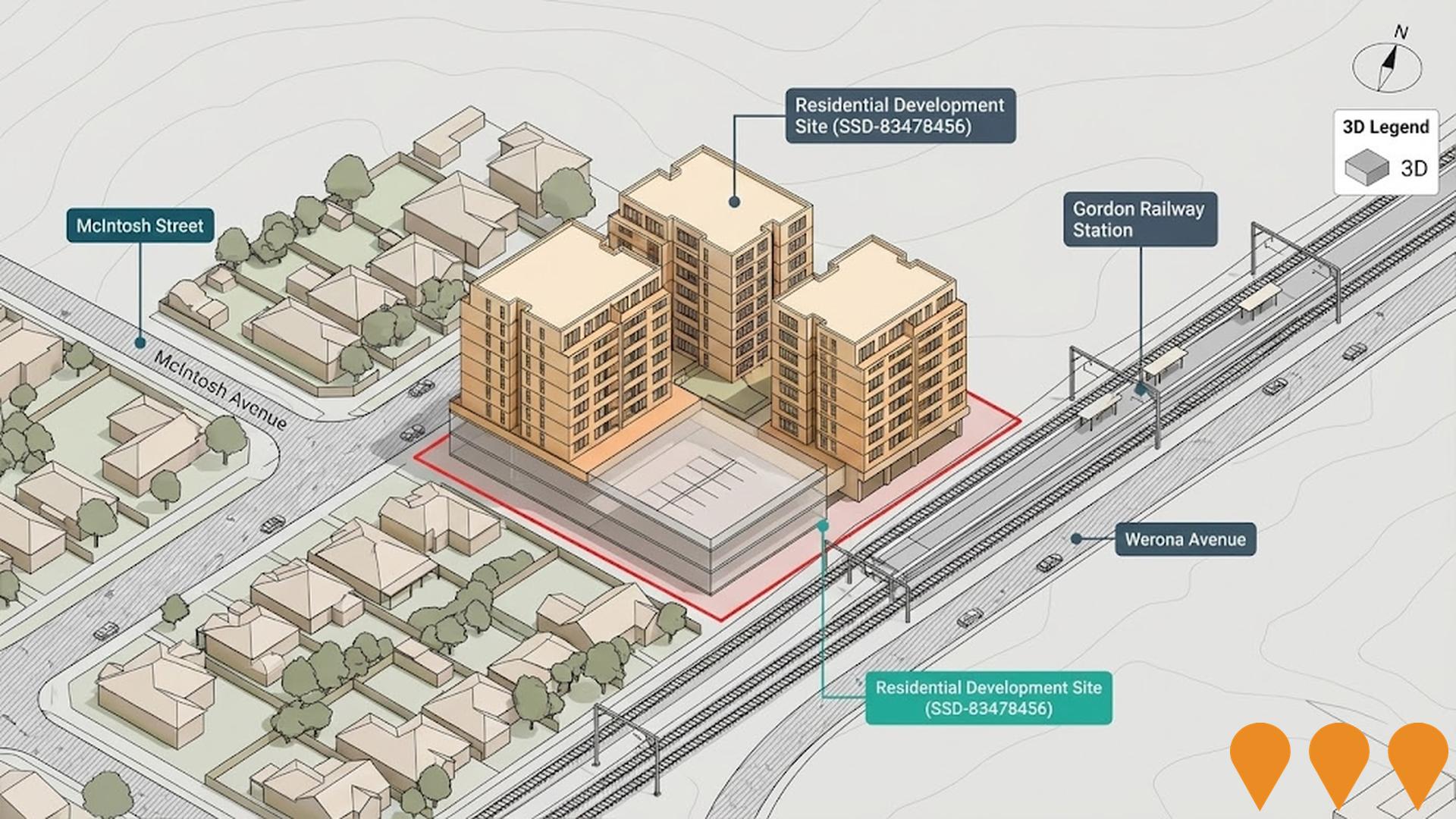

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Turramurra Community Hub

The Turramurra Community Hub is a major urban renewal project by Ku-ring-gai Council aimed at revitalizing the Ray Street precinct. The masterplan includes a new multi-purpose community building, a modern library, a town square, a public park, and a mixed-use residential and retail area. Due to significant funding gaps identified in 2024, the project is being transitioned to a staged delivery model. The initial stage focuses on a partnership with Coles Group to develop a full-line supermarket, specialty retail, and residential apartments on a portion of the site, which will help fund subsequent community infrastructure including the library and parklands.

4-10 Bridge Street Mixed Use Development

An 8-storey mixed-use development by Fife Capital featuring approximately 10,000 sqm of total Net Lettable Area (NLA). The proposal includes 3,300 sqm of large-format retail space across four tenancies and 6,700 sqm of commercial office space within a five-level tower. The site is strategically located at the intersection of Ryde Road and the Pacific Highway, adjacent to the new Pymble Bunnings, and includes basement parking and improved site access works.

Pymble Ladies College - Grey House Precinct

Redevelopment within the existing campus to deliver a five storey Grey House Precinct with Years 5-6 classrooms, STEM and specialist learning spaces, a dance academy with six studios, Out of School Hours Care, a health and wellbeing centre, and an Early Years School for up to 90 children. Main works are being delivered by Stephen Edwards Constructions following State Significant Development consent and approved modifications in 2025.

IC3 Super West Data Centre

Australias first purpose-built AI and cloud data centre at the Macquarie Park Data Centre Campus, offering 11,700 square meters of technical space and 47MW capacity. Designed with fungible data halls supporting air, liquid, and hybrid cooling for high-density AI and cloud workloads, providing flexibility for hyperscalers, government, and enterprise customers.

The Marian - 20, 22A & 22 Marian Street TOD Site

Amalgamated residential development opportunity branded 'The Marian' comprising 20, 22A and 22 Marian Street (approx. 3,876 sqm site) about 200 m to Killara Station. Within NSW TOD area around Killara Station with indicative FSR up to 2.5:1 under the government's TOD policy. Marketed via EOI closing 31 July 2024. No development application identified for the combined site as at August 17, 2025. Planning controls and local council positions on TOD are evolving in Ku-ring-gai.

Coachwood Residences

Exclusive collection of 10 luxury townhomes designed for discerning downsizers over 55, located on prestigious Telegraph Road in Pymble. Features 3 bedrooms plus study/media room, brushed brass fixtures, heated towel railings, and option for private lifts in select residences. Developed by Harvie Group, designed by Gelder Group Architects, and constructed by Dilcara. Premium finishes include secure parking (2-3 spaces per residence), ducted air conditioning, outdoor barbecue facilities, and custom joinery throughout. Due for completion Q1 2026.

Killara Golf Club Residential Development

Residential development on the northeast portion of Killara Golf Club comprising 165 apartments and 14 detached dwellings (179 total dwellings). The planning proposal seeks to rezone approximately 2.5 hectares from Residential 2(b) to R4 High Density Residential and R2 Low Density Residential zones with RE2 Private Recreation overlay. The proposal includes adaptive reuse or continued operation of the heritage-listed Art Deco clubhouse building (circa 1930s), retention of significant Blue Gum High Forest vegetation, and protection of heritage curtilage. Maximum building heights of 17.5m are proposed for R4 areas with floor space ratios ranging from 0.36:1 to 1.3:1. The Club submitted the planning proposal in 2017, which was publicly exhibited in May 2018 and adopted by Ku-ring-gai Council in November 2018. The proposal aims to provide financial sustainability for the golf club while delivering diverse housing options close to Killara Railway Station (800m walking distance). The development will maintain the 18-hole championship golf course and associated sporting facilities including tennis, bowls and squash courts.

The Origin Killara

Exclusive collection of 10 architecturally designed luxury townhomes featuring 3 and 4-bedroom layouts, Wolf appliances, European oak floors, private terraces and balconies. Located just 200m from Killara Station with underground parking and EV provisions.

Employment

The employment landscape in Gordon shows performance that lags behind national averages across key labour market indicators

Gordon's workforce is highly educated, with the technology sector notably represented. The unemployment rate stands at 4.7%, according to AreaSearch's aggregation of statistical area data.

As of September 2025, 4,969 residents are employed, with an unemployment rate of 4.2% above Greater Sydney's rate. Workforce participation is 62.7%, slightly higher than Greater Sydney's 60.0%. The dominant employment sectors include professional & technical, health care & social assistance, and finance & insurance. Notably, professional & technical jobs account for 1.6 times the regional level.

Conversely, construction employs only 3.9% of local workers, lower than Greater Sydney's 8.6%. Over the year to September 2025, labour force levels increased by 0.5%, while employment decreased by 1.1%, leading to a 1.6 percentage point rise in unemployment. In contrast, Greater Sydney saw employment grow by 2.1% and unemployment rise by only 0.2%. State-level data from 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%, compared to the national rate of 4.3%. Jobs and Skills Australia's forecasts project national employment growth of 6.6% over five years and 13.7% over ten years, but industry-specific projections suggest Gordon's employment could increase by 7.5% over five years and 15.0% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

In AreaSearch's aggregation of ATO data released for financial year 2023, Gordon suburb had a median taxpayer income of $60,033 and an average income of $121,248. These figures are exceptionally high nationally compared to Greater Sydney's median of $60,817 and average of $83,030. Based on Wage Price Index growth of 8.86% since financial year 2023, estimates for September 2025 would be approximately $65,352 (median) and $131,991 (average). According to the 2021 Census, Gordon's household, family, and personal incomes rank highly nationally, between the 84th and 89th percentiles. Income distribution shows that 30.1% of Gordon's population falls within the $4000+ range, contrasting with the metropolitan region where the $1,500 - 2,999 bracket leads at 30.9%. Economic strength is evident through 41.9% of households earning over $3,000 weekly, supporting high consumer spending. High housing costs consume 17.3% of income, but strong earnings place disposable income at the 87th percentile nationally. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Gordon features a more urban dwelling mix with significant apartment living, with a higher proportion of rental properties than the broader region

As per the latest Census evaluation in Gordon, dwelling structures consisted of 45.3% houses and 54.7% other dwellings (including semi-detached, apartments, 'other' dwellings). In contrast, Sydney metropolitan area had 68.8% houses and 31.3% other dwellings. Home ownership in Gordon stood at 32.9%, with mortgaged dwellings at 31.0% and rented ones at 36.1%. The median monthly mortgage repayment in Gordon was $3,033, lower than Sydney metro's average of $3,500. The median weekly rent figure in Gordon was recorded at $577, compared to Sydney metro's $630. Nationally, Gordon's median monthly mortgage repayments were higher at $3,033 against the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Gordon features high concentrations of family households, with a lower-than-average median household size

Family households account for 78.4% of all households, including 40.6% couples with children, 25.1% couples without children, and 11.8% single parent families. Non-family households make up the remaining 21.6%, with lone person households at 19.5% and group households comprising 2.2% of the total. The median household size is 2.7 people, which is smaller than the Greater Sydney average of 2.9.

Frequently Asked Questions - Households

Local Schools & Education

Gordon demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Gordon's educational attainment is notably higher than broader benchmarks. Among residents aged 15+, 60.6% hold university qualifications, compared to 30.4% nationally and 32.2% in NSW. This educational advantage is largely driven by bachelor degrees (35.9%), followed by postgraduate qualifications (21.2%) and graduate diplomas (3.5%). Vocational pathways account for 16.5%, with advanced diplomas at 9.7% and certificates at 6.8%.

Educational participation in Gordon is high, with 32.0% of residents currently enrolled in formal education. This includes 9.5% in secondary education, 8.9% in primary education, and 8.1% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 30 operational transport stops in Gordon, offering a mix of train and bus services. These stops are served by 67 unique routes, facilitating 5,643 weekly passenger trips. Transport accessibility is rated excellent, with residents typically residing 193 meters from the nearest stop.

Services average 806 trips daily across all routes, equating to about 188 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Gordon's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Health outcomes data shows excellent results across Gordon, with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 75% of the total population (7,089 people), compared to 78.8% in Greater Sydney and a national average of 55.7%. The most common medical conditions are asthma and mental health issues, affecting 5.4 and 4.6% of residents respectively, while 80.0% report being completely clear of medical ailments, compared to 76.0% in Greater Sydney.

As of 17th March 2023, the area has 17.4% of residents aged 65 and over (1,652 people), which is lower than the 20.2% in Greater Sydney. Health outcomes among seniors are particularly strong, broadly aligning with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Gordon is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Gordon has one of the most culturally diverse populations in Australia, with 50.4% speaking a language other than English at home and 54.5% born overseas as of 2016 Census data. Christianity is the predominant religion in Gordon, comprising 40.3% of its population. However, Judaism is notably overrepresented, making up 1.4% compared to the Greater Sydney average of 2.5%.

In terms of ancestry, Chinese residents make up 27.9%, higher than the regional average of 17.8%. English ancestry comprises 17.3%, lower than the regional average of 22.4%. Australian ancestry is at 13.3%. Notably, Korean ethnicity is overrepresented in Gordon at 4.7% (regional average: 2.3%), Russian at 0.7% (regional average: 0.5%), and South African at 1.0% (regional average: 1.6%).

Frequently Asked Questions - Diversity

Age

Gordon's population aligns closely with national norms in age terms

The median age in Gordon is 39 years, which is higher than Greater Sydney's average of 37 years and close to the national average of 38 years. The 15-24 cohort is over-represented at 15.4% locally compared to Greater Sydney's average, while the 25-34 age group is under-represented at 11.7%. According to post-2021 Census data, the 15-24 age group has grown from 13.5% to 15.4%, and the 0-4 cohort has declined from 4.3% to 3.4%. By 2041, population forecasts indicate significant demographic changes in Gordon. The 75-84 age group is expected to grow by 55% (from 560 to 871 people), led by demographic aging as residents aged 65 and older represent 69% of anticipated growth. Conversely, the 0-4 and 25-34 cohorts are projected to experience population declines.