Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Woodend are above average based on AreaSearch's ranking of recent, and medium to long-term trends

Based on analysis of ABS population updates for the broader area, as of Nov 2025, Woodend's population is estimated at around 1,518. This reflects an increase of 35 people since the 2021 Census, which reported a population of 1,483. The change was inferred from AreaSearch's estimate of 1,516 residents following examination of ABS' latest ERP data release in June 2024 and validation of two new addresses since the Census date. This level of population equates to a density ratio of 1,167 persons per square kilometer. Population growth was primarily driven by overseas migration contributing approximately 76% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024 with 2022 as the base year. For areas not covered, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. Exceptional growth is predicted over the period to 2041, with the Woodend (Qld) statistical area expected to increase by 827 persons, reflecting a 54.5% increase in total population over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Woodend, placing the area among the bottom 25% of areas assessed nationally

AreaSearch analysis of ABS building approval numbers shows Woodend recorded around 1 residential property approved per year. Between FY21 and FY25, approximately 7 homes were approved, with 1 more in FY26 to date.

On average, about 0.9 people moved to the area annually for each dwelling built during these years. This suggests new supply is meeting or exceeding demand, providing ample buyer choice and capacity for population growth beyond current forecasts. The average construction cost value of new homes was $444,000, indicating developers focus on the premium market with high-end developments. Compared to Greater Brisbane, Woodend had significantly less development activity, 92.0% below the regional average per person as of recent periods. This limited supply generally supports stronger demand and values for established dwellings.

However, development activity has picked up recently. Nationally, this activity is also below average, reflecting the area's maturity and possible planning constraints. Recent building activity in Woodend consists entirely of detached houses, sustaining its suburban identity with a concentration of family homes suited to buyers seeking space. As of now, there are approximately 506 people per dwelling approval in the location. Population forecasts indicate Woodend will gain 827 residents by 2041 (latest AreaSearch quarterly estimate). If current development rates continue, housing supply may not keep pace with population growth, potentially increasing buyer competition and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Woodend has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

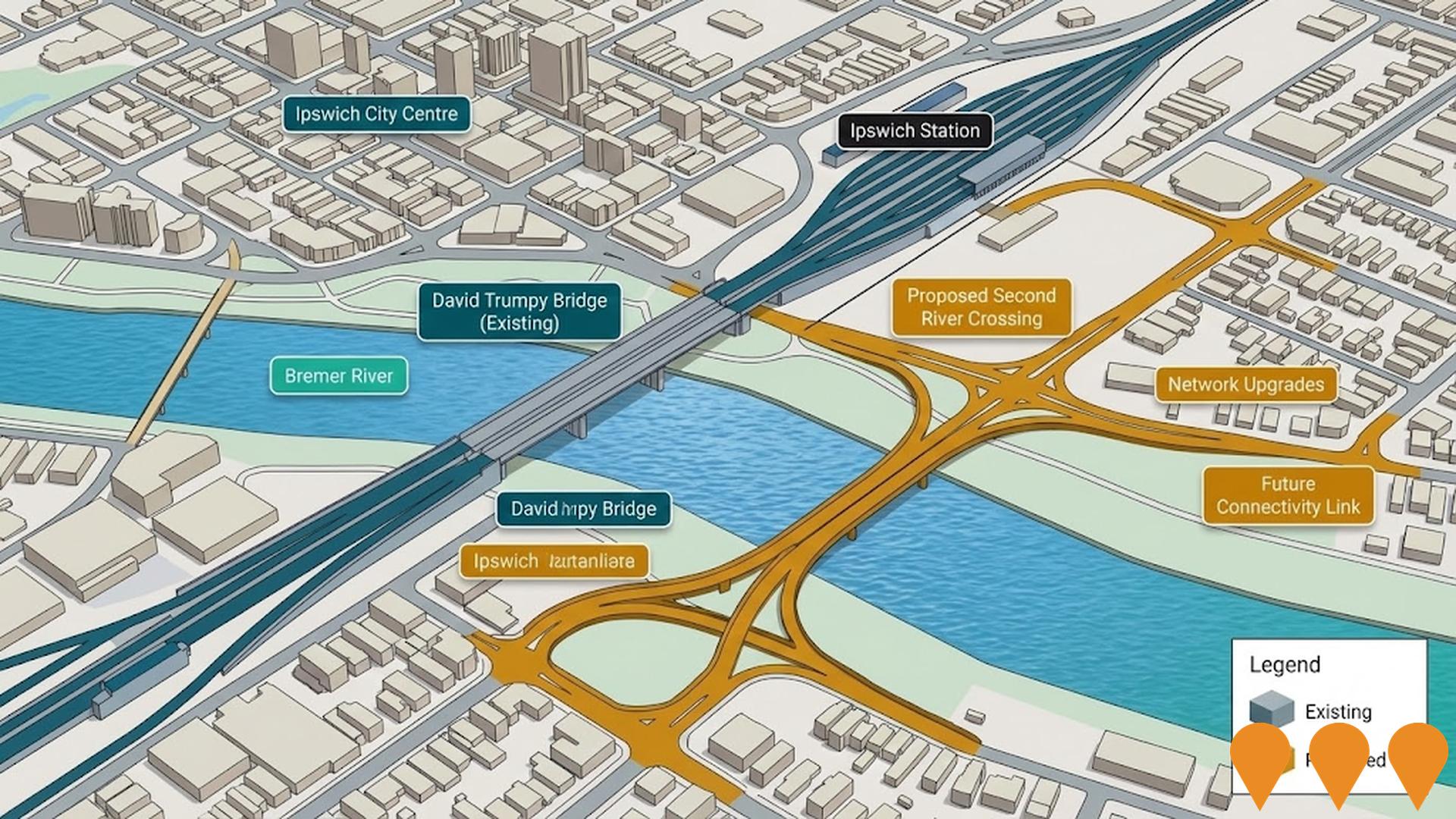

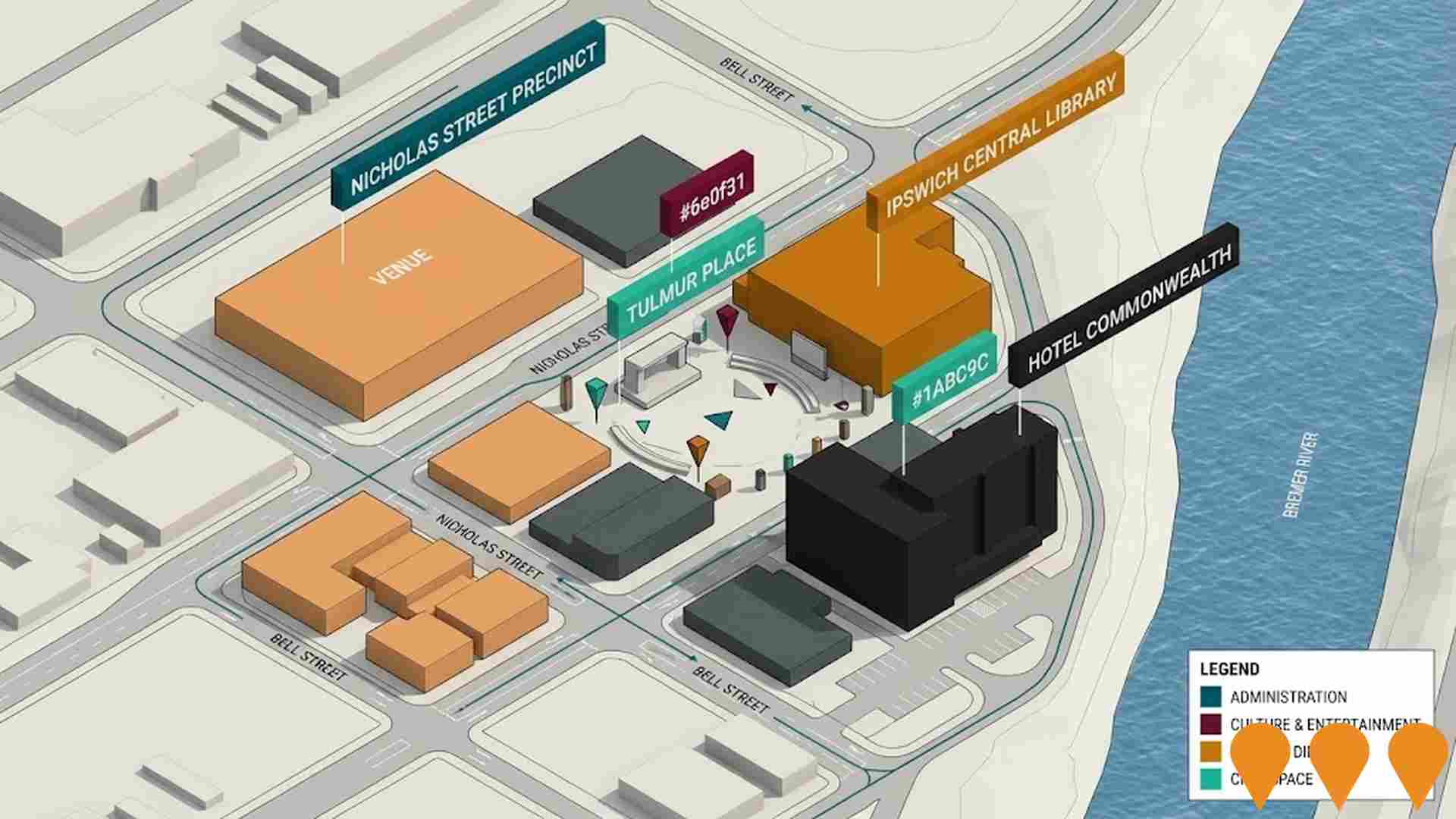

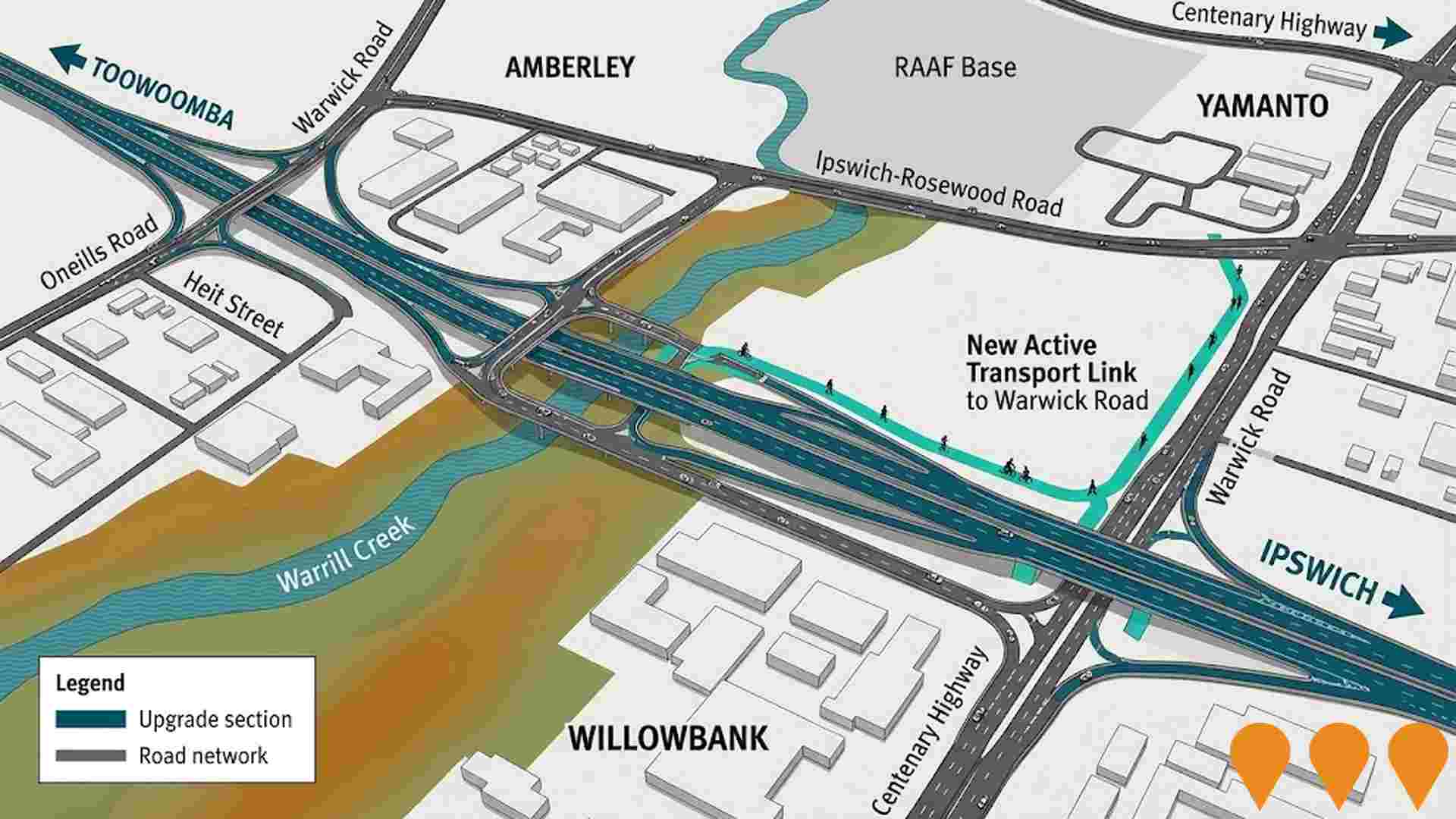

Changes in local infrastructure significantly impact an area's performance. AreaSearch has identified 17 projects that could affect this region. Notable initiatives include Ipswich Hospital Expansion Stage 2, Ipswich Better Bus Network, Ipswich Smart City Program, and Brassall Bikeway Stage 6 Extension. The following list details those most likely to be relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Ipswich Hospital Expansion Stage 2

A $1.066 billion expansion of Ipswich Hospital, forming a critical part of the Queensland Government Health Capacity Expansion Program. The project delivers a new multi-storey acute clinical services building featuring 200 new beds, an expanded Emergency Department, and six additional operating theatres. Key infrastructure includes a satellite medical imaging service, a Central Sterilisation Service Department, and enhanced parking facilities to support the rapidly growing West Moreton region.

Ipswich Smart City Program

The Ipswich Smart City Program is a city-wide digital transformation initiative led by Ipswich City Council to enhance liveability and economic prosperity through technology. Key components include an IoT sensor network, smart lighting, public Wi-Fi, environmental monitoring, and a centralized city data platform. As of 2026, the program is integrated into the iFuture 2021-2026 Corporate Plan and the Ipswich City Plan 2025, with ongoing rollouts of smart parking, flood monitoring sensors, and digital innovation hubs like Fire Station 101.

Ipswich Better Bus Network

A three-stage bus network improvement program for Ipswich funded by a $70 million state investment. Stage 1 commenced in November 2025, introducing four new routes (501, 520, 522, 523) and upgrades to existing services, benefiting over 42,000 residents in growth areas like Redbank Plains and Springfield. Stage 2 (2026) and Stage 3 (2027) are in planning to extend services to Yamanto, Ripley, and Karalee, supported by a new state-operated bus depot at New Chum designed to eventually house 240 buses.

Woolworths Emerald Hill Shopping Centre

A vibrant neighborhood shopping centre anchored by a full-line Woolworths supermarket. The project includes 300 on-grade car parks and approximately 15 specialty retail tenancies. It is designed to serve the rapidly growing Emerald Hill estate and the broader Brassall catchment area with everyday convenience and high accessibility near the Warrego Highway.

North Ipswich Sport and Entertainment Precinct

Stage 1 will modernise North Ipswich Reserve with a new western grandstand and field lighting as the first step toward a 12,000-seat rectangular stadium and broader precinct upgrades. The project is jointly funded by the Australian Government, Queensland Government and Ipswich City Council and targets operation of Stage 1 by late 2027.

Brassall Bikeway Stage 6 Extension

The final stage of the Brassall Bikeway, this project will connect the existing path to the Ipswich CBD via the Bradfield Bridge. The plan includes a lift to connect the riverbank level with the bridge, completing a 14km continuous bikeway network. This network links North Ipswich, Brassall, and Wulkuraka to the Brisbane Valley Rail Trail.

Gainsborough Meadows Estate

Master planned house and land estate in Brassall, Ipswich, delivering new lots with local roads, drainage and landscaping in staged releases. Close to schools, shopping and transport with packages marketed by Tribeca.

North Ipswich Apartments

Ipswich City Council approved a two-stage multiple dwelling project for 104 apartments (22 x 1-bedroom and 82 x 2-bedroom) across five titles at 28-30 Lowry St, 45-47 Flint St and 12 Pelican St (Approval: 2367/2016/MCU). As of mid-2025, council records show a later MCU for single residential use affecting 12 Pelican St, indicating at least part of the original scheme has been modified and the 104-unit approval may not be proceeding in full. No construction activity is evident on council's Development.i portal.

Employment

The employment landscape in Woodend shows performance that lags behind national averages across key labour market indicators

Woodend has a skilled workforce with significant representation in essential services sectors. The unemployment rate was 6.5% as of the past year, with an estimated employment growth of 5.1%.

As of September 2025, there are 739 residents employed, and the unemployment rate is 2.5% higher than Greater Brisbane's rate of 4.0%. The workforce participation rate in Woodend is lower at 61.4%, compared to Greater Brisbane's 64.5%. Employment is concentrated in health care & social assistance, education & training, and public administration & safety, with a particularly strong specialization in education & training at 1.7 times the regional level. Conversely, transport, postal & warehousing employs only 2.5% of local workers, below Greater Brisbane's 5.6%.

The area functions as an employment hub with 1.2 workers per resident, hosting more jobs than residents and attracting workers from surrounding areas. Over a 12-month period ending in September 2025, employment increased by 5.1% while the labour force grew by 3.7%, leading to a decrease in unemployment rate of 1.3 percentage points. In comparison, Greater Brisbane saw employment rise by 3.8%, labour force grow by 3.3%, and unemployment fall by 0.5 percentage points during this period. Statewide, Queensland's employment contracted by 0.01% (losing 1,210 jobs) as of 25-Nov-25, with the state unemployment rate at 4.2%. National employment forecasts from Jobs and Skills Australia project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Woodend's employment mix suggests local employment should increase by approximately 6.6% over five years and 13.8% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

Woodend suburb's income level is lower than average nationally per latest ATO data aggregated by AreaSearch for financial year 2023. Its median income among taxpayers is $53,535 and average income stands at $59,725, contrasting with Greater Brisbane's figures of $58,236 and $72,799 respectively. Based on Wage Price Index growth of 9.91% since financial year 2023, estimated incomes for September 2025 would be approximately $58,840 (median) and $65,644 (average). According to 2021 Census figures, household, family, and personal incomes rank modestly in Woodend, between the 37th and 43rd percentiles. Income analysis shows largest segment comprises 34.5% earning $1,500 - $2,999 weekly (523 residents), aligning with broader metropolitan trends at 33.3%. After housing costs, 85.9% of income remains for other expenses, and the area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Woodend is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Woodend's dwelling structure, as per the latest Census, consisted of 89.1% houses and 10.9% other dwellings (semi-detached, apartments, 'other' dwellings). Brisbane metro had 88.4% houses and 11.6% other dwellings. Woodend's home ownership level was at 28.1%, with mortgaged dwellings at 40.5% and rented ones at 31.3%. The median monthly mortgage repayment in Woodend was $1,452, below Brisbane metro's average of $1,517. The median weekly rent in Woodend was $300, matching Brisbane metro's figure. Nationally, Woodend's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Woodend has a typical household mix, with a lower-than-average median household size

Family households account for 69.6% of all households, consisting of 28.1% couples with children, 25.6% couples without children, and 15.2% single parent families. Non-family households make up the remaining 30.4%, with lone person households at 27.4% and group households comprising 2.5% of the total. The median household size is 2.4 people, which is smaller than the Greater Brisbane average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Woodend exceeds national averages, with above-average qualification levels and academic performance metrics

The area's educational profile is notable regionally, with university qualification rates at 24.2% of residents aged 15+, surpassing the SA3 area average of 17.2%. Bachelor degrees are most prevalent at 16.3%, followed by postgraduate qualifications (4.9%) and graduate diplomas (3.0%). Vocational credentials are prominent, with 38.2% of residents aged 15+ holding such qualifications – advanced diplomas comprise 12.6% and certificates make up 25.6%.

Educational participation is high at 34.7%, including 14.1% in secondary education, 9.4% in primary education, and 5.4% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Woodend has four active public transport stops operating, all of which are bus stops. These stops are served by a single route collectively providing 124 weekly passenger trips. The accessibility of transport in Woodend is rated as good, with residents typically located 296 meters from the nearest stop.

On average, there are 17 trips per day across all routes, equating to approximately 31 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Woodend is well below average with considerably higher than average prevalence of common health conditions and to an even higher degree among older age cohorts

Woodend faces significant health challenges with a notably higher prevalence of common conditions compared to averages.

Among older age groups, these issues are even more pronounced. Private health cover is relatively low at approximately 51% of Woodend's total population (~772 people). The most prevalent medical conditions in the area are mental health issues and asthma, affecting 11.9% and 10.8% of residents respectively. Conversely, 62.8% of Woodend residents report having no medical ailments, compared to 62.2% across Greater Brisbane. As of a recent study (date not specified), 15.3% of Woodend's population is aged 65 and over (232 people). Health outcomes among seniors in Woodend require particular attention due to the challenges they face.

Frequently Asked Questions - Health

Cultural Diversity

Woodend is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Woodend, as per the census data from June 2016, had a predominantly Australian-born population with 87.9% of residents born in Australia. This is lower than the national average. Additionally, 91.4% were citizens and 94.3% spoke English only at home.

Christianity was the dominant religion, with 48.1% adherents, slightly below the Greater Brisbane average of 49.5%. The top three ancestry groups in Woodend were English (27.9%), Australian (27.0%), and Irish (11.5%). Notable differences existed for Welsh (1.0%, compared to regional 0.6%), German (6.0%, vs regional 6.4%), and Scottish (9.3%, vs regional 7.7%) ancestry groups.

Frequently Asked Questions - Diversity

Age

Woodend's population is slightly younger than the national pattern

Woodend's median age is 37 years, nearly matching Greater Brisbane's average of 36 and close to Australia's median of 38. Compared to Greater Brisbane, Woodend has a higher proportion of 15-24 year-olds (15.7%) but fewer 25-34 year-olds (10.3%). Between the 2021 Census and present day, the 65-74 age group increased from 7.6% to 8.9%. Conversely, the 25-34 cohort decreased from 11.9% to 10.3%, and the 45-54 group dropped from 13.3% to 12.2%. By 2041, demographic modeling suggests Woodend's age profile will significantly evolve. The 75-84 cohort is projected to grow by 162%, adding 123 residents to reach 199.