Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Twin Waters are above average based on AreaSearch's ranking of recent, and medium to long-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch since Nov 2025, Twin Waters statistical area's population is estimated at around 3,089. This reflects an increase of 123 people (4.1%) since the 2021 Census which reported a population of 2,966 people. The change is inferred from the resident population of 3,073 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 60 validated new addresses since the Census date. This level of population equates to a density ratio of 788 persons per square kilometer, which is relatively in line with averages seen across locations assessed by AreaSearch. Over the past decade, Twin Waters has demonstrated resilient growth patterns with a compound annual growth rate of 2.6%, outpacing the SA3 area. Population growth for the area was primarily driven by overseas migration that contributed approximately 93.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, and for years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 and based on 2021 data. It should be noted that these state projections do not provide age category splits; hence where utilised, AreaSearch is applying proportional growth weightings in line with the ABS Greater Capital Region projections for each age cohort, released in 2023 based on 2022 data. Looking at population projections moving forward, a population increase just below the median of national non-metropolitan areas is expected, with Twin Waters (SA2) expected to grow by 270 persons to reach approximately 3,359 people by 2041 based on aggregated SA2-level projections, reflecting a gain of 10.3% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential approval activity sees Twin Waters among the top 30% of areas assessed nationwide

Based on AreaSearch analysis using ABS building approval numbers from statistical area data, Twin Waters has seen approximately 41 new homes approved each year. Over the past five financial years, between FY2021 and FY2025, around 209 homes were approved, with an additional three approved so far in FY2026.

On average, 1.3 new residents arrive per new home annually over these five years, indicating a balanced supply and demand market that supports stable conditions. The average construction value of new properties is $503,000, slightly above the regional average, suggesting a focus on quality developments. Compared to the Rest of Qld, Twin Waters has 75.0% higher building activity per person, offering buyers ample choice and reflecting strong developer confidence in the area. The new development composition consists of 71.0% detached houses and 29.0% attached dwellings, maintaining the area's traditional low density character with a focus on family homes. With around 53 people per approval, Twin Waters reflects a low-density area.

According to AreaSearch's latest quarterly estimate, population forecasts indicate Twin Waters will gain approximately 318 residents by 2041. Given current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Twin Waters has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Twelve projects identified by AreaSearch are expected to impact the area significantly. Key projects include Stockland Twin Waters West, New Sunshine Coast Planning Scheme (North Shore Local Plan), Wilkins Park, Pacific Paradise Improvements, and Sunshine Coast Infrastructure Coordination Plan. The following list details those considered most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sunshine Coast Infrastructure Coordination Plan

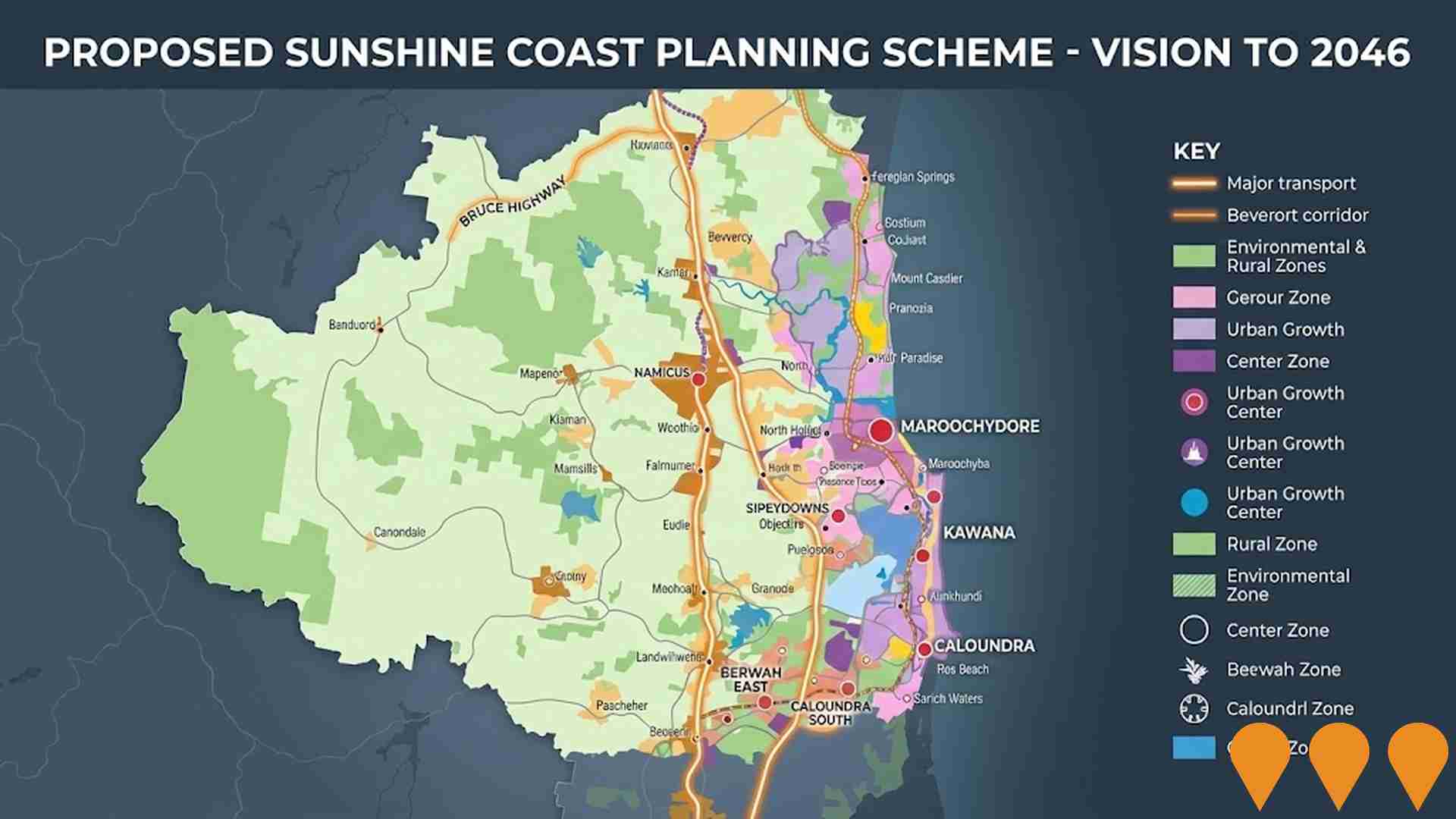

A collaborative plan between the Queensland Government and Sunshine Coast Council to coordinate infrastructure for the Sunshine Coast Urban Corridor (Maroochydore to Caloundra). It outlines network constraints and co-location opportunities across transport, energy, water, education, and health to support growth to 2041. As of 2026, it is being integrated into the new Sunshine Coast Planning Scheme 2046, with major focuses on the Direct Sunshine Coast Rail Line and urban consolidation in five key planning areas.

Sunshine Coast Public Transport Project (Coastal Corridor)

Planning for a high-frequency mass transit system along the Sunshine Coast coastal corridor. The project has transitioned from exploring various options to focusing on Bus Rapid Transit (BRT) as the preferred mode. BRT will involve rubber-tyred vehicles operating in a dedicated right-of-way corridor to provide reliable, high-capacity transport independent of general traffic. The project aims to link Maroochydore to the Sunshine Coast University Hospital at Birtinya, integrating with the proposed heavy rail (The Wave) and active transport networks to support regional growth and the 2032 Olympic and Paralympic Games.

Sunshine Coast Airport Expansion Project

Major airport expansion completed in June 2020 featuring a new 2,450m x 45m international runway (13/31) capable of handling wide-body aircraft including A330, B777, B787, and A350. The $347 million project enables direct international flights to Asia, China, and Hawaii, with new air traffic control tower and terminal upgrades. Declared a Priority Development Area in 2023, supporting ongoing terminal expansion, a 50-hectare aerospace precinct, and up to $1 billion in future infrastructure investments planned through 2040.

Proposed Sunshine Coast Planning Scheme

A comprehensive new Sunshine Coast Planning Scheme by Sunshine Coast Council to replace the 2014 scheme. It sets the planning vision for the region to 2046, guiding sustainable growth, housing diversity, climate resilience, and environmental protection. The scheme includes 18 local plan areas and aims to meet regional growth targets of 219,100 additional residents by 2046. Following formal public consultation which closed in late 2025, Council is currently reviewing approximately 4,600 formal submissions. This review process is expected to continue well into 2026 to determine required changes before proceeding with adoption.

Bruce Highway Upgrade - Maroochydore Road to Mons Road

Major upgrade of Bruce Highway interchange at Maroochydore Road and Mons Road, including new four-lane eastbound bridge, signalised interchange, service roads, and extension of Owen Creek Road. Project includes asphalt rehabilitation at Bli Bli interchange.

Stockland Twin Waters West

Approved masterplanned residential community on a 104 hectare site between the Maroochy River and the Sunshine Motorway. Council granted preliminary approval in December 2023. Site establishment works and trial embankments commenced in mid 2025. The plan includes about 450 detached homes with minimum lot size of 500sqm and average 700sqm, 1ha of community facilities, around 30.9ha of open space with three parks, and a new lake of about 17ha with a walkable waterfront network. Kangaroo habitat and central wetland protection are included.

Vantage Pacific Paradise

An established resort-style land lease community for over 50s operated as Vantage by AVID. Residents own their home and lease the land, with access to a clubhouse, heated pool and spa, gym, indoor bowls, tennis and pickleball, cinema, library, workshop, golf simulator and more inside a secure gated estate. Previously known as Living Gems Pacific Paradise.

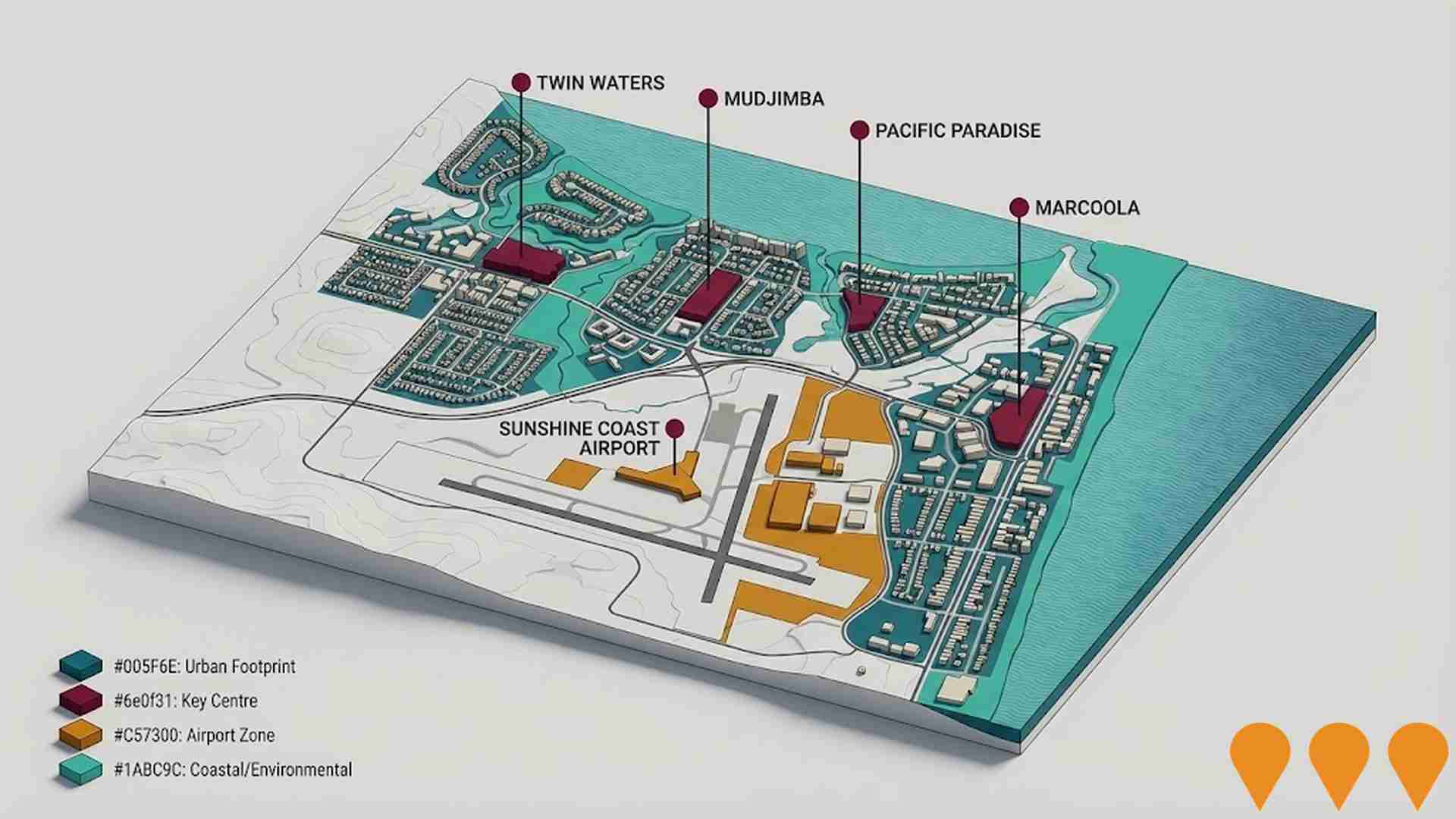

New Sunshine Coast Planning Scheme (North Shore Local Plan)

The Sunshine Coast Council is developing a new planning scheme to replace the 2014 scheme. The North Shore Local Plan, which covers Twin Waters, Mudjimba, Pacific Paradise, and Marcoola, is a key component. The plan aims to guide future development while protecting the area's coastal character, environmental features, and managing constraints like airport operations. The directions propose minimal changes to building heights and urban growth boundaries in Twin Waters, retaining its suburban character.

Employment

The labour market in Twin Waters shows considerable strength compared to most other Australian regions

Twin Waters has a highly educated workforce with significant representation in professional services. As of September 2025, its unemployment rate is 2.0%, lower than Rest of Qld's 4.1%.

Only 42.9% of residents participate in the workforce compared to Rest of Qld's 59.1%. Key industries for employment are health care & social assistance, education & training, and retail trade. The area specialises in professional & technical jobs, with an employment share 1.9 times the regional level. Agriculture, forestry & fishing employs just 0.5% of local workers compared to Rest of Qld's 4.5%.

In the year ending September 2025, Twin Waters' labour force decreased by 3.2%, and employment fell by 2.9%, reducing unemployment by 0.3 percentage points. This contrasts with Rest of Qld where employment rose by 1.7% and unemployment increased by 0.3 percentage points. As of 25-Nov-25, Queensland's employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts from May-25 suggest a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Twin Waters' employment mix indicates local employment growth of 7.0% over five years and 14.3% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

The suburb of Twin Waters had an income level below the national average according to ATO data aggregated by AreaSearch for the financial year ended June 2023. The median income among taxpayers in Twin Waters was $48,774 and the average income stood at $64,890. For comparison, Rest of Qld's figures were $53,146 and $66,593 respectively. Based on Wage Price Index growth of 9.91% from financial year 2023 to September 2025, estimated incomes would be approximately $53,608 (median) and $71,321 (average). According to Census data for 2021, income rankings in Twin Waters were modest, between the 44th and 46th percentiles. The majority of residents, 29.7% or 917 people, fell into the $1,500 - $2,999 bracket, similar to the regional average of 31.7%. After housing expenses, 86.5% of income remained for other expenses. The suburb's SEIFA income ranking placed it in the 8th decile.

Frequently Asked Questions - Income

Housing

Twin Waters is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Twin Waters' dwelling structure, as per the latest Census, consisted of 73.9% houses and 26.1% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro Qld's 51.7% houses and 48.3% other dwellings. Home ownership in Twin Waters stood at 58.0%, with the rest being mortgaged (30.0%) or rented (12.0%). The median monthly mortgage repayment was $2,167, higher than Non-Metro Qld's average of $1,820. Median weekly rent in Twin Waters was recorded at $650, compared to Non-Metro Qld's $420. Nationally, Twin Waters' mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Twin Waters features high concentrations of family households, with a higher-than-average median household size

Family households comprise 80.3% of all households, including 19.2% that are couples with children, 55.2% that are couples without children, and 5.5% that are single parent families. Non-family households make up the remaining 19.7%, with lone person households at 18.0% and group households comprising 1.5%. The median household size is 2.3 people, larger than the Rest of Qld average of 2.2.

Frequently Asked Questions - Households

Local Schools & Education

Twin Waters shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's university qualification rate is 29.5%, higher than the Rest of Queensland average of 20.6% and the SA4 region's 24.9%. Bachelor degrees are the most common at 20.3%, followed by postgraduate qualifications (5.9%) and graduate diplomas (3.3%). Vocational credentials are held by 35.2% of residents aged 15+, with advanced diplomas at 13.4% and certificates at 21.8%.

A total of 20.1% of the population is actively pursuing formal education, including 6.7% in secondary, 5.5% in primary, and 4.0% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Twin Waters is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Twin Waters faces significant health challenges, with common conditions prevalent across both younger and older age groups.

The area has a private health cover rate of approximately 53%, higher than the average SA2 area (~1,634 people). The most frequent medical conditions are arthritis (affecting 13.0% of residents) and heart disease (6.7%). Notably, 62.4% of residents report no medical ailments, compared to 67.2% in the rest of Queensland. Twin Waters has a higher proportion of seniors aged 65 and over at 43.0% (1,328 people), compared to 24.4% in the rest of Queensland. Despite this, health outcomes among seniors are strong and perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Twin Waters records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Twin Waters' population was approximately aligned with the broader area's average regarding cultural diversity, with 72.3% born in Australia, 87.7% being citizens, and 94.0% speaking English only at home. Christianity was the predominant religion, accounting for 60.3%. Judaism was overrepresented, comprising 0.4%, compared to 0.1% regionally.

The top three ancestry groups were English (37.0%), Australian (21.9%), and Scottish (9.7%). Notably, French (0.9%) Welsh (0.8%) and German (6.1%) were overrepresented compared to regional averages of 0.7%, 0.6%, and 4.8% respectively.

Frequently Asked Questions - Diversity

Age

Twin Waters ranks among the oldest 10% of areas nationwide

Twin Waters has a median age of 60, which is significantly higher than the Rest of Qld figure of 41 and Australia's median age of 38. The 65-74 age group makes up 22.7% of Twin Waters' population, compared to Rest of Qld's percentage, while the 25-34 cohort is less prevalent at 5.5%. This 65-74 concentration is well above Australia's national figure of 9.4%. Between 2021 and the present, the 25-34 age group has grown from 4.0% to 5.5%, while the 75-84 cohort increased from 14.1% to 15.5%. Conversely, the 55-64 cohort has declined from 18.8% to 17.1%, and the 45-54 group dropped from 11.3% to 9.7%. By 2041, demographic modeling suggests Twin Waters' age profile will evolve significantly. The 85+ group is projected to grow by 92%, reaching 285 people from 148. Residents aged 65 and older are expected to represent 79% of this growth. Conversely, both the 45-54 and 5-14 age groups are anticipated to see reduced numbers.