Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Edmonton are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch since the Census Edmonton statistical area's population is estimated at around 12,445 as of Nov 2025. This reflects an increase of 1,036 people (9.1%) since the 2021 Census, which reported a population of 11,409 people. The change is inferred from the resident population of 12,239, estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 392 validated new addresses since the Census date. This level of population equates to a density ratio of 622 persons per square kilometer, providing significant space per person and potential room for further development. Edmonton's 9.1% growth since the 2021 census exceeded that of the SA3 area (8.0%) and the SA4 region, marking it as a growth leader in the region. Population growth was primarily driven by natural growth contributing approximately 55.00000000000001% of overall population gains during recent periods, although all drivers including overseas migration and interstate migration were positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, and for years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. It should be noted that these state projections do not provide age category splits; hence where utilised, AreaSearch is applying proportional growth weightings in line with the ABS Greater Capital Region projections for each age cohort (released in 2023, based on 2022 data). Considering projected demographic shifts, a significant population increase in the top quartile of national regional areas is forecast, with the Edmonton statistical area expected to expand by 3,420 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 25.8% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Edmonton among the top 25% of areas assessed nationwide

Edmonton has averaged approximately 60 new dwelling approvals annually. Over the past five financial years, from FY-21 to FY-25, around 301 homes were approved, with an additional 20 approved so far in FY-26. Each year, on average, Edmonton gains about 2.6 new residents for each dwelling built, indicating strong demand that supports property values.

The average construction cost value of new homes is approximately $398,000. In the current financial year, $26.4 million in commercial development approvals have been recorded, suggesting steady commercial investment activity. Compared to the rest of Queensland, Edmonton exhibits moderately higher construction activity, 44.0% above the regional average per person over the past five years.

This preserves buyer options while sustaining existing property demand. All recent building activity consists of detached houses, maintaining the area's low-density nature and attracting space-seeking buyers. With around 162 people per approval, Edmonton reflects a developing area. According to AreaSearch's latest quarterly estimate, Edmonton is projected to add approximately 3,214 residents by 2041. Building activity is keeping pace with growth projections, though increased competition among buyers can be expected as the population grows.

Frequently Asked Questions - Development

Infrastructure

Edmonton has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

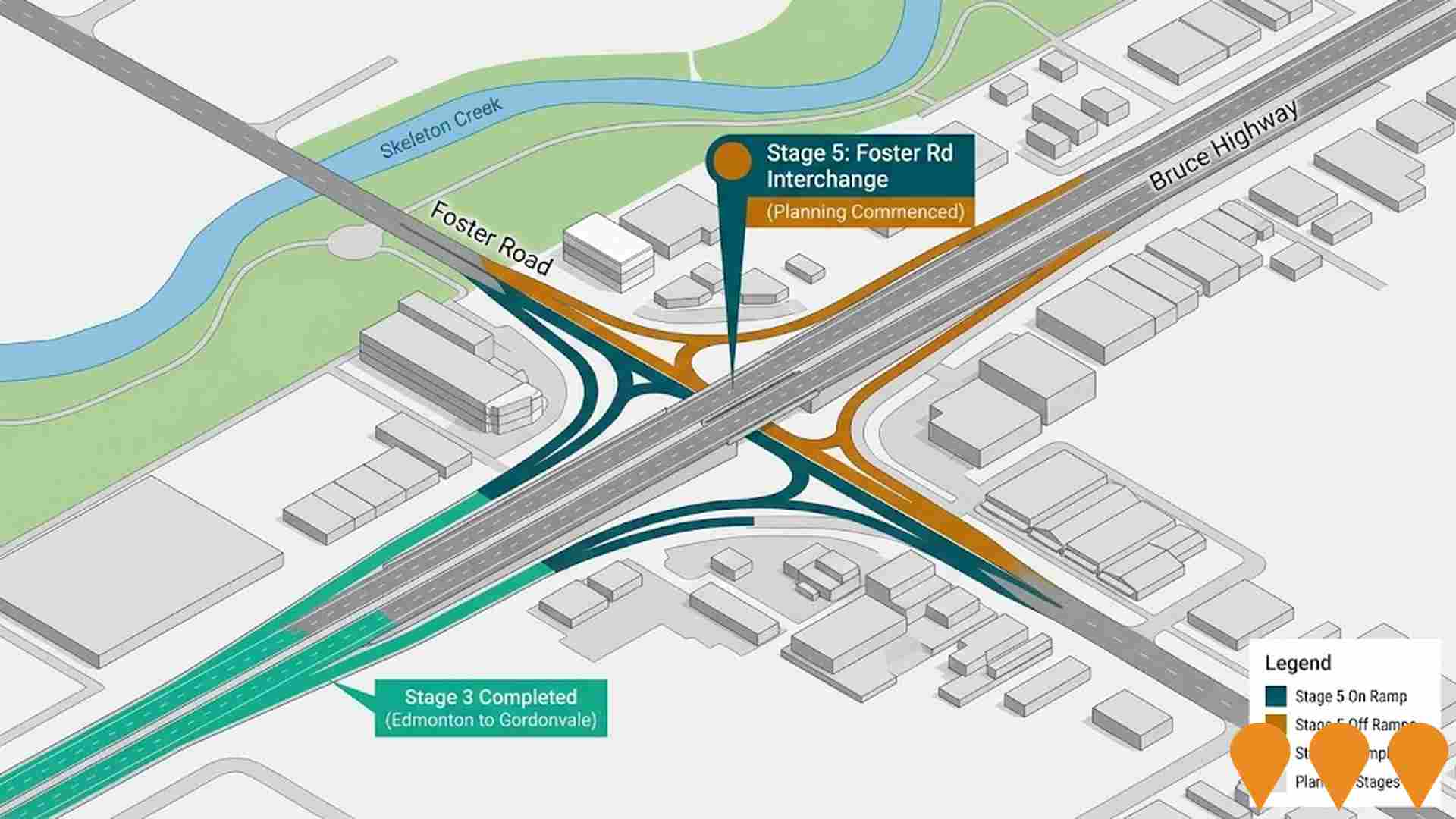

Changes to local infrastructure significantly affect an area's performance. AreaSearch identified 14 projects that could impact this region. Notable ones are Sugarworld Estate, Edmonton Business & Industry Park, Parkside Estate, and Pinecrest Master Planned Community. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

North Queensland Youth Alcohol and Other Drugs Residential Rehabilitation Service

The North Queensland Youth Alcohol and Other Drug Service (NQYAODS) is a 10-bed residential rehabilitation facility providing 24/7 specialist care for young people aged 13-18. The service offers a holistic, home-like environment with integrated education support, mental health services, and cultural programs overseen by the Gindaja Treatment and Healing Indigenous Corporation. Stays range from six weeks to six months, focusing on voluntary recovery and harm minimisation.

Edmonton Business & Industry Park

A 212-hectare masterplanned business and industry hub south of Cairns, developed by Pregno Family Investments. The project is delivered in six stages and includes industrial, manufacturing, and warehousing precincts, alongside 'big box' retail, a private hospital, and over 50 hectares of public open space incorporating the Blackfellows Creek environmental corridor restoration.

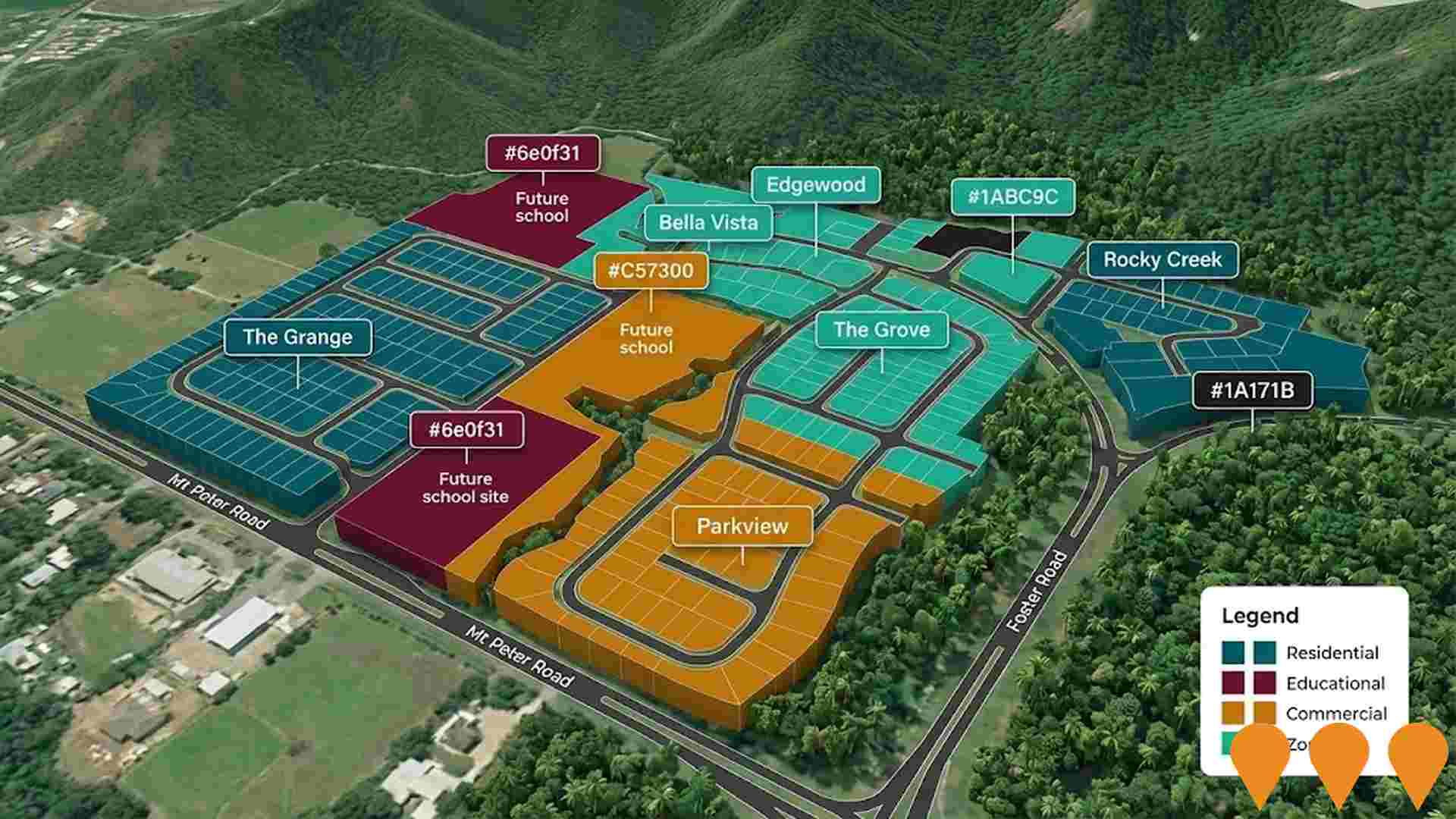

Mount Peter Priority Development Area

Declared on 30 July 2025, the 2,650-hectare Mount Peter PDA is Cairns' primary long-term growth corridor, designed to accommodate 18,500 new homes and 42,500 residents by 2050. Currently operating under an Interim Land Use Plan (ILUP), the project is in a 18-month planning phase to establish a permanent Development Scheme. The 'Securing Cairns Housing Foundations Plan' identifies a $450 million infrastructure requirement for Stage 1, seeking a three-way funding split between Council, State, and Federal governments to deliver critical water, wastewater, and transport networks. Precinct 1 (Residential North) is open for fast-tracked development applications to provide immediate housing relief.

Cairns Water Security Stage 1 (CWSS1) Project

The Cairns Water Security Stage 1 (CWSS1) project is the largest infrastructure project ever undertaken by the Cairns Regional Council, designed to provide a new, reliable, and sustainable water supply for the growing Cairns region. The project involves building a new water intake at the Mulgrave River near the Desmond Trannore Bridge and a new water treatment plant and reservoirs on Council-owned land on Jones Road. It also includes the construction of a 30 km pipeline network to transport water. Once operational, the new water treatment plant will supply up to 60 megalitres of treated water per day and will make the existing treatment plant at Behana redundant. The project has passed its halfway mark and is expected to be complete in mid-2026.

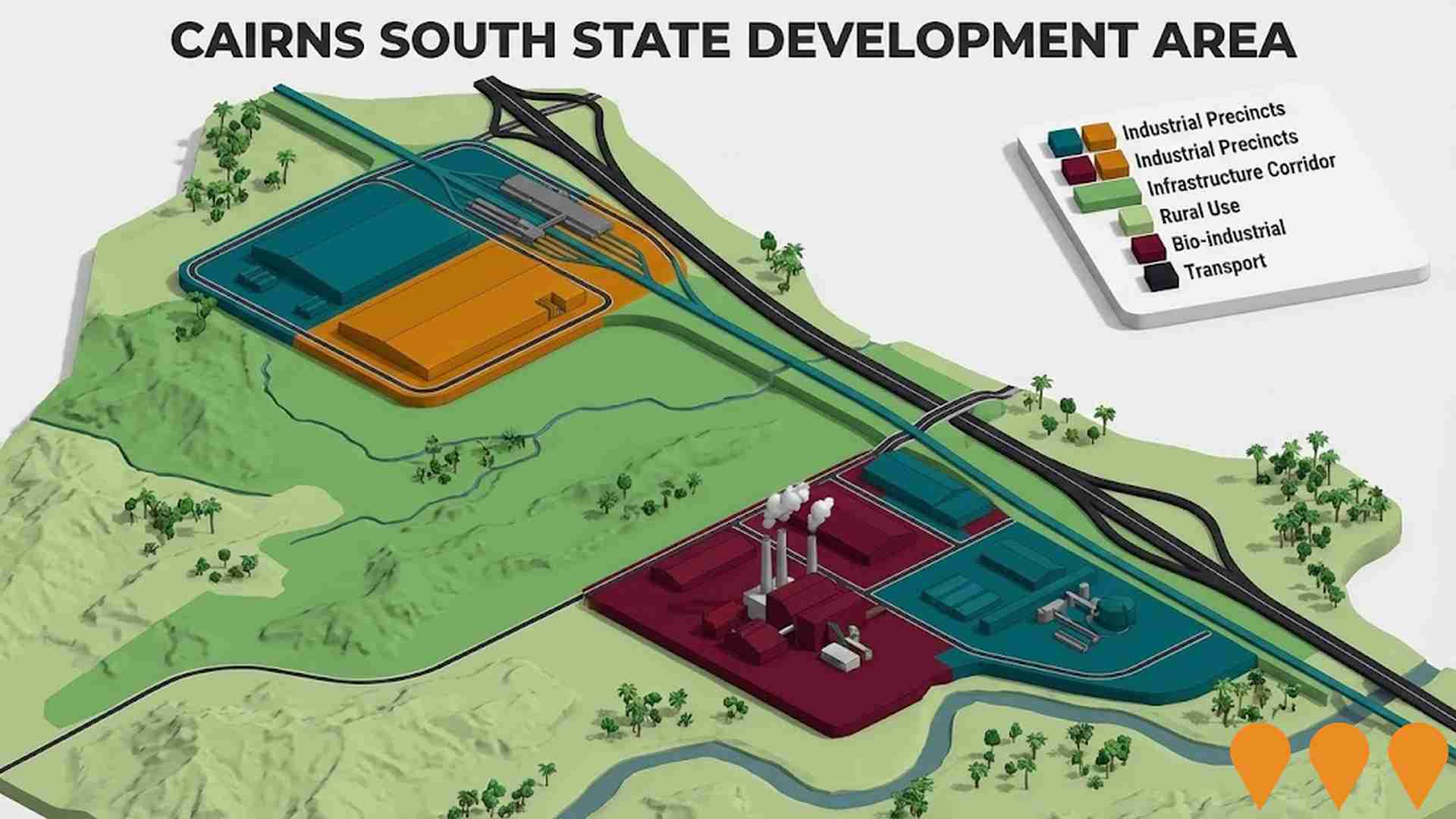

Cairns South State Development Area

A 1159-hectare state development area declared in November 2018 and expanded in February 2020 to facilitate regionally significant industrial development across two separate areas. The northern precinct at Wrights Creek enables freight, logistics, and large-scale industrial development with direct access to the Bruce Highway and North Coast Line. The southern precinct adjacent to the Mulgrave Mill supports bio-industrial development and value-added sugar processing industries. MSF Sugar has committed $150 million in planned investments including a biorefinery and cogeneration facility at the Gordonvale site.

Cairns Community and Multicultural Centre

The $8 million Cairns Community and Multicultural Centre will deliver social facilities and key support and outreach services for residents of White Rock and surrounding areas, as well as Cairns diverse multicultural community. The centre will include a fully equipped commercial kitchen, multipurpose spaces for up to 200 people, small meeting rooms, dedicated space for service providers, foyer and reception area, and covered areas for play groups and cultural practices. Detailed design commenced in January 2025, with construction to be fast-tracked. The facility will be adjacent to White Rock State School and will complement new sports fields being developed at the school.

Sugarworld Estate

Sugarworld Estate is a master planned mixed-use residential development featuring The Terrace and The Heights precincts. Offering 219 fully serviced lots ranging from 465m2 to 3,222m2 with mountain views, located 20 minutes from Cairns CBD with multiple stages actively selling.

Kowinka Village - Commercial Retail & Office Complex

Brand new commercial complex at the corner of Kowinka Street and Skull Road, White Rock. Ground floor retail, office, medical and food and beverage spaces ranging from 73 to 262 square meters. The development features high visibility from the Bruce Highway, ample parking with 33 onsite spaces, and serves as a growth-focused community hub. Located adjacent to Trinity Links Resort and Cairns Golf Club, the complex is positioned in a high-growth corridor just 10 minutes from Cairns CBD, servicing over 27,000 residents across nearby suburbs.

Employment

AreaSearch analysis reveals Edmonton recording weaker employment conditions than most comparable areas nationwide

Edmonton's workforce is balanced across white and blue collar jobs, with prominent essential services sectors. The unemployment rate in Edmonton was 5.9% as of an unspecified date based on AreaSearch data aggregation.

As of September 2025, Edmonton had 6,216 residents employed, with an unemployment rate at 1.8% above the Rest of Qld's rate of 4.1%. Workforce participation was 63.0%, slightly higher than the Rest of Qld's 59.1%. Employment in Edmonton is concentrated in health care & social assistance, retail trade, and construction. Retail trade has a particularly high employment share at 1.2 times the regional level.

Agriculture, forestry & fishing, however, has limited presence with only 1.3% of employment compared to the regional rate of 4.5%. The area may offer limited local employment opportunities, as indicated by the difference between the Census working population and resident population. Between September 2024 and September 2025, Edmonton's labour force decreased by 1.5%, while employment declined by 4.0%, leading to a rise in unemployment rate of 2.4 percentage points. In contrast, the Rest of Qld saw employment growth of 1.7% and a labour force expansion of 2.1%, with an unemployment increase of only 0.3 percentage points. State-level data up to 25-Nov shows Queensland's employment contracted by 0.01%, losing 1,210 jobs, with the state unemployment rate at 4.2%. National employment forecasts from Jobs and Skills Australia indicate a projected growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Edmonton's employment mix suggests local employment should increase by 6.3% over five years and 13.2% over ten years, although these are simple extrapolations for illustrative purposes and do not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

AreaSearch's latest postcode level ATO data for financial year 2023 shows Edmonton's median income among taxpayers is $52,547. The average income in the suburb was $58,478 during this period. Both figures are below the national average. In comparison, Rest of Qld had a median income of $53,146 and an average of $66,593 for financial year 2023. Based on Wage Price Index growth of 9.91% since then, current estimates suggest Edmonton's median income would be approximately $57,754 and the average around $64,273 by September 2025. According to Census 2021 income data, household, family and personal incomes in Edmonton rank modestly, between the 44th and 48th percentiles. Income analysis reveals that 38.0% of Edmonton's population (4,729 individuals) earns between $1,500 - $2,999 annually, which is similar to regional levels where 31.7% falls within this earnings band. Housing affordability pressures are severe in Edmonton, with only 83.5% of income remaining after housing costs, ranking at the 44th percentile.

Frequently Asked Questions - Income

Housing

Edmonton is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Edmonton's dwelling structures, as per the latest Census, consisted of 90.2% houses and 9.7% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro Qld had 68.4% houses and 31.6% other dwellings. Home ownership in Edmonton was at 22.7%, with the remaining dwellings either mortgaged (44.3%) or rented (33.0%). The median monthly mortgage repayment in Edmonton was $1,517, aligning with Non-Metro Qld's average. The median weekly rent figure was $350, compared to Non-Metro Qld's $315. Nationally, Edmonton's mortgage repayments were lower than the Australian average of $1,863, and rents were less than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Edmonton has a typical household mix, with a higher-than-average median household size

Family households constitute 76.0% of all households, including 34.9% couples with children, 24.0% couples without children, and 15.9% single parent families. Non-family households comprise the remaining 24.0%, with lone person households at 20.8% and group households making up 3.2%. The median household size is 2.8 people, higher than the Rest of Qld average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Edmonton faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 12.6%, significantly lower than the Australian average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most common at 9.5%, followed by graduate diplomas (1.6%) and postgraduate qualifications (1.5%). Trade and technical skills are prevalent, with 46.4% of residents aged 15 and above holding vocational credentials - advanced diplomas (11.0%) and certificates (35.4%).

Educational participation is notably high, with 35.4% of residents currently enrolled in formal education. This includes 13.8% in primary education, 11.0% in secondary education, and 3.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Edmonton has 30 active public transport stops operating currently. These are served by a mix of buses along five different routes. Together, these routes facilitate 546 weekly passenger trips.

The accessibility of transport in Edmonton is rated as good, with residents typically located 364 meters away from the nearest stop. On average, there are 78 trips per day across all routes, which translates to approximately 18 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Edmonton is notably higher than the national average with prevalence of common health conditions low among the general population though higher than the nation's average across older, at risk cohorts

Edmonton shows above-average health outcomes with a low prevalence of common health conditions among its general population. This is higher than the national average for older and at-risk cohorts.

Approximately 50% of Edmonton's total population has private health cover (~6,269 people), compared to the national average of 55.7%. The most prevalent medical conditions in Edmonton are mental health issues and asthma, affecting 8.4% and 7.2% of residents respectively. About 72.2% of residents report being completely free from medical ailments, slightly higher than the Rest of Qld's 71.7%. Edmonton has a lower proportion of seniors aged 65 and over at 12.0% (1,493 people), compared to Rest of Qld's 15.7%. Health outcomes among seniors require more attention than those for the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Edmonton ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Edmonton's cultural diversity was below average, with 85.3% being citizens born in Australia speaking English only at home. Christianity was the main religion, comprising 50.7%. The 'Other' category was overrepresented at 1.2%, compared to 1.5% regionally.

Top ancestry groups were Australian (26.1%), English (23.4%), and Other (13.1%). Notably, Australian Aboriginal (8.5%) and Samoan (0.5%) populations were higher than regional averages of 6.7% and 0.3%, respectively. New Zealand's representation was also slightly higher at 0.9%.

Frequently Asked Questions - Diversity

Age

Edmonton's young demographic places it in the bottom 15% of areas nationwide

Edmonton's median age is 33, which is younger than the Rest of Queensland's figure of 41 and Australia's national median age of 38. The 25-34 age group constitutes 16.0% of Edmonton's population, higher than in the Rest of Queensland, while the 65-74 cohort makes up 6.7%. Between 2021 and present, the 25-34 age group has increased from 14.5% to 16.0%, and the 15-24 cohort has risen from 13.1% to 14.3%. Conversely, the 5-14 age group has declined from 16.6% to 13.8%. By 2041, demographic projections indicate significant shifts in Edmonton's age structure. Notably, the 25-34 age group is projected to grow by 42%, adding 842 people, reaching a total of 2,834 from its current figure of 1,991. Meanwhile, the 15-24 age group is expected to decrease by 10 residents.