Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Coniston reveals an overall ranking slightly below national averages considering recent, and medium term trends

Coniston's population, as of November 2025, is estimated at around 2,402 people. This reflects an increase of 135 people since the 2021 Census, which reported a population of 2,267 people. The change is inferred from AreaSearch's estimation of the resident population as 2,322 following examination of the latest ERP data release by the ABS in June 2024, along with an additional 13 validated new addresses since the Census date. This level of population equates to a density ratio of 2,266 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. Coniston's growth rate of 6.0% since the 2021 census exceeded the non-metro area's growth rate of 5.7%, marking it as a growth leader in the region. Overseas migration contributed approximately 85.0% of overall population gains during recent periods, driving primary population growth for the Coniston statistical area (Lv2).

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Considering projected demographic shifts, the Coniston (SA2) is forecasted to experience a significant population increase in the top quartile of regional areas nationally. By 2041, the area is expected to expand by 823 persons, reflecting a gain of 32.4% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Coniston, placing the area among the bottom 25% of areas assessed nationally

AreaSearch analysis indicates Coniston averaged approximately 7 new dwelling approvals annually over the past five financial years ending FY25. This totals an estimated 38 homes. As of FY26, one approval has been recorded. On average, 0.3 new residents per year arrive with each new home constructed between FY21 and FY25.

This suggests that new construction is meeting or exceeding demand, providing more buying options and facilitating population growth. The average expected construction cost value for new properties is $536,000, indicating a focus on the premium segment. In FY26, $1.9 million in commercial development approvals have been recorded, reflecting the area's residential nature. Building activity shows 12.0% detached houses and 88.0% attached dwellings, emphasizing higher-density living to create more affordable entry points for downsizers, investors, and first-home buyers.

This represents a shift from the current housing composition of 51.0% houses. Coniston's population density is around 276 people per dwelling approval. According to AreaSearch's latest quarterly estimate, Coniston is projected to add 778 residents by 2041. If current construction levels persist, housing supply may lag behind population growth, potentially intensifying buyer competition and supporting price growth.

Frequently Asked Questions - Development

Infrastructure

Coniston has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

The performance of an area can be significantly influenced by changes to local infrastructure, major projects, and planning initiatives. A total of one project has been identified by AreaSearch as potentially impacting the area. Notable projects include the Wollongong to Coniston Rail Infrastructure Upgrade, Illawarra Renewable Energy Zone (REZ), Wollongong Hospital ED Short Stay Units, and Kenny Street Mixed-Use Tower, with the following list providing details on those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

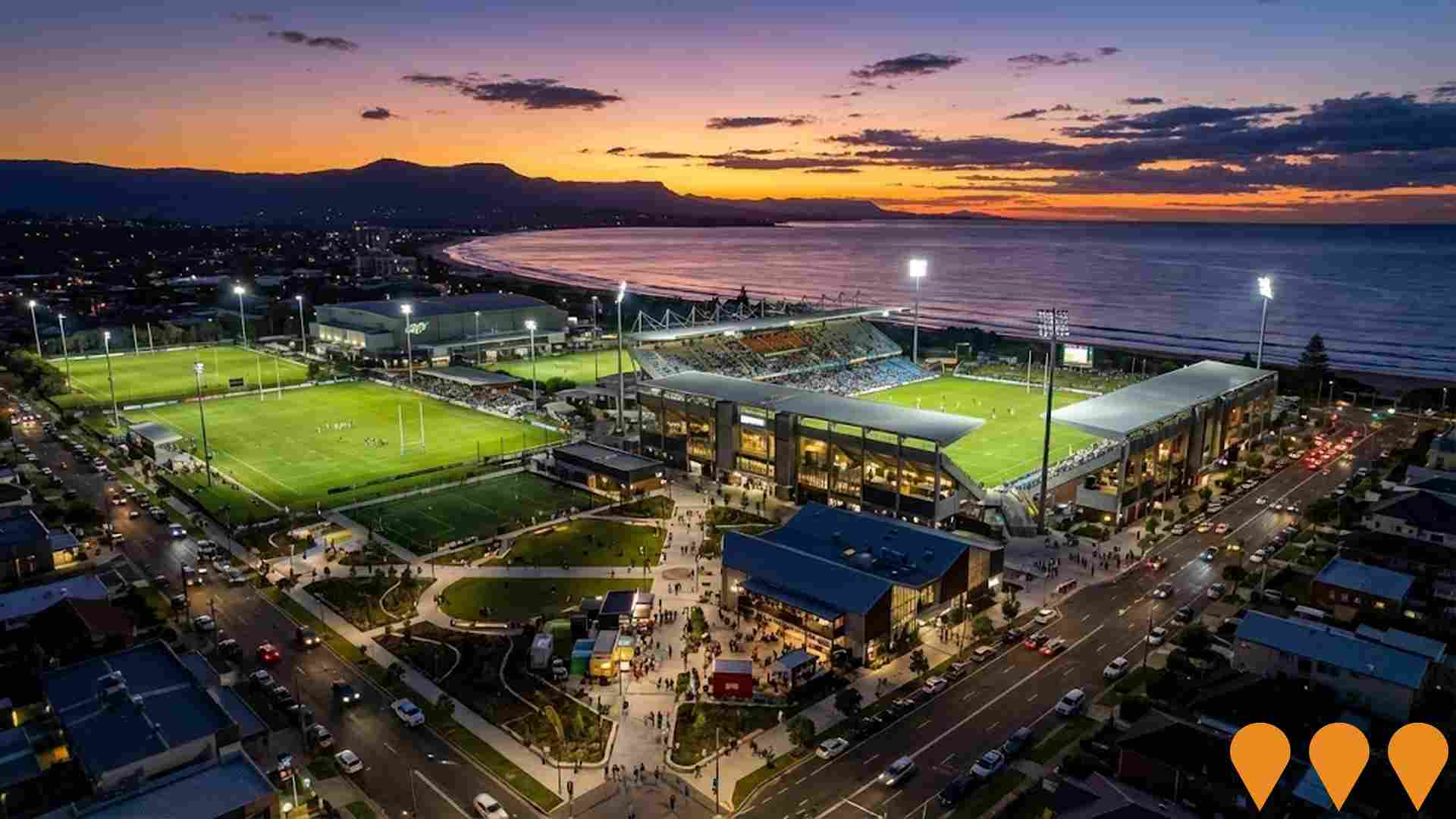

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Illawarra Renewable Energy Zone (REZ)

NSW's first urban Renewable Energy Zone designed to integrate 1 GW of network capacity. The project focuses on leveraging existing industrial, port, and grid infrastructure to support green hydrogen, green steel, and offshore wind industries. It uniquely emphasizes consumer energy resources like rooftop solar and community batteries. As of early 2026, EnergyCo continues detailed infrastructure planning and community engagement following the 2025 Roundtable which identified over $43 billion in potential private investment interest.

Wollongong to Coniston Rail Infrastructure Upgrade

Part of the Rail Service Improvement Program (formerly More Trains, More Services), this project involves upgrading the rail corridor between Wollongong and Coniston. Key works include replacing electrical cables and overhead wiring at the Coniston substation, installing new signalling equipment, and completing civil and structural activities to support more frequent services on the South Coast Line. The project also integrates with the Safe Accessible Transport Program for station-specific accessibility improvements.

Southern Suburbs Community Centre and Library

A new $41.5 million three-storey community hub in Warrawong featuring a modern library, community centre, flexible meeting and function rooms, spaces for community organisations, a town square, landscaped public spaces, and parking. Construction commenced September 2025 and is expected to be completed by mid-2027. The facility will serve the southern suburbs of Wollongong including Berkeley, Lake Heights, Cringila, Warrawong, Port Kembla, Primbee, and Windang.

Crown Street Wollongong Redevelopment Project (Northsea)

A landmark 13-storey mixed-tenure residential development in central Wollongong, featuring 65 apartments comprising 18 social housing units (with 8 dual-key units), 9 affordable housing units, and 38 private apartments. Completed in December 2024, this project represents Australia's first purpose-built mixed-tenure building with shared facilities, ground-floor retail, and 7-star energy rating for social housing units.

Wollongong Hospital ED Short Stay Units

New short stay observation units for Wollongong Hospital Emergency Department to reduce wait times and improve patient flow. Includes additional treatment spaces and supporting infrastructure.

Kenny Street Mixed-Use Tower

Eighteen-storey mixed-use project comprising a 107-room hotel (with food and drink premises), 105 residential apartments, ground-floor commercial space, two basement parking levels and communal open space including gym and pool.

21 Auburn Street, Wollongong

A $61.7 million, 23-storey mixed-use development by TQM Design & Construct on the former Illawarra Mercury site. Includes 164 residential apartments (with 30 affordable housing units), ground-floor commercial offices, communal open space featuring a swimming pool, and four levels of basement parking.

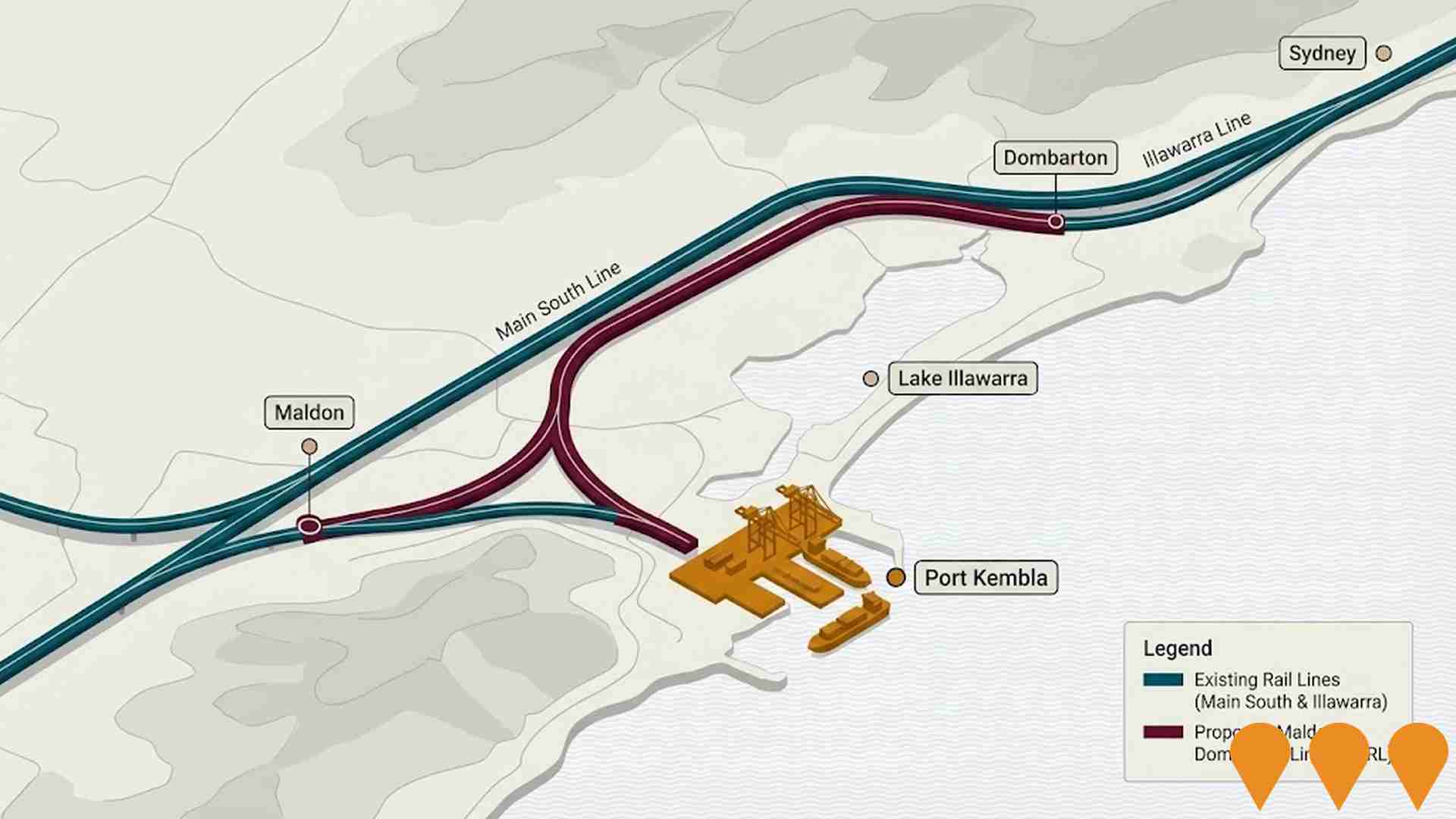

Freight Rail Access to Port Kembla (Maldon to Dombarton / SWIRL options)

Program of works to improve freight rail access to Port Kembla, including investigation of the Maldon to Dombarton (also known as South West Illawarra Rail Link, SWIRL) corridor and complementary network upgrades to address capacity constraints on existing lines and better connect Port Kembla to Western Sydney intermodals.

Employment

Employment drivers in Coniston are experiencing difficulties, placing it among the bottom 20% of areas assessed across Australia

Coniston has a skilled workforce with essential services sectors well represented. Its unemployment rate is 7.9%.

Employment stability has been relative over the past year, according to AreaSearch's aggregation of statistical area data. As of September 2025, 1,231 residents are employed while the unemployment rate is 4.0% higher than Rest of NSW's rate of 3.8%, indicating room for improvement. Workforce participation in Coniston is on par with Rest of NSW's 56.4%. Leading employment industries among residents include health care & social assistance, education & training, and retail trade.

The area specializes in finance & insurance, with an employment share 2.1 times the regional level. However, agriculture, forestry & fishing has limited presence at 0.3% compared to the regional average of 5.3%. There are 0.7 workers for each resident, indicating a higher than normal level of local employment opportunities, as per Census data from September 2025. Over the 12 months prior to this date, employment increased by 0.2%, while labour force remained stable at 0.0%, leading to a decrease in unemployment rate by 0.2 percentage points. This contrasts with Rest of NSW where employment fell by 0.5%, labour force contracted by 0.1%, and unemployment rose by 0.4 percentage points. State-level data from 25-Nov shows NSW employment contracted by 0.03% (a loss of 2,260 jobs), with the state unemployment rate at 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that while overall employment is expected to expand by 6.6% over five years and 13.7% over ten years, growth rates vary significantly between industry sectors. Applying these projections to Coniston's employment mix indicates local employment should increase by 6.5% over five years and 13.6% over ten years, although this is a simple extrapolation for illustrative purposes and does not consider localized population projections.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

The suburb of Coniston has a lower income level than the national average, according to the latest data from the Australian Taxation Office (ATO) aggregated by AreaSearch for the financial year 2023. The median income among taxpayers in Coniston is $44,272, while the average income stands at $60,504. This compares to figures for the Rest of NSW, which are $52,390 and $65,215 respectively. Based on Wage Price Index growth of 8.86% since financial year 2023, estimated incomes as of September 2025 would be approximately $48,194 (median) and $65,865 (average). Census data from 2021 shows household, family, and personal incomes in Coniston rank modestly, between the 36th and 37th percentiles. Income analysis reveals that 31.8% of the population (763 individuals) fall within the $1,500 - 2,999 income range, mirroring the metropolitan region where 29.9% occupy this bracket. Housing affordability pressures are severe in Coniston, with only 83.2% of income remaining after housing costs, ranking at the 37th percentile. The area's Socio-Economic Indexes for Areas (SEIFA) income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Coniston displays a diverse mix of dwelling types, with strong rates of outright home ownership

The dwelling structure in Coniston, as per the latest Census, consisted of 50.8% houses and 49.2% other dwellings including semi-detached properties, apartments, and 'other' dwellings. Home ownership stood at 31.6%, with mortgaged dwellings accounting for 25.6% and rented dwellings making up 42.8%. The median monthly mortgage repayment in the area was $1,820, recorded as of 20XX (exact year not specified). The median weekly rent figure stood at $350 during this period. Nationally, Coniston's mortgage repayments were lower than the Australian average of $1,863, while rents were less than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Coniston features high concentrations of group households and lone person households, with a median household size of 2.4 people

Family households account for 62.6% of all households, including 25.1% couples with children, 25.1% couples without children, and 11.7% single parent families. Non-family households constitute the remaining 37.4%, with lone person households at 31.7% and group households comprising 5.2%. The median household size is 2.4 people.

Frequently Asked Questions - Households

Local Schools & Education

Coniston shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's educational profile is notable regionally with university qualification rates at 27.3%, exceeding the Rest of NSW average of 21.3%. Bachelor degrees are most common at 18.6%, followed by postgraduate qualifications at 5.7% and graduate diplomas at 3.0%. Trade and technical skills are prominent, with 34.1% of residents aged 15+ holding vocational credentials – advanced diplomas at 10.8% and certificates at 23.3%.

Educational participation is high, with 31.2% of residents currently enrolled in formal education, including 9.1% in tertiary, 8.9% in primary, and 5.9% in secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Coniston has 24 active public transport stops, offering a mix of train and bus services. These stops are served by 32 individual routes, facilitating 2,186 weekly passenger trips in total. The average distance from residents to the nearest transport stop is 154 meters, indicating excellent accessibility.

On average, there are 312 daily trips across all routes, which translates to approximately 91 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Coniston is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Coniston faces significant health challenges, with common health conditions prevalent across both younger and older age cohorts.

Private health cover is relatively low at approximately 51% of the total population (~1,222 people). The most common medical conditions are mental health issues and arthritis, impacting 10.0 and 8.8% of residents respectively. 64.7% of residents declare themselves completely clear of medical ailments, compared to 0% across Rest of NSW. As of 2016, 18.8% of Coniston's residents are aged 65 and over (451 people). Health outcomes among seniors present some challenges, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Coniston was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Coniston's population showed higher cultural diversity than most local markets, with 31.9% born overseas and 33.0% speaking a language other than English at home. Christianity was the predominant religion in Coniston, comprising 55.2%. Islam had an overrepresentation of 4.2%, compared to none across Rest of NSW.

In ancestry, the top groups were English (20.8%), Australian (20.2%), and Other (10.7%). Notably, Macedonian was overrepresented at 9.2% in Coniston versus none regionally, Serbian at 3.4%, and Croatian at 1.9%.

Frequently Asked Questions - Diversity

Age

Coniston's population aligns closely with national norms in age terms

Coniston has a median age of 38, which is lower than the Rest of NSW figure of 43 but equivalent to the national norm of 38. The 25-34 age group makes up 19.1% of Coniston's population, higher than Rest of NSW, while the 65-74 cohort is less prevalent at 8.8%. According to the 2021 Census, the 25-34 age group has increased from 15.8% to 19.1%, and the 45-54 cohort has decreased from 12.6% to 11.2%. By 2041, Coniston's age profile is projected to change significantly. The 25-34 group is expected to grow by 58%, adding 264 people and reaching a total of 723. The 75-84 group will see more modest growth of 8%, with an increase of 13 residents.