Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Bundaberg North is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Based on ABS population updates, as of Nov 2025, the Bundaberg North statistical area (Lv2) has an estimated population of around 5843. This reflects a 5% increase since the 2021 Census, which reported a population of 5563 people. The change is inferred from AreaSearch's estimate of the resident population at 5841, following examination of the latest ERP data release by the ABS in June 2024, and an additional validated new address since the Census date. This level of population equates to a density ratio of 396 persons per square kilometer. Primary drivers for population growth were interstate migration, contributing approximately 64% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. Considering projected demographic shifts, a population increase just below the median of regional areas nationally is expected for Bundaberg North (SA2), with an expansion of 490 persons to 2041. This reflects an overall increase of approximately 9.8% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Bundaberg North when compared nationally

Based on AreaSearch analysis of ABS building approval numbers, Bundaberg North averaged around 8 new dwelling approvals each year. Between FY-21 and FY-25, an estimated 41 homes were approved, with none so far in FY-26. Over these five years, an average of 11 people moved to the area per dwelling built.

This demand outpaces supply, typically putting upward pressure on prices and increasing competition among buyers. New properties are constructed at an average value of $579,000, indicating a focus on the premium market with high-end developments. In FY-26, $208,000 in commercial development approvals have been recorded, suggesting a predominantly residential focus. Compared to the Rest of Qld, Bundaberg North shows substantially reduced construction (78.0% below regional average per person). This limited new supply generally supports stronger demand and values for established dwellings.

However, recent construction activity has intensified recently, though it remains under the national average, indicating the area's established nature and suggesting potential planning limitations. Recent building activity consists entirely of detached dwellings, maintaining Bundaberg North's traditional low density character with a focus on family homes appealing to those seeking space. New construction favours detached housing more than current patterns suggest (73.0% at Census), demonstrating ongoing robust demand for family homes despite increasing density pressures. The estimated count of 391 people in the area per dwelling approval reflects its quiet, low activity development environment. Future projections show Bundaberg North adding 571 residents by 2041 (from the latest AreaSearch quarterly estimate). If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Bundaberg North has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 18 projects that may impact the region. Notable ones include Edenbrook Estate, Belle Eden Estate Extensions, Young Street Residential Subdivision, and Bundaberg Solar Farm. The following list details those considered most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

New Bundaberg Hospital

The $1.2 billion New Bundaberg Hospital is a six-storey greenfield public hospital development in Thabeban. It will feature a rooftop helipad, an expanded emergency department, and over 400 beds including acute, mental health, and intensive care services. The facility serves as the anchor for the broader Bundaberg Health and Enterprise Precinct, incorporating teaching, training, and research spaces to support the growing Wide Bay region.

Bundaberg Civic and Cultural Precinct

A transformative civic and cultural arts precinct in Bundaberg's CBD designed to create a new city heart. The project features a new regional art gallery and a 750-seat performing arts centre. The design converts an existing carpark into an inner courtyard linking the historic School of Arts to the new gallery, with the performing arts centre creating a pedestrian spine. As of late 2025, Bundaberg Regional Council is reviewing and rescoping the 2019 masterplan to investigate staged delivery options that meet community priorities within current financial means.

Bundaberg East Levee

A $174.7 million flood resilience project featuring a 1.7 km concrete levee along the Burnett River's southern bank. The infrastructure includes floodgates, flood doors, and pump stations at Saltwater and Distillery Creeks, designed to protect over 600 properties in Bundaberg East, South, and the CBD from 1% AEP flood events. Recent milestones include the 2024 Ministerial Infrastructure Designation (MID) and Bundaberg Regional Council's 2025 formal acceptance of future asset ownership. Construction is anticipated to commence following the finalization of detailed designs and procurement.

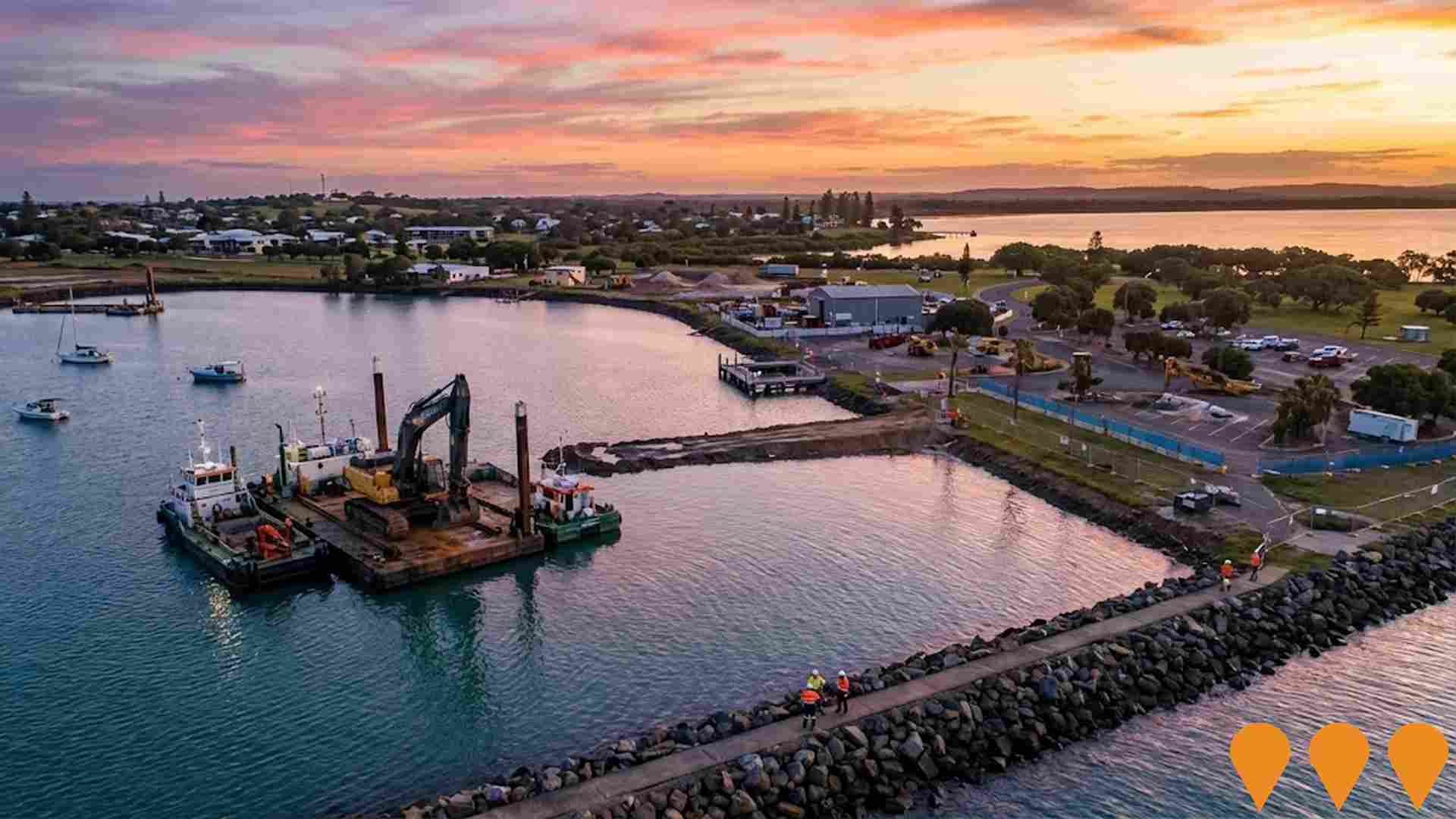

The Gateway Marina - Burnett Heads

A $250 million integrated master-planned marina village at Burnett Heads Boat Harbour. The project features a 318-berth state-of-the-art marina, a 24-hour fuel dock, and a waterfront residential community comprising 134 dwellings including the Musgrave and Elliot residences. The development includes boutique retail, restaurants, cafes, and public boardwalks. Following a director dispute and the appointment of receivers from HLB Mann Judd in early 2024, the project and its 7.26ha land/7.58ha wet lease assets were marketed for sale by Colliers. As of early 2026, the project remains in a pre-construction stage pending the commencement of works by a new owner or successor.

Bundaberg Aquatic Centre

A state-of-the-art year-round aquatic facility featuring a covered 50m FINA-standard 10-lane competition pool, an indoor 25m lap pool, a heated program/hydrotherapy pool with accessible ramp entry, multipurpose rooms, Reformer Pilates studio, cafe, and equitable access features including ramps, lifts, and hoists. Co-located with the Bundaberg Multiplex to form a high-performance sports precinct. Includes sustainability features such as solar arrays, hybrid heating, and rainwater harvesting. Provides fitness, education, therapy, competition, and recreation opportunities for all ages and abilities, with approximately 165 parking spaces.

Bundaberg Solar Farm

A 100 MW solar photovoltaic farm located in the Bundaberg region, approximately 360 kilometers north of Brisbane. The facility features 168,399 solar modules installed across 146 hectares and is expected to have a 25-year lifespan. The project will generate approximately 200 GWh of clean energy annually, enough to power around 36,000 homes and offset 104,000 tonnes of CO2 emissions each year. Construction is being delivered by Monford Group as EPC contractor, with commercial operation expected to commence in Q3-Q4 2025. The project includes a Power Purchase Agreement with Telstra for 153 GWh per annum.

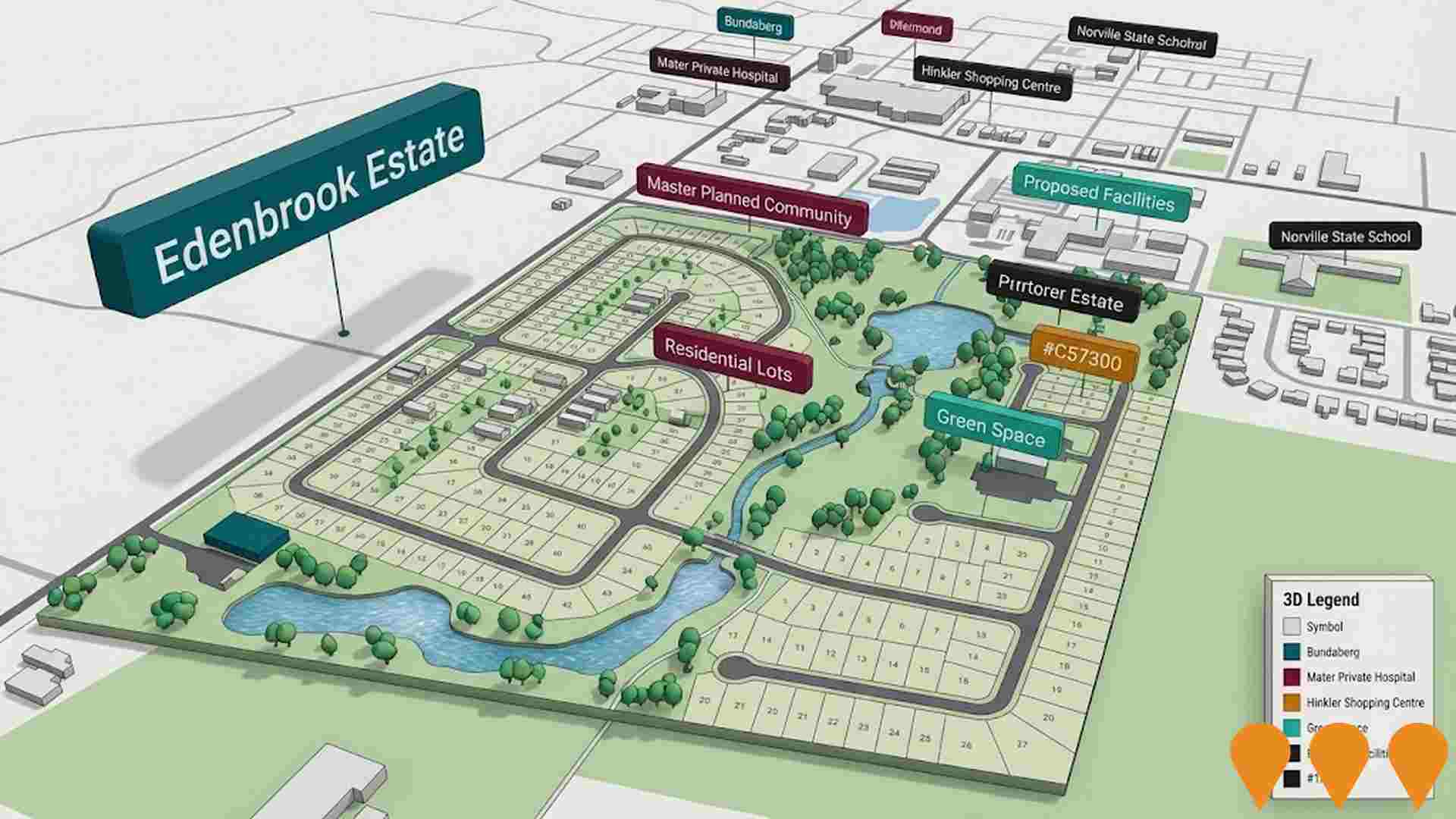

Edenbrook Estate

Premium master-planned residential community by Santalucia Corporation. Lots from 740m2-1,080m2 with 23m average frontages. Features high-speed internet, proximity to shopping, schools, and childcare facilities.

Belle Eden Estate Extensions

Two development sites: 23-hectare northern site for 150+ home sites (380 population) and 34-hectare southern site for 300+ home sites (750 population). Currently in final approval stages.

Employment

Bundaberg North shows employment indicators that trail behind approximately 70% of regions assessed across Australia

Bundaberg North's workforce is balanced across white and blue-collar jobs. Key sectors include health care & social assistance, retail trade, and agriculture, forestry & fishing.

As of September 2025, 2,555 residents are employed, with an unemployment rate of 6.9%. This rate has increased by 0.5 percentage points over the past year due to employment growth outpacing labour force growth (9.3% vs 9.9%). The area's unemployment rate is 2.8% higher than Rest of Qld's rate of 4.1%, and workforce participation is lower at 43.9%. Bundaberg North specializes in agriculture, forestry & fishing, with an employment share 2.2 times the regional level.

However, professional & technical services are under-represented, with only 2.4% of the workforce compared to Rest of Qld's 5.1%. State-level data shows Queensland's employment contracted by 0.01% between September 2024 and November 2025, losing 1,210 jobs, with an unemployment rate of 4.2%, closely aligned with the national rate of 4.3%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Bundaberg North's industry mix suggests local employment should grow by 6.0% over five years and 13.1% over ten years, assuming constant population ratios.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

The suburb of Bundaberg North had a median taxpayer income of $40,447 and an average income of $49,979 in the financial year 2023, according to postcode level ATO data aggregated by AreaSearch. This is lower than the national average. In comparison, Rest of Qld's median income was $53,146 with an average income of $66,593. By September 2025, estimated incomes would be approximately $44,455 (median) and $54,932 (average), based on a 9.91% increase in wages since the financial year 2023. Census data indicates that household, family, and personal incomes in Bundaberg North all fall within the 1st to 6th percentiles nationally. The earnings profile shows that 34.5% of residents earn between $400 and $799 weekly (2,015 individuals), unlike surrounding regions where 31.7% earn between $1,500 and $2,999 weekly. A significant portion of the community faces economic challenges, with 43.2% earning below $800 weekly. Housing affordability pressures are severe, as only 84.3% of income remains after housing costs, ranking at the 4th percentile nationally.

Frequently Asked Questions - Income

Housing

Bundaberg North is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Bundaberg North, as per the latest Census, 72.9% of dwellings were houses, with the remaining 27.1% being semi-detached homes, apartments, or other types. This differs from Non-Metro Queensland's dwelling structure, which was 84.6% houses and 15.4% other dwellings. Home ownership in Bundaberg North stood at 45.2%, with mortgaged dwellings at 20.9% and rented ones at 34.0%. The median monthly mortgage repayment in the area was $1,083, lower than Non-Metro Queensland's average of $1,300. The median weekly rent figure for Bundaberg North was $280, similar to Non-Metro Queensland's $285. Nationally, Bundaberg North's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Bundaberg North features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 63.0% of all households, including 15.8% that are couples with children, 32.4% that are couples without children, and 13.3% that are single parent families. Non-family households make up the remaining 37.0%, with lone person households at 33.5% and group households comprising 3.6%. The median household size is 2.2 people, which is smaller than the Rest of Qld average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Bundaberg North faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 9.9%, significantly lower than the Australian average of 30.4%. This disparity presents both challenges and opportunities for targeted educational initiatives. Bachelor degrees are the most common at 7.7%, followed by postgraduate qualifications (1.3%) and graduate diplomas (0.9%). Trade and technical skills are prominent, with 39.5% of residents aged 15+ holding vocational credentials - advanced diplomas (8.0%) and certificates (31.5%).

A substantial 24.9% of the population is actively pursuing formal education, including 9.6% in primary education, 7.6% in secondary education, and 2.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Bundaberg North has 20 active public transport stops, all of which are bus stops. These stops are served by two different routes that together offer 34 weekly passenger trips. The accessibility of these services is rated as good, with residents typically living within 360 meters of the nearest stop.

On average, there are four trips per day across all routes, which equates to approximately one weekly trip per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Bundaberg North is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Bundaberg North faces significant health challenges, with various conditions affecting both younger and older residents. Private health cover is low, at approximately 47% (~2,746 people), compared to the national average of 55.7%.

The most prevalent medical conditions are arthritis (12.9%) and mental health issues (10.7%). About 55.6% of residents report no medical ailments, slightly lower than the Rest of Qld's 59.1%. Residents aged 65 and over comprise 30.1% (1,758 people), higher than Rest of Qld's 26.3%. Senior health outcomes align with the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

Bundaberg North is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Bundaberg North had a cultural diversity index below the average, with 87.2% of its population being citizens, 86.7% born in Australia, and 94.5% speaking English only at home. Christianity was the predominant religion, comprising 52.1% of Bundaberg North's population. Notably, Judaism had a higher representation in Bundaberg North at 0.1%, compared to 0.0% across the rest of Queensland.

In terms of ancestry, the top three groups were English (32.7%), Australian (28.9%), and Scottish (8.3%). Some ethnic groups showed notable differences: German was slightly overrepresented at 6.3% in Bundaberg North compared to 6.4% regionally, Australian Aboriginal was higher at 4.2% versus 3.4%, and Samoan was also higher at 0.2% versus 0.1%.

Frequently Asked Questions - Diversity

Age

Bundaberg North hosts an older demographic, ranking in the top quartile nationwide

Bundaberg North has a median age of 48, which is higher than the Rest of Qld figure of 41 and significantly higher than the national norm of 38. The population aged 75-84 shows strong representation at 11.9%, compared to Rest of Qld's figure, while the 45-54 cohort is less prevalent at 8.1%. This 75-84 concentration is well above the national average of 6.0%. According to post-2021 Census data, the population aged 25 to 34 has grown from 11.6% to 13.3%. Conversely, the age group 5 to 14 has declined from 10.5% to 8.6%, and the 45-54 cohort has dropped from 10.0% to 8.1%. By 2041, Bundaberg North is expected to see notable demographic shifts. The 85+ age group is projected to grow by 87%, reaching 482 people from the current figure of 257. This growth will be led by those aged 65 and above, who are expected to comprise 59% of the population growth. Conversely, population declines are projected for the 45-54 and 55-64 age cohorts.