Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Yankalilla are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Yankalilla's population was approximately 6,933 as of November 2025. This figure is an increase of 435 people, representing a growth rate of 6.7% since the 2021 Census recorded a population of 6,498. The change is inferred from the estimated resident population of 6,874 in June 2024 and address validation since the Census date. This results in a population density ratio of 7.1 persons per square kilometer. Over the past decade, Yankalilla has shown resilient growth with a compound annual growth rate of 2.2%, surpassing the SA3 area's growth rate. Interstate migration accounted for approximately 85.5% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, based on 2021 data and adjusted using weighted aggregation from LGA to SA2 levels. Demographic trends suggest a population increase just below the median of Australian non-metropolitan areas, with an expected growth of 758 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of 10.1% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Yankalilla among the top 25% of areas assessed nationwide

Yankalilla has seen approximately 88 new homes approved annually. Over the past five financial years, from FY21 to FY25, around 444 homes were approved, with another 37 approved in FY26 so far. On average, about 1.4 people have moved to the area each year for every dwelling built over these five financial years, indicating a balanced supply and demand market that supports stable conditions.

New properties are constructed at an average expected cost of $290,000. This financial year has seen $5.8 million in commercial approvals registered, reflecting the area's primarily residential nature. Compared to the Rest of SA, Yankalilla maintains similar development levels per person, consistent with the broader area's market balance. However, building activity has slowed in recent years.

Nationally, Yankalilla's development level is significantly higher, indicating robust developer interest in the area. All new construction in Yankalilla consists of detached dwellings, preserving its traditional low-density character and appeal for families seeking space. With around 96 people moving to the area per dwelling approval, Yankalilla exhibits characteristics of a growth area. According to AreaSearch's latest quarterly estimate, Yankalilla is projected to add approximately 699 residents by 2041. Given current construction levels, housing supply should adequately meet demand, creating favourable conditions for buyers and potentially enabling population growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Yankalilla has limited levels of nearby infrastructure activity, ranking in the 8thth percentile nationally

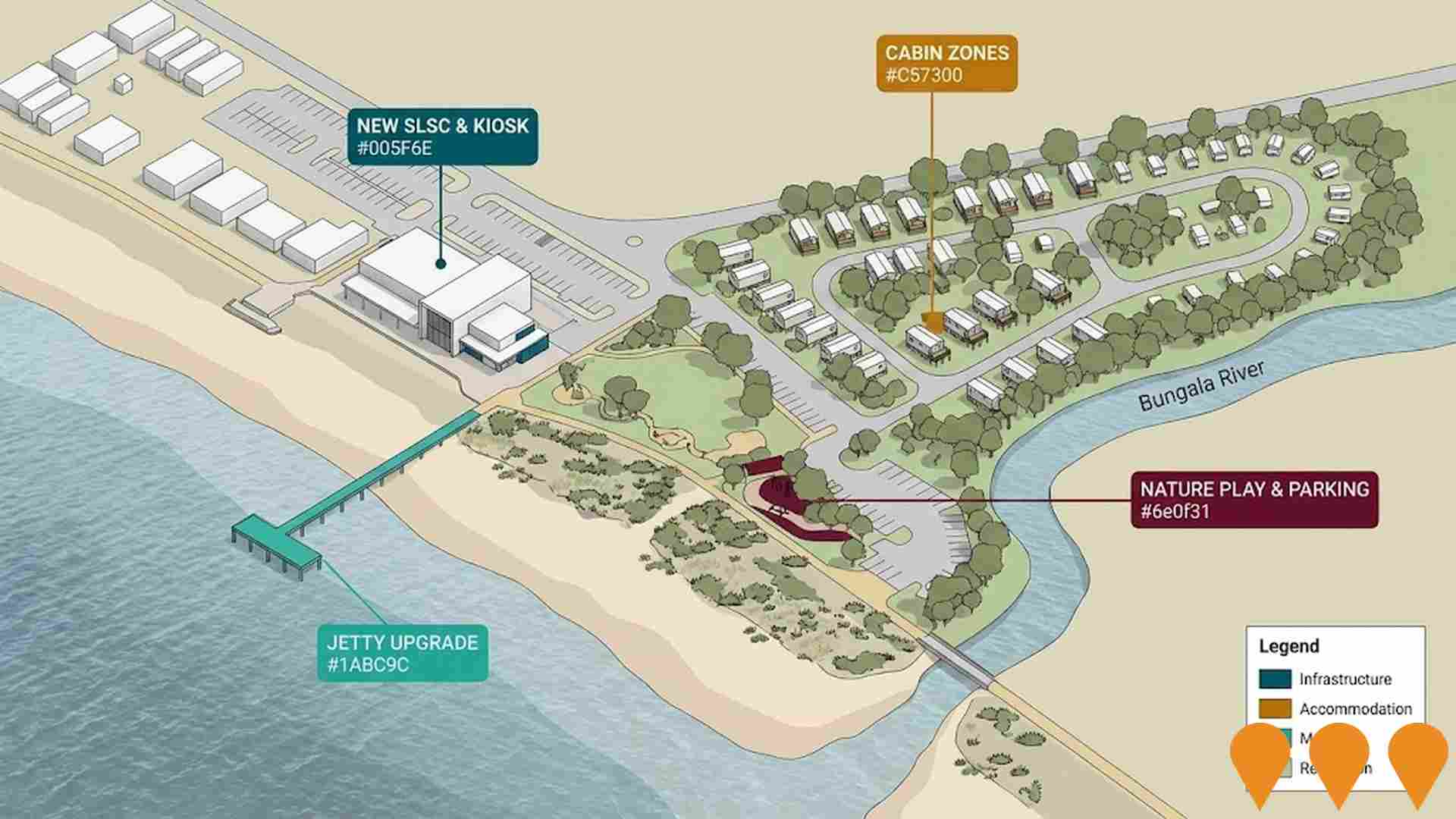

Infrastructure projects significantly impact an area's performance. AreaSearch has identified 20 such projects likely affecting the region. Notable ones include Aspen Normanville Lifestyle and Tourism Park, Normanville Foreshore and Jetty Caravan Park Masterplan, Main South Road Safety Upgrades (Myponga to Cape Jervis), and Fleurieu Connections - Main South Road and Victor Harbor Road Duplication. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Victor Retail Depot

Bulky goods retail development featuring two buildings accommodating four retail outlets with flexible tenancies ranging from 700sqm to 3,000sqm. Strategically positioned adjacent to national retailers including Aldi, Bunnings, and Coles in Victor Harbor's primary retail corridor along Adelaide Road. The development is designed to accommodate a wide spectrum of commercial uses within South Australia's fastest growing coastal retail precinct on the Fleurieu Peninsula.

Sellicks Beach Code Amendment

Major master planned residential development for 1,700 new homes across 130 hectares. Includes transport infrastructure upgrades, activity centre, open space network and range of housing options. Air quality assessment underway due to nearby quarry concerns.

Yilki Coastal Protection Stage 1b

The Yilki Coastal Protection Stage 1b involves constructing a sea defence wall consisting of a rock revetment and concrete wave wall along Franklin Parade in Encounter Bay to safeguard the natural environment and vital infrastructure from coastal erosion and storm surges. Funded by federal grants, the project aims to provide immediate protection for community assets and long-term resilience for low-lying urban areas.

Best Life Canterbury Victor Harbor

Over 50s land lease lifestyle community featuring 315 modern homes in a secure gated park. The community includes extensive facilities such as a community centre with function area for 100+ guests, gym, library, community kitchen, indoor bowls, outdoor petanque, tennis court, BBQ areas, and caravan and boat storage. Located 500 metres from Victor Harbor town centre, minutes from the beach, walking trails, and next to Victor Harbor Golf Course. Residents own their homes outright with no stamp duty, deferred management fees, or exit fees, and retain 100% of capital gains.

The Precinct Victor Harbor

The Regional Community, Sport and Recreation Precinct (The Precinct) is planned to include an indoor sport and recreation facility with four multi-purpose courts, gymnastics area, meeting rooms, gym, and cafe, as well as childcare, allied health/retail spaces, and hospitality offering. It aims to address the shortage of facilities in the southern Fleurieu region, support population growth, and provide a community hub for sport, recreation, and social activities, with expansion areas for future-proofing.

Oc'ane Victor Harbor

A master-planned village with globally inspired, European and Scandinavian architecture, featuring amenities like a micro-brewery, thermal pools, a providore with local produce, an artisan bakery, and glamping experiences. Designed to enhance lives with aspirational community living in Victor Harbor, South Australia.

Fleurieu Connections - Main South Road and Victor Harbor Road Duplication

A South Australian Government and Australian Government funded road upgrade delivered by the Fleurieu Connections Alliance. Stage 1 (Seaford to Aldinga) and Victor Harbor Road duplication are open to traffic, while Stage 2 (Aldinga to Sellicks Beach) remains under construction toward completion in 2026. The works add duplicated carriageways, an Aldinga interchange and intersection upgrades, median and safety barriers, shared path links, and related safety improvements to improve travel times and regional connectivity.

Sellicks Hill Quarry Operations

261-hectare quarry producing limestone, shale, marble and dolomite. Ongoing air quality monitoring and dust management due to community concerns affecting nearby residential areas and future developments.

Employment

AreaSearch analysis indicates Yankalilla maintains employment conditions that align with national benchmarks

Yankalilla has a skilled labor force with diverse sector representation. The unemployment rate was 2.8% in the year ending September 2025.

Employment growth over the past year was estimated at 0.9%. As of September 2025, 3,069 residents were employed, with an unemployment rate of 2.6%, compared to Rest of SA's 5.3%. Workforce participation was 49.2%, lower than Rest of SA's 54.1%. Major employment sectors include agriculture, forestry & fishing, health care & social assistance, and construction.

Construction is particularly specialized, with an employment share 1.3 times the regional level. Manufacturing employs only 6.2% of local workers, below Rest of SA's 9.3%. The area may offer limited local employment opportunities, as indicated by Census data comparing working population to resident population. Between September 2024 and September 2025, employment increased by 0.9%, while the labor force grew by 1.8%, resulting in a unemployment rise of 0.9 percentage points. In contrast, Rest of SA saw employment grow by 0.3%, the labor force by 2.3%, and unemployment increase by 1.9 percentage points. National employment forecasts from Jobs and Skills Australia, released in May-25, project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Yankalilla's current employment mix suggests local employment could increase by 5.7% over five years and 12.3% over ten years, though this is a simplified extrapolation for illustrative purposes only and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

The median income among taxpayers in Yankalilla SA2 was $38,976 in financial year 2022. The average income stood at $49,451 during the same period. These figures are lower than those for Rest of SA, which were $46,889 and $56,582 respectively. By September 2025, estimates project the median income to be approximately $43,977 and the average income to reach around $55,796, based on a Wage Price Index growth of 12.83% since financial year 2022. Census data indicates that incomes in Yankalilla fall between the 6th and 8th percentiles nationally for households, families, and individuals. The predominant income cohort spans 29.1% of locals, with 2,017 people earning between $800 and $1,499 annually. This is unlike surrounding regions where a higher percentage, 27.5%, falls within the $1,500 to $2,999 range. Despite modest housing costs allowing for 86.7% of income to be retained, total disposable income ranks at only the 10th percentile nationally.

Frequently Asked Questions - Income

Housing

Yankalilla is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Yankalilla's dwelling structure, as per the latest Census, consisted of 93.4% houses and 6.6% other dwellings. In comparison, Non-Metro SA had 92.1% houses and 7.9% other dwellings. Home ownership in Yankalilla was 50.5%, with mortgaged dwellings at 33.6% and rented ones at 15.9%. The median monthly mortgage repayment was $1,300, aligning with Non-Metro SA's average. The median weekly rent was $270, compared to Non-Metro SA's $280. Nationally, Yankalilla's mortgage repayments were lower at $1,300 versus Australia's $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Yankalilla has a typical household mix, with a fairly typical median household size

Family households account for 67.8% of all households, including 20.3% couples with children, 40.1% couples without children, and 7.0% single parent families. Non-family households constitute the remaining 32.2%, with lone person households at 29.9% and group households comprising 2.1%. The median household size is 2.2 people, which aligns with the Rest of SA average.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Yankalilla fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 17.7%, significantly lower than the Australian average of 30.4%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most common at 11.9%, followed by postgraduate qualifications (3.4%) and graduate diplomas (2.4%). Vocational credentials are prevalent, with 41.4% of residents aged 15+ holding them - advanced diplomas at 12.7% and certificates at 28.7%.

A substantial 21.9% of the population is actively pursuing formal education, including 9.1% in primary, 6.5% in secondary, and 1.8% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Yankalilla is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data indicates significant challenges for Yankalilla, with high prevalence of common health conditions across both younger and older age groups. Private health cover stands at approximately 46%, covering around 3,196 people, which is lower than the national average of 55.3%.

The most prevalent medical conditions are arthritis (affecting 12.9% of residents) and mental health issues (impacting 9.0%). Around 59.6% of residents report being free from medical ailments, slightly higher than the Rest of SA's 58.3%. Yankalilla has 34.8% of its population aged 65 and over (2,409 people), lower than the Rest of SA's 37.0%. Despite this, health outcomes among seniors in Yankalilla are above average and better than those seen in the general population.

Frequently Asked Questions - Health

Cultural Diversity

Yankalilla is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Yankalilla, as per the census conducted on 29 August 2016, had a cultural diversity index below the average. The population born in Australia stood at 81.3%, with 90.7% being citizens and 97.5% speaking English only at home. Christianity was the predominant religion, accounting for 38.5% of the population.

Notably, Judaism, which constituted 0.1% of Yankalilla's population, was overrepresented compared to the rest of South Australia where it was not present. In terms of ancestry, the top three groups were English (38.1%), Australian (27.3%), and Scottish (8.5%). Some ethnic groups showed notable differences in representation: German at 6.1% (versus 6.7% regionally), Welsh at 0.8% (versus 0.6%), and Dutch at 1.7% (versus 1.6%).

Frequently Asked Questions - Diversity

Age

Yankalilla ranks among the oldest 10% of areas nationwide

Yankalilla's median age is 56 years, notably exceeding Rest of SA's 47 and well above the Australian median of 38. The age profile shows that those aged 65-74 are particularly prominent, comprising 20.3%, while the 25-34 group is smaller at 5.3% compared to Rest of SA. This concentration of those aged 65-74 is higher than the national figure of 9.4%. Between 2021 and present, the 75-84 age group has grown from 9.5% to 11.6%, while the 15-24 cohort increased from 7.2% to 8.9%. Conversely, the 25-34 cohort has declined from 6.6% to 5.3%. By 2041, demographic projections reveal significant shifts in Yankalilla's age structure. The 85+ age cohort is projected to grow exceptionally, expanding by 317 people (164%) from 193 to 511. Senior residents aged 65 and above will drive 80% of population growth, highlighting demographic aging trends. In contrast, population declines are projected for the 55-64 and 0-4 cohorts.