Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Chisholm is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Chisholm's population is approximately 5,219 as of November 2025. This figure represents a decrease of 49 people from the 2021 Census count of 5,268, indicating a 0.9% decline since then. The estimated resident population of 5,221 in June 2024, along with an additional 13 validated new addresses since the Census date, supports this decrease. This results in a population density ratio of 1,683 persons per square kilometer, which is higher than the average across national locations assessed by AreaSearch. While Chisholm saw a 0.9% decline between censuses, the SA3 area experienced a 0.2% growth, demonstrating differing population trends within the region. Natural growth contributed approximately 66.0% of overall population gains during recent periods in Chisholm.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, age group growth rates from the ACT Government's SA2 area projections, also using 2022 as the base year, are adopted. According to these projections, Chisholm's population is expected to decrease by 325 persons by 2041, indicating an overall decline over this period. However, specific age cohorts are anticipated to grow; notably, the 75 to 84 age group is projected to increase by 125 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Chisholm is very low in comparison to the average area assessed nationally by AreaSearch

Chisholm has seen approximately 8 new home approvals per year over the past 5 financial years, totalling 42 homes. As of FY-26, 5 approvals have been recorded. On average, 0.4 new residents per year per dwelling constructed were added between FY-21 and FY-25. This suggests that new supply is keeping pace with or exceeding demand, providing ample buyer choice and creating capacity for population growth beyond current forecasts.

The average construction value of these properties was $215,000. In FY-26, $337,000 in commercial development approvals have been recorded, indicating minimal commercial development activity compared to residential. Relative to the Australian Capital Territory, Chisholm shows approximately 69% of the construction activity per person and ranks among the 18th percentile nationally for buyer options, suggesting somewhat limited choices while strengthening demand for established homes. This activity is also below average nationally, reflecting the area's maturity and possible planning constraints. New building activity comprises 57.0% detached houses and 43.0% attached dwellings, with an increasing blend of attached housing types offering choices across price ranges.

This shows a significant shift from the current housing mix of 96.0% houses, reflecting reduced availability of development sites and addressing shifting lifestyle demands and affordability requirements. The location has approximately 807 people per dwelling approval, demonstrating an established market. Given stable or declining population forecasts, Chisholm may experience less housing pressure in the future, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Chisholm has emerging levels of nearby infrastructure activity, ranking in the 23rdth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified two projects likely affecting this region. Notable ones are Calwell Retirement Living Precinct, Calwell Public Housing Development, Erindale Group Centre Master Plan Implementation - Stage 1, and Canberra Light Rail Stage 4 - Woden to Tuggeranong. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

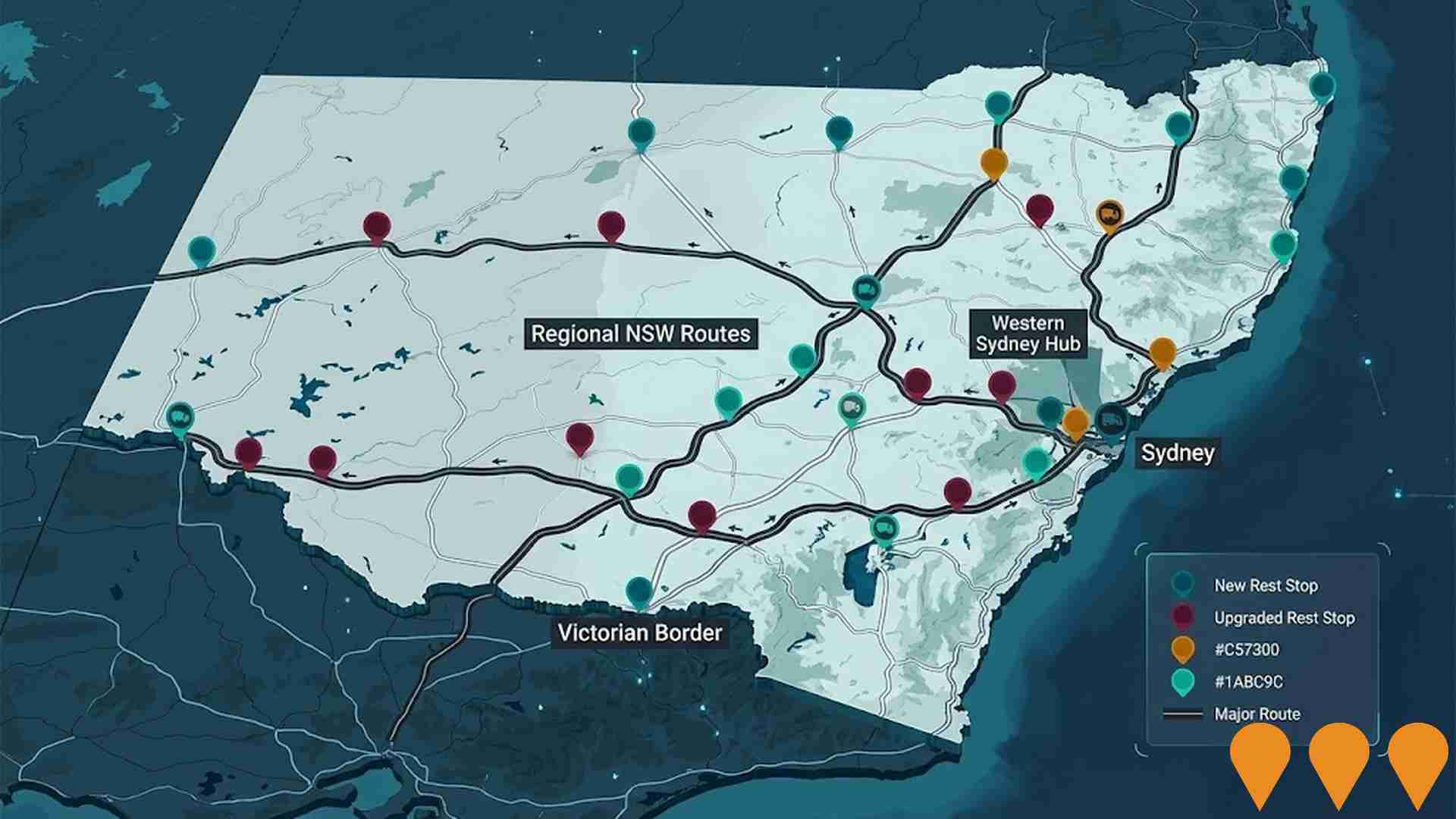

Low and Mid-Rise Housing Policy

State-wide NSW planning reforms via amendments to the State Environmental Planning Policy to enable more diverse low and mid-rise housing (dual occupancies, terraces, townhouses, manor houses and residential flat buildings up to 6 storeys) in well-located areas within 800 m of selected train, metro and light-rail stations and town centres. Stage 1 (dual occupancies in R2 zones statewide) commenced 1 July 2024. Stage 2 (mid-rise apartments, terraces and dual occupancies near stations) commenced 28 February 2025. Expected to facilitate up to 112,000 additional homes over the next five years.

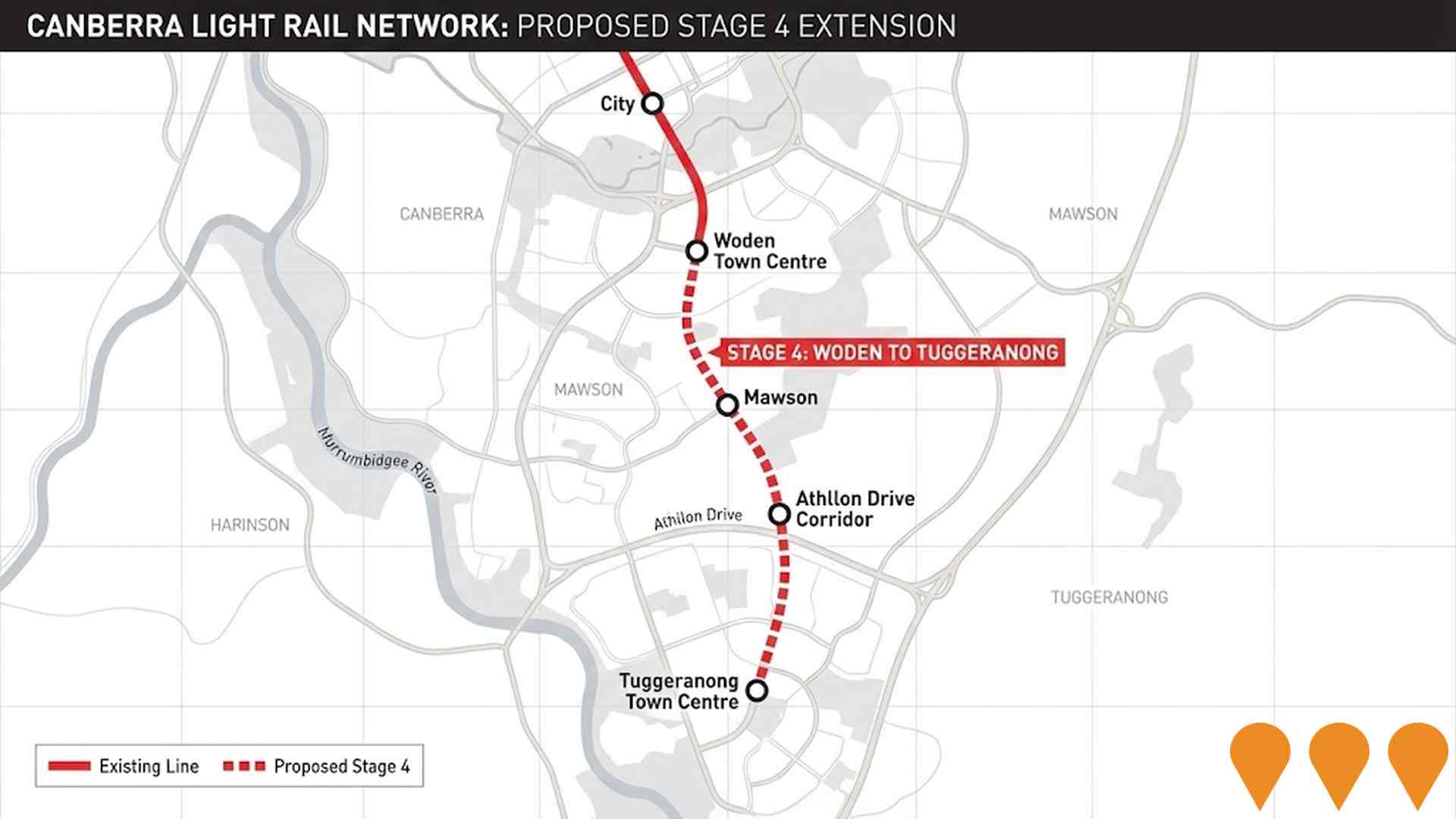

Canberra Light Rail Stage 4 - Woden to Tuggeranong

Proposed extension of Canberra's light rail network from Woden Town Centre south to Tuggeranong Town Centre via Mawson and the Athllon Drive corridor. This future stage aims to complete the north-south radial mass transit spine, connecting major residential, employment and activity centres while supporting bus, cycling, walking and private vehicle integration.

Erindale Group Centre Master Plan Implementation - Stage 1

Major revitalisation of the Erindale precinct including new community facilities, upgraded public realm, improved active travel links, and preparation for future mixed-use and residential development directly adjoining Wanniassa. The Erindale Group Centre master plan is a non-statutory document that outlines a vision to guide growth and development of the centre over the next 30 years.

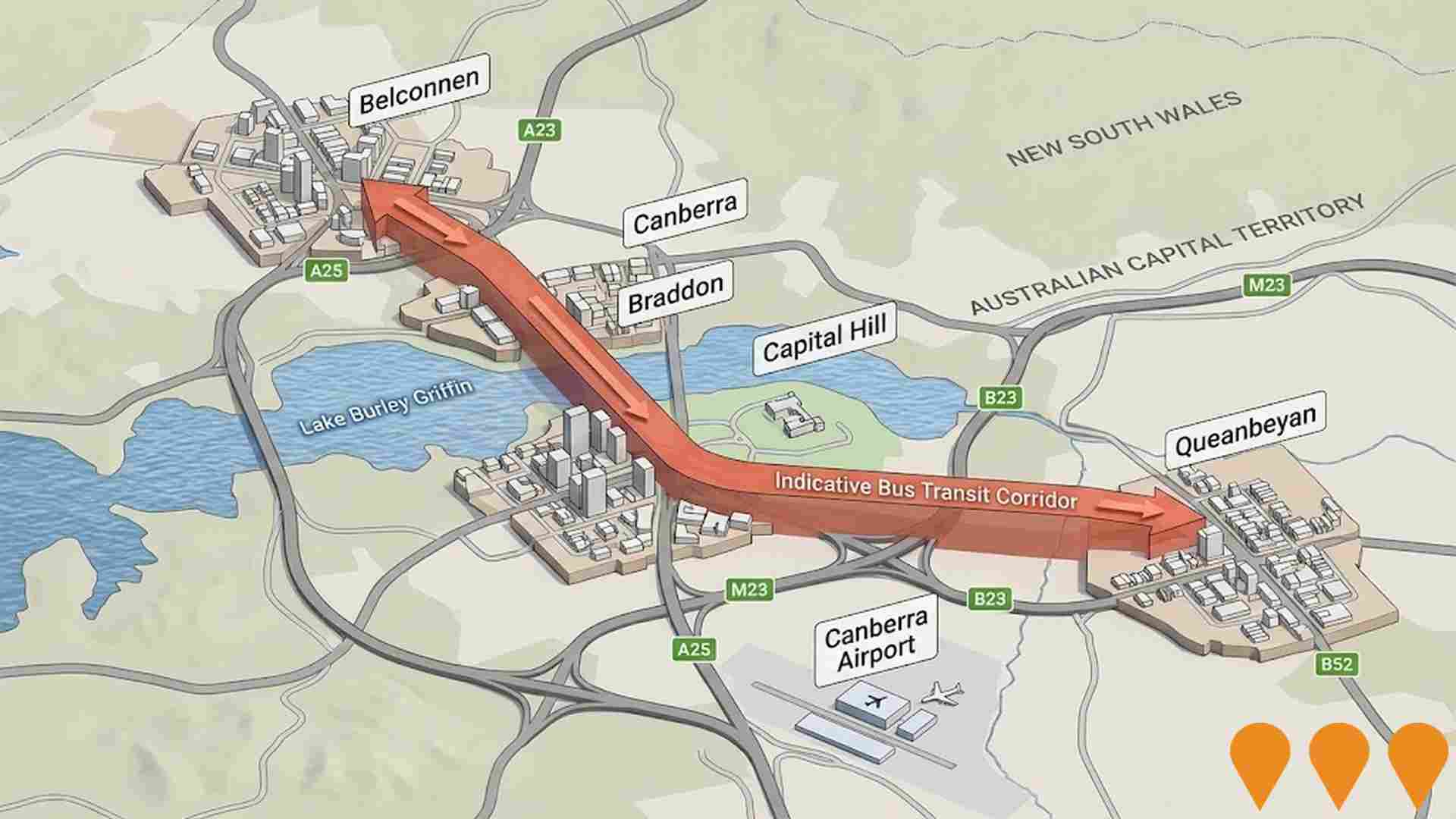

Enhanced bus and light rail corridors (Belconnen & Queanbeyan to Central Canberra)

ACT is progressing an integrated program to enhance high-frequency bus and future light rail corridors that link Belconnen and Queanbeyan with central Canberra. Light Rail Stage 2A (City to Commonwealth Park) commenced construction in early 2025 with services targeted from 2028, while planning and approvals continue for Stage 2B to Woden. The ACT Government has acknowledged and is planning upgrades for the Belconnen-to-City bus corridor as groundwork for a future east-west light rail Stage 3, and is coordinating cross-border public transport initiatives with NSW through the Queanbeyan Region Integrated Transport Plan and the ACT-NSW MoU for Regional Collaboration.

HumeLink

HumeLink is a new 500kV transmission line project connecting Wagga Wagga, Bannaby, and Maragle, spanning approximately 365 km. It includes new or upgraded infrastructure at four locations and aims to enhance the reliability and sustainability of the national electricity grid by increasing the integration of renewable energy sources such as wind and solar.

Queanbeyan Regional Integrated Transport Plan

Comprehensive transport planning initiative with 64 key actions for next 10 years. Addresses road safety, active transport connectivity, public transport availability, and future transport needs. Improved connections between Queanbeyan and ACT.

Big Canberra Battery (Williamsdale BESS)

A 250 MW / 500 MWh battery energy storage system at Williamsdale in southern Canberra, delivered by Eku Energy as Stream 1 of the ACT Government's Big Canberra Battery. Construction commenced in November 2024 with partners CPP and Tesla supplying Megapack systems. The asset will connect to Evoenergy's 132 kV network near the Williamsdale substation to provide two hours of dispatchable power, grid services and reliability for the ACT. Target operations in 2026.

Calwell Public Housing Development

30 new public housing townhouses (2 and 3 bedroom) built to Class C Adaptable standards. Features evaporative heating/cooling, 6-star energy rating hot water systems, double-glazed windows, and sustainable design.

Employment

Employment conditions in Chisholm remain below the national average according to AreaSearch analysis

Chisholm has a skilled workforce with an unemployment rate of 4.4% as of September 2025. The area experienced estimated employment growth of 2.8% over the past year.

There are 2,819 residents employed, with an unemployment rate of 4.4%, which is 0.8% higher than the Australian Capital Territory's rate of 3.6%. Workforce participation in Chisholm is similar to that of the ACT at 69.6%. Key industries of employment among residents are public administration & safety, health care & social assistance, and construction. Construction has particularly notable concentration with employment levels at 1.7 times the regional average.

However, professional & technical services are under-represented, with only 7.4% of Chisholm's workforce compared to 11.1% in the ACT. Over the 12 months to September 2025, employment increased by 2.8% while labour force increased by 1.1%, causing the unemployment rate to fall by 1.6 percentage points. In comparison, the ACT saw employment growth of 1.4%, labour force expansion of 1.2%, and a decrease in unemployment of 0.2 percentage points. State-level data from 25-Nov shows ACT employment grew by 1.19% year-on-year, adding 710 jobs, with the state unemployment rate at 4.5%. Jobs and Skills Australia's national employment forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Chisholm's employment mix suggests local employment should increase by 6.3% over five years and 13.0% over ten years, though these are simple extrapolations for illustrative purposes and do not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Chisholm SA2 had a median income of $64,238 and an average of $71,194. These figures are above the national average. In comparison, the Australian Capital Territory had a median income of $68,678 and an average of $83,634. Based on Wage Price Index growth of 13.6% since financial year 2022, estimated incomes as of September 2025 would be approximately $72,974 (median) and $80,876 (average). According to the 2021 Census, Chisholm's household, family, and personal incomes rank highly nationally, between the 83rd and 85th percentiles. Income distribution shows that 38.1% of individuals earn between $1,500 and $2,999, reflecting regional patterns where 34.3% fall within this range. Economic strength is evident with 33.9% of households earning high weekly incomes exceeding $3,000, supporting elevated consumer spending. Housing accounts for 13.8% of income, and residents rank in the 84th percentile for disposable income. The area's SEIFA income ranking places it in the 6th decile.

Frequently Asked Questions - Income

Housing

Chisholm is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

In Chisholm, as per the latest Census evaluation, 95.9% of dwellings were houses with the remaining 4.2% being semi-detached, apartments, or other types. This compares to the Australian Capital Territory's distribution of 79.6% houses and 20.4% other dwellings. Home ownership in Chisholm stood at 29.1%, with mortgaged dwellings accounting for 50.7% and rented ones making up 20.2%. The median monthly mortgage repayment was $2,000, aligning with the Australian Capital Territory average, while the median weekly rent was $410 compared to the ACT's $425. Nationally, Chisholm's median monthly mortgage repayments exceeded the Australian average of $1,863, and rents were higher than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Chisholm has a typical household mix, with a higher-than-average median household size

Family households account for 76.6% of all households, including 36.9% couples with children, 26.4% couples without children, and 12.4% single parent families. Non-family households constitute the remaining 23.4%, with lone person households at 20.9% and group households comprising 2.1%. The median household size is 2.7 people, larger than the Australian Capital Territory average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Chisholm aligns closely with national averages, showing typical qualification patterns and performance metrics

The area's university qualification rate is 25.6%, significantly lower than the SA4 region average of 46.8%. Bachelor degrees are most common at 15.6%, followed by postgraduate qualifications (6.2%) and graduate diplomas (3.8%). Vocational credentials are prevalent, with 36.7% of residents aged 15+ holding them, including advanced diplomas (12.4%) and certificates (24.3%). Educational participation is high at 28.6%, comprising primary education (10.2%), secondary education (8.0%), and tertiary education (3.8%).

Educational participation is notably high, with 28.6% of residents currently enrolled in formal education. This includes 10.2% in primary education, 8.0% in secondary education, and 3.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Chisholm has 39 active public transport stops, all of which are bus stops. These stops are served by 8 different routes that together facilitate 736 weekly passenger trips. The accessibility of these services is rated as excellent, with residents on average being located 174 meters from the nearest stop.

On a daily basis, there are an average of 105 trips across all routes, which equates to approximately 18 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Chisholm is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Chisholm faces significant health challenges, with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is very high at approximately 55% of the total population (~2870 people), compared to 57.2% across Australian Capital Territory.

Mental health issues impact 9.5% of residents, while asthma affects 8.8%. A total of 66.4% of residents declare themselves completely clear of medical ailments, similar to the 66.1% in Australian Capital Territory. As of 30 June 2021, 16.4% of residents are aged 65 and over (854 people), which is lower than the 17.6% in Australian Capital Territory. Health outcomes among seniors present some challenges, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Chisholm records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Chisholm's cultural diversity was found to be above average, with 19.0% of its population born overseas and 14.4% speaking a language other than English at home. Christianity was the main religion in Chisholm, comprising 50.0% of people. Islam was overrepresented compared to the Australian Capital Territory, making up 2.4% of Chisholm's population.

The top three ancestry groups were Australian (27.5%), English (26.5%), and Irish (8.2%). Notably, Serbian (0.5%) and Hungarian (0.4%) were overrepresented compared to regional averages, while Macedonian was also notably present at 0.4%.

Frequently Asked Questions - Diversity

Age

Chisholm's population is slightly younger than the national pattern

Chisholm's median age is 37 years, which is slightly older than Australian Capital Territory's 35 but aligned with Australia's national average of 38 years. The age group of 55-64 has a strong representation at 13.4%, compared to Australian Capital Territory's figure, while the 25-34 cohort is less prevalent at 11.3%. Between 2021 and present, the 65-74 age group has grown from 9.4% to 11.0%, and the 35-44 cohort increased from 13.5% to 15.0%. Conversely, the 25-34 cohort declined from 13.6% to 11.3%, and the 55-64 group dropped from 15.1% to 13.4%. By 2041, population forecasts indicate significant demographic changes for Chisholm. The 75-84 age cohort is projected to increase by 107 people (47%), from 229 to 337. Notably, the combined age groups of 65 and above will account for 97% of total population growth, reflecting the area's aging demographic profile. In contrast, both the 15-24 and 5-14 age groups are expected to decrease in numbers.