Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Calista is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Calista's population was 7,434 as of Nov 2021. By Nov 2025, it is around 7,902, an increase of 468 people (6.3%) since the 2021 Census. This growth is inferred from ABS estimates: 7,790 in June 2024 and 52 validated new addresses since the Census date. The population density is 521 persons per square kilometer. Calista's 6.3% growth since the census is within 2.6 percentage points of the national average (8.9%). Overseas migration contributed approximately 96.7% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and post-2032 estimates, AreaSearch utilises growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). Population projections indicate above median growth for national statistical areas. The area is expected to grow by 1,204 persons to 2041, reflecting a 13.8% increase over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Calista, placing the area among the bottom 25% of areas assessed nationally

Calista has seen approximately 12 dwellings approved for development annually. In the past five financial years, from FY-21 to FY-25, 64 homes were given approval, and another 6 have been approved in FY-26 so far. On average, each dwelling constructed over these years has brought in about 1.4 new residents per year.

This balance between supply and demand indicates stable market conditions, with new properties being constructed at an average cost of $195,000, which is below regional norms, offering more affordable housing options. In FY-26, $3.6 million worth of commercial development approvals have been recorded, reflecting the area's residential character. Compared to Greater Perth, Calista has significantly lower building activity, at 89.0% below the regional average per person, which typically strengthens demand and prices for existing properties. This activity is also lower than national averages, suggesting market maturity and possible development constraints. All recent building activity consists of standalone homes, preserving the area's low density nature and attracting space-seeking buyers.

The current estimated population per dwelling approval is 794 people. According to AreaSearch's latest quarterly estimate, Calista is projected to add 1,092 residents by 2041. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

Calista has emerging levels of nearby infrastructure activity, ranking in the 35thth percentile nationally

Changes in local infrastructure significantly impact an area's performance. AreaSearch identified 11 projects potentially influencing this region. Notable ones include Westport-Kwinana Container Port, Parmelia Primary School Modernisation Stage 2, Mandurah Line, and Anketell Road Upgrade (Leath Road to Kwinana Freeway). The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

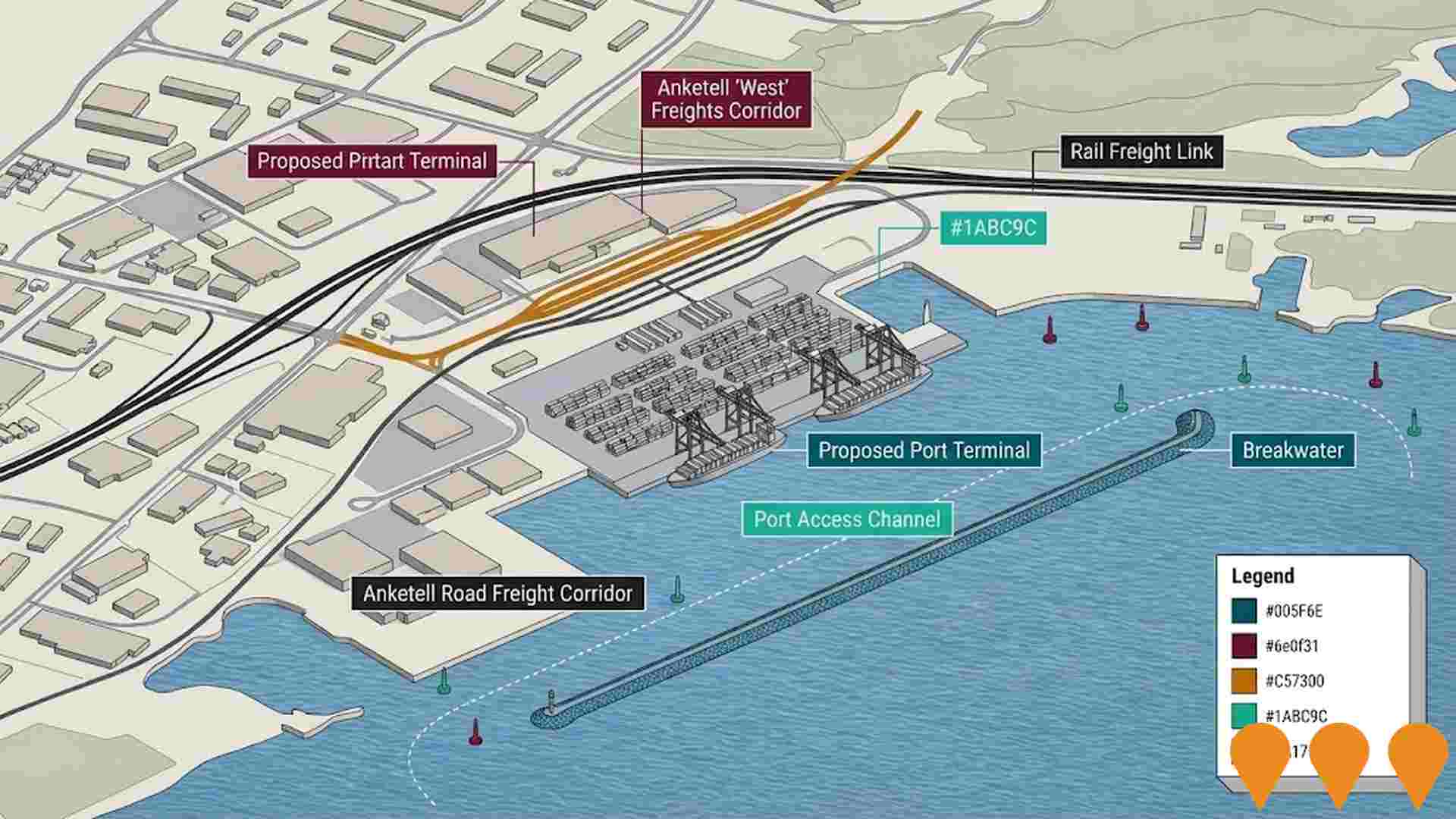

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

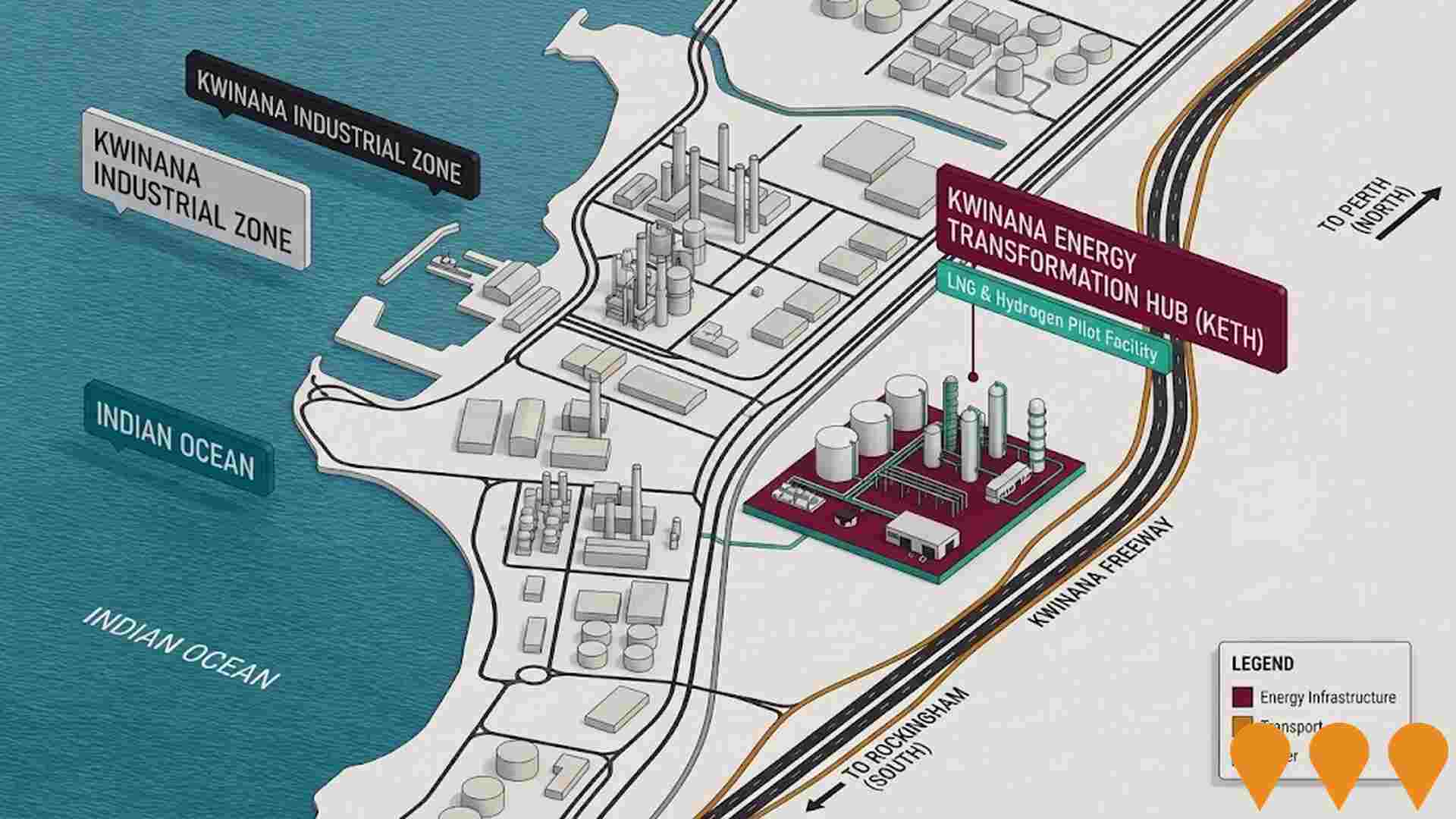

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Westport - Kwinana Container Port

Westport is the Western Australian State Government's planning program to relocate container trade from Fremantle Port to a new container port facility in Kwinana Outer Harbour by the late 2030s. The business case was endorsed by Infrastructure WA in April 2025, with the State Government committing $273 million for detailed project definition planning including design completion, approvals, risk resolution, and land acquisition. The project includes new port facilities with a breakwater, a new 18-meter deep shipping channel to accommodate larger vessels, integrated road and rail freight corridors including the Anketell-Thomas Road Freight Corridor, rail duplication between Kwinana and Cockburn, road upgrades along Anketell Road, Kwinana Freeway (with $700 million in combined State and Federal funding committed) and Roe Highway, and new intermodal terminals at Kenwick, Forrestfield and Kewdale. The project aims to increase rail container movement from 20% to 30%, achieve net zero emissions by 2050, and will unlock approximately 260 hectares of prime urban land in Fremantle for around 55,000 residents. Marine geotechnical investigations were awarded to WSP in July 2025.

Mandurah Line

70.8km suburban railway line connecting Perth CBD to Mandurah with 13 stations including Rockingham and Warnbro stations. Operates through Kwinana Freeway median with dedicated underground tunnels through Perth CBD. Serves as vital transport link for region. Recent extensions include integration with Thornlie-Cockburn Link in June 2025.

Latitude 32 Industry Zone

A 1,400-hectare master-planned industrial zone within the Western Trade Coast, one of Australia's largest industrial developments. Comprises six development areas at varying stages: Flinders Precinct (sold out and operational with businesses like ATCO, Imdex, and Southern Steel), Orion Industrial Park (95ha transforming former limestone quarries, Stage 3 lots released August 2024 with titles expected Q2 2025), and continuing development across Development Areas 2-6. Planned for 30-year build-out driven by market demand, providing general and transport industrial land for freight, logistics, manufacturing, fabrication, and engineering. Expected to create up to 10,000 jobs and generate over $15 billion annually when complete. Located 27km from Perth CBD with strategic access to road, rail, and sea transport networks, Australian Marine Complex, and planned Westport infrastructure.

Anketell Road Upgrade (Leath Road to Kwinana Freeway)

A 7.5km upgrade of Anketell Road to expressway standard with a free-flowing, dual carriageway between Leath Road and Kwinana Freeway. The proposal includes grade separated interchanges at six locations (Treeby Road, Kwinana Freeway, Mandogalup Road, Abercrombie Road, Armstrong Road and Rockingham Road) and grade separation of road over rail at two locations. The upgrade is critical to support future freight movement to industrial precincts and the proposed Westport container port. The project is currently undergoing State and Commonwealth environmental assessments.

Covalent Lithium Kwinana Refinery

A lithium hydroxide refinery in the Kwinana Strategic Industrial Area delivering battery grade product at nameplate capacity of up to 50,000 tonnes per annum. Construction is complete and first product was achieved in July 2025, with production ramp-up in progress as part of a fully integrated mine-to-refinery operation with Mt Holland.

Kwinana Energy Transformation Hub (KETH)

Flagship open-access LNG and hydrogen research, testing and training facility being developed in the Kwinana industrial zone. Led by Future Energy Exports CRC through its subsidiary Luth Eolas, KETH will host pilot-scale assets including a 10 t/day LNG unit, 100 kg/day hydrogen electrolyser and liquefier, storage and emissions rigs to de-risk decarbonisation technologies for export energy industries. Development Application approved with construction targeted to commence in 2025 and initial operations in 2026.

The Village at Wellard

320-hectare master planned community by DevelopmentWA and Peet Limited delivering 3,075 homes. Transit-oriented development around Wellard Train Station with shopping precinct, schools, and community facilities. Development completed in 2024 after 21-year journey.

Karnup Residential Land Release

Major residential land release as part of WA Government's $3.2 billion housing measures. The Karnup site comprises over 480 hectares strategically located adjacent to Kwinana Freeway and close to future Karnup train station. Expected to deliver over 3,300 new residential lots with potential for up to 450 social homes and house approximately 4,000 families. Part of larger 600+ hectare state-wide release including Eglinton site. Expression of Interest process opened October 2024, with development partnerships available under partnered or direct purchase models.

Employment

Employment conditions in Calista face significant challenges, ranking among the bottom 10% of areas assessed nationally

Calista has a balanced workforce with representation from both white and blue collar jobs. Manufacturing and industrial sectors are prominent, with an unemployment rate of 14.4% as of September 2025.

Employment growth over the past year was estimated at 1.4%. There are 3,446 residents employed currently, but the unemployment rate is higher than Greater Perth's rate by 10.4%, indicating room for improvement. Workforce participation in Calista lags behind Greater Perth at 56.2% compared to 65.2%. The dominant employment sectors among residents include health care and social assistance, manufacturing, and retail trade.

Manufacturing stands out with employment levels at 1.9 times the regional average. Conversely, professional and technical services show lower representation at 4.2%, compared to the regional average of 8.2%. Employment opportunities locally may be limited, as suggested by Census data comparing working population to resident population. Between September 2024 and September 2025, employment levels increased by 1.4% while labour force grew by 4.0%, leading to a rise in unemployment by 2.2 percentage points. In contrast, Greater Perth recorded higher employment growth at 2.9%. State-wide data from WA shows employment contracted by 0.27% between November 2024 and November 2025, with the state unemployment rate at 4.6%, slightly above the national rate of 4.3%. National employment forecasts from May 2025 project overall growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Calista's current employment mix suggests local employment should increase by approximately 5.8% over five years and 12.6% over ten years, though these are simple extrapolations for illustrative purposes only and do not account for localized population projections.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

Calista SA2 had a median taxpayer income of $57,626 and an average income of $66,563 in financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This was slightly above the national average, contrasting with Greater Perth's median income of $58,380 and average income of $78,020 in the same period. Based on Wage Price Index growth of 14.2% since financial year 2022, estimated incomes as of September 2025 would be approximately $65,809 (median) and $76,015 (average). Census data from 2021 shows household, family, and personal incomes in Calista all fell between the 10th and 14th percentiles nationally. Income distribution showed that 29.9% of the population (2,362 individuals) had incomes within the $1,500 - $2,999 range, consistent with broader trends across regional levels showing 32.0% in the same category. Housing affordability pressures were severe, with only 81.5% of income remaining, ranking at the 13th percentile nationally.

Frequently Asked Questions - Income

Housing

Calista is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Calista, as per the latest Census, consisted of 87.6% houses and 12.4% other dwellings (semi-detached, apartments, 'other' dwellings), whereas Perth metro had 93.0% houses and 7.0% other dwellings. Home ownership in Calista stood at 22.4%, with mortgaged dwellings at 44.5% and rented ones at 33.1%. The median monthly mortgage repayment was $1,300, lower than Perth metro's average of $1,724. The median weekly rent in Calista was $275, compared to Perth metro's $315. Nationally, Calista's mortgage repayments were significantly lower at $1,863 and rents substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Calista features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households constitute 62.5% of all households, including 23.7% couples with children, 20.5% couples without children, and 16.6% single parent families. Non-family households make up the remaining 37.5%, with lone person households at 33.3% and group households comprising 4.1% of the total. The median household size is 2.4 people, which is smaller than the Greater Perth average of 2.7.

Frequently Asked Questions - Households

Local Schools & Education

Calista faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area has university qualification rates of 12.6%, significantly lower than the Australian average of 30.4%. Bachelor degrees are the most common at 9.0%, followed by postgraduate qualifications at 2.3% and graduate diplomas at 1.3%. Vocational credentials are held by 40.4% of residents aged 15 and above, with advanced diplomas at 8.9% and certificates at 31.5%. Educational participation is high, with 29.3% of residents currently enrolled in formal education.

This includes 11.4% in primary education, 8.1% in secondary education, and 3.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis in Calista shows 49 operational public transport stops. These are served by buses on five different routes, offering a total of 749 weekly passenger trips. The average distance to the nearest stop for residents is 211 meters.

On average, there are 107 daily trips across all routes, equating to about 15 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Calista is well below average with a range of health conditions having marked impacts on both younger and older age cohorts

Calista faces significant health challenges, as indicated by its health data.

A variety of health conditions affect both younger and older residents. The rate of private health cover in Calista is approximately 52% of the total population (~4,140 people), which is higher than the average SA2 area. Mental health issues and arthritis are the most prevalent medical conditions, impacting 11.7% and 9.1% of residents respectively. However, 60.9% of Calista's residents report having no medical ailments, compared to 71.4% across Greater Perth. The area has a higher proportion of seniors aged 65 and over at 18.9%, with 1,491 people falling into this age category, compared to the 10.4% in Greater Perth. Health outcomes among seniors present some challenges, broadly mirroring those of the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Calista was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Calista's population, as of 2016 Census data, showed higher cultural diversity than most local markets. 12.1% spoke a language other than English at home, and 31.3% were born overseas. Christianity was the predominant religion, with 40.3%.

The 'Other' religious category had a lower representation in Calista (1.0%) compared to Greater Perth (2.8%). In terms of ancestry, the top groups were English (31.8%), Australian (25.1%), and Other (8.3%). Some ethnic groups showed notable differences: Maori was slightly overrepresented at 2.2% in Calista versus 2.1% regionally, Welsh at 0.9% versus 0.7%, and New Zealand at 1.1%.

Frequently Asked Questions - Diversity

Age

Calista's population aligns closely with national norms in age terms

Calista has a median age of 40, which is slightly higher than Greater Perth's figure of 37 and Australia's median age of 38. Comparing Calista's age distribution with Greater Perth's average, the 55-64 cohort stands out at 12.4%, while the 35-44 cohort is underrepresented at 12.8%. Between 2021 and present, the 65-74 age group has increased from 8.2% to 9.0% of Calista's population. Conversely, the 5-14 cohort has decreased from 13.8% to 11.5%. By 2041, demographic projections indicate significant changes in Calista's age profile. The 85+ cohort is expected to surge dramatically, growing by 391 people (147%) from 267 to 659. Notably, the combined 65+ age groups are projected to account for 78% of total population growth, reflecting Calista's aging demographic trend. Meanwhile, the 15-24 and 0-4 cohorts are expected to experience population declines.