Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Brookwater lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Based on ABS population updates and AreaSearch validation, the Brookwater statistical area's population was estimated at 3,686 as of November 2025. This reflects an increase of 784 people since the 2021 Census, which reported a population of 2,902. The change is inferred from AreaSearch's estimate of 3,683 residents following examination of ABS ERP data released in June 2024 and an additional 107 validated new addresses since the Census date. This level of population equates to a density ratio of 967 persons per square kilometer. Brookwater's growth of 27.0% since the 2021 Census exceeded both national (9.7%) and state averages, marking it as a growth leader in the region. Natural growth contributed approximately 37.0% to overall population gains during recent periods, with all drivers including overseas migration and interstate migration being positive factors.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024 using 2022 as the base year. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted. These state projections do not provide age category splits; hence proportional growth weightings aligned with ABS Greater Capital Region projections released in 2023 using 2022 data are applied where utilized. Exceptional growth is predicted over the period, placing Brookwater in the top 10 percent of national statistical areas. The area is expected to grow by 1,681 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 35.3% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Brookwater among the top 25% of areas assessed nationwide

AreaSearch analysis indicates Brookwater had approximately 52 residential properties approved annually. From FY-21 to FY-25, around 262 homes were approved, with an additional 50 in FY-26. Over the past five years, each dwelling accommodated an average of 2.4 new residents per year.

New homes are constructed at an average cost of $698,000, targeting the premium market. This financial year, there have been $4.1 million in commercial approvals. Compared to Greater Brisbane, Brookwater has 73.0% more construction activity per person. The new development consists of 38.0% standalone homes and 62.0% attached dwellings. There are approximately 89 people per dwelling approval in the location. By 2041, Brookwater is projected to grow by 1,301 residents. Current development patterns suggest that new housing supply should meet demand, potentially facilitating further population growth.

Looking ahead, Brookwater is expected to grow by 1,301 residents through to 2041 (from the latest AreaSearch quarterly estimate). Based on current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Brookwater has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

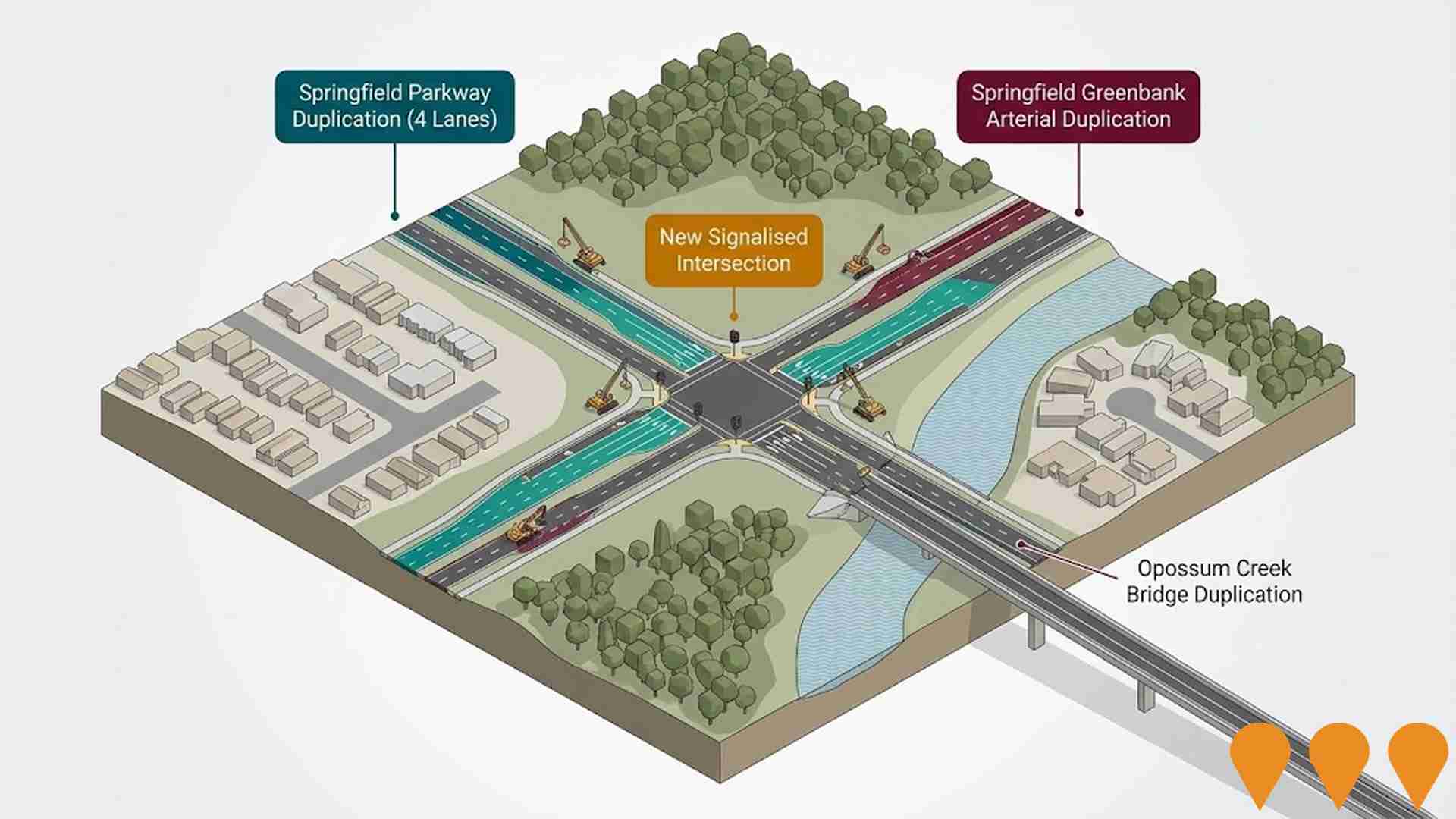

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 15 projects likely to impact the area. Notable projects include Greater Springfield Master Planned Community, Darra to Springfield Transport Corridor, Springfield Lakes Boulevard Commercial Precinct, and Opossum Creek Parklands Upgrade. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Greater Springfield Master Planned Community

Australia's largest privately funded master-planned city, covering 2,860 hectares in the Western Growth Corridor. As of 2026, the project has exceeded $30 billion in investment with a 2045 completion value estimated at $88 billion. Key developments currently underway include the $22 million Springfield Parkway and Greenbank Arterial duplication (Stage 2) and the Mater Public Hospital expansion, scheduled for completion in 2026. The city is designed around pillars of health, education, and technology, serving as a 'nation-building blueprint' for 21st-century urban growth.

Springfield Central Business District Expansion

A massive expansion of the Springfield Central CBD including the City Centre North precinct. The master plan for the 60ha site is approved for over 2.6 million sqm of mixed-use space, 22,855 apartments, and dedicated zones for health, education, and technology. Key features include IDEA City for innovation and design, integrated with a regional hospital and university campus to support a knowledge-driven economy.

Health City Springfield Central

Health City is a 52-hectare integrated health, medical research, and innovation precinct. The current focal point is the Mater Private Hospital Springfield Stage 2 expansion, which will deliver the region's first public hospital beds and a 24/7 emergency department. The expansion includes 174 public beds, an intensive care unit, maternity services, and a dedicated paediatric ward. The precinct also features the Pulse Health Hub and the planned Nightingale Specialist Suites. The hospital expansion is being delivered by Mater in partnership with the Queensland Government and is scheduled for a staged opening starting April 2026.

Darra to Springfield Transport Corridor

A $1.2 billion integrated transport project featuring a 14km dual-track passenger rail line, the expansion of Springfield Central and Richlands stations, and upgraded road infrastructure along the Centenary Highway. It provides a vital high-frequency link between the western growth corridor and the Brisbane CBD.

Knowledge Precinct (IDEA City)

The Knowledge Precinct is the economic heart of Greater Springfield, a 119-hectare innovation hub incorporating IDEA City (Innovation, Design, Entrepreneurship, Arts). It integrates Health City, Education City, and BioPark Australia. A key anchor is the $352 million Aegros plasma fractionation facility, which is set to begin operations in 2025. The precinct is designed for physical-digital fusion, supporting research, startup incubators, and advanced manufacturing with a planned GFA of 389,700sqm.

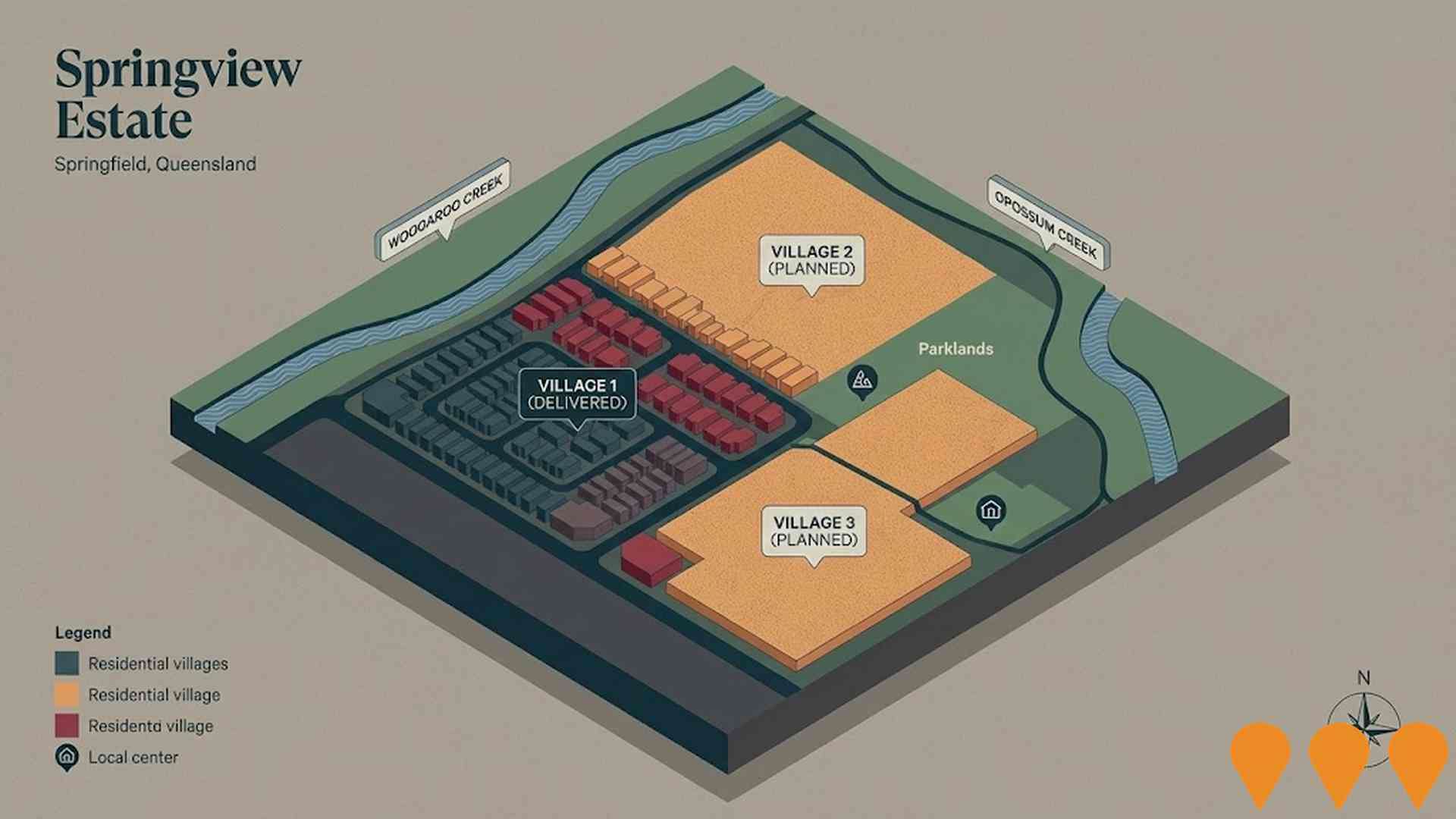

Springview Estate Villages 1, 2 and 3

A staged masterplanned community of approximately 240 hectares in Springfield by Stockland. Village 1 (~30ha, 400+ homes) has been delivered. The Precinct Plan for Villages 2 and 3 (~150-210ha) was approved by Ipswich City Council in March 2024, with Area Development Plans and Federal EPBC assessment ongoing. Villages 2 and 3 propose up to ~1,800 additional residential lots (reduced from original plans to enhance open space and wildlife corridors along Woogaroo and Opossum Creeks), plus parks, a local centre, childcare, and sports facilities.

Vicinity Business Park Augustine Heights

A 42-hectare mixed-use business park including major automotive showroom zone and areas for small to medium businesses. Features seven key zones: commercial office, high tech office warehouse, service trade, retail warehouses, showrooms, highway service centre, and fast food convenience.

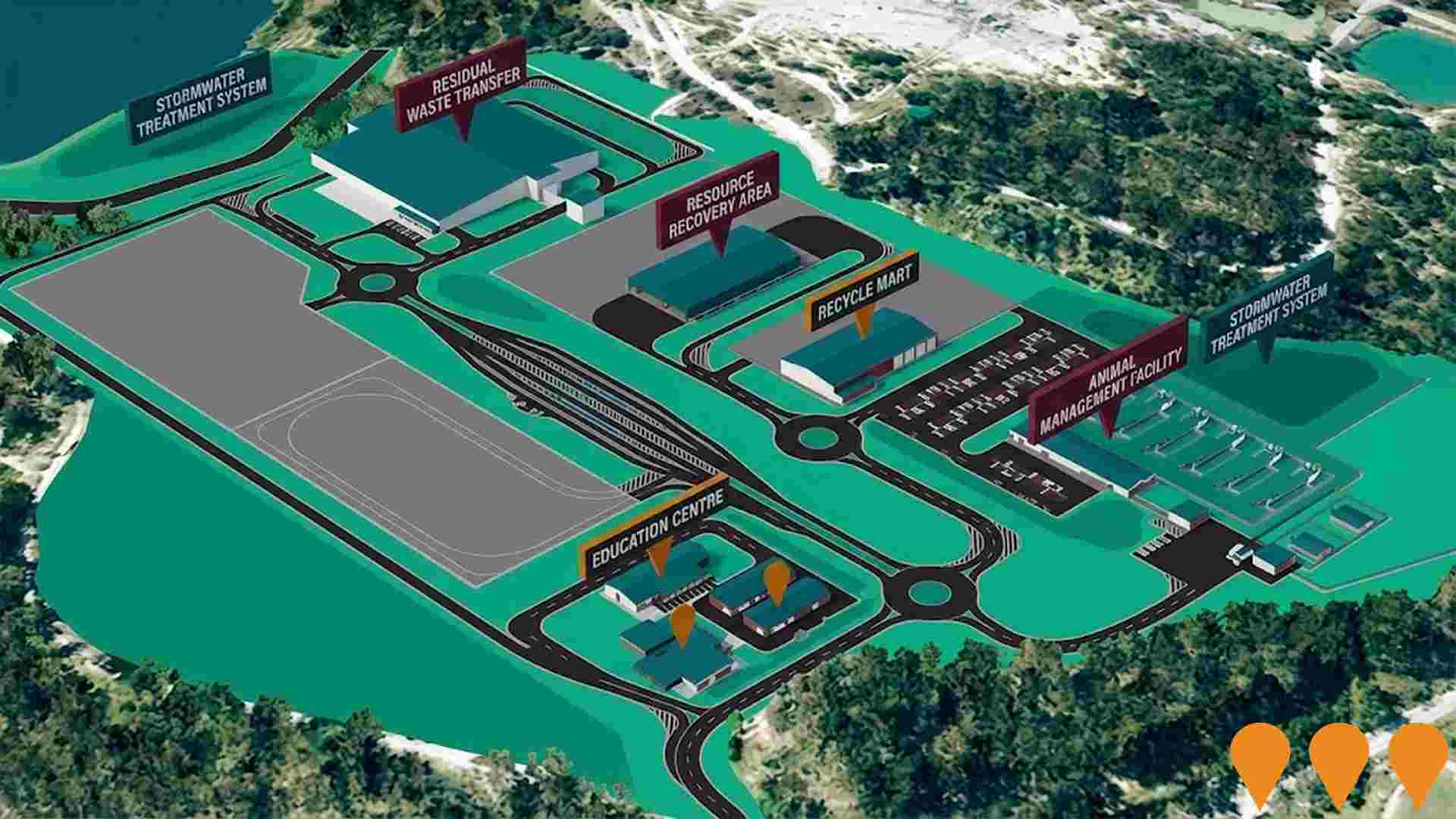

Southern Resource Recovery and Recycling Facility - Redbank Plains

Advanced resource recovery and recycling facility designed to process waste and recyclables for the southern region. The facility will feature modern waste processing technology, resource recovery systems, and environmental management to support circular economy principles.

Employment

AreaSearch analysis of employment trends sees Brookwater performing better than 90% of local markets assessed across Australia

Brookwater has an educated workforce with strong representation in essential services sectors. Its unemployment rate is 0.5% and it experienced a 4.1% employment growth over the past year (AreaSearch data).

As of September 2025, there are 2,129 residents employed, with an unemployment rate of 3.5%, lower than Greater Brisbane's 4.0%. Workforce participation is high at 79.0%. Key industries include health care & social assistance, education & training, and public administration & safety, the latter being particularly notable with employment levels at 1.4 times the regional average. However, transport, postal & warehousing employs only 3.0% of local workers, below Greater Brisbane's 5.6%.

Between September 2024 and September 2025, Brookwater's employment increased by 4.1%, with labour force increasing similarly at 4.1%, while unemployment remained stable. In contrast, Greater Brisbane saw employment growth of 3.8% and labour force growth of 3.3%. Statewide in Queensland, from November 2024 to November 2025, employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts (May-25) suggest a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Brookwater's employment mix indicates local employment should grow by 6.7% over five years and 14.0% over ten years, though these are simple extrapolations for illustrative purposes only.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

The median taxpayer income in Brookwater is $82,561, with an average of $94,010, according to the latest postcode level ATO data aggregated by AreaSearch for the financial year 2023. Nationally, this is extremely high, contrasting with Greater Brisbane's median income of $58,236 and average income of $72,799. By September 2025, based on a 9.91% Wage Price Index growth since financial year 2023, current estimates would be approximately $90,743 (median) and $103,326 (average). Census 2021 income data shows household, family and personal incomes in Brookwater rank highly nationally, between the 96th and 99th percentiles. Income analysis reveals that 43.9% of locals (1,618 people) fall into the $4000+ category, contrasting with the region where the $1,500 - 2,999 bracket leads at 33.3%. Higher earners represent a substantial presence, with 65.3% exceeding $3,000 weekly. After housing costs, residents retain 86.7% of their income, reflecting strong purchasing power. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Brookwater is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Brookwater's dwelling structure, as per the latest Census, consisted of 95.6% houses and 4.4% other dwellings (semi-detached, apartments, 'other' dwellings). Brisbane metro had 88.9% houses and 11.1% other dwellings. Home ownership in Brookwater was 19.1%, with mortgaged dwellings at 66.1% and rented ones at 14.8%. The median monthly mortgage repayment was $2,615, higher than Brisbane metro's average of $1,710. Median weekly rent in Brookwater was $565, compared to Brisbane metro's $360. Nationally, Brookwater's mortgage repayments were significantly higher at $2,615 versus the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Brookwater features high concentrations of family households, with a higher-than-average median household size

Family households constitute 91.7% of all households, including 58.2% couples with children, 26.2% couples without children, and 7.3% single parent families. Non-family households comprise the remaining 8.3%, with lone person households at 7.4% and group households making up 0.4%. The median household size is 3.2 people, larger than the Greater Brisbane average of 3.0.

Frequently Asked Questions - Households

Local Schools & Education

Brookwater demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Brookwater's educational attainment is notably higher than broader averages. Among residents aged 15+, 39.3% hold university qualifications, compared to 18.8% in the SA4 region and 20.6% in the SA3 area. Bachelor degrees are most common at 24.4%, followed by postgraduate qualifications (11.4%) and graduate diplomas (3.5%). Vocational credentials are also prevalent, with 32.0% of residents aged 15+ holding such qualifications - advanced diplomas account for 14.0% and certificates for 18.0%.

Educational participation is high, with 35.1% of residents currently enrolled in formal education. This includes 12.8% in primary education, 11.1% in secondary education, and 6.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Brookwater has seven active public transport stops offering a mix of train and bus services. These stops are served by 40 different routes that collectively facilitate 2,692 weekly passenger trips. The accessibility of these transport services is rated as moderate, with residents typically residing 529 meters from the nearest stop.

On average, there are 384 daily trips across all routes, which equates to approximately 384 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Brookwater's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Brookwater shows excellent health outcomes across all age groups, with very low prevalence of common health conditions. Approximately 64% of Brookwater's total population (2,375 people) have private health cover, compared to 50.9% in Greater Brisbane and a national average of 55.7%. The most prevalent medical conditions are asthma at 6.3%, and mental health issues at 5.7%.

Around 79.4% of residents report being completely clear of medical ailments, higher than the 72.4% across Greater Brisbane. Brookwater has 6.9% (254 people) of its population aged 65 and over, lower than Greater Brisbane's 8.8%. Seniors' health outcomes align with those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Brookwater was found to be above average when compared nationally for a number of language and cultural background related metrics

Brookwater was found to be more culturally diverse than most local markets, with 19.6% of its population speaking a language other than English at home and 34.8% born overseas. The dominant religion in Brookwater is Christianity, comprising 52.8% of the population. Hinduism is significantly overrepresented, making up 6.3% compared to 3.8% across Greater Brisbane.

In terms of ancestry, the top three groups are English (26.0%), Australian (22.5%), and Other (11.1%). Notably, South African (1.1%) Polish (1.0%), and Indian (5.3%) ethnicities are overrepresented compared to regional averages.

Frequently Asked Questions - Diversity

Age

Brookwater's population aligns closely with national norms in age terms

Brookwater's median age is 38, which is slightly higher than Greater Brisbane's figure of 36 but equal to Australia's median age of 38 years. The 45-54 age group comprises 19.5% of Brookwater's population compared to Greater Brisbane, while the 25-34 cohort constitutes only 5.3%. This concentration in the 45-54 age bracket is significantly higher than the national figure of 12.1%. Between 2021 and present day, the 15-24 age group has increased from 14.7% to 16.3%, while the 25-34 cohort has decreased from 7.5% to 5.3%, and the 35-44 group has dropped from 17.3% to 15.6%. By 2041, demographic projections indicate substantial shifts in Brookwater's age structure. The 45-54 age group is expected to grow by 49%, adding 349 people and reaching a total of 1,068 from the current figure of 718. Meanwhile, the 0-4 cohort is projected to grow by a modest 9%, with an increase of 14 people.