Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Maryborough is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Maryborough's population is 19,284 as of November 2025. This figure shows an increase of 726 people since the 2021 Census, which recorded a population of 18,558. The growth is inferred from ABS data showing an estimated resident population of 19,258 in June 2024 and an additional 83 validated new addresses since the Census date. This results in a density ratio of 228 persons per square kilometer. Population growth was primarily driven by interstate migration, contributing approximately 81.6% of overall population gains.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered and years post-2032, Queensland State Government's SA2 area projections from 2023 based on 2021 data are adopted, with proportional growth weightings applied where necessary. By 2041, the population is expected to increase by just below the median of national regional areas, reaching 20,301 persons, reflecting a gain of 5.1% over 17 years based on the latest annual ERP population numbers.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Maryborough when compared nationally

Maryborough has seen approximately 36 new homes approved annually over the past five financial years, totalling 182 homes. As of FY-26, 23 approvals have been recorded. On average, 3.9 new residents arrive per dwelling constructed yearly between FY-21 and FY-25. This demand outpaces supply, potentially influencing prices and competition among buyers.

New properties are constructed at an average cost of $312,000, below regional levels. In FY-26, commercial approvals totalled $112.4 million, indicating strong commercial development momentum. Compared to the Rest of Qld, Maryborough has significantly less development activity, with 71.0% fewer approvals per person. This constrained new construction may reinforce demand and pricing for existing homes. Nationally, development is lower in Maryborough, reflecting market maturity and possible development constraints.

New development consists of 81.0% detached dwellings and 19.0% attached dwellings, maintaining the area's traditional low density character focused on family homes. The estimated population per dwelling approval is 561 people. Looking ahead, Maryborough is expected to grow by 991 residents through to 2041. Current development appears well-matched to future needs, supporting steady market conditions without extreme price pressure.

Frequently Asked Questions - Development

Infrastructure

Maryborough has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

Infrastructure changes significantly influence an area's performance. AreaSearch has identified 12 projects likely impacting the area. Notable projects include Mary Harbour Development, Energy Storage Industries (ESI) Battery Manufacturing Facility, Homes for Queenslanders - Maryborough Social Housing, and Maryborough Manufactured Home Park Development. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Building Future Hospitals Program

Queensland's flagship hospital infrastructure program delivering over 2,600 new and refurbished public hospital beds by 2031-32. Includes major expansions at Ipswich Hospital (Stage 2), Logan Hospital, Princess Alexandra Hospital, Townsville University Hospital, Gold Coast University Hospital and multiple new satellite hospitals and community health centres.

Forest Wind Farm

Australia's largest wind farm project with up to 226 turbines and a capacity of 1,200 MW, located within commercial pine plantations in the Wide Bay region of Queensland. The project will generate enough clean energy to power approximately 650,000 Queensland homes and reduce CO2 emissions by over 3 million tonnes annually. It has received Commonwealth EPBC approval (2024) and Queensland Coordinated Project declaration, with construction expected to commence in 2026 subject to final investment decision.

Queensland Train Manufacturing Program

The Queensland Train Manufacturing Program is delivering 65 new six-car passenger trains at a new purpose-built manufacturing facility in Torbanlea (Fraser Coast) with an additional maintenance and stabling facility at Ormeau (Gold Coast). Construction of the Torbanlea facility is well advanced in 2025 with major structural works and roofing complete, internal fit-out progressing and utilities connections underway. The first train is scheduled for completion and testing in late 2026, entering service in 2027. All 65 trains will be in service by 2032 to support Cross River Rail and the Brisbane 2032 Olympic and Paralympic Games. The program is currently supporting around 800 jobs in construction and manufacturing.

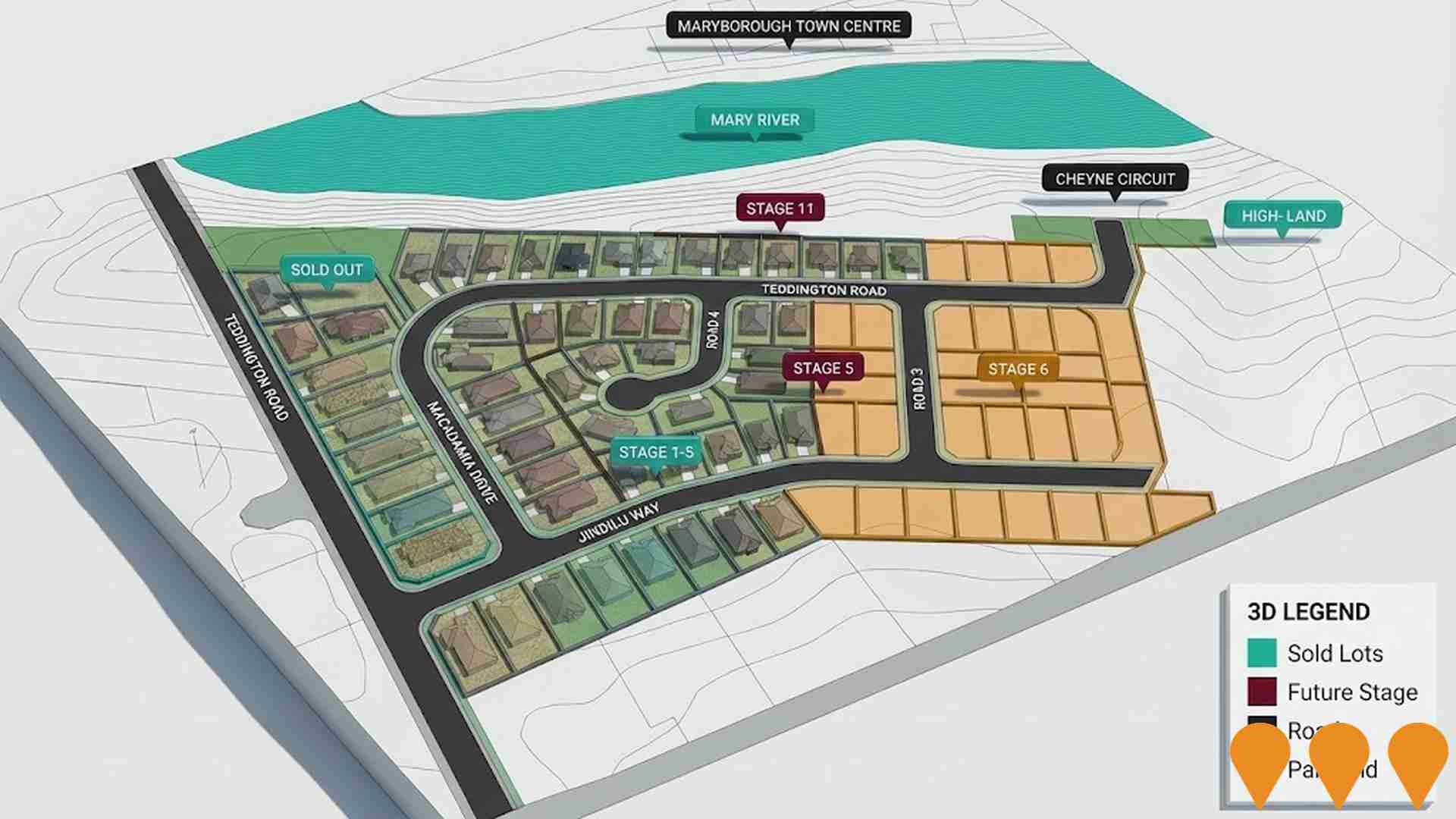

Mary Harbour Development

Large-scale 174-hectare master-planned mixed-use precinct proposed on the Mary River at Granville (Maryborough). Includes a 250-berth marina, 15-hectare harbour, resort hotel, conference centre, retail and community facilities, and residential development for approximately 3,500 residents (circa 1,800 dwellings). Originally proposed in the early 2000s by MSF Sugar, the project has remained shelved since 2015 due to lack of investment and market conditions. As of late 2025 there are no active development applications, construction contracts, or confirmed funding, and the project is considered dormant/indefinitely postponed.

Energy Storage Industries (ESI) Battery Manufacturing Facility

Australia's first grid-scale iron flow battery manufacturing facility. $70 million facility producing 400MW of energy storage annually with 25-year battery life and 14-hour storage duration. Creating 273 full-time jobs when operational by mid-2029.

Hyundai Rotem Steel Roll Forming Facility

The Hyundai Rotem Steel Roll Forming Facility is a 30,000 square meter manufacturing plant in Maryborough West, producing sub-components for train car bodies using roll forming technology. It supports the Queensland Train Manufacturing Program by providing essential steel components for 65 new passenger trains, boosting local employment and supply chain in the Wide Bay region.

Rheinmetall NIOA Munitions (RNM) Manufacturing Plant

World's most modern munitions facility for 155mm artillery shell production. $90 million facility supporting regional manufacturing capability and creating up to 120 skilled jobs. The facility uses a 1250-tonne hot forging press and computerised machinery to produce 155mm artillery projectiles and metal parts for other munitions used by the Australian Defence Force as well as export markets. Currently produces 40,000 projectiles per year, with plans to expand to 100,000 per year.

Hyne Timber Glue Laminated Manufacturing Plant

State-of-the-art 4000sqm glulam production facility incorporating latest automation technology. Supporting Queensland's sustainable timber industry with advanced engineered wood products.

Employment

Employment drivers in Maryborough are experiencing difficulties, placing it among the bottom 20% of areas assessed across Australia

Maryborough has a balanced workforce with both white and blue collar employment, well-represented essential services sectors, an unemployment rate of 8.3%, and estimated employment growth of 8.8% over the past year as of September 2025. There are 7,696 residents in work, with an unemployment rate of 4.2%, which is 0.1 percentage points higher than Rest of Qld's rate of 4.1%.

Workforce participation lags at 42.9% compared to Rest of Qld's 59.1%. Dominant employment sectors among residents include health care & social assistance, retail trade, and education & training. The area has a particular specialization in health care & social assistance, with an employment share of 130% compared to the regional level. Conversely, construction shows lower representation at 7.2% versus the regional average of 10.1%.

Many residents commute elsewhere for work based on Census data analysis. Between September 2024 and September 2025, employment levels increased by 8.8%, labour force increased by 9.7%, resulting in an unemployment rise of 0.7 percentage points. In contrast, Rest of Qld experienced employment growth of 1.7% and labour force growth of 2.1%, with a 0.3 percentage point rise in unemployment. As of 25-Nov-25, Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Job and Skills Australia projects national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Maryborough's employment mix suggests local employment should increase by 6.3% over five years and 13.5% over ten years, though this is a simplified extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

AreaSearch's latest postcode level ATO data for financial year 2022 shows Maryborough SA2 had a median income among taxpayers of $42,669 and an average of $49,261. This is lower than the national average. In comparison, Rest of Qld had a median income of $50,780 and an average of $64,844. Based on Wage Price Index growth of 13.99% since financial year 2022, estimated incomes for Maryborough as of September 2025 would be approximately $48,638 (median) and $56,153 (average). The 2021 Census reveals that incomes in Maryborough fall between the 2nd and 4th percentiles nationally. Income analysis indicates that the largest segment comprises 32.2% earning $400 - $799 weekly, with 6,209 residents. This differs from the surrounding region where the $1,500 - $2,999 category predominates at 31.7%. The prevalence of lower-income residents (40.7% under $800/week) suggests constrained household budgets across much of the locality. Housing affordability pressures are severe, with only 84.4% of income remaining, ranking at the 4th percentile nationally.

Frequently Asked Questions - Income

Housing

Maryborough is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Maryborough's dwelling structures, as per the latest Census, consisted of 86.5% houses and 13.5% other dwellings such as semi-detached homes, apartments, and 'other' dwellings. In comparison, Non-Metro Qld had 91.8% houses and 8.2% other dwellings. Home ownership in Maryborough stood at 39.7%, with mortgaged dwellings at 28.1% and rented ones at 32.3%. The median monthly mortgage repayment was $1,083, lower than Non-Metro Qld's average of $1,179. The median weekly rent in Maryborough was $255, compared to Non-Metro Qld's $260. Nationally, Maryborough's mortgage repayments were significantly lower at $1,083 versus Australia's average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Maryborough features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 62.2% of all households, including 18.7% couples with children, 27.7% couples without children, and 14.8% single parent families. Non-family households constitute the remaining 37.8%, with lone person households at 34.1% and group households comprising 3.7%. The median household size is 2.2 people, which is smaller than the Rest of Qld average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Maryborough faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 9.9%, significantly lower than the Australian average of 30.4%. This difference presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 7.3%, followed by postgraduate qualifications (1.3%) and graduate diplomas (1.3%). Vocational credentials are prominent, with 40.1% of residents aged 15+ holding them - advanced diplomas account for 8.5% and certificates for 31.6%.

Educational participation is high, with 27.8% of residents currently enrolled in formal education. This includes 10.9% in primary education, 9.7% in secondary education, and 2.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Maryborough has 111 active public transport stops. These are served by buses running along seven different routes. Together, these routes facilitate 527 weekly passenger trips.

The accessibility of public transport in Maryborough is moderate, with residents generally located 472 meters away from the nearest stop. On average, services run 75 times daily across all routes, translating to roughly four weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Maryborough is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Maryborough faces significant health challenges, with various conditions affecting both younger and older residents. Approximately 46% (~8,889 people) have private health cover, lower than the national average of 55.3%.

The most prevalent medical conditions are arthritis (13.0%) and mental health issues (11.9%), while 52.6% report no medical ailments, compared to 54.0% in Rest of Qld. Residents aged 65 and over comprise 26.3% (5,077 people), lower than the 29.9% in Rest of Qld. Health outcomes among seniors are broadly similar to those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Maryborough placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Maryborough's population showed low cultural diversity, with 87.7% being citizens, 90.3% born in Australia, and 97.3% speaking English only at home. Christianity was the predominant religion, practiced by 51.7%. This figure is slightly lower than the regional average of 52.8%.

In terms of ancestry, the top three groups were English (32.7%), Australian (31.2%), and Irish (8.0%). Notably, German ancestry was slightly higher in Maryborough at 6.5% compared to the regional figure of 6.6%. Australian Aboriginal ancestry was also higher at 3.8%, compared to 3.4% regionally. Scottish ancestry was marginally lower at 8.0% versus 8.2% regionally.

Frequently Asked Questions - Diversity

Age

Maryborough hosts an older demographic, ranking in the top quartile nationwide

Maryborough's median age is 47 years, which exceeds Rest of Qld's 41 years and is considerably older than the national norm of 38 years. Compared to the Rest of Qld average, the 65-74 cohort is notably over-represented at 13.6% locally, while the 5-14 year-olds are under-represented at 10.2%. Between 2021 and present, the 0-4 age group has grown from 4.3% to 4.9% of the population. Conversely, the 5-14 cohort has declined from 11.3% to 10.2%. By 2041, demographic modeling suggests Maryborough's age profile will evolve significantly. The 25-34 age cohort is projected to expand by 411 people (19%) from 2,119 to 2,531. Notably, the combined 65+ age groups are projected to account for 55% of total population growth, reflecting the area's aging demographic profile. In contrast, population declines are projected for the 45-54 and 5-14 cohorts.