Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Prestons reveals an overall ranking slightly below national averages considering recent, and medium term trends

As of November 2025, Preston's population is approximately 15,995, showing an increase of 303 individuals since the 2021 Census which reported a population of 15,692. This growth is inferred from ABS estimated resident population data of 15,603 in June 2024 and validated new addresses totalling 253 since the Census date. This results in a population density ratio of 1,732 persons per square kilometer, higher than the average observed across national locations assessed by AreaSearch. Overseas migration contributed roughly 66.7% to overall population gains in recent periods. AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022, and NSW State Government's SA2 level projections for areas not covered by this data, released in 2022 with a base year of 2021.

Growth rates by age group are applied to all areas from these aggregations for years 2032 to 2041. By 2041, the area is projected to increase by 93 persons based on latest annual ERP population numbers, reflecting a reduction of 2.3% in total over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Prestons, placing the area among the bottom 25% of areas assessed nationally

Prestons has averaged approximately 31 new dwelling approvals annually. Over the past five financial years, from FY21 to FY25, a total of 156 homes were approved, with an additional 15 approved so far in FY26. Despite a decline in population during this period, housing supply has remained adequate relative to demand, resulting in a balanced market with good buyer choice.

The average expected construction cost value for new dwellings is $303,000, aligning with regional trends. This financial year has seen $1.0 million in commercial approvals, reflecting the area's residential nature. Compared to Greater Sydney, Prestons has significantly less development activity, at 74.0% below the regional average per person. This scarcity of new properties typically strengthens demand and prices for existing properties, although recent periods have shown an increase in development activity. This is also under the national average, suggesting the area's established nature and potential planning limitations.

New development consists predominantly of detached dwellings at 86.0%, with townhouses or apartments making up the remaining 14.0%, sustaining Prestons' suburban identity with a concentration of family homes suited to buyers seeking space. The location has approximately 321 people per dwelling approval, indicating a low density market. Given stable or declining population forecasts, Prestons may experience less housing pressure in the future, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Prestons has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 31 projects likely to affect the region. Notable initiatives include Prestons Grove Estate, Prestons Industrial Estate, 44 Manildra Street Residential Development Site, and Chapter Place. The following list details those expected to have the most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

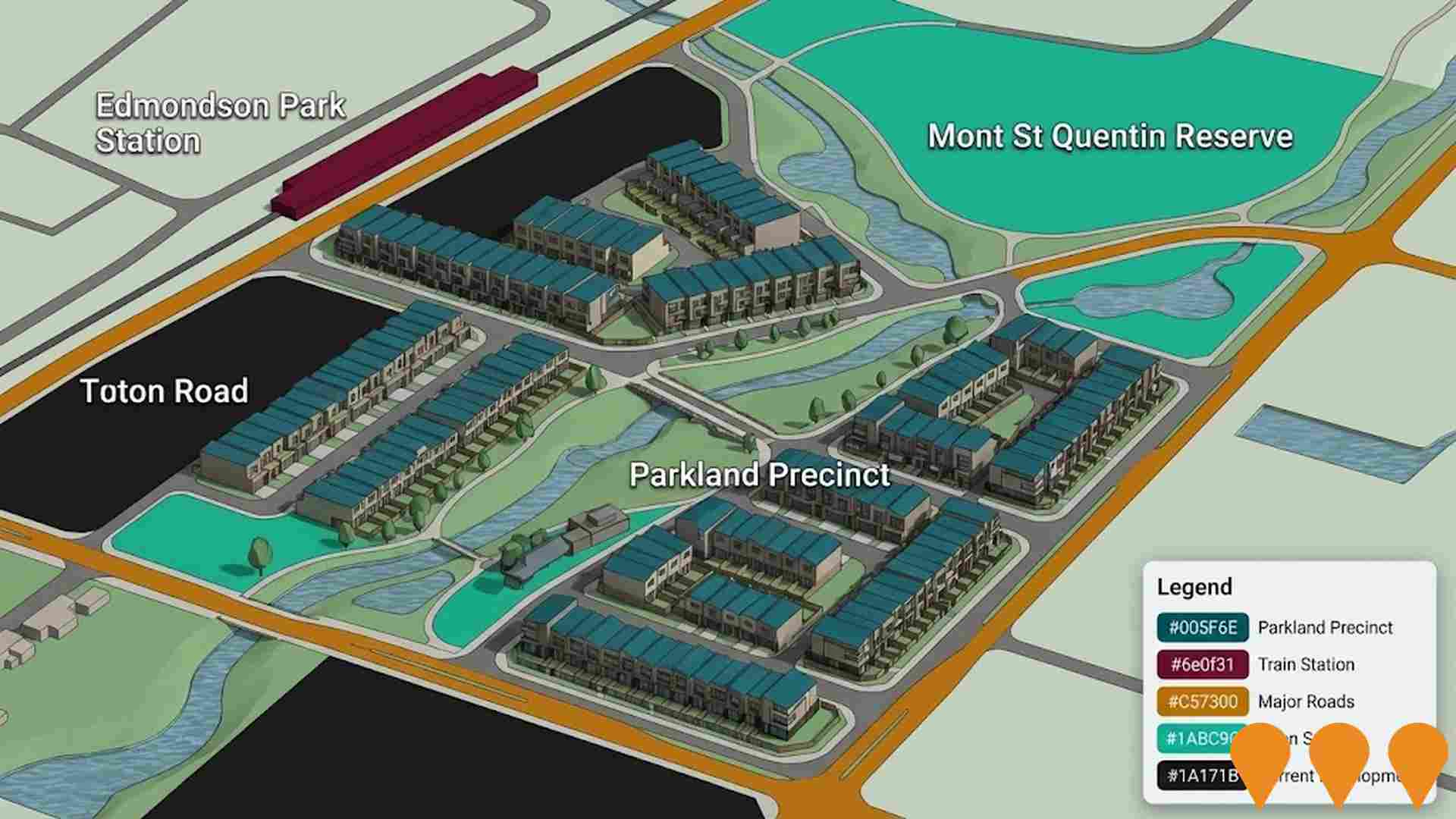

Edmondson Park Precinct Development

Large-scale urban renewal masterplan of 425 hectares in Sydney's South West Growth Area, incorporating Edmondson Park and Bardia. The long-term vision aims to deliver up to 8,000 new homes and community facilities by 2029. It includes the development of the Ed.Square town centre by Frasers Property, which offers retail, dining, entertainment, and housing, and Landcom's Town Centre North precinct, which will deliver 3,030 new high-density homes. Construction of critical roads, infrastructure, and housing precincts is underway, with the first residents of the new high-density precinct expected to move in by late 2026. The entire development, which commenced in 2012, is expected to be delivered by 2029.

Chapter Place

Chapter Place is a major residential and retail precinct in Edmondson Park, delivering up to 1,900 new homes including 272 affordable residences for essential workers, sustainable features like carbon-neutral bricks and solar storage, and creating 5,200 jobs. The development includes terraces and apartments designed by Cox Architecture, with the first stage of 43 terraces expected by mid-2026.

Crossroads Homemaker Centre Asset Enhancement

Large-format retail centre enhancement project on 14.3 hectare site featuring 38 homewares retailers. LaSalle Investment Management identified significant development upside with opportunities to expand and redevelop existing buildings. Recent $3M refurbishment completed with new food and beverage precinct. Centre serves over 4 million customers annually and is the fifth largest large-format retail centre in Australia.

M5 Motorway Westbound Upgrade

Upgrade of the M5 Motorway westbound between Moorebank Avenue and the Hume Highway to reduce congestion and improve safety. Key features include a new three-lane bridge over the Georges River and rail corridors, removal of the traffic weave, additional lanes, improved freight access, and a new shared user path for pedestrians and cyclists.

Edmondson Park Town Centre Expansion

Major town centre development and expansion providing retail, commercial, residential and community facilities. Multiple residential and commercial developments in Edmondson Park including The Edmondson Collection (416 apartments), Central Park at Ed.Square. The centre will serve the growing South West Growth Area with comprehensive services and amenities. Population growing to 26,000 by 2031.

Carnes Hill Aquatic and Recreational Precinct

$85 million regional aquatic and recreational facility featuring 50m competition pool, leisure pool with water play features, hydrotherapy pool, learn-to-swim pools, gymnasium, health and fitness facilities, cafe and community spaces. Part of Western Sydney Infrastructure Plan providing pools, sports courts, community facilities and parkland. Designed to serve growing south-west Sydney population and host regional competitions.

Avala Apartments Miller

Residential apartment development featuring 145 apartments across 3 buildings (9 storeys). Will include 380 car spaces, 66 bike spaces and communal open space areas.

Prestons Industrial Estate

Large-scale industrial warehouse and distribution centre development by ESR Group (formerly LOGOS Property). Prestons Logistics Estate featuring 141,000sqm of world-class logistics facilities with tenants including Toll, Volvo Group Australia and others.

Employment

Prestons ranks among the top 25% of areas assessed nationally for overall employment performance

Prestons has a skilled workforce with essential services sectors well represented. Its unemployment rate was 2.5% in the past year, with an estimated employment growth of 4.5%.

As of September 2025, 9,026 residents were employed, with an unemployment rate of 1.7%, below Greater Sydney's rate of 4.2%. Workforce participation was similar to Greater Sydney's 60.0%. Employment is concentrated in health care & social assistance, retail trade, and transport, postal & warehousing. Transport, postal & warehousing has particularly notable concentration, with employment levels at 1.9 times the regional average.

Professional & technical services have a limited presence, with 6.4% employment compared to 11.5% regionally. The worker-to-resident ratio of 0.8 indicates above-average local employment opportunities. Between September 2024 and September 2025, employment increased by 4.5%, labour force by 4.0%, reducing the unemployment rate by 0.4 percentage points. In contrast, Greater Sydney saw employment rise by 2.1% while unemployment rose by 0.2 percentage points. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%. National forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years, but industry-specific projections suggest Prestons' employment should increase by 6.3% over five years and 13.2% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates above-average performance, with income metrics exceeding national benchmarks based on AreaSearch comparative assessment

The Prestons SA2's median income among taxpayers was $48,609 and average income stood at $57,150 in the financial year 2022. These figures were below Greater Sydney's median of $56,994 and average of $80,856 respectively. Based on Wage Price Index growth of 12.61% since financial year 2022, estimated incomes for September 2025 would be approximately $54,739 (median) and $64,357 (average). Census data reveals household incomes rank at the 83rd percentile ($2,309 weekly), while personal income ranks at the 39th percentile. The earnings profile shows that 37.4% of residents earn between $1,500 and $2,999 weekly (5,982 people). A significant 32.9% earn above $3,000 weekly. High housing costs consume 16.8% of income, but strong earnings place disposable income at the 81st percentile. The area's SEIFA income ranking places it in the 6th decile.

Frequently Asked Questions - Income

Housing

Prestons is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Prestons, as per the latest Census, 92.5% of dwellings were houses with the remaining 7.4% comprising semi-detached homes, apartments, and other types. This contrasts with Sydney's metropolitan area where 63.3% were houses and 36.8% other dwellings. Home ownership in Prestons stood at 24.2%, with mortgaged properties making up 57.1% and rented dwellings accounting for 18.7%. The median monthly mortgage repayment was $2,200, exceeding Sydney's average of $2,167. Weekly rent in Prestons was $520 compared to Sydney's $400. Nationally, Prestons' mortgage repayments were higher at $2,200 versus the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Prestons features high concentrations of family households, with a higher-than-average median household size

Family households constitute 90.1% of all households, including 59.9% couples with children, 15.5% couples without children, and 13.9% single parent families. Non-family households comprise the remaining 9.9%, with lone person households at 8.8% and group households making up 1.2%. The median household size is 3.6 people, larger than the Greater Sydney average of 3.0.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Prestons exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 24.8%, significantly lower than Greater Sydney's average of 38.0%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 18.1%, followed by postgraduate qualifications (5.4%) and graduate diplomas (1.3%). Vocational credentials are prevalent, with 30.6% of residents aged 15 and above holding such qualifications, including advanced diplomas (11.7%) and certificates (18.9%).

Educational participation is high, with 36.5% of residents currently enrolled in formal education. This includes 11.8% in primary education, 11.7% in secondary education, and 7.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Prestons has 85 active public transport stops, all of which are bus stops. These stops are served by 67 different routes that together facilitate 2,955 weekly passenger trips. The average distance from a resident's location to the nearest transport stop is 152 meters.

On average, there are 422 trips per day across all routes, which equates to approximately 34 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Prestons's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Health outcomes data shows excellent results in Prestons, with younger cohorts particularly experiencing low prevalence of common health conditions. Private health cover stands at approximately 48% of the total population (~7,725 people), compared to Greater Sydney's 50.4%. Nationally, it averages 55.3%.

Diabetes and asthma are the most prevalent medical conditions in Prestons, affecting 5.9% and 5.7% of residents respectively. A total of 78.0% of residents report no medical ailments, compared to Greater Sydney's 76.4%. The area has 12.1% of residents aged 65 and over (1,930 people), requiring more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Prestons is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Preston has a high level of cultural diversity, with 44.9% of its population born overseas and 58.5% speaking a language other than English at home. Christianity is the predominant religion in Preston, accounting for 49.0% of its population. Islam is notably overrepresented, making up 23.1%, compared to the Greater Sydney average of 17.4%.

The top three ancestry groups are Other (31.5%), Australian (12.2%), and English (8.9%). Notably, Serbian (1.9%) and Spanish (1.2%) ethnicities are overrepresented in Preston compared to regional averages of 2.4% and 0.8%, respectively.

Frequently Asked Questions - Diversity

Age

Prestons hosts a young demographic, positioning it in the bottom quartile nationwide

Preston's median age is 34 years, which is lower than Greater Sydney's average of 37 years and considerably younger than Australia's median age of 38 years. Compared to Greater Sydney, Preston has a higher proportion of residents aged 15-24 (18.6%) but fewer residents aged 25-34 (11.1%). This concentration of 15-24 year-olds is well above the national average of 12.5%. Between 2021 and the latest data, the proportion of Preston's population aged 15 to 24 has increased from 16.7% to 18.6%, while the proportion of residents aged 65 to 74 has risen from 5.5% to 6.9%. Conversely, the proportion of residents aged 5 to 14 has declined from 16.6% to 14.4%, and the proportion of residents aged 35 to 44 has dropped from 13.8% to 12.7%. Population forecasts for Preston in 2041 indicate significant demographic changes, with the strongest projected growth in the 75 to 84 age cohort (136%), adding 807 residents to reach a total of 1,399. Senior residents aged 65 and above will drive 89% of population growth, highlighting trends towards demographic aging. Conversely, population declines are projected for the 0 to 4 and 25 to 34 age cohorts.