Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in North Perth are above average based on AreaSearch's ranking of recent, and medium to long-term trends

North Perth's population is 10,798 as of November 2025. This reflects a growth of 1,091 people since the 2021 Census, which reported a population of 9,707. The increase is inferred from the ABS estimated resident population of 10,780 in June 2024 and an additional 76 validated new addresses since the Census date. This results in a density ratio of 3,494 persons per square kilometer, placing North Perth in the upper quartile nationally according to AreaSearch's assessment. The area's 11.2% growth since the 2021 census exceeds the national average of 8.9%. Overseas migration contributed approximately 62.8% of overall population gains during recent periods, with all drivers being positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area released in 2024 using a base year of 2022. For areas not covered by this data and estimates post-2032, AreaSearch utilises growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections released in 2023 based on 2022 data. Future population trends project an above median growth for statistical areas nationally, with North Perth expected to expand by 1,829 persons to 2041, reflecting a total increase of 16.8% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential approval activity sees North Perth among the top 30% of areas assessed nationwide

North Perth averaged approximately 32 new dwelling approvals annually between FY-21 and FY-25. A total of 162 homes were approved during these five financial years, with an additional 11 approved in FY-26 to date. On average, 7.5 people moved to the area each year for every dwelling built over this period, indicating a significant demand outpacing supply.

This imbalance typically exerts upward pressure on prices and intensifies competition among buyers. The average value of new homes being constructed is $487,000, suggesting developers focus on the premium market with high-end developments. In FY-26, commercial development approvals totaled $3.0 million, reflecting the area's residential character. Compared to Greater Perth, North Perth has shown substantially reduced construction activity, at 57.0% below the regional average per person. This constrained new construction often reinforces demand and pricing for existing homes.

Nationally, this activity is also below average, indicating the area's maturity and possible planning constraints. Recent construction predominantly comprises detached houses (73.0%) and townhouses or apartments (27.0%), preserving North Perth's traditional suburban character with a focus on family homes. The location has approximately 326 people per dwelling approval, suggesting potential for growth. According to the latest AreaSearch quarterly estimate, North Perth is expected to grow by 1,811 residents through to 2041. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth.

Frequently Asked Questions - Development

Infrastructure

North Perth has emerging levels of nearby infrastructure activity, ranking in the 20thth percentile nationally

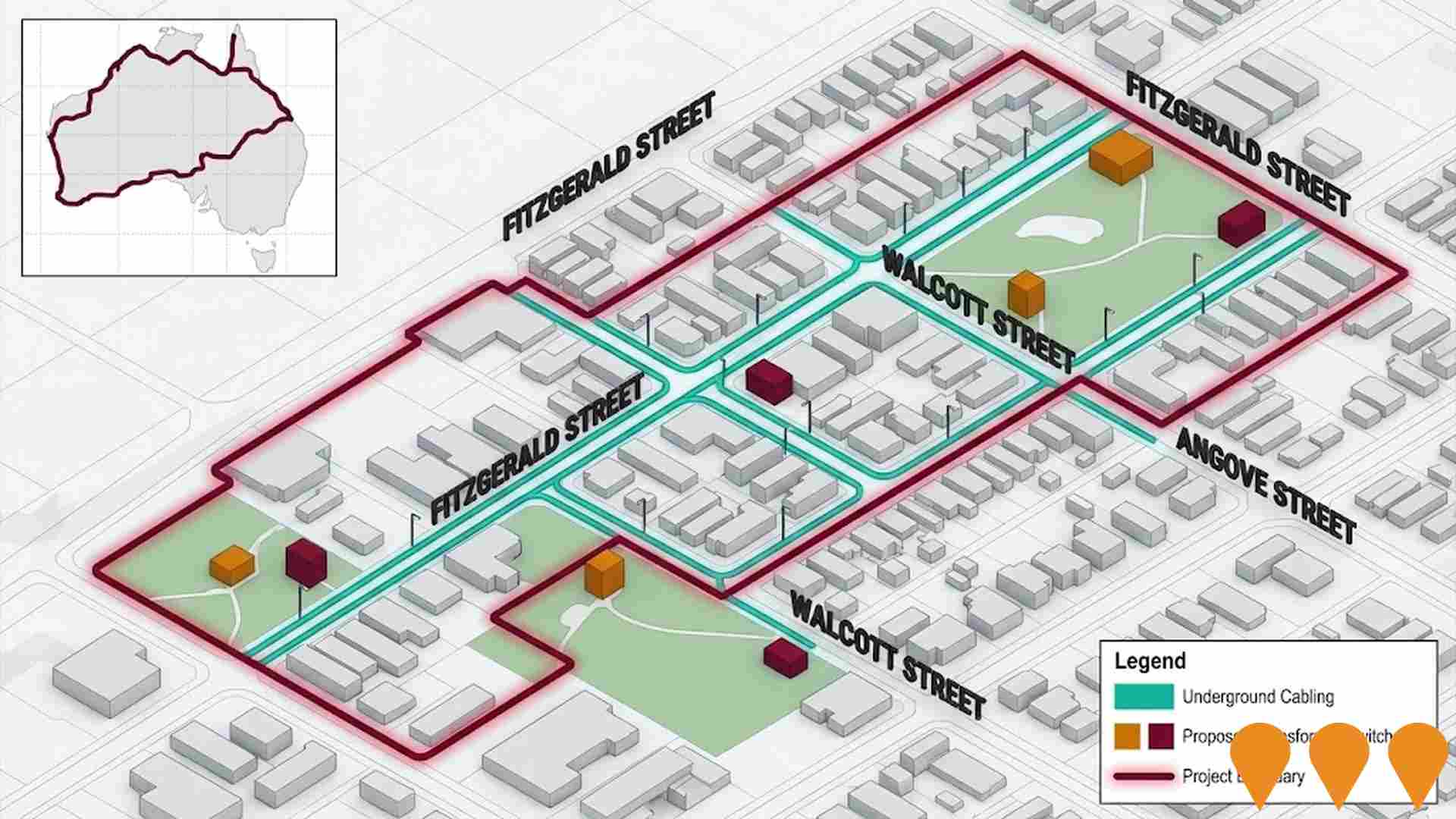

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 21 projects that could affect the region. Notable initiatives include Alma Square, Targeted Underground Power Program in Joondanna, Osborne Park, Tuart Hill, North Perth Town Centre Planning Framework, and North Perth / Mount Lawley Underground Power Project. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

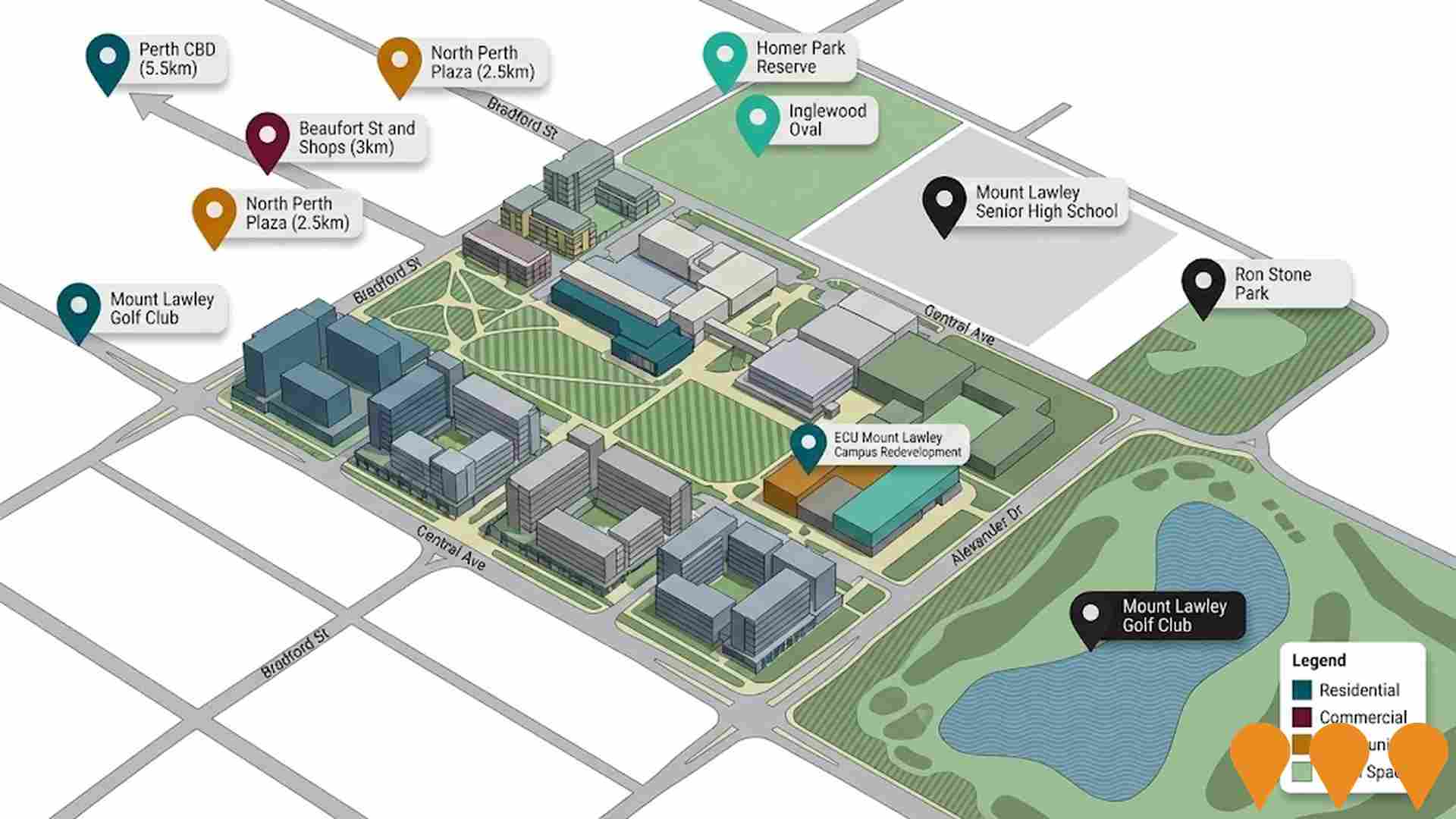

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

METRONET

METRONET is Western Australia's largest-ever public transport infrastructure program, delivering over 72 kilometres of new passenger rail and 23 new stations across the Perth metropolitan area. As of December 2025, multiple stages are complete or nearing completion: Yanchep Rail Extension (opened July 2024), Morley-Ellenbrook Line (opened December 2024), Thornlie-Cockburn Link (opened June 2025), and Byford Rail Extension (opened October 2025). Remaining projects including the Airport Line upgrades, Victoria Park-Canning Level Crossing Removal (six crossings removed by late 2025), Circle Route Bus Priority, and final stages of the Ellenbrook Line are under active construction, with the overall program on track for substantial completion by 2027-2028. The program also includes 246 locally built C-series railcars, high-capacity signalling, and extensive station precinct activation.

Edith Cowan University City Campus

Australia's first comprehensive inner-city university campus spanning 11 super-levels and 65,000 square metres. It reached its full structural height in late 2024 ('top out' milestone), with internal fit-out continuing in 2025. The campus will house the Western Australian Academy of Performing Arts (WAAPA), School of Business and Law, creative industries programs, and emerging technology faculties, including a Cyber Security Operations Center. Key features include six world-class WAAPA performance venues, a dynamic digital media facade with over 2,800 custom LED fixtures, and an immersive digital foyer screen. The campus integrates with the Perth Busport and will accommodate over 10,000 students and staff. It is a $853M joint investment by the Australian Government, WA Government, and ECU, and is set to open in semester one 2026.

ECU Mount Lawley Campus Redevelopment

Comprehensive redevelopment of the 18.6-hectare former ECU Mount Lawley campus into a mixed-use precinct featuring diverse residential living options, commercial and community facilities. Following university relocation to Perth CBD in 2026, DevelopmentWA is leading master planning to transform this heritage site while maintaining key heritage elements and modernizing infrastructure. Community consultation was completed in 2024.

Scarborough Beach Road Activity Corridor Plan (Mount Hawthorn section)

Long term planning and place making framework for the Scarborough Beach Road activity corridor through Mt Hawthorn. The project implements the state Scarborough Beach Road Activity Corridor Framework at a local level by guiding future development in the Mt Hawthorn Town Centre between Braithwaite Park and Britannia Road, including parts of Oxford Street. Led by the City of Vincent with input from the Western Australian Planning Commission, it aims to transform Scarborough Beach Road into a vibrant mixed use main street with higher quality public spaces and tree canopy, safer walking and cycling, and better integration with public transport and local businesses.

North Perth Town Centre Planning Framework

A comprehensive planning framework developed by the City of Vincent to guide future development in the North Perth Town Centre. The framework will establish planning controls for land use, building design, scale, and public realm improvements across the commercial and mixed-use areas of North Perth. The framework addresses community values, heritage protection, traffic management, and sustainable growth while balancing increased density with character retention. Community consultation closed in May 2024, with the draft framework currently being prepared for Council endorsement and formal advertising.

Alma Square

Alma Square is a landmark mixed-use development transforming North Perth's town centre, featuring 108 residential apartments across 40 floor plans, over 1,500 square metres of ground-floor retail and hospitality venues, and 7 commercial tenancies. The 8-level development offers resort-style amenities including a swimming pool, gym, sauna, cinema, and rooftop sky lounge with panoramic CBD views. Designed by Space Collective Architects and Place Fabric, the project blends modern design with North Perth's heritage character. With a 7-star NatHERS rating, solar power, EV charging infrastructure, and sustainable features, construction commenced September 2025 with completion expected Q1 2028.

Litis Stadium Development and Britannia Reserve Upgrades

Upgrade program delivering the Britannia Reserve Landscape Master Plan, focused on Litis Stadium and the north west corner of the reserve. Works include demolition of the old grandstand and ablution block, construction of new multi sport changerooms and public toilets, upgrades to Floreat Athena clubrooms, improved paths and landscaping, and new sports lighting to meet National Premier League and major training standards for football and gridiron.

Perth City Deal - Cultural Precinct

Major redevelopment of Perth Cultural Centre including new contemporary art gallery, museum upgrades, public realm improvements, and increased cultural programming. Part of broader Perth City Deal to revitalize central Perth.

Employment

The labour market in North Perth demonstrates typical performance when compared to similar areas across Australia

North Perth has a highly educated workforce with professional services well represented. Its unemployment rate is 3.3%.

As of September 2025, 6,665 residents are employed and the unemployment rate is 0.7% lower than Greater Perth's rate of 4.0%. Workforce participation in North Perth is higher at 71.8% compared to Greater Perth's 65.2%. The dominant employment sectors among residents include professional & technical, health care & social assistance, and education & training. North Perth has a particular specialization in professional & technical jobs, with an employment share 1.9 times the regional level.

Conversely, construction shows lower representation at 6.5% versus the regional average of 9.3%. The area appears to offer limited local employment opportunities as indicated by Census data on working population vs resident population. In the 12 months prior to analysis, North Perth's labour force decreased by 3.0% and employment decreased by 3.8%, causing unemployment rate to rise by 0.8 percentage points. Meanwhile, Greater Perth experienced employment growth of 2.9% and labour force growth of 3.0%. State-level data up to 25-Nov shows WA employment contracted by 0.27% (losing 5,520 jobs), with the state unemployment rate at 4.6%, compared to the national rate of 4.3%. National employment forecasts from May-25 suggest total employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to North Perth's employment mix, local employment is estimated to increase by 7.0% over five years and 14.3% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch's latest postcode level ATO data for financial year 2022 shows that North Perth SA2 has exceptionally high incomes nationally. The median income is $70,335 and the average income stands at $96,097. This contrasts with Greater Perth's figures of a median income of $58,380 and an average income of $78,020. Based on Wage Price Index growth of 14.2% since financial year 2022, current estimates would be approximately $80,323 (median) and $109,743 (average) as of September 2025. According to the 2021 Census figures, incomes in North Perth rank highly nationally, between the 84th and 88th percentiles for household, family, and personal incomes. The predominant income cohort spans 28.5% of locals (3,077 people) earning $1,500 - 2,999 weekly, aligning with regional trends where this cohort represents 32.0%. A significant 38.9% earn above $3,000 weekly. Housing accounts for 14.8% of income, and residents rank within the 85th percentile for disposable income. The area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

North Perth displays a diverse mix of dwelling types, with above-average rates of outright home ownership

In North Perth, as per the latest Census evaluation, 65.6% of dwellings were houses, with the remaining 34.4% comprising semi-detached homes, apartments, and other dwelling types. This contrasts with Perth metro's dwelling structure, which was 37.1% houses and 62.9% other dwellings. Home ownership in North Perth stood at 29.7%, with mortgaged dwellings at 36.7% and rented ones at 33.6%. The median monthly mortgage repayment in the area was $2,492, higher than Perth metro's average of $2,167. The median weekly rent in North Perth was $400, slightly above Perth metro's figure of $390. Nationally, North Perth's median monthly mortgage repayment exceeded the Australian average of $1,863, and its median weekly rent surpassed the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

North Perth features high concentrations of group households and lone person households, with a higher-than-average median household size

Family households constitute 61.8% of all households, including 27.3% couples with children, 26.2% couples without children, and 7.1% single parent families. Non-family households account for the remaining 38.2%, with lone person households at 30.5% and group households comprising 7.8%. The median household size is 2.3 people, larger than the Greater Perth average of 2.1.

Frequently Asked Questions - Households

Local Schools & Education

North Perth shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

North Perth has a higher proportion of residents aged 15+ with university qualifications compared to Western Australia (WA) and Greater Perth. Specifically, 50.1% of North Perth residents have such qualifications, while WA has 27.9% and Greater Perth has 30.1%. Bachelor degrees are the most common at 33.8%, followed by postgraduate qualifications at 11.1% and graduate diplomas at 5.2%. Vocational pathways account for 22.8%, with advanced diplomas at 9.6% and certificates at 13.2%.

Educational participation is high, with 26.8% of residents currently enrolled in formal education. This includes 7.9% in tertiary education, 7.6% in primary education, and 6.1% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is high compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

North Perth has 55 active public transport stops operating within its boundaries. These stops serve a mix of bus routes, with 18 individual routes in total. The combined weekly passenger trips across these routes amount to 4,187.

Residents have excellent accessibility to transport, with an average distance of 155 meters to the nearest stop. Service frequency is high, averaging 598 trips per day across all routes, which translates to approximately 76 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

North Perth's residents are extremely healthy with both young and old age cohorts seeing low prevalence of common health conditions

Analysis shows North Perth performing well in health metrics, with both young and elderly experiencing low prevalence of common conditions. Private health cover is high at approximately 69% (7,483 people), compared to the national average of 55.3%.

Mental health issues and asthma are most common, affecting 10.0% and 6.6% respectively. 72.5% report no medical ailments, slightly lower than Greater Perth's 74.5%. The area has 15.6% aged 65 and over (1,679 people). Seniors' health outcomes align with the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in North Perth was found to be above average when compared nationally for a number of language and cultural background related metrics

North Perth's population showed higher cultural diversity compared to most local areas, with 19.3% speaking a language other than English at home and 30.6% born overseas. Christianity was the predominant religion in North Perth, accounting for 42.2% of its population. Notably, Judaism was overrepresented at 1.0%, compared to 0.6% across Greater Perth.

The top three ancestry groups were English (24.4%), Australian (19.7%), and Italian (9.1%). Macedonian (1.4%) and Croatian (1.3%) were notably more prevalent in North Perth than regionally (0.4% and 0.9%, respectively), while French showed similar representation at 0.8%.

Frequently Asked Questions - Diversity

Age

North Perth's population is slightly younger than the national pattern

The median age in North Perth is 38 years, close to Greater Perth's average of 37 and equivalent to Australia's median of 38. Compared to Greater Perth, North Perth has a higher percentage of residents aged 25-34 (18.2%) but fewer residents aged 5-14 (9.2%). Between the 2016 and 2021 censuses, the population aged 65-74 grew from 7.8% to 8.8%, while the 5-14 age group declined from 10.3% to 9.2%. By 2041, North Perth's age composition is projected to change significantly. The 75-84 age group is expected to grow by 108% (502 people), reaching 969 from 466. Those aged 65 and above are projected to comprise 59% of the population growth. Meanwhile, declines are projected for the 0-4 and 35-44 age groups.