Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Collie is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Collie's population is approximately 9,465 as of November 2025. This figure represents an increase of 653 people, a rise of 7.4% since the 2021 Census which reported a population of 8,812. The change is inferred from ABS's estimated resident population of 9,408 in June 2024 and additional validated new addresses since the Census date. This results in a population density ratio of 5.5 persons per square kilometer. Collie's growth rate of 7.4% since the census is within 1.5 percentage points of the national average of 8.9%, indicating strong fundamentals for growth. Population growth was primarily driven by interstate migration, contributing approximately 48.8% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area released in 2024 with a base year of 2022. For areas not covered and post-2032 estimations, AreaSearch utilises growth rates by age cohort provided by the ABS in its Greater Capital Region projections released in 2023 based on 2022 data. Looking ahead, regional areas are projected to have above median population growth, with Collie expected to expand by 1,368 persons to 2041, reflecting a total increase of 13.8% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Collie when compared nationally

Collie has recorded approximately 28 residential properties granted approval annually. Over the past five financial years, from FY-21 to FY-25, around 140 homes were approved, and an additional 20 have been approved so far in FY-26. On average, about 3.4 people moved to the area each year for every dwelling built during these five years.

This high demand has outpaced supply, putting upward pressure on prices and increasing competition among buyers. The average expected construction cost value of new homes being built is around $277,000. In terms of commercial investment activity, Collie has registered approximately $16.9 million in approvals this financial year. Compared to the rest of WA, Collie records roughly half the building activity per person.

Nationally, it places among the 49th percentile of areas assessed, indicating relatively constrained buyer choice and supporting interest in existing dwellings. The new building activity shows a traditional low density character with around 82.0% detached houses and 18.0% medium and high-density housing. This focus on family homes appeals to those seeking space. With approximately 331 people per dwelling approval, Collie indicates a developing market. Looking ahead, the latest AreaSearch quarterly estimate projects that Collie is expected to grow by 1,311 residents through to 2041. At current development rates, housing supply may struggle to match population growth, potentially heightening buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Collie has limited levels of nearby infrastructure activity, ranking in the 14thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified nine projects that could affect this region. Notable ones include Collie Micronising Facility, Collie Magnesium Plant, Quantum Filtration Medium Manufacturing Plant, and Collie to Mumballup Road Upgrade. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

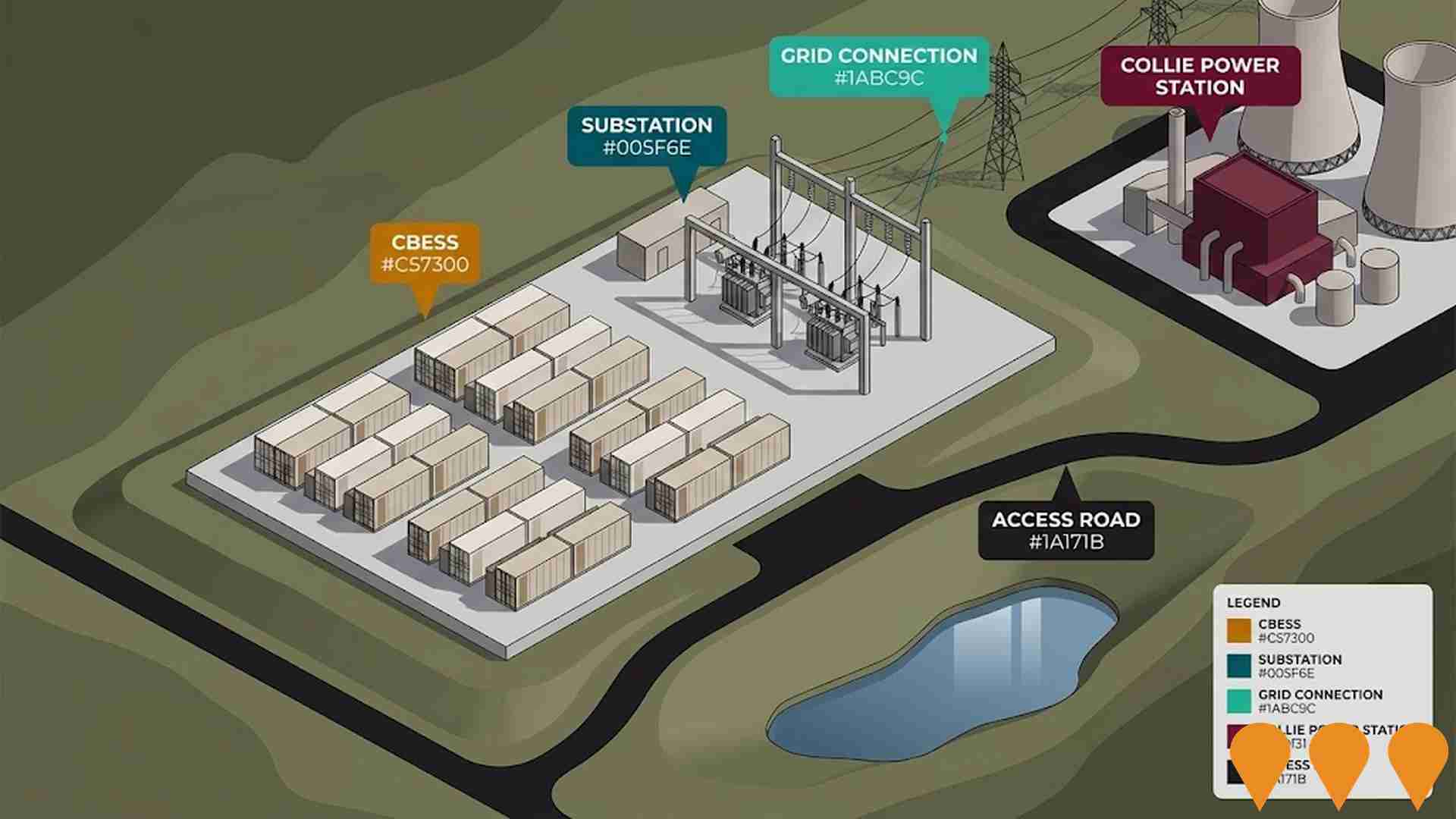

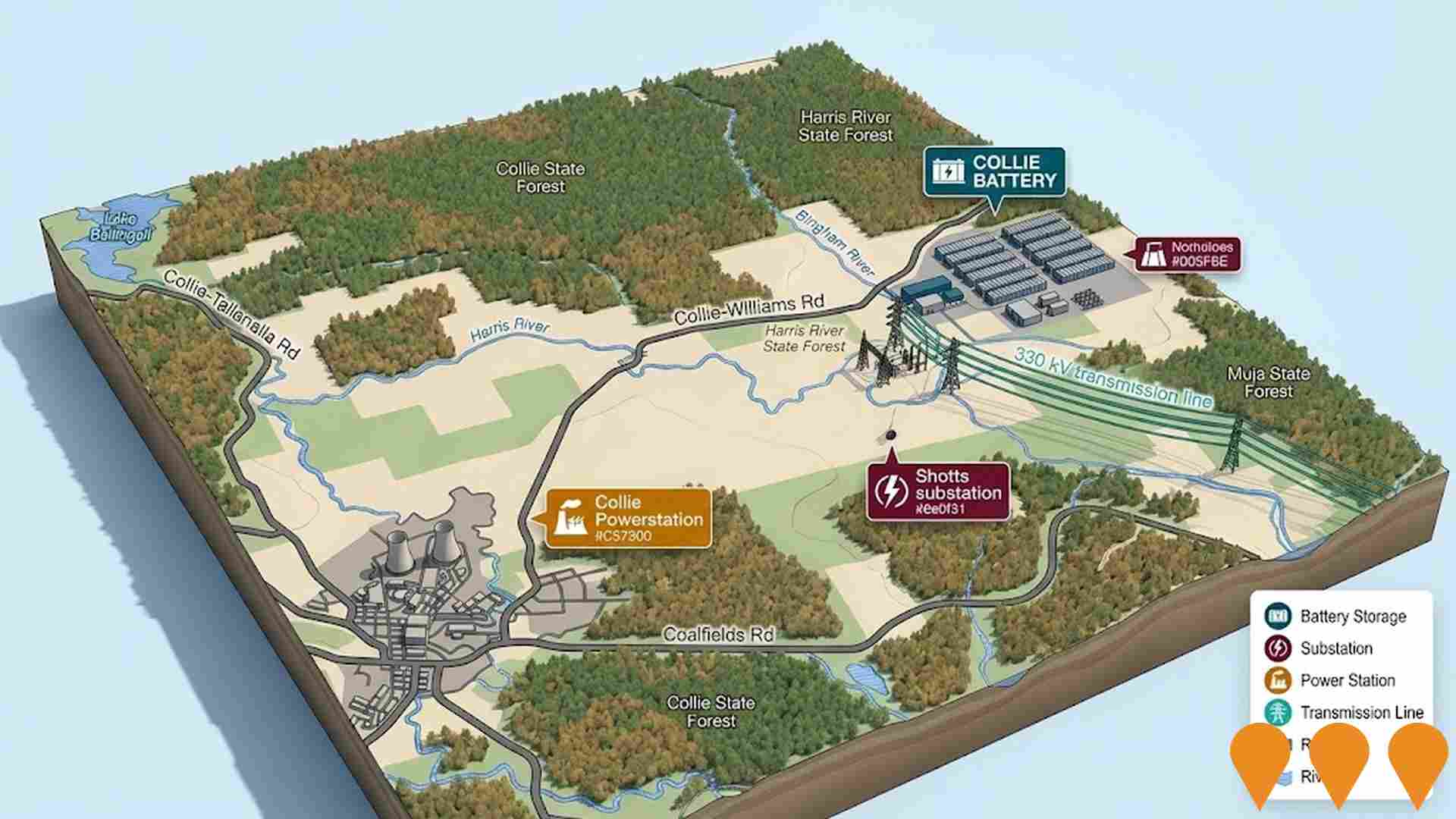

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

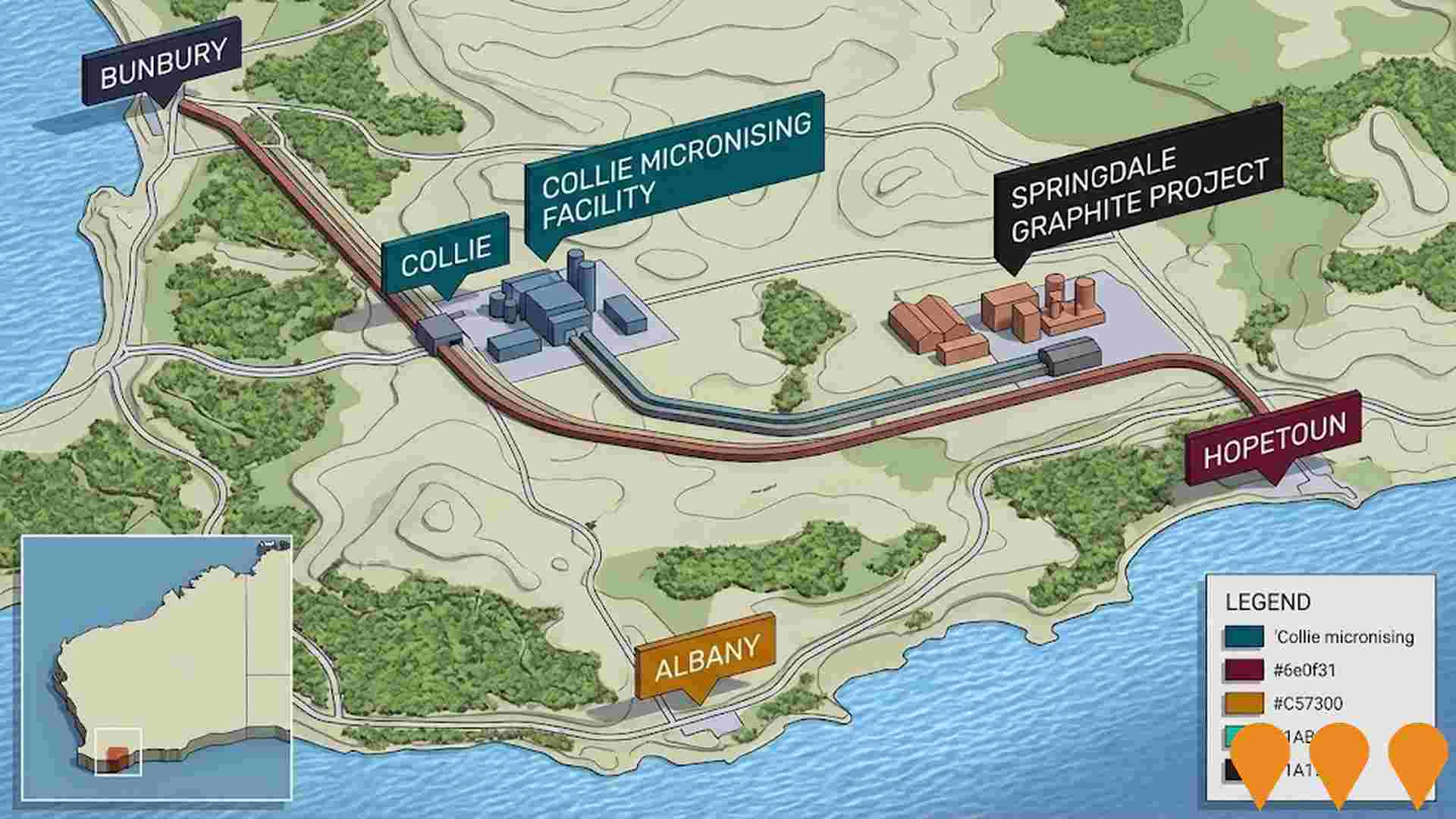

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Bellwether Wind Farm

A flagship renewable energy project for the Wheatbelt region of Western Australia. The proposed wind farm would consist of up to 400 turbines with 6.2MW capacity each over a project area of 100,000 hectares with dozens of landowners, with a potential generation capacity of approximately 3 GW. The project is strategically located along the proposed Clean Energy Link - East transmission line. It would provide drought-resistant incomes to farmers and support local towns with new business opportunities, as well as the chance to retrain or re-skill into the renewable energy sector, while providing power to existing businesses seeking to decarbonize their operations. Construction is proposed to start in 2028 with completion targeted for 2030.

Ambrosia Wind Farm

A 600+ MW wind farm being developed by Green Wind Renewables and Aula Energy to provide large-scale renewable energy into Western Australia's South West Interconnected System (SWIS). The project is expected to comprise up to 100 turbines and is currently in the Early Development phase, with an anticipated commissioning year of 2027.

METRONET High Capacity Signalling Program

The High Capacity Signalling Project will upgrade the existing signalling and control systems to an integrated communications-based train control system, making better use of the existing rail network by allowing more trains to run more often. The project aims to increase network capacity by 40 percent, provide energy-saving benefits, enhance cybersecurity, and future-proof the network for growth.

Collie Steel Mill

Western Australia's first green steel recycling mill, converting local scrap steel into low-emission rebar using electric arc furnace technology. The project aims to be the cleanest and most efficient steel mill in Australia, supporting Collie's transition to a circular economy and creating over 200 jobs.

Coolangatta Industrial Estate Activation

The project involves a $134 million investment to unlock and develop the Coolangatta Industrial Estate in Collie to attract new industries and create jobs as part of the region's transition away from coal. Recent updates include securing land for a graphite processing facility and a potential green steel mill, with infrastructure upgrades progressing.

Collie Battery

Large grid scale battery energy storage system developed by Neoen near Collie in Western Australia. The project has planning approval for up to 1 GW / 4 GWh of storage and is being delivered in stages. Stage 1 (219 MW / 877 MWh) began operating in October 2024 under a 197 MW, 4 hour capacity services contract with the Australian Energy Market Operator. Stage 2 (341 MW / 1,363 MWh) was completed in 2025 and from October 2025 delivers a 300 MW, 4 hour grid capacity service. Together the 560 MW / 2,240 MWh Collie Battery is one of Australias largest operating batteries, able to charge or discharge about 20 percent of average demand on the South West Interconnected System.

Collie Micronising Facility

First purpose-built commercial graphite micronising plant in Australia, comprising a ~3,000 tpa micronising facility in Stage 1, as part of downstream processing and research program for battery anode materials.

Collie Magnesium Plant

A pilot magnesium refinery using carbothermic reduction technology to produce high-purity magnesium from waste resources. The pilot plant opened in January 2025, creating 18 ongoing jobs, with plans for scaled expansion to 100,000 tonnes per annum by 2027.

Employment

AreaSearch analysis reveals Collie recording weaker employment conditions than most comparable areas nationwide

Collie's workforce is balanced across white and blue collar jobs, with manufacturing and industrial sectors prominent. The unemployment rate was 5.6% in September 2024, showing an estimated employment growth of 6.6%.

As of September 2025, 4,425 residents are employed, with an unemployment rate of 5.9%, which is 2.3% higher than Rest of WA's rate of 3.6%. Workforce participation in Collie lags at 51.2%, compared to Rest of WA's 59.4%. Leading employment industries among residents are mining, health care & social assistance, and retail trade. Mining shows strong specialization with an employment share 1.6 times the regional level, while agriculture, forestry & fishing has lower representation at 1.6% versus the regional average of 9.3%.

Over the year to September 2025, employment increased by 6.6%, and unemployment fell by 0.7 percentage points, compared to Rest of WA's employment growth of 1.4% and unemployment fall of 0.2 percentage points. National employment forecasts from Jobs and Skills Australia, published in May-25, project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Collie's employment mix suggests local employment should increase by 5.2% over five years and 11.8% over ten years.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

AreaSearch's latest postcode level ATO data for financial year ended 30 June 2022 shows median income in Collie SA2 was $49,801 and average income was $65,475. This is comparable to national averages but lower than Rest of WA's figures, which were $57,323 (median) and $71,163 (average). Based on Wage Price Index growth of 14.2% from financial year ended 30 June 2022 to September 2025, estimated median income in Collie is approximately $56,873 and average income is $74,772 as of September 2025. According to Census 2021 data, incomes in Collie fall between the 10th and 15th percentiles nationally for households, families, and individuals. The most common income bracket, capturing 27.0% of the community (2,555 individuals), is $1,500 - $2,999, which aligns with metropolitan regions where this cohort represents 31.1%. Despite modest housing costs allowing for 86.8% income retention, total disposable income ranks at just the 19th percentile nationally.

Frequently Asked Questions - Income

Housing

Collie is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Collie, as per the latest Census evaluation, 93.3% of dwellings were houses with the remaining 6.8% comprising semi-detached units, apartments, and other dwelling types. This compares to Non-Metro WA's figures of 88.1% houses and 11.8% other dwellings. Home ownership in Collie stood at 42.3%, with mortgaged dwellings accounting for 37.5% and rented ones making up 20.2%. The median monthly mortgage repayment was $1,300, significantly lower than the Non-Metro WA average of $1,616 and the national figure of $1,863. The median weekly rent in Collie was recorded at $250, substantially below the Non-Metro WA figure of $300 and the national average of $375.

Frequently Asked Questions - Housing

Household Composition

Collie features high concentrations of lone person households, with a lower-than-average median household size

Family households compose 66.2% of all households, including 24.1% couples with children, 29.9% couples without children, and 11.2% single parent families. Non-family households account for the remaining 33.8%, with lone person households at 31.4% and group households comprising 2.5%. The median household size is 2.3 people, which is smaller than the Rest of WA average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Collie faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

In the specified area, university qualification rates are notably lower than the Australian average, with a rate of 7.4%, compared to the national average of 30.4%. This disparity presents both challenges and opportunities for targeted educational initiatives. Bachelor degrees are the most prevalent among residents with higher education qualifications, at 5.7%, followed by graduate diplomas (1.0%) and postgraduate qualifications (0.7%). Vocational credentials are widely held in the area, with 44.9% of residents aged 15 and above possessing them.

Advanced diplomas account for 6.8%, while certificates make up the majority at 38.1%. Educational participation is significantly high, with 26.9% of residents currently enrolled in formal education programs. This includes 10.6% in primary education, 8.8% in secondary education, and 1.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Collie shows that there are three active transport stops currently operating. These stops offer a mix of bus services, with three individual routes serving the area. Together, these routes provide thirteen weekly passenger trips.

The accessibility of transport is rated as limited, with residents typically located 1764 meters away from the nearest transport stop. On average, service frequency across all routes is one trip per day, which equates to approximately four weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Collie is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data indicates significant challenges for Collie with high prevalence of common health conditions across both younger and older age groups.

The rate of private health cover in Collie is approximately 52%, higher than the average SA2 area (~4,959 people). The most prevalent medical conditions are arthritis (10.9%) and mental health issues (9.2%). Conversely, 62.2% of residents report no medical ailments, compared to 66.4% in Rest of WA. Collie has a higher proportion of residents aged 65 and over at 22.0% (2,086 people), compared to the state average of 17.6%.

Frequently Asked Questions - Health

Cultural Diversity

Collie is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Collie's cultural diversity was found to be below average, with 88.8% of its population being citizens, 87.6% born in Australia, and 97.1% speaking English only at home. Christianity is the predominant religion in Collie, comprising 41.3% of people. Notably, the 'Other' category comprises 0.5% of Collie's population compared to 0.6% across Rest of WA.

In terms of ancestry, the top three represented groups are English (34.4%), Australian (32.5%), and Scottish (7.4%). Some ethnic groups show notable differences: Welsh is overrepresented at 1.0% in Collie versus 0.6% regionally, Polish at 1.3% versus 0.7%, and Maori at 0.9% versus 1.0%.

Frequently Asked Questions - Diversity

Age

Collie hosts a notably older demographic compared to the national average

Collie's median age is 44 years, which is higher than the Rest of WA average of 40 years and exceeds the national average of 38 years. The 65-74 age group comprises 13.3% of Collie's population, compared to the Rest of WA's percentage. The 35-44 age group makes up 11.0% of Collie's population. Post-2021 Census data shows that the 15 to 24 age group has grown from 10.8% to 11.5%. Conversely, the 45 to 54 cohort has declined from 12.7% to 11.9%. By 2041, demographic modeling suggests significant changes in Collie's age profile. The 25 to 34 cohort is projected to grow by 42%, adding 439 residents to reach 1,476. However, population declines are projected for the 85+ and 15 to 24 cohorts.