Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Bridgetown - Boyup Brook are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Bridgetown-Boyup Brook's population was 7,822 as of November 2025, reflecting a 10.7% increase from the 2021 Census figure of 7,068 people. This growth is inferred from ABS data showing an estimated resident population of 7,756 in June 2024 and an additional 28 validated new addresses since the census date. The population density was 1.9 persons per square kilometer. The area's growth exceeded the SA3 average (8.1%) and the national average. Interstate migration contributed approximately 89.6% of overall population gains. AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022.

For areas not covered by this data, growth rates by age cohort from the ABS's Greater Capital Region projections (released in 2023, based on 2022 data) are used. By 2041, an above median population growth is projected for regional areas nationwide, with Bridgetown-Boyup Brook expected to expand by 1,110 persons, reflecting a 13.3% increase over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Bridgetown - Boyup Brook among the top 25% of areas assessed nationwide

Bridgetown - Boyup Brook granted approval for approximately 51 residential properties annually. Over the past five financial years, from FY-21 to FY-25, around 255 homes were approved, with an additional 28 approved in FY-26. On average, about 3.5 people moved to the area each year for every dwelling built during this period.

This high demand has led to increased competition among buyers and upward pressure on prices. The average expected construction cost of new homes was $220,000, which is below the regional average, suggesting more affordable housing options. In FY-26, commercial development approvals totaled $4.2 million, indicating limited focus on commercial development compared to other areas in WA.

However, Bridgetown - Boyup Brook has seen slightly higher development activity than the rest of WA over the past five years, with 16.0% more development per person. Building activity has slowed recently, with all new developments consisting of detached dwellings, maintaining the area's traditional low-density character and appealing to those seeking family homes with space. With around 203 people moving in for each dwelling approval, Bridgetown - Boyup Brook shows characteristics of a growth area. According to AreaSearch quarterly estimates, the area is projected to gain approximately 1,044 residents by 2041. Given current development patterns, new housing supply should meet demand, creating favorable conditions for buyers and potentially facilitating further population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Bridgetown - Boyup Brook has limited levels of nearby infrastructure activity, ranking in the 14thth percentile nationally

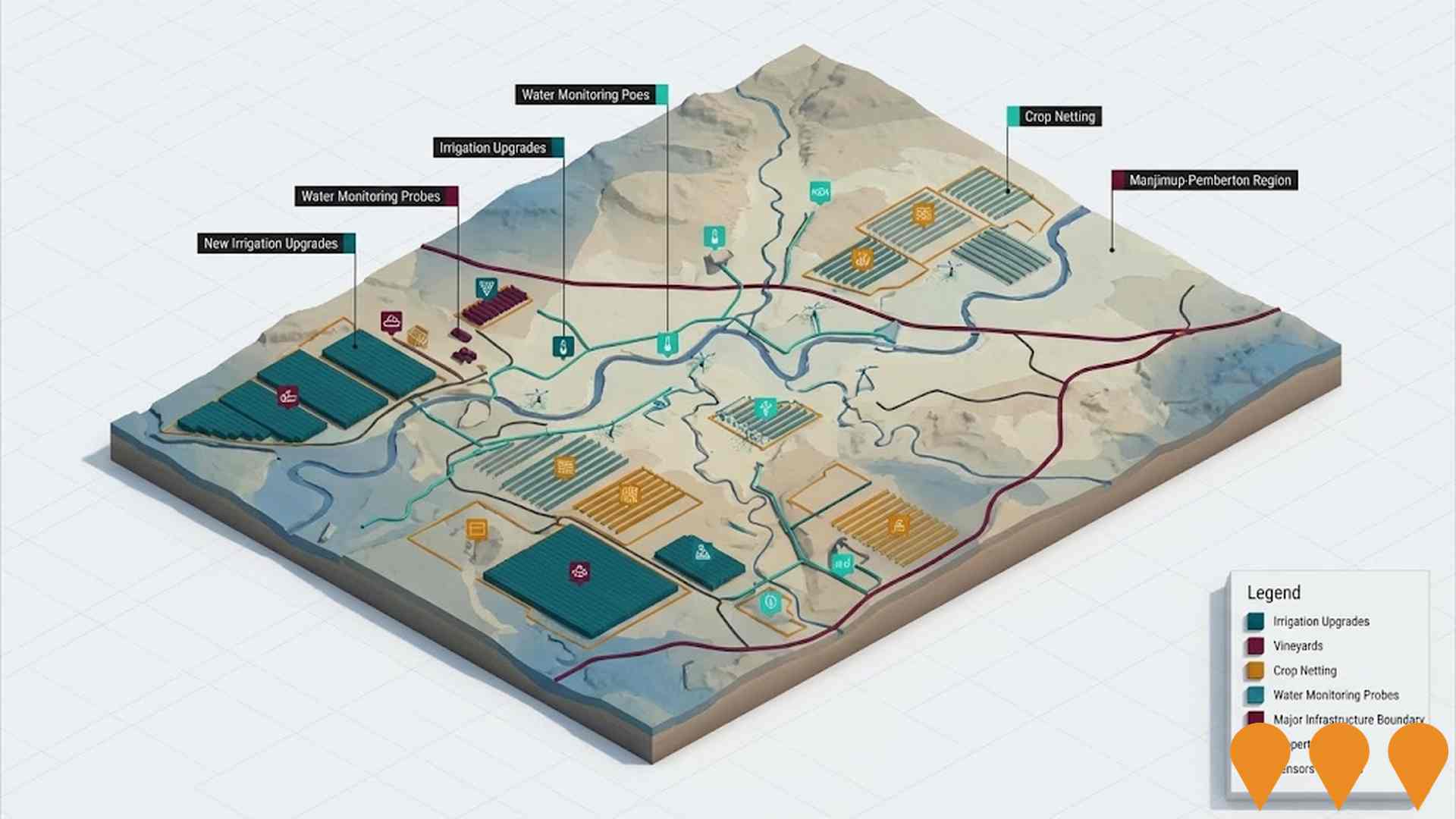

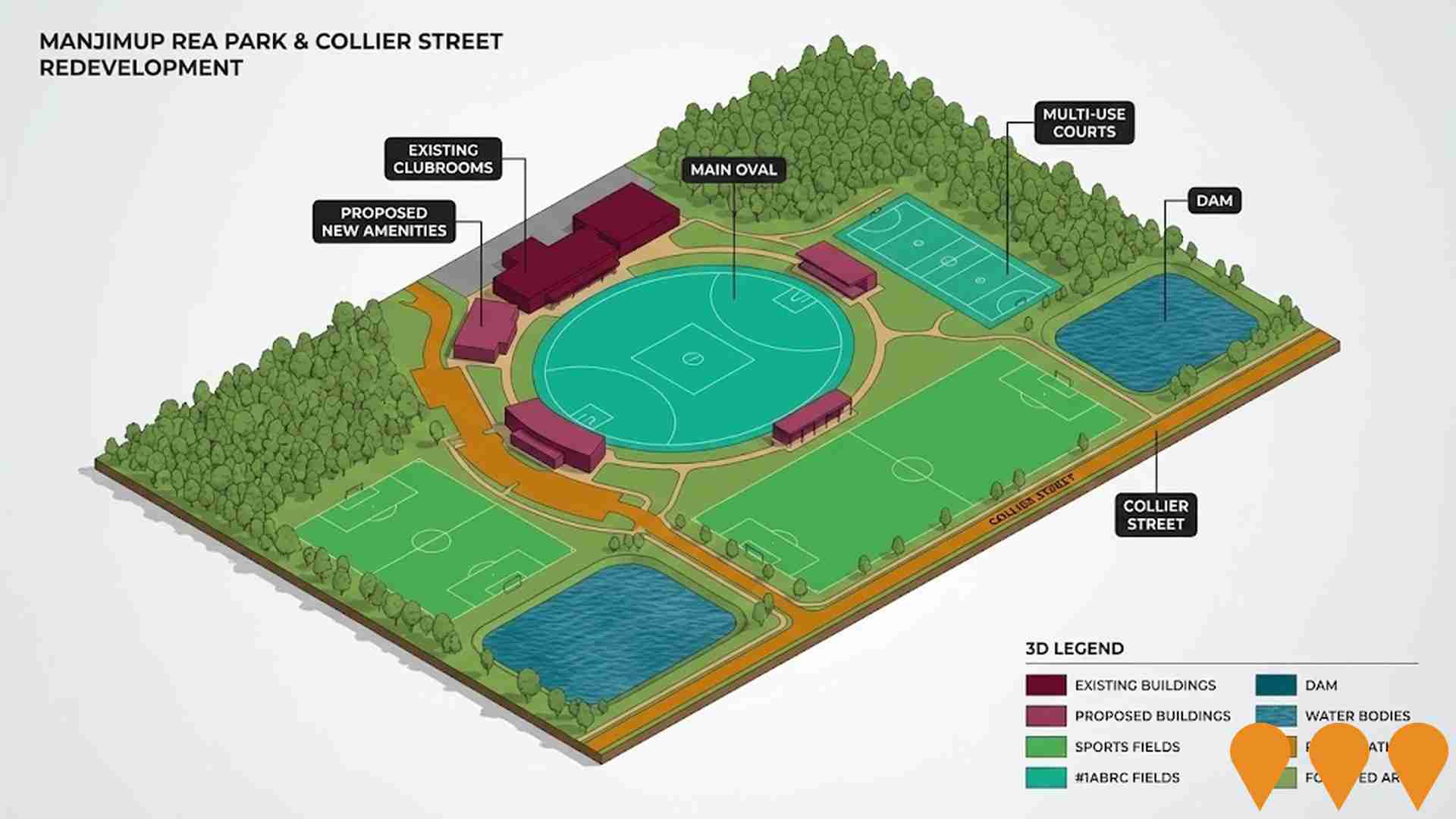

The performance of an area is significantly influenced by changes in local infrastructure, major projects, and planning initiatives. AreaSearch has identified a total of 11 projects that are expected to impact the area. Notable projects include the Greenbushes Lithium Mine Expansion, Global Advanced Metals Tantalum Processing, Manjimup Rea Park & Collier Street Redevelopment, and Shire of Manjimup Town Blueprints. The following list details those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Bellwether Wind Farm

A flagship renewable energy project for the Wheatbelt region of Western Australia. The proposed wind farm would consist of up to 400 turbines with 6.2MW capacity each over a project area of 100,000 hectares with dozens of landowners, with a potential generation capacity of approximately 3 GW. The project is strategically located along the proposed Clean Energy Link - East transmission line. It would provide drought-resistant incomes to farmers and support local towns with new business opportunities, as well as the chance to retrain or re-skill into the renewable energy sector, while providing power to existing businesses seeking to decarbonize their operations. Construction is proposed to start in 2028 with completion targeted for 2030.

Greenbushes Lithium Mine Expansion

Expansion of the existing lithium mine to substantially increase production capacity of spodumene ore and lithium mineral concentrate. The proposal includes construction of new waste rock landforms (S2 and S8 WRL), expansion of existing dams to create the larger Salt Water Gully Dam (SWG Dam), a highway crossing (overpass or underpass), and additional supporting infrastructure. The proposal will increase the development envelope by 28% to 2,826 hectares and requires state and federal environmental approvals.

Ambrosia Wind Farm

A 600+ MW wind farm being developed by Green Wind Renewables and Aula Energy to provide large-scale renewable energy into Western Australia's South West Interconnected System (SWIS). The project is expected to comprise up to 100 turbines and is currently in the Early Development phase, with an anticipated commissioning year of 2027.

Manjimup Town Centre Revitalisation

Multi-stage renewal delivering eight components including Brockman Street town square canopy and CBD streetscape, Manjimup Timber and Heritage Park upgrades (Power Up Museum and State Timber Museum), linear recreation park, new access points and town entries, highway enhancements and pedestrian/cycling links. Key construction elements were completed by 2020 with Heritage Park works finished in 2018.

Manjimup Rea Park & Collier Street Redevelopment

Staged renewal of the Rea Park and Collier Street sporting precinct to create a premier multi-sport community facility. Stage 1 (power and LED field lighting) is complete. The Shire is now seeking funding for Stage 2 works including ground upgrades, drainage and amenities.

Manjimup Timber and Heritage Park Revitalisation

Revitalisation of the Manjimup Heritage Park as part of the Manjimup Town Centre Revitalisation, delivering refurbished museums (State Timber Museum and Power Up Electricity Museum), new and upgraded park entries, cafe and visitor amenities, extensive landscaping and paths, the Sandra Donovan Sound Shell and a major adventure playground, strengthening the site as a regional tourism and community hub.

Lake Towerrinning Upgrade Project

Upgrade funded under the Australian Government LRCI Round 3 to extend the public boat ramp, add an all-access boardwalk and accessible ramp to the BBQ area, and convert the old change rooms to all-weather seating. Works complement earlier jetty refurbishment and playground/shade upgrades, improving universal access and visitor amenity at this key recreation lake.

Shire of Manjimup Town Blueprints

Community planning program to prepare five new Town Blueprints for Manjimup, Northcliffe, Walpole, Pemberton and Quinninup. The Blueprints will guide land use, infrastructure and economic priorities for the next decade and inform the Shire's new Council Plan.

Employment

AreaSearch analysis places Bridgetown - Boyup Brook well above average for employment performance across multiple indicators

Bridgetown-Boyup Brook has a skilled workforce with strong manufacturing and industrial sectors. The unemployment rate was 2.4% in September 2025, compared to the Rest of WA's 3.3%.

Employment growth over the past year was estimated at 6.6%. As of September 2025, 4,099 residents were employed, with workforce participation at 54.7%, below the Rest of WA's 59.4%. Leading employment industries include agriculture, forestry & fishing, mining, and health care & social assistance. The area specializes in agriculture, forestry & fishing, with an employment share 2.1 times the regional level.

Conversely, construction shows lower representation at 6.3% compared to the regional average of 8.9%. Over the year to September 2025, employment increased by 6.6%, while labour force grew by 6.0%, reducing unemployment by 0.5 percentage points. Rest of WA recorded employment growth of 1.4%, with unemployment falling by 0.2 percentage points during this period. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years for national employment. Applying these projections to Bridgetown-Boyup Brook's employment mix suggests local employment should increase by 5.1% over five years and 11.6% over ten years, based on a simple weighting extrapolation.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows median income in Bridgetown - Boyup Brook SA2 is $47,909 and average income is $64,917. These figures are comparable to national averages. In contrast, Rest of WA has a median income of $57,323 and an average income of $71,163. Based on Wage Price Index growth of 14.2% since financial year 2022, estimated incomes as of September 2025 are approximately $54,712 (median) and $74,135 (average). Census 2021 income data indicates household, family, and personal incomes in Bridgetown - Boyup Brook fall between the 15th and 17th percentiles nationally. The $1,500 - $2,999 earnings band captures 27.7% of the community (2,166 individuals), similar to metropolitan regions where this cohort represents 31.1%. Housing costs are modest with 87.8% of income retained. Total disposable income ranks at the 20th percentile nationally and the area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Bridgetown - Boyup Brook is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Bridgetown-Boyup Brook's dwellings were 96.6% houses and 3.4% other types (semi-detached, apartments, 'other') in the latest Census, compared to Non-Metro WA's 95.2% houses and 4.9% others. Home ownership was 48.3%, with mortgaged dwellings at 34.3% and rented ones at 17.5%. Median monthly mortgage repayments were $1,327, lower than Non-Metro WA's average of $1,387. Median weekly rent was $260, slightly higher than Non-Metro WA's $250. Nationally, Bridgetown-Boyup Brook had significantly lower mortgage repayments ($1,327 vs $1,863) and substantially lower rents ($260 vs $375).

Frequently Asked Questions - Housing

Household Composition

Bridgetown - Boyup Brook has a typical household mix, with a fairly typical median household size

Family households make up 70.3% of all households, including 24.1% couples with children, 37.9% couples without children, and 7.6% single parent families. Non-family households account for the remaining 29.7%, with lone person households at 27.7% and group households comprising 2.1%. The median household size is 2.3 people, which matches the average for the Rest of WA.

Frequently Asked Questions - Households

Local Schools & Education

Bridgetown - Boyup Brook shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's university qualification rate is 17.8%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 13.5%, followed by postgraduate qualifications (2.2%) and graduate diplomas (2.1%). Vocational credentials are prominent, with 43.3% of residents aged 15+ holding them - advanced diplomas at 11.3% and certificates at 32.0%. Educational participation is high, with 26.4% of residents currently enrolled in formal education.

This includes 11.1% in primary education, 8.7% in secondary education, and 1.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in the Bridgetown-Boyup Brook area shows that there are eight active transport stops currently operating. These stops serve a mix of bus routes, with four individual routes providing service. In total, these routes offer thirty weekly passenger trips.

The accessibility to these transport services is rated as limited, with residents typically residing 1960 meters away from the nearest stop. On average, there are four trips per day across all routes, which equates to approximately three weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Bridgetown - Boyup Brook is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Bridgetown - Boyup Brook faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is approximately 52% of the total population (~4,059 people), leading that of the average SA2 area compared to 49.8% across Rest of WA.

The most common medical conditions in the area are arthritis and mental health issues, impacting 11.0 and 8.9% of residents respectively, while 64.9% declared themselves completely clear of medical ailments compared to 65.4% across Rest of WA. As of 2016, 23.6% of residents are aged 65 and over (1,849 people). Health outcomes among seniors in the area perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Bridgetown - Boyup Brook ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Bridgetown-Boyup Brook, surveyed in June 2016, showed low cultural diversity with 87.1% citizens, 78.7% born in Australia, and 96.6% speaking English only at home. Christianity was the dominant religion, comprising 44.0%. The 'Other' category was similarly represented at 0.6%, matching regional levels.

Top ancestral groups were English (37.9%), Australian (29.5%), and Scottish (7.9%). Notably, Dutch (1.9%) and Welsh (0.7%) were overrepresented compared to regional averages of 1.6% and 0.6% respectively. New Zealanders also showed higher representation at 0.9%, compared to the region's 0.8%.

Frequently Asked Questions - Diversity

Age

Bridgetown - Boyup Brook ranks among the oldest 10% of areas nationwide

Bridgetown - Boyup Brook has a median age of 49, which is higher than the Rest of WA figure of 40 and significantly higher than the national norm of 38. The 65-74 age group shows strong representation at 14.9%, compared to 12.7% in Rest of WA and 9.4% nationally. Conversely, the 25-34 cohort is less prevalent at 8.9%. Post-2021 Census data shows the 25 to 34 age group grew from 7.2% to 8.9%, while the 15 to 24 cohort increased from 8.0% to 9.6%. Meanwhile, the 65 to 74 cohort declined from 16.5% to 14.9% and the 75 to 84 group dropped from 8.2% to 6.8%. By 2041, Bridgetown - Boyup Brook is expected to see notable shifts in its age composition, with the 25 to 34 group growing by 60% to reach 1,117 people from 697. The 15 to 24 and 85+ cohorts are expected to experience population declines.