Chart Color Schemes

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Mowbray reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on AreaSearch's analysis, Mowbray's population is around 4,189 as of Nov 2025. This reflects an increase of 141 people since the 2021 Census, which reported a population of 4,048 people. The change is inferred from the estimated resident population of 4,142 from the ABS as of June 2024 and an additional 26 validated new addresses since the Census date. This level of population equates to a density ratio of 451 persons per square kilometer. Mowbray's 3.5% growth since census positions it within 0.4 percentage points of the SA3 area (3.9%), demonstrating competitive growth fundamentals. Population growth for the area was primarily driven by overseas migration that contributed approximately 84.9% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, and to estimate growth by age group in the years post-2032, the Tasmania State Government's Regional/LGA projections are adopted with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. Anticipating future population dynamics, Over this period, projections indicate a decline in overall population, with the area's population expected to reduce by 16 persons by 2041 according to this methodology. However, growth across specific age cohorts is anticipated, led by the 45 to 54 age group, which is projected to expand by 72 people.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Mowbray according to AreaSearch's national comparison of local real estate markets

Mowbray averaged approximately 10 new dwelling approvals annually from FY-21 to FY-25, with a total of 54 homes approved during this period. In FY-26, 6 dwellings have been approved so far. The average annual increase in residents per dwelling constructed over these years was 0.9.

This pace suggests that new construction is keeping up with or exceeding demand, providing more options for buyers and potentially driving population growth beyond current projections. The average expected construction cost value of new homes was $331,000, aligning with regional patterns. In FY-26, $1.3 million in commercial development approvals have been recorded, indicating a predominant focus on residential development. Compared to the Rest of Tas., Mowbray accounts for about 59% of building activity per capita but ranks at the 49th percentile nationally when considering areas assessed.

This suggests more limited housing choices for buyers compared to other regions, supporting demand for existing properties. The area's development activity is below average nationally, which could be attributed to its maturity and possible planning constraints. Recent development in Mowbray has exclusively consisted of detached dwellings, maintaining the area's traditional low-density character with a focus on family homes that appeal to those seeking space. Notably, developers are constructing more detached housing than the existing pattern implies (85.0% at Census), reflecting persistent strong demand for family homes despite densification trends. The estimated population per dwelling approval in Mowbray is 381 people, indicating a quiet and low-activity development environment. Given that population is expected to remain stable or decline, there may be reduced pressure on housing in the area, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

Mowbray has limited levels of nearby infrastructure activity, ranking in the 8thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 22 projects likely to affect the area. Key projects include Northern Suburbs Community Recreation Hub (The Hub), kanamaluka Cultural Centre (Incorporating Conference & Exhibition Space), UTAS Stadium Redevelopment, and Newnham Subdivision (Fairlands Property). The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Launceston General Hospital Northern Integrated Mental Health Precinct

New Northern Integrated Mental Health Precinct at Launceston General Hospital comprising a 30-bed Acute Mental Health Unit, 5-bed Short Stay Unit, Recovery College, Safe Haven cafe, and expanded community mental health services. Construction commenced in 2025 as part of the broader LGH Redevelopment Master Plan.

kanamaluka Cultural Centre (Incorporating Conference & Exhibition Space)

Proposed $70 million cultural centre and conference facility, a joint venture between developer Errol Stewart (JMC) and the Tasmanian Symphony Orchestra. The centre is planned to include a 750-seat concert hall, a 1,000-seat conference and exhibition centre, a black-box theatre, and a First Nations cultural space. The project is awaiting state and federal funding commitments and a development application submission. The previous name, 'Silo Convention Entertainment Centre' appears to have evolved into this new, larger proposal.

Northern Suburbs Community Recreation Hub (The Hub)

A $43.6 million (Stage 2) multi-purpose community sport and recreation hub in Mowbray, Launceston. Stage 2 delivers over 10,000 sqm of indoor space with 7 courts (4 dedicated netball, 3 multi-use), rock climbing wall, gymnastics area, gym/dojo/boxing/weights, cafe, community rooms, youth space and spectator seating. As of October 2025, construction is approximately 85% complete by Vos Construction & Joinery, with practical completion expected mid-2026 (delayed from early 2026 due to supply chain and weather impacts). Stage 3 ($18.8 million, 4 additional courts) remains in concept/planning phase with no firm start date. Funded through the Launceston City Deal (Australian Government, Tasmanian Government, City of Launceston).

UTAS Stadium Redevelopment

The $130 million redevelopment of UTAS Stadium (York Park) in Launceston is transforming it into a world-class sporting and entertainment venue. Key features include a new Centre West Stand with premium seating, corporate and hospitality facilities, media spaces; a fully redeveloped Eastern Stand with 3,629 new seats and modern amenities; Western Stand infill adding over 2,000 seats total and more than 50 accessible seats; upgraded sports lighting, safety features, spectator facilities, and LED ribbon board. Main construction by Fairbrother Pty Ltd commenced in 2025, with completion expected early 2027 ahead of the Tasmania Football Club's AFL/AFLW entry in 2028. The stadium continues to host events during construction. Managed by Stadiums Tasmania with funding from Tasmanian and Australian Governments.

Flood Levee Protected Areas Specific Area Plan

This is a Planning Scheme Amendment (PSA-LLP0029) to the Tasmanian Planning Scheme - Launceston Local Provisions Schedule. It proposes to remove the Invermay/Inveresk Flood Inundation Specific Area Plan and related overlays, insert the Flood Levee Protected Areas Specific Area Plan and related overlays (LAU-S17), and modify the Flood-Prone Areas Hazard Code overlay map (C12.0). The purpose is to enhance flood management and protection for areas protected by the levee system, with a focus on future land use and development being managed to minimise flood risk. This specific plan is related to the broader Launceston Flood Protection Scheme.

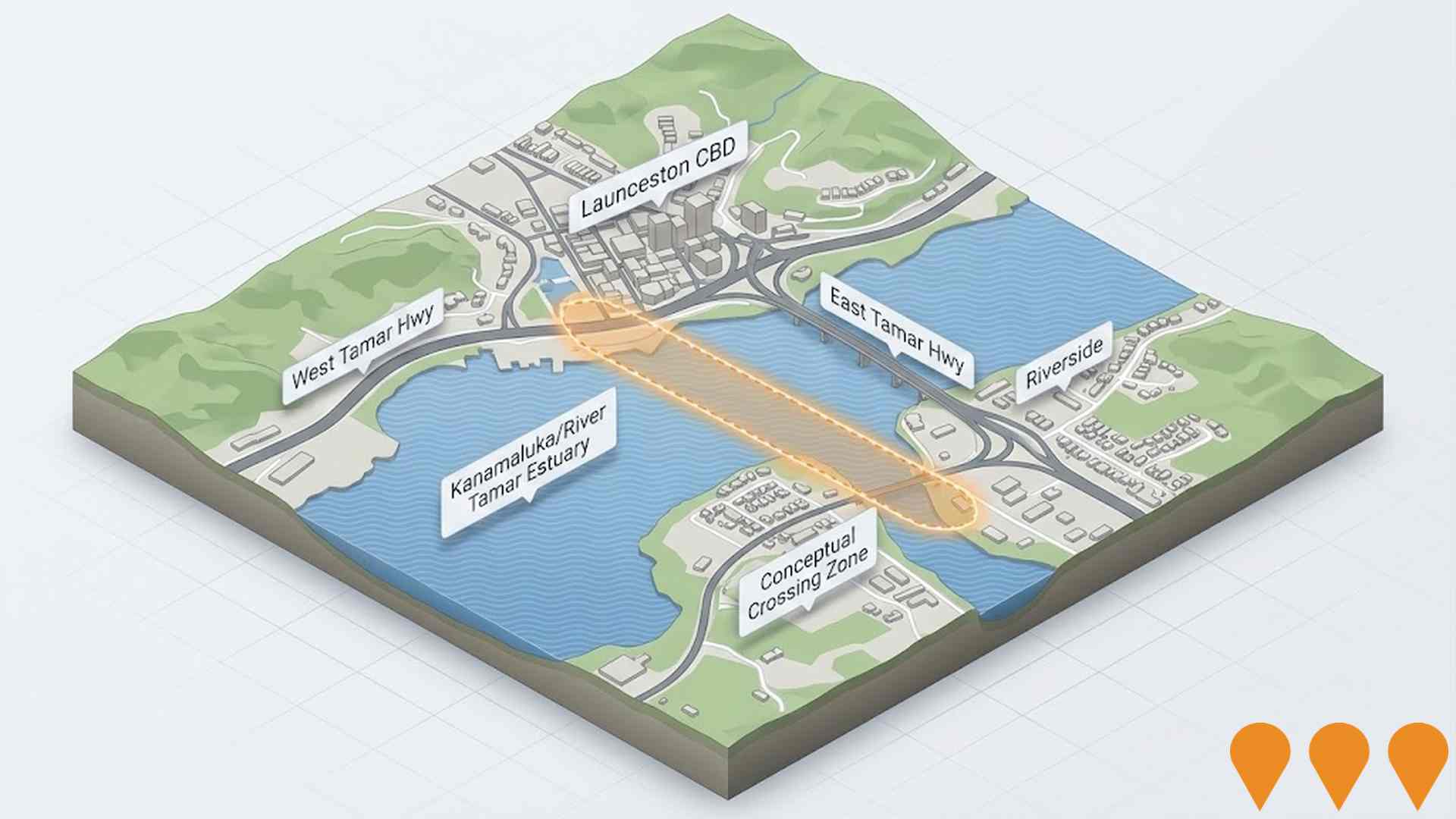

Second Kanamaluka/River Tamar Crossing

A second multi-modal bridge crossing of the kanamaluka / River Tamar between the East and West Tamar Highways in Launceston to improve travel time reliability, reduce congestion through Riverside, Trevallyn and the Launceston CBD, enhance safety, and provide active transport pathways. Community consultation on five options closed in April 2025; feedback is informing the preferred option and business case development (as of November 2025, no preferred option yet selected).

Newnham Campus Development Strategy

The Newnham Campus Development Strategy aims to revitalize the UTAS Newnham Campus into a vibrant, inclusive, and sustainable hub with mixed uses including housing, community spaces, health services, and educational facilities, emphasizing cultural significance, sustainability, and community engagement through phased development over a 20-year horizon. Key features include expansion of the Australian Maritime College, a $30 million Defence and Maritime Innovation and Design Precinct, a $15 million Defence Cadet facility, and a new Tasmanian Agricultural Precinct.

Ravenswood Subdivision

A planned subdivision on a 12.6 hectare site at 50 Wildor Crescent, Ravenswood, delivering approximately 100 residential lots ranging from 501 square metres to 1863 square metres. The development includes 4421 square metres of public open space and a new road with two junctions to Wildor Crescent. Most lots will initially be available through the MyHome shared equity program, with open market sales after 30 days. The site was transferred to Homes Tasmania in June 2023 under a Housing Land Supply Order.

Employment

AreaSearch assessment indicates Mowbray faces employment challenges relative to the majority of Australian markets

Mowbray has a skilled workforce with diverse sector representation and an unemployment rate of 6.6%. Over the past year, it has maintained relative employment stability.

As of June 2025, 2,066 residents are employed while the unemployment rate is 2.7% higher than Rest of Tas.'s rate of 3.9%. Workforce participation in Mowbray stands at 59.0%, slightly above Rest of Tas.'s 55.7%. Key industries for employment among residents include health care & social assistance, retail trade, and accommodation & food. Notably, the concentration in accommodation & food is high, with employment levels at 1.5 times the regional average.

Conversely, construction is under-represented, employing only 5.6% of Mowbray's workforce compared to Rest of Tas.'s 8.9%. While local employment opportunities exist, many residents commute elsewhere for work based on Census data. Over the 12 months to June 2025, labour force levels in Mowbray decreased by 1.3% while employment declined by 0.3%, leading to a fall in unemployment rate of 1.0 percentage points. In comparison, Rest of Tas. saw employment fall by 0.5%, labour force contract by 0.6%, and a marginal decrease in unemployment. State-level data to Nov-25 shows TAS employment contracted by 0.35% (losing 2,010 jobs) with an unemployment rate of 4.1%, slightly below the national unemployment rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that over five years, national employment will expand by 6.6%. Over ten years, this growth is projected to reach 13.7%. Applying these projections to Mowbray's employment mix indicates potential local employment increases of 6.3% over five years and 13.4% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

In AreaSearch's latest postcode level ATO data released for financial year 2022, Mowbray SA2's median income among taxpayers is $42,608. The average income in the area is $47,116. This is below the national average. In comparison, Rest of Tas.'s median income is $47,358 with an average of $57,384. Based on Wage Price Index growth of 13.83% since financial year 2022, estimated incomes for September 2025 would be approximately $48,501 (median) and $53,632 (average). Census data shows that household, family, and personal incomes in Mowbray fall between the 9th and 10th percentiles nationally. Income brackets indicate that 31.6% of locals (1,323 people) earn between $800 - 1,499, differing from broader area patterns where $1,500 - 2,999 is dominant at 28.5%. Housing affordability pressures are severe in the area, with only 82.0% of income remaining after housing costs, ranking at the 9th percentile nationally.

Frequently Asked Questions - Income

Housing

Mowbray is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Dwelling structure in Mowbray, as per the latest Census, consisted of 84.6% houses and 15.4% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro Tas.'s 82.1% houses and 17.9% other dwellings. Home ownership in Mowbray was at 25.6%, with the rest being mortgaged (23.3%) or rented (51.1%). The median monthly mortgage repayment was $1,050, lower than Non-Metro Tas.'s average of $1,300. Median weekly rent in Mowbray was $290, compared to Non-Metro Tas.'s $280. Nationally, Mowbray's mortgage repayments were significantly lower at $1,050 versus the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Mowbray features high concentrations of group households and lone person households, with a higher-than-average median household size

Family households account for 58.8 percent of all households, including 21.7 percent couples with children, 20.6 percent couples without children, and 14.9 percent single parent families. Non-family households constitute the remaining 41.2 percent, with lone person households at 31.2 percent and group households comprising 9.8 percent of the total. The median household size is 2.5 people, larger than the Rest of Tas. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Mowbray shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's educational profile is notable regionally with university qualification rates at 25.9%, surpassing the Rest of Tas. average of 19.3%. This reflects the community's emphasis on higher education. Bachelor degrees are most prevalent at 14.2%, followed by postgraduate qualifications (10.2%) and graduate diplomas (1.5%).

Trade and technical skills are prominent, with 29.0% of residents aged 15+ holding vocational credentials – advanced diplomas (6.5%) and certificates (22.5%). Educational participation is high, with 34.2% of residents currently enrolled in formal education. This includes 9.6% in primary education, 9.2% in tertiary education, and 6.7% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Public transport analysis reveals seven active transport stops operating within Mowbray. These stops are serviced by thirty-three individual routes, collectively providing three thousand forty-two weekly passenger trips. Transport accessibility is rated as moderate, with residents typically located five hundred twenty-six meters from the nearest transport stop.

Service frequency averages four hundred thirty-four trips per day across all routes, equating to approximately four hundred thirty-four weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Mowbray is lower than average with common health conditions somewhat prevalent across the board, though to a considerably higher degree among older age cohorts

Mowbray faces significant health challenges with common health conditions somewhat prevalent across the board, particularly among older age cohorts. The rate of private health cover is extremely low at approximately 46%, affecting around 1,926 people in total. This compares to a state average of 50.6%.

The most common medical conditions in the area are mental health issues and arthritis, impacting 10.2% and 8.6% of residents respectively. Meanwhile, 68.1% of residents declare themselves completely clear of medical ailments, compared to 63.9% across the rest of Tasmania. The area has 13.5% of residents aged 65 and over, which is lower than the state average of 19.9%. However, health outcomes among seniors present some challenges that require more attention than the broader population.

Frequently Asked Questions - Health

Cultural Diversity

Mowbray was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Mowbray's population was found to be more culturally diverse than most local markets, with 33.1% born overseas and 30.2% speaking a language other than English at home. Christianity was the predominant religion in Mowbray, comprising 36.2% of its population. Notably, the 'Other' religious category made up 3.2%, compared to 1.1% across Rest of Tas.

In terms of ancestry, the top three groups were Australian (27.6%), English (26.7%), and Other (18.4%). The Australian Aboriginal group was overrepresented at 3.7% in Mowbray, compared to 2.7% regionally. Similarly, Chinese (3.8% vs 1.6%) and Korean (0.3% vs 0.1%) groups were also notably more prevalent in Mowbray than the regional averages.

Frequently Asked Questions - Diversity

Age

Mowbray hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Mowbray has a median age of 32, which is considerably lower than the Rest of Tas. figure of 45. This is also significantly lower than Australia's median age of 38 years. Compared to the Rest of Tas. average, Mowbray has an over-representation of the 25-34 cohort (23.7% locally) and an under-representation of the 65-74 year-olds (6.9%). This concentration of the 25-34 age group is well above the national average of 14.5%. Between 2021 and present, the 35 to 44 age group has grown from 12.5% to 14.5%, while the 55 to 64 cohort increased from 9.9% to 11.5%. Conversely, the 5 to 14 cohort has declined from 11.0% to 8.7%, and the 45 to 54 group dropped from 10.0% to 8.6%. Demographic modeling suggests Mowbray's age profile will evolve significantly by 2041. The 45 to 54 age cohort is projected to expand by 82 people (23%), growing from 360 to 443. Notably, the combined 65+ age groups are expected to account for 63% of total population growth, reflecting the area's aging demographic profile. Meanwhile, the 0 to 4 and 55 to 64 cohorts are projected to experience population declines.