Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Stockton reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, Stockton's estimated population is around 4,386 as of Nov 2025. This reflects an increase of 340 people (8.4%) since the 2021 Census, which reported a population of 4,046. The change was inferred from AreaSearch's resident population estimate of 4,339 following examination of ABS' latest ERP data release in June 2024 and an additional 31 validated new addresses since the Census date. Stockton's population density ratio is 1,191 persons per square kilometer, relatively in line with averages seen across locations assessed by AreaSearch. Stockton's growth exceeded the non-metro area (5.7%) and SA3 area, marking it as a growth leader. Population growth was primarily driven by interstate migration contributing approximately 80% of overall population gains.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area released in 2024 with 2022 as the base year and NSW State Government's SA2-level projections where applicable, projecting growth rates by age group from these aggregations to all areas for years 2032 to 2041. Considering projected demographic shifts, exceptional growth is predicted over this period, placing Stockton in the top 10 percent of national regional areas with an expected increase of 2,355 persons to 2041, reflecting a total increase of 53% over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Stockton when compared nationally

AreaSearch analysis of ABS building approval numbers indicates Stockton has received approximately 20 dwelling approvals per year over the past five financial years. This totals an estimated 100 homes from FY-21 to FY-25. As of FY-26, three approvals have been recorded. On average, 4.7 new residents are associated with each home built in Stockton during these years.

This demand outpaces supply, potentially putting upward pressure on prices and increasing buyer competition. The average construction cost value for new properties is $551,000, suggesting a focus on the premium segment. In FY-26, $6.5 million in commercial development approvals have been recorded, indicating the area's residential character.

Comparatively, Stockton has 10.0% less new development per person than the Rest of NSW. Nationally, it ranks at the 62nd percentile for areas assessed. New development consists of 76.0% detached houses and 24.0% attached dwellings, maintaining Stockton's suburban nature with a preference for detached housing attracting space-seeking buyers. The population per approval is around 239 people. AreaSearch's latest quarterly estimate projects Stockton to grow by 2,325 residents by 2041. If current construction levels continue, housing supply may lag behind population growth, likely intensifying buyer competition and supporting price growth.

Frequently Asked Questions - Development

Infrastructure

Stockton has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

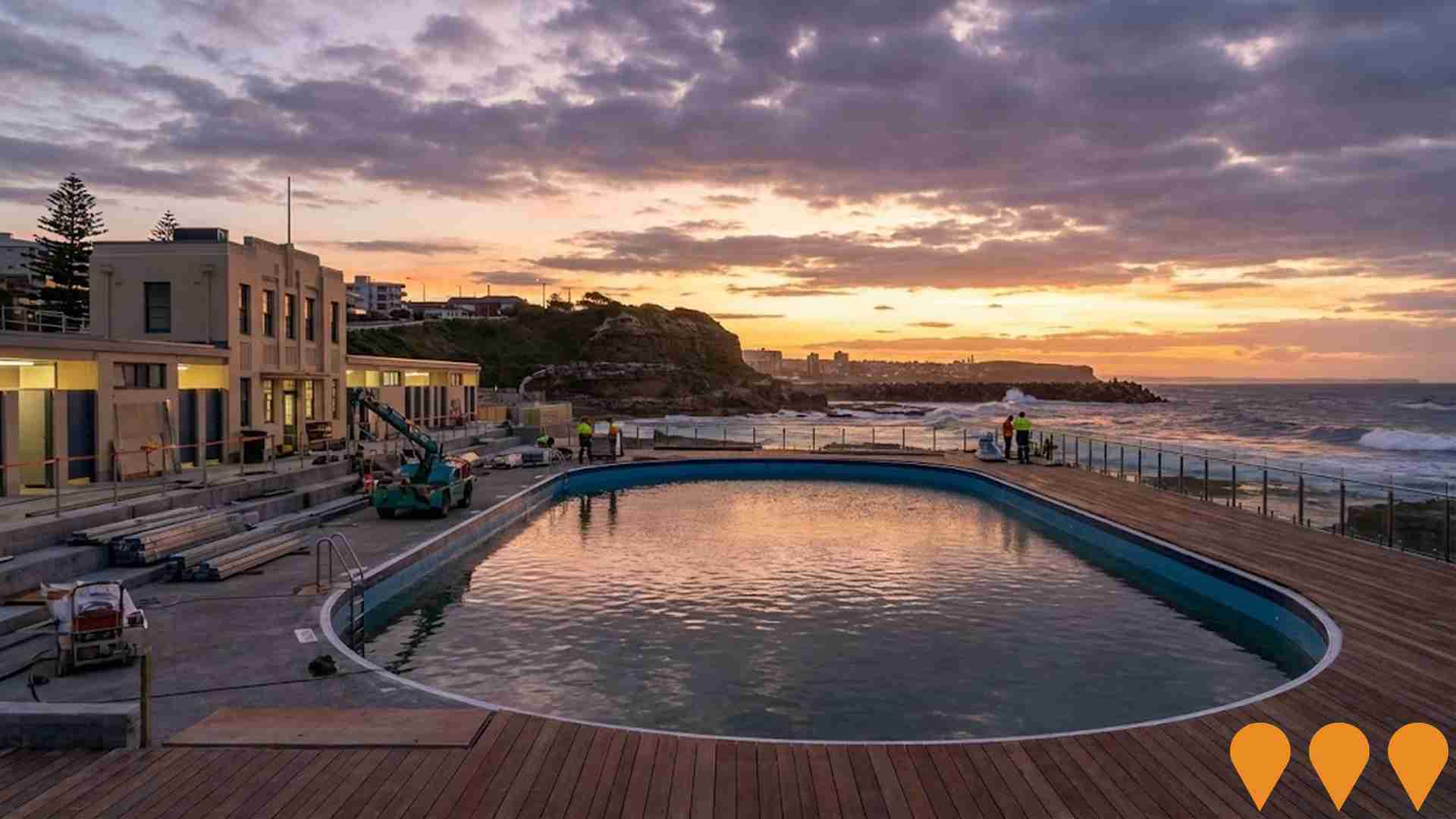

Changes in local infrastructure significantly affect an area's performance. AreaSearch has identified 24 projects likely to impact the area. Notable ones include Stockton Centre Repurposing, Dairy Farmers Towers, Hunter Valley Hydrogen Hub, and Pottery Lane Residential Development - Newcastle. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Port of Newcastle Master Plan 2040

The Port Master Plan 2040 is a long-term strategic framework for diversifying and expanding the Port of Newcastle. Central to the plan is the Clean Energy Precinct (CEP) on Kooragang Island, a 220-hectare hub for the production, storage, and export of green hydrogen and ammonia, with construction slated for 2027 and full operations by 2030. Other major pillars include the $2.4 billion Newcastle Deepwater Container Terminal (NDCT), designed to handle 2 million TEUs annually, and the expansion of the Mayfield Precinct into a multi-purpose cargo facility to reduce reliance on coal trade.

Hunter Valley Hydrogen Hub

The Hunter Valley Hydrogen Hub (HVHH) is a commercial-scale renewable hydrogen production facility led by Orica. The first phase features a 50 MW electrolyser designed to produce approximately 4,700 tonnes of green hydrogen annually, primarily to decarbonize Orica's adjacent ammonia plant by replacing natural gas feedstock. The project achieved a major milestone in July 2025 with an award of $432 million through the federal Hydrogen Headstart program. While Origin Energy exited the joint venture in late 2024, Orica remains the primary developer, with construction expected to start in mid-2025 and commissioning targeted for 2028.

High Speed Rail - Newcastle to Sydney (Stage 1)

The first stage of Australia's High Speed Rail network involves a 194km dedicated rail line connecting Newcastle to Sydney. The project features trains reaching speeds of 320 km/h on surface sections and 200 km/h in tunnels, aiming to reduce travel time to approximately one hour. Following the 2025 business case evaluation, the project has moved into a two-year Development Phase focusing on design refinement (to 40% maturity), securing planning approvals, and corridor preservation. The route includes approximately 115km of tunneling and six planned stations: Broadmeadow, Lake Macquarie, Gosford, Sydney Central, Parramatta, and Western Sydney International Airport.

Dairy Farmers Towers

Newcastle's tallest residential towers comprising 191 luxury apartments across two towers (99m and 89m) at the historic Dairy Farmers Corner. Features 1, 2 & 3 bedroom apartments with 5 floors of commercial space, pool with harbour views, gym, wine bar, shared work hub, and 360-degree Newcastle vistas. Plans include reimagining heritage structures for a public art installation.

Fullerton Cove Shopping Centre

A new mixed-use shopping centre including a Woolworths supermarket, liquor store, commercial tenancies, a medical centre, and car parking. The development site at 42 Fullerton Cove Road was rezoned in 2022 as part of the Fern Bay and North Stockton Strategy plan. The development application was approved by the Hunter & Central Coast Regional Planning Panel in January 2025.

Newcastle Art Gallery Expansion

Major expansion of Newcastle Art Gallery to create a contemporary arts and cultural hub, including new contemporary galleries, education facilities, conservation laboratories, public amenities, exhibition spaces, and community areas. Part of Newcastle's cultural precinct development strategy with enhanced accessibility and visitor experience to enhance cultural offerings in the city.

Pottery Lane Residential Development - Newcastle

525 high-quality residential units development by Olympian Homes in the Forth Goods Yard area of Newcastle city centre. Build-to-rent scheme funded by Hines, featuring net-zero enabled design with geothermal heat pumps and solar PV. Two phases with completion by 2027.

East End Village - Hunter Street Revitalisation

$16 million revitalisation project for Hunter Street's eastern precinct including streetscape improvements, new public spaces, enhanced pedestrian facilities, and support for local businesses to create a vibrant cultural and commercial hub.

Employment

Stockton has seen below average employment performance when compared to national benchmarks

Stockton's workforce is skilled with well-represented essential services sectors. The unemployment rate was 3.8% in September 2025, matching Rest of NSW's rate.

Employment growth over the past year was estimated at 3.1%. There were 2,210 residents employed as of September 2025, with workforce participation similar to Rest of NSW's 56.4%. Dominant employment sectors include health care & social assistance, construction, and education & training. Professional & technical services show notable concentration at 1.5 times the regional average, while agriculture, forestry & fishing have lower representation at 0.9%.

Employment opportunities locally may be limited as indicated by Census data. Over the year to September 2025, employment increased by 3.1% and labour force by 3.6%, causing unemployment to rise by 0.5 percentage points. In comparison, Rest of NSW saw employment decline by 0.5%. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, with a state unemployment rate of 3.9% compared to the national rate of 4.3%. Jobs and Skills Australia's projections suggest national employment will expand by 6.6% over five years and 13.7% over ten years, but growth rates vary significantly between sectors. Applying these projections to Stockton's employment mix indicates local employment should increase by 6.6% over five years and 13.8% over ten years.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates above-average performance, with income metrics exceeding national benchmarks based on AreaSearch comparative assessment

AreaSearch's data from June 2023 shows Stockton's median income is $59,700 and average income is $72,436. This is higher than Rest of NSW's median income of $52,390 and average income of $65,215. By September 2025, estimated incomes are approximately $64,989 (median) and $78,854 (average), based on an 8.86% Wage Price Index growth since June 2023. Stockton's household, family, and personal incomes rank modestly, between the 37th to 39th percentiles. The predominant income cohort in Stockton is 28.5%, or 1,250 people, earning $1,500 - $2,999, similar to the surrounding region at 29.9%. Housing affordability pressures are severe, with only 83.2% of income remaining after housing costs, ranking at the 37th percentile. Stockton's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Stockton is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Stockton's dwelling structure, as per the latest Census, consisted of 82.5% houses and 17.6% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro NSW had 70.5% houses and 29.5% other dwellings. Home ownership in Stockton stood at 37.9%, with mortgaged dwellings at 31.5% and rented ones at 30.6%. The median monthly mortgage repayment was $2,000, higher than Non-Metro NSW's average of $1,962. The median weekly rent in Stockton was $370, lower than Non-Metro NSW's figure of $400. Nationally, Stockton's mortgage repayments were higher at $2,000 compared to the Australian average of $1,863, while rents were lower at $370 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Stockton features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 66.3% of all households, including 24.8% couples with children, 27.9% couples without children, and 12.7% single parent families. Non-family households constitute the remaining 33.7%, with lone person households at 30.5% and group households comprising 3.1%. The median household size is 2.3 people, which is smaller than the Rest of NSW average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Educational attainment in Stockton aligns closely with national averages, showing typical qualification patterns and performance metrics

Stockton's educational qualifications trail regional benchmarks, with 23.1% of residents aged 15+ holding university degrees compared to 32.2% in NSW as of the latest available data (Australian Bureau of Statistics Census Data, 2016). Bachelor degrees are most common at 15.1%, followed by postgraduate qualifications at 5.0% and graduate diplomas at 3.0%. Trade and technical skills are prominent, with 40.1% of residents aged 15+ holding vocational credentials – advanced diplomas at 11.4% and certificates at 28.7%. Educational participation is high, with 26.1% of residents currently enrolled in formal education as of the latest data (New South Wales Department of Education, 2019).

This includes 9.3% in primary education, 7.1% in secondary education, and 4.1% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Stockton has 46 active public transport stops operating within its boundaries. These include a mix of ferry and bus services. There are 34 individual routes servicing these stops, collectively providing 1,400 weekly passenger trips.

Residents have excellent transport accessibility, with an average distance of 150 meters to the nearest stop. Service frequency averages 200 trips per day across all routes, equating to approximately 30 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Stockton is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Stockton faces significant health challenges, as indicated by its health data.

Both younger and older age groups have high prevalence rates for common health conditions. Approximately 56% (~2,436 people) of Stockton's total population has private health cover, which is notably high. The most prevalent medical conditions in the area are arthritis (10.7%) and mental health issues (9.4%). Conversely, 62.4% of residents report being free from medical ailments, compared to 64.9% across Rest of NSW. Stockton has a higher proportion of seniors aged 65 and over at 22.1% (969 people), compared to the 16.7% in Rest of NSW. The health outcomes among seniors present some challenges, generally aligning with the overall population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Stockton is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Stockton's population showed low cultural diversity, with 90.6% born in Australia, 92.4% being citizens, and 96.3% speaking English only at home. Christianity was the predominant religion, accounting for 53.4%, compared to 47.7% across Rest of NSW. The top three ancestry groups were English (33.1%), Australian (28.8%), and Irish (9.5%).

Some ethnic groups had notable differences: Welsh was overrepresented at 0.9% in Stockton (vs 0.8% regionally), Scottish at 9.4% (vs 8.4%), and Macedonian at 0.2% (vs 0.8%).

Frequently Asked Questions - Diversity

Age

Stockton hosts an older demographic, ranking in the top quartile nationwide

Stockton's median age was 46 as of the 2021 Census, slightly higher than Rest of NSW's figure of 43 and significantly above the national norm of 38. The 45-54 age group made up 13.0% of Stockton's population compared to Rest of NSW, while the 25-34 cohort was less prevalent at 10.1%. Post-Census data shows a rejuvenation with the median age falling from 47 to 46 years. Specifically, the 15-24 age group grew from 10.3% to 12.5%, and the 35-44 cohort increased from 11.2% to 12.4%. Conversely, the 55-64 cohort declined from 16.1% to 13.9%, and the 65-74 group dropped from 13.9% to 11.8%. By 2041, Stockton's age composition is projected to shift notably, with the 45-54 age cohort expected to expand by 362 people (64%), from 570 to 933.