Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Marino reveals an overall ranking slightly below national averages considering recent, and medium term trends

The population of the Marino statistical area (Lv2) is estimated to be around 2,346 as of Nov 2025. This reflects an increase of 69 people since the 2021 Census, which reported a population of 2,277 people. The change is inferred from the resident population of 2,340 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 2 validated new addresses since the Census date. This level of population equates to a density ratio of 678 persons per square kilometer. Population growth for the area was primarily driven by overseas migration, contributing approximately 65.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with a base year of 2022. For areas not covered and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, released in 2023 and based on 2021 data, with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. Anticipating future population dynamics, the Marino (SA2) is expected to expand by 151 persons to 2041, reflecting an increase of 7.2% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Marino according to AreaSearch's national comparison of local real estate markets

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Marino has experienced around 3 dwellings receiving development approval each year. Over the past 5 financial years, from FY-21 to FY-25 inclusive, approximately 18 homes were approved, with a further 5 approved in FY-26 as of the current date. Each dwelling built over these years attracted an average of 5.2 people per year to the area.

This supply lagging demand has led to heightened buyer competition and pricing pressures. The average construction value of new properties was $475,000, indicating a focus on the premium segment with upmarket properties. In FY-26, commercial approvals totalled $1.7 million, suggesting minimal commercial development activity in Marino compared to Greater Adelaide. Marino's building activity is 78.0% below the regional average per person, reflecting its mature nature and possible planning constraints. Recent development has been exclusively detached houses, preserving Marino's low density character and attracting space-seeking buyers.

As of now, there are an estimated 588 people in Marino for each dwelling approval. Future projections estimate Marino will add 170 residents by 2041, potentially intensifying buyer competition and underpinning price growth if current construction levels persist.

Frequently Asked Questions - Development

Infrastructure

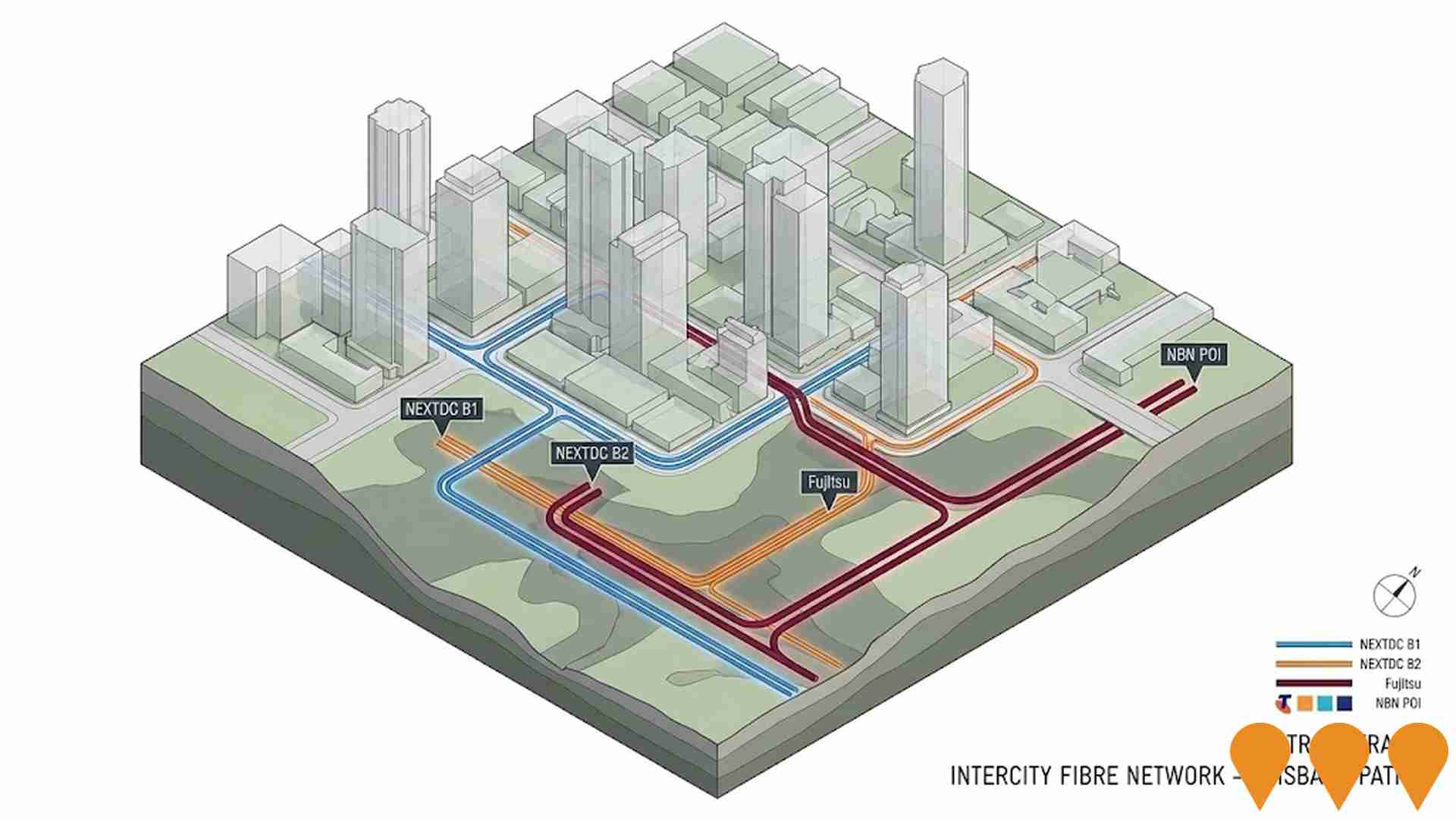

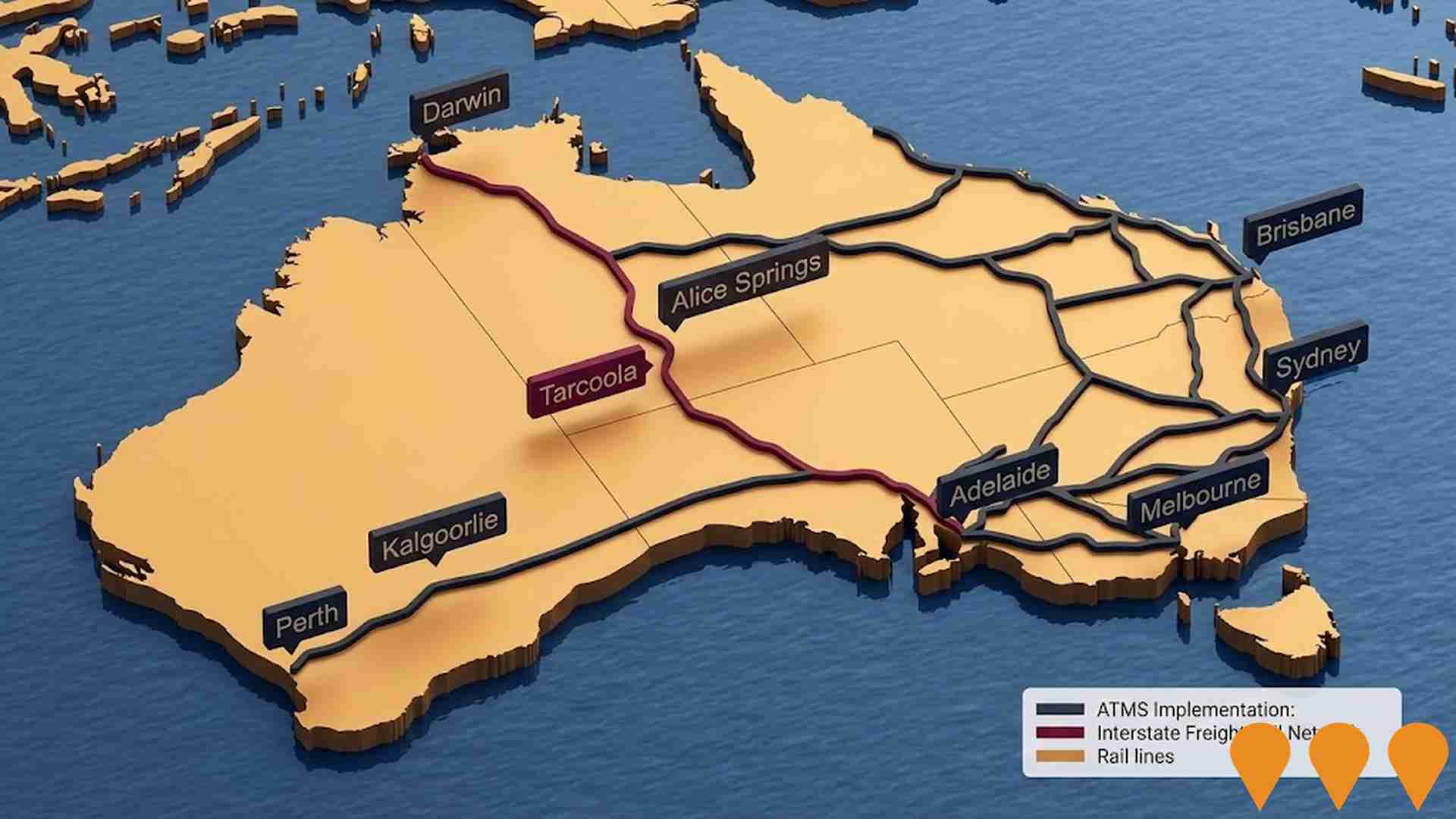

Marino has limited levels of nearby infrastructure activity, ranking in the 17thth percentile nationally

No factors influence a region more than local infrastructure alterations, significant projects, and planning initiatives. In total, zero projects have been identified by AreaSearch that could impact this area. Notable projects include Southern Suburbs Residential Policy Code Amendment, Adelaide Public Transport Capacity and Access, Adelaide's Inner And Outer Ring Route Capacity Improvements, and North South Corridor. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Enabling Infrastructure for Hydrogen Production

A national initiative to coordinate and deploy infrastructure supporting large-scale renewable hydrogen production. Following the 2024 National Hydrogen Strategy refresh and the National Hydrogen Infrastructure Assessment (NHIA) to 2050, the program focuses on aligning transport, storage, water, and electricity inputs with Renewable Energy Zones and hydrogen hubs. Key financial drivers include the $4 billion Hydrogen Headstart program (with Round 2 EOI launched in October 2025) and the Hydrogen Production Tax Incentive (HPTI) legislated to provide a $2 per kg credit from July 2027 to 2040.

Adelaide Public Transport Capacity and Access

State-led program work to increase public transport capacity and access to, through and within central Adelaide. Current work is focused on the City Access Strategy (20-year movement plan for the CBD and North Adelaide) and the State Transport Strategy program, which together will shape options such as bus priority, interchange upgrades, tram and rail enhancements, and better first/last mile access.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

National EV Charging Network (Highway Fast Charging)

Partnership between the Australian Government and NRMA to deliver a backbone EV fast charging network on national highways. Program funds and co-funds 117 DC fast charging sites at roughly 150 km intervals to connect all capital cities and regional routes, reducing range anxiety and supporting EV uptake.

Network Optimisation Program - Roads

A national program concept focused on improving congestion and reliability on urban road networks by using low-cost operational measures and technology (e.g., signal timing, intersection treatments, incident management) to optimise existing capacity across major city corridors.

North South Corridor

The North-South Corridor in Australia, a 78 km non-stop motorway from Gawler to Old Noarlunga through Adelaide, includes several projects like the Southern Expressway and Darlington Upgrade. Completion expected by 2031.

Southern Suburbs Residential Policy Code Amendment

A proposed planning amendment affecting residential zones in Southern Suburbs, including Seaview Downs, to transition areas to Hills Neighbourhood Zone and facilitate low-density infill development.

Adelaide's Inner And Outer Ring Route Capacity Improvements

Enhancement of Adelaide's Inner and Outer Ring Routes to alleviate congestion, aiming for integrated urban mobility and addressing impacts from population growth, economic activity, and travel demand.

Employment

The labour market strength in Marino positions it well ahead of most Australian regions

Marino has an educated workforce with essential services sectors well represented. The unemployment rate is 2.0%, lower than Greater Adelaide's 3.9%.

Employment growth over the past year was estimated at 3.2%. As of September 2025, 1,306 residents are employed. Workforce participation is similar to Greater Adelaide's 61.7%. Key employment sectors include health care & social assistance, education & training, and construction.

Education & training has a particularly strong presence with an employment share 1.3 times the regional level. Retail trade has limited presence at 7.1% compared to the regional average of 10.0%. The area may offer limited local employment opportunities based on Census data comparison. Over the past year, employment increased by 3.2%, labour force by 3.3%, with unemployment remaining essentially unchanged. This compares to Greater Adelaide's employment growth of 3.0% and labour force expansion of 2.9%. State-level data as of 25-Nov shows SA employment grew by 1.19% year-on-year, with an unemployment rate of 4.0%, outpacing the national average of 0.14%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Marino's employment mix suggests local employment should increase by 7.0% over five years and 14.2% over ten years, though this is an illustrative extrapolation not accounting for localised population projections.

Frequently Asked Questions - Employment

Income

The area exhibits notably strong income performance, ranking higher than 70% of areas assessed nationally through AreaSearch analysis

AreaSearch's aggregation of ATO data for financial year 2023 shows Marino had a median taxpayer income of $59,732 and an average income of $76,184. Nationally, the averages were $54,808 and $66,852 respectively in Greater Adelaide. By September 2025, adjusted for Wage Price Index growth of 8.8%, median income is estimated at $64,988 and average at $82,888. Marino's incomes cluster around the 71st percentile nationally, with 30.6% (717 people) in the $1,500 - 2,999 bracket. High weekly earnings exceed $3,000 for 32.7% of households, indicating strong consumer spending power. After housing costs, residents retain 88.5% of income. Marino's SEIFA income ranking is in the 8th decile.

Frequently Asked Questions - Income

Housing

Marino is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Marino's dwelling structure, as assessed at the latest Census, consisted of 97.1% houses and 2.8% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Adelaide metro's 70.8% houses and 29.2% other dwellings. Home ownership in Marino was at 46.6%, with the rest either mortgaged (43.2%) or rented (10.2%). The median monthly mortgage repayment in Marino was $1,997, higher than Adelaide metro's average of $1,700 and the national average of $1,863. The median weekly rent figure for Marino was $400, exceeding Adelaide metro's $330 and the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Marino features high concentrations of family households, with a higher-than-average median household size

Family households comprise 80.0% of all households, including 35.4% couples with children, 35.5% couples without children, and 8.3% single parent families. Non-family households account for the remaining 20.0%, with lone person households at 17.6% and group households making up 2.5%. The median household size is 2.6 people, larger than the Greater Adelaide average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Marino demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

The area's educational profile is notable regionally, with university qualification rates of 35.5% among residents aged 15+, surpassing the South Australian average of 25.7% and the SA4 region average of 28.1%. Bachelor degrees are most prevalent at 21.1%, followed by postgraduate qualifications (10.6%) and graduate diplomas (3.8%). Trade and technical skills are prominent, with 34.6% of residents aged 15+ holding vocational credentials – advanced diplomas account for 13.0% and certificates for 21.6%.

Educational participation is notably high, with 27.6% of residents currently enrolled in formal education. This includes 9.7% in primary education, 7.0% in secondary education, and 6.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Marino has seven active public transport stops offering a mix of train and bus services. These stops are served by four distinct routes that facilitate 437 weekly passenger trips in total. The accessibility of transport is deemed good, with residents generally situated 317 meters from the nearest stop.

On average, service frequency stands at 62 trips per day across all routes, translating to roughly 62 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Marino's residents are relatively healthy in comparison to broader Australia with a fairly standard level of common health conditions seen across both young and old age cohorts

Marino's health metrics closely match national benchmarks, with common health conditions seen across both young and old age cohorts at a fairly standard level. Approximately 57% (~1,339 people) of Marino residents have private health cover, compared to 51.4% across Greater Adelaide.

The most prevalent medical conditions are arthritis (9.0%) and asthma (8.0%). About 68.5% of residents report no medical ailments, similar to the 68.1% in Greater Adelaide. Marino has a higher proportion of seniors aged 65 and over at 23.4% (548 people), compared to 19.2% in Greater Adelaide. Health outcomes among seniors are notably strong, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Marino was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

Marino's cultural diversity was found to be above average, with 9.7% of its population speaking a language other than English at home and 27.2% born overseas. Christianity was the predominant religion in Marino, comprising 42.5% of its population. Notably, Judaism was overrepresented in Marino compared to Greater Adelaide, making up 0.4% versus 0.1%.

In terms of ancestry, the top three represented groups were English at 34.3%, Australian at 21.0%, and Irish at 7.7%. Some ethnic groups showed notable divergences: Welsh was overrepresented at 1.1% compared to the regional average of 0.6%, Dutch at 2.2% versus 1.3%, and Polish at 1.2% versus 1.1%.

Frequently Asked Questions - Diversity

Age

Marino hosts an older demographic, ranking in the top quartile nationwide

Marino has a median age of 47, which is higher than Greater Adelaide's figure of 39 and also above the national average of 38. The age profile shows that those aged 55-64 are particularly prominent at 15.5%, while the 25-34 group is smaller at 6.4% compared to Greater Adelaide. Between the 2021 Census and now, the 15-24 age group has grown from 10.8% to 13.1% of the population, while the 75-84 cohort increased from 7.2% to 8.6%. Conversely, the 65-74 cohort has declined from 14.0% to 12.7%. By 2041, demographic projections show significant shifts in Marino's age structure. The 85+ group is projected to grow by 125%, reaching 111 people from the current figure of 49. Conversely, population declines are projected for the 0-4 and 5-14 cohorts.