Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Burnside has seen population growth performance typically on par with national averages when looking at short and medium term trends

As of November 2025, the population of the Burnside (SA) statistical area (Lv2) is estimated to be around 3,209 people. This represents an increase of 149 individuals since the 2021 Census, which reported a population of 3,060 people in the same area. AreaSearch's analysis, based on the latest ERP data release by the ABS (June 2024) and validation of new addresses, suggests a resident population estimate of 3,164 for the Burnside (SA) (SA2). This results in a population density ratio of 1,898 persons per square kilometer, which is higher than the average seen across national locations assessed by AreaSearch. The primary driver of population growth was overseas migration, contributing approximately 94.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections by age category are used, based on 2021 data and released in 2023. These projections have been adjusted employing a method of weighted aggregation of population growth from LGA to SA2 levels. Considering these projected demographic shifts, a population increase just below the median of Australian statistical areas is expected for the Burnside (SA) (SA2). By 2041, the area is projected to expand by 194 persons, reflecting a gain of 7.2% in total over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Burnside recording a relatively average level of approval activity when compared to local markets analysed countrywide

AreaSearch analysis of ABS building approval numbers in Burnside shows approximately 8 new homes approved annually over the past five financial years, totalling around 42 dwellings. As of FY-26, there have been 5 approvals recorded to date. On average, about 2.8 people move to the area each year for every new home constructed between FY-21 and FY-25, indicating strong demand that supports property values. The average construction cost value of new homes is around $838,000, suggesting a focus on premium properties by developers.

In FY-26, commercial development approvals totalled $998,000, reflecting minimal commercial activity compared to previous years. Compared to Greater Adelaide, Burnside has significantly lower building activity, at 55.0% below the regional average per person. This constrained new construction typically reinforces demand and pricing for existing dwellings, although development activity has increased recently. Nationally, Burnside's building activity is also lower, suggesting market maturity and potential development constraints. New building activity in Burnside consists of 89.0% detached houses and 11.0% townhouses or apartments, maintaining the area's suburban identity with a concentration of family homes that appeal to buyers seeking space.

This preference for detached housing is more pronounced than current patterns suggest (71.0% at Census), indicating ongoing robust demand for family homes despite increasing density pressures. The location has approximately 215 people per dwelling approval, reflecting a low-density market. According to the latest AreaSearch quarterly estimate, Burnside is expected to grow by 231 residents through to 2041. Current construction rates appear balanced with future demand, fostering steady market conditions without excessive price pressure.

Frequently Asked Questions - Development

Infrastructure

Burnside has limited levels of nearby infrastructure activity, ranking in the 18thth percentile nationally

No factors influence an area's performance more than changes to local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that may impact this area. Key projects include UniSA Magill Campus Redevelopment (Magill Project), SA Water Capital Work Delivery Contracts, Adelaide Level Crossings Congestion and Safety, and SA Public Housing Maintenance and Services Contracts. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

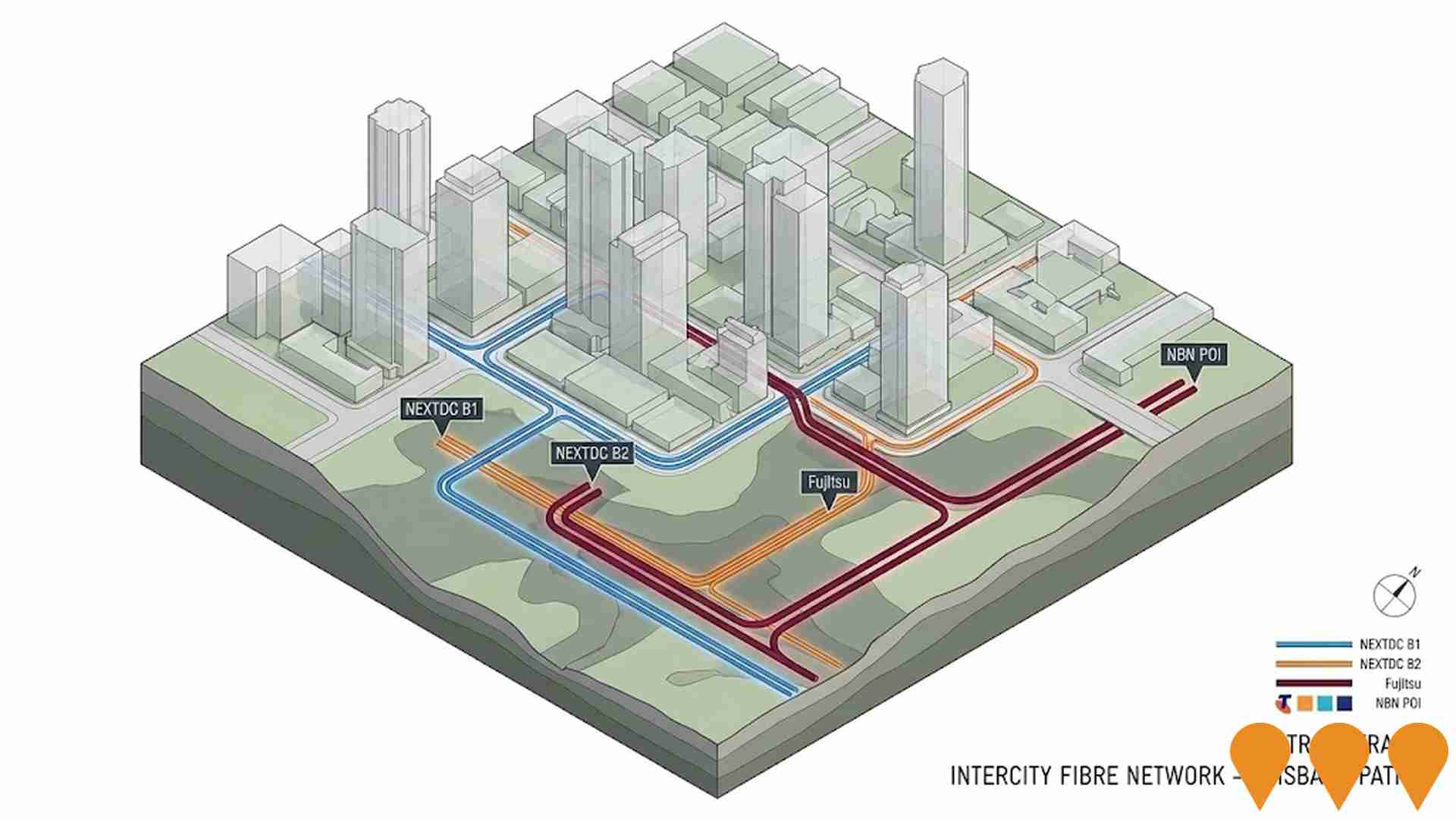

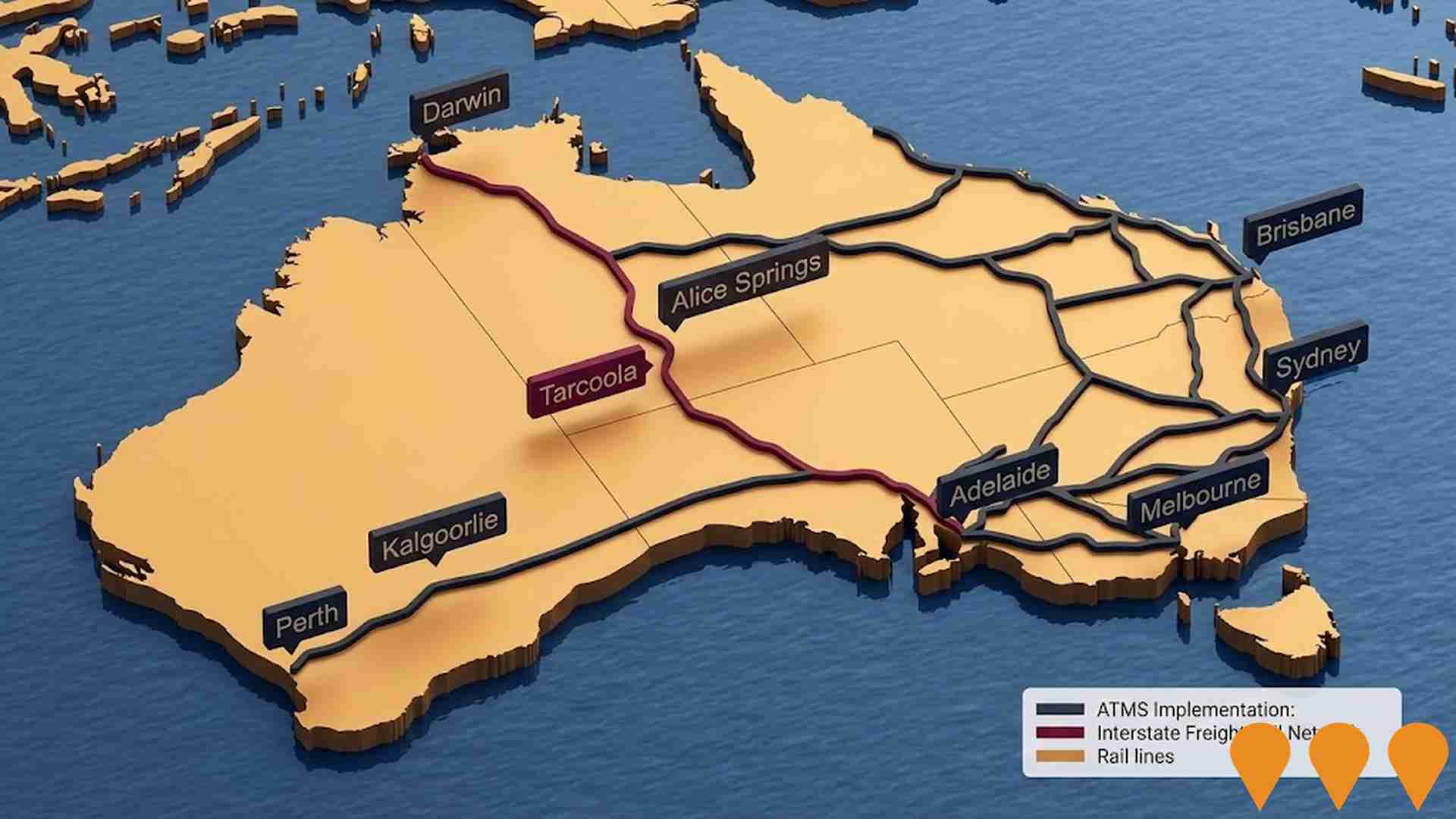

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Enabling Infrastructure for Hydrogen Production

A national initiative to coordinate and deploy infrastructure supporting large-scale renewable hydrogen production. Following the 2024 National Hydrogen Strategy refresh and the National Hydrogen Infrastructure Assessment (NHIA) to 2050, the program focuses on aligning transport, storage, water, and electricity inputs with Renewable Energy Zones and hydrogen hubs. Key financial drivers include the $4 billion Hydrogen Headstart program (with Round 2 EOI launched in October 2025) and the Hydrogen Production Tax Incentive (HPTI) legislated to provide a $2 per kg credit from July 2027 to 2040.

Adelaide Public Transport Capacity and Access

State-led program work to increase public transport capacity and access to, through and within central Adelaide. Current work is focused on the City Access Strategy (20-year movement plan for the CBD and North Adelaide) and the State Transport Strategy program, which together will shape options such as bus priority, interchange upgrades, tram and rail enhancements, and better first/last mile access.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

Network Optimisation Program - Roads

A national program concept focused on improving congestion and reliability on urban road networks by using low-cost operational measures and technology (e.g., signal timing, intersection treatments, incident management) to optimise existing capacity across major city corridors.

Northern Adelaide Transport Study

A comprehensive transport study managed by the Department for Infrastructure and Transport to inform future investment across Northern Adelaide's inner and outer suburbs. The study area spans from Prospect to Roseworthy and Buckland Park to One Tree Hill, focusing on road safety, freight efficiency, and public transport integration to support a projected population increase of over 140,000 residents by 2041. It specifically evaluates the resilience of strategic road corridors and identifies improvements to active transport networks to accommodate rapid urban expansion.

UniSA Magill Campus Redevelopment (Magill Project)

The South Australian Government has acquired the 14.62 hectare UniSA Magill campus site, on both sides of St Bernards Road, and transferred it to Renewal SA to be planned as a mixed use residential precinct. Renewal SA is preparing a master plan and structure plan that will guide future rezoning and development, with a vision for more than 400 new homes in a range of housing types including affordable housing, together with enhanced open space, tree canopy, community and recreational facilities, and protection of key features such as Murray House and the Third Creek corridor. Initial community engagement on the high level vision and opportunities for the site ran from November 2024 to February 2025, and feedback is now being used to refine the draft structure plan ahead of a future Code Amendment and staged redevelopment over the next decade, once UniSA leaseback arrangements expire.

North South Corridor

The North-South Corridor in Australia, a 78 km non-stop motorway from Gawler to Old Noarlunga through Adelaide, includes several projects like the Southern Expressway and Darlington Upgrade. Completion expected by 2031.

SA Water Capital Work Delivery Contracts

SA Water's major infrastructure delivery program for water and wastewater systems across South Australia, with a record $3.3 billion investment from 2024 to 2028 to ensure reliable services, support housing growth, and maintain essential infrastructure.

Employment

Employment conditions in Burnside rank among the top 10% of areas assessed nationally

Burnside has a highly educated workforce with strong representation in professional services. Its unemployment rate was 1.6% in September 2025, lower than Greater Adelaide's 3.9%.

Employment growth over the past year was estimated at 3.4%. Workforce participation is similar to Greater Adelaide's 61.7%. Key industries of employment are health care & social assistance, professional & technical, and education & training. Burnside has a notable concentration in professional & technical services, with levels at 2.2 times the regional average.

However, construction is under-represented, with only 4.9% of Burnside's workforce compared to Greater Adelaide's 8.7%. Employment opportunities locally may be limited as indicated by Census data comparing working population to resident population. Over the 12 months to September 2025, employment increased by 3.4%, while labour force and unemployment remained broadly flat in Burnside. In contrast, Greater Adelaide saw employment rise by 3.0% and unemployment fall by 0.1 percentage points. State-level data from 25-Nov shows SA employment grew by 1.19% year-on-year, with the state unemployment rate at 4.0%. National unemployment was 4.3%, but SA's employment growth outpaced the national average of 0.14%. Jobs and Skills Australia forecasts national employment to expand by 6.6% over five years and 15.1% over ten years, with local projections suggesting Burnside's employment should increase by 7.5% over five years and 15.1% over ten years based on industry-specific projections.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

The median taxpayer income in Burnside is $63,323, with an average of $97,845, according to postcode level ATO data aggregated by AreaSearch for the financial year 2023. Nationally, these figures are exceptionally high compared to Greater Adelaide's median income of $54,808 and average income of $66,852. By September 2025, estimated incomes would be approximately $68,895 (median) and $106,455 (average), based on Wage Price Index growth since financial year 2023. In Burnside, household, family, and personal incomes rank highly nationally, between the 81st and 81st percentiles according to 2021 Census figures. Income analysis shows that 30.5% of residents (978 people) fall into the $1,500 - 2,999 bracket, mirroring the surrounding region where 31.8% occupy this bracket. Economic strength is evident with 36.5% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. After housing costs, residents retain 87.7% of their income, reflecting strong purchasing power and the area's SEIFA income ranking places it in the 9th decile.

Frequently Asked Questions - Income

Housing

Burnside is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

In Burnside, as per the latest Census evaluation, houses accounted for 70.9% of dwellings, with other types such as semi-detached homes, apartments, and 'other' dwellings making up the remaining 29.0%. This is compared to Adelaide metro's 67.0% houses and 33.0% other dwellings. Home ownership in Burnside stood at 44.7%, similar to Adelaide metro, with mortgaged dwellings at 38.6% and rented ones at 16.8%. The median monthly mortgage repayment in the area was $2,400, higher than Adelaide metro's average of $2,300. Median weekly rent in Burnside was $375, slightly higher than Adelaide metro's $360. Nationally, Burnside's mortgage repayments were significantly higher at $2,400 compared to the Australian average of $1,863, while rents were comparable at $375.

Frequently Asked Questions - Housing

Household Composition

Burnside has a typical household mix, with a higher-than-average median household size

Family households account for 74.9% of all households, including 39.1% that are couples with children, 27.0% that are couples without children, and 8.0% that are single parent families. Non-family households make up the remaining 25.1%, with lone person households at 24.0% and group households comprising 1.0%. The median household size is 2.7 people, larger than the Greater Adelaide average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Burnside demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Burnside's educational attainment significantly exceeds broader benchmarks. Among residents aged 15+, 51.9% hold university qualifications, compared to 25.7% in South Australia (SA) and 28.9% in Greater Adelaide. This educational advantage positions the area strongly for knowledge-based opportunities. Bachelor degrees are most common at 31.4%, followed by postgraduate qualifications (15.6%) and graduate diplomas (4.9%).

Vocational pathways account for 20.8% of qualifications among those aged 15+, with advanced diplomas at 10.8% and certificates at 10.0%. Educational participation is notably high, with 31.9% of residents currently enrolled in formal education. This includes 11.8% in primary education, 8.0% in secondary education, and 7.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Burnside has 18 active public transport stops, all of which are bus stops. These stops are served by eight different routes that together offer 496 weekly passenger trips. The accessibility of the transport system is rated as good, with residents typically living within 203 meters of their nearest stop.

On average, there are 70 trips per day across all routes, which equates to approximately 27 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Burnside's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Burnside's health outcomes data shows excellent results with very low prevalence of common health conditions across all age groups. The rate of private health cover is exceptionally high at approximately 66% (2,104 people), compared to Greater Adelaide's 67.8%. Nationally, the average is 55.7%.

Arthritis and asthma are the most common medical conditions in Burnside, impacting 7.0 and 5.8% of residents respectively. 74.2% of residents declared themselves completely clear of medical ailments, compared to Greater Adelaide's 72.6%. Burnside has 21.9% (702 people) of residents aged 65 and over, which is lower than Greater Adelaide's 23.6%. Health outcomes among seniors in Burnside are particularly strong, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Burnside was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Burnside's population showed high diversity, with 33.0% born overseas and 25.7% speaking a language other than English at home. Christianity was the predominant religion, at 45.9%. Judaism was slightly overrepresented compared to Greater Adelaide, at 0.4% versus 0.3%.

The top three ancestry groups were English (25.0%), Australian (21.1%), and Other (11.2%). Some ethnic groups showed notable differences: Russian was higher at 0.5%, Italian lower at 5.5%, and Chinese lower at 8.2% compared to regional percentages.

Frequently Asked Questions - Diversity

Age

Burnside hosts a notably older demographic compared to the national average

The median age in Burnside is 43 years, which is significantly higher than Greater Adelaide's average of 39 years, and considerably older than Australia's median age of 38 years. Compared to Greater Adelaide, Burnside has a higher proportion of residents aged 75-84 (9.7%) but fewer residents aged 25-34 (8.6%). According to the 2021 Census, the population aged 15-24 has increased from 11.7% to 13.0%, while the population aged 65-74 has decreased from 10.4% to 9.5%. By 2041, demographic projections indicate significant shifts in Burnside's age structure. The 85+ group is projected to grow by 86%, reaching 161 people from 86. Notably, the combined population aged 65 and above will account for 56% of total population growth, reflecting Burnside's aging demographic profile. In contrast, both the 35-44 and 5-14 age groups are projected to decrease in number.