Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Coober Pedy has shown very soft population growth performance across periods assessed by AreaSearch

Coober Pedy's population, as per AreaSearch's analysis, is approximately 1,518 as of November 2025. This figure represents a decrease of 48 individuals, equating to a 3.1% drop from the 2021 Census total of 1,566 people. The change is inferred from the estimated resident population of 1,527 in June 2024 and address validation since the Census date. This results in a population density ratio of 19.5 persons per square kilometer. Overseas migration was the primary driver of population growth in recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, based on 2021 data and adjusted using weighted aggregation from LGA to SA2 levels. By 2041, projections indicate a decline in overall population by 17 persons. However, specific age cohorts are expected to grow, notably the 85 and over group, projected to increase by 53 people.

Frequently Asked Questions - Population

Development

Residential dwelling approval activity has been practically non-existent in Coober Pedy

Coober Pedy has seen minimal development activity over the past five years, with an average of fewer than one approval per year. This translates to just two approved projects in total during this period. The rural nature of Coober Pedy contributes to these low development levels, as housing needs are often specific and local rather than driven by broader market demand.

It is important to note that the small sample size can significantly impact annual growth and relative statistics, with individual projects able to substantially influence them. Compared to other areas in South Australia and nationally, Coober Pedy's development levels are notably lower.

Despite stable or declining population forecasts, which may alleviate housing pressure, this creates favourable conditions for property buyers in the area.

Frequently Asked Questions - Development

Infrastructure

Coober Pedy has limited levels of nearby infrastructure activity, ranking in the 13thth percentile nationally

No changes can significantly influence a region's performance like modifications to local infrastructure, major projects, and planning initiatives. AreaSearch has identified zero projects that could potentially impact this area. Notable projects include Gawler Craton Rail Access, Bulk Water Supply Security, Northern Water Supply Project, and Enabling Infrastructure for Hydrogen Production. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

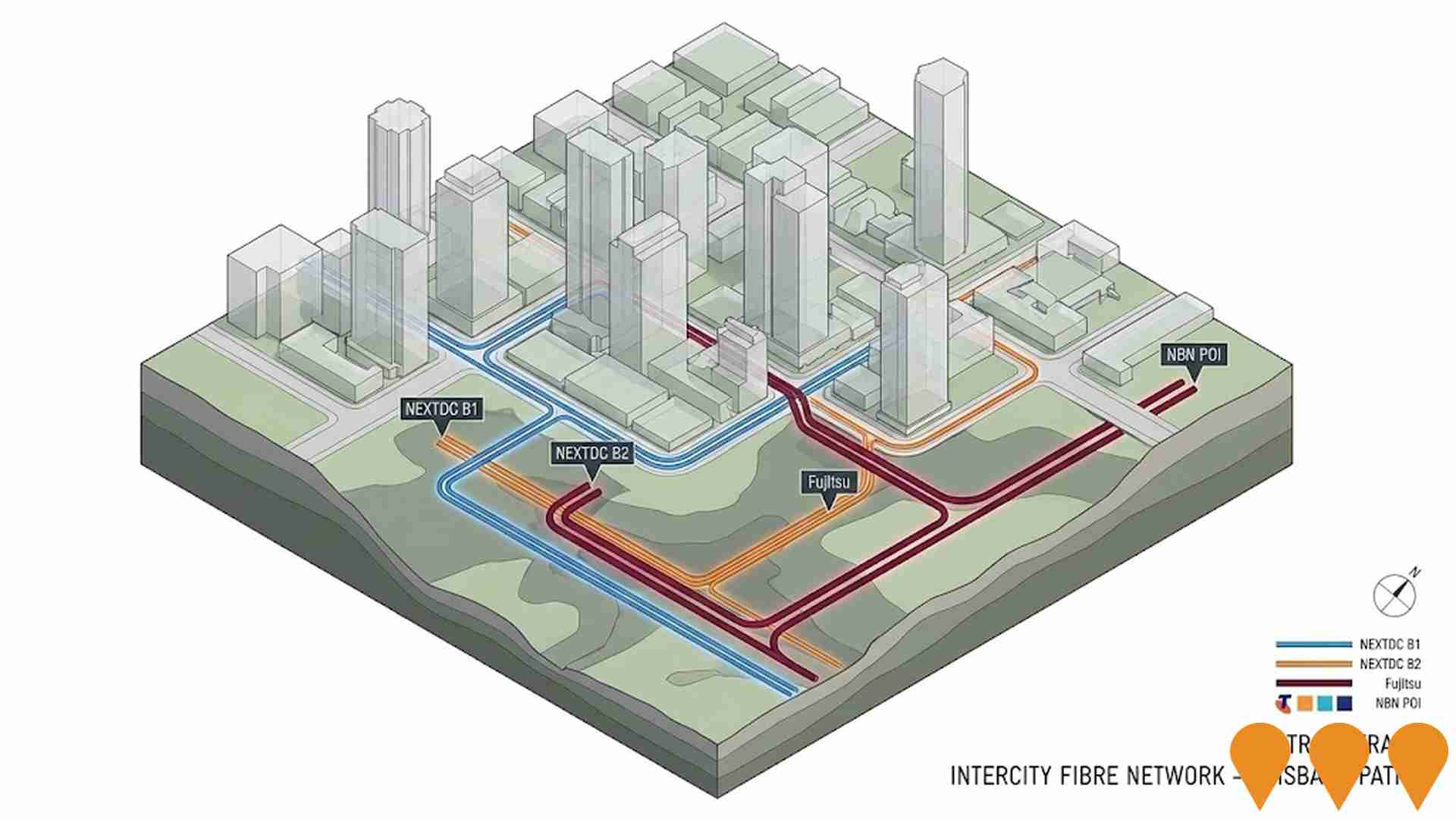

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

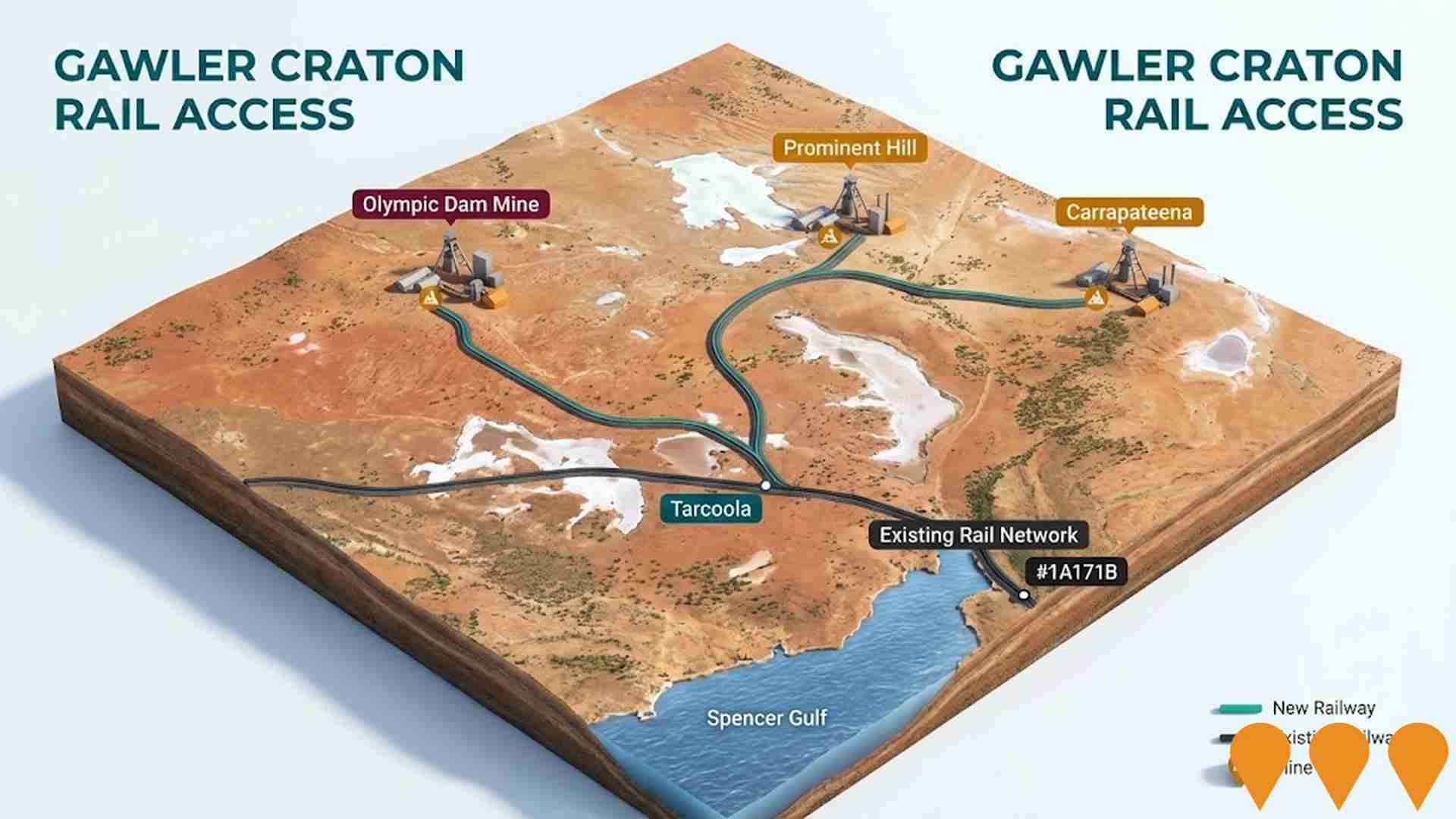

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Enabling Digital Health Services for Regional and Remote Australia

National initiative to expand and improve digital health access for people in regional and remote Australia. Focus areas include enabling telehealth and virtual care, upgrading clinical systems and connectivity, supporting secure information exchange, and building workforce capability in digital health, aligned with the Australian Government's Digital Health Blueprint and Action Plan 2023-2033.

Enabling Infrastructure for Hydrogen Production

Australia has completed the National Hydrogen Infrastructure Assessment (NHIA) to 2050 and refreshed its National Hydrogen Strategy (2024). The programmatic focus has shifted to planning and enabling infrastructure through measures such as ARENA's Hydrogen Headstart and the Hydrogen Production Tax Incentive (from April 2025). Round 2 of Hydrogen Headstart consultation occurred in 2025. Collectively these actions aim to coordinate investment in transport, storage, water and electricity inputs linked to Renewable Energy Zones and priority hubs, supporting large-scale renewable hydrogen production and future export supply chains.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

National EV Charging Network (Highway Fast Charging)

Partnership between the Australian Government and NRMA to deliver a backbone EV fast charging network on national highways. Program funds and co-funds 117 DC fast charging sites at roughly 150 km intervals to connect all capital cities and regional routes, reducing range anxiety and supporting EV uptake.

Network Optimisation Program - Roads

A national program concept focused on improving congestion and reliability on urban road networks by using low-cost operational measures and technology (e.g., signal timing, intersection treatments, incident management) to optimise existing capacity across major city corridors.

Gawler Craton Rail Access

The proposal is for a third party to build, own, and operate a 350 km railway in the Gawler Craton province, linking to the existing interstate rail network. It aims to provide significant transport connections to mines such as Prominent Hill, Olympic Dam, and Carrapateena, and open up other potential reserves including Wirrda Well, Acropolis, Vulcan, Titan, and Millers Creek. The project could facilitate exploration and development in the remote mineral region, which contains extensive copper, gold, silver, and iron ore deposits.

Northern Water Supply Project

The Northern Water Supply Project is a transformational water infrastructure initiative to enhance water security in Far North South Australia. The project involves construction of a seawater reverse osmosis desalination plant at Cape Hardy in the Spencer Gulf with up to 260 megalitres per day capacity, connected by a 600-kilometre pipeline network to the Upper Spencer Gulf and Far North regions. The project aims to service mining operations, industry (including hydrogen), Department of Defence, remote communities, pastoralists and SA Water, reducing reliance on the Great Artesian Basin, River Murray and local groundwater resources. The main transfer pipeline will link Eastern Eyre Peninsula, Whyalla, Port Augusta, Woomera, Carapateena, Roxby Downs, Pimba, Oak Dam and Olympic Dam. Supporting infrastructure includes pumping stations, large storage facilities, flow regulation valves, control facilities, and electricity transmission lines. The project supports the South Australian Government's Copper Strategy to triple copper production to 1 million tonnes per year by 2030 and enables growth in clean energy and hydrogen industries.

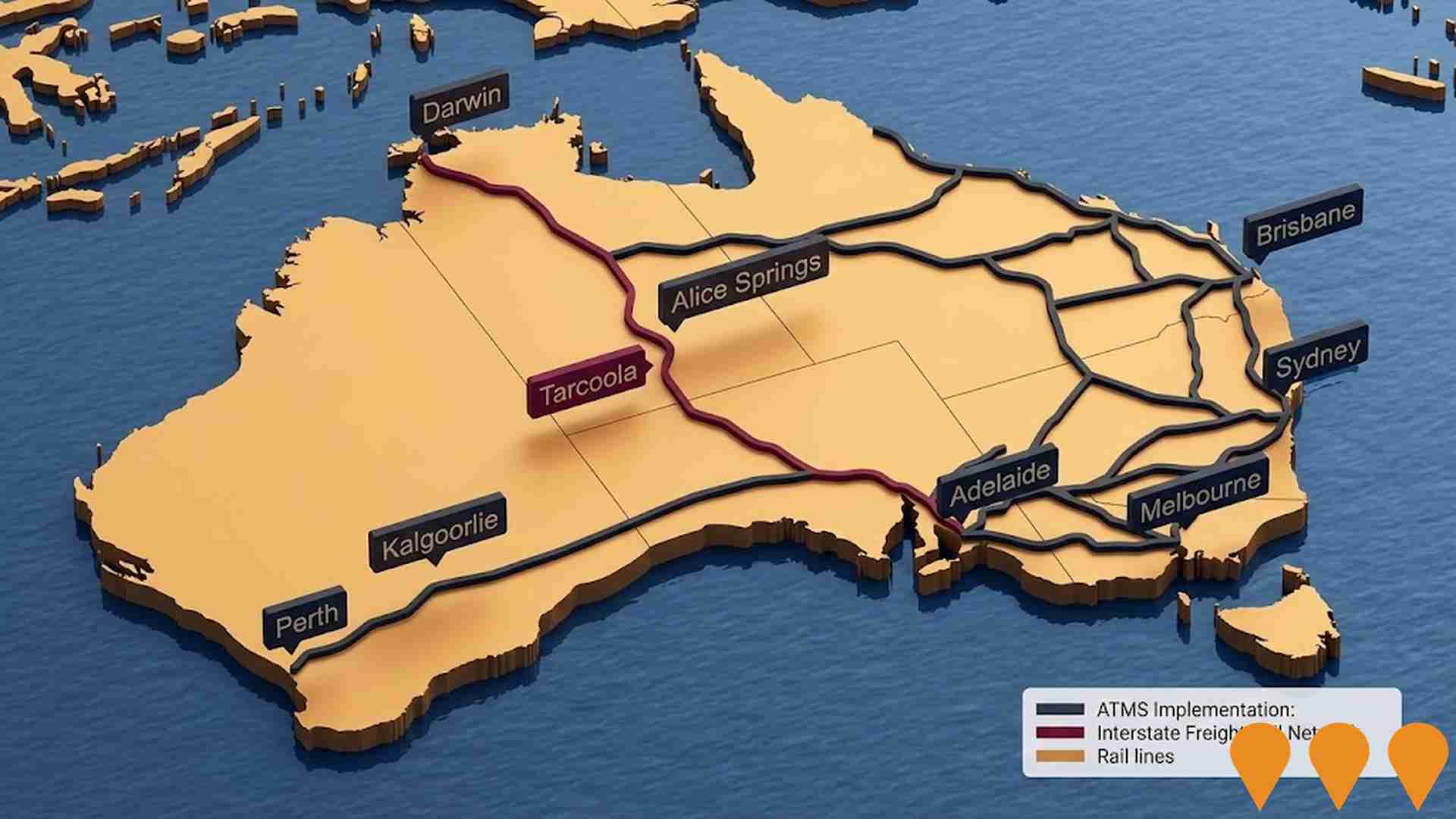

Advanced Train Management System Implementation On The Interstate Rail Network

The Advanced Train Management System (ATMS) enhances Australia's interstate freight rail network's safety, efficiency, and capacity by replacing traditional signalling with a communication-based control system.

Employment

Employment conditions in Coober Pedy face significant challenges, ranking among the bottom 10% of areas assessed nationally

Coober Pedy has a skilled workforce with essential services sectors well represented. Its unemployment rate is 19.4%.

As of September 2025, there are 603 residents in work while the unemployment rate is 14.0% higher than Rest of SA's rate of 5.3%, indicating room for improvement. Workforce participation lags significantly at 43.1%, compared to Rest of SA's 54.1%. Employment among residents is concentrated in accommodation & food, health care & social assistance, and retail trade. The area has a notably high concentration in accommodation & food, with employment levels at 2.8 times the regional average.

Conversely, agriculture, forestry & fishing is under-represented, with only 0.0% of Coober Pedy's workforce compared to 14.5% in Rest of SA. The area appears to offer limited local employment opportunities, as shown by the count of Census working population vs resident population. Over the 12 months to September 2025, labour force levels increased by 3.9%, while employment declined by 4.7%, resulting in a rise in unemployment rate by 7.3 percentage points. In contrast, Rest of SA experienced employment growth of 0.3% and labour force growth of 2.3%, with a 1.9 percentage point rise in unemployment rate. Jobs and Skills Australia's national employment forecasts from May-25 offer further insight into potential future demand within Coober Pedy. These projections estimate that national employment will expand by 6.6% over five years and 13.7% over ten years, with growth rates differing significantly between industry sectors. Applying these industry-specific projections to Coober Pedy's employment mix suggests local employment should increase by 6.3% over five years and 13.4% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

According to AreaSearch's aggregation of ATO data released for financial year 2022, Coober Pedy SA2 had a median income among taxpayers of $45,028 and an average level of $53,629. This is below the national average of $46,889 and the Rest of SA's $56,582. Based on Wage Price Index growth of 12.83% from financial year 2022 to September 2025, estimated median income would be approximately $50,805 and average income $60,510. From the 2021 Census, incomes in Coober Pedy fall between the 0th and 3rd percentiles nationally for households, families, and individuals. The largest income bracket comprises 34.9% earning $400 - $799 weekly (529 residents), differing from regional patterns where $1,500 - $2,999 dominates with 27.5%. Lower income households are prevalent, with 52.7% earning below $800 weekly, indicating affordability pressures. Despite modest housing costs resulting in 89.1% of income retained, total disposable income ranks at the 3rd percentile nationally.

Frequently Asked Questions - Income

Housing

Coober Pedy is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Coober Pedy's dwelling structures, as per the latest Census, comprised 88.6% houses and 11.3% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro SA had 85.7% houses and 14.3% other dwellings. Home ownership in Coober Pedy stood at 47.3%, with mortgaged dwellings at 15.6% and rented ones at 37.1%. The median monthly mortgage repayment was $630, lower than Non-Metro SA's average of $1,138. The median weekly rent in Coober Pedy was $163, compared to Non-Metro SA's $187. Nationally, Coober Pedy's mortgage repayments were significantly lower at $630 versus Australia's average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Coober Pedy features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 42.3% of all households, including 12.7% couples with children, 20.4% couples without children, and 7.7% single parent families. Non-family households comprise the remaining 57.7%, with lone person households at 53.3% and group households making up 3.7% of the total. The median household size is 1.8 people, which is smaller than the Rest of SA average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Coober Pedy faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

In the specified area, educational challenges are evident with university qualification rates at 19.2%, significantly lower than Australia's average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most prevalent at 13.0%, followed by postgraduate qualifications (4.2%) and graduate diplomas (2.0%). Vocational credentials are prominent, with 41.0% of residents aged 15+ holding such qualifications – advanced diplomas account for 10.7% and certificates for 30.3%.

Educational participation is notably high, with 32.6% of residents currently enrolled in formal education. This includes 10.5% in primary education, 9.6% in secondary education, and 3.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Coober Pedy is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Coober Pedy faces significant health challenges, with common conditions prevalent across both younger and older age groups. Only approximately 47% (about 713 people) have private health cover, compared to 53.1% in the rest of South Australia and a national average of 55.3%. The most frequent medical conditions are arthritis and diabetes, affecting 9.5 and 6.9% of residents respectively.

However, 64.5% claim to be free from any medical ailments, compared to 68.2% in the rest of South Australia. Coober Pedy has a higher proportion of seniors aged 65 and over, with 30.2% (458 people) compared to 16.3% in the rest of South Australia. Despite this, health outcomes among seniors are notably strong, even outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Coober Pedy was found to be more culturally diverse than the vast majority of local markets in Australia, upon assessment of a range of language and cultural background related metrics

Coober Pedy's population showed high cultural diversity, with 33.3% born overseas and 27.6% speaking a language other than English at home. Christianity was the predominant religion, accounting for 51.2%. Buddhism, however, had a higher representation at 6.4%, compared to the Rest of SA average of 0.9%.

In terms of ancestry, Australian parents comprised 20.3%, lower than the regional average of 28.5%. English parents accounted for 19.4%, also lower than the regional average of 25.2%. Australian Aboriginal parents made up 12.0%, below the regional average of 17.2%. Notable overrepresentation was seen in Croatian ancestry at 3.2% (vs regional 0.4%), Serbian at 2.0% (vs regional 0.2%), and Hungarian at 0.9% (vs regional 0.2%).

Frequently Asked Questions - Diversity

Age

Coober Pedy ranks among the oldest 10% of areas nationwide

The median age in Coober Pedy is 50 years, which is slightly higher than Rest of SA's average of 47 and significantly older than Australia's national norm of 38. Comparing with the Rest of SA average, those aged 25 to 34 are notably overrepresented at 13.3% in Coober Pedy, while those aged 5 to 14 are underrepresented at 6.2%. According to the 2021 Census, the population aged 15 to 24 has increased from 7.7% to 9.4%, while the age group of 5 to 14 has decreased from 7.8% to 6.2%. By 2041, Coober Pedy's age composition is expected to change significantly. The number of those aged 85 and above is projected to increase by 49 people (164%) from 30 to 80. Notably, the combined age groups of 65 and above will account for 75% of total population growth, reflecting Coober Pedy's aging demographic profile. Conversely, both age groups of 5 to 14 and 15 to 24 are expected to decrease in number.