Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

APY Lands has shown very soft population growth performance across periods assessed by AreaSearch

As of November 2025, APY Lands' population is approximately 2,658 people. This figure reflects a growth of 325 individuals since the 2021 Census, which recorded a population of 2,333. The increase was inferred from ABS's estimated resident population of 2,654 in June 2024 and address validation post-Census date. This results in a density ratio of approximately zero persons per square kilometer. APY Lands' growth rate of 13.9% since the 2021 Census exceeds that of its SA3 area (4.2%) and SA4 region, indicating it as a leader in regional population growth. Interstate migration contributed around 50% to overall population gains during recent periods, with all drivers including natural growth and overseas migration being positive factors.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024, using 2022 as the base year. For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections by age category are used. These projections were released in 2023 and based on 2021 data with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. According to these projections over this period, APY Lands' overall population is expected to decline by 62 persons by 2041. However, specific age cohorts are anticipated to grow, notably the 35-44 age group which is projected to increase by 71 people.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in APY Lands according to AreaSearch's national comparison of local real estate markets

APY Lands has averaged approximately 4 new dwelling approvals per year over the past five financial years, totalling 20 homes. As of FY-26, 3 approvals have been recorded. Over these five years, an average of 7.4 people moved to the area annually for each dwelling built. This demand significantly outpaces supply, typically putting upward pressure on prices and increasing competition among buyers.

The average construction cost value of new properties was $199,000, which is below regional levels, indicating more accessible housing choices for buyers. In FY-26, $6.2 million in commercial approvals have been registered, demonstrating the area's primarily residential nature. Compared to Rest of SA, APY Lands has seen slightly more development, with 14.0% above the regional average per person over the five-year period.

This maintains good buyer choice while supporting existing property values. However, development activity has moderated in recent periods, reflecting market maturity and possible development constraints. Recent building activity consists entirely of standalone homes, preserving the area's low density nature and attracting space-seeking buyers. Population projections indicate stability or decline, which should reduce housing demand pressures and benefit potential buyers.

Frequently Asked Questions - Development

Infrastructure

APY Lands has limited levels of nearby infrastructure activity, ranking in the 3rdth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 20 projects that could affect the region. Key initiatives include APY Lands Groundwater Quantity and Quality Investigation, Umuwa Multi-Agency Facility, Umuwa Central Power House Renewable Energy Upgrade, and Fregon Anangu School Upgrade. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Enabling Infrastructure for Hydrogen Production

Australia has completed the National Hydrogen Infrastructure Assessment (NHIA) to 2050 and refreshed its National Hydrogen Strategy (2024). The programmatic focus has shifted to planning and enabling infrastructure through measures such as ARENA's Hydrogen Headstart and the Hydrogen Production Tax Incentive (from April 2025). Round 2 of Hydrogen Headstart consultation occurred in 2025. Collectively these actions aim to coordinate investment in transport, storage, water and electricity inputs linked to Renewable Energy Zones and priority hubs, supporting large-scale renewable hydrogen production and future export supply chains.

National EV Charging Network (Highway Fast Charging)

Partnership between the Australian Government and NRMA to deliver a backbone EV fast charging network on national highways. Program funds and co-funds 117 DC fast charging sites at roughly 150 km intervals to connect all capital cities and regional routes, reducing range anxiety and supporting EV uptake.

Umuwa Central Power House Renewable Energy Upgrade

Upgrade of the Umuwa Central Power House on the APY Lands under South Australia's Remote Area Energy Supply (RAES) scheme. Works delivered a ground-mount solar PV system of approximately 2.42 MWp and a Battery Energy Storage System of about 1.56 MVA / 1.1 MWh integrated with the existing diesel plant via modern controls. The system is intended to supply around 4.4 GWh per year (about 40% of total demand) and reduce diesel use by roughly 1 million litres annually, improving reliability and cutting emissions across the RAES 33 kV network.

Network Optimisation Program - Roads

A national program concept focused on improving congestion and reliability on urban road networks by using low-cost operational measures and technology (e.g., signal timing, intersection treatments, incident management) to optimise existing capacity across major city corridors.

APY Lands Groundwater Quantity and Quality Investigation

Research and planning project to investigate groundwater quantity and quality across the APY Lands to identify sustainable water supplies for communities and local enterprises. Scope includes drilling, sampling and testing, hydrogeological assessment of newly identified aquifers near Kaltjiti, and community engagement to set water use priorities. Funded by the National Water Grid Fund with delivery led by the SA Department for Environment and Water.

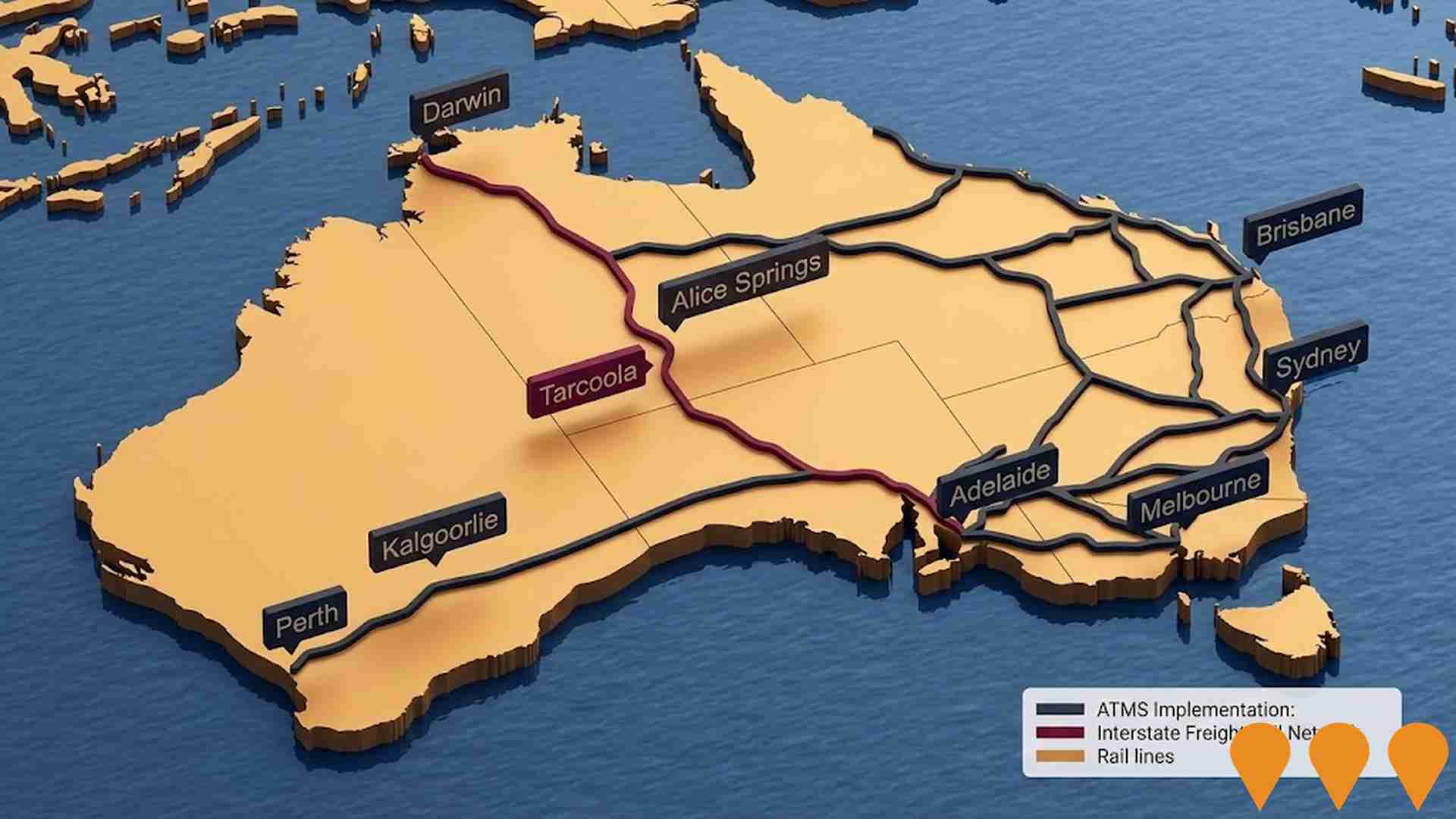

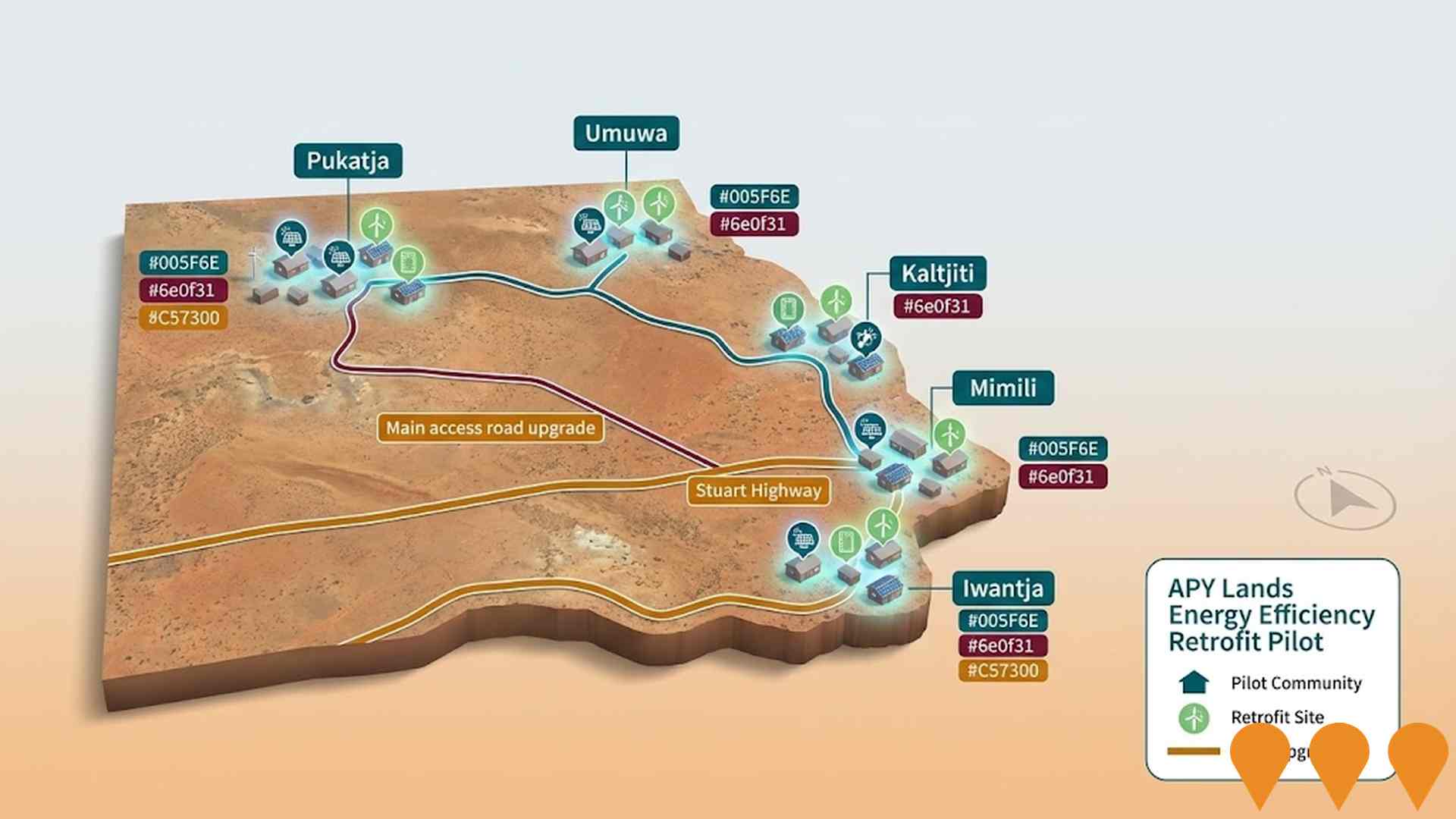

APY Lands Main Access Road Upgrade

Upgrade of 210 km of the Main Access Road between the Stuart Highway and Pukatja (Ernabella) in the Anangu Pitjantjatjara Yankunytjatjara (APY) Lands, plus about 21 km of community and airstrip access roads serving Pukatja (Ernabella), Umuwa, Kaltjiti (Fregon), Mimili and Iwantja (Indulkana). The project improves safety, accessibility and delivery of services for APY communities. All upgrades on the 210 km Main Access Road were completed in December 2021.

Umuwa Multi-Agency Facility

Purpose-built multi-agency facility accommodating SA Police and child protection agencies. Features forensic interview capabilities, family breakout areas, communal agency areas and improved technology connectivity. Designed to improve community safety and child protection outcomes through enhanced inter-agency collaboration.

Fregon Anangu School Upgrade

Fregon Anangu School is undergoing a facility upgrade. Construction of a new Primary School building and Secondary School buildings including covered outdoor areas with general learning areas, withdrawal spaces, breakout spaces and amenities. The upgrade includes new construction providing administration spaces, primary and secondary learning areas, food technology and canteen; refurbishment of the library resource and general teaching to provide a new art space; refurbishment of the gymnasium amenities; a vehicle storage shed; a new covered outdoor learning area (COLA) and external works; and demolition of ageing infrastructure.

Employment

Employment conditions in APY Lands face significant challenges, ranking among the bottom 10% of areas assessed nationally

APY Lands has a balanced workforce comprising white and blue collar jobs, with essential services sectors well represented. As of September 2025, the unemployment rate is 54.6%.

Compared to Rest of SA's rate of 5.3%, APY Lands' unemployment rate is 49.3% higher, indicating room for improvement. Workforce participation in APY Lands lags behind Rest of SA, at 41.7% versus 54.1%. Key industries of employment among residents are education & training, health care & social assistance, and arts & recreation. Notably, education & training has a significantly higher representation, at 3.9 times the regional level.

Conversely, agriculture, forestry & fishing shows lower representation, at 3.1% compared to the regional average of 14.5%. The area appears to offer limited local employment opportunities, as indicated by the difference between Census working population and resident population. Between May-24 and May-25, labour force increased by 5.1%, while employment declined by 34.9%, leading to a rise in unemployment rate of 27.9 percentage points. In contrast, Rest of SA saw employment rise by 0.3%, labour force grow by 2.3%, and unemployment rise by 1.9 percentage points. Jobs and Skills Australia's national employment forecasts from May-25 project overall employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to APY Lands' employment mix suggests local employment should increase by 6.3% over five years and 13.4% over ten years, though this is a simplified extrapolation for illustrative purposes only and does not consider localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

The APY Lands SA2 had a median taxpayer income of $25,535 and an average of $32,592 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This is lower than national averages, contrasting with Rest of SA's median income of $46,889 and average income of $56,582. By September 2025, estimates based on Wage Price Index growth suggest the median would be approximately $28,811 and the average around $36,774. Census data indicates household income ranks at the 18th percentile with a weekly income of $1,266, while personal income is at the 0th percentile. The earnings profile shows that 32.2% of residents (855 people) fall into the $800 - 1,499 bracket, contrasting with the region where the $1,500 - 2,999 bracket leads at 27.5%. Housing costs are modest, with 93.5% of income retained, but total disposable income ranks at just the 29th percentile nationally.

Frequently Asked Questions - Income

Housing

APY Lands is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

The dwelling structure in APY Lands, as per the latest Census, consisted of 91.1% houses and 9.0% other dwellings (semi-detached, apartments, 'other' dwellings). In contrast, Non-Metro SA had 85.7% houses and 14.3% other dwellings. Home ownership in APY Lands was at 2.3%, with the rest being mortgaged (0.0%) or rented (97.7%). The median monthly mortgage repayment was $0, below Non-Metro SA's average of $1,863. The median weekly rent was $85, compared to Non-Metro SA's $187 and the national average of $375.

Frequently Asked Questions - Housing

Household Composition

APY Lands features high concentrations of family households, with a higher-than-average median household size

Family households constitute 80.0% of all households, including 35.2% couples with children, 17.3% couples without children, and 20.2% single parent families. Non-family households account for the remaining 20.0%, with lone person households at 17.5% and group households comprising 2.9%. The median household size is 4.0 people, larger than the Rest of SA average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

APY Lands faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 13.0%, significantly lower than the Australian average of 30.4%. Bachelor degrees are the most common at 9.2%, followed by postgraduate qualifications (2.6%) and graduate diplomas (1.2%). Vocational pathways account for 19.1% of qualifications among those aged 15+, with advanced diplomas at 3.2% and certificates at 15.9%. Educational participation is high, with 28.8% of residents currently enrolled in formal education.

This includes 14.7% in primary education, 7.6% in secondary education, and 1.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

APY Lands's residents boast exceedingly positive health performance metrics with both young and old age cohorts seeing low prevalence of common health conditions

Health outcomes data shows excellent results across APY Lands, with both young and elderly age groups exhibiting low prevalence of common health conditions. The rate of private health cover is extremely low at approximately 44% of the total population (around 1,180 people), compared to 53.1% across the Rest of SA. Nationally, this figure stands at 55.3%.

Diabetes and asthma are the most common medical conditions in the area, affecting 9.5% and 4.6% of residents respectively. A total of 78.6% of residents report being completely free from medical ailments, compared to 68.2% across the Rest of SA. The area has 4.6% of residents aged 65 and over (122 people), which is lower than the 16.3% in the Rest of SA. Despite this, health outcomes among seniors require more attention than those in the broader population.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in APY Lands was found to be slightly above average when compared nationally for a number of language and cultural background related metrics

APY Lands had a higher cultural diversity with 2.7% overseas-born residents and 88.5% speaking languages other than English at home. Christianity was the predominant religion at 53.7%. Notably, the 'Other' category comprised 9.4%, significantly higher than Rest of SA's average of 1.9%.

In terms of ancestry, Australian Aboriginal was highest at 85.1%, much higher than the regional average of 17.2%. English ancestry was lower at 3.7%, below the regional average of 25.2%. Australian ancestry also stood at 3.6%, lower than the regional average of 28.5%.

Frequently Asked Questions - Diversity

Age

APY Lands hosts a very young demographic, ranking in the bottom 10% of areas nationwide

The median age in APY Lands is 28 years, which is notably lower than the average of Rest of SA at 47 years and also substantially under the Australian median of 38 years. Relative to Rest of SA, APY Lands has a higher concentration of residents aged 25-34 (22.1%) but fewer residents aged 65-74 (3.4%). This concentration of 25-34 year-olds is well above the national average of 14.5%. Between the 2021 Census and the present, the population aged 25 to 34 has grown from 20.4% to 22.1%, while the 35 to 44 cohort increased from 12.9% to 14.2%. Conversely, the 0 to 4 cohort has declined from 8.4% to 6.0% and the 15 to 24 group dropped from 18.8% to 16.8%. By 2041, APY Lands is expected to see notable shifts in its age composition. Leading this demographic shift, the 35 to 44 age group is projected to grow by 20%, reaching 452 people from the current 377. Meanwhile, both the 65 to 74 and 25 to 34 age groups are expected to see reduced numbers.