Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Sylvania - Taren Point reveals an overall ranking slightly below national averages considering recent, and medium term trends

Sylvania - Taren Point's population is around 16,527 as of Nov 2025. This reflects an increase of 97 people since the 2021 Census, which reported a population of 16,430 people. The change is inferred from the estimated resident population of 16,534 in June 2024 and an additional 65 validated new addresses since the Census date. This level of population equates to a density ratio of 2,727 persons per square kilometer. Population growth was primarily driven by overseas migration during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with 2021 as the base year. Growth rates by age group are applied to all areas for years 2032 to 2041. Based on demographic trends and latest ERP population numbers, the area is expected to grow by 1,520 persons to 2041, reflecting an increase of approximately 9.2% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Sylvania - Taren Point recording a relatively average level of approval activity when compared to local markets analysed countrywide

Sylvania - Taren Point has recorded approximately 88 residential properties granted approval annually over the past five financial years, totalling 440 homes. As of FY26, 26 approvals have been recorded. The population has declined in recent years, indicating that new supply has likely kept pace with demand, providing good options for buyers. The average expected construction cost value of new homes is $632,000, suggesting developers are targeting the premium market segment with higher-end properties.

In FY26, $86.9 million in commercial approvals have been registered, indicating high levels of local commercial activity. Compared to Greater Sydney, Sylvania - Taren Point records about three-quarters the building activity per person and ranks among the 61st percentile of areas assessed nationally. New building activity comprises approximately 19.0% standalone homes and 81.0% townhouses or apartments, promoting higher-density living that caters to downsizers, investors, and first-home buyers. This shift reflects reduced availability of development sites and evolving lifestyle demands and affordability requirements, marking a significant change from the current housing mix (currently 64.0% houses). The location has approximately 242 people per dwelling approval, indicating a low density market.

According to AreaSearch's latest quarterly estimate, Sylvania - Taren Point is expected to grow by 1,525 residents through to 2041. Based on current development patterns, new housing supply should readily meet demand, potentially facilitating population growth beyond current projections and offering good conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Sylvania - Taren Point has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes in local infrastructure significantly impact an area's performance. AreaSearch has identified twelve projects likely affecting the region. Notable ones are Florida Street Affordable Housing, 117-131 Taren Point Road Specialised Retail Development, Frank Vickery Village Renewal, and Southgate Shopping Centre Expansion. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sutherland Hospital Redevelopment

A $88.5 million expansion and modernisation of Sutherland Hospital, delivering six new operating theatres, a surgical short stay unit, recovery areas, staff amenities, admission/discharge facilities, an MRI facility, a new central sterilising services department, an upgraded emergency department, an intensive care unit, patient accommodation, and supporting infrastructure. Completed in February 2024 as part of NSW Health's infrastructure investment program.

Frank Vickery Village Renewal

Major seniors housing renewal project to redevelop the existing retirement village, expanding capacity from 203 to 519 independent living units (ILUs) and from 69 to 126 residential aged care beds. The planning proposal, gazetted in July 2022, rezones the 5.7-hectare site from R2 Low Density to R4 High Density Residential, with increased floor space ratio to 1.26:1 and height to 26.5m. The masterplan includes five connected precincts with retail facilities (1,000 sqm), indoor recreation facilities (3,000 sqm), medical centre (1,000 sqm), cafe, and community amenities. Buildings will cascade to follow the site's natural topography, retaining significant green space and heritage cottage. The project will be rolled out over approximately 10 years to meet the growing demand for seniors living in Sutherland Shire.

Southgate Shopping Centre Expansion

A 28.7 million dollar expansion project involving the demolition of former squash courts at 27-29 Melrose Avenue and construction of a three-level extension to the shopping centre. The development will create new major retailer spaces including a relocated and enlarged Woolworths supermarket with innovative rooftop direct-to-boot service, three new lifts, new loading zones, and expanded car parking facilities. The project aims to meet the growing demands of the Sutherland Shire community through enhanced retail offerings and improved accessibility.

M6 Motorway Stage 1

The M6 Stage 1 is the missing link connecting President Avenue, Kogarah, to the M8 at Arncliffe via a four-kilometre twin tunnel. It is designed to link southern Sydney to the wider motorway network, bypass 23 traffic lights, and reduce truck traffic on surface roads by over 2,000 vehicles daily. The project includes tunnel stubs for a future Stage 2 extension, as well as new and upgraded shared pedestrian and cyclist pathways and parklands in the local area.

117-131 Taren Point Road Specialised Retail Development

Planning Proposal to introduce Additional Permitted Use for specialised retail premises including bulky goods retail such as household appliances, furniture, homewares, office equipment, automotive parts and accessories, recreation equipment, pet supplies and party supplies. The proposal seeks to add retail use to the existing E4 General Industrial zoning across two properties on the western side of Taren Point Road.

M6 Stage 2

M6 Stage 2 is the proposed southern extension of the M6 motorway from President Avenue at Kogarah through twin tunnels to connect with the Princes Highway near Loftus and ultimately link to the M1 Princes Motorway. The project has been indefinitely shelved since 2022 due to market conditions, labour shortages and lack of funding commitment. The corridor remains reserved but there is no active planning, approval process or construction timeline as of December 2025.

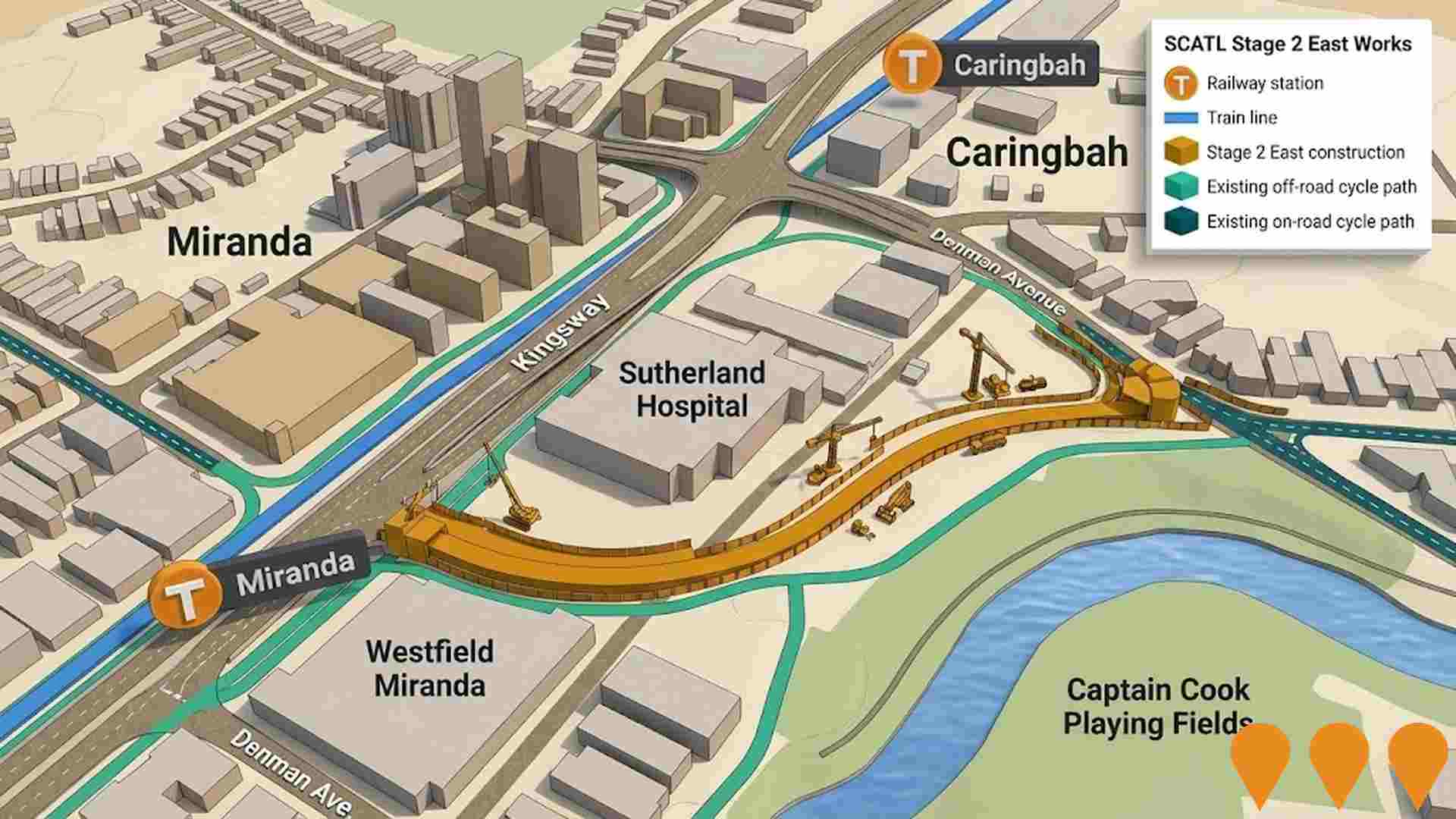

Sutherland to Cronulla Active Transport Link (SCATL)

The Sutherland to Cronulla Active Transport Link (SCATL) is an 11km cycleway and pedestrian path connecting Sutherland to Cronulla, utilizing the rail corridor and various locations. Stage 1 (Sutherland to Kirrawee) and Stage 2 (Kirrawee to Caringbah, including Jackson Avenue, Miranda to Gannons Road, Caringbah) are completed, with Stage 2 finalized in early 2024 using $65M in funding. Stage 3 (Caringbah to Cronulla) is in construction, with a focus on connecting key centers, transport hubs, schools, and business precincts in the Sutherland Shire.

Live Caringbah

Live Caringbah is an approved mixed-use development in the Caringbah Medical Precinct comprising approximately 240 apartments (1-, 2-, and 3-bedroom) across two eight-storey towers, together with a five-storey medical/health facility. Designed with contemporary coastal-inspired architecture by DKO, the project includes rooftop gardens, study/home office spaces, and high-quality resident amenities. Originally proposed as residential-only, the project was approved on appeal by the Land and Environment Court in April 2024 following initial refusals by the planning panel.

Employment

AreaSearch assessment positions Sylvania - Taren Point ahead of most Australian regions for employment performance

Sylvania - Taren Point has an educated workforce with strong professional services representation. Its unemployment rate is 3.1%, lower than Greater Sydney's 4.2%.

Employment grew by 1.3% in the year to September 2025. Key industries are health care & social assistance, construction, and retail trade. Construction employment is high at 1.3 times the regional average. Professional & technical services have lower representation at 9.3%.

The area has limited local employment opportunities. Employment levels increased by 1.3% and labour force by 1.1% in the year to September 2025, reducing unemployment by 0.2 percentage points. In comparison, Greater Sydney had employment growth of 2.1%, labour force growth of 2.4%, and a rise in unemployment of 0.2 percentage points. State-level data to 25-Nov shows NSW employment contracted by 0.03% with an unemployment rate of 3.9%. National forecasts suggest employment will expand by 6.6% over five years and 13.7% over ten years, but growth rates vary between industries. Applying these projections to Sylvania - Taren Point's employment mix indicates local employment should increase by 6.7% over five years and 13.5% over ten years.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

The Sylvania - Taren Point SA2's income level is extremely high nationally according to the latest ATO data aggregated by AreaSearch for financial year 2022. The median income among taxpayers in this area is $55,451 and the average income stands at $88,050. These figures compare to those of Greater Sydney's which are $56,994 and $80,856 respectively. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates would be approximately $62,443 for median income and $99,153 for average income as of September 2025. According to the 2021 Census figures, household, family and personal incomes in Sylvania - Taren Point cluster around the 63rd percentile nationally. Distribution data shows that the $1,500 - 2,999 bracket dominates with 27.8% of residents (4,594 people), mirroring regional levels where 30.9% occupy this bracket. Sylvania - Taren Point demonstrates considerable affluence with 32.7% earning over $3,000 per week, supporting premium retail and service offerings. High housing costs consume 16.9% of income, though strong earnings still place disposable income at the 65th percentile nationally. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Sylvania - Taren Point displays a diverse mix of dwelling types, with above-average rates of outright home ownership

The dwelling structure in Sylvania - Taren Point, as per the latest Census, consisted of 63.5% houses and 36.6% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Sydney metro's 52.4% houses and 47.6% other dwellings. Home ownership in Sylvania - Taren Point was at 44.6%, with mortgaged dwellings at 36.2% and rented ones at 19.2%. The median monthly mortgage repayment was $2,817, higher than Sydney metro's average of $2,774. The median weekly rent figure was $550, compared to Sydney metro's $500. Nationally, Sylvania - Taren Point's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Sylvania - Taren Point has a typical household mix, with a higher-than-average median household size

Family households constitute 75.5% of all households, including 36.8% couples with children, 27.8% couples without children, and 10.2% single parent families. Non-family households account for the remaining 24.5%, with lone person households at 22.9% and group households comprising 1.6%. The median household size is 2.6 people, larger than the Greater Sydney average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Sylvania - Taren Point exceeds national averages, with above-average qualification levels and academic performance metrics

Educational qualifications in Sylvania show that 28.5% of residents aged 15 and above hold university degrees, compared to Greater Sydney's 38.0%. Bachelor degrees are the most common at 20.1%, followed by postgraduate qualifications (6.4%) and graduate diplomas (2.0%). Vocational credentials are also prevalent, with 34.7% of residents aged 15 and above holding them. Advanced diplomas account for 13.3% and certificates for 21.4%.

Educational participation is high, with 27.5% of residents currently enrolled in formal education. This includes 9.3% in primary education, 8.1% in secondary education, and 4.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Public transport analysis shows 86 active transport stops operating within Sylvania-Taren Point. These stops serve a mix of bus routes totalling 29 individual routes. They collectively provide 1,440 weekly passenger trips.

Transport accessibility is rated excellent, with residents typically located 156 meters from the nearest stop. Service frequency averages 205 trips per day across all routes, equating to approximately 16 weekly trips per stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health outcomes in Sylvania - Taren Point are marginally below the national average with common health conditions slightly more prevalent than average across both younger and older age cohorts

Sylvania - Taren Point shows below-average health indicators. Common health conditions are slightly more prevalent here across both younger and older age groups compared to averages.

Private health cover is exceptionally high at approximately 64% of the total population (10,544 people), exceeding the national average of 55.3%. The most common medical conditions are arthritis and mental health issues, affecting 9.3 and 5.6% of residents respectively. Conversely, 69.7% of residents declare themselves completely clear of medical ailments, compared to 72.3% across Greater Sydney. The area has a higher proportion of seniors aged 65 and over at 27.0% (4,458 people), compared to the Greater Sydney average of 21.1%. Health outcomes among seniors are above average, generally aligning with the overall population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Sylvania - Taren Point was found to be above average when compared nationally for a number of language and cultural background related metrics

Sylvania-Taren Point has a higher cultural diversity than most local markets, with 27.0% of its population born overseas and 29.7% speaking a language other than English at home. Christianity is the predominant religion in Sylvania-Taren Point, accounting for 69.0%, compared to 61.2% across Greater Sydney. The top three ancestry groups are English (21.7%), Australian (19.1%), and Other (10.1%).

Notably, Greek ethnicity is overrepresented at 9.0%, Macedonian at 2.3%, and Lebanese at 2.1%.

Frequently Asked Questions - Diversity

Age

Sylvania - Taren Point hosts an older demographic, ranking in the top quartile nationwide

The median age in Sylvania - Taren Point is 46 years, notably higher than Greater Sydney's average of 37 years and also above the Australian median of 38 years. Compared to Greater Sydney, the 75-84 age cohort is significantly over-represented in Sylvania - Taren Point at 10.8%, while those aged 25-34 are under-represented at 8.8%. Between the 2021 Census and now, the population of those aged 15 to 24 has grown from 10.9% to 12.3%, while the percentage of those aged 5 to 14 has declined from 11.8% to 10.8%. By 2041, projections indicate substantial demographic changes for Sylvania - Taren Point. The population aged 85 and above is expected to grow significantly, increasing by 834 people (an 85% rise) from 986 to 1,821. The aging population trend is clear, with those aged 65 and above comprising 85% of the projected growth. Conversely, the populations of those aged 25-34 and 0-4 are expected to decline.