Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Greenfields is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Greenfields's population is around 10,918 as of Nov 2025. This reflects an increase of 1,049 people since the 2021 Census, which reported a population of 9,869 people. The change is inferred from the estimated resident population of 10,785 in June 2024 and an additional 106 validated new addresses since the Census date. This level of population equates to a density ratio of 1,096 persons per square kilometer. Greenfields's growth of 10.6% since the 2021 census exceeded the national average (8.9%). Population growth was primarily driven by interstate migration contributing approximately 71.7% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and post-2032 estimates, AreaSearch uses growth rates by age cohort provided by the ABS in its latest Greater Capital Region projections (released in 2023, based on 2022 data). An above median population growth is projected for the area, expected to grow by 1,485 persons to 2041, reflecting a gain of 12.4% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential approval activity sees Greenfields among the top 30% of areas assessed nationwide

Greenfields has received approximately 33 dwelling approvals annually over the past five financial years, totalling 165 homes. As of FY26, 4 approvals have been recorded. On average, 4.5 new residents arrive per year for each dwelling constructed between FY21 and FY25. This supply lagging demand has led to heightened buyer competition and pricing pressures, with new properties constructed at an average cost of $221,000, reflecting more affordable housing options.

In this financial year, $16.6 million in commercial approvals have been registered, indicating moderate levels of commercial development. Compared to Greater Perth, Greenfields shows significantly reduced construction, which is 74.0% below the regional average per person. This limited new supply generally supports stronger demand and values for established properties. However, building activity has accelerated recently, though it remains lower than the national average, suggesting market maturity and possible development constraints. New building activity consists of 92.0% standalone homes and 8.0% attached dwellings, sustaining the area's suburban identity with a concentration of family homes suited to buyers seeking space.

The location has approximately 289 people per dwelling approval, indicating room for growth. Future projections show Greenfields adding 1,352 residents by 2041, according to the latest AreaSearch quarterly estimate. Construction is maintaining a reasonable pace with projected growth, although buyers may encounter growing competition as population increases.

Frequently Asked Questions - Development

Infrastructure

Greenfields has limited levels of nearby infrastructure activity, ranking in the 10thth percentile nationally

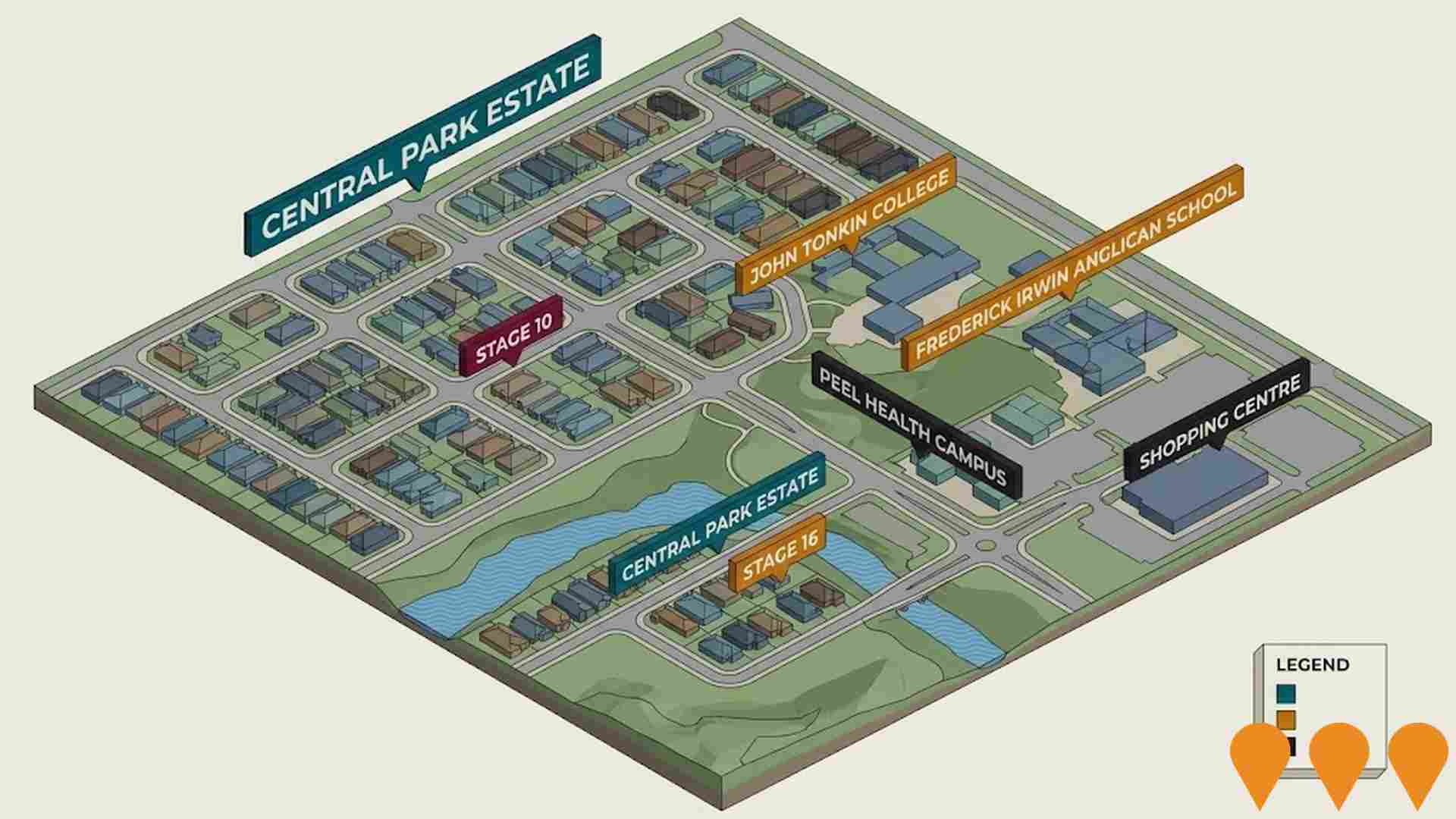

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified ten projects likely to impact the area. Notable ones are Structure Plan Lot 601 Old Pinjarra Road, Ocean Hill Estate, Varsity Park Estate, and Central Park Estate. The following details those deemed most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Mandurah Line

70.8km suburban railway line connecting Perth CBD to Mandurah with 13 stations including Rockingham and Warnbro stations. Operates through Kwinana Freeway median with dedicated underground tunnels through Perth CBD. Serves as vital transport link for region. Recent extensions include integration with Thornlie-Cockburn Link in June 2025.

Mandurah Health Precinct Structure Plan

A Structure Plan prepared by the City of Mandurah to guide the long-term coordinated development of land, transport, and health services in the precinct surrounding the Peel Health Campus. It focuses on health-related land uses, coordinated access arrangements, and future road upgrades like Lakes Road. The draft plan was open for public comment until November 10, 2025, with final Council consideration anticipated in February 2026.

Dudley Park Transit Precinct Structure Plan (Proposed)

City of Mandurah structure plan to create a higher-density mixed-use precinct around the future Dudley Park train station (DENISON project - part of METRONET Lakelands to Mandurah extension), enabling significant residential and commercial growth.

Meadow Springs Master Plan Redevelopment

Comprehensive master plan redevelopment of Meadow Springs area including residential subdivisions, commercial precincts, recreational facilities, and infrastructure upgrades. Major urban renewal project transforming the northern Mandurah suburbs.

Ocean Hill Estate

Master planned residential estate in North Lakelands offering modern family homes in a coastal setting. Located within walking distance of Madora Beach and Lakelands Shopping Centre. Features 1,900 lots across 23 stages when completed, with CP Group and Satterley Property Group as developers.

Gordon Road Train Station

Proposed train station at Gordon Road in the Business Industry area of Meadow Springs. Part of future public transport planning to serve the growing northern Mandurah suburbs and provide convenient access to the Mandurah railway line.

Southern Beaches Coastal Hazard Risk Management and Adaptation Plan (CHRMAP)

A long-term (100-year) strategic plan by the City of Mandurah to address the risks posed by coastal hazards, such as erosion, sea level rise, and flooding, along the southern coastline from Roberts Point to Clifton. The plan involves technical studies and community engagement to identify key assets, assess risks, and develop sustainable adaptation strategies. Stage 1 and 2 community engagement are complete, and the draft CHRMAP is anticipated for public comment in the coming months.

Additional Australind Trains Procurement

Procurement of two additional three-car Australind diesel railcar sets to improve service reliability and support increased frequency on the Perth to Bunbury route. Part of WA Government's broader rail improvement strategy, these trains will be manufactured by Alstom at the Bellevue facility and are scheduled to commence operations when the Armadale Train Line reopens in early 2026.

Employment

The employment landscape in Greenfields shows performance that lags behind national averages across key labour market indicators

Greenfields has a diverse workforce with both white and blue collar jobs, notably in manufacturing and industrial sectors. Its unemployment rate is 5.0%, with an estimated employment growth of 9.9% over the past year as of September 2025.

In this month, 4,266 residents are employed while the unemployment rate is higher than Greater Perth's at 1.0%. Workforce participation in Greenfields lags behind Greater Perth at 46.6% compared to 65.2%. Key industries for employment among residents include health care & social assistance, retail trade, and mining, with mining particularly prominent being 1.5 times the regional level. However, professional & technical services are under-represented at 3.0%, compared to Greater Perth's 8.2%.

Many Greenfields residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, employment levels increased by 9.9% while the labour force grew by 9.2%, reducing the unemployment rate by 0.7 percentage points. In contrast, Greater Perth had employment growth of 2.9% and a marginal rise in unemployment rate during this period. Statewide, WA's employment contracted by 0.27% between November 2024 and 25-Nov-25, losing 5,520 jobs, with an unemployment rate of 4.6%, slightly higher than the national rate of 4.3%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Greenfields' employment mix suggests local employment should grow by 5.7% over five years and 12.5% over ten years, though this is an illustrative extrapolation not accounting for localized population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

The median taxpayer income in Greenfields SA2 was $44,784 and the average was $63,152 according to postcode level ATO data aggregated by AreaSearch for financial year 2022. This is lower than the national average of $58,380 (median) and $78,020 (average), which were reported for Greater Perth during the same period. By September 2025, with a 14.2% increase in wages as per the Wage Price Index, these figures would be approximately $51,143 (median) and $72,120 (average). According to the 2021 Census, incomes in Greenfields fall between the 3rd and 6th percentiles nationally. The income bracket of $400 - 799 dominated with 31.8% of residents, contrasting with regional levels where the $1,500 - 2,999 bracket led at 32.0%. This concentration highlights economic challenges faced by a significant portion of Greenfields' community. Housing affordability pressures were severe; only 79.9% of income remained after housing costs, ranking at the 4th percentile nationally.

Frequently Asked Questions - Income

Housing

Greenfields is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Greenfields' dwelling structure, as per the latest Census, consisted of 77.5% houses and 22.5% other dwellings. In contrast, Perth metro had 85.0% houses and 15.0% other dwellings. Home ownership in Greenfields was at 35.0%, similar to Perth metro's level. Dwellings were either mortgaged (38.2%) or rented (26.8%). The median monthly mortgage repayment in Greenfields was $1,387, below the Perth metro average of $1,733. The median weekly rent figure in Greenfields was $295, compared to Perth metro's $300 and the national average of $375. Nationally, Greenfields' mortgage repayments were significantly lower than the Australian average of $1,863.

Frequently Asked Questions - Housing

Household Composition

Greenfields features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 64.3% of all households, including 20.8% couples with children, 28.3% couples without children, and 14.1% single parent families. Non-family households constitute the remaining 35.7%, with lone person households at 33.0% and group households comprising 2.6%. The median household size is 2.3 people, which is smaller than the Greater Perth average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Greenfields faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 9.8%, significantly lower than the Australian average of 30.4%. This discrepancy presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most prevalent at 7.5%, followed by postgraduate qualifications (1.3%) and graduate diplomas (1.0%). Vocational credentials are prominent, with 41.6% of residents aged 15+ holding such qualifications - advanced diplomas at 9.1% and certificates at 32.5%.

Educational participation is high, with 26.5% of residents currently enrolled in formal education. This includes 10.4% in primary education, 7.7% in secondary education, and 2.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Greenfields has 84 active public transport stops. These are mixed-use bus stops serviced by 9 routes. Together, they facilitate 886 weekly passenger trips.

Residents' proximity to these stops is rated good, with an average distance of 273 meters to the nearest stop. The service frequency across all routes averages 126 trips per day, which translates to about 10 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Greenfields is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Greenfields faces significant health challenges, with various conditions affecting both younger and older residents. Private health cover stands at approximately 51% of the total population (~5,590 people), slightly lower than Greater Perth's 54.9%.

The most prevalent medical conditions are arthritis (12.1%) and mental health issues (10.1%). Conversely, 56.6% reported no medical ailments, compared to 63.6% in Greater Perth. Residents aged 65 and over comprise 30.0% of the population (3,278 people), higher than Greater Perth's 27.5%. Senior health outcomes present challenges broadly aligned with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Greenfields ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Greenfields, according to a study, showed lower cultural diversity with 76.1% of its population born in Australia, 86.7% being citizens, and 93.7% speaking English only at home. Christianity was the predominant religion, comprising 45.8% of Greenfields' population. Notably, the 'Other' religious category was overrepresented in Greenfields at 1.1%, compared to 0.6% across Greater Perth.

Regarding ancestry, the top groups were English (35.6%), Australian (29.2%), and Scottish (6.7%). Some ethnic groups showed notable differences: Maori were slightly overrepresented at 1.5% in Greenfields versus 1.2% regionally, New Zealand was similarly represented at 1.0%, and Welsh were slightly underrepresented at 0.7% compared to the regional average of 0.8%.

Frequently Asked Questions - Diversity

Age

Greenfields hosts an older demographic, ranking in the top quartile nationwide

Greenfields's median age is 47 years, which is higher than the Greater Perth average of 37 years and exceeds the national average of 38 years. The 75-84 age group comprises 12.1% of Greenfields' population, compared to Greater Perth and the national average of 6%. The 25-34 cohort makes up 9.1%, which is less prevalent than in Greater Perth. According to post-2021 Census data, the 75-84 age group has increased from 11.2% to 12.1%, while the 45-54 cohort has decreased from 11.2% to 10.2%. By 2041, Greenfields' age profile is projected to change significantly. The 75-84 cohort is expected to grow by 50%, adding 653 residents to reach 1,970. Residents aged 65 and above will drive 89% of population growth. Meanwhile, the 15-24 and 25-34 cohorts are projected to decline in population.