Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Augusta lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Augusta's population was around 8,503 as of November 2025. This figure reflects an increase of 1,908 people since the 2021 Census, which reported a population of 6,595. The change is inferred from the estimated resident population of 7,723 in June 2024 and an additional 768 validated new addresses since the Census date. This results in a population density ratio of 4.0 persons per square kilometer. Augusta's growth rate of 28.9% since the 2021 census exceeded the national average of 8.9%. Population growth was primarily driven by interstate migration, contributing approximately 80.0% of overall gains.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered, growth rates by age cohort from the ABS's Greater Capital Region projections (released in 2023, based on 2022 data) are used. Looking ahead, above median population growth is projected for Australia's non-metropolitan areas. The area is expected to expand by 1,429 persons to 2041, reflecting an increase of 7.6% over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Augusta was found to be higher than 90% of real estate markets across the country

Augusta has seen approximately 176 new homes approved annually. Over the past five financial years, from FY21 to FY25882 homes were approved, with an additional 80 approved so far in FY26. The average population growth associated with these dwellings over this period is 1.7 people per year per dwelling.

This suggests a balance between supply and demand, contributing to stable market dynamics. The average expected construction cost of new homes is $348,000. In terms of commercial development, $10.3 million in approvals have been registered during FY26. Compared to the rest of WA, Augusta has 92.0% more building activity per person, indicating a higher level of developer interest and providing buyers with greater choice. All recent building activity consists of detached houses, maintaining the area's traditional low-density character focused on family homes.

The location currently has approximately 39 people per dwelling approval, suggesting an expanding market. By 2041, Augusta is projected to grow by 648 residents according to the latest AreaSearch quarterly estimate. At current development rates, new housing supply should comfortably meet demand, creating favorable conditions for buyers and potentially supporting population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Augusta has limited levels of nearby infrastructure activity, ranking in the 3rdth percentile nationally

The performance of an area is significantly influenced by changes in local infrastructure and major projects. AreaSearch has identified a total of nineteen projects that are expected to impact the area. Notable projects include Witchcliffe Ecovillage, Witchcliffe Streetscape Plan and Activation, Margaret River Net-Positive Circular Hotel, and Margaret River Wa 6285. The following list details those projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

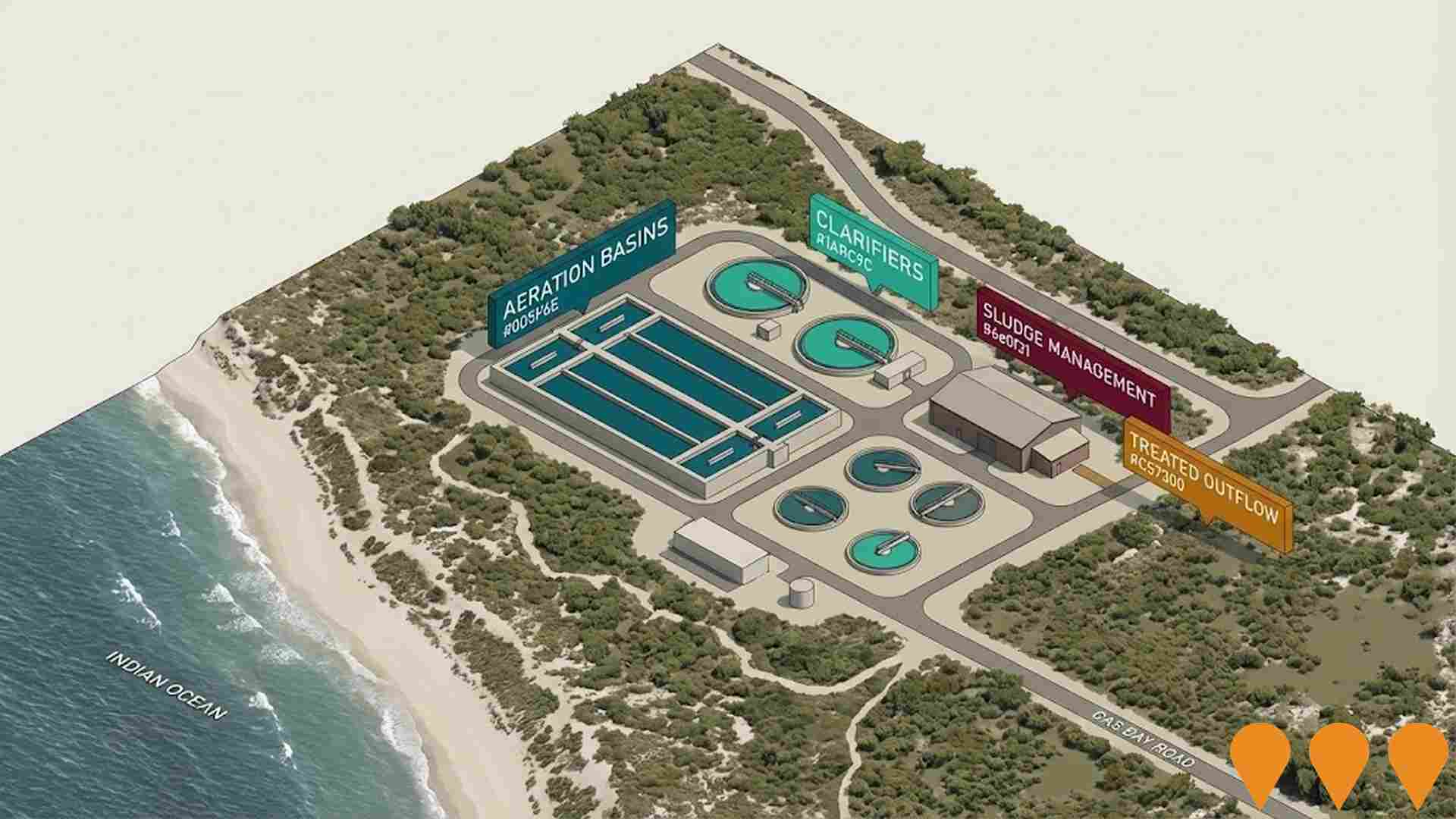

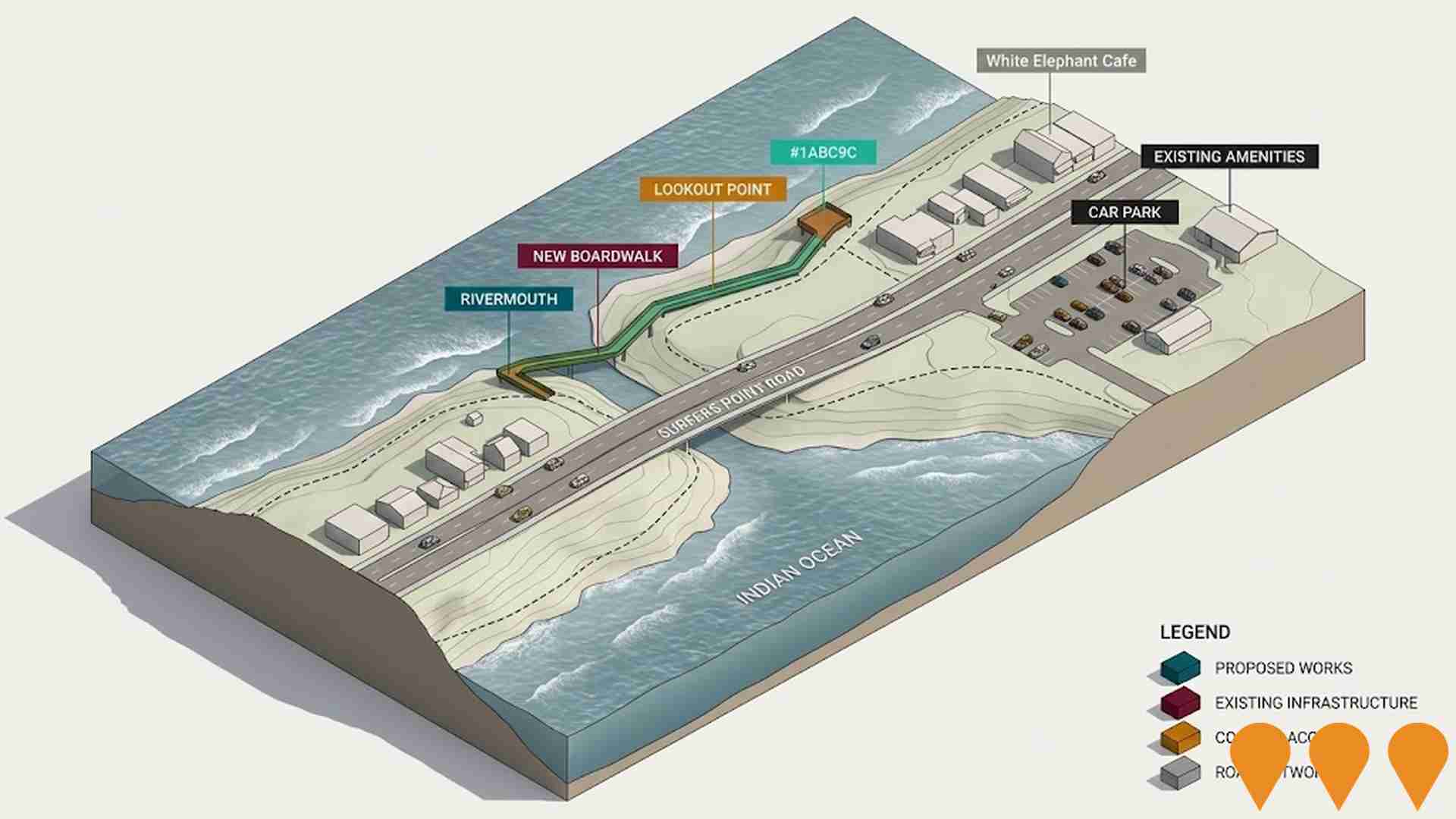

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Gnarabup Beach Resort and Village (Westin Margaret River Resort & Spa)

Luxury 121-room five-star Westin Margaret River Resort & Spa (Marriott International) plus Gnarabup Beach Village comprising 51 beach houses, 4 townhouses, 25 apartments and a village store/cafe. 8.1 ha site 8 km south-west of Margaret River. Construction commenced in 2025 with first stage (resort) expected to open late 2027.

Witchcliffe Ecovillage

A pioneering sustainable residential development featuring 350+ homes across 11 residential clusters with extensive permaculture areas, community gardens, renewable energy systems, and environmental conservation areas. The 120-hectare ecovillage is designed to be self-sufficient in renewable energy, water, and fresh food production.

Margaret River South Structure Plan

A comprehensive 67.63-hectare residential development featuring 411 residential lots at a variety of densities ranging from R10-R60, a 250-dwelling lifestyle living component, and an integrated open space network. The structure plan facilitates subdivision and development following LPS1 Amendment 74.

Rapids Landing Masterplanned Community

A comprehensive masterplanned community by The Lester Group located 800 metres from Margaret River town centre. The development includes an established residential estate with various sized lots, a proposed over-50s lifestyle community, village centre with retail and commercial spaces, Rapids Landing Primary School, parklands, and native bush reserves. The community features modern infrastructure including reticulated gas, NBN fibre, and extensive walking/cycling trails.

Margaret River Net-Positive Circular Hotel

Australia's first net-positive circular hotel in Margaret River with 32 rooms and 5 villas, designed to enhance local tourism while operating with net-positive environmental impact through renewable energy and sustainable design.

Goldfields Group Darch Road Development

A major residential development by Goldfields Group featuring a 400-lot masterplanned residential community with various housing densities, parks, and community facilities located near Margaret River township.

Cowaramup Country Estate by Yolk Property Group

A masterplanned community development featuring 180+ residential lots and a 250-dwelling lifestyle living component set within the agricultural landscape near Cowaramup township.

Margaret River Wa 6285

A high-end hotel and spa in Margaret River region, restoring a historic homestead destroyed by bushfire with luxury accommodation and wellness facilities designed to showcase the region's natural beauty.

Employment

The labour market strength in Augusta positions it well ahead of most Australian regions

Augusta has a skilled workforce with strong manufacturing and industrial sectors. Its unemployment rate was 1.8% in the past year, with an estimated employment growth of 6.8%.

As of September 2025, 4,294 residents are employed, with an unemployment rate of 1.5% below Rest of WA's rate of 3.3%, and workforce participation at 59.4%. Key industries for Augusta residents include agriculture, forestry & fishing, accommodation & food, and construction. Agriculture, forestry & fishing is particularly strong, with an employment share 1.5 times the regional level. Mining has a limited presence in Augusta, with 7.0% employment compared to 11.7% regionally.

Over the year to September 2025, employment increased by 6.8%, while labour force grew by 6.3%, reducing unemployment by 0.4 percentage points. In comparison, Rest of WA saw employment rise by 1.4%, labour force grow by 1.2%, and unemployment fall by 0.2 percentage points. National employment forecasts from Jobs and Skills Australia project a growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Augusta's employment mix suggests local employment should increase by 5.1% over five years and 11.4% over ten years, though this is an illustrative extrapolation not accounting for localised population projections.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

The median income among taxpayers in the Augusta SA2 region was $44,520 in financial year 2022. The average income stood at $62,068 during the same period. In comparison, Rest of WA's median and average incomes were $57,323 and $71,163 respectively. By September 2025, adjusted for Wage Price Index growth of 14.2%, estimated median income in Augusta SA2 would be approximately $50,842, with the average being around $70,882. According to Census 2021 data, incomes in Augusta rank modestly, between the 25th and 29th percentiles for household, family, and personal incomes. Income distribution shows that 31.3% of residents (2,661 people) fall within the $1,500 - 2,999 bracket, similar to the surrounding region at 31.1%. Housing affordability pressures are severe in Augusta SA2, with only 84.7% of income remaining, ranking at the 27th percentile. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Augusta is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Augusta, as per the latest Census evaluation, 94.1% of dwellings were houses, with the remaining 5.8% comprising semi-detached homes, apartments, and other types of dwellings. This compares to Non-Metro WA's figures of 89.8% houses and 10.1% other dwellings. The home ownership rate in Augusta stood at 43.9%, with mortgaged dwellings at 34.2% and rented ones at 21.9%. The median monthly mortgage repayment in the area was $1,816, exceeding Non-Metro WA's average of $1,733. The median weekly rent figure in Augusta was recorded at $300, compared to Non-Metro WA's $360. Nationally, Augusta's median monthly mortgage repayments were lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Augusta has a typical household mix, with a lower-than-average median household size

Family households constitute 71.0% of all households, including 28.1% couples with children, 35.5% couples without children, and 6.9% single parent families. Non-family households comprise the remaining 29.0%, with lone person households at 26.4% and group households making up 2.5%. The median household size is 2.4 people, which is smaller than the Rest of WA average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Augusta performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

The area's educational profile is notable regionally with university qualification rates of 24.7%, exceeding the Rest of WA average of 17.6% and that of SA4 region at 18.0%. Bachelor degrees are most prevalent at 18.5%, followed by postgraduate qualifications (3.4%) and graduate diplomas (2.8%). Trade and technical skills are prominent, with 41.3% of residents aged 15+ holding vocational credentials – advanced diplomas at 11.8% and certificates at 29.5%.

Educational participation is high, with 28.0% of residents currently enrolled in formal education. This includes 12.7% in primary education, 7.4% in secondary education, and 1.7% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 8 active stops operating in Augusta, offering mixed bus services. These stops are served by 1 route, collectively offering 22 weekly passenger trips. Transport access is rated limited, with residents typically located 2882 meters from nearest stop.

Service frequency averages 3 trips per day across all routes, equating to approximately 2 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Augusta's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low across both younger and older age cohorts

Augusta residents show positive health outcomes with low prevalence of common conditions across age groups. Private health cover stands at approximately 51%, compared to 52.6% in the rest of WA.

Arthritis and mental health issues are most prevalent, affecting 8.9% and 7.3% respectively. Around 70.7% report no medical ailments, slightly higher than the 69.5% in the rest of WA. Approximately 22.0% of residents are aged 65 and over (1,874 people), higher than the 20.0% in the rest of WA. Health outcomes among seniors are strong, outperforming general population metrics.

Frequently Asked Questions - Health

Cultural Diversity

Augusta ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Augusta's cultural diversity was found to be below average, with 84.8% of its population being Australian citizens and 77.9% born in Australia. English was spoken at home by 95.3%. Christianity was the predominant religion, comprising 34.1%.

Judaism was overrepresented at 0.2%, compared to 0.1% across Rest of WA. In terms of ancestry, the top three groups were English (36.4%), Australian (28.8%), and Scottish (8.1%). Notably, Welsh (0.8%) was slightly overrepresented compared to the regional average of 0.7%. New Zealanders comprised 1.1%, marginally higher than the regional average of 1.0%. Dutch ancestry was also slightly overrepresented at 1.8% versus 1.7% regionally.

Frequently Asked Questions - Diversity

Age

Augusta hosts an older demographic, ranking in the top quartile nationwide

Augusta's median age is 46, which is higher than the Rest of WA figure of 40 and the national average of 38. The age profile shows that those aged 65-74 make up 14.1% of the population, while those aged 25-34 are smaller at 8.8%. Between the 2021 Census and now, the 15 to 24 age group has grown from 6.0% to 7.2%, while the 45 to 54 cohort has declined from 13.8% to 13.1%. By 2041, demographic projections show significant shifts in Augusta's age structure. The 45 to 54 group is expected to grow by 20%, reaching 1,333 people from 1,114. Conversely, population declines are projected for the 5 to 14 and 85+ cohorts.