Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Regency Downs lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Based on ABS population updates and AreaSearch validations, the Regency Downs statistical area (Lv2) had an estimated population of 2,917 as of Nov 2025. This reflects a growth of 294 people since the 2021 Census, which reported a population of 2,623. The increase was inferred from AreaSearch's estimate of 2,839 residents following examination of ABS ERP data released in June 2024 and an additional 40 validated new addresses since the Census date. This results in a density ratio of 191 persons per square kilometer. Since the 2021 Census, Regency Downs (SA2) has seen an 11.2% growth rate, exceeding both national (9.7%) and state averages, marking it as a growth leader regionally. Interstate migration accounted for approximately 66.0% of overall population gains during recent periods, with all drivers contributing positively to growth.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in 2024 using 2022 as the base year. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are adopted, with proportional growth weightings applied for age cohorts. Future population dynamics project an above median growth rate for the area, with an expected expansion of 640 persons to 2041, reflecting a total gain of 20.8% over the 17-year period.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Regency Downs when compared nationally

AreaSearch analysis of ABS building approval numbers shows Regency Downs received around 15 dwelling approvals per year over the past five financial years, totalling an estimated 79 homes. As of FY26, 11 approvals have been recorded. This results in approximately 3.3 new residents arriving annually per dwelling constructed between FY21 and FY25. Commercial approvals registered this financial year totalled $10.1 million.

Compared to Greater Brisbane, Regency Downs records about 66% of the building activity per person and ranks among the 62nd percentile nationally. New building activity comprises 91.0% detached houses and 9.0% medium and high-density housing. With around 238 people per dwelling approval, Regency Downs displays a developing market.

Population forecasts indicate an addition of 608 residents by 2041. Current development aligns with future needs, suggesting steady market conditions without extreme price pressure.

Frequently Asked Questions - Development

Infrastructure

Regency Downs has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

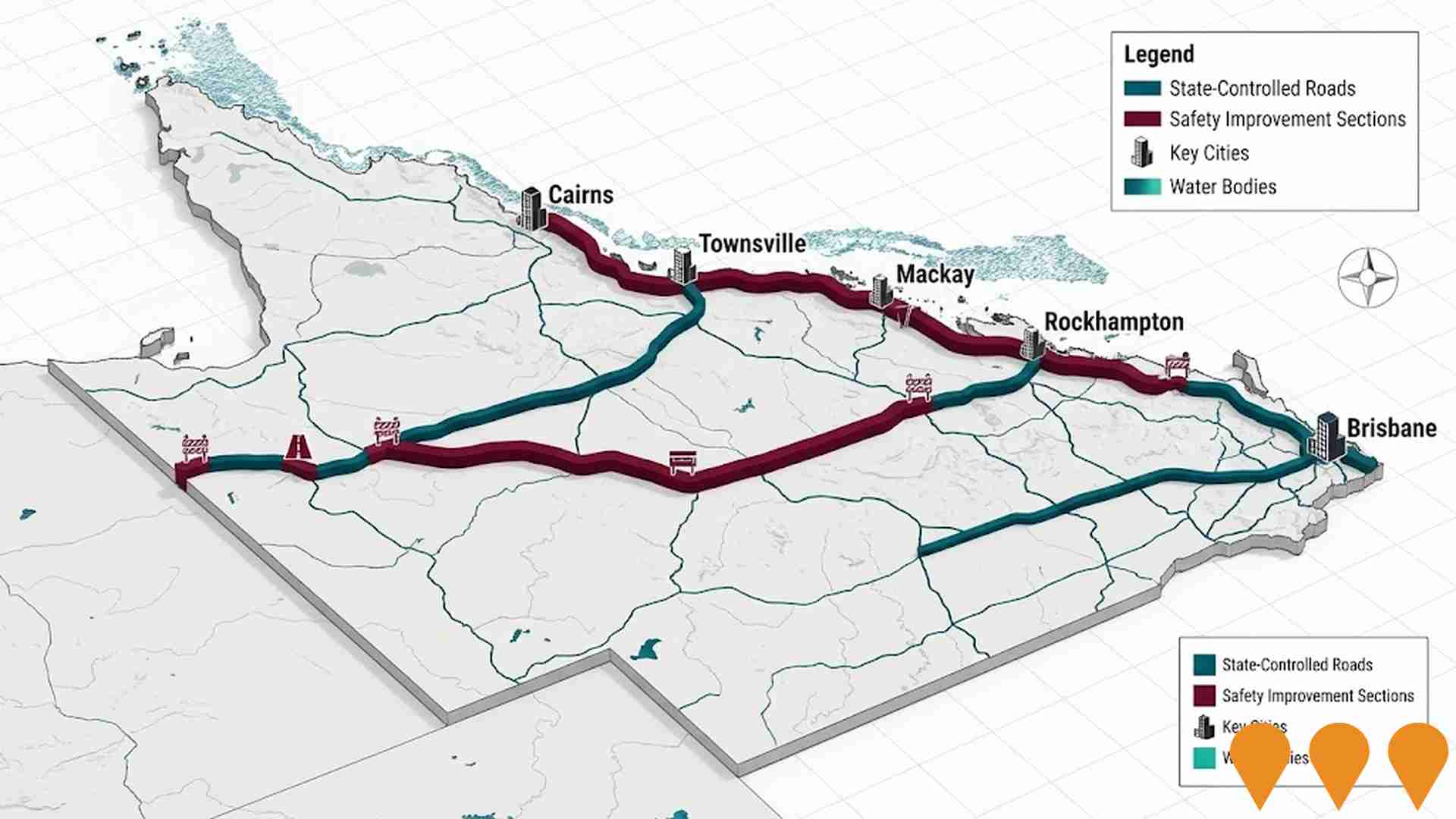

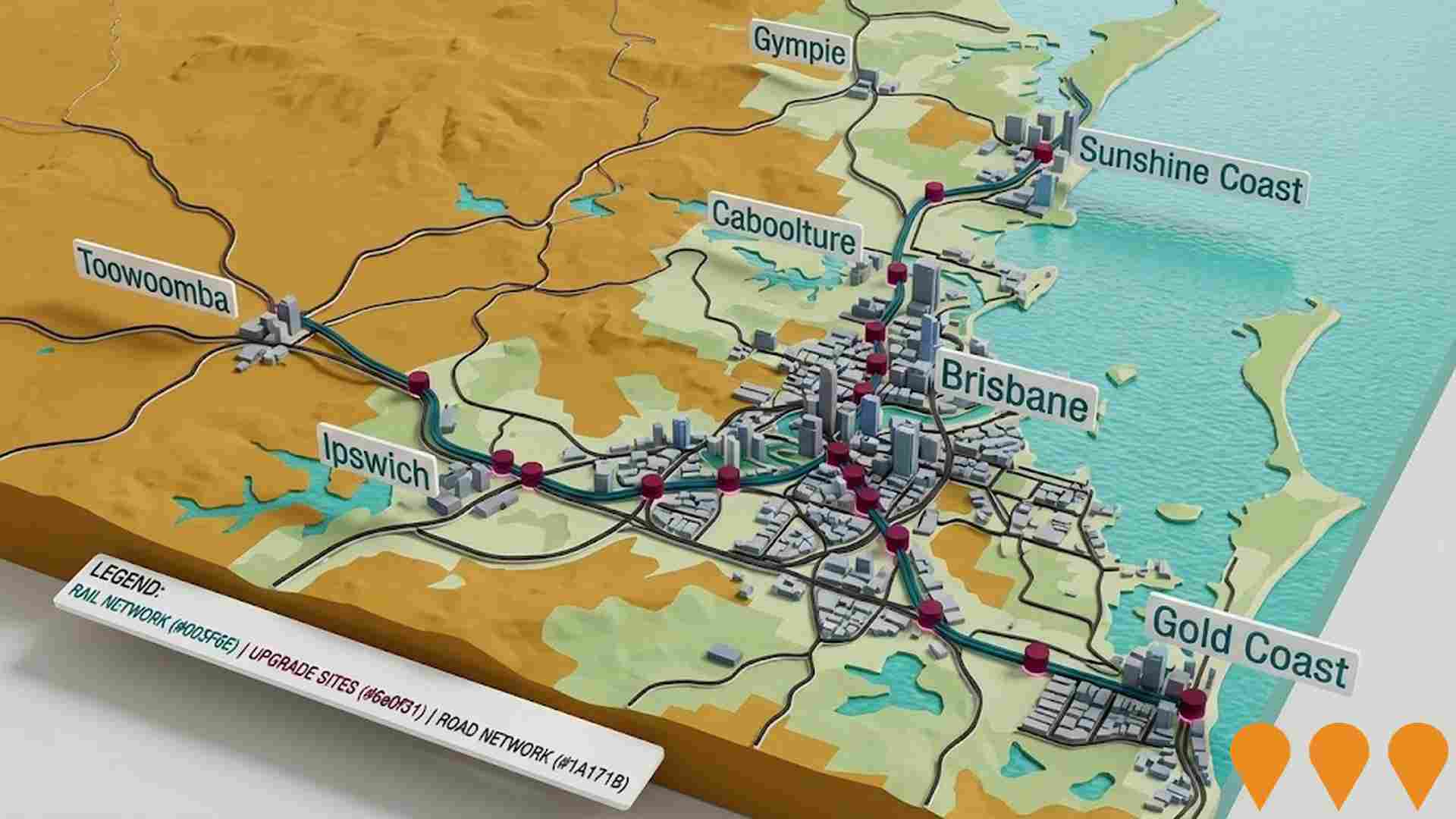

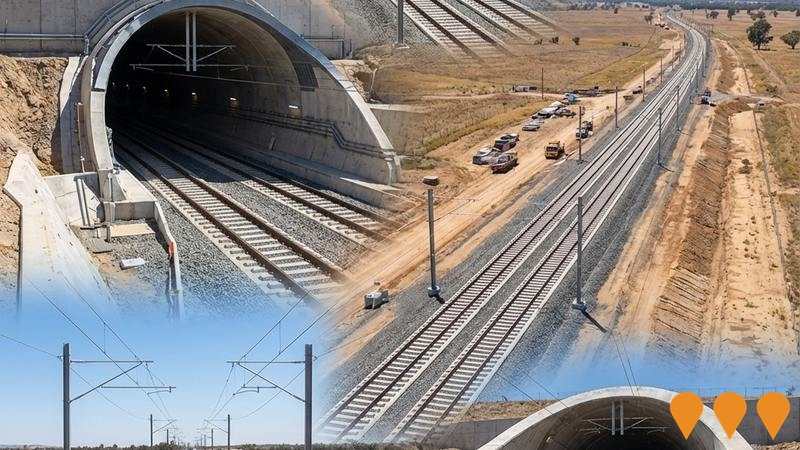

Area infrastructure changes significantly impact local performance. AreaSearch identified zero projects likely affecting the area. Notable projects include Warrego Highway Upgrade Program, Inland Rail Queensland Sections, Proposed Inland Rail Tunnel Gowrie to Brisbane Port, and Inland Rail - Gowrie to Kagaru (G2K). Below details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on energy affordability and reliability. Key initiatives include a $1.6 billion Electricity Maintenance Guarantee to extend the life of state-owned coal assets until at least 2046 and a $400 million Queensland Energy Investment Fund to catalyze private sector investment. Major infrastructure priorities include the delivery of the CopperString Eastern Link (330kV) by 2032 and a 400MW Central Queensland Gas Power Tender to be operational by 2032. The plan replaces the former Energy and Jobs Plan and shifts from renewable targets to Regional Energy Hubs and emission reduction goals.

Brisbane 2032 Olympic and Paralympic Games Infrastructure Program

A $7.1 billion infrastructure program overseen by the Games Independent Infrastructure and Coordination Authority (GIICA). Key projects include a new 63,000-seat multi-purpose stadium at Victoria Park for ceremonies and athletics, a new National Aquatic Centre, and the Brisbane Athletes Village at the Showgrounds. The program focuses on 17 new and upgraded venues alongside major transport improvements to create a long-term legacy for South East Queensland.

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is a strategic framework focused on energy affordability, reliability, and sustainability, replacing the previous 2022 Energy and Jobs Plan. Key initiatives include a $400 million Energy Investment Fund, a $1.6 billion Electricity Maintenance Guarantee for existing assets, and a new Regional Energy Hubs framework. The plan targets 6.8 GW of new wind/solar and 3.8 GW of storage by 2030 through private sector investment. It also prioritizes the CopperString Eastern Link (330kV) to be delivered by 2032 and a 400MW gas-fired generation tender in Central Queensland. The Energy Roadmap Amendment Act 2025, passed in December 2025, formally repealed previous renewable energy targets while maintaining a net zero by 2050 commitment.

Building Future Hospitals Program

Queensland's Hospital Rescue Plan is a landmark $18.5 billion infrastructure initiative delivering over 2,600 new and refurbished public hospital beds by 2032. The program includes the construction of three new hospitals in Coomera, Bundaberg, and Toowoomba, alongside major expansions at Ipswich (Stage 2), Logan, Princess Alexandra, and Townsville University hospitals. It also encompasses satellite hospitals and a statewide cancer network to address the needs of a growing and aging population.

South East Queensland Infrastructure Plan and Supplement (SEQIP & SEQIS)

The South East Queensland Infrastructure Plan (SEQIP) and its Supplement (SEQIS) establish a multi-decade strategic framework for infrastructure investment across the SEQ region. As of 2026, the plan is being updated to align with ShapingSEQ 2023, focusing on a record $103.9 billion pipeline over five years. Key priorities include unlocking housing supply via the $2 billion Residential Activation Fund, delivering Brisbane 2032 Olympic venues like the Victoria Park Games Precinct, and major transport projects such as Cross River Rail and the Coomera Connector to support a population reaching 4 million by 2026.

Queensland Energy and Jobs Plan - South East Queensland

The Queensland Energy and Jobs Plan (QEJP) is a comprehensive 30-year roadmap to transform the state's energy system into a publicly-owned renewable energy network. Key South East Queensland components include the $14.2 billion Borumba Pumped Hydro Project (2,000 MW / 48 GWh), which is currently in the Environmental Impact Statement (EIS) phase with exploratory works approved as of late 2025. The plan also encompasses the Queensland SuperGrid South transmission program, involving 430km of new 500kV lines (Borumba to Woolooga and Borumba to Halys) scheduled for construction commencement in 2026 to facilitate the renewable transition.

Inland Rail - Queensland Sections

The Queensland sections of Inland Rail comprise several key projects including Gowrie to Helidon, Helidon to Calvert, and Calvert to Kagaru. These sections involve building approximately 128km of new dual-gauge track, including a 6.2km tunnel through the Toowoomba Range and a 985m tunnel through the Teviot Range. As of February 2026, the Queensland sections remain in the planning and environmental assessment phase. The Queensland Coordinator-General recently extended the project declaration lapse dates to November 2029 while additional Environmental Impact Statement (EIS) information is being prepared. The project will connect to a proposed intermodal terminal at Ebenezer and then to the interstate network at Kagaru.

Proposed Inland Rail Tunnel (Gowrie to Brisbane Port)

The Gowrie to Kagaru section is the most technically complex part of the Inland Rail program, involving a 6.2km tunnel through the Toowoomba Range and an 850m tunnel through the Little Liverpool Range. As of February 2026, the Gowrie to Helidon, Helidon to Calvert, and Calvert to Kagaru sections remain in the Approvals and Planning stages, with the Queensland Coordinator-General having recently extended project declaration lapse dates out to 2029 to allow for continued Environmental Impact Statement (EIS) refinements. The project will eventually provide a dual-gauge link connecting regional freight to the Port of Brisbane via an intermodal terminal at Ebenezer.

Employment

AreaSearch analysis reveals Regency Downs recording weaker employment conditions than most comparable areas nationwide

Regency Downs has a balanced workforce consisting of white and blue collar jobs, with manufacturing and industrial sectors prominently featured. The unemployment rate was 7.0% as of September 2025, with an estimated employment growth of 4.5% over the past year.

This figure is based on AreaSearch's aggregation of statistical area data. As of September 2025, 1,267 residents were employed while the unemployment rate was 3.0% higher than Greater Brisbane's rate of 4.0%. The workforce participation rate lagged significantly at 58.9%, compared to Greater Brisbane's 64.5%. Leading employment industries among residents included health care & social assistance, construction, and retail trade.

Notably, the area had a strong specialization in agriculture, forestry & fishing, with an employment share of 5.1 times the regional level. Conversely, professional & technical services showed lower representation at 3.4% compared to the regional average of 8.9%. The predominantly residential area appeared to offer limited local employment opportunities, as indicated by the count of Census working population versus resident population. Over the 12 months to September 2025, employment increased by 4.5%, while labour force increased by 3.1%, resulting in a decrease in unemployment by 1.3 percentage points. In comparison, Greater Brisbane recorded employment growth of 3.8% and unemployment fell by 0.5 percentage points. State-level data to 25-Nov showed Queensland employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 offered further insight into potential future demand within Regency Downs. These projections estimated that national employment would expand by 6.6% over five years and 13.7% over ten years, but growth rates varied significantly between industry sectors. Applying these industry-specific projections to Regency Downs' employment mix suggested local employment should increase by 5.8% over five years and 12.3% over ten years.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

The latest AreaSearch postcode level ATO data for financial year 2023 shows that Regency Downs' median income is $50,952 and average income is $58,137. This is below Greater Brisbane's median income of $58,236 and average income of $72,799. Based on a 9.91% Wage Price Index growth since financial year 2023, estimated incomes as of September 2025 would be approximately $56,001 (median) and $63,898 (average). Census 2021 data ranks Regency Downs' household income at the 39th percentile ($1,570 weekly) and personal income at the 21st percentile. Income brackets indicate that 38.3% of individuals earn between $1,500 - 2,999, aligning with metropolitan regions where this cohort represents 33.3%. Housing affordability pressures are severe, with only 83.4% of income remaining after expenses, ranking at the 39th percentile.

Frequently Asked Questions - Income

Housing

Regency Downs is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Regency Downs' dwellings, as per the latest Census, were entirely houses (100.0%) with no other dwelling types recorded (0.0%). Brisbane metropolitan area had 96.6% houses and 3.4% other dwellings. Home ownership in Regency Downs was at 26.6%, compared to mortgaged dwellings at 55.6% and rented ones at 17.8%. The median monthly mortgage repayment was $1,517, matching Brisbane's average, while the median weekly rent stood at $368, compared to Brisbane's $300. Nationally, Regency Downs' mortgage repayments were lower than the Australian average of $1,863, and rents were less than the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Regency Downs features high concentrations of family households, with a higher-than-average median household size

Family households constitute 80.7% of all households, including 35.8% couples with children, 30.3% couples without children, and 13.2% single parent families. Non-family households account for the remaining 19.3%, with lone person households at 16.5% and group households comprising 3.2%. The median household size is 2.9 people, larger than the Greater Brisbane average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Regency Downs shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's university qualification rate is 8.8%, significantly lower than Greater Brisbane's average of 30.5%. Bachelor degrees are the most common at 5.9%, followed by graduate diplomas (1.6%) and postgraduate qualifications (1.3%). Vocational credentials are prevalent, with 49.3% of residents aged 15+ holding them, including advanced diplomas (10.2%) and certificates (39.1%). Educational participation is high, with 31.0% currently enrolled in formal education: 12.3% in primary, 10.5% in secondary, and 1.8% in tertiary education.

Educational participation is notably high, with 31.0% of residents currently enrolled in formal education. This includes 12.3% in primary education, 10.5% in secondary education, and 1.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Regency Downs is well below average with considerably higher than average prevalence of common health conditions and to an even higher degree among older age cohorts

Regency Downs faces significant health challenges with a notably higher prevalence of common health conditions compared to average, particularly among older age groups. Approximately half (50%) of its total population (~1,465 people) has private health cover, lower than the national average of 55.7%.

The most prevalent medical conditions in the area are asthma and mental health issues, affecting 11.0% and 10.1% of residents respectively. Conversely, 62.0% of residents report being completely clear of medical ailments, slightly higher than the Greater Brisbane average of 60.9%. The area has a lower proportion of seniors aged 65 and over at 14.9% (434 people), compared to Greater Brisbane's 21.8%. However, health outcomes among seniors require more attention due to these challenges.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Regency Downs placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Regency Downs, surveyed in June 2016, showed low cultural diversity with 90.0% citizens, 89.1% born in Australia, and 97.6% speaking English only at home. Christianity dominated at 51.9%, compared to Greater Brisbane's 54.9%. Top ancestry groups were English (31.8%), Australian (31.5%), and German (8.1%).

Notably, New Zealanders comprised 0.9% vs regional 0.7%, Samoans 0.4% vs 0.1%, and Australian Aboriginals 3.9% vs 3.2%.

Frequently Asked Questions - Diversity

Age

Regency Downs's population is slightly younger than the national pattern

At 37 years, Regency Downs's median age is nearly matching Greater Brisbane's average of 36, while also being close to Australia's median of 38. Compared to Greater Brisbane, Regency Downs has a higher percentage of residents aged 5-14 (16.1%) but fewer residents aged 25-34 (10.8%). Between the 2021 Census and the present, the 75-84 age group has increased from 3.7% to 4.9% of the population. Conversely, the 5-14 age group has decreased from 16.8% to 16.1%. By 2041, demographic modeling suggests Regency Downs's age profile will change significantly. The 45-54 cohort is projected to grow by 33%, adding 130 residents to reach a total of 524. In contrast, both the 0-4 and 25-34 age groups are expected to decrease in number.