Chart Color Schemes

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Perth are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Perth's population, as of November 2025, is estimated at around 3747 people. This reflects an increase of 275 individuals since the 2021 Census, which reported a population of 3472 people. The change is inferred from AreaSearch's estimation of the resident population at 3635 following examination of ABS' latest ERP data release in June 2024, and an additional 152 validated new addresses since the Census date. This level of population results in a density ratio of 51 persons per square kilometer. Perth's growth rate of 7.9% since the 2021 census exceeded both the state average of 4.8% and the SA4 region, marking it as a growth leader. Interstate migration contributed approximately 54.0% of overall population gains during recent periods, with natural growth and overseas migration also being positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, Tasmania State Government's Regional/LGA projections are adopted with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. Considering the projected demographic shifts, lower quartile growth is anticipated for Australia's regional areas, with the suburb expected to increase by 134 persons to 2041 based on aggregated SA2-level projections, reflecting a gain of 1.6% in total over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Perth when compared nationally

Perth recorded approximately 23 residential properties granted approval each year based on AreaSearch analysis of ABS building approval numbers. Over the past five financial years, from FY-21 to FY-25, around 118 homes were approved, with a further 12 approved in FY-26 so far. Each dwelling built over these years accommodated an average of 2.3 new residents per year, reflecting strong demand that supports property values.

The average construction cost value of new homes was $377,000. In terms of commercial development, $15.3 million in approvals have been registered this financial year, indicating balanced activity. Compared to the Rest of Tas., Perth's new home approvals per person are comparable, maintaining market equilibrium with surrounding areas.

Recent building activity consists solely of detached dwellings, preserving the area's traditional low-density character and catering to families seeking space. As of now, there are approximately 183 people per dwelling approval in the location. AreaSearch's latest quarterly estimate projects Perth adding 60 residents by 2041. With current construction levels, housing supply is expected to meet demand adequately, creating favourable conditions for buyers and potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Perth has emerging levels of nearby infrastructure activity, ranking in the 21stth percentile nationally

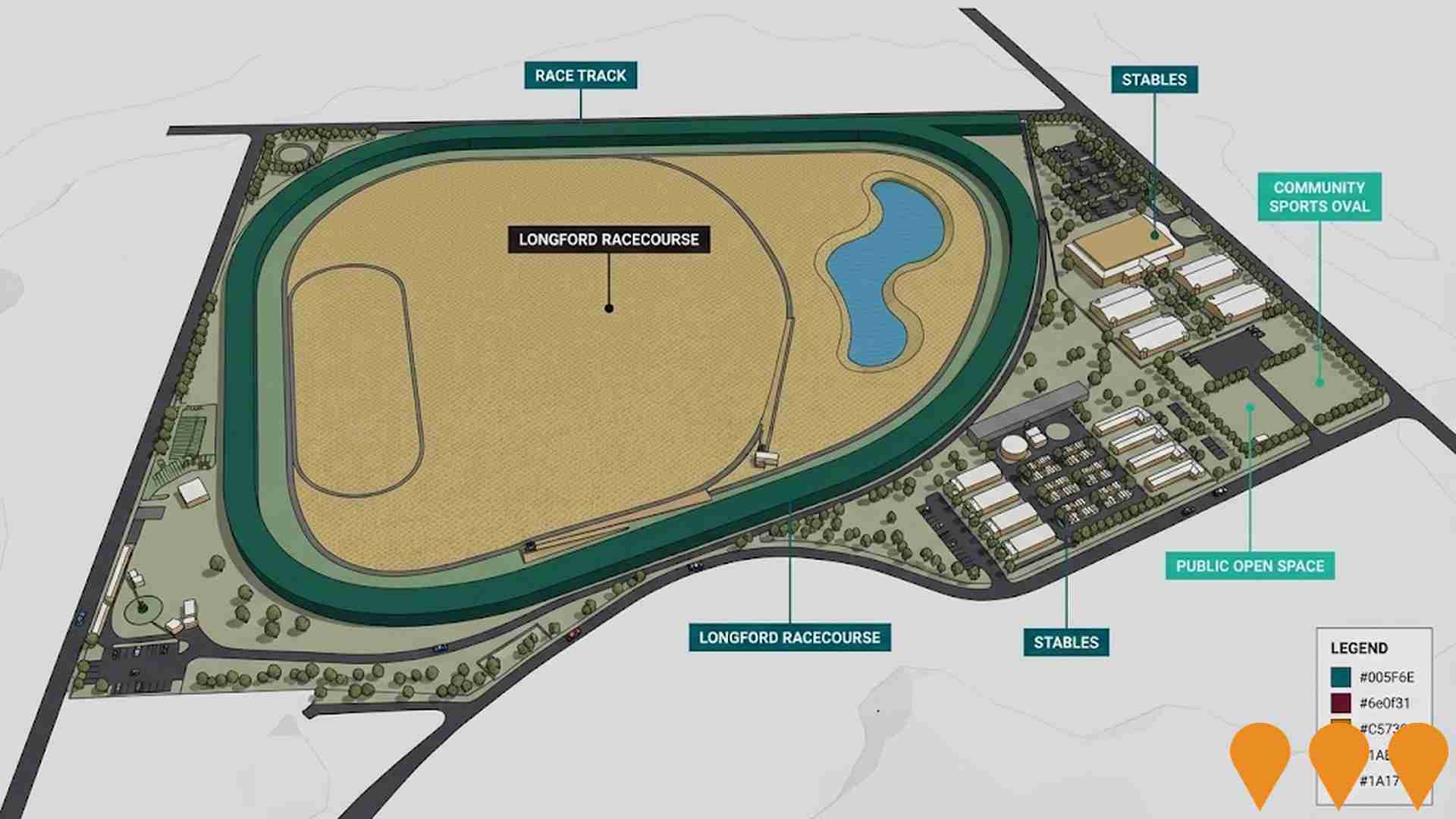

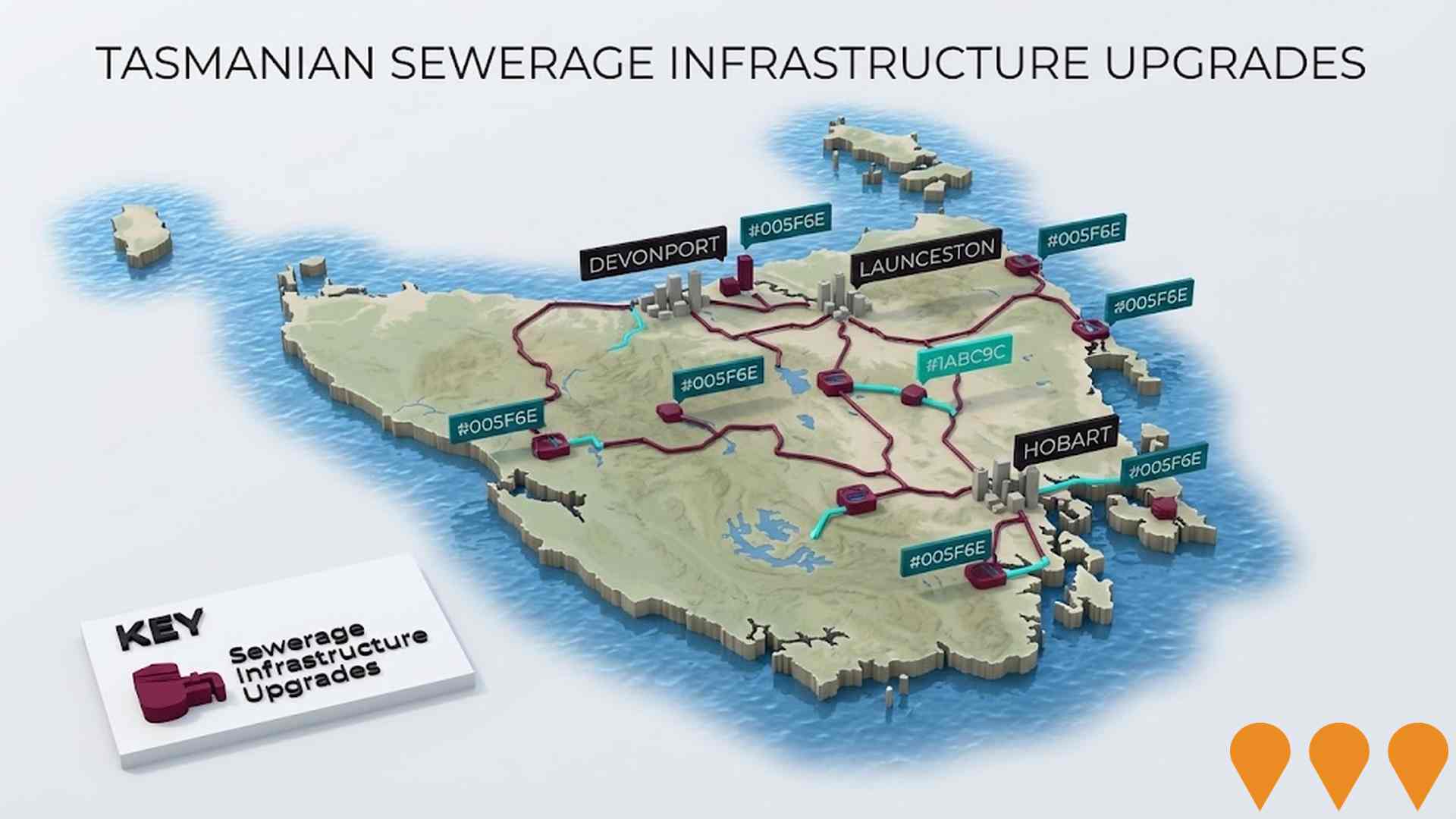

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified a total of eleven projects that could affect the region. Notable initiatives include Skyeview Estate, South Perth Outline Development Plan, Perth Sports Precinct Master Plan, and West Perth Stormwater Upgrades (Stages 1-3). The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

South Perth Outline Development Plan

Outline development plan for a 60-hectare greenfield site to accommodate residential growth. It is designated as an emerging residential area in the Perth Structure Plan (2017) and is intended for 250-280 lots, including medium to high-density housing, a potential retail centre, community uses, open spaces, and integrated road and path networks. The Outline Development Plan (ODP) forms a critical part of the overall strategy for future growth in Perth, Tasmania. The land is identified in the Perth Structure Plan for future residential development, and the next step involves the necessary planning scheme amendments (rezoning) under the Tasmanian Planning Scheme - Northern Midlands Local Provisions Schedule to guide the development of the ODP.

Longford Ambulance Station

New two-bay ambulance station with volunteer training room and modern infection control facilities to replace the existing Smith Street station. DA approved (subject to conditions) in Aug 2025; principal contractor tender open with construction targeted to start late 2025 and complete late 2026.

Perth Sports Precinct Master Plan

Development of a greenfield site, subject to land purchase and community need, into a regional sports facility. The draft master plan proposes a combined AFL and cricket oval, multi-purpose community centre, netball and tennis courts, adventure playground, skatepark, and potential aquatic centre. The project is a key recommendation in the Northern Tasmania Sports Facility Plan 2023.

West Perth Stormwater Upgrades (Stages 1-3)

Comprehensive upgrades to stormwater drainage infrastructure in West Perth to address flooding issues. The project is planned over three stages and includes culvert replacements under Drummond Street, the rail line, Youl Road, Edwards Street, and Phillip Street. The total estimated cost for the three stages is $3.7 million, with an expected completion in a two-year timeframe, targeting June 30, 2025. This includes a tender awarded for the TasRail Culvert at Youl Road.

Longford Child and Family Learning Centre

Tasmanian Government project to deliver a new Child and Family Learning Centre in Longford. Project initiation and planning commenced in 2025, with the preferred site to be confirmed following consultation in 2026. Master plan and design are targeted for completion by 2028, construction from 2029, and opening in 2030. State Government has allocated $32m for four new CFLCs (including Longford).

Skyeview Estate

A residential subdivision in Perth, offering various stages of lots (Stages 1, 2, and 3 sold; Stage 4 available) with a total of 130 dwellings anticipated. The development is situated 15 minutes from Launceston and includes construction of a new public park on Napoleon Street with play equipment, BBQ, and toilet facilities.

Perth South Esk River Parklands

Master plan to improve public open space connectivity along the South Esk River at Perth, including upgrading and installing new picnic facilities, extending the William Street concrete walking path to connect with the proposed George Street Park via a new bridge structure spanning the gully, and landscaping using endemic plant species to reinstate native flora and fauna. The project is part of a broader set of proposed Perth Combined Projects driven by population growth and community demand for sports and recreation facilities in the area.

Perth Main Street Streetscape Development

Redevelopment of Perth's Main Street to revitalise the town centre following the Midland Highway bypass. The project, part of the Perth Structure Plan, includes upgrading footpaths, adding new street furniture, landscaping, interpretive signage, and enhancing pedestrian crossings for better accessibility. Stage 1 (between Fairtlough Street and Scone Street) is complete, with Stage 2 starting soon.

Employment

Perth ranks among the top 25% of areas assessed nationally for overall employment performance

Perth has a balanced workforce with white and blue collar jobs equally represented. Essential services sectors are well-represented in the area.

The unemployment rate is 2.0% as of June 2025, lower than Rest of Tas.'s rate of 3.9%. Workforce participation is high at 64.0%, compared to Rest of Tas.'s 55.7%. Major employment industries include health care & social assistance, construction, and retail trade. Construction has particularly notable concentration with employment levels at 1.3 times the regional average.

Agriculture, forestry & fishing shows lower representation at 4.2% versus the regional average of 8.4%. Local employment opportunities appear limited based on Census data. In the 12 months prior to June 2025, labour force decreased by 1.5% and employment declined by 1.4%, resulting in a fall in unemployment rate by 0.1 percentage points. Jobs and Skills Australia's national employment forecasts from Sep-22 suggest potential future demand within Perth. National employment is forecast to expand by 6.6% over five years and 13.7% over ten years, but growth rates differ significantly between industry sectors. Applying these projections to Perth's employment mix suggests local employment should increase by 6.3% over five years and 13.3% over ten years.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

Perth's median income among taxpayers in the financial year 2022 was $52,636, with an average of $62,879. This is just below the national average. In comparison, Rest of Tas.'s median income was $47,358 and average was $57,384 during the same period. Based on Wage Price Index growth of 13.83% since financial year 2022, current estimates for Perth's median income would be approximately $59,916 and average would be around $71,575 as of September 2025. According to the 2021 Census, household, family, and personal incomes in Perth rank modestly, between the 32nd and 40th percentiles. Income brackets indicate that 36.4% of Perth's population (1,363 individuals) fall within the $1,500 - $2,999 income range, reflecting patterns seen in the broader area where 28.5% similarly occupy this range. After housing expenses, 86.5% of income remains for other expenses.

Frequently Asked Questions - Income

Housing

Perth is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

In Perth, as per the latest Census evaluation, 88.3% of dwellings were houses with the remaining 11.7% comprising semi-detached homes, apartments, and other types. In comparison, Non-Metro Tasmania had 92.6% houses and 7.4% other dwellings. Home ownership in Perth stood at 34.0%, with mortgaged properties at 47.6% and rented ones at 18.4%. The median monthly mortgage repayment was $1,317, surpassing Non-Metro Tasmania's average of $1,198. The median weekly rent in Perth was $280, higher than Non-Metro Tasmania's figure of $230. Nationally, Perth's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Perth has a typical household mix, with a higher-than-average median household size

Family households constitute 73.1% of all households, including 29.1% couples with children, 32.4% couples without children, and 10.8% single parent families. Non-family households comprise the remaining 26.9%, with lone person households at 26.2% and group households making up 1.0%. The median household size is 2.4 people, larger than the Rest of Tas. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Perth faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate stands at 13.4%, significantly lower than the Australian average of 30.4%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common, with 9.9% of residents holding such qualifications, followed by postgraduate qualifications (2.3%) and graduate diplomas (1.2%). Vocational credentials are prominent, with 41.8% of residents aged 15+ possessing them, including advanced diplomas (8.3%) and certificates (33.5%).

Educational participation is high, with 25.0% of residents currently enrolled in formal education. This includes primary education (10.7%), secondary education (7.0%), and tertiary education (2.3%). Perth Primary School serves the local area, enrolling 298 students as of a recent report. The school operates under typical Australian conditions, with an ICSEA score of 973, indicating balanced educational opportunities. It focuses exclusively on primary education, with secondary options available in nearby areas.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Perth has two active public transport stops operating, both offering bus services. These stops are served by two different routes, together facilitating 433 weekly passenger trips. Transport accessibility is limited, with residents on average located 742 meters from the nearest stop.

On average, there are 61 trips per day across all routes, translating to approximately 216 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Perth is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Perth faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is approximately 52% (1,951 people), leading that of the average SA2 area compared to 49.4% in Rest of Tas.

The most common medical conditions are arthritis and mental health issues, impacting 10.3 and 9.0% of residents respectively. Meanwhile, 64.3% of residents declare themselves completely clear of medical ailments, compared to 60.6% across Rest of Tas. The area has 21.0% (786 people) of residents aged 65 and over, lower than the 27.6% in Rest of Tas. Health outcomes among seniors present challenges broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Perth placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Perth's population shows lower cultural diversity, with 91.8% born in Australia, 94.7% being citizens, and 97.8% speaking English only at home. Christianity is the predominant religion, accounting for 45.6%. Judaism, however, has no representation in Perth, mirroring its 0.0% prevalence elsewhere.

Top ancestry groups are English (37.1%), Australian (35.6%), and Scottish (7.6%). Some ethnic groups diverge from regional averages: Dutch at 2.0% (vs 1.5%), Australian Aboriginal at 2.3% (vs 3.0%), and Hungarian at 0.2% (vs 0.1%).

Frequently Asked Questions - Diversity

Age

Perth's population is slightly older than the national pattern

The median age in Perth is 38 years, which is notably lower than the average for the Rest of Tasmania at 45 years, but equal to the Australian median age of 38 years. The 25-34 age cohort is over-represented in Perth at 15.4%, compared to the Rest of Tasmania's average, while the 45-54 year-olds are under-represented at 9.9%. Between the 2021 Census and present, the 75-84 age group has increased from 6.2% to 7.4% of Perth's population. Conversely, the 45-54 cohort has decreased from 12.0% to 9.9%, and the 55-64 group has dropped from 13.7% to 12.4%. Population forecasts for 2041 indicate significant demographic changes in Perth. The 85+ age cohort is projected to grow by 78 people, from 78 to 157, a 100% increase. Those aged 65 and above are expected to comprise 65% of the population growth. Conversely, the 5-14 and 0-4 age cohorts are forecasted to experience population declines.