Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Hay has shown very soft population growth performance across periods assessed by AreaSearch

Hay's population, as of November 2025, is approximately 2,926 people. This figure represents an increase from the 2021 Census count of 2,897 people, reflecting a growth of 29 individuals (1.0%). The change can be inferred from ABS's estimated resident population of 2,880 in June 2024 and an additional 36 validated new addresses since the Census date. This results in a population density ratio of 0.20 persons per square kilometer, indicating ample space per person. Overseas migration was the primary driver for this growth during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by these data, AreaSearch employs NSW State Government's SA2 level projections from 2022 using the 2021 Census as the base year. Growth rates by age group are applied to all areas for years 2032 to 2041. According to these projections, Hay's population is expected to decline over this period, contracting by 281 persons by 2041. However, specific age cohorts are projected to grow, notably the 75 to 84 age group which is anticipated to increase by 61 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Hay is very low in comparison to the average area assessed nationally by AreaSearch

Hay has recorded approximately four residential properties granted approval annually. Over the past five financial years, from FY21 to FY25, 23 homes were approved, with three more approved in FY26 so far. Despite population decline during this period, housing supply has remained adequate relative to demand, resulting in a balanced market with good buyer choice.

The average expected construction cost value of new dwellings is $365,000. This financial year has seen $19.1 million in commercial approvals registered, indicating steady commercial investment activity. Compared to the rest of NSW, Hay has significantly less development activity, 63.0% below the regional average per person. The limited new supply generally supports stronger demand and values for established homes, although construction activity has recently intensified. This level is also lower than nationally, reflecting market maturity and possible development constraints.

All new construction consists of standalone homes, preserving Hay's low-density nature and attracting space-seeking buyers. With an estimated 477 people per dwelling approval, the area reflects its quiet, low-activity development environment. Population projections indicating stability or decline suggest reduced housing demand pressures in the future, benefiting potential buyers.

Frequently Asked Questions - Development

Infrastructure

Hay has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 15 projects likely affecting this region. Notable initiatives include the Hay Structure Plan, John Houston Memorial Pool Upgrade, Hay Health Services Redevelopment, and Bishops Lodge Affordable Housing Development. The following list details those expected to have the most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

South West Renewable Energy Zone

The South West Renewable Energy Zone (REZ) in NSW is one of five declared REZs under the Electricity Infrastructure Roadmap. Declared in April 2024, access rights were granted to successful projects in April 2025. The REZ is now in delivery phase, with construction underway on EnergyConnect (interstate transmission link, expected completion 2027) and early works progressing on VNI West. Four initial generation and storage projects (totalling ~3.56 GW generation and >700 MW storage) have secured access rights and are advancing toward financial close and construction in 2026-2028. The REZ will ultimately support up to 5.5 GW of new renewable capacity.

Bullawah Wind Farm

The Bullawah Wind Farm is a proposed large-scale renewable energy project by BayWa r.e. Projects Australia, located approximately 40km southeast of Hay in NSW's South West Renewable Energy Zone. The current layout includes up to 143 wind turbines with a generating capacity of ~1,000 MW and an integrated Battery Energy Storage System (BESS) of ~359 MW / 718 MWh. The project will connect to the Project EnergyConnect transmission line. The Environmental Impact Statement was exhibited in 2024, Response to Submissions completed in 2025, and in April 2025 the project secured access rights in the competitive South West REZ process. As of November 2025, the project remains under assessment with 'More Information Required' status at the NSW Planning Portal.

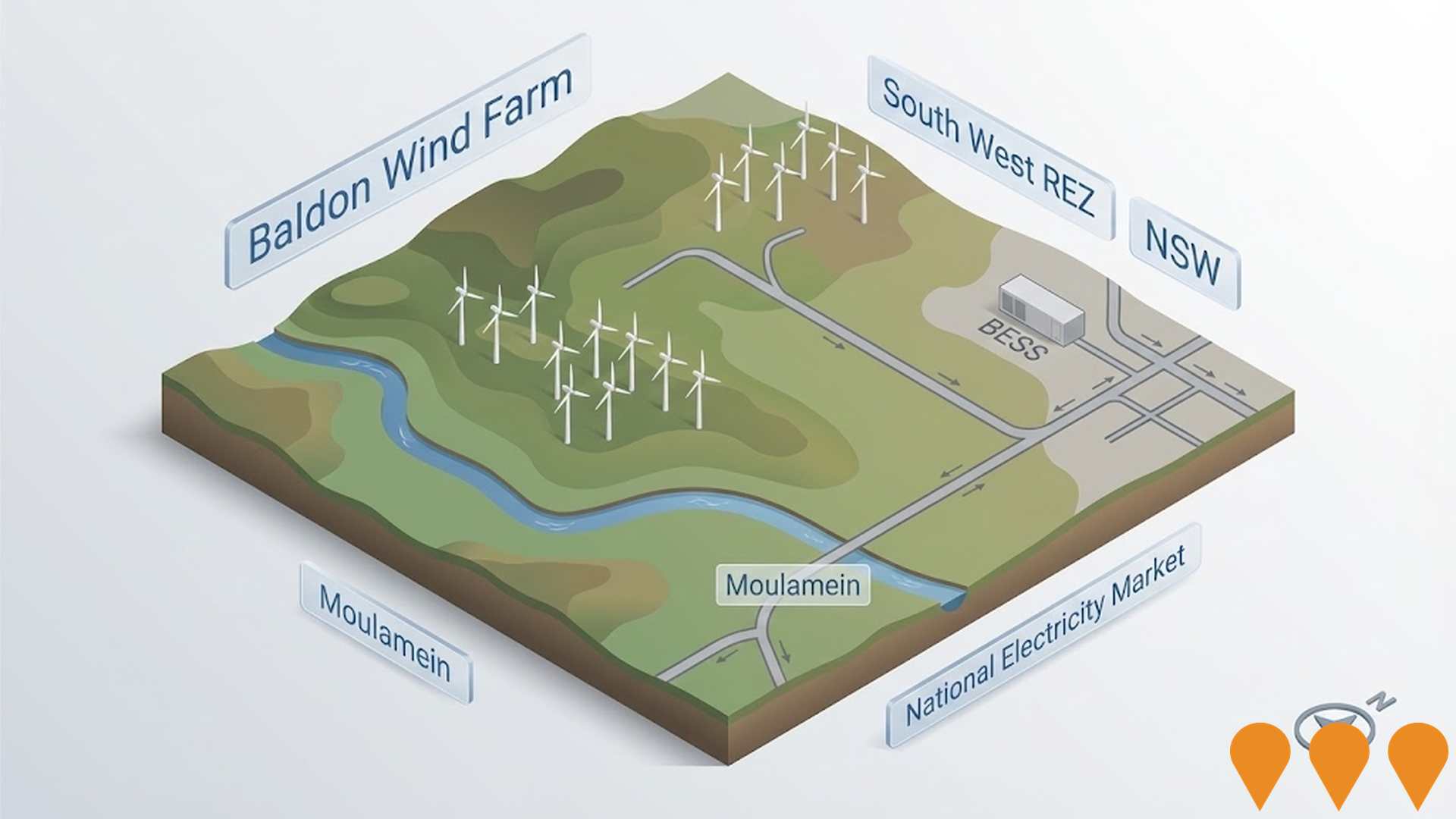

Baldon Wind Farm

Baldon Wind Farm is a proposed renewable energy project located approximately 15 km north of Moulamein in the South West Renewable Energy Zone, NSW. Developed by Goldwind Australia (in partnership with Omni Energy), the project includes up to 180 wind turbines with a total generation capacity of up to ~1,000-1,400 MW and an integrated 200 MW / 400-800 MWh battery energy storage system (BESS). The wind farm will connect to the National Electricity Market and is capable of powering over 700,000 average NSW homes. The Environmental Impact Statement (EIS) was exhibited in 2024, with a Response to Submissions lodged as part of the ongoing NSW planning assessment process.

VNI West (NSW section)

NSW portion of the VNI West interconnector: a proposed 500 kV double-circuit transmission line linking Transgrid's Dinawan Substation (near Coleambally) to the NSW/Victoria border north of Kerang, with associated upgrades including works on Transmission Line 51 near Wagga Wagga and expansion works at Dinawan Substation. The NSW Environmental Impact Statement (EIS) is on public exhibition in August 2025, and Transgrid has announced staged delivery with Stage 1 to Dinawan/South West REZ by early 2029 and Stage 2 to the Victorian border aligned to November 2030.

Saltbush Wind Farm

Proposed onshore wind farm in the South West Renewable Energy Zone near Booroorban, NSW. The project is targeting about 400 MW of wind capacity with up to 70 turbines (tip height up to 280 m), a battery energy storage system, substation and associated cabling. It is currently preparing an Environmental Impact Statement.

Tchelery Wind Farm

Neoen Australia is proposing a wind and battery project in the NSW South-West Renewable Energy Zone near Moulamein. The current concept is up to 577 MW from as many as 74 turbines, plus a 350 MW/1450 MWh battery. The project would connect to either the existing 220 kV line or the new Project EnergyConnect transmission line. The Development Application and Environmental Impact Statement have been lodged and publicly exhibited, and the project is now in the Response to Submissions stage with NSW planning authorities.

Coleambally Irrigation Water Savings Program (RRWIP)

Proposed water efficiency works across the Coleambally Irrigation Area under the Resilient Rivers Water Infrastructure Program. Scope includes around 4.7 km of new pipeline, three new regulating structures and re-lining about 12 km of earthen channels to reduce seepage and evaporation. The program targets improved delivery performance, drought resilience and approximately 1 GL of conveyance water savings for environmental outcomes and network efficiency.

Hay Structure Plan

Strategic land use framework adopted by Hay Shire Council to implement the Hay Local Strategic Planning Statement (LSPS). It guides residential, rural residential and industrial development in Hay over a 20 year horizon, including township growth directions, infrastructure sequencing and policy actions.

Employment

Employment performance in Hay has been below expectations when compared to most other areas nationally

Hay has a balanced workforce with representation from both white and blue collar jobs across various sectors. The unemployment rate in Hay is 4.3%, showing relative stability over the past year.

As of September 2025, there are 1,643 residents employed, with an unemployment rate of 4.7% compared to Rest of NSW's 3.8%. Workforce participation is similar to Rest of NSW at 56.4%. Key industries for Hay residents include agriculture, forestry & fishing, retail trade, and construction. The area has a strong specialization in agriculture, forestry & fishing with an employment share 4.7 times the regional level.

However, health care & social assistance employs only 7.9% of local workers, lower than Rest of NSW's 16.9%. Many residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, employment levels in Hay increased by 0.1%, with a labour force increase of 1.4%, leading to a rise in unemployment rate by 1.2 percentage points. In contrast, Rest of NSW saw employment contract by 0.5% during the same period. Statewide, NSW employment contracted by 0.03% (losing 2,260 jobs) as of 25-Nov-25, with an unemployment rate of 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Hay's employment mix suggests local employment should increase by 5.0% over five years and 11.0% over ten years, though this is an illustrative extrapolation not accounting for localized population projections.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows that income in Hay SA2 is lower than average nationally. The median income is $49,311 and the average income is $55,183. In comparison, Rest of NSW has a median income of $49,459 and an average income of $62,998. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates for Hay SA2 would be approximately $55,529 (median) and $62,142 (average) as of September 2025. Census data indicates that household, family, and personal incomes in Hay all fall between the 15th and 28th percentiles nationally. Income analysis reveals that the $1,500 - 2,999 bracket dominates with 29.6% of residents (866 people), which is similar to regional levels where 29.9% occupy this bracket. Housing costs are modest, with 91.9% of income retained, but the total disposable income ranks at just the 24th percentile nationally.

Frequently Asked Questions - Income

Housing

Hay is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Hay's dwelling structure, as per the latest Census, consisted of 91.6% houses and 8.5% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro NSW's 92.7% houses and 7.2% other dwellings. Home ownership in Hay was at 47.3%, with mortgaged dwellings at 23.9% and rented dwellings at 28.8%. The median monthly mortgage repayment in the area was $894, lower than Non-Metro NSW's average of $1,179. The median weekly rent figure was recorded at $175, compared to Non-Metro NSW's $200. Nationally, Hay's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Hay features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 64.7% of all households, including 22.1% couples with children, 30.6% couples without children, and 10.5% single parent families. Non-family households account for the remaining 35.3%, with lone person households at 33.7% and group households comprising 2.2% of the total. The median household size is 2.2 people, which is smaller than the Rest of NSW average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Hay faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 12.0%, significantly lower than the NSW average of 32.2%. Bachelor degrees are most common at 9.0%, followed by graduate diplomas (1.7%) and postgraduate qualifications (1.3%). Vocational credentials are prevalent, with 38.9% of residents aged 15+ holding them, including advanced diplomas (9.4%) and certificates (29.5%). Educational participation is high at 28.6%, comprising 11.8% in primary education, 7.9% in secondary education, and 1.6% in tertiary education.

Educational participation is notably high, with 28.6% of residents currently enrolled in formal education. This includes 11.8% in primary education, 7.9% in secondary education, and 1.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Hay has 16 active public transport stops, offering a mix of train and bus services. These stops are served by 8 different routes, resulting in 74 weekly passenger trips. Residents have limited access to these services, with an average distance of 1749 meters to the nearest stop.

On average, there are 10 trips per day across all routes, equating to roughly 4 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Hay is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Health data indicates significant challenges for Hay, with high prevalence of common health conditions across both younger and older age groups. Private health cover is low, at approximately 48% of the total population (around 1,392 people), compared to the national average of 55.3%.

The most prevalent medical conditions are asthma and arthritis, affecting 10.3 and 9.8% of residents respectively. However, 61.3% of residents report being completely clear of medical ailments, slightly lower than the Rest of NSW figure at 65.8%. Hay has a higher proportion of residents aged 65 and over, at 26.8% (784 people), compared to the Rest of NSW average of 22.9%.

Frequently Asked Questions - Health

Cultural Diversity

Hay is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Hay's cultural diversity was found to be below average, with 84.7% of its population being citizens, 92.2% born in Australia, and 95.4% speaking English only at home. The predominant religion in Hay was Christianity, accounting for 69.7% of the population, compared to 57.0% across Rest of NSW. In terms of ancestry, the top three represented groups were Australian (33.9%), English (32.8%), and Irish (8.2%).

Notably, certain ethnic groups showed divergent representations: Australian Aboriginal was overrepresented at 6.3% in Hay (compared to 5.9% regionally), Maori at 0.5% (compared to 0.3%), and Scottish at 7.7% (compared to 7.8%).

Frequently Asked Questions - Diversity

Age

Hay hosts an older demographic, ranking in the top quartile nationwide

Hay's median age is 48 years, which is significantly older than Rest of NSW's median age of 43 and the Australian median age of 38. The age profile shows that the 55-64 year-old group is particularly prominent at 17.1%, while the 35-44 year-old group is smaller at 8.7% compared to Rest of NSW. This concentration of 55-64 year-olds is well above the national average of 11.2%. Post-2021 Census data shows that the 65 to 74 age group grew from 11.5% to 13.6% and the 85+ cohort increased from 3.1% to 4.2%. Conversely, the 45 to 54 year-old group declined from 11.6% to 10.2%, and the 55 to 64 year-old group dropped from 18.2% to 17.1%. Demographic modeling suggests that Hay's age profile will evolve significantly by 2041. The 75 to 84 age cohort is projected to grow steadily, increasing by 53 people (20%) from 263 to 317. Senior residents aged 65 and above will drive all population growth, underscoring demographic aging trends. Meanwhile, both the 65 to 74 year-old group and the 45 to 54 year-old group are projected to decrease in numbers.