Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Rural View lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Based on analysis of ABS population updates for the broader area, and new addresses validated by AreaSearch, the Rural View statistical area (Lv2) had an estimated population of around 6533 as of November 2025. This reflected an increase of 876 people (15.5%) since the 2021 Census, which reported a population of 5657 people. The change was inferred from the resident population of 6517 estimated by AreaSearch following examination of the latest ERP data release by the ABS in June 2024 and an additional 172 validated new addresses since the Census date. This level of population equates to a density ratio of 703 persons per square kilometer, which is relatively in line with averages seen across locations assessed by AreaSearch. The Rural View's 15.5% growth since the 2021 census exceeded the SA3 area (6.8%), along with the SA4 region, marking it as a growth leader in the region. Population growth for the area was primarily driven by natural growth that contributed approximately 46.0% of overall population gains during recent periods, although all drivers including interstate migration and overseas migration were positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, and for years post-2032, Queensland State Government's SA2 area projections, released in 2023 and based on 2021 data, are adopted. It should be noted that these state projections do not provide age category splits; hence where utilised, AreaSearch is applying proportional growth weightings in line with the ABS Greater Capital Region projections (released in 2023, based on 2022 data) for each age cohort. Considering the projected demographic shifts, a significant population increase in the top quartile of locations outside of capital cities is forecast, with the Rural View expected to increase by 2374 persons to 2041 based on aggregated SA2-level projections, reflecting an increase of 30.8% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Rural View among the top 25% of areas assessed nationwide

AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, shows Rural View recorded approximately 69 residential properties granted approval annually. Over the past five financial years, between FY-21 and FY-25, around 348 homes were approved, with an additional 37 approved so far in FY-26. On average, about 1.8 new residents arrived per year for each new home over these five financial years, suggesting a balance between supply and demand, which supports stable market dynamics.

The average construction cost value of new homes was $455,000, slightly above the regional average, indicating a focus on quality developments. In FY-26, approximately $14.4 million in commercial development approvals have been recorded, suggesting balanced commercial development activity in Rural View compared to the rest of Queensland. However, this activity has moderated in recent periods. Compared to the national average, Rural View records significantly higher developer confidence, with 230.0% more development activity per person. New developments in Rural View consist predominantly of detached houses (98.0%) and a smaller proportion of townhouses or apartments (2.0%), maintaining the area's traditional low-density character focused on family homes.

With around 119 people per approval, Rural View reflects an actively developing area. According to AreaSearch's latest quarterly estimate, Rural View is projected to add approximately 2,014 residents by 2041. At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Rural View has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

Area infrastructure changes significantly impact local performance. AreaSearch identified 14 projects likely affecting the area. Notable ones include Northern Beaches Community Hub, Reed Street Extension (Norwood Parade/Reed Street Connection), Mackay-Bucasia Road and Golf Links Road Intersection Upgrade, Landsborough Drive Over 50s Community. Below details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Blacks Beach Shopping Precinct

A 5.7ha mixed-use development featuring the 'Allied Village' healthcare hub and a 126-place childcare centre. The precinct includes a GP practice, pharmacy, veterinary clinic, allied health services, and a convenience store. The project also incorporates 16 residential lots and received recent council recognition for its role in supporting the growth of Mackay's Northern Beaches.

Northern Beaches Community Hub

The Northern Beaches Community Hub is a multi-stage precinct designed to serve Mackay's fastest-growing northern suburbs. Stage 1A, completed in mid-2025, delivered an undercover multi-purpose court, nature play area with a 29m crocodile-shaped amphitheatre, and picnic spaces. Stage 1B is currently under construction and features a modern library, flexible community rooms, a town square for events, and a 103sqm cafe space. The project aims to foster social connection for a population projected to exceed 32,000 by 2041.

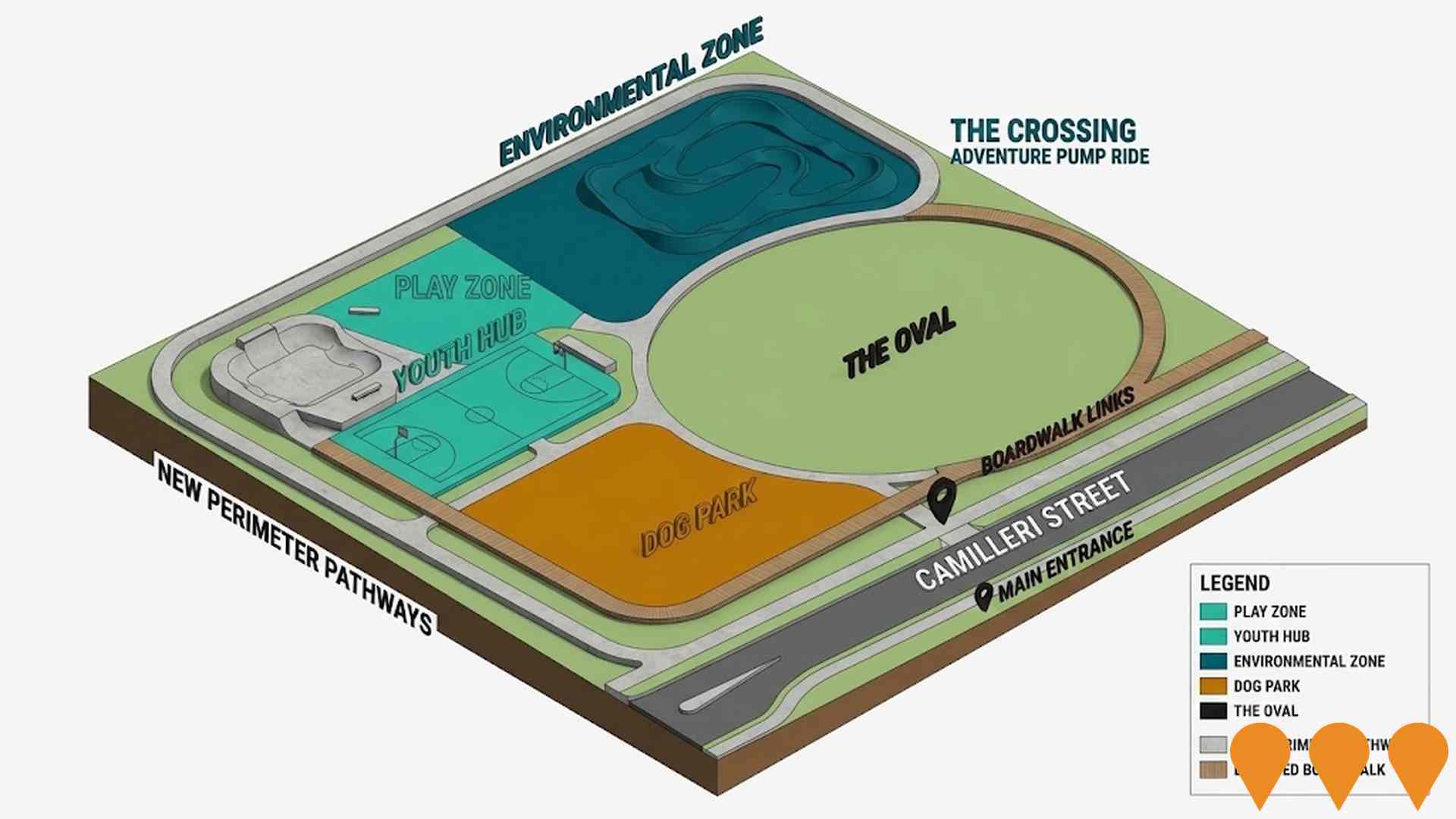

Camilleri Street District Park Upgrade

Multi stage upgrade to a district park in Blacks Beach delivering a youth hub with skate park and pump track, half basketball court and hit up wall, new amenities, dog park, boardwalk links and picnic areas. Current Stage 3 works (2025) add a formalised entry, perimeter pathways, shade trees, seating and an elevated boardwalk to improve accessibility and connectivity across the park.

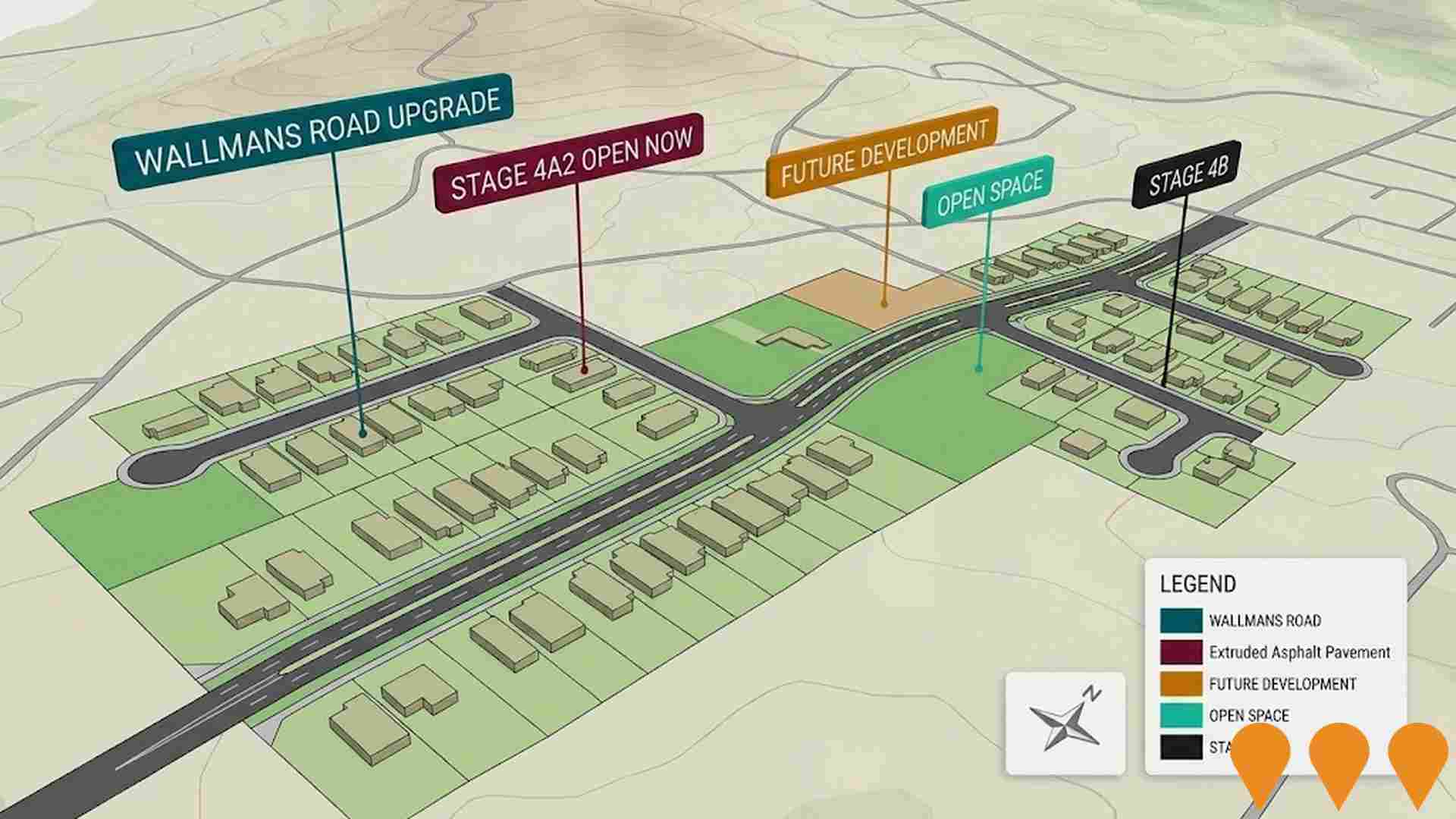

Andergrove Lakes Estate

Master planned lakeside community in north Mackay delivering residential lots (approximately 167 across completed and current stages), a neighbourhood retail hub anchored by an ALDI store, childcare centre(s), the Wake House cable water ski park, two man-made lakes, and future mixed-use tenancies. Built around flood retention, recreation, and lifestyle amenities with stages continuing to sell and construct.

Mackay-Bucasia Road and Golf Links Road Intersection Upgrade

Upgrade to the Mackay-Bucasia Road and Golf Links Road intersection to reduce congestion, improve road safety, and address flooding impacts. This is the first priority phase of broader capacity upgrades for the 11km corridor connecting the Bruce Highway to the Northern Beaches communities of Rural View, Bucasia, Eimeo, Blacks Beach and Shoal Point. The project will include traffic signal upgrades, road widening, and flood mitigation works.

Slater Avenue Childcare and Retail Precinct

DA-approved mixed-use project offered via Expressions of Interest (closing 31 Jul 2025). Lot 2 is approved for a 126-place long day care centre (services connected; operational works and building approvals in place; 27 on-grade car parks; AFL in place to Daisy Cottage Early Learning). Lot 3B is a retail, health and commercial precinct with DA for 1,095 sqm GFA, 55 on-grade car parks and multiple EOIs from national tenants. Total site area 7,908 sqm across both lots.

Bucasia 186 Homes and Childcare Centre

Proposed masterplanned residential community transforming 27.91 hectares of farmland into a housing estate with 186 homes and an integrated childcare centre in Mackay's fastest-growing northern beaches region. The site is designated as Emerging Community and Rural under the Mackay Region Planning Scheme 2017, with water and sewer infrastructure nearby. Located in close proximity to Bucasia Beach, schools, and local shopping facilities.

Landsborough Drive Over 50s Community

A 15.07ha development with Development Approval for 386 dwellings in an over 50s land lease community, located in Mackays northern growth region. The site includes council infrastructure credits worth approximately $1 million and a pre-constructed stormwater basin saving about $1.725 million. It is shovel-ready and was offered for sale via expressions of interest closing on August 7, 2025.

Employment

Employment conditions in Rural View rank among the top 10% of areas assessed nationally

Rural View's workforce is skilled with strong representation in manufacturing and industrial sectors. The unemployment rate was 0.9% as of September 2025.

Employment growth over the past year was estimated at 4.9%. There were 3,782 residents employed while the unemployment rate was 3.2% lower than Rest of Qld's rate of 4.1%. Workforce participation in Rural View was 74.3%, well above Rest of Qld's 59.1%. Employment is concentrated in health care & social assistance, mining, and retail trade.

Mining has a particularly high employment share at 4.2 times the regional level. However, agriculture, forestry & fishing is under-represented with only 0.5% of Rural View's workforce compared to 4.5% in Rest of Qld. Employment opportunities locally appear limited based on Census data analysis. Over the 12 months to September 2025, employment increased by 4.9%, labour force by 4.8%, with unemployment remaining essentially unchanged. In contrast, Rest of Qld had employment growth of 1.7% and labour force growth of 2.1%. State-level data from 25-Nov shows Queensland's employment contracted by 0.01% with a state unemployment rate of 4.2%. National employment forecasts from May-25 suggest Rural View's employment should increase by 5.9% over five years and 12.8% over ten years, based on industry-specific projections applied to the local employment mix.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

According to AreaSearch's aggregation of ATO data released on 28/03/2023 for financial year 2022-2023, Rural View suburb had a median income among taxpayers of $73,792. The average income level stood at $92,211. Nationally, these figures are high compared to the Rest of Qld's levels of $53,146 and $66,593 respectively. Based on Wage Price Index growth of 9.91% from financial year 2022-2023 to September 2025, estimated median income is approximately $81,105, and average income is around $101,349. Data from the Census conducted on 10/08/2021 shows household, family, and personal incomes in Rural View rank between the 84th and 90th percentiles nationally. Income distribution indicates that 38.5% of residents (2,515 people) fall within the $1,500 - $2,999 bracket, reflecting a pattern seen regionally where 31.7% occupy this range. Notably, 37.8% of residents earn above $3,000 per week, suggesting strong economic capacity in the area. Housing accounts for 14.2% of income, with residents ranking within the 90th percentile for disposable income. The suburb's SEIFA income ranking places it in the 6th decile.

Frequently Asked Questions - Income

Housing

Rural View is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

As of the latest Census evaluation, dwelling structures in Rural View consisted of 96.2% houses and 3.8% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro Qld's 85.1% houses and 14.9% other dwellings. Home ownership in Rural View stood at 19.2%, with the rest of dwellings either mortgaged (53.1%) or rented (27.7%). The median monthly mortgage repayment was $1,907, higher than Non-Metro Qld's average of $1,733 and the national average of $1,863. The median weekly rent figure in Rural View was $420, compared to Non-Metro Qld's $340 and the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Rural View features high concentrations of family households, with a higher-than-average median household size

Family households comprise 83.4% of all households, including 45.0% couples with children, 27.9% couples without children, and 10.0% single parent families. Non-family households account for the remaining 16.6%, with lone person households at 13.0% and group households comprising 3.4%. The median household size is 3.0 people, larger than the Rest of Qld average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Rural View shows below-average educational performance compared to national benchmarks, though pockets of achievement exist

The area's university qualification rate is 19.0%, significantly lower than the Australian average of 30.4%. Bachelor degrees are the most common university qualifications, with a rate of 13.6%. Postgraduate qualifications and graduate diplomas follow, at 3.0% and 2.4% respectively. Vocational credentials are prevalent among residents aged 15 and above, with 45.4% holding such qualifications.

Advanced diplomas account for 9.6%, while certificates make up 35.8%. Educational participation is high, with 35.2% of residents currently enrolled in formal education. This includes 14.2% in primary education, 11.2% in secondary education, and 3.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is very low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Rural View has ten active public transport stops, all serving buses. These stops are covered by two routes that together offer 98 weekly passenger trips. The transport accessibility is moderate, with residents usually situated 401 meters from the nearest stop.

On average, there are 14 daily trips across all routes, which amounts to roughly nine weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Rural View's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Rural View's health outcomes data shows excellent results, particularly for younger cohorts with low prevalence rates for common conditions. Private health cover stands at approximately 64% (4,164 people), exceeding Rest of Qld's 58.1%. Nationally, it is 55.7%.

Common medical conditions include asthma and mental health issues, affecting 7.9% and 6.8%, respectively, with 76.4% reporting no ailments compared to Rest of Qld's 69.7%. The area has 8.0% (522 people) aged 65+, lower than Rest of Qld's 16.2%. While seniors' health outcomes require more attention, overall results are positive.

Frequently Asked Questions - Health

Cultural Diversity

Rural View ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Rural View's cultural diversity was found to be below average, with 87.2% of its population being citizens, 85.1% born in Australia, and 92.4% speaking English only at home. Christianity was the predominant religion, making up 52.3% of Rural View's population, compared to 56.8% across the rest of Queensland. The top three ancestry groups were Australian (28.8%), English (27.5%), and Scottish (7.5%).

Notably, South African ancestry was overrepresented at 1.2%, compared to 0.5% regionally, as were New Zealand (1.1%, vs 0.7%) and Maltese (1.3%, vs 2.4%) ancestries.

Frequently Asked Questions - Diversity

Age

Rural View hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Rural View's median age of 31 years is significantly younger than Rest of Qld's 41 and considerably younger than the national average of 38 years. The 35-44 age group makes up 17.4% of Rural View's population compared to Rest of Qld, while the 65-74 cohort is less prevalent at 5.4%. Between 2021 and present, the 15 to 24 age group has increased from 13.7% to 14.6%, while the 5 to 14 cohort has decreased from 17.3% to 15.5% and the 45 to 54 group has dropped from 12.9% to 11.4%. By 2041, population forecasts indicate substantial demographic changes for Rural View. The 25 to 34 age cohort is projected to increase significantly, expanding by 535 people (50%) from 1,077 to 1,613.