Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Freshwater reveals an overall ranking slightly below national averages considering recent, and medium term trends

Based on analysis of ABS population updates for the broader area, the estimated population of the Freshwater (Qld) statistical area (Lv2) as of Nov 2025 is around 2,230. This reflects an increase of 88 people since the 2021 Census, which reported a population of 2,142 people. The change is inferred from the resident population of 2,205 estimated by AreaSearch following examination of the latest ERP data release by the ABS (June 2024) and an additional 7 validated new addresses since the Census date. This level of population equates to a density ratio of 1,411 persons per square kilometer, which is above the average seen across national locations assessed by AreaSearch. Population growth for the area was primarily driven by overseas migration that contributed approximately 67.0% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. It should be noted that these state projections do not provide age category splits; hence where utilised, AreaSearch applies proportional growth weightings in line with the ABS Greater Capital Region projections for each age cohort (released in 2023, based on 2022 data). Moving forward with demographic trends, lower quartile growth of non-metropolitan areas nationally is anticipated. The Freshwater (Qld) (SA2) is expected to grow by 95 persons to 2041 based on aggregated SA2-level projections, reflecting a gain of 3.2% in total over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development drivers sees a low level of activity in Freshwater, placing the area among the bottom 25% of areas assessed nationally

Freshwater has had minimal residential development activity with 2 dwelling approvals annually on average over the past five years (14 approvals total). This low level of development is typical in rural areas due to modest housing needs and limited construction activity influenced by local demand and infrastructure capacity. Notably, the small number of approvals can significantly impact annual growth and relative statistics.

Compared to Rest of Qld, Freshwater has shown significantly less construction activity, with its development pattern also below national averages. Recent building activity in Freshwater consists entirely of detached dwellings, aligning with rural living preferences for space and privacy. New construction favours detached housing more than current patterns suggest (58.0% at Census), indicating ongoing robust demand for family homes despite increasing density pressures. With approximately 732 people per dwelling approval, Freshwater reflects a highly mature market.

According to the latest AreaSearch quarterly estimate, Freshwater is projected to add 71 residents by 2041, with development keeping pace with projected growth. However, buyers may face increasing competition as the population expands.

Frequently Asked Questions - Development

Infrastructure

Freshwater has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified five projects likely impacting the area. Key projects include Bel Plas Estate, Cairns Western Arterial Road Duplication, Currunda Creek Development, and Larsen Place Estate. The following details projects likely most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Cairns Smart Green Economy Initiative

A multi-stage strategic initiative by Cairns Regional Council to transform the region into a leader in the Smart Green Economy. Key focus areas include net-zero energy systems, circular economy activation (waste-to-energy and recycling), and biodiversity markets. Active projects under this umbrella include the $472M Cairns Water Security Stage 1, installation of 37,000 smart water meters, EV charging infrastructure, and major renewable energy transitions for council facilities.

Cairns Western Arterial Road Duplication

A $300 million major infrastructure project duplicating the remaining single-lane sections of the Cairns Western Arterial Road (CWAR) to a four-lane dual carriageway. The scope includes duplicating the Redlynch rail overpass, a new four-lane bridge over the Barron River at Kamerunga, and significant upgrades to active transport facilities. The project is delivered in three stages: Stage 1 (Lake Placid Road to Captain Cook Highway), Stage 2 (Redlynch Connector Road to Harley Street), and Stage 3 (Harley Street to Lake Placid Road). Early works for Stage 1 commenced in August 2024 and are nearing completion as of early 2026, with an updated business case for the main construction works expected in early 2026.

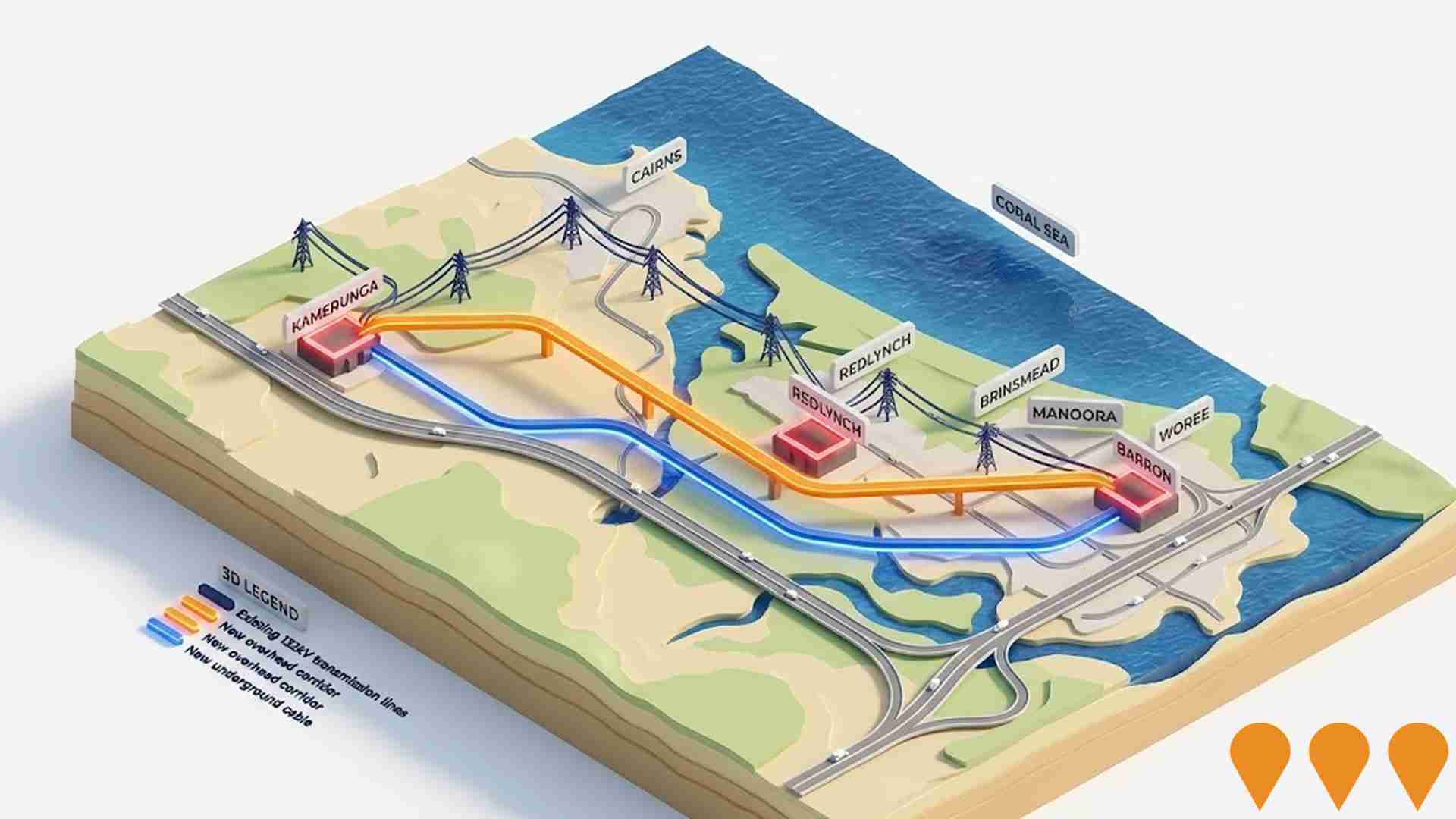

Kamerunga to Woree Transmission Line Replacement Project

The Kamerunga to Woree Replacement Project involves the decommissioning of aging 132kV transmission infrastructure originally built in the 1960s-1970s. The upgrade includes a new substation in Barron, a 4.1km overhead transmission line segment between Kamerunga and Redlynch, and a 10.4km underground transmission cable from Redlynch to the Woree Substation. The project is currently undergoing a Ministerial Infrastructure Designation (MID) assessment to secure planning approvals, with geotechnical investigations slated for mid-2026 and construction expected to commence in 2027.

Currunda Creek Development

Low-impact trades and services development providing storage facilities, light industry, vehicle storage, bulk landscape supplies, and commercial services to support the Redlynch community. The project involves subdividing the eastern precinct into 4 lots on 8 hectares adjacent to Boral Quarry, creating over 120 permanent jobs while preserving the western precinct's vegetation.

Redlynch Central Shopping Centre Expansion (Stage 3)

The $10 million Stage 3 expansion of Redlynch Central Shopping Centre involves constructing a new two-storey building attached to the Coles supermarket end of the centre. It will add an additional 1200 square metres of space, including 500 square metres of retail space on the ground floor and 700 square metres on the first floor, attracting new specialty stores. Construction commenced in April 2025.

JCU Private Hospital - Dugurrdja Precinct

$80 million private hospital development by James Cook University in Cairns CBD, part of health innovation precinct supporting medical education and research.

Cairns Tropical Enterprise Centre (CTEC)

James Cook University's $50 million tropical health research facility forming part of Far North Queensland Health Innovation Precinct, adjacent to new surgical centre.

Cairns Airport International Terminal Upgrade

$55 million upgrade to the international terminal (T1) at Cairns Airport, enhancing passenger experience and capacity for tourism growth in Far North Queensland. Includes refurbishment of the terminal, expansion of the departure lounge and baggage reclaim hall, upgrades to airside infrastructure such as taxiways and power cabling, and development of the Eastern Aviation Precinct (EAP) to increase aero stand capacity and create a new general aviation precinct.

Employment

AreaSearch analysis reveals Freshwater significantly outperforming the majority of regions assessed nationwide

Freshwater has an educated workforce with significant representation in essential services sectors. As of September 2025, the unemployment rate is 2.5%.

This is 1.6% lower than Rest of Qld's rate of 4.1%, and workforce participation is high at 73.5%, compared to Rest of Qld's 59.1%. Key employment industries include health care & social assistance, education & training, and public administration & safety. The area specializes in health care & social assistance, with an employment share 1.5 times the regional level. Agriculture, forestry & fishing has limited presence at 0.7%, compared to 4.5% regionally.

Over the year to September 2025, labour force levels decreased by 2.1% and employment declined by 2.9%, causing unemployment to rise by 0.8 percentage points. In contrast, Rest of Qld saw employment grow by 1.7%. State-level data to 25-Nov shows QLD employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Freshwater's employment mix suggests local employment should increase by 7.3% over five years and 15.1% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year ending June 2023 shows Freshwater suburb has one of Australia's highest incomes. The median is $68,290 and the average stands at $84,932. This contrasts with Queensland excluding Brisbane (Rest of Qld) which has a median income of $53,146 and an average of $66,593. Based on Wage Price Index growth of 9.91% from July 2023 to September 2025, estimated incomes would be approximately $75,058 (median) and $93,349 (average). Census data shows individual earnings rank at the 85th percentile nationally ($1,095 weekly), but household income ranks lower at the 57th percentile. Income distribution reveals that 35.5% of residents earn between $1,500 and $2,999 (791 individuals), similar to the broader area where this group represents 31.7%. After housing costs, residents retain 86.7% of their income, indicating strong purchasing power. The suburb's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Freshwater displays a diverse mix of dwelling types, with above-average rates of outright home ownership

In Freshwater, as per the latest Census evaluation, 57.6% of dwellings were houses while 42.5% were other types such as semi-detached homes, apartments, and 'other' dwellings. This is in contrast to Non-Metro Qld where 80.8% of dwellings were houses and 19.2% were other types. Home ownership in Freshwater stood at 32.0%, with mortgaged dwellings at 39.3% and rented ones at 28.7%. The median monthly mortgage repayment was $1,625, lower than Non-Metro Qld's average of $1,733. The median weekly rent figure in Freshwater was $350 compared to Non-Metro Qld's $390. Nationally, Freshwater's mortgage repayments were significantly lower at $1,625 against the Australian average of $1,863, while rents were also lower at $350 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Freshwater features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 66.4% of all households, including 24.6% couples with children, 26.6% couples without children, and 15.0% single parent families. Non-family households constitute the remaining 33.6%, with lone person households at 29.9% and group households comprising 3.1%. The median household size is 2.3 people, which is smaller than the Rest of Qld average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Freshwater shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Freshwater's educational attainment exceeds broader averages. Among residents aged 15+, 38.3% hold university qualifications, compared to 20.6% in the rest of Queensland and 21.1% in the SA4 region. Bachelor degrees are most common at 25.3%, followed by postgraduate qualifications (8.4%) and graduate diplomas (4.6%). Vocational credentials are also prevalent, with 35.8% of residents aged 15+ holding such qualifications - advanced diplomas at 12.6% and certificates at 23.2%.

Educational participation is high in Freshwater, with 30.8% of residents currently enrolled in formal education. This includes 11.4% in primary education, 9.8% in secondary education, and 4.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis shows 11 active stops operating in Freshwater. These are mixed bus routes. There's 1 route serving these stops, providing 114 weekly passenger trips collectively.

Transport accessibility is rated good, with residents typically located 230 meters from the nearest stop. Service frequency averages 16 trips per day across all routes, equating to approximately 10 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Freshwater's residents boast exceedingly positive health performance metrics with very low prevalence of common health conditions across all age groups

Freshwater has excellent health outcomes, with very low prevalence of common health conditions across all age groups. Approximately 61% of its total population of 1,356 people have private health cover, compared to 53.6% in Rest of Qld and a national average of 55.7%. Mental health issues affect 8.0% of residents, while arthritis impacts 6.6%.

A significant majority, 74.9%, report being completely clear of medical ailments, slightly higher than the 73.1% in Rest of Qld. As of a recent study (date not specified), 15.9% of Freshwater's residents are aged 65 and over, totaling 354 people. The health profile of seniors in Freshwater is strong and largely aligns with that of the general population.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Freshwater records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Freshwater's population was found to be approximately aligned with the broader regional average in terms of cultural diversity, with 78.7% born in Australia, 88.9% being citizens, and 90.6% speaking English only at home. Christianity was identified as the predominant religion in Freshwater, accounting for 41.5% of its population. However, Judaism showed a notable overrepresentation, comprising 0.2% compared to the regional average of 0.2%.

The top three ancestry groups in Freshwater were English (29.7%), Australian (22.4%), and Irish (10.4%). There were also significant differences in the representation of certain ethnic groups: Dutch was overrepresented at 1.8% compared to the regional average of 1.5%, German at 5.1% versus 4.3%, and Scottish at 8.9% compared to 8.0%.

Frequently Asked Questions - Diversity

Age

Freshwater's median age exceeds the national pattern

The median age in Freshwater is 42 years, close to Rest of Qld's average of 41, and well above Australia's median of 38. Compared to Rest of Qld, the 45-54 cohort is notably over-represented at 15.3% locally, while the 65-74 age group is under-represented at 9.2%. Between the 2021 Census and present, the 25 to 34 age group has grown from 10.7% to 12.3%, and the 15 to 24 cohort increased from 9.8% to 11.3%. Conversely, the 5 to 14 cohort declined from 15.4% to 13.4%, and the 45 to 54 group dropped from 16.9% to 15.3%. Population forecasts for 2041 indicate substantial demographic changes in Freshwater. The 25 to 34 age cohort is projected to expand by 61 people (22%), from 274 to 336, while the 55 to 64 and 5 to 14 cohorts are expected to experience population declines.