Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Caloundra West lies within the top 10% of areas nationally in terms of population growth performance according to AreaSearch analysis of short and medium-term trends

Based on ABS population updates and AreaSearch validation, as of Nov 2025, Caloundra West's estimated population is around 9,593. This reflects a growth of 2,323 people since the 2021 Census, which reported a population of 7,270. The increase is inferred from AreaSearch's estimated resident population of 8,468 in Jun 2024 and an additional 103 validated new addresses since the Census date. This results in a density ratio of 1,193 persons per square kilometer, comparable to averages seen across locations assessed by AreaSearch. Caloundra West's growth rate of 32% since the 2021 census exceeded both national and non-metro averages, marking it as a growth leader. Interstate migration contributed approximately 82% of overall population gains during this period.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area released in Jun 2024 with 2022 as the base year. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections released in 2023 are adopted. Exceptional growth is predicted over the period 2025 to 2041, with Caloundra West expected to expand by 12,699 persons, reflecting an increase of 134.7% in total over the 17 years.

Frequently Asked Questions - Population

Development

The level of residential development activity in Caloundra West was found to be higher than 90% of real estate markets across the country

Based on AreaSearch analysis of ABS building approval numbers, allocated from statistical area data, Caloundra West averaged around 76 new dwelling approvals annually between FY-21 and FY-25. Approximately 380 homes were approved over the past five financial years, with an additional 60 approved so far in FY-26. This results in a significant demand for new residents, estimated at about 10.5 per year per dwelling constructed during this period.

The average construction cost of new dwellings was $396,000. In FY-26, there have been $197,000 in commercial approvals, indicating the area's residential nature. Compared to the rest of Queensland, Caloundra West records about 67% of building activity per person and ranks among the 82nd percentile nationally. The new building activity shows a mix of detached houses (52.0%) and attached dwellings (48.0%), with an increasing number of townhouses and apartments being developed to cater to different price points.

This shift marks a significant departure from existing housing patterns, which are currently 83.0% houses. The location has approximately 123 people per dwelling approval, indicating an expanding market. Population forecasts indicate Caloundra West will gain around 12,920 residents by 2041, based on the latest AreaSearch quarterly estimate. If current construction levels persist, housing supply may lag behind population growth, potentially intensifying buyer competition and underpinning price growth.

Frequently Asked Questions - Development

Infrastructure

Caloundra West has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

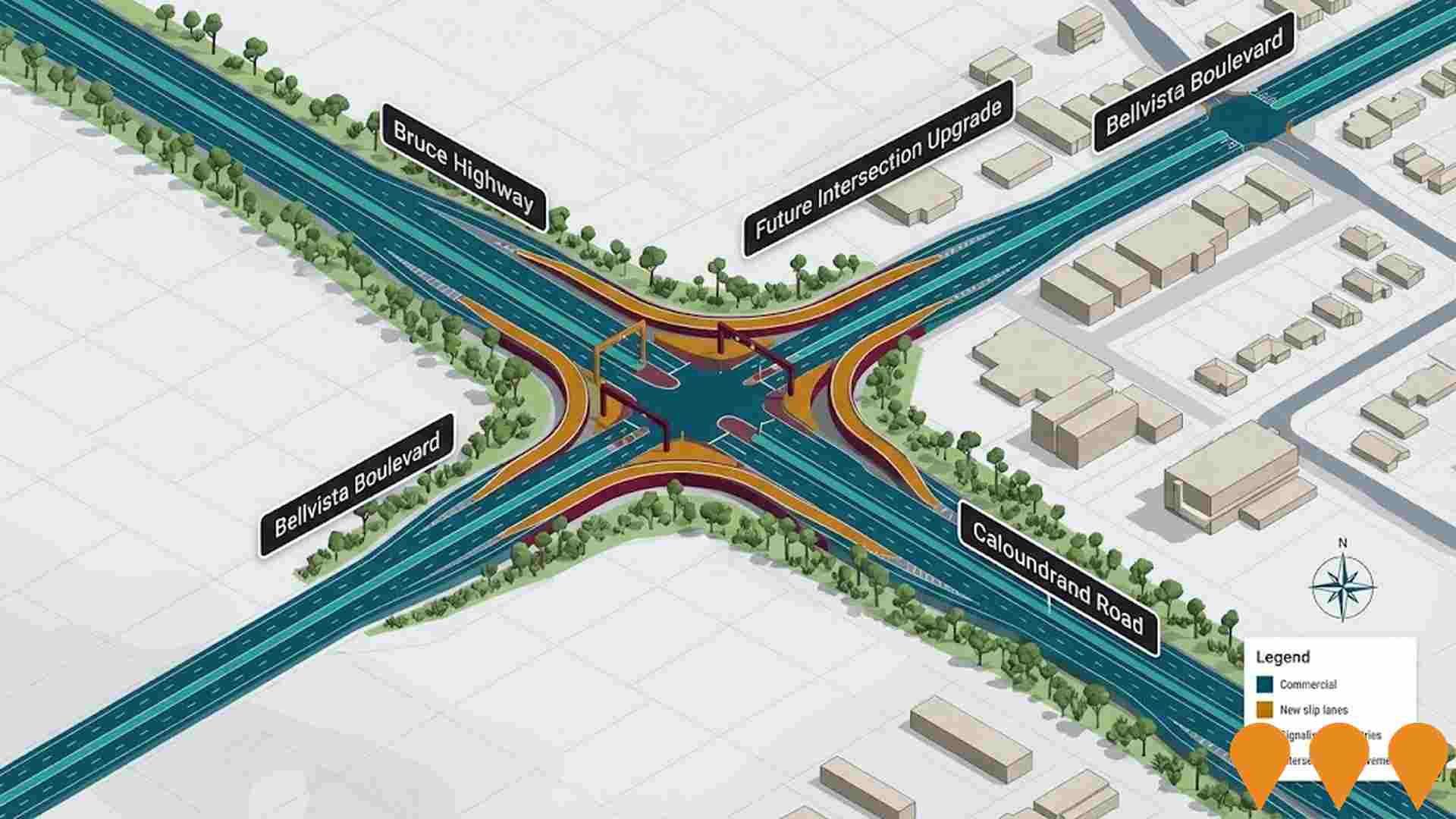

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 52 projects likely to affect the area. Notable ones include Aura Business Park, Aura District Sports Parks, Aura Hotel, and Aura (Caloundra South) Infrastructure. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Aura (Caloundra South) Infrastructure

Major infrastructure delivery for the 20,000-home Aura masterplanned community. Current 2026 works include the duplication of Aura Boulevard and Graf Drive, construction of the Nirimba Drive bridge, and the development of the Aura Town Centre and Aura Hotel. The project also supports enabling works for the Direct Sunshine Coast Rail Line (CAMCOS) and major water and sewer network expansions.

The Wave - Sunshine Coast Rail and Metro

A transformative public transport project delivering a new 37.8km dual-track heavy rail line from Beerwah to Birtinya (Stages 1 & 2) and a metro-style high-capacity bus rapid transit connection to the Sunshine Coast Airport via Maroochydore (Stage 3). Stage 1, between Beerwah and Caloundra, is fully funded and involves 19km of track including elevated viaducts and an upgrade to Beerwah Station. Major construction is scheduled to commence in late 2026 to ensure completion for the 2032 Brisbane Olympic Games.

Caloundra Centre Activation Project

The Caloundra Centre Activation Project is a major urban renewal initiative delivering the 2017 Master Plan. Key milestones include the opening of the new Library+ Caloundra in September 2025 and the ongoing development of the Caloundra Community and Creative Hub. This hub integrates the Events Centre, a new regional art gallery, and a fast-tracked $12.8 million town square. The project aims to create a walkable, vibrant city heart with enhanced pedestrian links to Bulcock Beach and revitalised public spaces at Felicity Park and Omrah Avenue.

Aura Hotel

Aura Hotel is a 45 million dollar large-scale entertainment and hospitality development by the Comiskey Group. Located in the Aura City Centre, it features a 2,500-capacity live music venue equipped with world-class audio-visual systems, a band room, and a mezzanine level. The Mediterranean-inspired venue spans three levels and includes six bars, internal and alfresco dining, gaming facilities, and multiple function spaces. It is positioned adjacent to a 5-hectare parkland and swimming lagoon, aiming to be a premier regional destination for international and local musical talent.

Palmview Residential Community (Palmview Master Planned Area)

The Palmview residential community is a 926-hectare master-planned area on the Sunshine Coast, designed to accommodate approximately 16,000 residents across 7,000+ homes by 2036. The project includes three major estates: Harmony (AVID Property Group), Village Green (Peet), and Flame Tree Rise (Living Choice). As of early 2026, construction is well-advanced with multiple schools (Palmview State Primary, Special, and Secondary) operational and over 120 hectares of open space under development. Major infrastructure including the Harmony Water Project (12ML reservoir) is nearing completion, and the Southern Road Link to Caloundra Road is slated for finalisation by mid-2026.

Aura Business Park

Aura Business Park is a major industrial and commercial precinct within the Aura masterplanned community, designed to become a significant employment hub on the Sunshine Coast. The $215 million development comprises over 300 industrial lots accommodating light industry, manufacturing, warehousing, storage, bulky goods showrooms, commercial office space, research and development, and indoor sports and recreation facilities. Located adjacent to Bells Creek Arterial Road with direct connections to the Bruce Highway, the business park is expected to generate approximately 3,000 new jobs. With over 130 lots already sold and developed as of 2025, the park is rapidly establishing itself as the premier business location on the Sunshine Coast, featuring high-speed NBN connectivity and proximity to educational facilities, parks, and the future Aura Town Centre. The latest 2025 land release includes final remaining lots ranging from 1,550 to 3,902 square meters.

Aura District Sports Parks

Multi-purpose sports and recreation facilities serving Aura community including playing fields, courts, clubhouses and support facilities. Part of Aura's planned 10 sporting grounds designed to accommodate various sports including football, cricket, tennis and community events.

Caloundra TAFE Centre of Excellence

A new TAFE Centre of Excellence dedicated to construction and allied trades, located in Caloundra on the Sunshine Coast. The centre aims to address labour skills shortages and deliver a skilled workforce for infrastructure projects. It will feature industry-leading training facilities in carpentry, plumbing, fabrication, electrotechnology, and engineering, including large flexible workshops, advanced learning areas, student spaces, and industry collaboration spaces.

Employment

AreaSearch assessment positions Caloundra West ahead of most Australian regions for employment performance

Caloundra West has a skilled workforce with essential services sectors well represented. Its unemployment rate is 3.0%, according to AreaSearch's aggregation of statistical area data.

As of September 2025, there are 5,030 residents employed, with an unemployment rate of 1.1% lower than Rest of Qld's rate of 4.1%. Workforce participation is at 63.8%, compared to Rest of Qld's 59.1%. Health care & social assistance, construction, and retail trade are the leading employment industries among residents. The area has a particular specialization in health care & social assistance, with an employment share 1.3 times the regional level, while agriculture, forestry & fishing employs just 0.5% of local workers, below Rest of Qld's 4.5%.

Analysis of SALM and ABS data for the wider area shows that over a 12-month period, labour force decreased by 1.2%, employment declined by 0.8%, leading to a fall in unemployment rate by 0.4 percentage points. In comparison, Rest of Qld recorded employment growth of 1.7% and labour force growth of 2.1%, with unemployment rising by 0.3 percentage points. State-level data up to 25-Nov shows Queensland employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%, broadly in line with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 suggest that national employment is expected to expand by 6.6% over five years and 13.7% over ten years, but growth rates differ significantly between industry sectors. Applying these projections to Caloundra West's employment mix indicates local employment should increase by 6.7% over five years and 14.0% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income levels sit below national averages according to AreaSearch assessment

AreaSearch's latest postcode level ATO data for financial year 2023 indicates that Caloundra West had a median taxpayer income of $49,559 and an average of $63,274. These figures are lower than the national averages. The Rest of Qld had a median income of $53,146 and an average of $66,593 during this period. Based on Wage Price Index growth of 9.91% since financial year 2023, current estimates for Caloundra West would be approximately $54,470 (median) and $69,544 (average) as of September 2025. According to Census 2021 income data, incomes in Caloundra West rank modestly, between the 38th and 39th percentiles for household, family, and personal incomes. Income analysis shows that 36.9% of the population (3,539 individuals) fall within the $1,500 - $2,999 income range, which aligns with the regional average of 31.7%. Housing affordability pressures are severe in Caloundra West, with only 80.1% of income remaining after housing costs, ranking at the 36th percentile. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Caloundra West is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Caloundra West's dwelling structure, as per the latest Census, consisted of 83.3% houses and 16.7% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro Qld had 70.4% houses and 29.6% other dwellings. Home ownership in Caloundra West was at 29.5%, with dwellings either mortgaged (37.8%) or rented (32.7%). The median monthly mortgage repayment was $1,842, lower than Non-Metro Qld's average of $1,950 and the national figure of $1,863. The median weekly rent in Caloundra West was $465, higher than Non-Metro Qld's $450 and significantly above the national average of $375.

Frequently Asked Questions - Housing

Household Composition

Caloundra West has a typical household mix, with a higher-than-average median household size

Family households account for 74.2% of all households, including 33.1% couples with children, 26.3% couples without children, and 14.0% single parent families. Non-family households constitute the remaining 25.8%, with lone person households at 22.6% and group households comprising 3.1%. The median household size is 2.6 people, which is larger than the Rest of Qld average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Caloundra West exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 18.0%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 13.1%, followed by postgraduate qualifications (2.7%) and graduate diplomas (2.2%). Vocational credentials are prevalent, with 43.2% of residents aged 15+ holding them, including advanced diplomas (12.2%) and certificates (31.0%). Educational participation is high, with 30.4% of residents currently enrolled in formal education, comprising 11.7% in primary, 8.6% in secondary, and 4.1% in tertiary education.

Educational participation is notably high, with 30.4% of residents currently enrolled in formal education. This includes 11.7% in primary education, 8.6% in secondary education, and 4.1% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Caloundra West has 19 active public transport stops. These are served by a mix of buses along four different routes. The total weekly passenger trips facilitated by these routes is 370.

Residents' accessibility to transport is rated as good, with an average distance of 309 meters to the nearest stop. Service frequency across all routes averages 52 trips per day, equating to about 19 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Caloundra West is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Caloundra West experiences notable health challenges with common conditions affecting both younger and older age groups.

Its private health cover rate stands at approximately 52%, slightly higher than the average SA2 area (~5,015 people). Mental health issues and arthritis are the most prevalent medical conditions, impacting 9.7% and 9.3% of residents respectively. About 66.8% of residents report being completely free from medical ailments, compared to 66.2% across Rest of Qld. The area has 16.0% of residents aged 65 and over (1,534 people), lower than the 22.3% in Rest of Qld.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Caloundra West records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Caloundra West, as per the census conducted on 9 August 2016, had a cultural diversity profile roughly similar to its wider region's average. In terms of birthplace, 77.3% of Caloundra West residents were born in Australia, with 86.9% being Australian citizens and 92.3% speaking only English at home. Christianity was the predominant religion, accounting for 48.0% of the population.

However, Judaism showed a slight overrepresentation compared to the rest of Queensland, with 0.1% of Caloundra West residents identifying as such. Regarding ancestry, the top three groups were English (33.0%), Australian (26.8%), and Scottish (8.2%). Notably, New Zealanders comprised 1.2%, Maori made up 1.2%, and Germans accounted for 4.3% of Caloundra West's population, each showing a divergence from their regional representation percentages.

Frequently Asked Questions - Diversity

Age

Caloundra West's population is slightly younger than the national pattern

Caloundra West has a median age of 36, which is lower than the Rest of Qld figure of 41 and marginally lower than Australia's median age of 38 years. Compared to the Rest of Qld average, the 35-44 cohort is notably over-represented in Caloundra West at 16.5%, while the 55-64 year-olds are under-represented at 8.6%. Between 2021 and present, the 35 to 44 age group has grown from 15.0% to 16.5% of the population, while the 25 to 34 cohort increased from 12.4% to 13.7%. Conversely, the 65 to 74 cohort has declined from 9.6% to 8.7%. Demographic modeling suggests that Caloundra West's age profile will evolve significantly by 2041. The 35 to 44 age cohort is projected to surge dramatically, expanding by 2,441 people (154%) from 1,582 to 4,024.