Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Golden Beach - Pelican Waters lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Golden Beach - Pelican Waters' population is around 14,437 as of November 2025. This reflects an increase of 1,402 people since the 2021 Census, which reported a population of 13,035 people. The change is inferred from the estimated resident population of 13,987 in June 2024 and an additional 495 validated new addresses since the Census date. This level of population equates to a density ratio of 1,381 persons per square kilometer. Golden Beach - Pelican Waters' growth rate of 10.8% since the 2021 census exceeded both the non-metro area (8.8%) and national average. Population growth was primarily driven by interstate migration contributing approximately 59.1% of overall population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, Queensland State Government's SA2 area projections released in 2023 based on 2021 data are used. These state projections do not provide age category splits; hence proportional growth weightings from ABS Greater Capital Region projections released in 2023 based on 2022 data are applied where utilized. Future population trends project an above median growth for non-metropolitan areas nationally, with the area expected to expand by 2,677 persons to 2041 based on latest annual ERP population numbers, reflecting a total increase of 15.4% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Golden Beach - Pelican Waters among the top 25% of areas assessed nationwide

Golden Beach - Pelican Waters has averaged approximately 136 new dwelling approvals per year over the past five financial years, totalling 684 homes. As of FY26, 53 approvals have been recorded. This results in an average of about 1.7 new residents arriving per new home each year between FY21 and FY25, indicating a balanced supply and demand market with stable conditions. The average construction cost value for new homes is around $648,000, reflecting developers' focus on the premium segment with upmarket properties.

This financial year has seen $1.6 million in commercial development approvals, suggesting a predominantly residential focus. Compared to the rest of Queensland, Golden Beach - Pelican Waters has about two-thirds the rate of new dwelling approvals per person, while it ranks among the 87th percentile nationally when measured against other areas assessed. Recent construction comprises approximately 80% detached houses and 20% townhouses or apartments, maintaining the area's suburban identity with a concentration of family homes suited to buyers seeking space.

With about 99 people per approval, Golden Beach - Pelican Waters reflects an area in development. According to the latest AreaSearch quarterly estimate, the area is expected to grow by around 2,227 residents through to 2041. Given current construction levels, housing supply should meet demand adequately, creating favourable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Golden Beach - Pelican Waters has very high levels of nearby infrastructure activity, ranking in the top 10% nationally

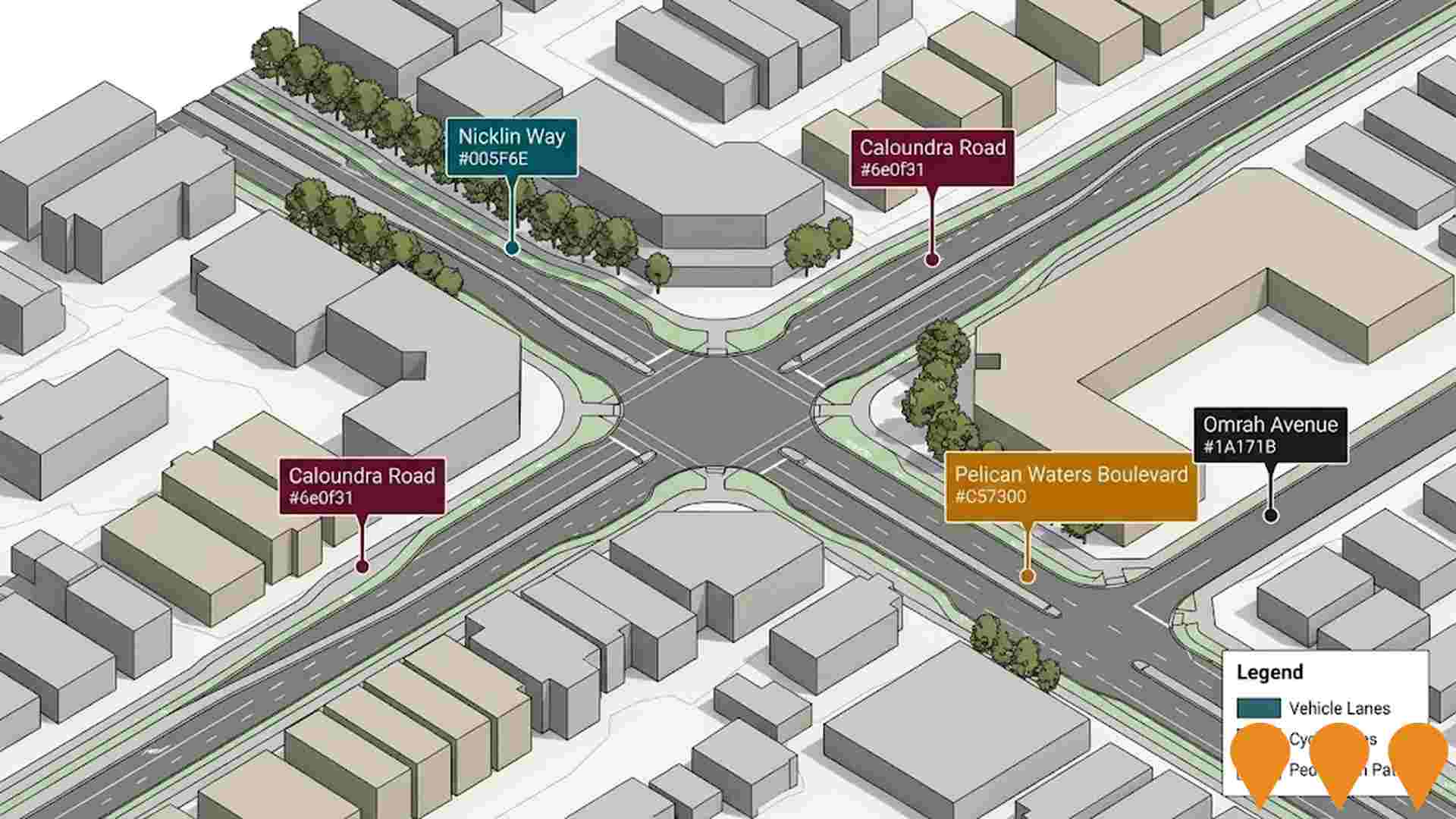

Changes to local infrastructure significantly influence an area's performance. AreaSearch identified 45 projects likely impacting the region. Notable initiatives include Aura Home + Life, Palm Lake Resort Pelican Waters, Pelican Waters Infrastructure Upgrade B, and Caloundra South Industrial Precinct, with the following list detailing those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Aura Home + Life

An $80 million large-format retail and lifestyle precinct developed by Capital Property Group within the City of Colour master-planned community on the Sunshine Coast. Features major anchors Spotlight, Anaconda and Harris Scarfe plus additional homewares, lifestyle and bulky goods retailers across approximately 20,000 sqm. Includes food and beverage offerings, over 400 car parks and will deliver around 250 ongoing jobs. Construction is progressing well with opening scheduled for mid-2026.

Aura Parklands & Lagoon

Aura Parklands & Lagoon is a 5.3-hectare landmark leisure destination within the future Aura City Centre on the Sunshine Coast. Features a 2,100mý swimming lagoon (nearly two Olympic pools), water play areas, BBQ and picnic facilities, event spaces, walking paths surrounded by Wallum forest, and forms part of a larger 11.3-hectare recreational park. Operated and maintained by Sunshine Coast Council with lifeguard services and daily management. Serves as a key community hub connecting to the future Aura Retail Town Centre.

Baringa Sports Complex

A new district sports park within Stockland's Aura community at Baringa. The 7.5ha precinct is designed to include two full-sized AFL fields, eight tennis courts and four multi-use courts suitable for pickleball and hot shots, along with supporting amenities. Construction commenced in late 2023 with Stockland most recently forecasting opening in late 2025.

Caloundra TAFE Centre of Excellence

A new TAFE Centre of Excellence dedicated to construction and allied trades, located in Caloundra on the Sunshine Coast. The centre aims to address labour skills shortages and deliver a skilled workforce for infrastructure projects. It will feature industry-leading training facilities in carpentry, plumbing, fabrication, electrotechnology, and engineering, including large flexible workshops, advanced learning areas, student spaces, and industry collaboration spaces.

Palm Lake Resort Pelican Waters

Luxury over-50s resort community featuring Palm Springs-inspired architecture, The Springs Country Club, Sonora rooftop bar, El Dorado sporting precinct, and Mirador wellness centre. Modern luxury redefined for active retirees.

Nirimba Sports Complex

Planned sports and recreation facility in Nirimba to serve the northern areas of the Sunshine Coast. Will include various sporting facilities, community spaces, and recreational amenities.

The Quays Waterfront Residential

Final tidal waterfront lots at Pelican Waters featuring boutique two-storey sites ranging from 380-475 sqm. Prestigious residential precinct offering the last available tidal waterfront opportunities.

Pelican Waters Infrastructure Upgrade B

Second phase infrastructure improvements for continued community growth and development.

Employment

AreaSearch assessment positions Golden Beach - Pelican Waters ahead of most Australian regions for employment performance

Golden Beach - Pelican Waters has an unemployment rate of 2.7% as of September 2025, with 5,982 residents employed. This is 1.4% lower than the Rest of Qld's rate of 4.1%.

Workforce participation is at 46.9%, significantly lower than the regional average of 59.1%. Employment is concentrated in health care & social assistance, construction, and retail trade. Construction employment is particularly notable, at 1.3 times the regional average. Agriculture, forestry & fishing has limited presence, with only 0.8% employment compared to the regional average of 4.5%.

The area appears to offer limited local employment opportunities, as indicated by Census data comparing working population and resident population. In the 12-month period ending September 2025, labour force decreased by 2.5% and employment decreased by 2.2%, resulting in a fall of 0.3 percentage points in unemployment rate compared to Rest of Qld. State-level data from 25-Nov-25 shows Queensland's employment contracted by 0.01%, with an unemployment rate of 4.2%. Jobs and Skills Australia forecasts national employment growth of 6.6% over five years and 13.7% over ten years, but local projections suggest Golden Beach - Pelican Waters' employment should increase by 6.8% over five years and 13.9% over ten years based on its current industry mix.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

According to AreaSearch's aggregation of latest postcode level ATO data released for financial year 2022, Golden Beach - Pelican Waters SA2 had median income among taxpayers of $43,818 and average income of $55,945. Nationally, the median was $50,780 and average was $64,844. Based on Wage Price Index growth of 13.99% since financial year 2022, current estimates for Golden Beach - Pelican Waters are approximately $49,948 (median) and $63,772 (average) as of September 2025. Census 2021 income data shows household, family and personal incomes in Golden Beach - Pelican Waters fall between the 21st and 23rd percentiles nationally. Income brackets indicate that 26.8% of individuals earn $800 - $1,499 annually. Housing affordability pressures are severe with only 83.7% of income remaining, ranking at the 23rd percentile. The area's SEIFA income ranking places it in the fifth decile.

Frequently Asked Questions - Income

Housing

Golden Beach - Pelican Waters is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Golden Beach - Pelican Waters had 72.8% houses and 27.1% other dwellings in its dwelling structure as of the latest Census. This compares to Non-Metro Qld's 70.4% houses and 29.6% other dwellings. Home ownership in Golden Beach - Pelican Waters was 53.1%, with mortgaged dwellings at 24.9% and rented ones at 22.1%. The median monthly mortgage repayment was $2,123, higher than Non-Metro Qld's average of $1,950. Median weekly rent in the area was $440, compared to Non-Metro Qld's $450. Nationally, Golden Beach - Pelican Waters' mortgage repayments were significantly higher at $2,123 than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Golden Beach - Pelican Waters has a typical household mix, with a lower-than-average median household size

Family households constitute 73.4% of all households, including 22.0% couples with children, 42.2% couples without children, and 8.5% single parent families. Non-family households account for the remaining 26.6%, with lone person households at 23.9% and group households comprising 2.6%. The median household size is 2.3 people, which is smaller than the Rest of Qld average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Golden Beach - Pelican Waters performs slightly above the national average for education, showing competitive qualification levels and steady academic outcomes

Golden Beach's Pelican Waters region has educational qualifications that lag behind Australian averages. Specifically, as of 2021, 20.8% of residents aged 15 and above hold university degrees, compared to the national average of 30.4%. This disparity suggests potential for educational advancement and skill improvement. Among these degree holders in Golden Beach, bachelor degrees are most common at 14.2%, followed by postgraduate qualifications at 4.2% and graduate diplomas at 2.4%.

Vocational credentials are also prevalent, with 39.7% of residents aged 15 and above possessing them. This includes advanced diplomas held by 13.0% of the population and certificates by 26.7%. Notably, 22.3% of the total population is actively engaged in formal education as of 2021. This comprises 7.7% in secondary education, 7.6% in primary education, and 3.3% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Golden Beach - Pelican Waters has 36 active public transport stops. These are mixed bus services. There is 1 route operating, offering a total of 191 weekly passenger trips.

The area's transport accessibility is rated good, with residents typically living 391 meters from the nearest stop. Service frequency averages 27 trips per day across all routes, equating to around 5 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Golden Beach - Pelican Waters is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Golden Beach - Pelican Waters faces significant health challenges, with common conditions prevalent across both younger and older age groups. Only approximately 48% (~6,929 people) have private health cover, compared to 52.7% in the rest of Queensland and a national average of 55.3%. The most frequent medical conditions are arthritis (12.2%) and mental health issues (7.3%).

About 61.1% of residents report no medical ailments, compared to 66.2% in the rest of Queensland. The area has a higher proportion of seniors aged 65 and over at 35.4% (5,104 people), compared to 22.3% in the rest of Queensland. Despite this, health outcomes among seniors are above average and better than those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Golden Beach - Pelican Waters ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Golden Beach-Pelican Waters had a cultural diversity score below average, with 77.9% of its population born in Australia, 88.9% being citizens, and 95.3% speaking English only at home. Christianity was the predominant religion, comprising 59.2%, compared to the regional average of 50.0%. The top three ancestry groups were English (34.7%), Australian (25.3%), and Irish (9.6%).

Notably, Scottish ancestry was overrepresented at 9.4% versus the regional average of 8.8%, as were German (4.9% vs 4.6%) and Welsh (0.7% vs 0.6%).

Frequently Asked Questions - Diversity

Age

Golden Beach - Pelican Waters ranks among the oldest 10% of areas nationwide

Golden Beach - Pelican Waters has a median age of 55, which is considerably higher than the Rest of Qld figure of 41 and substantially exceeds the national norm of 38. Relative to Rest of Qld, Golden Beach - Pelican Waters has a higher concentration of 65-74 residents at 17.8%, but fewer 25-34 year-olds at 6.1%. This 65-74 concentration is well above the national figure of 9.4%. Between the 2021 Census and the present, the 75 to 84 age group has grown from 11.7% to 13.7%, while the 15 to 24 cohort increased from 8.4% to 9.4%. Conversely, the 45 to 54 cohort has declined from 13.9% to 12.2%, and the 65 to 74 group dropped from 19.3% to 17.8%. Looking ahead to 2041, demographic projections reveal significant shifts in Golden Beach - Pelican Waters's age structure. The 85+ group is projected to grow by 127%, reaching 1,272 people from 560. The aging population dynamic is clear, with those aged 65 and above comprising 71% of the projected growth. Conversely, both the 5-14 and 45-54 age groups are expected to see reduced numbers.