Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Coonabarabran has shown very soft population growth performance across periods assessed by AreaSearch

Coonabarabran's population, as of November 2025, is around 8,052. This figure represents an increase of 131 people since the 2021 Census, which recorded a population of 7,921. The growth was inferred from the estimated resident population of 7,956 in June 2024 and an additional 51 validated new addresses since the Census date. This results in a population density ratio of 0.80 persons per square kilometer. Coonabarabran's 1.7% growth since the census places it within 1.7 percentage points of its SA4 region (3.4%), indicating competitive growth fundamentals. Overseas migration was the primary driver of population gains in recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch utilises NSW State Government's SA2 level projections, released in 2022 with a base year of 2021. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. Looking ahead, population projections indicate a decline over this period, with the area's population expected to contract by 774 persons by 2041. However, growth is anticipated in specific age cohorts, notably the 85 and over age group, which is projected to increase by 80 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Coonabarabran is very low in comparison to the average area assessed nationally by AreaSearch

Coonabarabran has recorded approximately six residential properties granted approval each year over the past five financial years, totalling 33 homes. In FY26 so far, seven approvals have been recorded. The population decline during this period suggests that new supply has likely kept pace with demand, providing good choice for buyers. The average expected construction cost value of new properties is $375,000.

Additionally, $3.2 million in commercial development approvals have been recorded this financial year, indicating the area's primarily residential nature. Compared to the Rest of NSW, Coonabarabran shows substantially reduced construction activity (85.0% below regional average per person), which generally supports stronger demand and values for established properties. However, building activity has accelerated in recent years. This limited new supply is also below national averages, reflecting the area's maturity and possible planning constraints. Recent construction comprises 67.0% standalone homes and 33.0% attached dwellings, offering a mix of medium-density options across price brackets. This represents a significant change from the current housing mix (currently 96.0% houses), addressing reduced availability of development sites and shifting lifestyle demands.

The estimated population per dwelling approval is 1060 people, reflecting Coonabarabran's quiet, low activity development environment. With population projections showing stability or decline, the area should see reduced housing demand pressures, benefiting potential buyers in the future.

Frequently Asked Questions - Development

Infrastructure

Coonabarabran has emerging levels of nearby infrastructure activity, ranking in the 33rdth percentile nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 19 projects likely to impact the area. Notable projects include Valley of the Winds Wind Farm, Oxley Highway Improvements at Goolhi, Liverpool Range Wind Farm, and Coolah Multipurpose Service. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

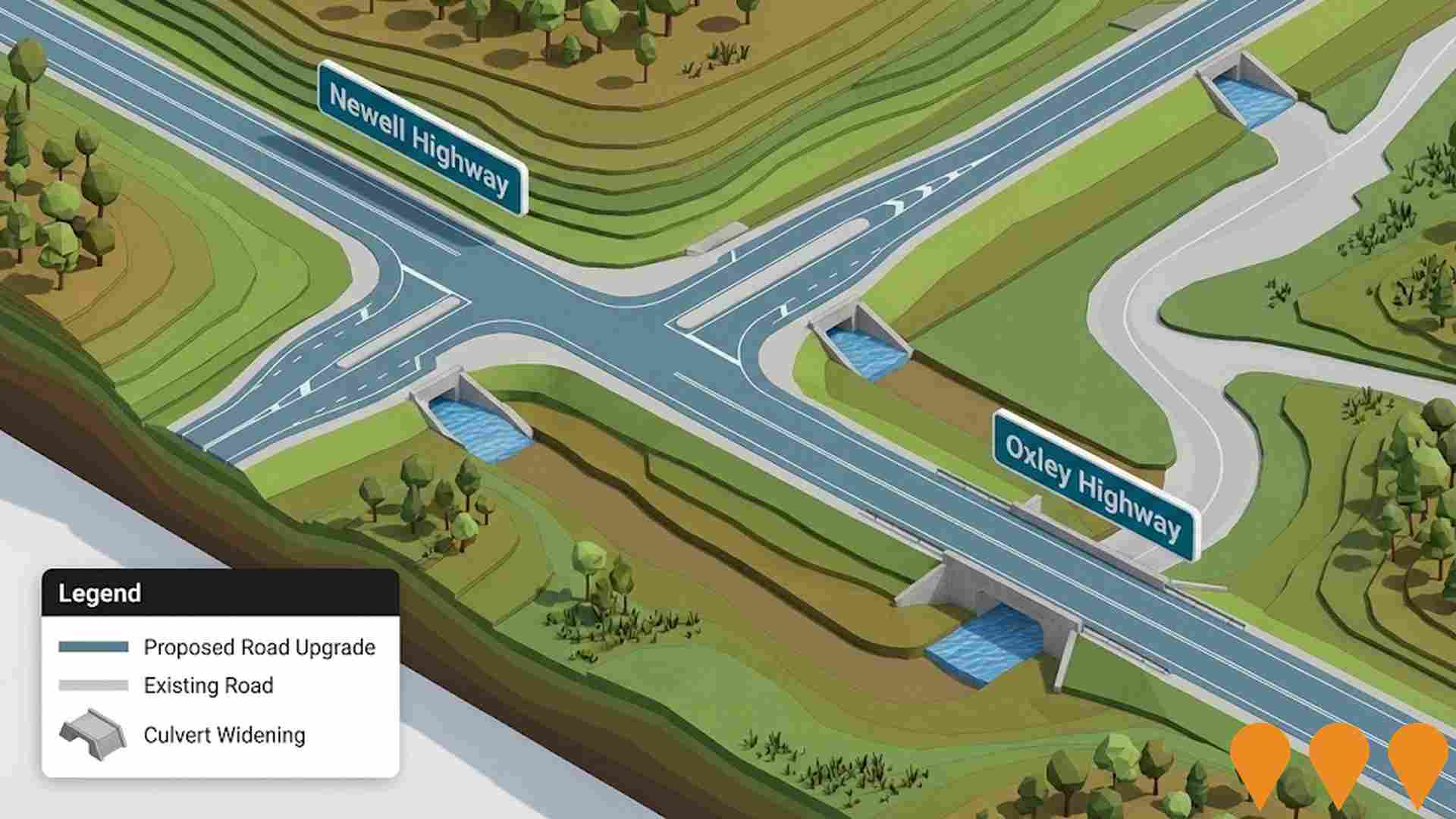

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Central-West Orana REZ Transmission Network

Major transmission infrastructure project involving the design, construction, and operation of new 500kV and 330kV transmission lines to connect the Central-West Orana Renewable Energy Zone (REZ) to the National Electricity Market. The project includes network upgrades and new substations centred around Dubbo, Dunedoo, and Mudgee, connecting to the existing grid near Wollar and Mount Piper.

Dapper Solar Farm

Proposed 300 MW utility-scale solar farm with associated infrastructure in the Warrumbungle Shire, within the Central-West Orana REZ. Origin Energy is the proponent. The project is a State Significant Development and is currently at the 'Prepare EIS' stage per the NSW Planning Portal (SSD-52217961).

Avonside Solar Farm

Proposed 180 MW solar farm with a 400 MW / 400 MWh battery energy storage system (BESS) in the Central West - Orana REZ. The project is a State Significant Development currently in the Prepare EIS stage and includes solar PV arrays, BESS, grid connection and supporting infrastructure.

Inland Rail - Narromine to Narrabri

The Narromine to Narrabri section is the longest segment of the Inland Rail project, comprising approximately 306km of new single-track greenfield rail corridor in north-western New South Wales. It connects the completed Parkes to Narromine section with the Narrabri to North Star section (under construction). Designed for 1,800m double-stacked freight trains, key features include seven crossing loops (up to 2.2km long), 75 new bridges and viaducts, 49 new public level crossings, millions of cubic metres of earthworks, thousands of concrete culvert drains, road realignments, and utility relocations. The project received NSW Government approval in February 2023 and Australian Government EPBC approval in January 2024. As of November 2025, the project remains in planning and preparation with ongoing field investigations (geotechnical, biodiversity, cultural heritage), design refinement, and landowner consultations; construction has not yet commenced.

Oxley Highway Improvements at Goolhi

Upgrades to a six-kilometre stretch of the Oxley Highway at Goolhi, including widening the road, widening nine culverts for improved drainage, installing safety barriers, and resealing the section of road to provide smoother and safer journeys.

Valley of the Winds Wind Farm

Approximately 900-megawatt wind project with up to 131 wind turbines and a 320MW/640MWh battery. Approved June 2025 by NSW IPC. Will power approximately 500,000 average Australian homes. Expected to create around 500 jobs during peak construction. Includes a proposed temporary workforce accommodation facility.

Liverpool Range Wind Farm

Up to 185 turbines, 1,332 MW capacity. Will reduce carbon footprint by approximately 2.5 million tonnes and supply power for up to 570,000 dwellings. Modification for taller turbines approved October 2024. Federal approval March 2025.

Coolah Multipurpose Service

Provides improved access to health and aged care services in rural and remote communities. Part of the NSW Government's $300 million Multipurpose Service (MPS) Program.

Employment

AreaSearch analysis reveals Coonabarabran recording weaker employment conditions than most comparable areas nationwide

Coonabarabran's workforce is balanced across white and blue-collar jobs. Essential services sectors are well-represented, with an unemployment rate of 4.1% as of September 2025.

There are 3,215 residents employed, which is 0.3% higher than the Rest of NSW's rate of 3.8%. Workforce participation in Coonabarabran lags at 47.0%, compared to the Rest of NSW's 56.4%. Leading industries for residents include agriculture, forestry & fishing, health care & social assistance, and education & training. Agriculture, forestry & fishing is particularly specialized, with an employment share 5.2 times higher than the regional level.

However, construction has a limited presence at 5.5%, compared to the regional average of 9.7%. The area may have limited local employment opportunities, as indicated by the difference between Census working population and resident population. Between August 2024 and September 2025, labour force decreased by 4.1% alongside a 5.1% employment decline, resulting in an unemployment rate rise of 1.0 percentage points. In contrast, Rest of NSW saw employment fall by 0.5%, labour force contract by 0.1%, and unemployment rise by 0.4 percentage points. State-level data from 25-Nov-25 shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. Nationally, the unemployment rate is 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% expansion over five years and 13.7% over ten years. Applying these projections to Coonabarabran's employment mix suggests local employment should increase by 5.3% over five years and 11.8% over ten years, assuming constant population projections.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

The Coonabarabran SA2 had an income level below the national average in financial year 2022, according to ATO data aggregated by AreaSearch. The median income among taxpayers was $40,487 and the average income stood at $49,761. These figures compared to Rest of NSW's median income of $49,459 and average income of $62,998 respectively. By September 2025, estimates based on a 12.61% Wage Price Index growth suggest the median income would be approximately $45,592 and the average income around $56,036. Census data indicated that household, family, and personal incomes in Coonabarabran all fell between the 6th and 7th percentiles nationally. The $400 - $799 income bracket dominated with 28.6% of residents (2,302 people), unlike other regional patterns where the $1,500 - $2,999 bracket dominated at 29.9%. Housing costs were modest, with 91.2% of income retained, but total disposable income ranked at just the 12th percentile nationally.

Frequently Asked Questions - Income

Housing

Coonabarabran is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Coonabarabran's dwelling structure, as per the latest Census, consisted of 96.0% houses and 4.0% other dwellings (semi-detached, apartments, 'other' dwellings). This compares to Non-Metro NSW's 88.0% houses and 12.1% other dwellings. Home ownership in Coonabarabran stood at 52.7%, with mortgaged dwellings at 25.2% and rented ones at 22.1%. The median monthly mortgage repayment was $871, lower than Non-Metro NSW's average of $1,450. The median weekly rent in Coonabarabran was recorded at $200, compared to Non-Metro NSW's $280. Nationally, Coonabarabran's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Coonabarabran features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 65.0% of all households, including 21.9% couples with children, 31.0% couples without children, and 10.8% single parent families. Non-family households account for the remaining 35.0%, with lone person households at 32.6% and group households comprising 2.5%. The median household size is 2.3 people, smaller than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Coonabarabran faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 15.3%, significantly lower than the NSW average of 32.2%. Bachelor degrees are the most common at 11.2%, followed by postgraduate qualifications (2.3%) and graduate diplomas (1.8%). Vocational credentials are held by 41.1% of residents aged 15+, including advanced diplomas (9.8%) and certificates (31.3%). Educational participation is high, with 32.2% currently enrolled in formal education.

This includes primary education (11.9%), secondary education (11.1%), and tertiary education (2.4%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Coonabarabran indicates there are 471 active transport stops currently operating. These stops offer a mix of train and bus services. There are 41 individual routes serving these stops, collectively providing 338 weekly passenger trips.

The accessibility of transport is rated as good, with residents typically located 204 meters from the nearest stop. On average, there are 48 trips per day across all routes, which equates to approximately zero weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Coonabarabran is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Coonabarabran faces significant health challenges with various conditions affecting both younger and older age groups. As of 2021, approximately 46% (~3711 people) have private health cover, compared to Rest of NSW's 49.7%. Nationally, this figure stands at 55.3%.

Common medical conditions include arthritis (12.6%) and asthma (8.9%), while 59.6% report no medical ailments, compared to Rest of NSW's 64.1%. The area has a higher proportion of seniors aged 65 and over (28.7%, or 2310 people), compared to Rest of NSW's 19.5%. Despite this, health outcomes among seniors are challenging but generally better than the general population in terms of health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Coonabarabran placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Coonabarabran, surveyed in 2016, had a predominantly homogeneous population: 84.0% were Australian citizens, 93.1% born in Australia, and 97.2% spoke English only at home. Christianity was the dominant religion, practiced by 67.0%, slightly higher than the Rest of NSW average of 65.6%. The top three ancestry groups were Australian (33.3%), English (32.6%), and Australian Aboriginal (8.3%).

Notably, Maltese (0.4% vs regional 0.2%) and Macedonian (0.1% vs regional 0.0%) were overrepresented, while Irish (7.8% vs regional 8.2%) were slightly underrepresented.

Frequently Asked Questions - Diversity

Age

Coonabarabran ranks among the oldest 10% of areas nationwide

Coonabarabran has a median age of 50, which is higher than the Rest of NSW figure of 43 and above the national average of 38. The 65-74 age group makes up 15.1% of Coonabarabran's population, compared to Rest of NSW's percentage and well above the national average of 9.4%. Meanwhile, the 25-34 cohort is less prevalent at 8.5%. According to the 2021 Census, the 35 to 44 age group has increased from 8.9% to 9.9%, while the 45 to 54 cohort has decreased from 12.0% to 11.1%. By 2041, demographic modeling suggests significant changes in Coonabarabran's age profile. The 85+ age group is projected to grow by 86 people (28%), from 302 to 389. Notably, the combined 65+ age groups will account for all population growth, reflecting the area's aging demographic trend. Conversely, population declines are projected for the 35 to 44 and 0 to 4 age cohorts.