Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Auburn - South has seen population growth performance typically on par with national averages when looking at short and medium term trends

Auburn - South's population was approximately 9,342 as of November 2025. This figure represents an increase of 482 people since the 2021 Census, which reported a population of 8,860. The growth is inferred from ABS estimates: 9,345 in June 2024 and 71 new addresses validated since the Census date. This results in a population density of 3,844 persons per square kilometer, placing Auburn - South among the top 10% of national locations assessed by AreaSearch. The area's 5.4% growth since the census is close to the state average of 6.7%. Overseas migration contributed approximately 75.7% of recent population gains.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, NSW State Government's SA2 level projections released in 2022 with a base year of 2021 are used. Growth rates by age group from these aggregations are applied to all areas for years 2032 to 2041. By 2041, Auburn - South is projected to increase by approximately 952 persons, reflecting a total increase of 10.1% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Auburn - South according to AreaSearch's national comparison of local real estate markets

Auburn - South has seen approximately 39 new homes approved annually. Over the past five financial years, from FY-21 to FY-25, around 197 homes were approved, with an additional 16 approved so far in FY-26. On average, over these five years, about 0.2 new residents arrived per year for each new home, indicating that new supply is meeting or exceeding demand, providing ample buyer choice and capacity for population growth beyond current forecasts.

The average construction cost of new homes was around $276,000 during this period, reflecting more affordable housing options compared to regional norms. In FY-26, approximately $37.6 million in commercial approvals have been registered, suggesting strong local business investment. Compared to Greater Sydney, Auburn - South shows significantly reduced construction levels, with 54.0% below the regional average per person. This constrained new construction typically reinforces demand and pricing for existing dwellings. The recent construction in Auburn - South comprises approximately 52.0% detached houses and 48.0% townhouses or apartments, demonstrating an increasing blend of attached housing types that offer choices across various price ranges, from spacious family homes to more compact and accessible options.

This represents a notable shift from the current housing mix, which is currently around 73.0% houses, reflecting reduced availability of development sites and addressing changing lifestyle demands and affordability requirements. The location has approximately 261 people per dwelling approval, indicating a low-density market. According to the latest AreaSearch quarterly estimate, Auburn - South is projected to add around 940 residents by 2041. With current construction levels, housing supply should adequately meet demand, creating favorable conditions for buyers while potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Auburn - South has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 7 projects likely impacting the area. Notable ones include Aura by Crown Group, Berala Village Redevelopment, Berala TOD Precinct, and Pippita Rail Trail Lidcombe to Olympic Park. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

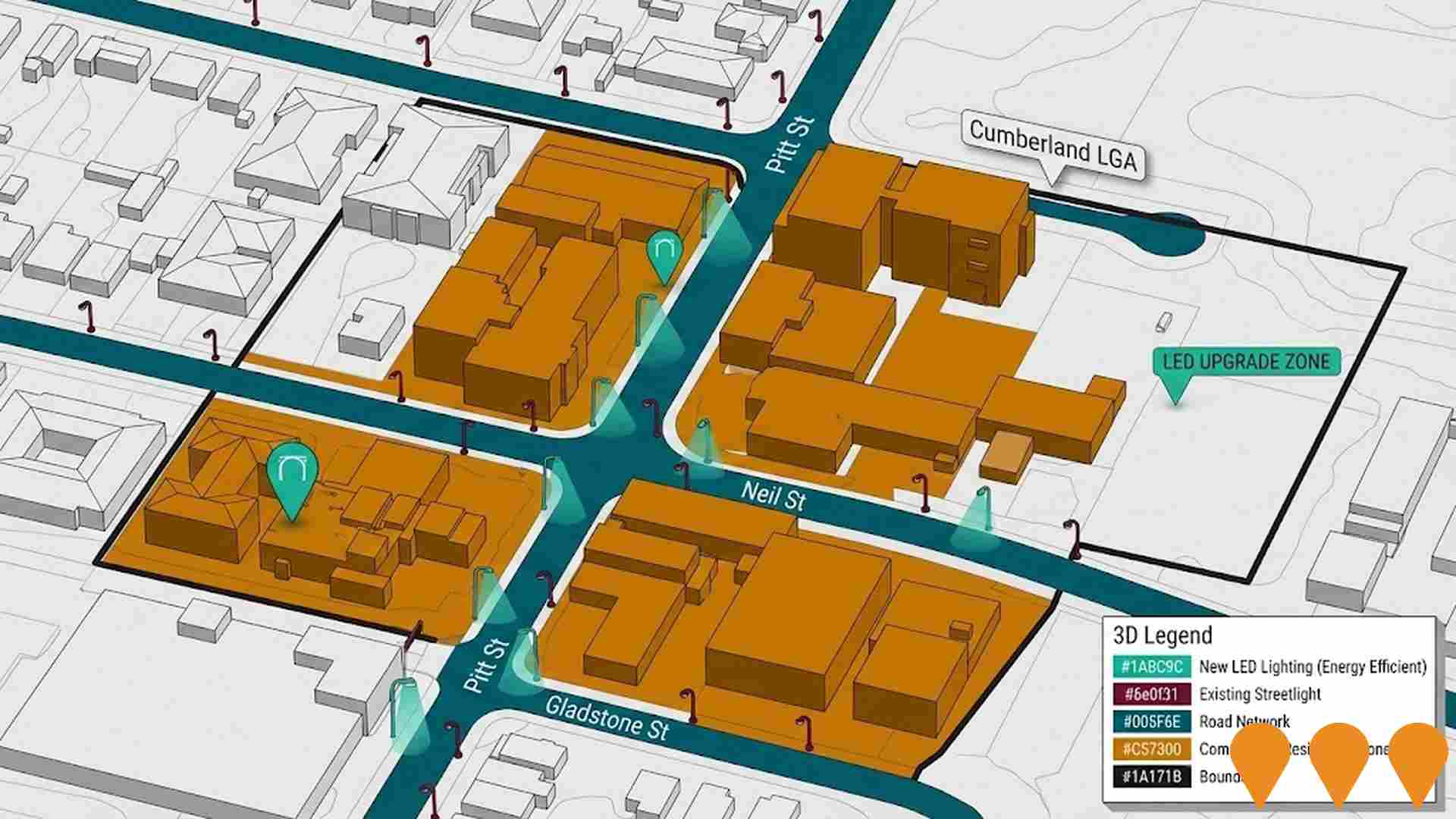

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Sydney Metro West - Westmead to The Bays

Sydney Metro West is a new 24km underground railway connecting Greater Parramatta and Sydney CBD with stations at Westmead, Parramatta, Sydney Olympic Park, North Strathfield, Burwood North, Five Dock, The Bays and Pyrmont (plus integration with the existing metro at Martin Place). Tunnelling is complete, station excavation and major construction is underway at all sites. The project remains on track for opening in 2032.

Lidcombe Wellbeing and Accommodation Precinct

State-of-the-art wellbeing centre and accommodation precinct providing comprehensive neurological health services for people with MS, Parkinson's, stroke, MND, muscular dystrophy, epilepsy, and dementia. Features 8 therapy areas, purpose-built gym, multipurpose spaces, sensory garden, cafe areas, and 20 fully furnished apartments for supported accommodation. Officially opened March 2025.

Berala Village Redevelopment

Long term urban renewal of the Berala village centre focused on new and upgraded public domain, a future town square, improved pedestrian links around Berala Station and Woodburn Road, and planning controls that enable higher density mixed use redevelopment with capacity for up to around 650 new apartments and supporting retail and commercial space.

Chester Square Redevelopment

Mixed-use urban renewal of Chester Square shopping centre by Holdmark Property Group. Planning proposal seeks amendment to Canterbury-Bankstown LEP to enable up to 515 dwellings across six buildings with heights up to 60m (18 storeys) and FSR of 4:1. Development includes approximately 12,400sqm of retail space, 8,300sqm of employment space, a new public plaza of about 2,800sqm and at least 2,000sqm of indoor community space. Mandates 5% affordable housing requirement. Urban design by SJB Architects and Turner. Planning proposal exhibited in mid-2025 and currently post-exhibition under assessment.

Transport Oriented Development Program - Lidcombe

NSW Government Transport Oriented Development (TOD) Program precinct at Lidcombe. Rezoning effective 13 May 2024 (400m radius) and expanded 22 August 2025 (400-1200m radius) to permit buildings up to 24m (6-8 storeys) close to the station and 18m further out. The program enables higher-density apartments and shop-top housing around Lidcombe railway station with a mandatory 2% affordable housing contribution on larger sites. Multiple private developments are now lodging DAs under the new controls.

Berala TOD Precinct (Transport Oriented Development)

State-led rezoning of land within walking distance of Berala Station under the NSW Transport Oriented Development Program. New TOD SEPP planning controls have been finalised with Cumberland City Council, enabling mid-rise apartment buildings and shop-top housing with increased building heights and densities and mandatory affordable housing for larger projects. The Berala precinct is expected to deliver more than 9,200 new homes over the next 15 years close to rail, shops and essential services.

Cumberland LED Street Lighting Program

Large-scale LED street lighting upgrade program across Cumberland LGA, improving energy efficiency and reducing maintenance costs. Part of the Light Years Ahead project coordinated by WSROC and Ausgrid's LED rollout.

Abel Tasman Village Seniors Housing

State Significant Development concept and Stage 1 for redevelopment of the existing aged care site into five buildings, including 55 independent living units and a 106-bed residential care facility with supporting amenities such as dementia garden, retail, parking and communal spaces.

Employment

Employment drivers in Auburn - South are experiencing difficulties, placing it among the bottom 20% of areas assessed across Australia

Auburn - South has a skilled workforce with diverse sector representation. Its unemployment rate was 9.4% in the past year, with an estimated employment growth of 1.6%.

As of September 2025, 3,649 residents are employed, while the unemployment rate is 5.2%, above Greater Sydney's rate of 4.2%. Workforce participation lags significantly at 41.4% compared to Greater Sydney's 60.0%. Key industries include health care & social assistance, retail trade, and construction. Transport, postal & warehousing has notable concentration with employment levels at 1.7 times the regional average.

Professional & technical services have limited presence at 7.1%, compared to the regional average of 11.5%. Employment opportunities locally appear limited as indicated by Census data. Over the year to September 2025, employment increased by 1.6% while labour force grew by 3.3%, resulting in a 1.5 percentage point rise in unemployment. In comparison, Greater Sydney saw employment grow by 2.1%. State-level data to 25-Nov-25 shows NSW employment contracted by 0.03%, with an unemployment rate of 3.9%. National forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.4% over ten years, with local projections based on industry-specific growth rates.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

Auburn - South SA2's median income among taxpayers in financial year 2022 was $30,664. The average income stood at $37,842. This is lower than Greater Sydney's figures of $56,994 and $80,856 respectively. Based on Wage Price Index growth of 12.61% since financial year 2022, current estimates for Auburn - South SA2 would be approximately $34,531 (median) and $42,614 (average) as of September 2025. Census data shows individual incomes lag at the 3rd percentile ($496 weekly), while household income performs better at the 36th percentile. Income analysis reveals that 30.0% of residents fall within the $1,500 - 2,999 income bracket (2,802 people). This is similar to regional levels where 30.9% occupy this range. Housing affordability pressures are severe in Auburn - South SA2, with only 78.8% of income remaining, ranking at the 30th percentile.

Frequently Asked Questions - Income

Housing

Auburn - South is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Dwelling structure in Auburn-South, as per the latest Census, consisted of 72.8% houses and 27.1% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Sydney metro had 33.5% houses and 66.5% other dwellings. Home ownership in Auburn-South was 30.7%, with the rest being mortgaged (32.4%) or rented (36.8%). The median monthly mortgage repayment was $2,167, aligning with Sydney metro's average. Median weekly rent was $435, compared to Sydney metro's $2,167 and $470 respectively. Nationally, Auburn-South's mortgage repayments were higher at $2,167 than the Australian average of $1,863, while rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Auburn - South features high concentrations of family households and group households, with a higher-than-average median household size

Family households account for 80.2% of all households, including 48.9% couples with children, 16.9% couples without children, and 12.7% single parent families. Non-family households constitute the remaining 19.8%, with lone person households at 15.5% and group households comprising 4.4%. The median household size is 3.5 people, which is larger than the Greater Sydney average of 2.8.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Auburn - South fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 25.6%, significantly lower than the SA3 average of 39.9%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 18.1%, followed by postgraduate qualifications (6.3%) and graduate diplomas (1.2%). Vocational pathways account for 22.6% of qualifications among those aged 15 and above, with advanced diplomas at 10.0% and certificates at 12.6%.

Educational participation is high, with 35.9% of residents currently enrolled in formal education. This includes 12.2% in primary education, 9.0% in secondary education, and 7.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in Auburn - South shows that there are currently 49 active transport stops operating within the area. These stops serve a mix of bus routes, with 21 individual routes providing service to them collectively. This results in 594 weekly passenger trips being made through these stops.

The accessibility of transport in the region is rated as excellent, with residents typically located just 119 meters away from their nearest transport stop. On average, there are 84 trips per day across all routes, which equates to approximately 12 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Auburn - South's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Health outcomes data shows impressive results in Auburn-South, with younger cohorts experiencing notably low prevalence of common health conditions. As of approximately mid-2021, around 45% (~4,203 people) have private health cover, compared to Greater Sydney's 48.5%. Nationally, the average is 55.3%.

Diabetes and arthritis were the most prevalent medical conditions, affecting 5.6% and 5.2% of residents respectively, as of late 2021. About 79.3% declared no medical ailments, compared to Greater Sydney's 83.5%. As of recent data, 13.0% (1,209 people) are aged 65 and over, higher than Greater Sydney's 11.1%. Health outcomes among seniors require more attention despite being above average.

Frequently Asked Questions - Health

Cultural Diversity

Auburn - South is among the most culturally diverse areas in the country based on AreaSearch assessment of a range of language and cultural background related metrics

Auburn-South is among the most culturally diverse areas in Australia, with 55.5% of its population born overseas and 80.2% speaking a language other than English at home. The dominant religion in Auburn-South is Islam, comprising 47.7% of people, compared to 23.4% across Greater Sydney. In terms of ancestry, the top three represented groups are Other (34.4%), Chinese (23.0%), and Lebanese (11.4%), which is substantially higher than the regional average of 4.1%.

Notably, Vietnamese (2.7%) and Korean (1.4%) groups are overrepresented in Auburn-South compared to regional averages of 2.6% and 7.7%, respectively.

Frequently Asked Questions - Diversity

Age

Auburn - South's young demographic places it in the bottom 15% of areas nationwide

Auburn - South has a median age of 33, which is younger than Greater Sydney's figure of 37 and Australia's national average of 38 years. Compared to Greater Sydney, Auburn - South has a higher proportion of residents aged 5-14 (14.4%) but fewer residents aged 45-54 (10.6%). Between the 2021 Census and now, the population share of those aged 15-24 has increased from 14.0% to 15.3%, while the share of those aged 35-44 has risen from 12.5% to 13.6%. Conversely, the share of those aged 55-64 has decreased from 11.7% to 10.3%. By 2041, population forecasts indicate significant demographic changes for Auburn - South. The 75-84 age cohort is projected to grow by 99%, adding 332 residents to reach a total of 670. This growth contributes to the overall demographic aging trend, with residents aged 65 and older representing 60% of anticipated population growth. Meanwhile, the 25-34 and 5-14 age cohorts are expected to experience population declines.