Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Red Hill has shown very soft population growth performance across periods assessed by AreaSearch

Red Hill's population was 3,553 as of November 2025. This figure reflects an increase of 407 people (12.9%) since the 2021 Census, which reported a population of 3,146 people. The change is inferred from the estimated resident population of 3,542 in June 2024 and an additional 144 validated new addresses since the Census date. This level of population results in a density ratio of 731 persons per square kilometer, which aligns with averages seen across locations assessed by AreaSearch. Red Hill's growth of 12.9% since the 2021 census exceeded the state's (5.9%), positioning it as a growth leader in the region. Interstate migration contributed approximately 63.1% of overall population gains during recent periods, driving primary growth for the area.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered by this data and years post-2032, age group growth rates from the ACT Government's SA2 area projections are adopted, using 2022 as a base. Future population dynamics anticipate an increase just below the median of statistical areas across the nation, with Red Hill expected to expand by 308 persons to reach 2041 based on the latest annual ERP population numbers, reflecting an overall increase of 8.3% over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Red Hill according to AreaSearch's national comparison of local real estate markets

Red Hill has seen approximately 78 dwellings granted development approval annually. Over the past five financial years, from FY21 to FY25, a total of 392 homes were approved, with one additional approval in FY26 so far. On average, 0.8 people have moved to the area each year for every dwelling built during these years.

This suggests that supply is meeting or exceeding demand, offering more buyer choices while supporting potential population growth beyond projections. The average construction cost of new properties has been $344,000, indicating a focus on the premium segment with upmarket properties. In FY26, $22.0 million in commercial approvals have been registered, demonstrating steady commercial investment activity in the area. Compared to the Australian Capital Territory, Red Hill records 174.0% more building activity per person, providing ample buyer choice. However, development activity has moderated recently. This high level of activity is significantly above the national average, indicating robust developer interest in Red Hill. New development consists of 27.0% standalone homes and 73.0% townhouses or apartments.

This shift towards denser development offers accessible entry options, appealing to downsizers, investors, and entry-level buyers. This marks a significant change from the current housing pattern, which is predominantly houses (79.0%). The estimated population density in Red Hill is 524 people per dwelling approval, reflecting its quiet, low activity development environment. Future projections estimate that Red Hill will add 296 residents by 2041, according to the latest AreaSearch quarterly estimate. At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Red Hill has emerging levels of nearby infrastructure activity, ranking in the 39thth percentile nationally

Infrastructure changes significantly influence an area's performance. AreaSearch identified nine projects likely impacting the area. Notable ones are Griffith-Narrabundah Community Centre & Oval Upgrade, Yarra Rossa, The Parks, Red Hill, and Canberra Hospital Master Plan. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

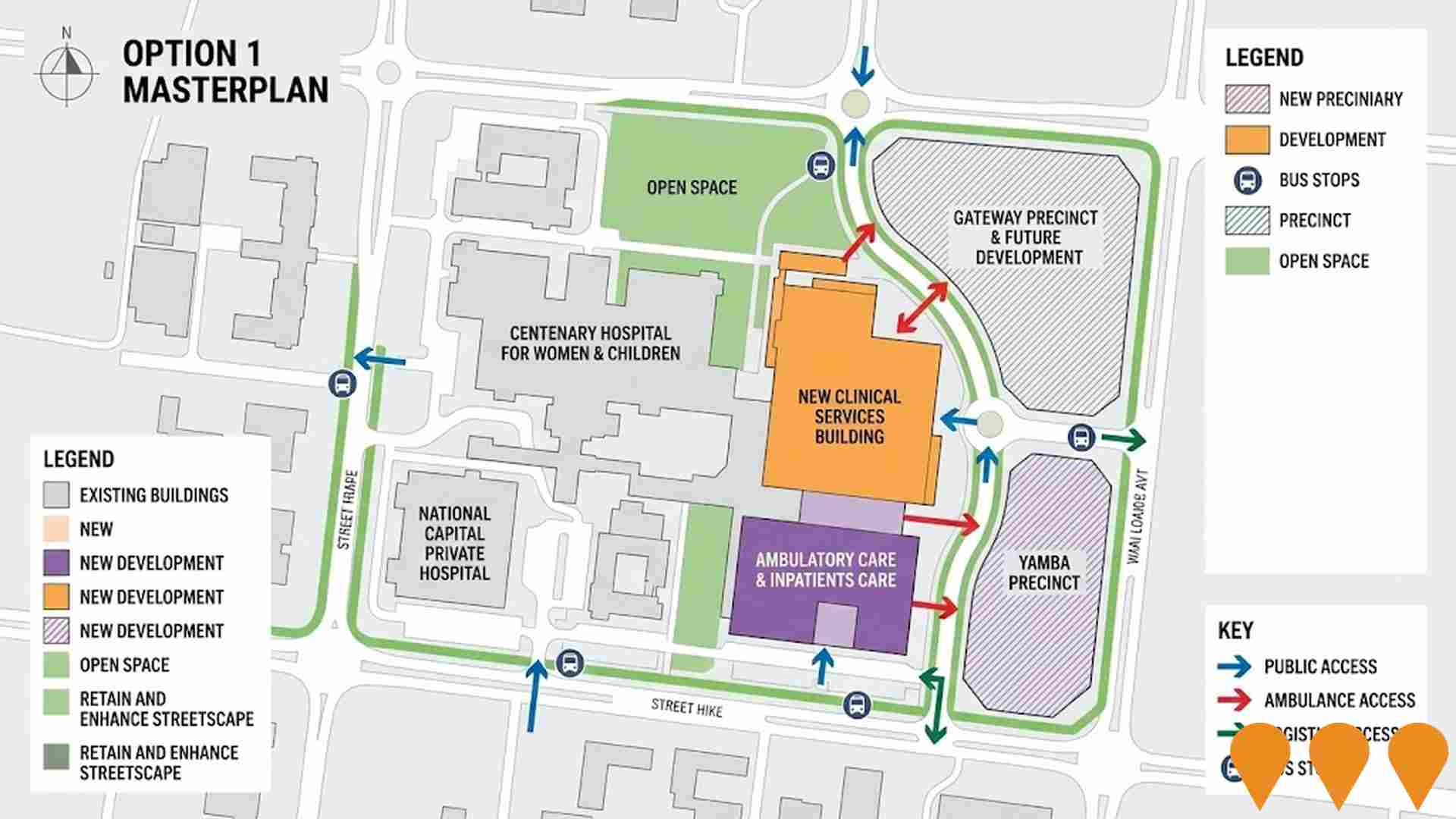

Canberra Hospital Master Plan

Long-term transformation of Canberra Hospital campus (2021-2041). The new Critical Services Building (Building 5) opened in 2023. Multiple stages are now in construction or detailed planning, including SPIRE Stage 1 (new emergency, surgical and intensive care facilities) and ongoing campus renewal works to deliver modern clinical facilities.

Kingston Foreshore Precinct

Award-winning mixed-use waterfront precinct featuring premium apartments, restaurants, bars, retail, public art and parklands along the southern shore of Lake Burley Griffin.

Canberra Hospital Critical Services Building (SPIRE Centre)

Australia's first fully-electric hospital building, the Canberra Hospital Critical Services Building (also known as SPIRE Centre), is an eight-storey, 45,000 square metre facility. It includes a new Emergency Department with 128 treatment spaces, a 48-bed Intensive Care Unit with two outdoor terraces, 22 operating theatres, 148 inpatient beds, cardiac catheter laboratories, and enhanced radiology and pathology services. The largest healthcare infrastructure project in ACT history, it was built by Multiplex with a 5 Star Green Star design rating, featuring innovative sustainability measures. Completed and opened August 2024.

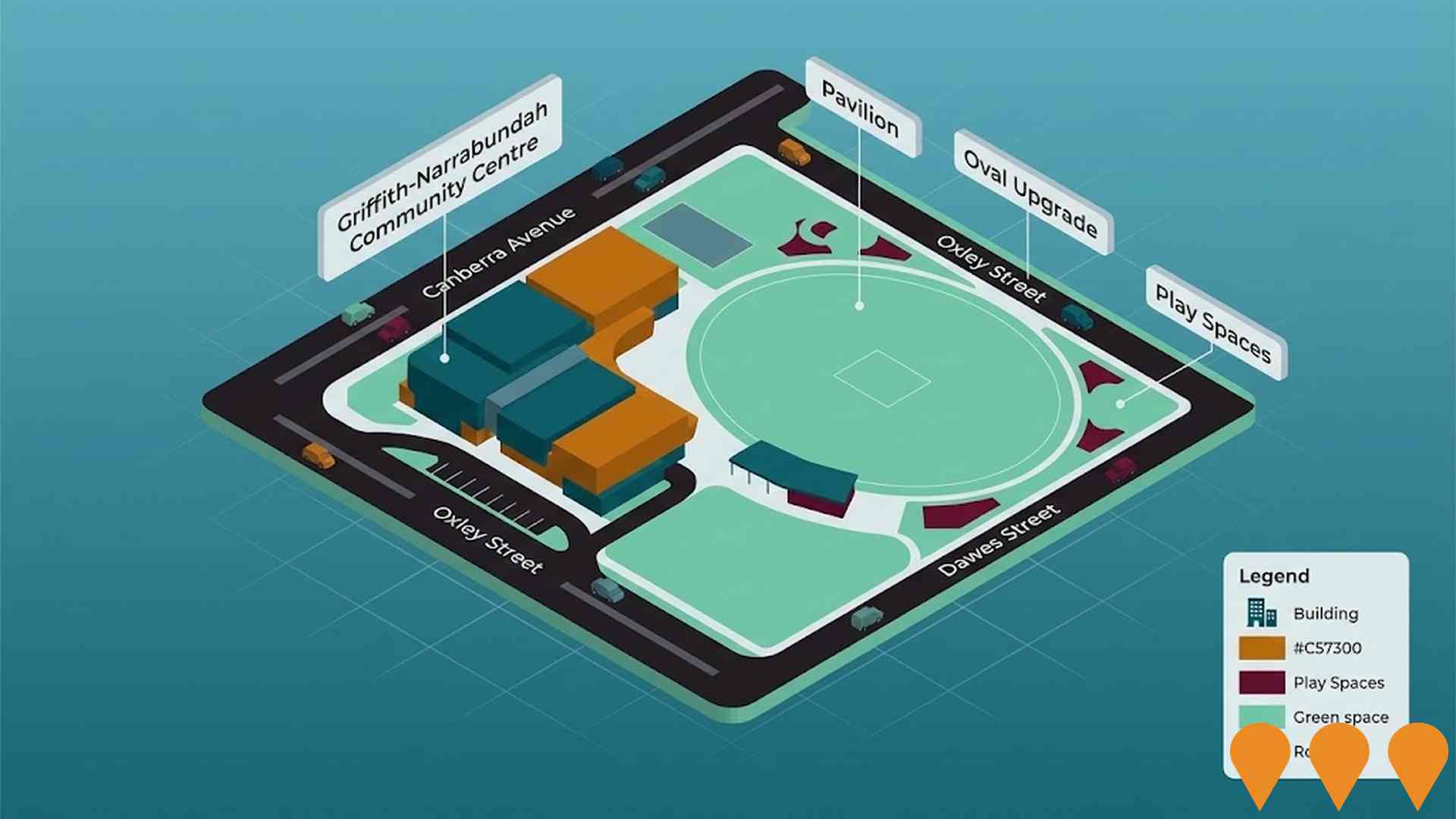

Griffith-Narrabundah Community Centre & Oval Upgrade

New multi-purpose community centre and upgrades to Griffith Oval including new pavilion, play spaces and improved amenities serving both Griffith and Narrabundah residents.

Draft Inner South District Strategy

A strategic planning framework by the ACT Government to guide the future development of the Inner South district, including Deakin. The strategy proposes to manage growth and change, potentially allowing for increased housing density, particularly in West Deakin and along the new light rail corridor. It aims to protect the valued characteristics of the district while accommodating future population growth.

The Embassy Residences

A residential development of 53 high-end apartments, primarily with three and four bedrooms, and three ground-floor commercial units for a day spa, club lounge, and art gallery. The project is aimed at downsizers and retirees and is located on the former Margaret Dimoff Art Gallery site. The development includes two basement levels with 134 car parking spaces.

Narrabundah Long Stay Caravan Park Redevelopment

Major redevelopment of the former Narrabundah Long Stay Caravan Park into a contemporary residential community featuring 120 new homes including townhouses and apartments, completed in 2023.

Deakin District Playing Fields Upgrade

Upgrades to the Deakin District Playing Fields, including the installation of new LED sportsground floodlighting to allow for night games.

Employment

Employment conditions in Red Hill rank among the top 10% of areas assessed nationally

Red Hill's workforce is highly educated with strong representation in professional services. The unemployment rate was 1.4% as of September 2025, lower than the Australian Capital Territory's (ACT) rate of 3.6%.

Employment growth over the past year was estimated at 2.0%. There were 1,980 residents employed while the unemployment rate was 2.2% below ACT's rate. Workforce participation in Red Hill was 65.9%, compared to ACT's 69.6%. Leading employment industries among residents include public administration & safety, professional & technical services, and health care & social assistance.

The area has a significant specialization in professional & technical services, with an employment share of 1.5 times the regional level. However, public administration & safety is under-represented, at 26.6% compared to ACT's 30.4%. Many residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, employment levels increased by 2.0%, labour force grew by 1.5%, causing the unemployment rate to fall by 0.4 percentage points. In contrast, ACT saw employment rise by 1.4% and unemployment fall by 0.2 percentage points. State-level data from November 25 shows ACT employment grew by 1.19% year-on-year, with an unemployment rate of 4.5%, compared to the national rate of 4.3%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Red Hill's employment mix suggests local employment should increase by 7.1% over five years and 14.3% over ten years, based on simple weighting extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch reports that based on postcode level ATO data for financial year 2022, Red Hill SA2 had a median taxpayer income of $79,758 and an average income of $129,618. Nationally, these figures place Red Hill in the top percentile. In comparison, the Australian Capital Territory's median and average incomes were $68,678 and $83,634 respectively. By September 2025, considering a 13.6% Wage Price Index growth since financial year 2022, estimated median and average incomes for Red Hill would be approximately $90,605 and $147,246 respectively. According to Census 2021 income data, household, family, and personal incomes in Red Hill rank highly nationally, between the 97th and 99th percentiles. Income distribution shows that 50.2% of individuals earn above $4,000 weekly, differing from metropolitan patterns where the $1,500 - $2,999 band dominates at 34.3%. Notably, 60.8% of residents earn above $3,000 weekly. After housing costs, residents retain 89.5% of their income, indicating strong purchasing power. The area's SEIFA income ranking places it in the 10th decile.

Frequently Asked Questions - Income

Housing

Red Hill is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Red Hill's dwelling structure, as per the latest Census, consisted of 79.3% houses and 20.7% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Australian Capital Territory had 40.7% houses and 59.3% other dwellings. Home ownership in Red Hill was at 40.3%, with mortgaged dwellings at 36.8% and rented ones at 22.9%. The median monthly mortgage repayment in the area was $3,500, higher than Australian Capital Territory's average of $2,275. Median weekly rent in Red Hill was recorded at $500, matching Australian Capital Territory's figure but significantly higher than the national average of $375. Nationally, Red Hill's mortgage repayments were considerably higher than the Australian average of $1,863.

Frequently Asked Questions - Housing

Household Composition

Red Hill features high concentrations of group households and family households, with a higher-than-average median household size

Family households constitute 77.5% of all households, including 43.0% couples with children, 25.1% couples without children, and 8.0% single parent families. Non-family households account for the remaining 22.5%, with lone person households at 19.3% and group households comprising 4.0% of the total. The median household size is 2.8 people, which is larger than the Australian Capital Territory average of 2.2.

Frequently Asked Questions - Households

Local Schools & Education

Red Hill demonstrates exceptional educational outcomes, ranking among the top 5% of areas nationally based on AreaSearch's comprehensive analysis of qualification and performance metrics

Red Hill's educational attainment exceeds broader standards significantly. Among residents aged 15+, 59.1% possess university qualifications, compared to Australia's 30.4% and the SA4 region's 46.8%. This notable advantage positions Red Hill favourably for knowledge-based opportunities. Bachelor degrees are most prevalent at 32.8%, followed by postgraduate qualifications (20.5%) and graduate diplomas (5.8%).

Technical qualifications comprise 14.0% of educational achievements, with advanced diplomas at 7.1% and certificates at 6.9%. Educational participation is notably high in Red Hill, with 36.4% of residents currently enrolled in formal education. This includes 13.4% in secondary education, 10.7% in primary education, and 7.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Red Hill has 23 active public transport stops, all of which are bus stops. These stops are served by 17 different routes that together facilitate 729 weekly passenger trips. The accessibility of these services is considered good, with residents on average living just 230 meters from the nearest stop.

On a daily basis, there are an average of 104 trips across all routes, which equates to approximately 31 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in Red Hill is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

Red Hill demonstrates above-average health outcomes for both young and old age cohorts, with low prevalence of common health conditions. The rate of private health cover is exceptionally high at approximately 81% of the total population (2,885 people), compared to 78.0% across Australian Capital Territory, and 55.3% nationally. The most common medical conditions in the area are arthritis and asthma, impacting 8.2 and 7.0% of residents respectively, while 72.2% declared themselves completely clear of medical ailments compared to 69.8% across Australian Capital Territory.

As of 2021, 20.5% of residents are aged 65 and over (726 people). Health outcomes among seniors in Red Hill are above average, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Red Hill was found to be above average when compared nationally for a number of language and cultural background related metrics

Red Hill's population shows high cultural diversity, with 29.6% born overseas and 24.0% speaking a language other than English at home. Christianity is the dominant religion in Red Hill, comprising 48.0%. Judaism is overrepresented compared to the Australian Capital Territory, making up 0.4% of the population.

The top three ancestry groups are English (24.1%), Australian (20.7%), and Other (11.5%). Notable divergences exist in French (0.9% vs regional 0.9%), Croatian (1.1% vs 0.9%), and Macedonian (0.6% vs 0.3%) ethnic groups.

Frequently Asked Questions - Diversity

Age

Red Hill's median age exceeds the national pattern

Red Hill's median age is 42, which is higher than the Australian Capital Territory figure of 35 and Australia's median age of 38. Compared to the ACT average, Red Hill has an over-representation of the 55-64 cohort (13.6%) and an under-representation of the 25-34 age group (8.3%). Between 2021 and present, the 75-84 age group grew from 4.8% to 7.3%, while the 5-14 cohort declined from 15.2% to 13.9%. By 2041, demographic modeling suggests significant changes in Red Hill's age profile. The 65-74 age cohort is projected to expand by 99 people (30%), from 326 to 426. Conversely, both the 35-44 and 0-4 age groups are expected to decrease in number.