Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Woodend lies within the top quartile of areas nationally for population growth performance according to AreaSearch analysis of recent, and medium to long-term trends

Woodend's population is 8,061 as of November 2025. This is an increase from the 7,949 reported in the 2021 Census, reflecting a growth of 112 people (1.4%). The estimated resident population was 8,035 in June 2024, with an additional 66 validated new addresses since the Census date contributing to this increase. This results in a population density ratio of 38 persons per square kilometer. Over the past decade, Woodend has shown resilient growth patterns with a compound annual growth rate of 1.6%, outperforming its SA4 region. Interstate migration drove much of this growth, contributing approximately 53.5% of overall population gains in recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, AreaSearch employs the VIC State Government's Regional/LGA projections from 2023, using weighted aggregation methods to adjust population growth from LGA to SA2 levels. Growth rates by age group are applied across all areas for years 2032 to 2041. Future trends indicate a significant population increase in the top quartile of national regional areas, with Woodend expected to expand by 2,874 persons to 2041 based on the latest annual ERP population numbers, reflecting a gain of 35.3% over these 17 years.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Woodend recording a relatively average level of approval activity when compared to local markets analysed countrywide

Woodend has recorded approximately 33 residential properties granted approval per year. Over the past five financial years, from FY-21 to FY-25, a total of 166 homes were approved, with an additional 6 approved so far in FY-26. Each dwelling built over these years attracted an average of 2.7 new residents annually, indicating strong demand that supports property values.

New homes are being constructed at an average expected construction cost value of $502,000, suggesting developers target the premium market segment with higher-end properties. In FY-26, commercial development approvals totaled $10.3 million, reflecting steady commercial investment activity in Woodend. Compared to Rest of Vic., Woodend has around two-thirds the rate of new dwelling approvals per person and ranks among the 42nd percentile nationally for areas assessed, offering limited choices for buyers and supporting demand for existing homes.

New building activity comprises 88.0% detached houses and 12.0% townhouses or apartments, maintaining Woodend's low-density nature with a focus on detached housing that appeals to space-seeking buyers. The estimated population per dwelling approval is 412 people, reflecting the area's quiet, low-activity development environment. By 2041, Woodend is projected to grow by 2,848 residents according to AreaSearch's latest quarterly estimate. At current development rates, housing supply may struggle to keep pace with population growth, potentially intensifying buyer competition and supporting price increases.

Frequently Asked Questions - Development

Infrastructure

Woodend has moderate levels of nearby infrastructure activity, ranking in the 42ndth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified six projects that may affect this region. Notable projects include the Hanging Rock to Daylesford Shared Trail, Hamilton Road Reconstruction from New Gisborne to Riddells Creek, Macedon Ranges Sports Precinct, and Kyneton Recycled Water Irrigation Project. The following list details those most likely to be relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

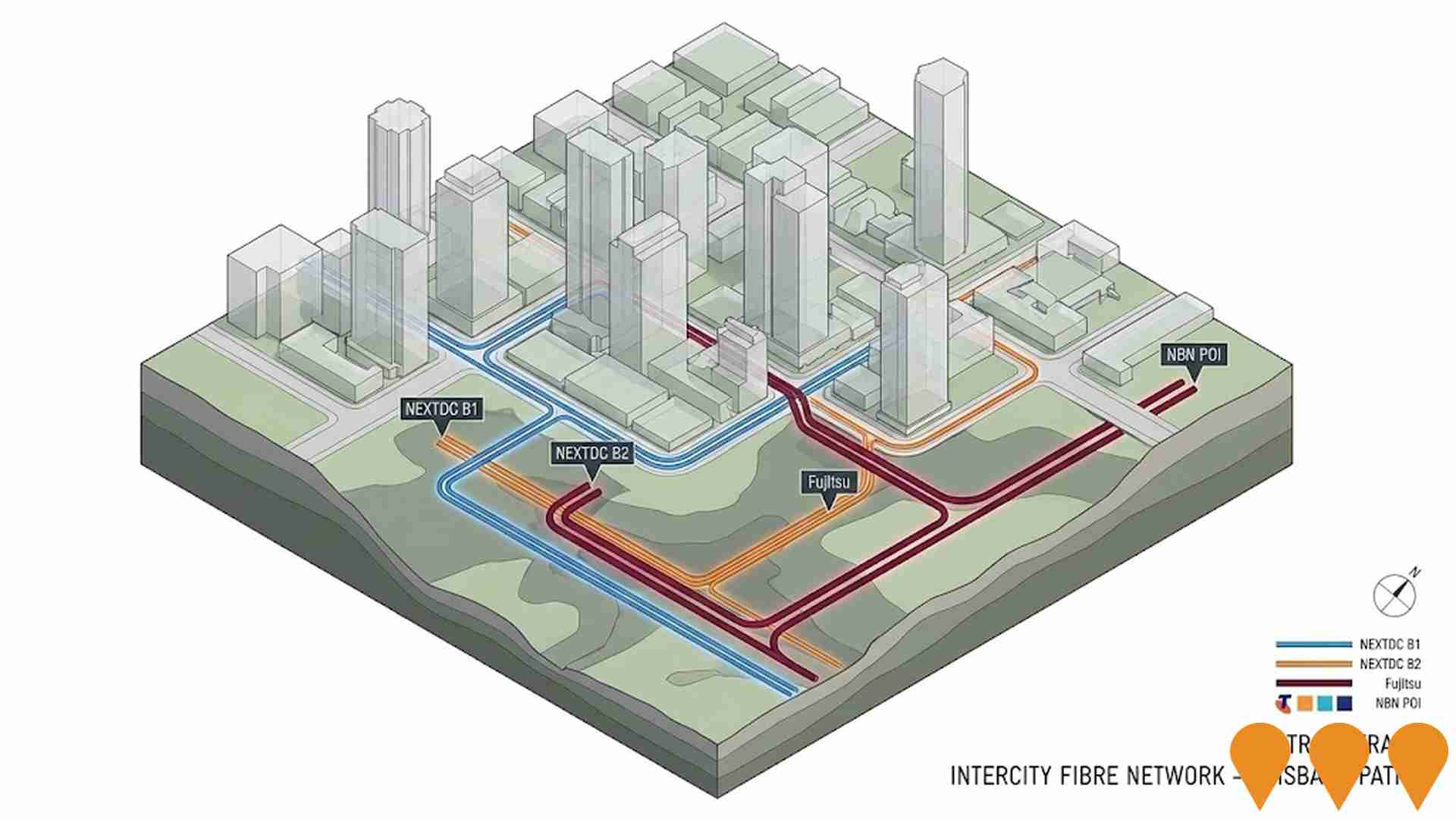

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

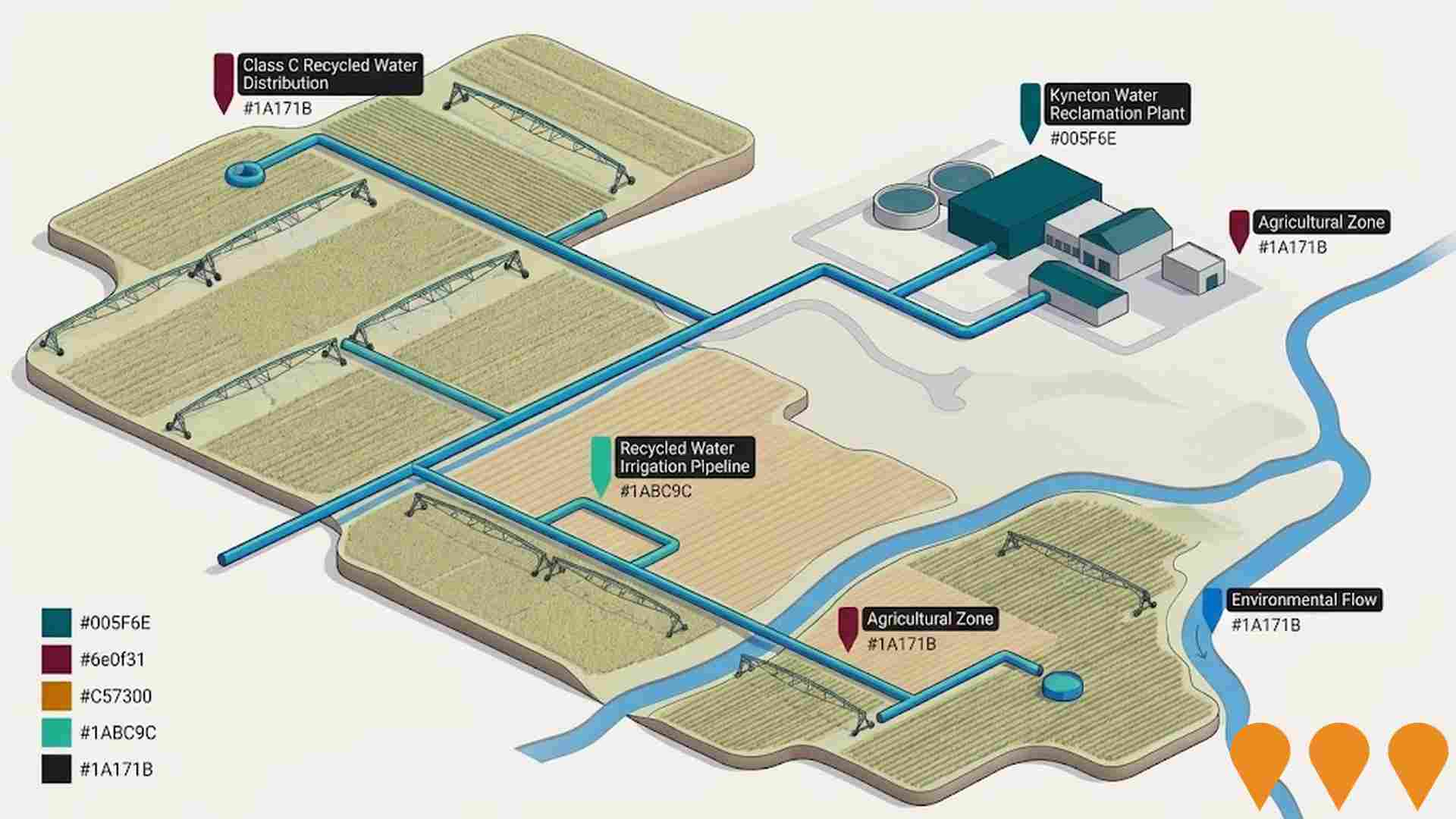

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

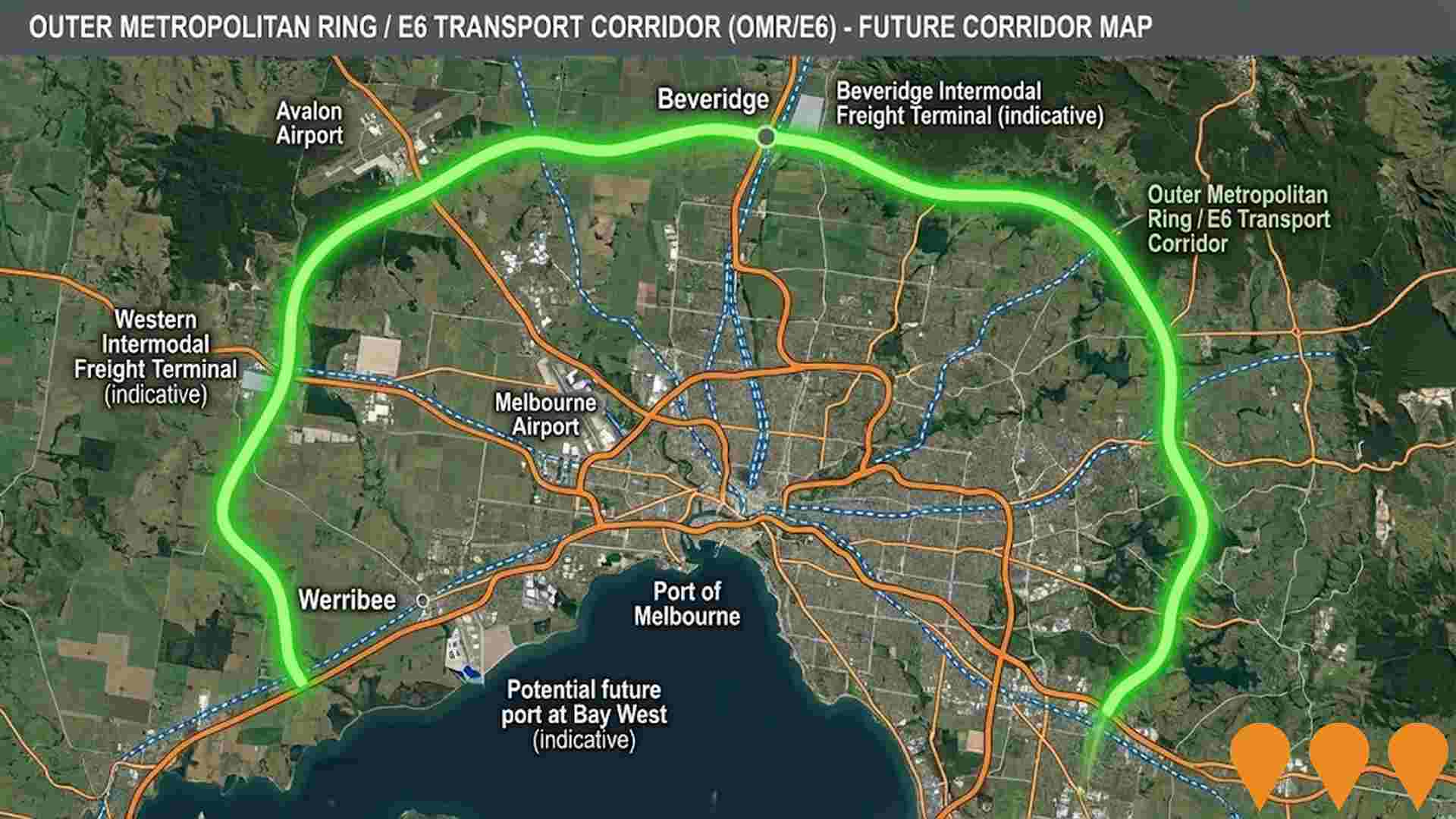

Outer Metropolitan Ring / E6 Transport Corridor

The Outer Metropolitan Ring / E6 Transport Corridor is a long-term planning project to reserve a 100km corridor for a future high-speed freeway and rail link in Melbourne's north and west. It will connect key growth areas from Werribee to Beveridge, linking major freeways and providing capacity for both road and up to four rail tracks for passenger and freight services.

Victorian Renewable Energy Zones

VicGrid, a Victorian Government agency, is coordinating the planning and staged declaration of six proposed onshore Renewable Energy Zones (plus a Gippsland shoreline zone to support offshore wind). The 2025 Victorian Transmission Plan identifies the indicative REZ locations, access limits and the transmission works needed to connect new wind, solar and storage while minimising impacts on communities, Traditional Owners, agriculture and the environment. Each REZ will proceed through a statutory declaration and consultation process before competitive allocation of grid access to projects.

Outer Metropolitan Ring / E6 Transport Corridor

The Outer Metropolitan Ring / E6 Transport Corridor is a proposed 100km high-speed transport link for people and freight in Melbourne's north and west. The project will connect the Princes Freeway near Werribee to the Hume Freeway north of Craigieburn, incorporating a four-lane freeway and a four-track railway line. It aims to support population growth and improve transport connectivity in the outer suburbs, with construction unlikely to commence before 2030.

Kyneton Recycled Water Irrigation Project

The project involves the construction of a 14-kilometre pipeline to distribute Class C recycled water from the Kyneton Water Reclamation Plant to local irrigators, enabling the reuse of 200-300 megalitres annually for agricultural irrigation, supporting regional agriculture, and improving environmental outcomes for the Campaspe River by reducing non-compliant discharges.

Gisborne Business Park Development

New commercial and industrial development providing employment opportunities for Gisborne region. Mixed-use business park with technology focus, supporting local economic diversification beyond tourism and residential.

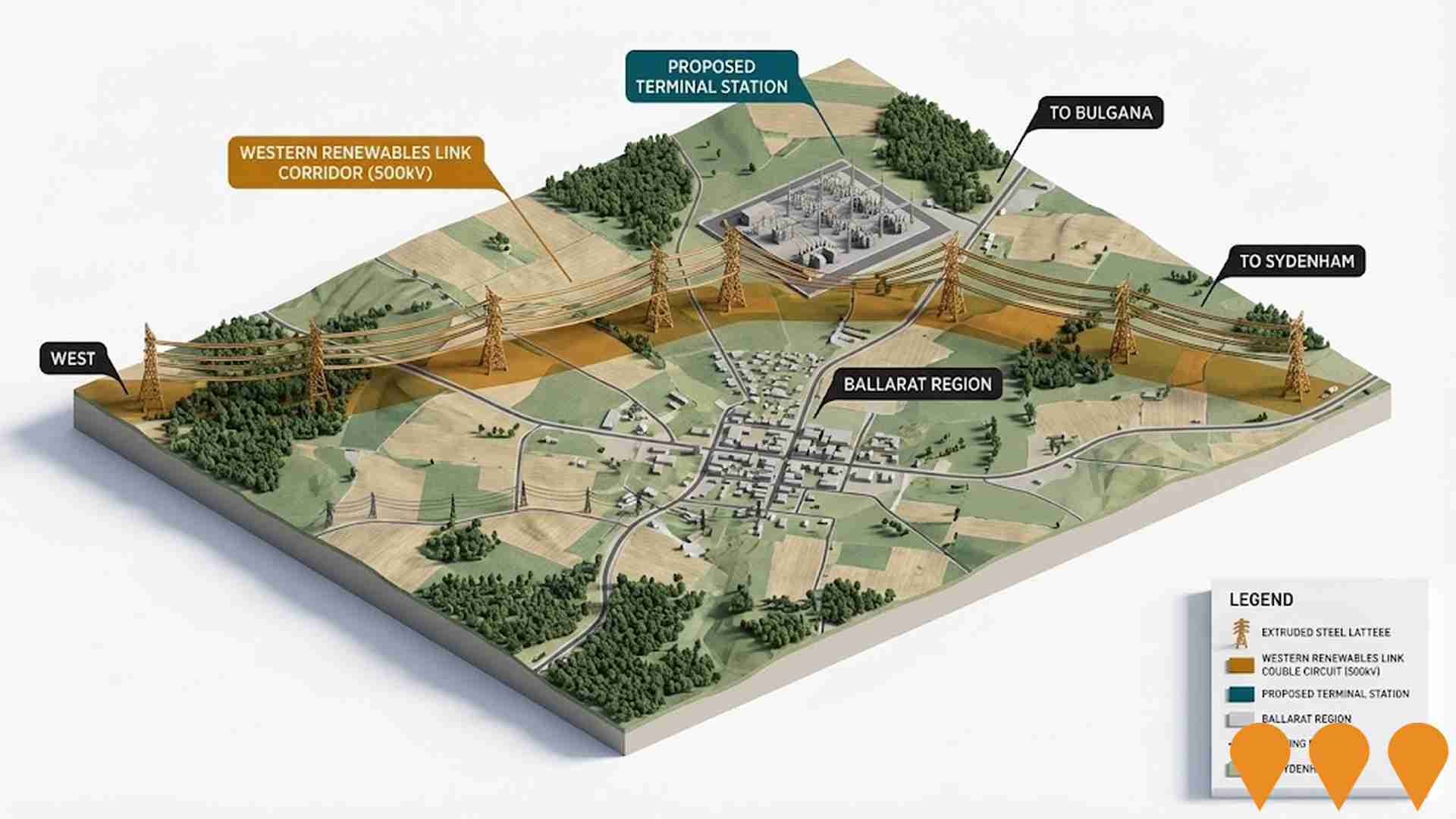

Western Renewables Link

Proposed 190km overhead 500kV double circuit high-voltage electricity transmission line from Bulgana in western Victoria to Sydenham in Melbourne's north-west. The project is currently in the EES public exhibition process (30 June to 25 August 2025).

Macedon Ranges Sports Precinct

Major regional sports facility development providing multipurpose courts, ovals, and community facilities. Serving broader Macedon Ranges region with high-quality sports infrastructure for multiple codes and community events.

Hanging Rock to Daylesford Shared Trail

Regional shared trail connecting Hanging Rock Reserve to Daylesford, passing through Gisborne area. Multi-use path for cycling, walking, and horse riding supporting tourism and recreation in Macedon Ranges region.

Employment

Employment performance in Woodend ranks among the strongest 15% of areas evaluated nationally

Woodend has an educated workforce with strong professional services representation. The unemployment rate was 1.6% in the past year, with estimated employment growth of 2.2%.

As of September 2025, 3979 residents are employed, with a 2.1% lower unemployment rate than Rest of Vic.'s 3.8%. Workforce participation is similar to Rest of Vic., at 60.8%. Employment is concentrated in health care & social assistance, professional & technical services, and education & training. The area specializes in professional & technical jobs, with an employment share 2.5 times the regional level.

Agriculture, forestry & fishing has limited presence, at 2.1% compared to the regional 7.5%. Local employment opportunities appear limited based on Census data comparison. In the past year, employment increased by 2.2%, while labour force rose by 2.6%, raising unemployment by 0.4 percentage points. This contrasts with Rest of Vic., where employment fell by 0.7% and unemployment rose marginally. State-level data to 25-Nov shows VIC employment grew by 1.13% year-on-year, with a state unemployment rate of 4.7%. National forecasts project total employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Woodend's employment mix suggests local employment should increase by 6.8% over five years and 13.8% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows that Woodend SA2 has a median income of $57,970 and an average income of $85,059. This is higher than the Rest of Vic.'s median income of $48,741 and average income of $60,693. Based on Wage Price Index growth of 12.16% since financial year 2022, current estimates for Woodend are approximately $65,019 (median) and $95,402 (average) as of September 2025. Census data shows that incomes in Woodend cluster around the 67th percentile nationally. Income brackets indicate that 27.7% of Woodend's population falls within the $1,500 - $2,999 income range, which is similar to metropolitan regions where this cohort represents 30.3%. The area has a substantial proportion of high earners, with 34.5% earning above $3,000 per week, indicating strong economic capacity. After housing costs, residents retain 88.0% of their income, reflecting strong purchasing power. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

Woodend is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Woodend's dwelling structures, as per the latest Census, consisted of 92.0% houses and 7.9% other dwellings. In comparison, Non-Metro Vic. had 95.2% houses and 4.8% other dwellings. Home ownership in Woodend was at 42.9%, with mortgaged dwellings at 42.5% and rented ones at 14.7%. The median monthly mortgage repayment was $2,000, higher than Non-Metro Vic.'s average of $1,600. The median weekly rent in Woodend was $392, compared to Non-Metro Vic.'s $320. Nationally, Woodend's mortgage repayments were higher at $2,000 versus the Australian average of $1,863, and rents were also higher at $392 compared to the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Woodend features high concentrations of family households, with a higher-than-average median household size

Family households constitute 77.2% of all households, including 35.4% couples with children, 30.4% couples without children, and 11.1% single parent families. Non-family households account for the remaining 22.8%, with lone person households at 21.1% and group households comprising 1.7% of the total. The median household size is 2.6 people, which is larger than the Rest of Vic. average of 2.4.

Frequently Asked Questions - Households

Local Schools & Education

Educational achievement in Woodend places it within the top 10% nationally, reflecting strong academic performance and high qualification levels across the community

Woodend's educational attainment is notably higher than broader averages. Among residents aged 15 and above, 39.2% have university qualifications, compared to 21.7% in the rest of Victoria and 25.4% in the SA4 region. Bachelor degrees are most common at 23.6%, followed by postgraduate qualifications (10.1%) and graduate diplomas (5.5%). Vocational credentials are also prevalent, with 29.6% of residents holding such qualifications - advanced diplomas at 11.6% and certificates at 18.0%. Educational participation is high, with 30.3% of residents currently enrolled in formal education.

This includes 11.5% in primary education, 9.5% in secondary education, and 3.9% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Woodend has five active public transport stops offering a mix of train and bus services. These stops are served by fifteen different routes that collectively facilitate 532 weekly passenger trips. Residents' access to these services is limited, with an average distance of 1312 meters to the nearest stop.

Across all routes, there are an average of 76 daily trips, equating to approximately 106 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Woodend's residents are relatively healthy in comparison to broader Australia with a fairly standard level of common health conditions seen across both young and old age cohorts

Woodend's health metrics closely match national benchmarks, with common health conditions seen across both young and old age cohorts. Private health cover stands at approximately 62% (5,030 people), compared to Rest of Vic.'s 52.9% and the national average of 55.3%. Mental health issues affect 8.8% of residents, while arthritis impacts 8.2%.

A total of 67.4% declare themselves completely clear of medical ailments, compared to Rest of Vic.'s 63.4%. The area has 23.2% (1,869 people) aged 65 and over, lower than Rest of Vic.'s 24.9%. Health outcomes among seniors are particularly strong, outperforming the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Woodend ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Woodend's population showed low cultural diversity, with 83.2% born in Australia, 90.9% being citizens, and 95.1% speaking English only at home. Christianity was the dominant religion, comprising 41.1%. Judaism, however, was slightly overrepresented at 0.2%, compared to 0.2% regionally.

In terms of ancestry, the top groups were English (30.5%), Australian (26.7%), and Irish (12.2%). Scottish (10.3%) and Maltese (0.9%) were notably overrepresented in Woodend compared to regional averages.

Frequently Asked Questions - Diversity

Age

Woodend hosts an older demographic, ranking in the top quartile nationwide

Woodend has a median age of 46, which is slightly higher than the Rest of Vic's figure of 43 and significantly higher than Australia's national norm of 38. The 45-54 age group makes up 16.1% of Woodend's population compared to the Rest of Vic., while the 25-34 cohort is less prevalent at 5.1%. Post-2021 Census data shows that the 75-84 age group has grown from 6.7% to 8.4%, and the 15-24 cohort has increased from 9.7% to 11.2%. Conversely, the 25-34 cohort has declined from 6.6% to 5.1%. By 2041, Woodend is expected to see notable shifts in its age composition, with the 45-54 group leading this demographic shift by growing by 43%, reaching 1,860 people from the current figure of 1,296.