Chart Color Schemes

This analysis uses Suburbs and Localities (SAL) boundaries, which can materially differ from Statistical Areas (SA2) even when sharing the same name.

SAL boundaries are defined by Australia Post and the Australian Bureau of Statistics to represent commonly-known suburb names used in postal addresses.

Statistical Areas (SA2) are designed for census data collection and may combine multiple suburbs or use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Tumby Bay has seen population growth performance typically on par with national averages when looking at short and medium term trends

As of Nov 2025, the estimated population for the Tumby Bay statistical area (Lv2) is around 1,938. This reflects an increase of 157 people since the 2021 Census, which reported a population of 1,781. The change was inferred from AreaSearch's estimation of the resident population at 1,804 as of June 2024, based on examination of the latest ERP data release by the ABS and an additional 34 validated new addresses since the Census date. The population growth in Tumby Bay (SA2) since the 2021 Census was 8.8%, exceeding the SA4 region's growth rate of 5.3%. Interstate migration contributed approximately 64.0% of overall population gains during recent periods, with all drivers including overseas migration and natural growth being positive factors. AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022.

For areas not covered by this data and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, released in 2023 and based on 2021 data, with adjustments made employing a method of weighted aggregation of population growth from LGA to SA2 levels. Future population trends project an above median growth for Australia's non-metropolitan areas. The Tumby Bay (SA2) area is expected to increase by 269 persons to 2041 based on aggregated SA2-level projections, reflecting a total increase of 13.3% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Tumby Bay when compared nationally

Based on AreaSearch analysis of ABS building approval numbers, Tumby Bay has seen around 11 new homes approved each year. Over the past five financial years, from FY21 to FY25, approximately 55 homes were approved, with an additional three approved in FY26 so far. This suggests a solid demand for housing, supporting property values.

The average number of people moving to the area per new home constructed over these five years is 2.8, indicating a focus on family homes. Developers are constructing new homes at an average expected construction cost value of $471,000, targeting the premium segment with upmarket properties. In FY26, there have been $170,000 in commercial approvals, predominantly residential-focused. Compared to the Rest of SA, Tumby Bay records 89.0% more construction activity per person, offering buyers greater choice.

Recent building activity consists entirely of detached dwellings, maintaining the area's traditional low density character with a focus on family homes appealing to those seeking space. Interestingly, developers are building more traditional houses than the current mix suggests (85.0% at Census), indicating continued strong demand for family homes despite density pressures. The location has approximately 201 people per dwelling approval, indicating an expanding market. Population forecasts indicate Tumby Bay will gain 257 residents through to 2041, based on the latest AreaSearch quarterly estimate. Given current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Tumby Bay has emerging levels of nearby infrastructure activity, ranking in the 22ndth percentile nationally

Five projects have been identified by AreaSearch as potentially impacting the area's performance. These include Green Iron Magnetite Project, CH4 Global Asparagopsis Seaweed EcoPark, Cape Hardy Advanced Fuels Precinct.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

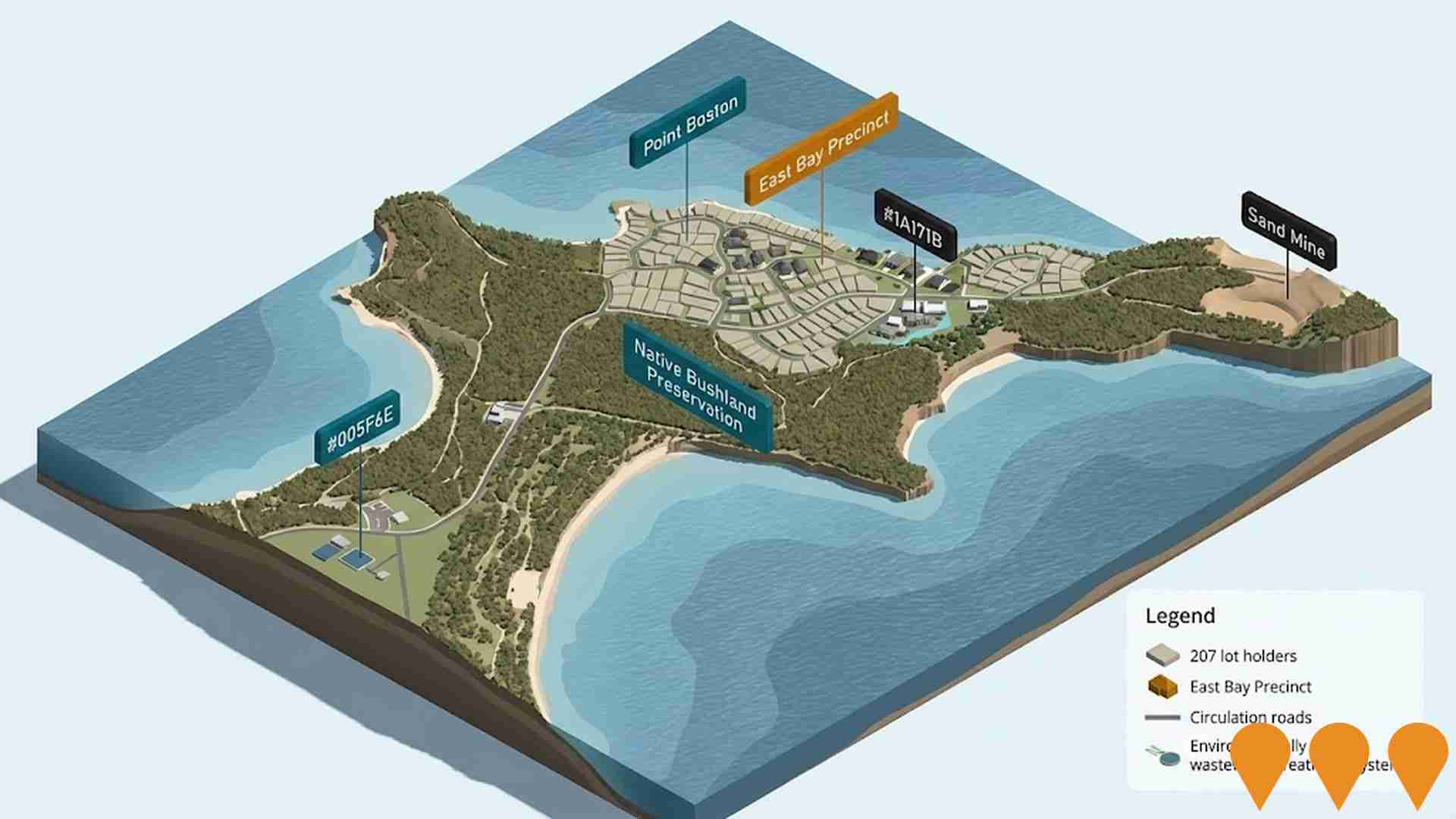

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Cape Hardy Advanced Fuels Precinct

The Cape Hardy Advanced Fuels Precinct is a large-scale green hydrogen and green ammonia production facility on the Eyre Peninsula. The project aims to develop up to 10 GW of electrolyser capacity, with an initial 1 GW stage powered by integrated wind and solar arrays. It includes Australia's first purpose-built green fuels export terminal and is integrated with the Northern Water Supply desalination project to produce over 5 million tonnes of green ammonia per annum for domestic and global markets. The project was granted Major Project Status by the Federal Government in late 2024 and is currently in the pre-FEED and feasibility phase.

Eyre Peninsula Desalination Plant

A reverse osmosis seawater desalination plant at Billy Lights Point designed to secure long-term water supply for the Eyre Peninsula, reducing reliance on vulnerable groundwater basins. The plant features an initial capacity of 16 ML/day (5.8 GL/year) with future expansion potential to 21.9 ML/day. Construction involves a 435-metre micro-tunnelled intake and outfall system beneath the shoreline, a transfer pipeline, and new power infrastructure. The project is being delivered by SA Water with Acciona and McConnell Dowell as key contractors.

Enabling Infrastructure for Hydrogen Production

A national initiative to coordinate and deploy infrastructure supporting large-scale renewable hydrogen production. Following the 2024 National Hydrogen Strategy refresh and the National Hydrogen Infrastructure Assessment (NHIA) to 2050, the program focuses on aligning transport, storage, water, and electricity inputs with Renewable Energy Zones and hydrogen hubs. Key financial drivers include the $4 billion Hydrogen Headstart program (with Round 2 EOI launched in October 2025) and the Hydrogen Production Tax Incentive (HPTI) legislated to provide a $2 per kg credit from July 2027 to 2040.

CH4 Global Asparagopsis Seaweed EcoPark

The world's first commercial-scale Asparagopsis seaweed production facility, the EcoPark grows and processes red seaweed to produce Methane Tamer feed supplements that reduce methane emissions in livestock by up to 90%. Phase 1 includes 10 cultivation ponds with 2 million liters capacity, producing 80 tonnes annually and serving 4,500 cattle per day. Expansion planned to 100 ponds serving 45,000 cattle daily, with potential for 500 ponds serving hundreds of thousands of cattle.

CH4 Global Asparagopsis Seaweed EcoPark

The world's first commercial-scale EcoPark for growing and processing Asparagopsis seaweed, designed to reduce livestock methane emissions by up to 90%. Phase 1 is operational with 10 large-scale cultivation ponds (2 million litres capacity), producing 80 metric tonnes annually. Phase 2 expansion is planned to increase capacity to 100 ponds.

Northern Water

Northern Water is a large-scale desalination and pipeline project designed to provide a climate-independent water source for South Australia's Upper Spencer Gulf and Far North. The project features a seawater reverse osmosis plant at Mullaquana Station with an initial capacity of 130 ML/day (scalable to 260 ML/day) and a 400km pipeline network connecting Whyalla, Port Augusta, and Olympic Dam. It aims to support the green hydrogen industry and critical mineral mining while reducing reliance on the Great Artesian Basin and River Murray.

Green Iron Magnetite Project

A global-scale magnetite project with 1.2 billion tonnes JORC resource aimed at producing 6 million tonnes per annum of high-quality magnetite concentrate for green iron and steel production. The project is part of South Australia's Green Iron and Steel Strategy and supports decarbonization of the steel industry through Direct Reduction Iron (DRI) processes using renewable energy.

Port Lincoln Housing Strategy Implementation

Comprehensive housing strategy addressing availability and affordability concerns through sustainable residential development, social housing initiatives, and planning reforms to meet growing demand in Port Lincoln region.

Employment

The labour market in Tumby Bay shows considerable strength compared to most other Australian regions

Tumby Bay has a diverse workforce with both white and blue collar jobs, representing various sectors. The unemployment rate was 2.4% in the year to September 2025, with an estimated employment growth of 4.0%.

As of September 2025856 residents are employed, with an unemployment rate of 3.0%, below Rest of SA's rate of 5.3%. Workforce participation is lower at 47.6% compared to Rest of SA's 54.1%. Key employment sectors include agriculture, forestry & fishing, health care & social assistance, and retail trade. The area has a high specialization in construction (1.3 times the regional level) but lower representation in manufacturing (2.4% vs regional average of 9.3%).

Employment opportunities appear limited locally, with Census data showing fewer working residents than expected based on population. In the year to September 2025, employment levels increased by 4.0%, labour force by 5.4%, raising unemployment rate by 1.2 percentage points. Rest of SA saw slower growth: employment up 0.3%, labour force up 2.3%, unemployment rose by 1.9 percentage points. National employment forecasts from Jobs and Skills Australia, covering five and ten-year periods starting May-25, project national employment growth at 6.6% and 13.7%. Applying these projections to Tumby Bay's employment mix suggests local employment should increase by 6.0% over five years and 12.7% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

AreaSearch's latest postcode level ATO data for financial year 2023 shows Tumby Bay's median income among taxpayers is $41,685. The average income in this period was $51,303. Both figures are below the national averages. In comparison, Rest of SA had a median income of $48,920 and an average of $58,933 during the same financial year. Based on Wage Price Index growth of 8.8% since financial year 2023, current estimates for Tumby Bay's median income would be approximately $45,353 by September 2025. The average income is estimated to reach around $55,818 during the same period. Census 2021 data indicates that household, family, and personal incomes in Tumby Bay all fall between the 5th and 14th percentiles nationally. Income analysis reveals that the largest segment of residents, comprising 34.2%, earn $400 - $799 weekly (662 residents). This is in contrast to metropolitan regions where the highest earning bracket is $1,500 - $2,999 at 27.5%. The prevalence of lower-income residents in Tumby Bay, with 41.3% earning under $800 per week, suggests constrained household budgets across much of the suburb. Despite this, housing costs are relatively modest, with 89.1% of income retained after housing expenses. However, the total disposable income ranks at just the 10th percentile nationally.

Frequently Asked Questions - Income

Housing

Tumby Bay is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The dwelling structure in Tumby Bay, as per the latest Census data, consisted of 84.6% houses and 15.4% other dwellings such as semi-detached homes, apartments, and 'other' dwellings. This is compared to Non-Metro SA's structure of 75.9% houses and 24.1% other dwellings. The level of home ownership in Tumby Bay stood at 53.7%, with the remaining dwellings either mortgaged (23.1%) or rented (23.2%). The median monthly mortgage repayment in the area was $1,200, higher than Non-Metro SA's average of $1,170. Meanwhile, the median weekly rent figure was recorded at $220, compared to Non-Metro SA's $195. Nationally, Tumby Bay's mortgage repayments were significantly lower than the Australian average of $1,863, as of the latest available data. Similarly, rents in Tumby Bay were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Tumby Bay features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 61.7% of all households, including 16.5% couples with children, 37.8% couples without children, and 6.5% single parent families. Non-family households account for the remaining 38.3%, with lone person households at 37.0% and group households comprising 2.2% of the total. The median household size is 2.0 people, which is smaller than the Rest of SA average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Tumby Bay faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 13.2%, significantly lower than Australia's average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 10.6%, followed by postgraduate qualifications (1.4%) and graduate diplomas (1.2%). Vocational credentials are prevalent, with 36.6% of residents aged 15+ holding them, including advanced diplomas (8.5%) and certificates (28.1%).

Currently, 20.1% of the population is actively engaged in formal education, comprising 8.7% in primary, 6.3% in secondary, and 1.5% in tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Tumby Bay is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Tumby Bay faces significant health challenges, with various conditions impacting both younger and older residents. Private health cover is low at approximately 47%, covering around 917 people, compared to 51.5% across the rest of South Australia (Rest of SA) and a national average of 55.7%. The most prevalent medical conditions are arthritis and mental health issues, affecting 10.8% and 8.5% of residents respectively, while 59.3% report no medical ailments compared to 65.6% in Rest of SA.

The area has a higher proportion of seniors aged 65 and over at 39.8%, with around 771 people, compared to 22.1% in Rest of SA. Despite this, health outcomes among seniors are above average and better than the general population's metrics.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Tumby Bay placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Tumby Bay, as per the 2016 Census, had a population where 93.3% were born in Australia, with 93.4% being citizens and 98.8% speaking English only at home. Christianity was the predominant religion, accounting for 49.4%. This compares to 43.7% across the Rest of SA.

The top three ancestry groups based on parents' country of birth were English (35.5%), Australian (34.3%), and Scottish (8.9%). Notably, German ancestry was higher at 6.8%, compared to 6.6% regionally; Welsh ancestry was also slightly higher at 0.6%, versus 0.5%; Polish ancestry stood at 0.7%, against 0.4%.

Frequently Asked Questions - Diversity

Age

Tumby Bay ranks among the oldest 10% of areas nationwide

Tumby Bay's median age is 57 years, which is significantly higher than Rest of SA's 47 and Australia's 38-year national average. Compared to the Rest of SA average, Tumby Bay has a notably over-represented cohort of 65-74 year-olds (19.4%) while those aged 25-34 are under-represented (5.4%). This concentration is well above the national average of 9.4%. According to the 2021 Census, Tumby Bay's population structure has changed since the previous census. The 15 to 24 age group grew from 6.7% to 8.5%, while the 25 to 34 cohort declined from 6.9% to 5.4%. Additionally, the 55 to 64 group decreased from 14.3% to 12.8%. By 2041, demographic projections show significant shifts in Tumby Bay's age structure. The 85+ age cohort is projected to increase dramatically by 143 people (118%), from 122 to 266. Senior residents aged 65 and above will drive 91% of population growth, indicating a demographic aging trend. Conversely, the 5 to 14 and 55 to 64 age cohorts are expected to experience population declines.