Chart Color Schemes

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in East Devonport reveals an overall ranking slightly below national averages considering recent, and medium term trends

East Devonport's population was around 5,406 as of November 2025, according to AreaSearch's analysis. This reflected an increase of 331 people, a 6.5% rise since the 2021 Census which reported a population of 5,075. The change was inferred from the estimated resident population of 5,281 in June 2024 and an additional 149 validated new addresses since the Census date. This resulted in a density ratio of 408 persons per square kilometer. East Devonport's growth exceeded both the SA4 region (4.7%) and the state level, making it a growth leader in the region. Overseas migration was the primary driver of population gains during recent periods.

AreaSearch adopts ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and to estimate growth by age group post-2032, Tasmania State Government's Regional/LGA projections are used, released in 2022 with a base year of 2021, adjusted employing a method of weighted aggregation from LGA to SA2 levels. Considering projected demographic shifts, lower quartile growth is anticipated for non-metropolitan areas nationally. The area is expected to grow by 95 persons to 2041 based on the latest population numbers, with an overall reduction of 0.6% over the 17 years.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within East Devonport when compared nationally

East Devonport has seen approximately 37 new homes approved annually. Over the past five financial years, from FY21 to FY25, a total of 189 homes were approved, with an additional 13 approved so far in FY26. On average, 1.3 people moved to the area each year for each dwelling built over these five years. However, this figure has eased to 0.8 people per dwelling over the past two financial years.

The average construction value of new properties is $238,000. This financial year, $951,000 in commercial approvals have been registered, indicating the area's residential focus. Compared to the rest of Tasmania, East Devonport has seen slightly more development, with 23.0% above the regional average per person over the five-year period.

Recent building activity consists entirely of standalone homes, maintaining the area's low-density character and appealing to those seeking family homes with space. The location currently has approximately 144 people per dwelling approval, suggesting an expanding market. However, population projections indicate stability or decline, which should reduce housing demand pressures in East Devonport, benefiting potential buyers.

Frequently Asked Questions - Development

Infrastructure

East Devonport has limited levels of nearby infrastructure activity, ranking in the 11thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 14 projects likely to influence the area. Notable ones include Devonport Mental Health Hub, Spirit of Tasmania New Vessels and Port Upgrade, TasPorts QuayLink Port Development, and Devonport Oval Sports Complex. The following list details those most relevant:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Devonport Mental Health Hub

A new $40 million purpose-built mental health facility for Tasmania's North West region. The hub includes a Safe Haven for people experiencing suicidal or situational distress, a Recovery College offering free peer-led education, and an Integration Hub providing brief interventions and navigation support. Construction commenced in early 2025 and the facility is on track for completion in late 2027.

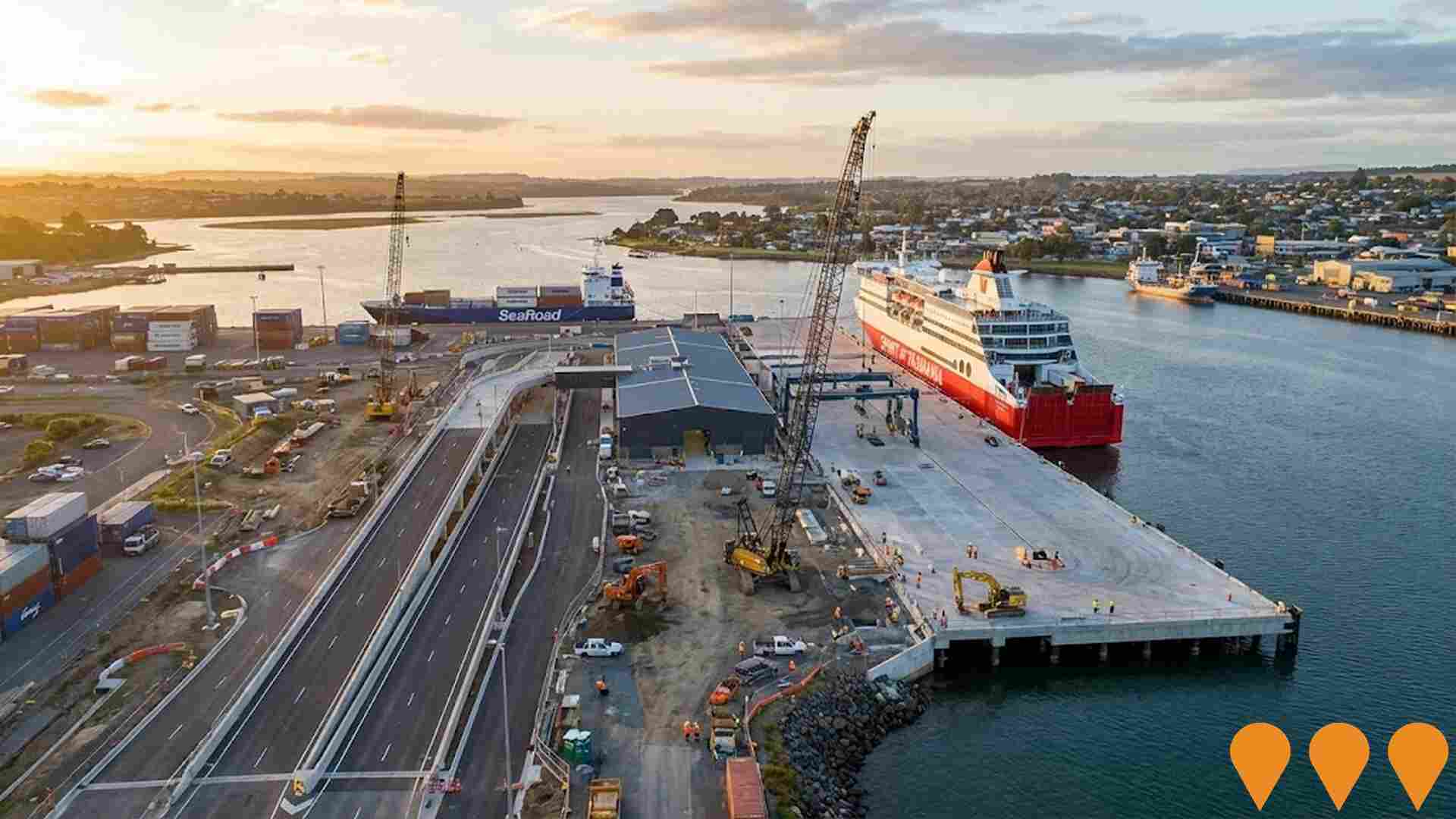

Spirit of Tasmania New Vessels and Port Upgrade

The project involves two new, larger vessels, **Spirit of Tasmania IV** and **Spirit of Tasmania V**, to replace the existing fleet, as well as the associated **QuayLink port infrastructure upgrades** in Devonport, Tasmania. The new vessels have significantly enhanced capacity, accommodating up to 1,800 passengers and 4,098 lane metres for vehicles. The new East Devonport terminal (Berth 3) and passenger terminal building are being constructed. **Spirit of Tasmania IV** has been delivered to TT-Line and is undergoing a final fit-out in Tasmania, while **Spirit of Tasmania V** is nearing completion with rectification works on its LNG system following sea trials. The expected in-service date for the new vessels is now aligned with the completion of the Devonport berth, anticipated to be in **October 2026** for the 2026-27 peak summer season.

TasPorts QuayLink Port Development

A once-in-a-generation infrastructure development project by TasPorts to upgrade the East Devonport port infrastructure. This $240 million investment will future-proof the Port of Devonport for the next 50 years, accommodating new, larger vessels. It's expected to increase freight capacity by 40% and facilitate an additional 160,000 passengers annually, creating over 2000 jobs during the peak construction phase. The works include marine and landside infrastructure improvements across Terminals 1, 2, and 3 for the operations of Spirit of Tasmania (TT-Line) and SeaRoad.

Hydrogen Devonport Project

A 5 MW PEM electrolyser facility at Wesley Vale (near Devonport) producing up to 690 tonnes of green hydrogen per year using renewable hydro and wind power. The plant will supply heavy transport, industrial users and power generation, forming a key part of Tasmania's Hydrogen HyWay#1 ecosystem. Construction commenced in late 2025 with first hydrogen production expected in 2026.

Devonport Showground Housing Development

Tasmania's largest private infill housing development on a 10ha CBD site, comprising approximately 200 homes of diverse and adaptable typologies (including affordable, aged care, and disability housing), a health facility, community facilities, a central lake, public parkland, and a large urban farm. The project follows rezoning approval in late 2022 and the first development application (a 'super lot' subdivision) was advertised for public exhibition in April 2024. The project is being developed to create a socially-inclusive, community-centered 'village in a city'.

Devonport Oval Sports Complex

Six-court indoor sports venue with five outdoor courts, serving at least six major sporting codes. Includes shared social facilities, administration facilities, and high-performance training areas. Contractor: Fairbrother Pty Ltd.

paranaple Convention Centre

Contemporary purpose-built convention centre with state-of-the-art facilities, versatile spaces, floor-to-ceiling windows and waterfront views. Part of $71 million paranaple centre construction including arts centre, library, and council offices.

Indie Education School Development (Devonport)

Three storey education facility for Indie School at 29 Fenton Way, delivering two levels for school operations plus a third level for Indie Education head office functions. Contractor: Fairbrother Pty Ltd. Architect: NH Architecture. Construction commenced October 2024 with a target completion in February 2026. Works include flexible learning spaces, home economics facilities, staff areas and an outdoor rooftop terrace. The project supports Devonport's Living City initiative and is adjacent to the current campus in the former Devonport Library.

Employment

The labour market performance in East Devonport lags significantly behind most other regions nationally

East Devonport has a balanced workforce with diverse sector representation. As of June 2025, its unemployment rate is 7.2%, with an estimated employment growth of 3.0% over the past year.

This rate is 3.2% higher than Rest of Tas.'s rate of 3.9%. Workforce participation in East Devonport lags at 48.0%, compared to Rest of Tas.'s 55.7%. Key industries include health care & social assistance, retail trade, and agriculture, forestry & fishing. The area shows strong specialization in transport, postal & warehousing, with an employment share 1.6 times the regional level.

However, education & training is under-represented at 5.1%, compared to Rest of Tas.'s 8.8%. Employment opportunities locally appear limited, as indicated by Census data. Over the year to June 2025, employment increased by 3.0% while labour force grew by 2.1%, reducing unemployment by 0.8 percentage points. National employment forecasts from Jobs and Skills Australia, May 2025, project national growth of 6.6% over five years and 13.7% over ten years. Applying these projections to East Devonport's employment mix suggests local growth of approximately 5.8% over five years and 12.6% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

East Devonport's median taxpayer income was $39,574 and average was $46,704 in financial year 2022. This is lower than national averages of $47,358 (median) and $57,384 (average). By September 2025, estimates suggest median income will be approximately $45,047 and average $53,163, based on a 13.83% Wage Price Index growth since financial year 2022. Census 2021 data shows incomes in East Devonport fall between the 2nd and 6th percentiles nationally for households, families, and individuals. The largest income segment comprises 32.9% earning $400-$799 weekly (1,778 residents). In contrast, the metropolitan region has the highest concentration in the $1,500-$2,999 bracket at 28.5%. A significant portion of East Devonport's community faces economic challenges, with 42.3% in sub-$800 weekly brackets. Housing affordability pressures are severe, with only 83.9% of income remaining, ranking at the 4th percentile nationally.

Frequently Asked Questions - Income

Housing

East Devonport is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

East Devonport's dwellings, as per the latest Census, were 87.5% houses and 12.6% other dwellings (semi-detached, apartments, 'other' dwellings). Non-Metro Tas., meanwhile, had 90.3% houses and 9.7% other dwellings. Home ownership in East Devonport was at 36.5%, with mortgaged dwellings at 24.4% and rented at 39.1%. The median monthly mortgage repayment was $1,083, compared to Non-Metro Tas.'s average of $1,300. The median weekly rent in East Devonport was $236, while Non-Metro Tas. recorded $250. Nationally, East Devonport's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

East Devonport features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households comprise 63.5% of all households, including 18.1% couples with children, 27.3% couples without children, and 16.8% single parent families. Non-family households account for the remaining 36.5%, with lone person households at 32.7% and group households making up 3.8%. The median household size is 2.2 people, smaller than the Rest of Tas. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

East Devonport faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area faces educational challenges with university qualification rates at 12.3%, significantly lower than the Australian average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most prevalent at 8.6%, followed by postgraduate qualifications (2.2%) and graduate diplomas (1.5%). Trade and technical skills are prominent, with 37.9% of residents aged 15+ holding vocational credentials - advanced diplomas (7.3%) and certificates (30.6%).

Educational participation is notably high at 27.0%, including 11.1% in primary education, 7.7% in secondary education, and 1.9% pursuing tertiary education. East Devonport Primary School serves the local educational needs within East Devonport, with an enrollment of 206 students as of the latest data available. The area demonstrates varied educational conditions across East Devonport, with 1 school focusing exclusively on primary education while secondary options are available in surrounding areas. Limited local school capacity, at 3.8 places per 100 residents compared to the regional average of 14.1, means many families travel to nearby areas for schooling.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in East Devonport is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Critical health challenges are evident across East Devonport, with a range of health conditions impacting both younger and older age cohorts. The rate of private health cover is extremely low at approximately 46% of the total population (~2,508 people), compared to the national average of 55.3%.

Mental health issues and arthritis are the most common medical conditions in the area, impacting 12.2 and 12.1% of residents respectively. Meanwhile, 56.0% of residents declare themselves completely clear of medical ailments, compared to 61.1% across Rest of Tas. The area has 25.0% of residents aged 65 and over (1,352 people). Health outcomes among seniors present some challenges but perform better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

East Devonport ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

East Devonport's cultural diversity was found to be below average, with 87.0% of its population being Australian citizens and 86.4% born in Australia. English was the language spoken at home by 93.1%. Christianity was the predominant religion, comprising 42.8% of East Devonport's population.

The 'Other' religious category showed an overrepresentation with 0.8%, compared to 0.5% across the rest of Tasmania. In terms of ancestry, Australian (33.8%), English (32.6%), and Scottish (7.0%) were the top represented groups. Notably, Australian Aboriginal was overrepresented at 6.8% versus 4.7% regionally, while Samoan (0.2%) and Korean (0.2%) showed significant increases compared to their regional percentages of 0%.

Frequently Asked Questions - Diversity

Age

East Devonport hosts an older demographic, ranking in the top quartile nationwide

East Devonport has a median age of 44, comparable to the Rest of Tasmania's figure of 45 but higher than Australia's national norm of 38. The 25-34 age group is strongly represented at 13.5%, compared to the Rest of Tasmania's figure. However, the 45-54 cohort is less prevalent at 10.6%. Post-2021 Census data shows that the 35-44 age group has grown from 9.6% to 11.1% of the population, while the 75-84 cohort increased from 8.0% to 9.4%. Conversely, the 65-74 cohort has declined from 14.2% to 12.9%. By 2041, East Devonport is expected to see notable shifts in its age composition. The 75-84 group is projected to grow by 22%, reaching 622 people from the previous figure of 508. This aging population dynamic is clear, with those aged 65 and above comprising 99% of the projected growth. Conversely, population declines are projected for the 45-54 and 5-14 age cohorts.