Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Gilbert Valley is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Gilbert Valley's population was approximately 5,329 as of November 2025, according to AreaSearch's analysis. This figure represents an increase of 313 people, a 6.2% rise from the 2021 Census which recorded a population of 5,016. The change was inferred from the estimated resident population of 5,168 in June 2024 and an additional 142 validated new addresses since the Census date. This results in a population density ratio of 3.2 persons per square kilometer. Gilbert Valley's growth rate exceeded that of the SA3 area (5.7%) during this period, indicating it as a growth leader in the region. Overseas migration was the primary driver of population growth.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, based on 2021 data and adjusted employing weighted aggregation from LGA to SA2 levels. Future demographic trends suggest lower quartile growth for locations outside capital cities. Gilbert Valley is projected to grow by 75 persons to 2041, reflecting a reduction of 1.6% in total over the 17 years based on the latest annual ERP population numbers.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Gilbert Valley according to AreaSearch's national comparison of local real estate markets

Gilbert Valley has averaged approximately 25 new dwelling approvals annually over the past five financial years, totalling 128 homes. As of FY-26, 12 approvals have been recorded. The average number of people moving to the area per year for each dwelling built over these five financial years (FY-21 to FY-25) is 0.6. New construction has matched or exceeded demand, providing more options for buyers and enabling population growth that may surpass current projections.

The average expected construction cost value of new homes is $265,000. In this financial year, $6.7 million in commercial approvals have been registered, indicating the area's residential character. Compared to the rest of South Australia, Gilbert Valley has seen slightly more development, with 39.0% above the regional average per person over the five-year period.

This preserves reasonable buyer options while sustaining existing property demand. All new construction during this period comprised standalone homes, maintaining the area's traditional low-density character and focusing on family homes appealing to those seeking space. With around 210 people per approval, Gilbert Valley reflects a developing area. Given that population is expected to remain stable or decline, there should be reduced pressure on housing in Gilbert Valley, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

Gilbert Valley has limited levels of nearby infrastructure activity, ranking in the 15thth percentile nationally

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified six projects likely to impact the region. Notable projects include Kidman Rise, Bundey BESS and Solar Project, Goyder Renewables Zone, and Robertstown Solar Project, with the following list detailing those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

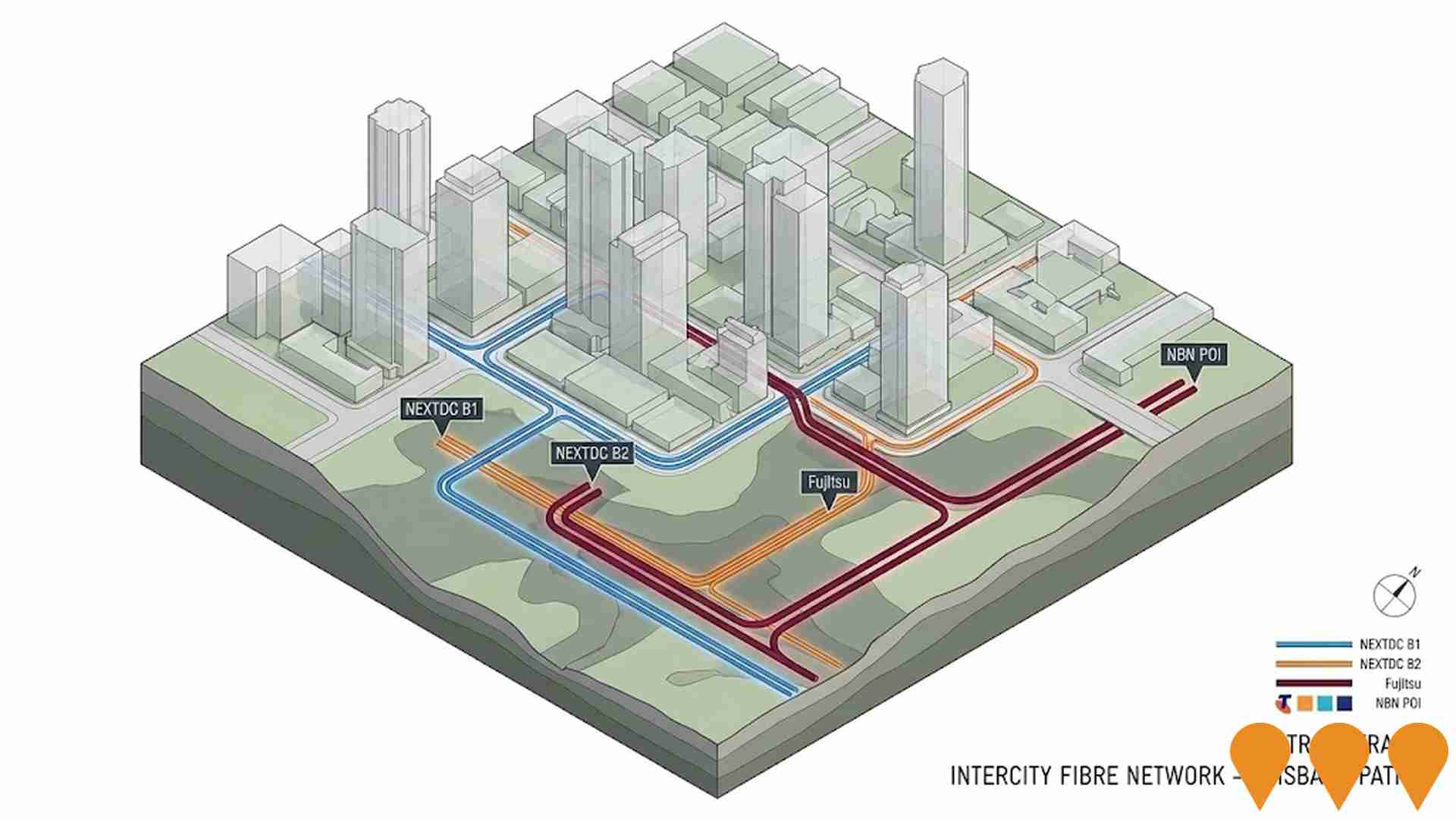

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

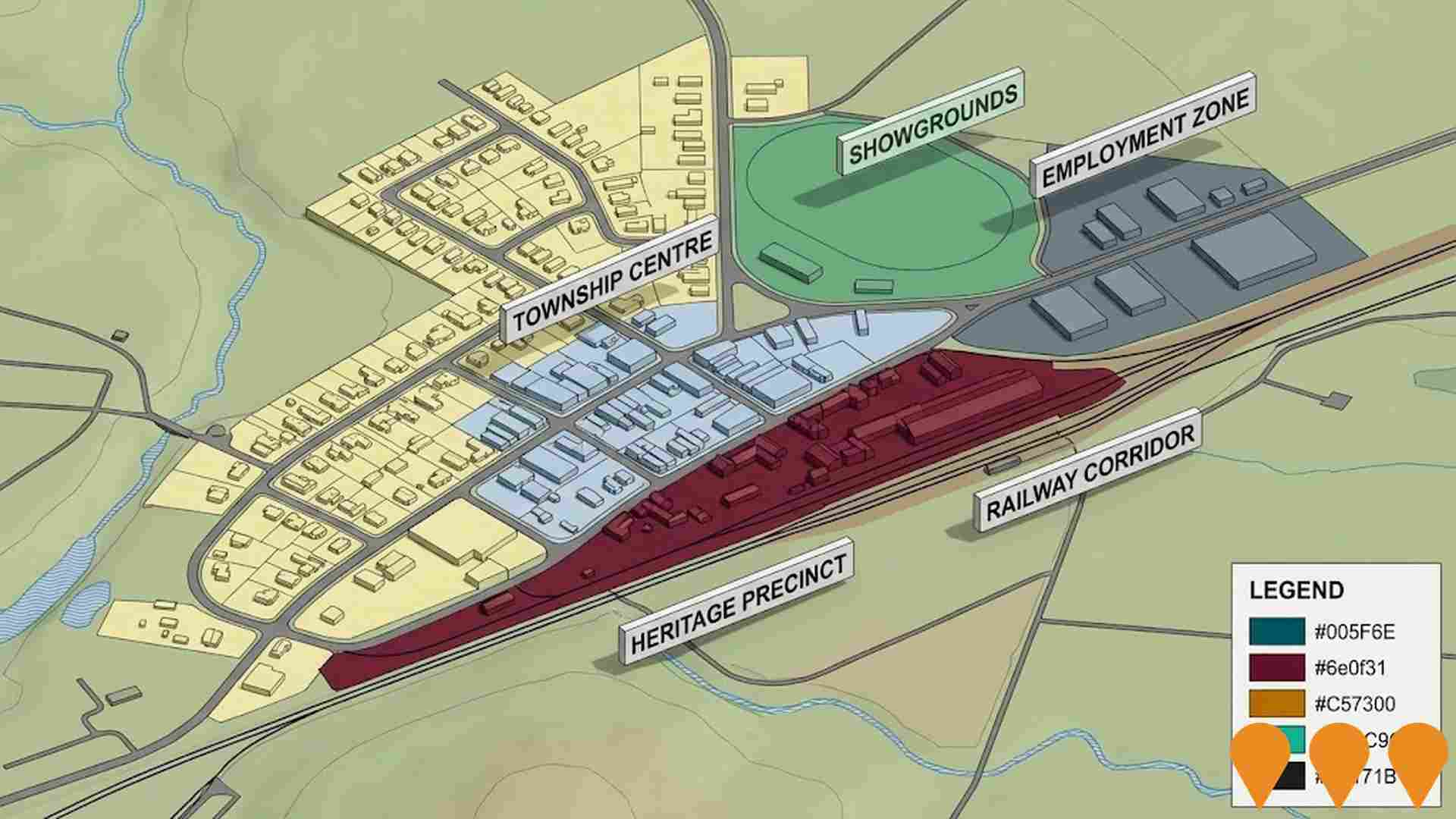

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Goyder Renewables Zone

Neoen's multi-stage hybrid renewable energy hub near Burra combines wind, solar and battery storage across Goyder South and Goyder North. Stage 1 of Goyder South (75 turbines, ~412 MW) completed turbine commissioning in May 2025 and began operations in 2025, with further stages (additional wind, solar and storage) progressing through approvals and delivery. Long-term PPAs include 100 MW with the ACT Government and 40 MW with Flow Power, and a baseload contract linked with Blyth Battery to supply BHP Olympic Dam.

Barossa Growth and Infrastructure Investment Strategy

A strategic plan by The Barossa Council to guide future growth and investment in the Barossa region. It includes proposals for new employment land at Nuriootpa, residential infill in Nuriootpa, Angaston, and Tanunda, and further investigation into tourism development rezoning at Kroemer Crossing.

Bulk Water Supply Security

Nationwide program led by the National Water Grid Authority to improve bulk water security and reliability for non-potable and productive uses. Activities include strategic planning, science and business cases, and funding of state and territory projects such as storages, pipelines, dam upgrades, recycled water and efficiency upgrades to build drought resilience and support regional communities, industry and the environment.

Burra Township Master Plan

Council-led township master plan guiding Burra's growth over the next 20 years. Draft master plans were released for community consultation in March-April 2025 following 2024 engagement. The plan focuses on managing growth pressures linked to heritage and tourism while protecting township character, identifying land use opportunities (e.g. showgrounds, employment zones, accommodation), and setting long-term strategies for infrastructure and amenity.

Bundey BESS and Solar Project

A large scale renewable energy project northeast of Robertstown, SA, being progressed by Genaspi Energy Group. Current scope comprises a battery energy storage system of up to 1,200 MW / 3,900 MWh co located with a solar farm of up to 900 MW. The developer indicates the solar component has been lodged for development application while the BESS component proceeds under planning approval exemption pathways under the Planning, Development and Infrastructure Act 2016. The project is intended to improve grid stability and support decarbonisation across South Australia and connected states.

Kidman Rise

Kidman Rise is a residential land estate on the northern edge of Kapunda, offering large lots ranging from 437m2 to 1045m2, oriented for northern sun. Situated an hour from Adelaide, between Clare and Barossa valleys. The land has historical connection to Sidney Kidman.

Robertstown Solar Project

The Robertstown Solar Project in South Australia proposes a 636-MW solar PV farm and 250 MW battery storage, connecting to the National Electricity Market at the Robertstown Substation over 1,800 hectares.

Barrier Highway Safety Upgrades

Upgrades to the Barrier Highway to improve safety and efficiency for all road users. The upgrades include pavement rehabilitation, shoulder widening, installation of safety barriers, and new line marking.

Employment

The employment landscape in Gilbert Valley shows performance that lags behind national averages across key labour market indicators

Gilbert Valley's workforce is skilled with diverse representation across sectors. The unemployment rate was 3.9% in the past year, with an estimated growth of 0.9%.

As of September 2025, 2,559 residents were employed at a rate 1.5% lower than Rest of SA's 5.3%, while workforce participation was 57.4%. Dominant employment sectors include agriculture, forestry & fishing, health care & social assistance, and manufacturing. Agriculture, forestry & fishing had particularly high concentration with levels at 1.6 times the regional average. Retail trade was under-represented at 6.4% compared to Rest of SA's 9.9%.

The area may have limited local employment opportunities as Census working population vs resident population suggests. Between September 2024 and September 2025, employment levels increased by 0.9%, labour force by 2.1%, leading to a 1.1 percentage point rise in unemployment. In contrast, Rest of SA saw employment rise by 0.3%, labour force grow by 2.3%, and unemployment increase by 1.9 percentage points. Jobs and Skills Australia's national employment forecasts from May-25 project overall growth at 6.6% over five years and 13.7% over ten years, but industry-specific projections vary significantly. Applying these to Gilbert Valley's employment mix suggests local employment should increase by 5.0% over five years and 11.4% over ten years.

Frequently Asked Questions - Employment

Income

Income figures position the area below 75% of locations analysed nationally by AreaSearch

Gilbert Valley SA2 had a median taxpayer income of $45,408 and an average income of $56,346 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This was lower than the national average, with Rest of SA's median income being $46,889 and average income being $56,582. By September 2025, estimated incomes would be approximately $51,234 (median) and $63,575 (average), based on a 12.83% growth in the Wage Price Index since financial year 2022. Census 2021 income data indicated that household, family, and personal incomes in Gilbert Valley all fell between the 17th and 20th percentiles nationally. The earnings profile showed that the largest segment comprised 27.7% earning $800 - $1,499 weekly (1,476 residents), unlike regional trends where 27.5% fell within the $1,500 - $2,999 range. Housing costs were modest, with 89.8% of income retained, but total disposable income ranked at just the 23rd percentile nationally.

Frequently Asked Questions - Income

Housing

Gilbert Valley is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

Gilbert Valley's dwelling structures, as per the latest Census, consisted of 96.1% houses and 3.9% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro SA's 94.2% houses and 5.8% other dwellings. Home ownership in Gilbert Valley was at 47.4%, with mortgaged dwellings at 35.7% and rented ones at 17.0%. The median monthly mortgage repayment was $1,100, higher than Non-Metro SA's average of $1,081. The median weekly rent figure in Gilbert Valley was $225, compared to Non-Metro SA's $220. Nationally, Gilbert Valley's mortgage repayments were significantly lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Gilbert Valley has a typical household mix, with a fairly typical median household size

Family households constitute 68.8% of all households, including 24.1% couples with children, 36.6% couples without children, and 7.7% single parent families. Non-family households comprise the remaining 31.2%, with lone person households at 29.1% and group households making up 2.2%. The median household size is 2.3 people, which aligns with the average for the Rest of South Africa.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Gilbert Valley fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 18.4%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 13.0%, followed by postgraduate qualifications (2.9%) and graduate diplomas (2.5%). Vocational credentials are prevalent, with 38.8% of residents aged 15+ holding them, including advanced diplomas (10.2%) and certificates (28.6%). Educational participation is high, with 25.2% of residents currently enrolled in formal education, comprising 11.1% in primary, 7.9% in secondary, and 1.8% in tertiary education.

Educational participation is notably high, with 25.2% of residents currently enrolled in formal education. This includes 11.1% in primary education, 7.9% in secondary education, and 1.8% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Gilbert Valley is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Gilbert Valley faces significant health challenges, with common conditions prevalent among both younger and older age groups. Only approximately 48% (~2,557 people) of the population has private health cover, compared to the national average of 55.3%.

The most frequent medical issues are arthritis (10.9%) and mental health problems (8.7%), while 62.4% report having no medical ailments, slightly higher than the Rest of SA's 60.9%. About 27.8% (~1,481 people) of residents are aged 65 or over. Health outcomes for seniors in Gilbert Valley exceed average metrics, even outperforming those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Gilbert Valley is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Gilbert Valley, surveyed in August 2016, had low cultural diversity with 90.4% citizens, 87.8% born in Australia, and 97.7% speaking English only at home. Christianity was the dominant religion, at 50.0%, compared to 51.3% regionally (Rest of SA). Top ancestral groups were English (34.8%), Australian (30.5%), and German (9.0%).

Notably, Polish residents were overrepresented at 0.8% (vs regional 0.5%), Dutch at 1.2% (vs 1.0%), and Irish at 7.9% (vs 6.8%).

Frequently Asked Questions - Diversity

Age

Gilbert Valley ranks among the oldest 10% of areas nationwide

Gilbert Valley's median age is 51 years, which is higher than the Rest of SA average of 47 years and considerably older than the national norm of 38 years. The age profile shows that those aged 55-64 are particularly prominent, making up 17.6% of the population, while those aged 25-34 make up only 7.7%, which is smaller compared to the Rest of SA. This concentration of those aged 55-64 is well above the national average of 11.2%. Between 2021 and present, the age group of 75 to 84 has grown from 8.0% to 9.7% of the population. Conversely, the age group of 45 to 54 has declined from 13.4% to 11.9%, and the age group of 5 to 14 has dropped from 11.8% to 10.7%. Looking ahead to the year 2041, demographic projections reveal significant shifts in Gilbert Valley's age structure. The age cohort of 75 to 84 is projected to increase solidly by 163 people (32%) from 515 to 679. Demographic aging continues as residents aged 65 and older represent 88% of anticipated growth. Conversely, population declines are projected for the age cohorts of 65 to 74 and 0 to 4 years old.