Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Malanda - Yungaburra has seen population growth performance typically on par with national averages when looking at short and medium term trends

Based on AreaSearch's analysis, Malanda-Yungaburra's population is around 9,858 as of Nov 2025. This reflects an increase of 763 people (8.4%) since the 2021 Census, which reported a population of 9,095 people. The change is inferred from the estimated resident population of 9,585 from the ABS as of June 2024 and an additional 446 validated new addresses since the Census date. This level of population equates to a density ratio of 7.9 persons per square kilometer. Malanda-Yungaburra's 8.4% growth since the 2021 census exceeded that of the SA3 area (7.3%) and the SA4 region, marking it as a growth leader in the region. Population growth for the area was primarily driven by interstate migration, contributing approximately 79.3% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. These state projections do not provide age category splits; hence proportional growth weightings in line with ABS Greater Capital Region projections are applied when utilised. Anticipating future population dynamics, a population increase just below the median of regional areas across the nation is expected for Malanda-Yungaburra, with an expected increase of 676 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of 4.1% over the 17 years.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Malanda - Yungaburra among the top 25% of areas assessed nationwide

Malanda - Yungaburra averaged approximately 61 new dwelling approvals annually over the past five financial years, from FY-21 to FY-25, with a total of 308 homes approved during this period. In FY-26, up until now, 56 dwellings have been approved. Each year, on average, 2.1 new residents were gained for each dwelling built over the past five financial years.

This indicates healthy demand which should support property values. The average expected construction cost value of new homes being built is $356,000. In this financial year, $4.7 million in commercial approvals have been registered, reflecting the area's primarily residential nature.

Compared to the rest of Queensland, Malanda - Yungaburra records somewhat elevated construction activity, with 25.0% above the regional average per person over the five-year period. Recent construction comprises 98.0% detached dwellings and 2.0% attached dwellings, preserving the area's low density nature and attracting space-seeking buyers. There are approximately 156 people per dwelling approval in the location, indicating an expanding market. According to the latest AreaSearch quarterly estimate, Malanda - Yungaburra is projected to add 403 residents by 2041. Based on current development patterns, new housing supply should readily meet demand, offering good conditions for buyers and potentially facilitating population growth beyond current projections.

Frequently Asked Questions - Development

Infrastructure

Malanda - Yungaburra has moderate levels of nearby infrastructure activity, ranking in the 45thth percentile nationally

Infrastructure changes significantly influence an area's performance. AreaSearch identified 13 projects likely impacting the region. Key projects are Atherton Hospital Redevelopment, Atherton Large Format Retail Precinct, Priors Creek Development, and Vernon Apartments. The following details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

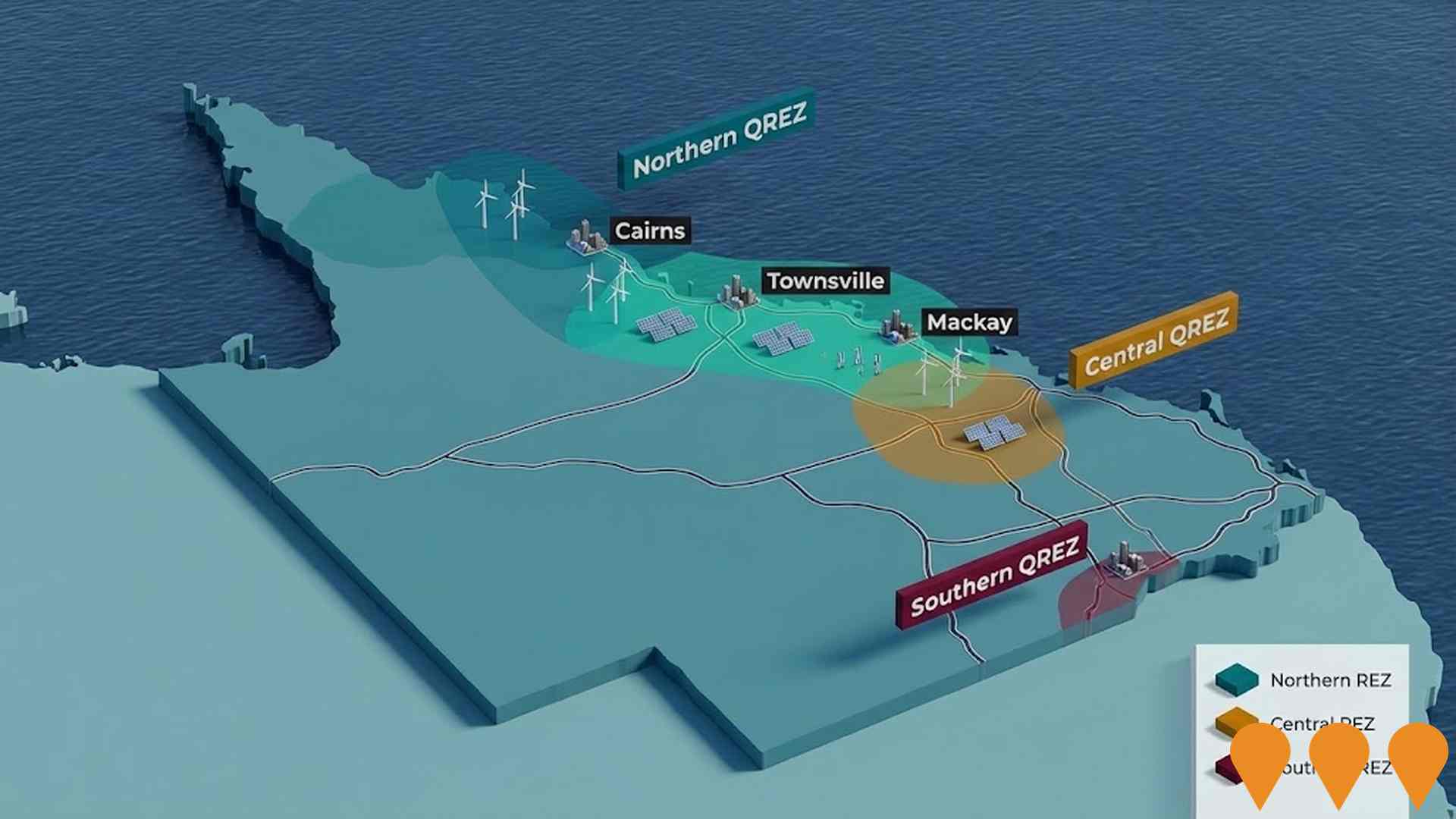

Cairns Smart Green Economy Initiative

Multi-year program led by Cairns Regional Council delivering renewable energy projects, smart waste and water systems, digital connectivity upgrades, EV charging network, and climate resilience infrastructure across the Cairns region.

Atherton Hospital Redevelopment

The redevelopment includes a new Clinical Services Building with emergency department, operating theatres, medical imaging, inpatient units, maternity services including birth suites and birthing pool, sterilising unit, and day surgical unit, along with a Community Allied and Mental Health Building, new helipad, and engineering services building, serving approximately 45,000 residents in the Tablelands region.

Atherton Large Format Retail Precinct

A new retail precinct aimed at attracting major large format retailers such as Bunnings and Harvey Norman, featuring expanded spaces, loading docks, additional parking, garden centres, showrooms, hardware, and trade supplies to boost the local economy and employment by generating approximately 164 full-time jobs and reducing escape spending by 12%.

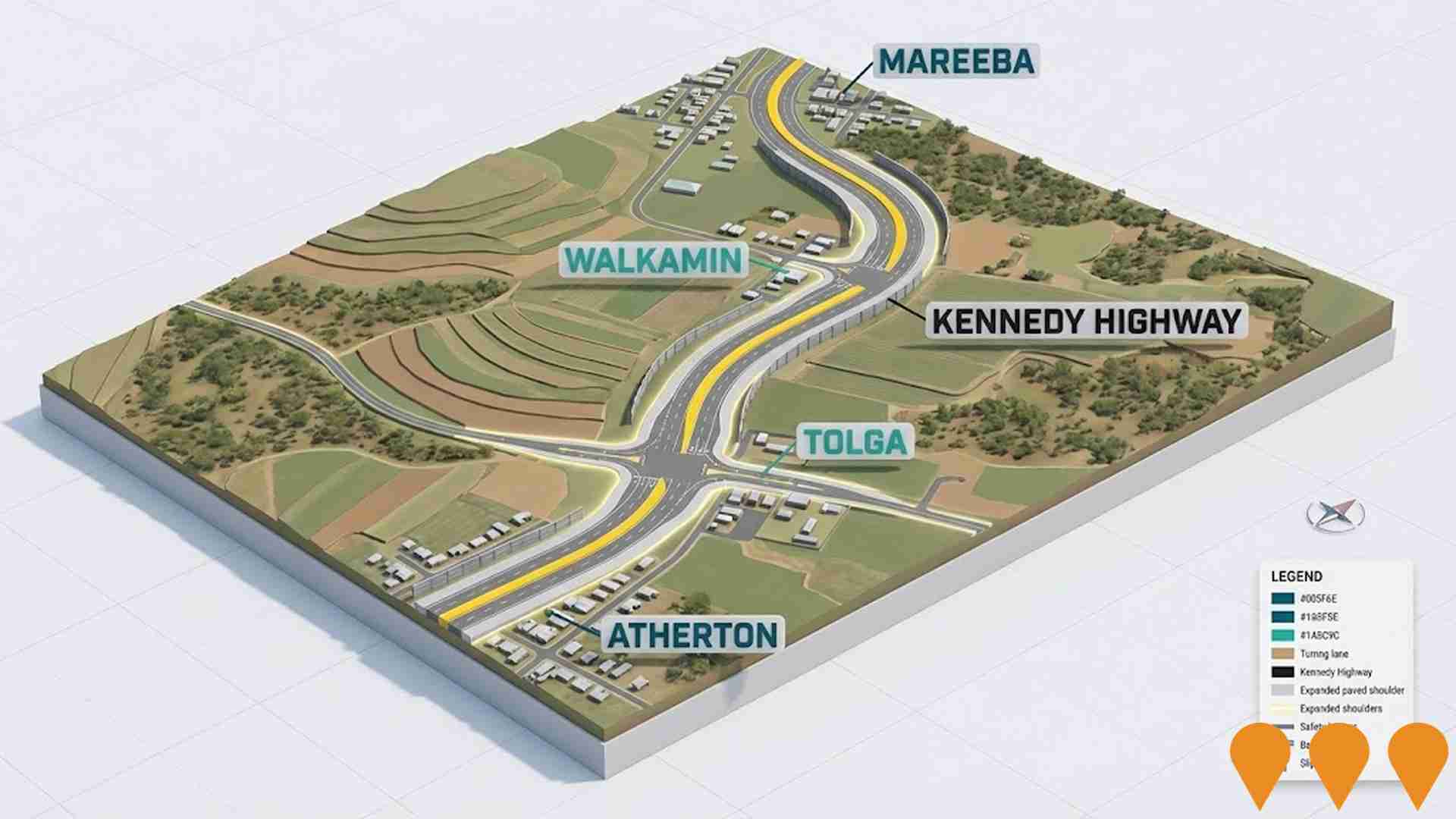

Tolga Main Street Shopping Centre (DA)

Development application to establish a small neighbourhood shopping centre on Main Street, Tolga. The proposal by HEDZ Constructions (Tom Hedley) comprises two single-storey buildings with four retail tenancies delivered over two stages and 12 on-site car parks. The application is currently being assessed by Tablelands Regional Council and will be referred to the Department of Transport and Main Roads due to proximity to the Kennedy Highway.

Mount Peter Priority Development Area

Queensland's newest Priority Development Area (PDA), declared 30 July 2025, covering 2,650 hectares in Cairns' Southern Growth Corridor. The Mount Peter PDA will deliver up to 18,500 new homes for approximately 42,000-42,500 residents by around 2050. An Interim Land Use Plan (ILUP) is in effect, enabling fast-tracked infrastructure and early development in Precinct 1 (Residential North). Economic Development Queensland (EDQ), in partnership with Cairns Regional Council, is preparing a full Development Scheme over the next 18 months with community input. The PDA provides streamlined planning and coordinated delivery of essential water, wastewater, transport, community facilities and open space infrastructure.

Priors Creek Development

The Priors Creek Development transforms a disused rail corridor into a family-oriented mixed-use leisure area with an urban plaza for markets, a 1000-person amphitheatre, nature-based playground, shared paths, Indigenous culture showcase, public art, and commercial opportunities including short-stay accommodation and units to boost economic activity and community engagement.

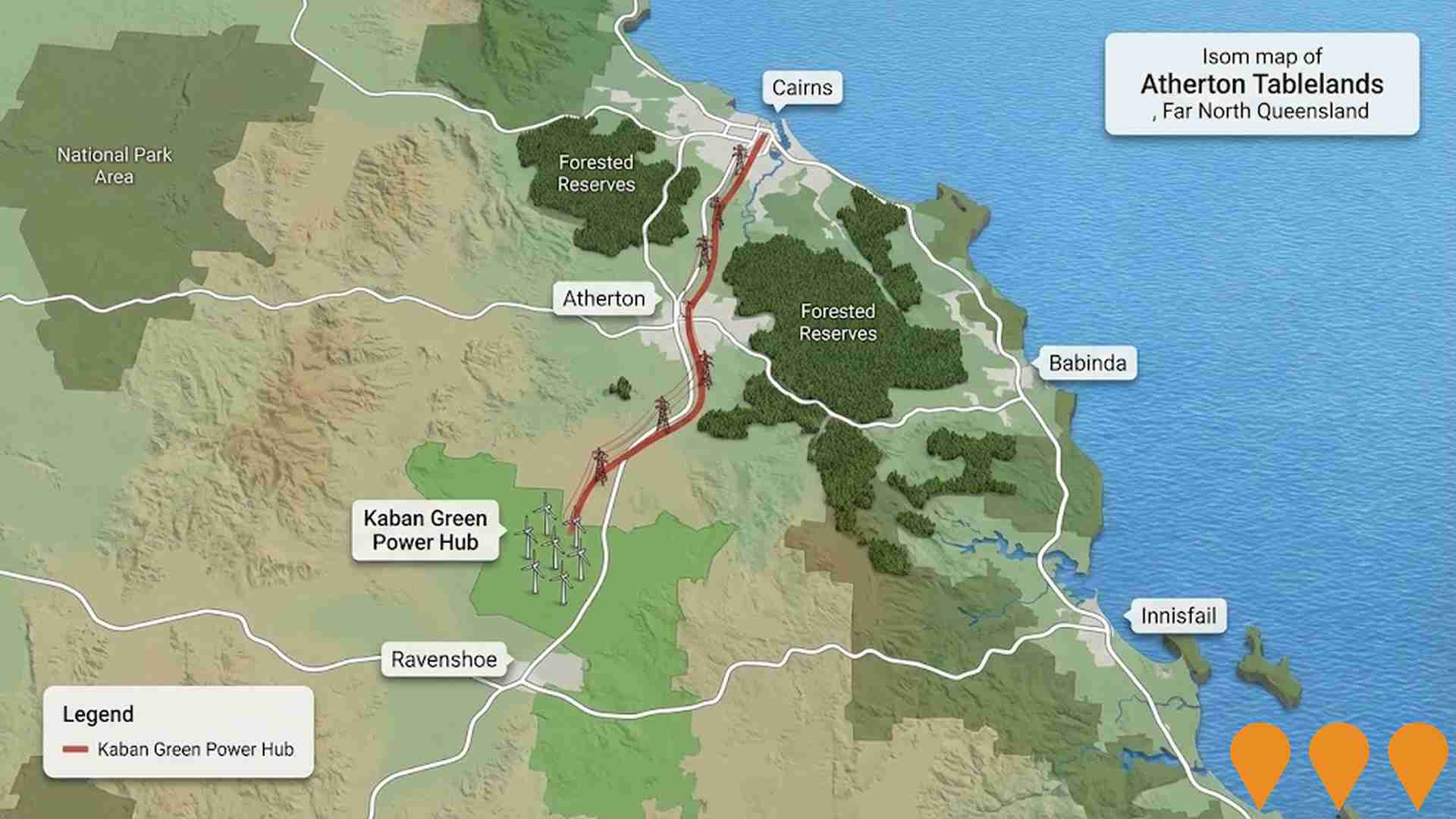

Kaban Green Power Hub

157 MW wind farm with 28 turbines located near Ravenshoe in the Atherton Tablelands, Far North Queensland. Generates approximately 460,000 MWh annually, powering around 95,900 homes. Developed, owned and operated by Neoen with a long-term PPA with CleanCo. Includes associated transmission upgrades. Approval exists for a future 100 MW battery storage system (not yet constructed). No solar component.

Bruce Highway Cairns Southern Access Corridor Stage 3 - Edmonton to Gordonvale

Major highway duplication project involving 10.5km upgrade and duplication of the Bruce Highway between Edmonton and Gordonvale. Includes new signalised intersections, bridges at Wrights Creek and Stoney Creek, new overpass south of Maitland Road, realignment of Queensland Rail North Coast Line, and dedicated off-road cycleway. Part of the 15-year Bruce Highway Upgrade Program to improve safety and reduce congestion on this critical freight and tourism corridor. The largest infrastructure project in Far North Queensland history, now completed and operational.

Employment

Despite maintaining a low unemployment rate of 3.6%, Malanda - Yungaburra has experienced recent job losses, resulting in a below average employment performance ranking when compared nationally

Malanda-Yungaburra has an unemployment rate of 3.6%. As of September 2025, it is 0.4% lower than the Rest of Qld's rate of 4.1%.

The workforce participation rate is 54.2%, compared to Rest of Qld's 59.1%. Key employment industries include agriculture, forestry & fishing, health care & social assistance, and education & training. Agriculture, forestry & fishing has a notably high concentration, with employment levels at 3.3 times the regional average. Health care & social assistance is under-represented, with only 13.5% of Malanda-Yungaburra's workforce compared to Rest of Qld's 16.1%.

Over the year to September 2025, labour force levels decreased by 1.7%, and employment declined by 3.2%, leading to a rise in unemployment rate by 1.5 percentage points. This contrasts with Rest of Qld, where employment rose by 1.7% and unemployment rose by 0.3 percentage points. State-level data from November 25 shows Queensland's employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts suggest a growth of 6.6% over five years and 13.7% over ten years, but local industry-specific projections estimate Malanda-Yungaburra's employment to increase by 5.8% over five years and 12.4% over ten years.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

The median taxpayer income in Malanda - Yungaburra SA2 was $42,429 and the average was $53,957 according to AreaSearch's aggregation of postcode level ATO data for financial year 2022. This is lower than the national averages of $50,780 median income and $64,844 average income in Rest of Qld. By September 2025, estimated incomes would be approximately $48,365 median and $61,506 average based on a 13.99% growth rate since financial year 2022. The 2021 Census shows Malanda - Yungaburra's household, family, and personal incomes fall between the 19th and 21st percentiles nationally. Income analysis reveals that 27.4% of residents (2,701 people) earn between $1,500 and $2,999 annually, which is similar to the surrounding region's pattern where 31.7% occupy this income range. Residents retain 88.7% of their income after housing costs, placing total disposable income at the 26th percentile nationally. The area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Malanda - Yungaburra is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

The latest Census evaluation shows that in Malanda - Yungaburra, 95.1% of dwellings are houses, with the remaining 4.9% being semi-detached, apartments, or other types. This compares to Non-Metro Qld's 91.0% houses and 9.0% other dwellings. Home ownership in Malanda - Yungaburra stands at 51.1%, with mortgaged properties making up 28.0% and rented ones accounting for 20.9%. The median monthly mortgage repayment in the area is $1,430, aligning with Non-Metro Qld's average. Weekly rent figures are recorded at $260, compared to Non-Metro Qld's $270. Nationally, Malanda - Yungaburra's median monthly mortgage repayments are lower at $1,430 versus the Australian average of $1,863, and rents are substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Malanda - Yungaburra has a typical household mix, with a fairly typical median household size

Family households account for 72.2% of all households, including 24.3% couples with children, 38.1% couples without children, and 9.4% single parent families. Non-family households constitute the remaining 27.8%, with lone person households at 25.2% and group households comprising 2.6%. The median household size is 2.4 people, which aligns with the average for the Rest of Qld.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Malanda - Yungaburra fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

Educational qualifications in the Malanda-Yungaburra trail region show that 21.4% of residents aged 15 and above hold university degrees, compared to Australia's 30.4%. Bachelor degrees are most common at 14.6%, followed by postgraduate qualifications at 4.2% and graduate diplomas at 2.6%. Vocational credentials are also prevalent, with 41.9% of residents aged 15 and above holding them, including advanced diplomas at 11.5% and certificates at 30.4%. Educational participation is high, with 27.8% of residents currently enrolled in formal education.

This includes 11.6% in primary education, 10.1% in secondary education, and 2.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Malanda - Yungaburra is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Malanda - Yungaburra faces significant health challenges with common health conditions prevalent across both younger and older age cohorts. The rate of private health cover is very low at approximately 47% of the total population (~4,633 people), compared to the national average of 55.3%.

The most common medical conditions are arthritis and mental health issues, impacting 9.6 and 7.0% of residents respectively. 67.0% of residents declare themselves completely clear of medical ailments, compared to 67.5% across Rest of Qld. The area has 27.6% of residents aged 65 and over (2,721 people), higher than the 25.1% in Rest of Qld. Health outcomes among seniors are particularly strong, performing better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Malanda - Yungaburra is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Malanda-Yungaburra has a low level of cultural diversity, with 87.9% of its population being citizens, 84.8% born in Australia, and 95.3% speaking English only at home. Christianity is the predominant religion in Malanda-Yungaburra, comprising 51.3% of people, compared to 52.6% across Rest of Qld. The top three ancestry groups are English (30.0%), Australian (28.9%), and Irish (9.8%).

Notably, German ancestry is overrepresented at 5.1%, New Zealand at 0.9%, and Scottish at 8.4%.

Frequently Asked Questions - Diversity

Age

Malanda - Yungaburra ranks among the oldest 10% of areas nationwide

The median age in Malanda - Yungaburra is 51, which is higher than the Rest of Qld figure of 41 and Australia's figure of 38. The 65-74 cohort is notably over-represented at 16.4% compared to the Rest of Qld average, while the 25-34 year-olds are under-represented at 6.4%. This concentration in the 65-74 age group is well above the national figure of 9.4%. Between 2021 and present, the 15 to 24 age group has increased from 8.0% to 8.8% of the population. Conversely, the 45 to 54 cohort has decreased from 13.5% to 12.7%. By 2041, demographic projections show significant shifts in Malanda - Yungaburra's age structure. The 85+ age cohort is projected to increase by 188 people (75%) from 250 to 439. Senior residents aged 65 and above will drive 58% of population growth, indicating demographic aging trends. In contrast, population declines are projected for the 35-44 and 5-14 age cohorts.