Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Glass House Mountains are strong compared to national averages based on AreaSearch's ranking of recent, and medium to long-term trends

Glass House Mountains' population was approximately 7,326 as of November 2025. This figure represents an increase of 774 people since the 2021 Census, which reported a population of 6,552. The growth is inferred from the estimated resident population of 7,194 in June 2024 and an additional 242 validated new addresses since the Census date. This results in a density ratio of 39 persons per square kilometer. Glass House Mountains' growth rate of 11.8% since the 2021 census exceeded both the non-metro area's average (8.8%) and the national average, indicating strong population growth in the region. Interstate migration contributed approximately 52.3% of overall population gains during recent periods, although all drivers including natural growth and overseas migration were positive factors.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. However, these state projections do not provide age category splits, so proportional growth weightings aligned with ABS Greater Capital Region projections are applied where utilized. Looking ahead, an above median population growth is projected for Australia's non-metropolitan areas, with Glass House Mountains expected to expand by 1,131 persons to 2041 based on the latest annual ERP population numbers, reflecting a total increase of 13.6% over the 17-year period.

Frequently Asked Questions - Population

Development

AreaSearch assessment of residential development activity positions Glass House Mountains among the top 25% of areas assessed nationwide

Glass House Mountains has seen approximately 61 new homes approved annually. Over the past five financial years, from FY-21 to FY-25, around 306 homes were approved, with a further 6 approved in FY-26 as of now. Each dwelling built over these years has resulted in an average of 2.5 new residents per year.

This robust demand supports property values and indicates more affordable housing options, with new homes being constructed at an average expected cost of $218,000, below the regional average. In FY-26, around $1.9 million in commercial approvals have been registered, suggesting a predominantly residential focus. Compared to the Rest of Qld, Glass House Mountains has about two-thirds the rate of new dwelling approvals per person, and it ranks among the 78th percentile nationally when measured against other areas assessed.

The area's development consists mainly of detached houses (92.0%) with medium and high-density housing making up the remainder (8.0%), maintaining its traditional low-density character appealing to families seeking space. With around 167 people per approval, Glass House Mountains reflects a developing area. According to the latest AreaSearch quarterly estimate, it is projected to add approximately 999 residents by 2041. At current development rates, new housing supply should comfortably meet demand, providing good conditions for buyers and potentially supporting growth beyond current population projections.

Frequently Asked Questions - Development

Infrastructure

Glass House Mountains has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

Changes to local infrastructure significantly affect an area's performance. AreaSearch has identified 14 projects that could impact this area. Notable ones include Glass House Mountains Surf Park, Old Gympie Road - Road widening, Beerwah Station Upgrade, and Australia Zoo. The following list details those likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Queensland Energy Roadmap 2025

The Queensland Energy Roadmap 2025 is the successor to the Queensland Energy and Jobs Plan. It is a five-year plan for Queensland's energy system, focused on delivering affordable, reliable, and sustainable energy, with a greater emphasis on private sector investment. Key elements include the $1.6 billion Electricity Maintenance Guarantee to keep existing assets reliable, a $400 million investment to drive private-sector development in renewables (solar, hydro) and storage, and a new focus on gas generation (at least 2.6 GW by 2035) for system reliability. The plan formally repeals the previous renewable energy targets while maintaining a net-zero by 2050 commitment. It also continues major transmission projects like CopperString's Eastern Link. The associated Energy Roadmap Amendment Bill 2025 is currently before Parliament.

Stockland Aura

A $5.3 billion master-planned community (also known as Caloundra South Priority Development Area) being developed over 30 years. The project spans 2,400 hectares and will feature 20,000 dwellings housing approximately 50,000 residents upon completion. It includes four suburbs (Baringa, Nirimba, Banya, and Gagalba), a major city centre, district and neighbourhood centres, 20 schools/learning centres, and 200km of cycleways. As of 2025, it is home to over 14,000 residents.

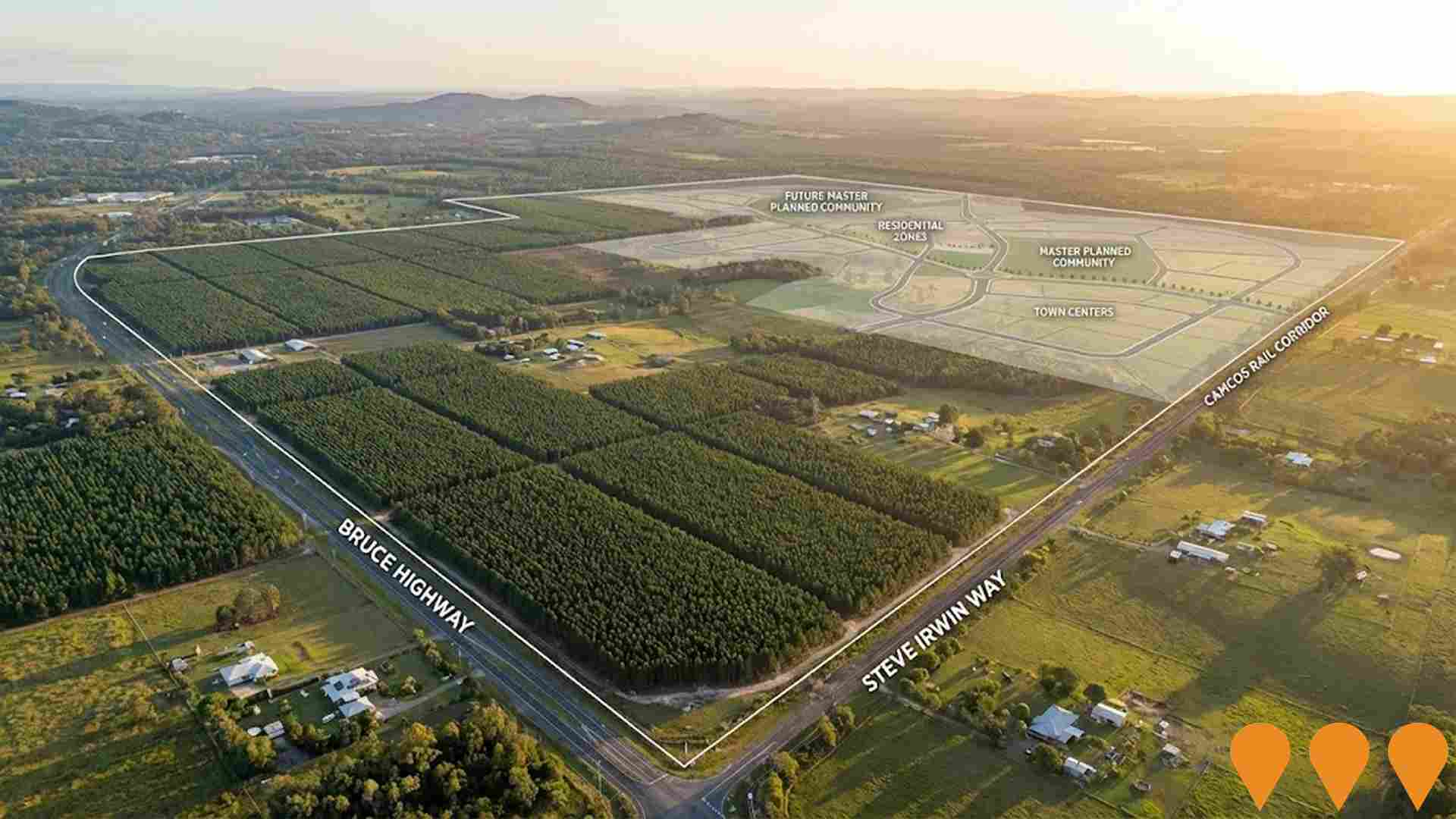

Beerwah East Identified Growth Area

Beerwah East is a 5,200-hectare Identified Growth Area (IGA) earmarked as the Sunshine Coast's primary long-term urban expansion zone. Located between the Bruce Highway and Steve Irwin Way with direct access to the CAMCOS rail corridor, it has potential capacity for up to 20,000 new homes and 50,000-60,000 residents by 2041-2060. The site remains predominantly pine plantation under HQPlantations lease until 2079 and is subject to native title processes. As of December 2025, the area remains zoned rural with no development applications lodged; detailed master planning and structure planning are still in early preparatory stages led by Sunshine Coast Council.

The Wave - Sunshine Coast Rail and Metro

A transformative public transport project delivering a new heavy rail line from Beerwah to Birtinya (Stages 1 & 2) and a metro-style connection to the Sunshine Coast Airport via Maroochydore (Stage 3). Stage 1 is fully funded and targets completion by 2032 for the Brisbane Olympic Games.

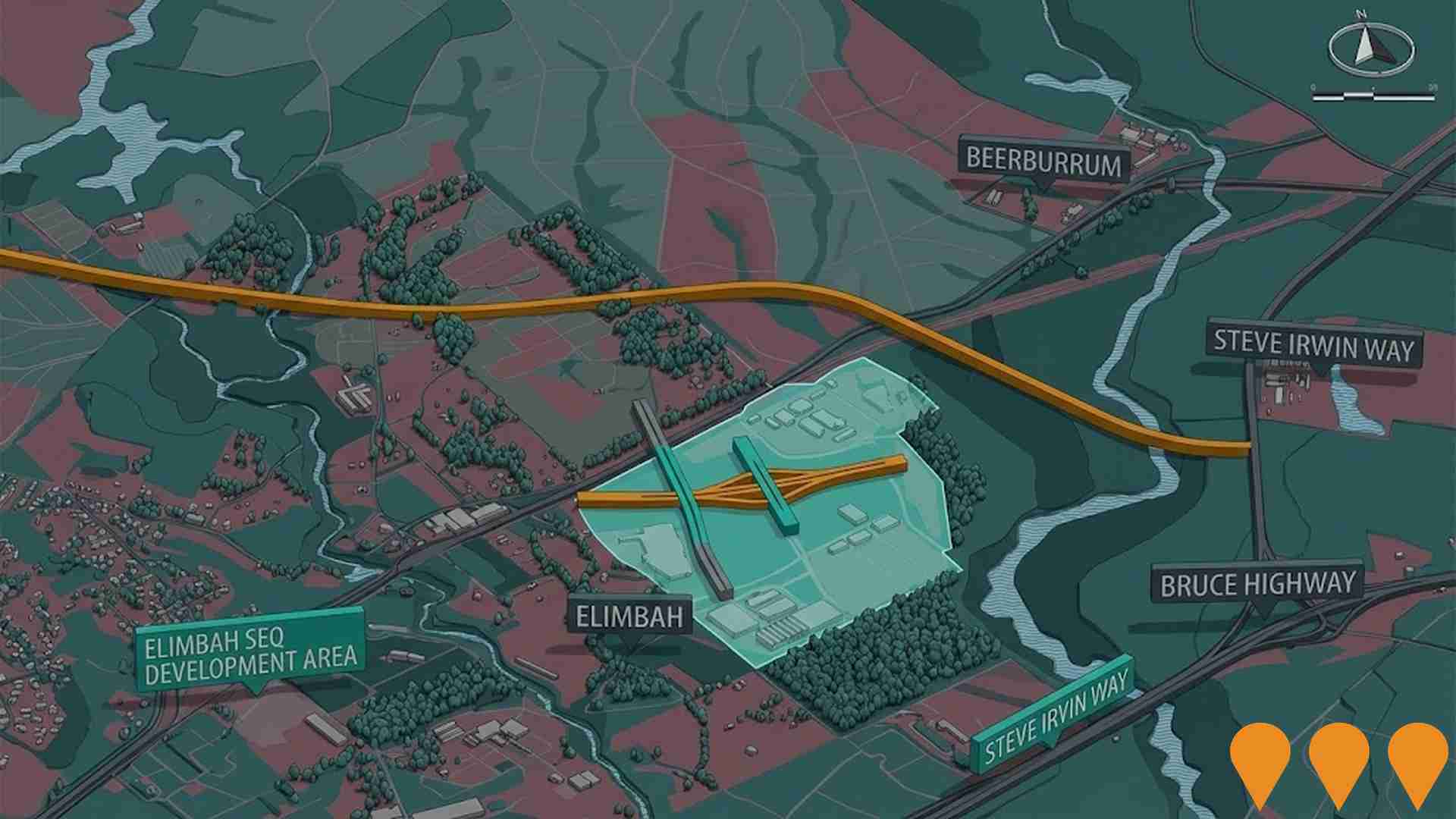

Northern Intermodal Terminal (Elimbah)

The Northern Intermodal Terminal is a proposed major freight hub north of Caboolture near Elimbah, designed to transfer freight between the North Coast Rail Line and road networks. It aims to reduce heavy vehicle movements through Brisbane, support growing freight demand in South East Queensland, and improve supply chain efficiency for regional industries.

Australia Zoo

700-acre zoo and major tourist attraction established by Steve Irwin family. Features Crocoseum stadium, wildlife hospital, and conservation programs. Includes ongoing expansions and improvements to facilities and animal habitats. Major economic driver for Beerwah region.

Bruce Highway Upgrade - Caboolture-Bribie Island Road to Steve Irwin Way (Exit 163)

A major $662.5 million upgrade of an 11km section of the Bruce Highway from Caboolture-Bribie Island Road to Steve Irwin Way (Exit 163). The project widened the highway from four to six lanes and delivered 10 new, higher bridges to significantly improve flood immunity, including at King Johns and Lagoon Creeks. It also included upgrading interchanges and installing smart motorways technology. Major construction was completed in April 2024.

Aura South

Aura South is a proposed masterplanned residential community spanning 1,231 hectares, located within the Halls Creek Priority Future Growth Area adjacent to Stockland's Aura development. The site is a former exotic pine plantation that has been cleared for over 50 years and is currently used for low-intensity grazing. The project is currently undergoing Commonwealth environmental assessment under the EPBC Act. If approved, it will provide much-needed housing supply for the Sunshine Coast region post-2046, with up to 400 hectares dedicated to environmental rehabilitation and conservation. The development would leverage existing infrastructure from the neighboring Aura community including the Bells Creek Arterial Road and planned transport connections.

Employment

While Glass House Mountains retains a healthy unemployment rate of 3.4%, recent employment declines have impacted its national performance ranking

Glass House Mountains had a balanced workforce in September 2025 with an unemployment rate of 3.4%. The area had 3,641 residents employed, below the Rest of Qld's rate of 4.1% by 0.6 percentage points.

Workforce participation was similar to Rest of Qld's 59.1%. Key industries were construction, health care & social assistance, and education & training. Construction had a strong presence with an employment share 1.5 times the regional level. Retail trade had limited presence at 8.1% compared to 10.0% regionally.

The area showed a decrease in labour force by 2.2% and employment by 1.2% over a 12-month period, causing unemployment to fall by 1.0 percentage points. State-level data from QLD to 25-Nov showed employment contracted by 0.01%, with the state unemployment rate at 4.2%. National employment forecasts from May-25 suggested national employment growth of 6.6% over five years and 13.7% over ten years, but local projections based on Glass House Mountains' employment mix estimated lower growth rates of 6.2% over five years and 13.0% over ten years.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

The Glass House Mountains SA2 had a lower than average income level nationally based on latest ATO data aggregated by AreaSearch for financial year ending June 2022. The median income among taxpayers was $49,801 and the average income stood at $60,446. These figures compared to Rest of Qld's median income of $50,780 and average income of $64,844 respectively. By September 2025, current estimates based on Wage Price Index growth of 13.99% would be approximately $56,768 for the median income and $68,902 for the average income. According to Census 2021 income data, household, family and personal incomes in Glass House Mountains ranked modestly between the 35th and 46th percentiles. Distribution data showed that the $1,500 - 2,999 income bracket dominated with 34.8% of residents (2,549 people), similar to the surrounding region where 31.7% occupied this bracket. Housing affordability pressures were severe, with only 84.8% of income remaining after housing costs, ranking at the 48th percentile. The area's SEIFA income ranking placed it in the fifth decile.

Frequently Asked Questions - Income

Housing

Glass House Mountains is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

The latest Census evaluation found that dwelling structures in Glass House Mountains comprised 98.0% houses and 2.0% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Non-Metro Qld's 93.2% houses and 6.7% other dwellings. Home ownership in Glass House Mountains was at 38.2%, similar to Non-Metro Qld's level. Dwellings were either mortgaged (46.1%) or rented (15.8%). The median monthly mortgage repayment was $1,814, below the Non-Metro Qld average of $1,863. The median weekly rent figure was $398, compared to Non-Metro Qld's $400. Nationally, Glass House Mountains' mortgage repayments were lower than the Australian average of $1,863, while rents exceeded the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Glass House Mountains features high concentrations of family households, with a higher-than-average median household size

Family households constitute 79.6% of all households, including 33.2% couples with children, 35.1% couples without children, and 10.8% single parent families. Non-family households account for the remaining 20.4%, with lone person households at 17.4% and group households comprising 3.0%. The median household size is 2.7 people, larger than the Rest of Qld average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Glass House Mountains fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 16.3%, significantly lower than the Australian average of 30.4%. Bachelor degrees are most common at 12.4%, followed by graduate diplomas (2.0%) and postgraduate qualifications (1.9%). Vocational credentials are prevalent, with 46.2% of residents aged 15+ holding them, including advanced diplomas (12.1%) and certificates (34.1%). Educational participation is high at 27.8%, comprising 10.5% in primary education, 8.5% in secondary education, and 3.5% in tertiary education.

Educational participation is notably high, with 27.8% of residents currently enrolled in formal education. This includes 10.5% in primary education, 8.5% in secondary education, and 3.5% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The Glass House Mountains have six operational public transport stops. These comprise a mix of train and bus services. There are 32 distinct routes servicing these stops, collectively offering 601 weekly passenger trips.

Transport accessibility is limited, with residents typically residing 1370 meters from the nearest stop. On average, there are 85 daily trips across all routes, equating to around 100 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Glass House Mountains is lower than average with common health conditions somewhat prevalent across both younger and older age cohorts

Glass House Mountains faces significant health challenges. Common health conditions are prevalent across both younger and older age cohorts.

The rate of private health cover is relatively low at approximately 50% of the total population (around 3,663 people). This is lower than the national average of 55.3%. The most common medical conditions in the area are arthritis and mental health issues, impacting 9.9% and 8.9% of residents respectively. Meanwhile, 64.8% of residents declare themselves completely clear of medical ailments, compared to 66.4% across the rest of Queensland. The area has 19.3% of residents aged 65 and over (around 1,416 people). Health outcomes among seniors present some challenges, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Glass House Mountains ranks below the Australian average when compared to other local markets across a number of language and cultural background related metrics

Glass House Mountains had a low cultural diversity, with 83.2% of its population born in Australia, 89.0% being citizens, and 95.6% speaking English only at home. Christianity was the predominant religion, accounting for 47.3% of the population, compared to 44.6% across Rest of Qld. The top three ancestry groups were English (32.9%), Australian (27.7%), and Scottish (8.5%).

Notably, New Zealand (1.1%) was overrepresented compared to the regional average of 1.0%, Dutch (1.8%) slightly exceeded the regional average of 1.6%, and German (5.1%) was nearly equal to the regional average of 5.0%.

Frequently Asked Questions - Diversity

Age

Glass House Mountains's median age exceeds the national pattern

The median age in Glass House Mountains is 41 years, matching Rest of Qld's average but somewhat older than Australia's average of 38 years. Compared to Rest of Qld, Glass House Mountains has a higher proportion of residents aged 35-44 (14.2%) but fewer residents aged 25-34 (11.7%). According to the 2021 Census, the age group 35-44 grew from 12.7% to 14.2%, while the groups 65-74 and 45-54 decreased from 12.1% to 10.5% and 13.4% to 12.1%, respectively. By 2041, demographic projections indicate significant shifts in Glass House Mountains' age structure. The 35-44 group is expected to grow by 28% (287 people), reaching 1,326 from 1,038. Conversely, the groups aged 55-64 and 15-24 are projected to experience population declines.